I've already shared some analysis on the $PNV financial results in earlier Straws, which I do not repeat here. However, I commented earlier this week that David, Swami and Jan provided a lot of detail both in their voiceover on the presentation and also in the Q&A.

So, I thought I'd share the key nuggets I extracted from going back over the call and the transcript. In total, I think it provides a much richer picture of the strength of this business, and underscores my bullishness on it as a long term growth stock.

I'll bear all this in mind when I do my major valuation update at FY. There is a lot to consider.

So here goes.

--------------------------

My Overall Key Takeaway: Sustained, capital efficient, long-term growth, driven by existing and new markets, existing and new indications, and potential new platforms. $PNV is now profitable and cash generative.

Key messages

- Strategy and capital allocation - long term growth

- Financials - outperformed their internal budgets and plans

- Capex - material step up in FY25 to build "Mega" for $25m, but fully budgeted in 2022 capital raise

- Markets - now serving 37 markets with increasingly material RoW growing strongly

- Organisation - now built out, so future growth in headcount slowing

- Clinical development - clinicians leading broad expansion of indications; potential for multiple new platforms

1. Strategy and Capital Allocation

DW made clear the strategy is to keep expanding “both in indications and in geographies” wherever they can see the margins. He said this in clarifying feedback he has received on his statement that he doesn’t care about profits. The clarification is that by focusing on growth where he can see margins, then profits will follow. He tweaked his rhetoric by saying, “if you want dividends, you’ll need to sell some shares.”

2. Financials

All details covered in previous straws, but CFO Jan made the comment that they have achieved profitability earlier than budgeted because sales have been above plan

For example, the $8m month in November wasn’t budgeted until April

On cashflow, the business is essentially cashflow breakeven.

DW discussed reporting. He said there has been feedback on their approach of reporting "record sales months". He's discussed it with the Board, and they've decided to continue because they want to keep investors informed as key milestones are achieved.

3. Capex

On the new facilities, the main investment is yet to come

1H24 Capex of $1,1m was design work for facilities plus some R&D equipment

2H Capex “marginal increase in capex as the design process nears completion and we expect to commence construction in 1Q FY25.”

Total planned capex for the third “Mega” production line is $25m over two-year period

Guidance on the spend profile will be given once design is completed (FT24?)

Until new facilities are ready there are no issues with current manufacturing output form the existing two lines, which see continuous improvements in output and efficiency, evidence by the very low % Gross Margin.

Mega will be designed to be modular and scalable, as they plan to have to accommodate many more SKUs than at present.

(My note: Key risk to monitor: will procurement and construction costs increase materially since project first announced in end-22 when the design is complete and contracts let in FY25? A 25-50% cost blowout would not be unprecedented. While that would not be good, it is not really that material, overall.)

4. Revenue & Markets

RoW sales are becoming material "from 16% of total sales to 24%"

Now have sold product into 37 countries

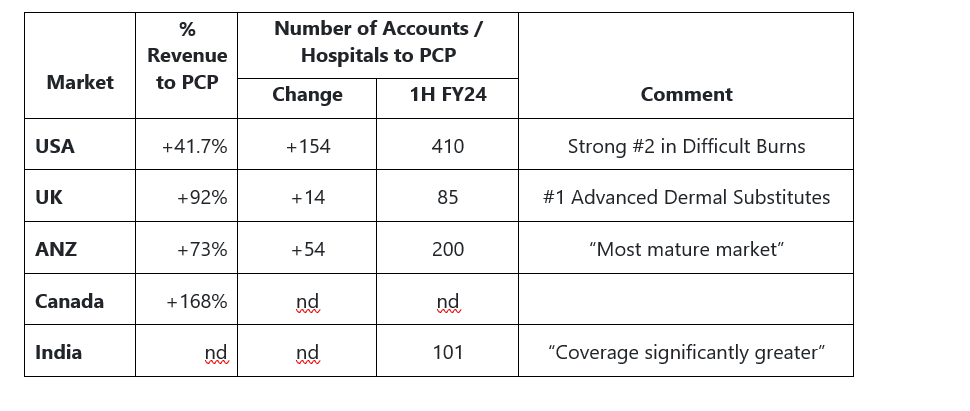

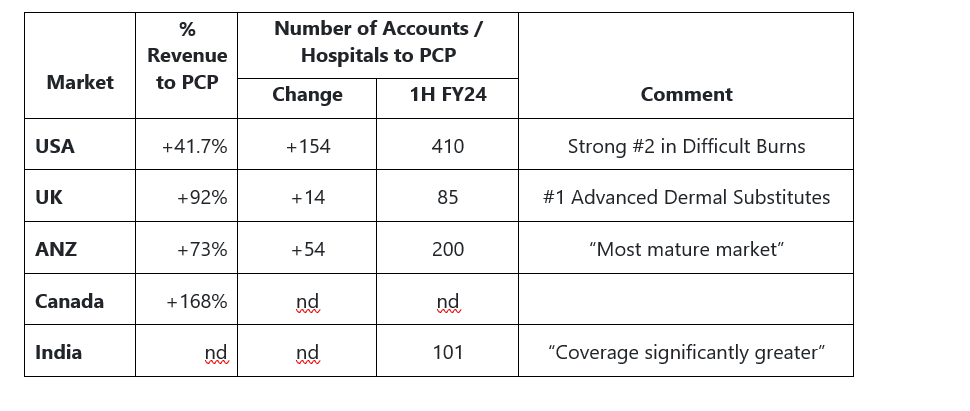

Key market details (not all presented but covered in voice-over):

