Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

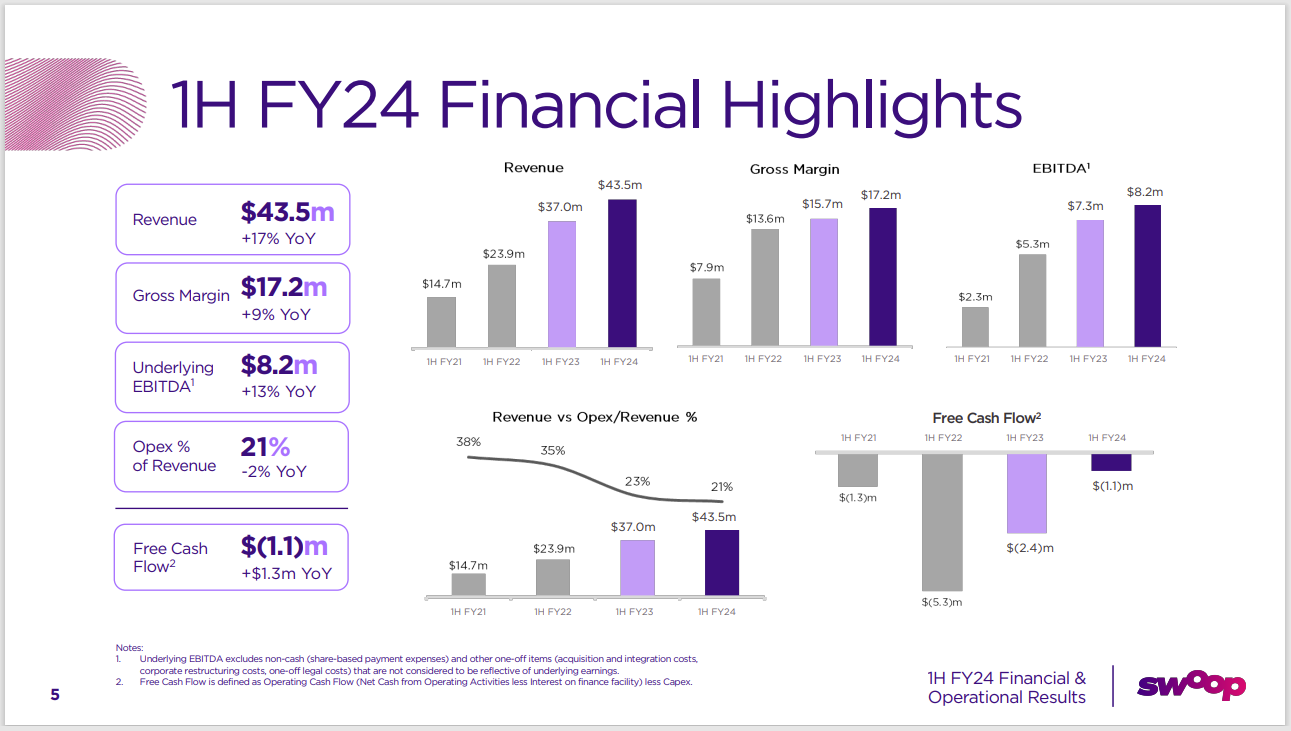

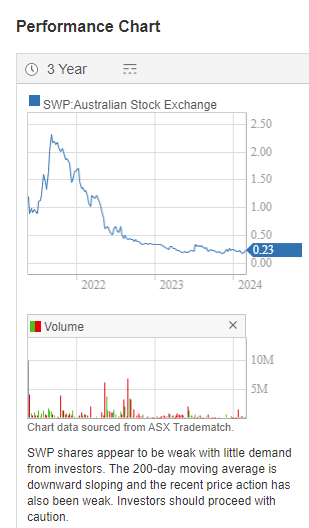

This is a company I review every 6 months and I can't understand why the market hates it so much - because I think they ARE making solid progress - although they didn't turn into the type of fast-growing Telco roll-up (growth via acquisition) story that some may have been hoping for, considering the pedigree of their Board and Management. Last night I used a graph of AVA over the past 3 years to underline that the market is not convinced they are growing and executing well with their business model and strategy. Well, Swoop (SWP), which I DO continue to hold, looks a LOT worse than AVA in terms of their share price graph, so share price movements can contain some information, but, in my opinion, not all information. The market has bid Swoop up +7.14% today so far, as I type this (or +1.5 cps from 21 to 22.5 cps) but they've come down a LONG way over the past couple of years:

