Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

It seems the market prefers knowhow over fanfare!

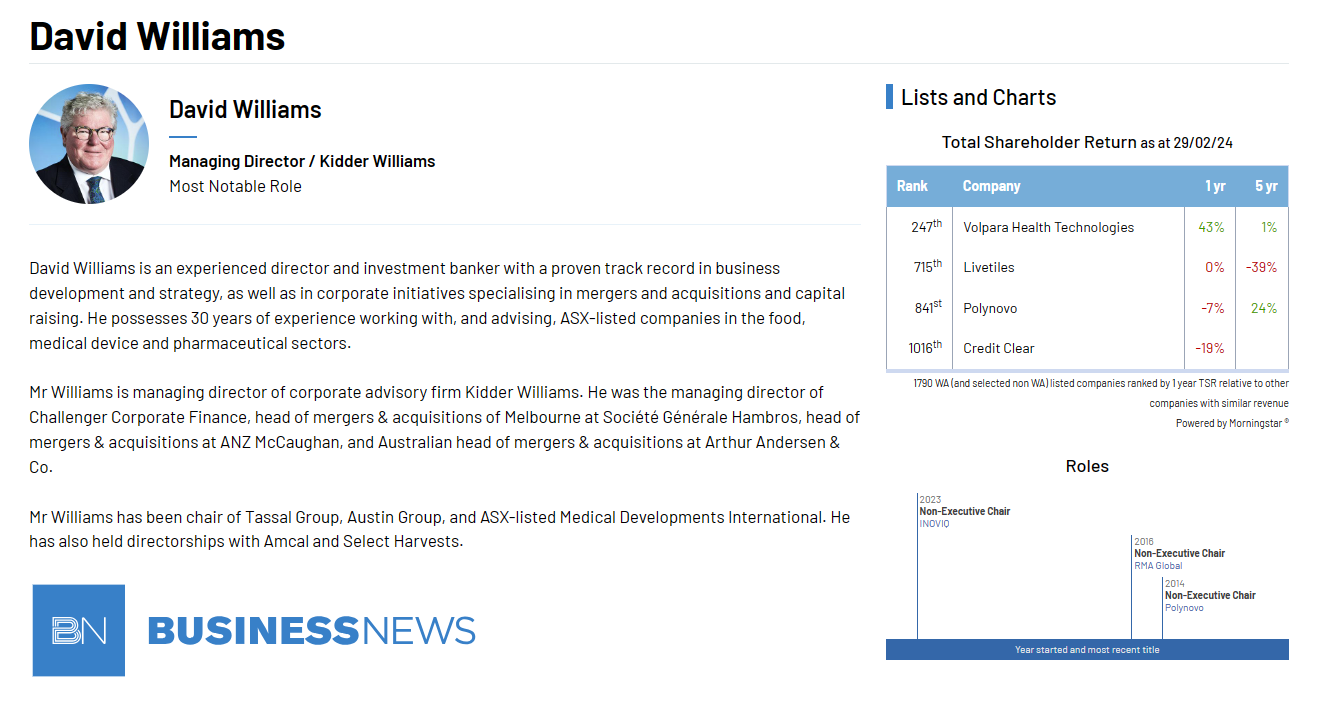

Resignation of Chair

PolyNovo Limited (ASX: PNV) (PolyNovo or Company) today announces that its Chairman, Mr David Williams, has resigned from the Board with immediate effect.

Mr Williams will not stand for re-election at the upcoming Annual General Meeting and the resolution for his re-election is withdrawn.

The Board has appointed current Non-Executive Director Mr Leon Hoare as Chair. Leon brings very strongly aligned industry knowledge acquired over 30+ years in executive roles and extensive leadership experience in wound management and related medical technology sectors. Leon also has extensive PolyNovo board experience, which in turn will support the new CEO, who commences in December. Leon’s appointment is timely as he will be stepping down from his current executive role at the end of December.

This development, together with the appointment of Rob Douglas to the PolyNovo Board, follows PolyNovo’s previously announced board succession plans and governance review, in line with the Company’s ongoing commitment to board renewal.

PolyNovo’s Board acknowledges Mr Williams' significant contributions and leadership during his tenure. Chair, Mr Leon Hoare commented: "On behalf of the Board and shareholders, I would like to thank David for his 11 years of dedicated service as Chair. Under David’s leadership, PolyNovo evolved from an early-stage medical device venture to a global medical technology company. The Company achieved record growth in sales and expanded its presence to 46 countries, delivering innovative wound care solutions to patients worldwide.”

Mr David Williams said: "It has been a privilege to serve as Chair of PolyNovo. I am extremely proud of what we have accomplished, especially the number of lives we have changed and saved. I am very pleased with PolyNovo’s new CEO; Bruce Peatey, new director Rob Douglas, and new Chair Leon Hoare.

There’s a bit of excitement in the market today on the back of PNV’s Q1 FY26 Trading Results announced yesterday. Evan’s & Partners have now rated PNV as a Speculative Buy with a $2.65 price target. Macquarie retained its Outperform rating and the $2.00 price target. Overall, I’m quite happy to hold the business. If revenue continues to grow at this rate it might look cheap in a year from now! I am expecting earnings growth and ROE to be both around 25% going forward. It currently holds more cash than it has debt, so it’s starting look like a reasonable investment again!

Trading Results Q1 FY26 (unaudited)

PolyNovo Limited is pleased to provide unaudited trading results for Q1 FY26.

- Q1 FY26 Group sales were A$34.7m up 33.3% on STLY of A$26.0m

- U.S. sales were A$27.4m up 33.4% on STLY of A$20.5m

- Rest of World sales were A$7.3m, up 33.1% on STLY of A$5.5m.

- NovoSorb MTX sales of A$2.9m up 174.8% on STLY A$1.1m

- Strong collections from U.S. customers, with days sales outstanding (DSO) averaging 61 in Q1FY26 down from 95 DSO in March 2025.

- The new R&D Innovation Centre is complete and operational, and capex is finished.

- Building works of the new manufacturing facility are now complete with circa A$2.5m in capital expenditure required to make operational.

- Q1 FY26 was EBITDA positive and cash on hand on 30 September 2025 was A$23.2m.

Chairman, David Williams said: “There is a lot to like and be proud of in the continued growth in sales, hospitals supplied, patients treated, countries supplied and surgeon engagement. Beyond these indications of continued growth, the real excitement for me is in:

• The near-term possibility of moving into the U.S. outpatient market and supporting plastic surgeons, podiatrists and home care. Proposed changes to U.S. pricing in CY26 will reinforce our market opportunity. Our new CEO and Board Director will add strength to that push.

• NovoSorb MTX has had tremendous growth off a low base, but our team are very bullish on the prospects in the U.S. and the rest of the world.

• I have observed before the slow start to sales in places like the United Kingdom but then followed by a ramp in sales. It is very exciting to see in Q1 FY26 that ramp in countries like Turkey up 97%, Germany 269% and Canada 63%

Held IRL & SM

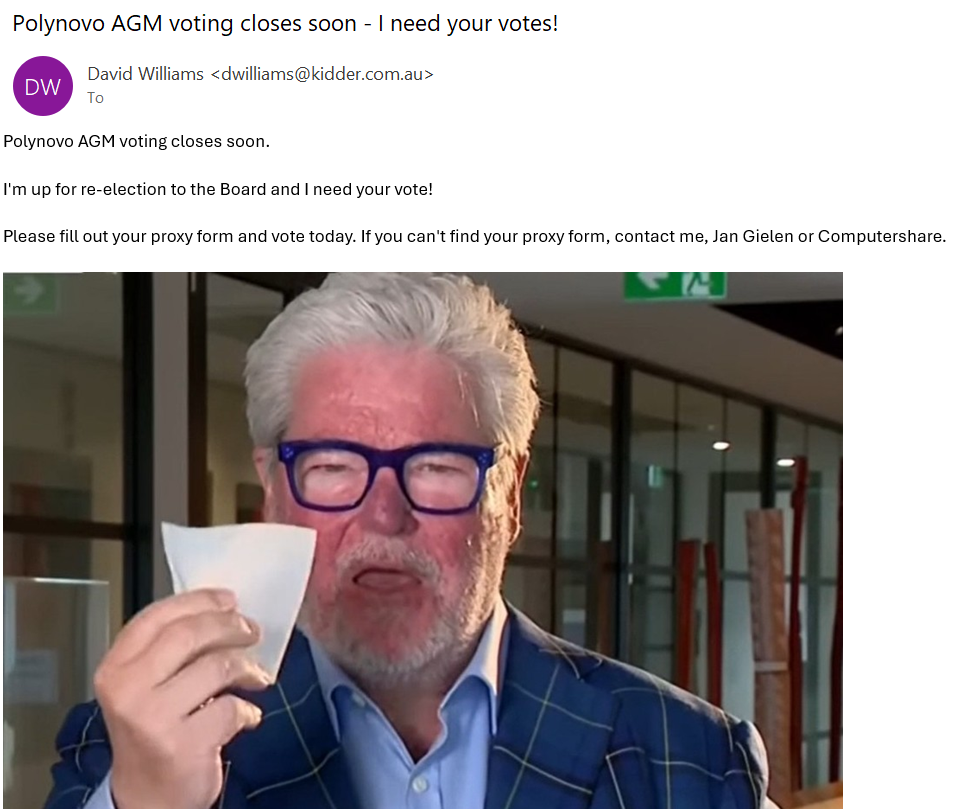

You would think David would be able to find a more flattering picture.