After not having raised prices in US for several years, there is now an agreed approach for price revisions

In the US, “narrowing the gap” to the market leader in the “difficult burns” category

BARDA trial now 91 patients enrolled; 1st patient enrolled in India (2 centres approved). Looking at options with FDA and BARDA. Base option is to get to 120. Enrolment expected to be complete by May. There will be announcement when it is decided how to close out the trial to a meaningful close. Also working with another FDA agency to see how “real world” data can be sed to give added claims into the trial.

Strong growth in ANZ where already #1 in burns is largely outside of burns

India – “half a dozen tenders” under way. “Getting good soundings.” “Very optimistic that in the very near term we’ll have something to say.”

HK also continues to “trade well”. China – pathway identified, but not yet going beyond HK. Developing plans for extending into Shenzen area (GBA).

Germany: market leader in “Advanced Dermal Substitutes” (4th largest market after US/UK/ANZ – note: Ger. is a distributor market)

Turkey – large initial sales

Middle East – sales driven by a physician who relocated to ME from East Coast US and wanted the product

Japan – have a partner defined and a lead KOL. Working to see if data already submitted to US FDA can be used for submission in Japan with MoH, KOLs and reimbursement agencies.

New demand arising from war zones in Ukraine ($1.2m sale in February - not 1H; “we believe another coming”) and Israel. They believe they are getting some sales orders from other countries that are ending up in these locations, as well as charities.

Several ongoing discussions with charities, UN agencies, Gates Foundation, WHO, MSF, etc. to help get the product to countries that otherwise can’t afford it.

5. Organisation

Headcount +64 on PCP, but only +19 in 1H FY24

Plan for 2H FY24 from 237 to 260 +(23-25)

- US sales: currently 75 (65 reps + 10 managers) going up to 85

- ANZ sales

- R&D and Manufacturing

- Back Office: now have the full teams and scalability

Completing the build-out of the senior management team

- HR lead has started in last few weeks

- Chief Medical Officer joining – leading on FDA and BARDA conversations

- General Counsel about to be appointed

- Close to appointing APAC lead, for entry to China and Japan, and other countries

6. Clinical Developments

My key takeaway: It is clear here is the potential for many years of development leading to new platforms and multiple groups of new indications. Most of this is clinican led.

A key observation is just how important the customer-led (clinicians) work is. (My Note: Just reflect on the following points and consider the tiny R&D budget. I don’t think I’ve ever seen this before in healthcare. There is so much upside to come.)

DFU study: stopped after 25 patients because not getting right wound debridement. Protocol to be re-written and brought back in-hospital (rather than outpatients) to get great consistency needed for a successful trial. Expecting to focus more on to limb salvage – new trial, Announcement on trials coming in a few weeks

Prof Marcus Wagstaff trained 30 surgeons in UK who then took the knowledge onwards to Ukraine

Much clinician-led development taking place into new indications; 230+ publications (214 at FY23), “literally across the entire clinical spectrum”

Customers proposing BTM could be a replacement for allografts (papers on this). Potential to upshift and replace grafts

Several authors proposing that BTM could be a good solution in low and middle income countries where other technologies are constrained

Overall global markets outside US and W. Europe and a few market in APAC “on the fringes” (hey! Swami, that’s no way to talk about ANZ) – we are focused on sustainable, global growth

MTX rolling out in US – demonstrating great outcomes in open abdominal and dehisced wounds. Will start compiling evidence to allow MTX to be rolled out globally. Focus has been using MTX with “expert clinicians” on complex applications, and expecting wider roll-out from July.

Working to be differentiated in connecting KOLs across the world who can teach other surgeons in how to treat acute complex wounds.

$PNV already recognised in burns and trauma, and now looking to go beyond these into:

- Oncological resections of head, neck, scalp, skin and oral cancer

- Potential to use in infections (necrotizing fasciitis and hidradentis) where competitor products cannot deliver

- Getting into complex vascular space to save limbs from being amputated

Developing an implantable platform in hernia and breast. Still not happy to share timelines, but happy with the feedback getting from clinicians. Addressing how to build a “sustainable platform in the implantable space”. (Sounds like still some time off, but I still think this is OK given the growth potential of BTM and MTX)

Working on developing Novosorb Mesh product, currently bench testing, testing with animals, and sharing it with clinicians to establish their expectations on added strength and flexibility. Work is being done to compare with the market leader.

Disc: Held in RL and SM