They have made some business decisions that the market hasn't been keen on, like pursuing regional broadband internet connectivity programs using both fixed and wireless models - see here: Vic govt taps Swoop for regional fixed wireless rollout - Telco - CRN Australia

Plain text: https://www.crn.com.au/news/vic-govt-taps-swoop-for-regional-fixed-wireless-rollout-603489

And here: Victorian Government partners with Swoop for the Connecting Victoria program (telconews.com.au)

Plain text: https://telconews.com.au/story/victorian-government-partners-with-swoop-for-the-connecting-victoria-program

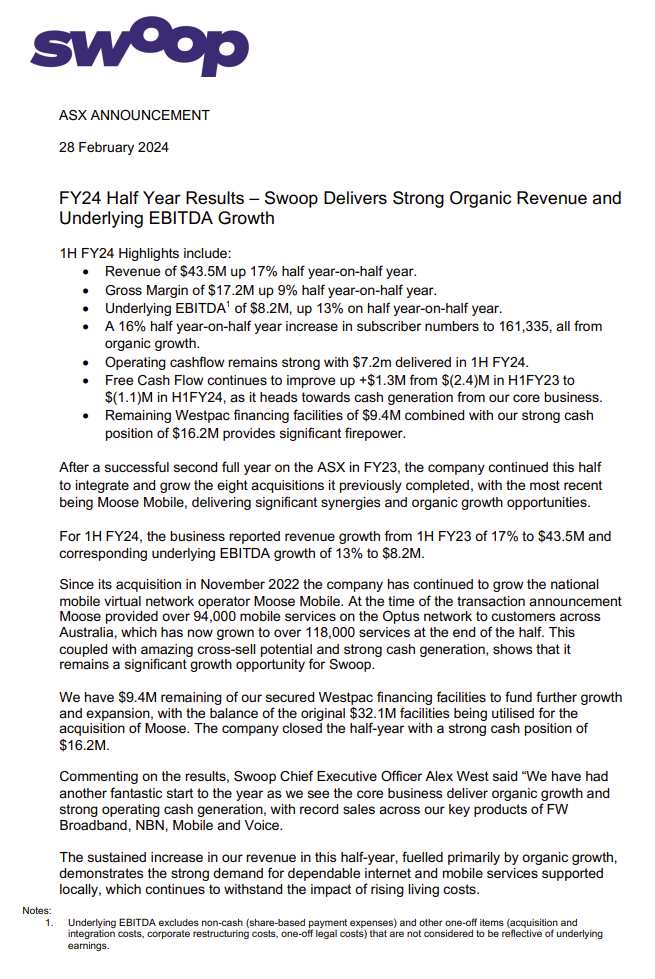

Here's Swoop's Report Today: Swoop-H1FY24-Results-Announcement.PDF

And their Presentation: Swoop H1FY24 Investor Briefing

And here's the first page of that Results Announcement:

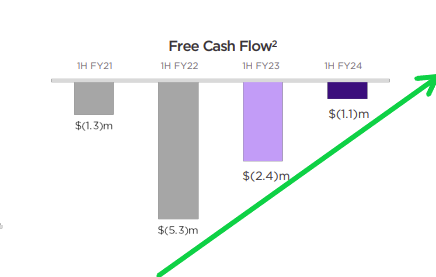

Not quite free cashflow positive, but the trajectory is good:

Also, both revenue and gross margins are improving and costs in terms of Opex/Revenue (%) is decreasing, so their core business is scaling OK. I could be wrong to keep Swoop and sell AVA - time will tell. Swoop look like they are making solid progress and my review today has resulted in me deciding to continue to hold them.

They have high management and board ownership, - with a few of them being substantial shareholders - and Andrew and Nicola Forrest's Tattarang is a cornerstone investor as well, and Tattarang remain invested in Swoop.