Maybe not.

Today I've undertaken a quick deep-dive (if there is such a thing) into Friday's announcement from $PNV on the application of Novosorb BTM in the treatment of diabetic food wounds (DFW).

This is a readout of a quick, initial scan to understand how excited I should be about findings.

TLDR: there is something here to consider, but I'm not in a rush to act.

I've investigated the following questions.

- How significant is the clinical result?

- How large is the market opportunity (starting with the US)?

- What other treatments are already serving this market?

- How might $PNV access the opportunity in the US?

- What's my overall view / implications for value?

1. How significant is the clinical result?

The acceleration in the time for the wound to heal is very significant: 191 days for BTM vs. 319 days for the SoC.

The ultimate improvement in outcomes is not statistically significant: 12 month healing rate of 66.7%for BTM+SoC vs. 56.5% for SoC but only with a p=0.48. Which means the results are barely distinguishable. i.e., a failed endpoint, were this a registration trial.

There was no significant difference observed in 12-month amputation rates.

So this looks promising, but it is important to understand that while the SoC is negative pressure wound therapy (NPWT) only, clinical practice in the US is already using a large number of alternative dermal substitutes with NPWT. So while the trial looks promising against the SoC, the industry has already largely moved beyond the SoC.

And here's the problem: I can find little if any evidence of clinical trials for these wounds pitting SoC alone against SoC + ny other dermal substitutes.

If fact, the whole field of how the various treatments have achieved their registrations and reimbursement codes is somewhat of a mystery to me and require further investigation. But that's for another day.

2. How large is the market opportunity (starting with the US)?

The overall DFW market is huge, and the segment of interest being post-surgical diabetes related neuropathic/neuroischimc wounds is anywhere from US$1.0 - US$2,5bn per year.

Importantly, the proportion of this market attributable to dermal substitutes appears to be in the order of US$0.3bn to $1.0bn p.a. (Sorry for the wide range, but the calculation combines varied factors, ranges and estimates)

3. What treatments are already serving this market?

In short, a lot. And more than I was expecting when I started the research.

I have (with support from my trusty BA) identifed no fewer than 23 existing dermal substitutes with relevant reimbursement codes, using a wide range of technologies including Novosorb BTM.

What? Novosorb BTM is already on the list? The answer is yes. And the reason is that many of the products appear to be being used in DFW using a more general registration code, and not exclusively a DFW code (or codes, as there are several procedures). That explains why Novosorb BTM is already being used, as it is being used under its more general registration for complex wounds.

How can this be, Well, some of the Novosorb super-users are general surgeons or trauma specialists, and they do sometimes treat DFW. So it is natural that they would give it a go. This is also consistent with the legion stories we've heard from David and recently departed Swami about "surgeon-led innovation".

The point is, it currently depends on surgeon initiative. $PNV reps. can't go in and say "Use this", "here's the evidence", "here's the reimbursement code", "order here". The trial is a step to changing that.

4. How might $PNV access the opportunity in the US?

It seems that much or even most of the DFW treatment is performed in the US by specialist Podiatric Surgeons. (DW has spoken about this repeatedly over the years).

The bad news for $PNV is that I think the burns, trauma and general surgeons in the locations which are BTM super-users perform a relatively small proportion of DFW treatment. Indeed, a large amount of the care is in outpatient settings. (Again DW has spoken about this before.)

I imagine (I don't know) that this means there will be only a limited overlap with the existing relationships and accounts for the salesforce. Resources will have to be reallocated or added, and new relationships built.

But importantly, many of these HCPs will have their existing preferred treatment methods, and will rely both on clinical evidence and economics to switch.

Now DW's most recent messaging on the costs of treatment starts to make sense. BTM is a relatively cheap product compared with many dermal substitutes, and has extremely high gross margins.

Therefore, I think if they can get the clinical evidence lined up, they could mount an assault on this market. But it will take condierable effort and time.

5. What's my overall view / implications for value?

I don't think attacking the DFW market in the US is going to be a quick process for $PNV.

By the looks of it, while the time-to-heal measure is good comapred with SoC, we don't know how it compares with other dermal substitutes. So it is not clear to me how $PNV can persuade a rusted-on podiatric surgeon to switch from their current practice.

The sales force will have to be augmented or retooled to go after this segment. That won't be quick.

The space already appears to be crowded with a vast array of choices for surgeons.

If you pushed me, I'd say that over 5-7 years, they might claw their way to a 10% market share in this segment, which could be anywhere from $US30 to US$100m incremental sales, as a BULL CASE.

That compares with FY25 US BTM sales of around US$57m sales, so it is a material opportunity and it has the potential to extend the growth runway in the US market.

Final Comments

These are very rough, back of fag packet calculations. For example, if existing practices are locked in, accessing practitioners is difficult, and the clinical data is judged not to be compelling or significantly differentiated to what the surgeons think they are already achieving, then maybe $PNV fights to get 5% or goes harder on price to get a bigger share. In that case it might not amount to very much ... maybe $US15m to US$50m p.a. incremental revenue in 5-7 years.

Alternatively, if the clinical data is built on over time and is strong, and it plays into a weak comparison set, and if US opinion leaders embrace the treatment, and if $PNV executes an effective sales strategy (perhaps partnering with a leading distributor in the podiatric market), them maybe they can get a bigger share, faster, pushing closer to US$100m p.a. in 5-7 years.

But there are a lot of "ifs" to get to that number.

It is impossible for me to be more definitive from this quick look. But I think I have sketched some bookends to think about. For sure, this looks interesting and seems to be an opportunity that DW and his team will be applying themselves to.

But I think there are a lot of both clincal and execution questions, so based on what I've learned, I'm not getting overly excited about it, just yet. It is clear that this is a competitive market with many treatment alternatives. Many more than I realised at the start of today.

Keen on the views of others who follow this sector.

Disc: Not held (yet)

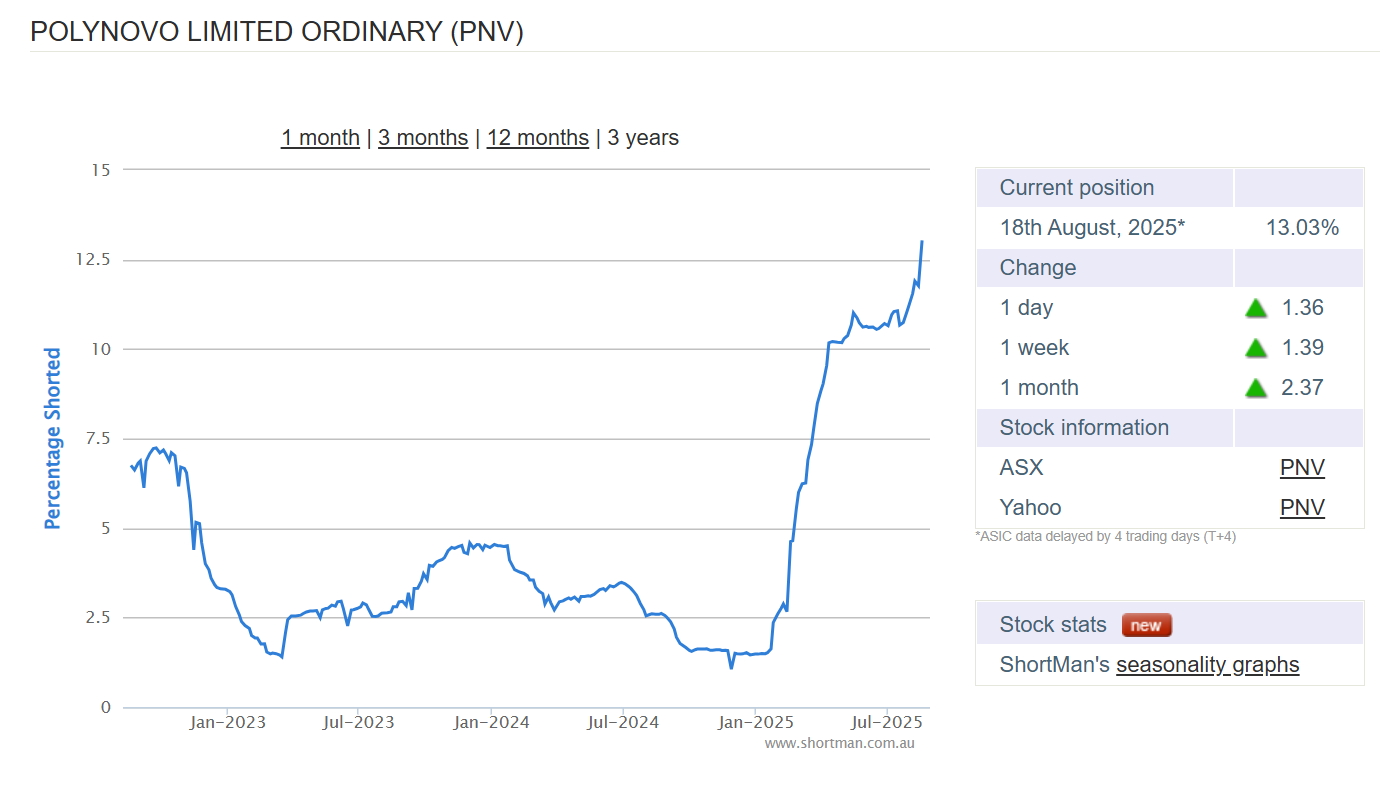

DW third day in a row buying shares on market. Is this history repeating itself? With over 12% of PNV held short and PNV dropping out of the asx 200 could another short squeeze be on the cards?

Very tempted to buy as this may run quite quickly. A few good news announcements would help.

David Williams and Leon Hoare have both bought shares in the last few days, with Mr Williams getting a another quick buy in this morning before a "pause in trading"

Trading in the securities of the entity will be temporarily paused

pending a further announcement.

Trading in the securities of Polynovo Limited (‘PNV’) will be halted at the request of PNV, pending the release of an announcement by PNV.

Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of:

• the commencement of normal trading on Wednesday, 3 September 2025; or

• the release of the announcement to the market.

The halt in trading was requested by PNV to address press speculation, as written in The Australian on 31 August 2025 article titled “Aussie medtech’s unlikely boost from RFK health crackdown, of a positive change in U.S. reimbursement of outpatient wound care.

I asked ChatGPT for some insight into the RFK health crackdown and what it means for Polynovo. Here is the summary:

Summary: RFK Crackdown → Upside for PolyNovo?

- RFK Jr.’s crackdown: Aggressive regulatory and budget reforms in healthcare and food industries—reformulating reimbursement models and tightening FDA oversight.

- PolyNovo’s advantage: A lean, lower-cost product that may become more competitive under CMS’s flat-fee scheme, increasing its attractiveness to U.S. outpatient clinics.

- Current footnote: PolyNovo has paused trading pending a company response to media coverage.

How PolyNovo Fits In (and Potential Benefits)

- Medtech Opportunity: The U.S. Centers for Medicare & Medicaid Services (CMS) is proposing a shift in reimbursement for outpatient wound care—from percentage-based pricing to a flat fee of USD 806 per square inch starting January. That’s a move meant to cap expenses currently reaching up to USD 2000 per square inch.

PolyNovo’s Position:

- Its NovoSorb artificial skin costs are understood to be well below USD 806, even factoring in a possible 10% tariff on Australian-made products.

With the FY25 results for $PNV due this afternoon, it is interesting to note the short position (below).

3-year high - while the SP languished at $1.10.

Could be interesting.

Disc: Not held

July 2025

$1.75 ($1.27 - $2.20)

A further update to my $PNV valuation, following the trading statement released after the close today.

I've rerun my model, by just putting in a series of more modest revenue growth rates (which appear to have stabilised somewhat H2 over H1).

NOTE: this is not a complete re-rerun of the valuation, but it is a better estimate than my January edition, which was too optimistic on revenu growth and which I therefore want to "correct".

BIG HEALTH WARNING: I need to look at the FY financials when these are available in a few weeks.

That said, DW's forecast for EBITDA of $11.2 - $12.4m is eerily in line with my central case ($11.7m) - but remember, even a broken clock is exactly right twice every day! The cash part of my model for FY25 isn't so good, so something ain't quite right.

Disc: Not held - staying on the sidelines until I can see the full picture.

Disc: Not held - staying on the sidelines until I can see the full picture.

January 2025

$2.20 ($2.00-$2.50)

This is a placeholder following 1H FY25 revenue report, which appears to take higher value scenarios off the table.

This is a rough estimate because cost structure can make all the difference so will update after the full financials are in.

August 2024

$2.60 Range = ($2.30 - $3.50)

Full model rebuild following FY24 results. Results of valuation broadly in-line with previous modelling - just a simpler model, which will be easier to update in future.

In FY24 $PNV passed through the profitability inflection - so you can still get pretty much any valuation you want, depending on what you believe.

Lot's of upside not captured in this range, but the downside is better characterised.

See today's straw "Valuation" for further details, assumptions and outputs (27/8/24).

----------------------------

February 2024

Manual adjustment by +5% to reflect growing evidence of capital discipline, as revenue growth strongly outstripping cost growth.

(January's improvement accounted for revenue numbers).

Full update after FY results in August.

----------------------------

January 2024

Raised from $2.00 to $2.12

Quick valuation update following 1H FY24 Trading Update.

Overall, tracking in line with my expected valuation.

-------------------------------

September 2023

Value $2.00 Range [$1.63 - $3.30]

See Valuation Straw for details

-------------------------------

September 2022

Value $2.46 (Bull $3.28, Bear $1.63)

This updated valuation replaces my earlier valuation from a year ago of $3.62 ($2.50 - $4.25). I make a comparison of the two valuations at the end of this note.

Detailed 10-year DCF developed to understand sensitivities and key value drivers.

MAJOR HEALTH WARNING – you can get pretty much any result you want in DCF modelling. Therefore, in each year key metrics of sales growth, and key metrics (employee expense, R&D, Overhead, investment) and resulting EBITDA, EV, p/e and EV/EBITDA have been extracted and are tabulated below.

The estimate is driven by the following key assumptions, which are constant across BULL and BEAR scenarios.

Key Assumptions - Common to Both Scenarios

1. Sales and Marketing

Modelled sales are driven by growth of the global sales and marketing (S&M) organisation starting in USA, ANZ, UK&I and Canada (“Initial direct markets” or IDMs)

Sales per S&M Employee reach an “Experienced Average” after two years, with ramp up to “Experienced Average” of: 0% in 0-6 months; 25% in 6-12m and 75% over 12-24m. This has been modelled by data on headcount and sales over the last three years and extrapolating various statement from DW and management on investor calls over the last 2 years. The model will continue to be calibrated over time. (Note: Aroa CEO has said that the ramp-up takes 3 years. This is a sensitivity to be tested.)

The current average sales per “Experienced Average” S&M employee is $1.0m p.a. (Note: This doesn’t history match to the data for 2020, 2021 and 2022 because of access issues during COVID19. Results in FY23 will be the first test in a "clean year".)

S&M build-out extends to Europe, China, JKT, India, Middle East in FY23/24/25

Ultimate growth of sales teams by 2032 in IDM markets is tested by an assessment of number of large hospitals and burn units in each market, to ensure number of accounts per territory at maturity does not fall below 6. i.e., the model explicity tests that it does not over-saturate the market with S&M staff.

As indications extend from burns to wound care and onwards to reconstruction, the amount of work per account will increase.

Sales and marketing footprint in 2032 has 53% of sales force in IDMs, 24% in continental Europe and only 14% in JKT and China. Clearly, there is scope for significant upside, particularly towards the end of the decade.

By 2032 the global S&M organisation comprises c. 500FTE, about 55% of the total workforce, which is not very different from the mix today.