12-July-2023: Back in Adelaide (from our short trip to Sydney), and, as usual, something positive has happened to one of the companies that I hold shares in (usually happens when I go away and stop watching the market for a few days). Not a takeover offer this time, and I'm glad of that, because this company is trading WAY too low for me to want them to be taken out by someone else down here, but Swoop (SWP, the worst performing company of the three that I picked to do well in FY23, i.e. they didn't!) appears to have finally broken that downtrend that they've been in for a decent amount of time - like, since September 2021 when they got up to over $2.30/share. They were recently (in mid-June 2023) trading down at 17.5 cps (cents per share). They've been heading the right way lately however, on no news, just the continued on-market share buyback that they've been doing for many months now. In fact their share price has damn near doubled from that 17.5 cps low to today - in about 4 weeks.

Of course, they're coming off a very low base now, so it's clearly a lot easier to go up by double digit percentages when your share price has come down that much from over $2.30 to under 20 cents/share.

I hold SWP shares, and it's not been a fun ride so far. Perhaps the rollercoaster has bottomed?!

Don't really want to do that drop again!

20-Feb-2022: I recently sold out of Uniti Group (UWL) IRL and here - at a good profit. I started buying Uniti shares in July 2020 at $1.59 and added more the following month at $1.45. I sold out on 16-Feb-2021 (last Wednesday) at $3.80/share. Here on SM I sold out on Friday (20-Feb-2022) at $3.89. I tend to trade here on SM after I've finished adjusting my position(s) IRL.

The driving force behind UWL now is Vaughan Bowen and Michael Simmons who have between them an impressive history in the Telecommunications industry - and it was on the back of their prior histories and achievements that I invested in UWL.

Uniti Group (UWL) Board and Management (link to their website)

Michael Simmons is a seasoned media and telecommunications executive with more than 30 years industry experience. Michael was employed by TPG Telecom Limited (was ASX:TPM, now ASX:TPG) for over 26 years. Michael held various executive positions and served as CEO for much of this time. TPM became a public company following acquisition by ASX-listed SP Telemedia Limited (SPT Group) which listed in 2001.

Prior to listing, SPT Group was a wholly owned subsidiary of the Washington H. Soul Pattinson Limited controlled NBN Enterprises Group (NBNE). NBNE invested principally in media, entertainment and hospitality businesses including television and newspaper interests. Michael held executive roles within the SPT/NBNE Group of Companies, including as Chief Financial Officer. During his time with SPT/NBNE, Michael developed and implemented the business plan to create a telecommunications business within the Group, which became SP Telemedia and resulted in Michael being Group CEO. Michael continued to lead the growth of SP Telemedia until the acquisition of TPG Telecom.

In 2008, Michael left TPG Telecom to become the Managing Director of TERRiA, a telecommunications consortium of infrastructure-based telecommunications carriers, formed to bid for the contract to build, own and operate the National Broadband Network. At this time, Michael also joined the M2 Telecommunications Group, as a Director, when MTU's market capitalisation was less than $100M. Michael remained a Director until 2016 when M2 merged with Vocus (ASX:VOC) as a $2.2B enterprise. Michael joined the Board of Vocus as a non-executive Director before being appointed CEO of Enterprise, Wholesale and Government. Michael went on to serve as Group CEO of Vocus Limited.

Vaughan Bowen is a highly successful business builder, M&A practitioner & philanthropist. As founder of M2 Group, which became an ASX100 telecommunications company and then became part of Vocus Group following a merger in 2016, Vaughan took M2 from a start-up to a business valued at greater than $2B, with more than 3,000 team members, nearly 1 million customer services across Australia & New Zealand and owner of household names including Dodo, iPrimus and Commander. During the M2 journey, Vaughan led the identification, vendor negotiation and acquisition of more than 30 companies.

In 2012 Vaughan founded, seeded and continues to serve as Chairman of the Telco Together Foundation (“TTF”), the Australian telco industry’s only united charitable entity, endorsed by the federal government’s Department of Communications. In only a few years, TTF has raised several million dollars for various disadvantaged communities and implemented national programs for the benefit of the not-for-profit sector as a whole, including carrier-unified text message giving.

However in September 2021 the AFR revealed that Bowen was facing two charges of insider trading over the sale of 5.6 million Vocus shares on June 4, 2019, allegedly made with inside knowledge that private equity firm EQT would withdraw its $3.3 billion takeover tilt for the once-troubled company.