2. R&D expense grows y-o-y. However, as a % of revenue, non-employee R&D expense falls as a % of rapidly growing sales from 14% in 2022 to 7.5% in 2026. It is then maintained at a constant 7.5% of revenue. Total R&D expense (including employee costs) is estimated to reach 15% of revenue based on benchmarks, assuming a 50:50 employee:non-employee split.

3. Investment in Facilities: Investment in facilities is assumed to resume at a constant 5% of revenue per annum. In practice, it is likely to be much lower during FY23/FY24, but eventually additional facilities for growing sales and growing product variants will be required.

4. Corporate, Overheads and Other Expenses: Operating leverage means these fall as a % of revenue from 25% in FY22 to 10% in FY32. They are assumed to scale at 60% of the rate of revenue growth each year. (They were lagely flat from FY21 to FY22, but this cannot be sustained, and is considered to be as a result of resource discipline to avoid a capital raising.)

5. Other assumptions

- Effective cash profit tax rate of 25%

- Discount rate 10%

- Inflation 2.5%

- No debt. (Modest gearing will deliver further upside to valuation)

Key Assumptions - Scenarios-specific

Product uptake

A key uncertainty once accounts are established is the organic growth within an account as surgeons use the product across a wider range of indications, and as new products are added to the portfolio in the longer term (Note: this is not "blue sky" as they already exist). Rather than model different indications and applications (e.g., diabetic foot ulcer), a generic factor is applied to the average sales per account to model this growth. Annual in-account growth modelled is:

- +5% p.a. Bull Case (+62% compounded to 2032)

- +3% p.a. Bear Case (+34% compounded to 2032)

These numbers appear conservative given the statement by Max Johnston in the FY22 Results call that accounts existing at the start of the year saw on average of 88% growth. Clearly, this level of growth represents an adoption curve that must flatten off. In any event, the modelled scenarios are likely highly conservative. However, it is equally important not to double-count the two-year learning curve for the sales and marketing team effectiveness.

The combine effects of i) sales and marketing effectiveness and ii) in-account growth (use, indications, products) means that the average annal sales per S&M employee grows from $0.80m in 2024 to $1.34m in 2032, expressed in $2022 for compariso (Bull Case)n. This is reasonable in that the top performers are already achieving $2m p.a. and recognises that within any salesforce there is a wide range of productivities per employee.

Margins

$PNV currently reported continued improvement of gross margins to 95%, assisted by high volumes and increased plant utilisation.

It is hard to make reasonable assumptions for margins into the future, however the following are considered:

- As product development continues, the product portfolio will become increasingly complex lowering GM

- As the sales mix broadens to include more sales outside North America, averaged realised prices will fall

- As synthetic and biologics continue to displace traditional therapies, product-to-product competition will increase

- Attractive margins and expiring patents will lead to entry of alternatives

- Increasing market footprint will require higher inventories

- It may be more challenging to execute a direct sales model and deals via distributors have lower margins.

Over the modelled period margins are assumed to decline by 0.5% p.a. every year in both the Bull and the Bear case, driven by different factors. In the Bull case, cost of complexity and market mix are the dominant factors. In the Bear Case, greater reliance of distributors and competition are the major factor.

Market Penetration – sense-checking model outputs

2032 sales of almost $900m are sense-checked against 2020 figures on TAM and growth provided by $PNV for dermal repair, reconstruction, and hernia markets. Assuming lower market CAGRs of 7.5% than those projected by $PNV to provide a significant margin of safety, the project Bull Case modelled sales represent the following market shares: dermal scaffold 15%, reconstructions 3%, hernia 2%, with correspondingly lower shares in the Bear Case. There is a significant upside if synthetic implants become the standard of care displacing both traditional methods and biologics. Neither are assumed in the Bull Case. Drug elution remains a blue sky upside, as significant sales from this are unlikely to arise during the period modelled given longer regulatory approval timeframes, and are account for in part by the growth rate in the Continuing Value period (See below).

Continuing Value Growth Assumptions

Both Bull and Bear scenarios assume that $PNV continues to establish itself as a leading, global wound care company, continuing to invest in innovation to drive growth beyond 2032. Continuing period growth assumptions are a significant drivers of valuation. The two modelled assumptions are:

- Bull Case: 7% p.a. growth ahead of growth in global healthcare, given by continuing market penetration outside developed markets, with new products driving penetration of the reconstruction and drug elution markets

- Bear Case: 5% p.a. growth in line with mature, leading healthcare companies. $PNV like remains focused on dermal treatments. (Limited success in reconstructive surgeries and drig elution).

Conclusions

The Bull and Bear cases are both intended to represent reasonably probable cases given everything we know today.

On the downside, major mis-steps such as a botched acquisition, product quality issues or emergence of a new, superior technology are not considered.

Equally, on the upside there is ample room for stronger growth cases. For example, Swami is looking for a bolt-on acquisition that put 100 people on the ground with access to the US podiatric surgery market. If acquired at a reasonable multiple, the revenue synergies could be material over a few years.

Some key indicators to be tracked over the next 2 years, to update the model mechanisms include:

- Gross margin evolution

- Build out of sales and market organisation

- Account growth and $ sales per S&M employee, esp. in USA

- Mix of direct to indirect S&M models (The Canada experience is key)

- Market share (Continue to track Integra and Aroa)

- FDA approvals for new indications; progress of clinical trials; publications

- Evidence of trajectory in most mature markets (ANZ)

Comparison to the last valuation

The major difference between the current valuation and prior model, is that the latest model explicitly recognises the challenges of building out a global S&M organisation. This is now considered the key value driver, particularly given the sluggish growth achieved in Europe via the distributor model. More generally, growth assumptions have been toned down by explicitly considering more of the factors that can slow progress - arguably better representing real life!

Disclaimer:

This is not financial advice. Modelling is for author's personal use only and illustrates hypothetical scenarios. No undertaking is given that model is free of errors. Do not use as the basis for investment decisions.

We are still holding Polynovo shares IRL and feeling a little pain with our shares down 15%. However, if Macquarie’s target price is anything to go by, we shouldn’t be too concerned at all!

Macquarie is forecasting 2H25 revenue of $71.7m, and will be looking for management commentary regarding its BARDA trial and performance of its new MTX product when it releases its upcoming results.

Macquarie currently has a 1 year price target of $2.80 on Polynovo shares suggesting a 130% upside over the next 12 months (https://www.fool.com.au/2025/07/21/broker-tips-these-3-asx-small-cap-healthcare-stocks-to-rise-56-79-and-130/).

Macquarie is much more bullish than most analysts with the 1 year price target consensus from 9 analysts on Simply Wall Street at $2.02. Analysts are forecasting EPS growth of 33% and ROE of 23% over the next 3 years.

Held IRL and SM

$PNV's requested a halt as it is about to announce a "significant collaboration" with beta-cell technologies in Europe.

I'm assuming this could be a drug elution product that would use Novosorb as some kind of implant/drug elution carrier to use in concert with one of Betacells drugs? Drug elution technologies were always in prospect at $PNV, but we haven't heard much about it for a while.

Despite the trading haly, I am assuming that this would have to be proven through a full clinical trial program. My assumption is that it is early stage. But I am only guessing here.

There's nothing I can see on their latest pipeline chart (below from Macquarie Conference)

Polynovo ($PNV) announcing this morning that CEO Swami Raote will be finishing up in June but stepping down immediately.

Obviously discussions between the Board (specifically David Williams) and Swami didn't go well.

Very odd announcement, entitled a repsonse to an article in The Australian, rather than what it appears to be .... CEO Swami's intended resignation, at the request of the Board (DW?).

Very odd indeed.

The language makes it clear that agreement on the separation has not yet been reached. So is the announcement a device to force the end?

As some of us have speculated here, given the rapid fall in growth rate including the lack lustre progress in India, it was looking increasingly likely that Swami's incentives are likely out of the money, and that his retention was also a potential issue. Now it looks like that rather than jumping, he is being pushed.

Margin call gave a different lens on this issue, focusing on the behaviour of Chairman David Williams.

Whatever the reality and the truth, it appears all is not well with management and the Board at $PNV.

Disc: Not held

https://investorpa.com/announcement-pdf/20250307/111468.pdf

7 March 2025

ASX Announcement

Response to article in 'Margin Call'

PolyNovo Limited (ASX: PNV) refers to the article in this morning's 'Margin Call' column in The

Australian newspaper.

PNV confirms that on Friday last week there was a confidential discussion with the Chief Executive

Officer, Mr Swami Raote, requesting his agreement to cease his employment with PNV effective

June 2025 at the end of his contractual notice period and to step down as Chief Executive Officer

effective from an earlier date. The discussion proposed terms for his separation if agreement was

reached and revealed that non-executive director, Dr Robyn Elliott, would be stepping into the role

as Acting Chief Executive Officer pending the appointment of a permanent replacement.

This announcement has been authorised by the Board of PolyNovo Limited.

About PolyNovo®

$PNV published their HY result, with the call starting in 3 minutes.

A few quick observations from me, not going over old ground that we've covered here before:

- Expense control OK, with Opex up +15.4% cf. Revenue +22.8%

- Operating Cashflow strongly negative .... why is this?

- Modest NPAT increase up to $3.338m compared with $2.694m in PCP

- New products still at the pre-clinical phase, with R&D spending modest

- New facilities on track.

Overall impression - nothing here causing me regret on my exit decision. I still think its trajectory has slowed too quickly for this to represent a compelling investment proposition. I don't have a view on fair value based on these numbers. But my model is shot, as is my thesis.

Here's a complete summary courtesy of my BA ChatGPT (I've had a quick look - it seems OK, but I've not vetted it in detail, so beware!)

PolyNovo 1H FY25 Performance Summary (Compared to 1H FY24)

Summary

PolyNovo delivered a strong first-half FY25 performance, marked by record sales, improved profitability, and strategic advancements in product development and market expansion. While operating cash flow turned negative due to increased investment in growth, the company remains well-funded, with A$30.5 million in cash reserves. With continued investments in manufacturing, R&D, and clinical trials, PolyNovo is positioning itself for sustained long-term growth.

Financial Highlights

- Total Sales: A$54.1 million, up 28.1% from A$42.2 million in 1H FY24.

- Total Revenue (Including BARDA): A$59.9 million, up 22.8% from A$48.8 million.

- Net Profit After Tax (NPAT): A$3.3 million, an increase of 23.9% from A$2.7 million.

- U.S. Sales: A$41.2 million, up 27.9% from A$32.2 million.

- Rest of the World (ROW) Sales: A$12.9 million, up 28.6% from A$10.0 million.

Cash Flow Highlights

- Net Operating Cash Flow: -A$12.5 million, compared to A$0.6 million positive in 1H FY24.

- This reflects increased payments to suppliers and employees (A$63.9 million vs. A$45.3 million in 1H FY24).

- Receipts from customers: A$44.3 million, up from A$41.1 million.

- Receipts from BARDA reimbursements: A$7.3 million, up from A$5.1 million.

- Net Investing Cash Flow: -A$4.5 million, compared to -A$0.5 million in 1H FY24.

- Driven by increased capital expenditure of A$5.1 million (up 361.2% from A$1.1 million) for R&D and new facilities.

- Net Financing Cash Flow: -A$2.2 million, compared to -A$1.4 million in 1H FY24.

- Repayment of borrowings (A$1.9 million) and lease liabilities.

- Cash & Cash Equivalents (End of Period): A$30.5 million, down from A$45.9 million at June 2024.

- Key Driver: Increased investments in infrastructure, R&D, and sales expansion.

Operational and Strategic Developments

- NovoSorb MTX Launch: Achieved A$2.1 million in sales following a successful U.S. launch in Q4 2024.

- Pipeline Expansion: Introduced new sizes and thicknesses for NovoSorb BTM and NovoSorb MTX.

- Hernia Repair & Plastic Mesh Development: Pre-clinical stage initiated for new medical applications.

- Full-Thickness Burns Clinical Trial (BARDA Supported): Achieved enrollment of 120 patients, paving the way for FDA engagement on potential paediatric burn treatment.

- Manufacturing Expansion: Construction commenced for a new facility in Port Melbourne (Operational by December 2025).

- Innovation Centre: Finalised design, with opening planned for June 2025.

Key Financial Metrics

- BARDA Revenue: A$5.4 million, up 10.2% from A$4.9 million.

- Capital Expenditure: A$5.1 million, up 361.2% from A$1.1 million, reflecting investment in R&D and infrastructure.

- Research & Development (R&D) Expenditure: A$5.1 million, up 3.8% from A$4.9 million.

- Employee Growth: Workforce increased to 282 employees, up 19.0% from 237 in 1H FY24.

Market & Growth Strategy

- Market Penetration: Focus on expanding U.S. market share, taking business from established competitors.

- Rest of World Growth: Increased procedure and market development efforts in Europe, the UK, and Ireland.

- Innovation & Expansion: Developing solutions for trauma, reconstructive surgery, and general surgical applications.

Disc: Not Held

A good friend of mine is a plastic surgeon in Sydney and I asked them if they had used PolyNovo's NovoSorb.

They said:

"Have extensive experience

Only works 50% of the Time

So sometimes a get out of jail card

But frequently disappointed so not the magic bullet that will revolutionise recon.

I wouldn't invest if that's what you're asking"

Poynovo (ASX:PNV) announced to the market that it had a record monthly sales of $A10.1m (unaudited) for November 2024.

Highlights:

• The U.S. business grew strongly, with monthly sales of $A7.0m (unaudited) and YTD November sales of $A33.9m are up $A7.3m or 27.3% on STLY.

• Rest of World had monthly sales of $A3.1m (unaudited) and YTD November sales of $A10.5m are up $A2.0m or 24.0% on STLY. After attaining market leadership in UK and Germany in full thickness burns, we continue to disrupt the market by expanding into soft-tissue reconstruction use cases in UK and Germany by displacing the current gold standard in oncological excisions and surgical dermatology.

• Total group revenue for the month, including BARDA was $A11.0m (unaudited), and YTD November group revenue of $A49.6m is up $A10.1m or 25.4% on STLY.

Particularly pleased with the growth in Rest of the World (ROW) Monthly sales.

David Williams providing milestone monthly sales results will serve well enough for interim updates.

Keen to see how NovoSorb MTX uptake continues from here.

Will continue to hold both in RL and here on SM.

Just in case you missed @Jimmy’s News Summary DJ Australian Equities Roundup -- Market Talk 26 Nov 2024 15:01:13 straw:

2311 GMT - Morgans senses a buying opportunity in skin-healing tech developer PolyNovo. The stock has fallen roughly 25% since the end of September, which analyst Scott Power thinks is partly because PolyNovo didn't give a trading update at its annual meeting of shareholders. "Consensus has revenue growth of 29% for FY 2025 which will be skewed to the 2H and we are confident it can be achieved," Morgans says. "Growth of 20%+ is expected to continue in FY26/27 driven by regional expansion as well as additional indications." Morgans has a A$2.85/share price target and add call on PolyNovo, which ended Monday at A$2.04. ([email protected]; @dwinningWSJ)

Those following $PNV will no doubt be aware of the production problems competitor Integra ($IART) has faced following product recalls from the key Boston manufacturing facility. I got my BA (Perplexity.AI) to do a run down of the 4th November $IART analyst call.

Key message is that, while the problems have had a significant impact over the last year, $IART seems to be on the way back.

Clearly, in a market with a range of competing options in dermal repair, some surgeons facing supply problems will have been forced to switch. It will be interesting to see whether they switch back.

The next couple of quarters will likely be positively impacted by restocking orders, so over the coming quarters I'll need to analyse the Tissue segment sales across mutiple quarters to look through that.

It should also provide some insight into the overall progress of the segment, via comparisons with $AVH, $ARX and $PNV. While these companies have products that are not equivalent (there are both overlaps and complementarities!) a key question I am trying to get a better handle on is the respective growth contributions from 1) expansion of the market segement within established indications, 2) expansion into new indications, and 3) market share gains. My deep dive into this segment a couple of years ago (published here) made some assumptions about the market depth and breadth in the US. It's time to revisit that analysis, ahead of the learning about $PNV's US sales in February.

Here's the detailed analysis of the transcript

-------------

Integra provided several key points regarding its Tissue Technologies segment and recent production issues:

Tissue Technologies Performance

- Tissue Technologies sales were $110 million in Q3 2024, down 3.6% on a reported basis and 3.7% on an organic basis compared to the prior year.

- Excluding the prior year impact from the return of product manufactured in Boston, organic growth was down 9.4%

Production Challenges

- Production shortfalls for Integra Skin limited the company's ability to fully meet demand

- These production issues were the primary cause of the decline in Wound Reconstruction sales

Recovery and Outlook

- The company has been ramping up production of Integra Skin through the third quarter

- They expect to return to historical revenue run rates for Integra Skin in the fourth quarter of 2024

Other Tissue Segment Highlights

- Despite the Integra Skin challenges, there was strong growth across other parts of the Wound Reconstruction franchise:Low double-digit growth for DuraSorb

- Low double-digit growth for MicroMatrix and Cytal in the UBM platform

- Overall high single-digit growth in the UBM platform

- Private label sales were up approximately 13% compared to last year due to favorable order timing

International Impact

- International sales in Tissue Technologies were down mid-double digits, primarily due to the Integra Skin production shortages

The company appears to be addressing the production issues and expects improvement in the near future, particularly for Integra Skin products.