Vaughan Bowen denies the allegations. [photo: James Brickwood, AFR]

If sold at the closing point of Vocus’ share price on June 4 ($4.58), the shares were worth $25.7 million, compared with the $22.1 million they would have been worth when Vocus shares opened on June 5 at just $3.94.

Mr Bowen has denied the charges and has vowed to fight them, with Uniti backing their man in a statement to the ASX.

“The UWL board does not intend to make any changes to Mr Bowen’s role and position of executive director (M&A) of the company, which will continue, until the outcome of this matter has been determined,” it said.

Source: Uniti backs Vaughan Bowen despite insider trading allegations (afr.com)

What attracted me to Uniti however was that these guys had overseen a successful roll-up strategy with M2 and Vocus that involved more than 30 acquisitions and had created an enormous amount of shareholder value.

Now I am well aware that roll-ups tend to go pear-shaped at some point, and Vocus was no exception, but Uniti was in its early days and I figured the ride should be worth it, and it was. But they look like they've rolled over now, so I've locked in my profits and moved on.

I've recently started building a position in a much younger company, Swoop Holdings (ASX:SWP). They did a reverse takeover in May last year of Stemify (SF1) (sometimes called a "back door listing") and then promptly changed the company name to Swoop Holdings and the ticker code from SF1 to SWP, so SWP have only been listed for 9 months. But what a 9 months!

They listed at 50 cps, closed on their first day at $1.25 (+150% higher than their 50c listing price, or recapitalisation price, and they made an intraday high of $1.33 on that first day), then drifted down to 90 cps over the next 8 days (6 trading days), then headed North and peaked at $2.46/share on 22-Sep-2021, before going into a downtrend, which they are still in.

I wanted to add SWP to my portfolio here on Strawman.com when they first listed in late May, and through June, but it took some months for this site's data provider to start recognising SWP as a valid stock code, so I moved on and forgot about them for a while. By the time I realised Swoop was now a recognised company here and SWP was a recognised ticker code here on Strawman (and that the pricing data had all been backdated to their 27-May-2021 listing date), the share price had climbed too high, especially for a company that had listed at 50 cents per share (cps). They were up to over $2/share in just over 3 months from listing (+300% from their 50 cps IPO/recap price).

One of the reasons was that they were backed by FMG's Andrew ("Twiggy") Forrest's private family investment company, Tattarang Ventures, who own 19.7% of SWP.

Another reason was they started to make regular acquisitions - and look at who they have running the company:

Lots of talent there!! I've highlighted a few company names there, including Superloop (ASX:SLC), TPG Telecom (TPM/TPG), Pipe Networks (acquired by TPG), Vocus (acquired in 2021 by Voyage Australia Pty Limited, a consortium of Macquarie Infrastructure and Real Assets (MIRA) and superannuation fund Aware Super), Amcom (acquired by Vocus in 2015), Anycast (now part of Swoop), NodeOne (now part of Swoop), and OptiComm (acquired by Uniti Group - UWL - in late 2020). The underlying theme there is M&A, and Swoop's latest two acquisitions have both been Dark Fibre - being Adelaide-based provider iFibre and Sydney based dark fibre provider Luminet. Vocus started out by building their own fibre network in Sydney, and the guys at Swoop are no strangers to dark fibre and its advantages. Swoop's Chairman James Spenceley was the founder of Vocus and its first CEO.

Matt Hollis was director of sales at Vocus and he jumped ship to go to Superloop around the time that Vocus started turning pear-shaped. Then a number of those Superloop guys (Matt Hollis, Julian Breen, Alex West) all left Superloop and turned up at Swoop. Interestingly, those 3 - Matt, Julian and Alex - all worked at TPG, then all worked at Vocus, then they went to Superloop, and now they are all at Swoop. Coincidence. Methinks not! With Uniti I thought we had the old gang back together. Well, at Swoop it's a bigger gang, with more experience, more success, and more potential to outperform from here IMHO.

Uniti's (UWL's) m/cap is now $2.7 billion, and it was over $3 billion before they started falling at the beginning of last month (January 2022). Swoop's m/cap is now down to $188 million, so UWL are currently more than 14 times bigger than Swoop. However, hardly anyone knows about Swoop, particularly now that the hype that surrounded them when they first listed in May last year has completely dissipated. And Swoop are clearly much more early-stage than Uniti are, and that's why I'm now more attracted to Swoop than Uniti.