DW was interviewed this morning by John Hester, Bell Potter (Healthcare Analyst) at the Bell Potter Heathcare conference. No slides or significant information, apart from one. John took David head on about the lack of update or guidance at the recent AGM.

David explained that the Board is comfortable with analyst consensus, and if they weren't - either up or down - they would update the market. At the same time, he said they will not give forward guidance because, with their high growth, doing that is a pathway to trouble (I agree!)

So, the best view is that $PNV is on track to achieve about 28% revenue growth in FY25, with consensus at $134.5m. (My source: www. marketscreener.com. n= 9)

Disc: Held in RL and SM

Here are the Chairman and CEO speeches for the $PNV AGM to start in a few minutes.

NO trading update! (There should at least have been a 1Q revenue update, as they have an established record of updating even if irregularly - what are they playing at?)

Under their continuous disclosure obligations, if the sales information was materially different to what the market is expecting, then you'd have expected an announcement. So, at this stage I am assuming revenue is in-line.

Indeed the statement in Swami's speech "The US remains the driving force for our company, growing by 49% over prior year. As we expand into other trauma, infection and active complex wounds, the number of patients healed is expanding at a stronger pace."

"Expanding at a stronger pace" is definitely ambiguous, but it implies that the rate of sales growth is not slowing.

It will be interesting to see if there is an update after the meeting? There will certainly be Q&A on this topic!

(I cannot quiet the voice inside that says this level of obfuscation is deliberate.)

Disc: Held

Those who follow me here and also follow $PNV will know that I am NOT a technical investor.

However, I am always eager to learn, and so today plotted the chart below within my CommSec Ap. using the Bollinger band technicals views, which plots the Simple Moving Average (in this case 20-day) with the +/- 2 standard deviations. The basic idea being that when it flies above the upper limit, the stock is overbought and when is flies below, it is oversold. (I have no idea what other technical alogithms say ... @Saiton ... momentum traders are probably offloading?)

So, in this year's version of the $PNV rollercoaster, we've breached the lower Bollinger bound for the first time in over a year.

The other thing I'd note is that the volumes have been modest for a while now, in part because the shorts have quietened down quite a bit on this stock.

Let's overlay newsflow on that:

- 8th May - Record Month

- 23rd July - FY Trading Update (a good news story)

- 16th August - FY Presentation (confirm in the details of the good news story)

- 4th September - Pivotal Trial Complete (quite a good news story)

- 18th Sept and 2 Oct - Director Selling (not good news)

- Number of days since material good news: c. 95

Make no mistake, $PNV is still a highly-valued company, based on the fundamentals, and riding the rollercoaster is a condition of being a shareholder. But I think this is primed well for the next update.

So What?

I don't buy or sell on technicals, I only do that on valuation. And my current valuation is $2.60 ($2.30-$3.50). My problem is, that $PNV is already my largest RL holding. But it has fallen so far below my lower limit of valuation that it sure is tempting to take a small bite, particularly given that I am well within my maximum single stock exposure on a cost-base basis.

Decisions, decisions.

Disc: Held in RL and SM

$PNV have today announced the conclusion of the patient enrolment phase of the BARDA trial (PIVOTAL CLINICAL TRIAL), which started (I recall) in late 2021.

It has taken some 3 years to enrol 120 patients with full thickness burns (FTB) sufficient to meet the criteria, although the recent addition of India as an enrolment location has significantly accelerated the conclusion of the trial enrolment process.

It's not clear what the forward timelines are. Presumably, all patients have to progress through treatment to their end point. In the case of FTBs, I understand the primary end point is wound closure after 12 months. If it is required that all patients have to reach this end point, then there would be at least another year before submission of the data, and then around a further year for a Final FDA decision.

However, given that $PNV have repeatedly referred to ongoing dialgoue between BARDA, the FDA and $PNV, and given that many of the early patients will have passed the end point, as well as the repeated references to this in the last three investor presentations, I anticipate that the PMA decision may run to a shorter timeframe.

$PNV have been very disciplined not to say anything about timeframes (although DW always sails close to the wind on this), because ultimately, neither $PNV nor BARDA are in control of this. That said, given that BARDA is a government agency, then that probably counts for something.

Essentially, a FTB on-label indication will likely 1) lead to a BARDA stockpile purchase and 2) further accelerate adoption for FTBs in the US and 3) facilitate approval for FTB in those countries where FTB is not yet an approved indication. Note: it is used for FTB in many countries, and is already used for this off-label in the US.

Given all of this, the announcement is not price sensitive.

That, at least, is my understanding. Happy to be corrected by any StrawPeople who know better.

Disc: Held in RL and SM

Courtesy of DW's mail round, here are some of the analyst responses to the $PNV result:

Bell Potter: TP from $2.52 to $3.00; upgrade to BUY

Morgans: TP from $2.50 to $2.85; retained as ADD

Macquarie: TP from $2.75 to $2.85; retained as OUTPERFORM

Evans & Partners: TP $2.65; Positive

Wilsons: No TP - First Look only; OVERWEIGHT

OVERALL: Modest increases in TP overall. Generally positive

Given that DW has signalled the potential end of "record month" reporting, then 1H25 is the next catalyst as, in my view, the FY25 revenue growth assumption of the consensus is undemanding ($133.3 / $104.8 = +27%), which I expect will be readily surpassed even given a potential "BARDA" effect.

Disc: Held in RL and SM

Following the FY24 results, I have update my valuation for $PNV.

Result: $2.60 Range = ($2.30 - $3.50)

Method: 10 yr DCF

Key Assumptions:

- BTM/MTX only

- Market growing at 8% CAGR

- Assumes market share grows from 2.7% today to 15%/19%/22% by 2034 (Integra estimate of $2.5bn TAM burns & trauma)

- New products beyond BTM/MTX platform treated as a sensitivty to the Continuing Value Growth 5% instead of 4% base.

- %GM declines from 94% (2024) to 88% (2034) due to increasing mix of 1) developing markets, 2) complex product mix, and 3) large increments of capacity that will be under-utilised from time to time

- Capex to deliver just in time capacity: 1st $500m for $27m, 2nd $500m for $40m

- Range of expense/revenue ratios modelled from FY24 to reach reasonable benchmark for global medical device company by 2034.

- WACC 10%; Tax=30%

- Other minor assumptions for interest and working capital scale with revenue

Comments

Compared with my last detailed valuation from Sept-22, I consider the FY24 result puts a much firmer base under the low case.

@Parko5 my top end just hits your $3.50. This is worthy of a comment. There are plausible scenarios where I can get up to $4.00 without stretching my own belief, and so it's worth looking at what's not included (see section below). You'll also see that I contradicted myself a little about revenue growth in FY25. I do indeed model values ranging from 39% to 58%. The reason is a modelling convenience, as the market share increases linearly from today and I didn't break out BARDA. In practice, the "BARDA Effect" that I mentioned in the earlier post is a transient 1-year thing that hits 2025 disporportionately (I'm assuming). It has little consequence in the overall valuation, so I chose to ignore it, as my model is complex enough without adding more complexity!

What's Not Included

Upsides

1. BARDA full thickness burns approval by FDA in 2025, driving "higher for longer" growth rates

2. A strongly favourable IQVIA report in 2025/26 - showing economic and patient outcome advantages of Novosorb, leading to wide adoption by HMOs etc and accerlating market shift away from biologcs More "higher for longer".

3. Award of multiple Federal or State Government Tenders in India, leading to India rapidly taking off

4. Early entry to China beyond Hong Kong (pre-2027)

5. New Products (i.e., beyond BTM and MTX variants) commercialised before 2028 and achieving significant revenues before 2030.

Downsides

6. Emergence of alternative synthetics competitors eroding market share gains in the later years

7. Loss of momentum due to Integra-like product recall (These things happen in medical devices!)

1.& 2. can be argue to be contained within the high revenue growth assumptions. However, the impact could be more material increasing the 2034 market share by accelerating switching from competing treatments. They would also likley accelerate global adoption, particularly in countries without capacity to conduct their own trials.

Model Outputs and Inputs

(I can answer and provide more detail on methods used to get to each of the items below, if anyone wants.)

1. Valuation

2. Model Output Table

2. Model Output Table

3. Input Tables

"i" related to FY24; "f" related to FY34 - model shows linead trend in expense ratios across 2024-2034

Disclaimer: This is intended for my personal use only. It is not advice and must not be used as the basis of an investment decision.

I'm limbering up for the DW Show at 2pm this afternoon with a quick review of the $PNV results. The financials have been well-telegraphed in advance, and I've gone through the Accounts and it's all remarkably close to my forecasts.

FY24 Results and Financial Statements

Their Highlights

- Total revenue including BARDA of A$104.8m, up 57.5% on STLY of A$66.5m

- Strong growth in U.S. achieving record sales of A$68.7m up 49.0% on STLY of A$46.1m.

- ROW sales of A$23.4m up by 73.3% on STLY of A$13.5m.

- Positive cash flow from operations of A$3.7m up 155.7% on STLY (A$6.6m)

- Net profit after tax of A$5.3m (FY23: A$4.9m loss)

- At year end the business had A$45.9m cash and cash equivalents

During the Period, the Company’s other key initiatives and achievements include:

- Record monthly sales in April of A$9.2m (monthly revenue: A$10.5m) and May of A$9.8m (monthly revenue: A$11.3m).

- Initiated a full market launch campaign in the U.S. for NovoSorb MTX in June 2024.

- Strengthened the U.S. team from 93 to 107 (June 2024)

- Increased U.S. customer accounts by 197 from 299 to 496 (June 2024)

- Increased global employee headcount from 218 to 254

- New C-suite roles - Chief Medical Officer, Chief People Officer, General Counsel and President, Asia Pacific.

- Supplied into certain war zones for humanitarian needs.

- Obtained registrations for Bolivia, Ecuador, Thailand, and Sri Lanka.

- Enrolled 120 patients into the U.S. BARDA pivotal trial for full thickness burns.

- Finalised design and selected a builder of the third manufacturing facility to service up to $500m in additional revenue.

- Awarded Victorian Government grant of A$2 million for R&D facilities expansion, subject to customary conditions.

My Analysis

The key for today is that $PNV delivered on their commitment at the capital raise to be profiable in FY24.

EBITDA, EBIT, NPAT, and FCF all positive. The first year we've had this.

Gross Margin % of 94.8%

In the US, with modest sales team growth, new accounts and revenue grew strongly, reflecting the lag effect of 1-2 years between adding headcount and driving revenue per account. A key question is where is the US trajectory from here?

2024 has been a foundational year: 1) broading market approvals across the global where Novosorb can be sold 2) progressing the design of the major manufacturing capacity expansion, 3) re-igniting R&D to build out further products to exploit the platform technology (R&D expense in FY24 up to $11m from $7,4m, but still only a CSL-esque 10% of revenue), and 4) building out the management team. These are all important steps in building a business from this start-up with a genuous product.

In the Chairman and CEO remarks, there were further details on revenue progression in key markets:

- UKI up 81.5%

- EU/Germany distributor markets up 81.2%

- Australia up 38.7%

I take the UKI as a good indicator of what the EU can ultimately do, and it looks like the distributor is kicking into gear. UK/EU growth will be important in maintaining the group trajectory as the US inevitably matures.

The addition of licensing in SUPRATHEL means it looks like $PNV are taking a leaf out of the $AVH book. Once you have the sales foot print, who need to give them more things to help drive contribution margin per account. So, good.

What's not mentioned - India. There is a lack of granularity there. So hopefully the analysts will try to tease out some more on that on the call. After all, we've had 20+ people now working that market for over a year, and there have been some qualitative stories of progress. India does not need to be a "today thing", however, over the longer term the potential for the product to get traction at a reasonable contribution margin in middle income/developing markets helps the long-term growth thesis. (And after all, it's why - or one reason why - Swami joined the company!)

My Key Take Aways

Report entirely as expected. No surprises. So the question is what else can we learn on the call at 2pm.

Lunch now, and then I'll be sure to get my ringside seat for the DW show!

Disc: Held in RL and SM

$PNV is presenting at the Canaccord Genuity Growth Conference.

There's no market sensitive or significant news we haven't heard before, but we don't always get the information in the most cohesive manner (!!), so this might be of interest to some. The presentation pulls everything together quite nicely.

What has been interesting in the last two conference presentations, is that the portrayal of new products and timeframes has re-emerged, after an absence of over three years. The new head of R&D has been in place for over a year now, so this makes sense.

Looking forward to the FY results - not expecting any surprises or material new information, but hoping for a little more granularity on how some of the RoW markets are tracking. Also, I'm looking to see if there has been any signficant change on capex, not that the costs for the new facilities must be in.

With RoW at $23.3m sales and 73.1% annual growth, that's ahead of where all of $PNV was in 2020, when it was growing at 54%! Just reflect on that.

Disc: Held in RL and SM - my largest position in both

To start a standard bull base for me - given revenue for 2024 of $104m and assuming a 25% CAGR to 2029

=> 2029 Revenue: $316m

Assuming GP% drops to 75% (due to the majority of sales in developing countries), $77m opex this year and a 10% CAGR in opex going forward to $124m

=> 2029 EBT: 114

Assuming 360m shares (modest buy back over time)

=> 2029 SP: $5.18

discounting at 10%

=> 2024 Share Price: $3.20

What if I wanted to get hyper-bullish? A different approach:

According to the Macquarie Presentation, they will have capacity to produce 680k units by 2027

Lets assume they are selling at 80% of that capacity in 2029: 544k units

In 2023 they produced 38k at a total cost of $12m (Revenue - GP; 65 - 53)

=> Cost per "unit": 315k

Lets assume costs remain the same (productivity improvements offset inflation in costs)

=> 2029 COGS: $167m

Assuming the same 75% GP margin

=> 2029 Revenue: $666m (ooh, spooky, maybe DW is Satan not Santa)

Let's assume it is gonna take a big sales team to get there so Opex increases at 30% CAGR from 2023 levels to $280m

=> 2029 EBT $220

with 660m Shares

=> 2029 SP: $10

=> 2024 SP: $6.20 (10% Discount)

For now, for now I'll stick with the first approach, but nice to have a possible upper limit if things start to get crazy.

I have no opinion on the accuracy, but thought I’d throw it out there if people would like to compare assumptions that go into the valuation:

Our fair value estimate for Polynovo is $1.05 per share and assumes the company is profitable from fiscal 2024 onward.

We forecast a five-year group revenue compounded annual growth rate ("CAGR") of 26% forward to fiscal 2028 versus a trailing two-year revenue CAGR of 50%. This is driven by Polynovo’s key US geography where we forecast a five-year revenue CAGR of 21% for the region.

We expect the firm increasing its sales staff to support market share gains. In addition, we expect the recent product launch of NovoSorb MTX to increase penetration within existing hospital accounts given its broader applications. Our forecast five-year revenue CAGR for geographies outside the US is 40%. This is driven by recent entries in India, France, Spain, Canada, and Hong Kong, as well as planned entries into China and Japan. As such, we forecast revenue contribution from the US to drop to 65% of group sales in fiscal 2028 from 79% in fiscal 2023.

On the profitability front, we expect group midcycle operating margins to settle at around 35% by fiscal 2033. We forecast Polynovo’s maiden profit in fiscal 2024 and margin expansion from operating leverage. Our estimates deliver EPS growth of 18% at midcycle. We forecast average annual capital expenditures of roughly AUD 6 million over the next 10 years, or 3% of group sales. We also factor $25 million in capital expenditure over fiscal 2025 and fiscal 2026 to fund a new manufacturing facility which has capacity to service an additional AUD 500 million in annual sales

DW has just circulated two analyst notes to everyone on his email list. Macquarie (who are maintaining their TP of $2.75 and Outperform) and Wilson (who are at $2.65 are Overweight). Neither are updating recommendations and I assume are awaiting the FY, with its forward looking statements.

My reason for this Straw is that the Wilson report contains some interesting insights, both on the US and also on PMI the distributor in Europe - who is running a full thickness burns trials. The commentary is rather encouraging and succinct, so I've extracted the relevant paragraphs.