Roll-ups can be very profitable investments, but you want to be in them for a good time, not a long time, because they all unravel at some point. And you'll usually find the key players moving on at that point, or just before it, and trying to do it all again with another business.

From their 17-Dec-2021 Business Update and Upgraded Guidance

- Upgraded guidance to reflect VoiceHub acquisition and improvements in overall business performance

- The businesses acquired since listing have all seen organic growth under Swoop ownership

- Organic Net Service Growth is tracking ahead of budget

- FY22 Revenue now expected to be between $50m - $53m

- FY22 underlying EBITDA now expected to be between $12m - $12.5m

- Acquisition pipeline has increased in quality and size since capital raise

- Final stages with several acquisitions which are on track to be announced in the coming weeks

- Reviewing credit approved term sheets from multiple banks for debt facilities of between $30m-$40m.

Swoop Holdings Limited (ASX: SWP) is pleased to announce an upgrade to its FY22 Revenue and Underlying EBITDA guidance previously provided in October 2021:

- FY22 Revenue is upgraded from $43.0m - $45.0m to $50.0m - $53.0m, which represents ~72% yoy growth from FY21

- FY22 underlying EBITDA is upgraded from $10.5m - $11.0m to $12.0m - $12.5m which represents ~150% yoy growth from FY21.

The upgraded guidance consists of an 8 month estimated contribution from the VoiceHub acquisition, stronger performances from the businesses acquired since listing as well as better growth from the original Swoop/NodeOne business. As a result, Net Service Growth (new connections less churn) is tracking ahead of budget and the business is performing better than previously guided.

Swoop CEO, Alex West stated, “Our focus on the right acquisitions and discipline in both the due diligence and integration process, together with strong organic growth, has resulted in us tracking to an improved result. Integrations are progressing well, and we are starting to see the early-stage benefits of increased and centralised marketing on the businesses we have acquired.”

“This along with an amazing team which continues to provide a great service to our growing customer base, is leading to a lower than industry standard churn and strong sales performance. I could not be prouder of what we have achieved in such a short time.”

--- end of excerpt --- [yoy = year on year]

See their website - Fixed Wireless Internet and nbn™ Plans Melbourne & Victoria | Swoop Broadband

They do provide NBN internet, but their niche has been wireless internet for people in rural and remote areas where the NBN hasn't been rolled out yet. However, their services are growing, and I expect the company will keep expanding in new directions, especially with these recent dark fibre acquisitions.

Andrew Forrest-backed Swoop plugs into South Australia with deal for Beam Internet

by Daniel Newell, The West Australian

Mon, 12 July 2021

Andrew Forrest-backed telco Swoop Holdings has continued its acquisition spree and snapped up another wireless internet network provider that will further expand its reach across Australia.

The company will add South Australia-based Beam Internet to its growing portfolio in a cash and scrip deal worth $6.7 million.

Beam is the State’s biggest privately owned regional fixed wireless network provider, with more than 60 towers and masts servicing 3600 residential and SME customers.

The network covers the Fleurieu Peninsula, Barossa, Kangaroo Island, Mid North, Murray Bridge and South East regions.

The deal also expands Swoop’s reach into parts of the West Victoria and Mallee regions in regional Victoria, building on its recent purchase of Speedweb, which provides services in the Gippsland and Latrobe Valley areas.

Swoop chief executive Alex West said Beam had a recently upgraded and well-built modern network and would give it a strong springboard for growth into the South Australian market.

Swoop — which is backed by the Forrest family’s private investment arm Tattarang, Vocus founder James Spenceley and Amcom founder Tony Grist — made its debut on the Australian Securities Exchange in May through a reverse takeover through Stemify.

Last month it picked up WA-based fixed wireless provider Community Communications. Swoop’s services in the State operate under the NodeOne brand, a Geraldton-based telco which merged with the telco in a $61.3 million deal made shortly before listing.

Swoop shares listed at 50¢ and rose as high as $1.33 on debut but have since dropped back below $1.

[published on 12-July-2021] Source: https://thewest.com.au/business/andrew-forrest-backed-swoop-plugs-into-south-australia-with-deal-for-beam-internet

In summary:

- Swoop are a small Telco who are carving out a niche and are rolling up smaller companies in a similar way to what occurred in the best years of the better companies that these guys worked for in the past. Roll-ups can work very well in the early years. Need to be watched closely though and you have to be ready to jump ship fast, especially when the KMP (key management personnel) move on.

- Their management and board are impressive, in terms of experience and prior track records of creating shareholder value; in my experience it's rare to find so many people of this quality and with this much industry experience all together in such a small company, suggesting it's not going to stay this small for too long.

- Growing fast – mostly via acquisitions – and already cashflow positive because they avoid debt, issuing shares to raise capital for acquisitions instead of borrowing money.

- Good balance sheet, net cash, no debt, cashflow positive, heading towards statutory profitability.

- Young company that very few people have heard of or are following.

- Over half the shares are owned by the management and board as well as Andrew Forrest’s Tattarang Ventures and WAM Microcap (WMI, with 5%).

- Andrew Forrest has a good track record of backing winners and Tattarang own 19.7% of SWP.

- SWP have now come back from a $2.46 high (in September) to around $1.30/share, so they look like a more reasonable proposition at these levels.

05-Sep-2022: Update: Swoop is now down to 42.5 cents/share, despite a good FY22 (full year) report. Click here to view Swoop's FY22 full year results presentation. Uniti Group (UWL) has been bought out (acquired) and taken private, and WAM Microcap (WMI - and WAM Funds in general) have sold down or out of Swoop (SWP) in early August so they're no longer substantial shareholders (or possibly shareholders at all) so there have been some changes since I wrote all of that above.

Swoop have issued additional shares, mostly as part-payment for acquisitions, but also because of options that have been exercised and due to capital raisings (including a share purchase plan [SPP] in November), so a number of their management's and other substantial shareholder's (sub's) holdings have been diluted a bit now and so the percentages have changed. The following is the current percentages of shares owned by their management and their subs as at August 14th, 2022:

James Spencely, their Board Chairman and one of the main driving forces behind Swoop, owns 4.66% (~9.6m shares). Tony Grist (through Oaktone Nominees), Swoop's Deputy Chairman, owns 6.2% of Swoop (~12.8m shares). Paul Reid, another Director and another main driving force behind Swoop, owns 11.03% of Swoop (~22.7m shares). Matt Hollis (another director) owns around 3.8m Swoop shares (1.84%). Their 5th director, Jonathon Pearce, portfolio manager at the CVC Emerging Companies Fund and a Director of AI-Media (ASX:AIM), owns ~2.6m Swoop shares (1.3%). Between them the 5 Board members own just over 25% of the company.

Another Substantial Holder (sub) is N & J Enterprises (WA) Ltd, which is the trustee of the Van Namen Family Trust; Nick Van Namen was the co-founder of NodeOne (and N1 Wholesale) which was originally started in Geraldton, WA, and Nick was also a director and CTO (Chief Technology Officer) of NodeOne, which was acquired by Swoop - and Swoop shares were used as part of the settlement for that acquisition. N & J Enterprises (WA) Ltd own 6.36% of Swoop.

Swoop's largest shareholder is Tattarang Ventures, the private family investment company of Andrew (Twiggy) Forrest, best known for building up Fortescue Metals Group (FMG) from nothing to now be one of the 4 largest iron ore producers in the world, and Australia's third largest (behind BHP & RIO). Twiggy is also heavily involved in philanthropy and investments in food, land and a handful of start-ups, of which Swoop was one. If you add Tattarang Ventures' 16.25%, to the 25% of Swoop owned by their 5 board members, to the 6.36% owned by Nick Van Namen's N & J Enterprises (WA) Ltd, that's 47.6% of the company accounted for, as at mid-August 2022.

Swoop's latest takeover is of Moose Mobile - see here: Swoop-to-acquire-Moose-Mobile.pdf

No, not that one, this one...

https://moosemobile.com.au/

They are also buying back their own shares now (on-market for up to 43c/share so far) - as discussed here.

Disclosure: I hold Swoop shares both here and in real life.

Post a valuation or endorse another member's valuation.