From Wilson's Report

"Polynovo has pre-released its unaudited revenue results for FY24. US sales increased 49% to $104.8M; with ROW sales up 73% to $23.3M. US performance in 2H24 was 8% lower than we forecast; offset by a 10% beat from ROW businesses plus grant support from BARDA. We’re not allowing a $3.5M sales ‘miss’ in USA dissuade us from our O/W thesis on PNV. Burns still constitutes ~68% of product volume and is invariably lumpy. Anecdotally, PNV was winning up to 70% market share by surface area in key US centres over 4Q24, thanks to its competitor’s protracted difficulties (Integra’s recall). We assess that >30% of the absolute US growth dollars in FY24 has come from pricing, with more to come, as described in our recent upgrade. The ROW business stands to benefit in FY25e as well, with several jurisdictions set to re-tender business"

"The absence of Integra’s PriMatrix and SurgiMend in the marketplace created a $30-40M annualised revenue opportunity in burns, trauma and reconstructive surgery. Notwithstanding hefty price increases, BTM remains super-competitive on (per cm2 ) pricing and enjoys a broad clinical following. Feedback suggests BTM has usurped Integra now on a volume basis (at least in some major ABA accredited burns centres) and carries that incremental share tailwind into FY25e. Internationally, we understand that PMI’s markets (distributing into Germany, Austria, Switzerland), Spain and Turkey starred. BARDA revenue support was also higher than forecast, given how quickly Polynovo’s PMA-directed trial in full-thickness burns has enrolled."

"Forecasts under review. At this stage we see little change to revenue forecasts, expecting continued market share gains (both organically in burns and at Integra’s expense), incremental volume via extension into trauma indications and flagged pricing momentum. Thinking about costs leading into FY25e, we’re cognisant of a few (positive) areas where investments may be drawn forward (e.g. SKU expansion for MTX, building on early product traction in trauma; and an earlier PMA filing in relation to full-thickness burns)."

Disc: Held in RL and SM

I'm not sure how much notice the market is paying to Broker/Analyst views for $PNV, however, I wanted to share some analysis which I know some of us will find interesting.

My valuation

First, I want to state that I won't be updating my own model until after the FY results are out. But for the record, my valuation is $2.37 (if I adjust my $2,25 from Feb-24 by a further manual adjustment of +5%)

My last full evaluation across a range of scenarios from almost a year ago was: $2.16 ($1.63 - $3.63), which if I roll forward by one year becomes $2.37 ($1.80 - $4.00). \

Now when I update the model in late August, I'll have to re-run the growth scenarios, have an updated cost structure and view on capex. So, it could end up looking quite different. My sense, however, is that the range will narrow, and that the low end of the range will come up.

For those of us who who might respond with "what good is a valuation with such a wide range?", my answer is that it represents unresolvable uncertainty. Remember, $PNV is still passing through the inflection point so, good luck justifying a tighter range.

Brokers Consensus

I use two sources when I look at brokers/analysts:

- Marketscreener.com: $2.18 ($1.00 - $2.75); n=8

- Tradingview.com: $2.46 ($2.00 - $2.75); n=5

I'm going to ditch the low value on marketscreener.com of $1.00, because I think it has no credibility. That moves the marketscreener.com average TP to $2.34 ... closer to Tradingview. (Note: on these services I can't see the individial datapoints)

Because of my concern in this case about the marketscreener.com dataset, I am going to focus the rest of the analysis on the analysts in tradingview.com.

So, based on today's close of $2.60, the market is now only about 6% ahead of the analysts.

Revenue Growth

The insight I wanted to share, is that over the next 6-9 months there is a chance for a material re-rating of $PNV.

I'll make the case by focusing on revenue growth - because it is still the dominant factor.

The analyst "consensus" for revenues are as follows, with % growth yoy in parentheses:

FY24: $104.8m (+57.5%)

FY25: $133.5m (+27%)

FY26: $167.8m (+26%)

Of course, it is reasonable to expect revenue growth to start tailing off at some point, but if you consider the last 3 annual y-o-y growth rates of FY21 (32.0% - COVID access impact) FY22(42.8%) FY23(58.8%) FY24 (57.5%), something dramatic would have to happen in FY25.

However, we know that:

- The category is expanding

- BTM is taking market share

- MTX is now also being rolled out

- The global rollout is still firing on all cylinders

My Conclusions

I'm not a seller of any $PNV much below about $3.80.

Of course, it will continue to be volatile. But the risk of getting off the bus and then being unable to get back on with this one is just too great for me.

I believe this is going to get more focus from the market as we move through the inflection point - i.e. in FY25. Of course, I realise that - for a couple of years at least - some "talking heads" will shake their heads at eye-watering P/Es. But that is an irrelvant measure AT THIS STAGE.

I'm very interested to see what upgrades come through for FY25 and FY26 over the coming 6-9 months, and everything that entails.

If I wasn't at a full allocation, I'd still be a BUY today.

Finally, I said in another straw recently, that I would test all valuations in healthcare through an M&A lens. I have not yet done that for $PNV. I will in August.

Disc: Held in RL and SM

Especially for you @Rick !

Their Headlines:

• Total revenue including BARDA of A$104.8m up 57.5% on STLY of A$66.5m.

• FY24 sales of A$92.0m up 54.5% on STLY of A$59.6m.

• Strong growth in U.S. sales of A$68.7m up 49.0% on STLY of A$46.1m.

• ROW sales of A$23.3m up by 73.1% on STLY of A$13.5m including strong performances in developed markets like UKI, Germany and ANZ.

• Surgeon education and charitable contributions, widely used to support patients in conflict zones.

My analysis

Revenue is bang on where I expected. I had them coming in anywhere between $102m and $106m, which was easy to pick, given the absence of "record months" in the last few months.

All this should be good enough for them to hit their positive NPAT commitment for the FY.

I'm pleased revenue growth is holding up strongly. Analyst views have this starting to decline in % terms quite quickly over the next two years and, if they can hold it around +50%, then that's the opportunity for the next significantly leg up in SP, as that will drive a few years of very high EPS growth.

Conclusion.

On track. Holding for long term. My biggest RL position.

Although enjoying volatility is part and parcel of being a long term $PNV holders and, in that context, the price action of recent days is simply par for the course, I found the announcement below in a search of the news-wires. It came out last week.

It is not surprising that $PNV didn't make an announcement, as in my view it doesn't have a direct or material bearing on $PNV's sales, but it is good that $PNV is being sought out by innovators for collaborations.

Full text follows.

---------------------------------------

Spectral AI Announces Collaboration with Global Wound Care Company PolyNovo to Introduce DeepView System for Burn Indication to Australian Market

861 words

8 July 2024

12:00 GMT

GlobeNewswire

PZON

English

© Copyright 2024 GlobeNewswire, Inc. All Rights Reserved.

Spectral AI Announces Collaboration with Global Wound Care Company PolyNovo to Introduce DeepView System for Burn Indication to Australian Market

DALLAS, July 08, 2024 (GLOBE NEWSWIRE) -- Spectral AI, Inc. (Nasdaq: MDAI) ("Spectral AI" or the "Company"), an artificial intelligence (AI) company focused on medical diagnostics for faster and more accurate treatment decisions in wound care, today announced that it has signed a Memorandum of Understanding ("MOU") with global medical device company and burn wound therapy leader PolyNovo Limited ("PolyNovo") under which the companies will collaborate to assist Spectral AI in a potential limited deployment of its DeepView System for burn indication in Australia.

Under the MOU, PolyNovo will support Spectral AI's application to the Australian Special Access Scheme (SAS) with an ultimate goal of allowing Spectral AI to deploy up to two DeepView Systems at the Royal Adelaide Hospital and The Alfred Hospital in Melbourne to lay the groundwork for the Company's eventual commercial roll-out based on clinician evaluations and experiences.

The SAS was introduced by Australia's Therapeutics Goods Administration in recognition that there are circumstances where patients need access to certain medicines, medical devices, or biologics that are not already included in the Australian Register of Goods.

Spectral AI's DeepView(TM) System is a predictive device that offers clinicians an immediate and objective assessment of a burn wound's healing potential prior to treatment or other medical intervention. The image processing algorithm employed by the DeepView(TM) System utilizes multispectral imaging that is trained and tested against a proprietary database of more than 340 billion clinically validated data points. The DeepView(TM) System is non-invasive and cart-based, allowing for exceptional mobility within the healthcare setting.

PolyNovo develops and sells patented, bioabsorbable, synthetic, polymer technology used to reconstruct complex wounds, including deep dermal and full--thickness burns, and aid the body in generating new tissue. PolyNovo's FDA-approved NovoSorb(R) BTM (Biodegradable Temporising Matrix) and NovoSorb(R) MTX product portfolio is available in 37 countries around the world.

"PolyNovo's innovative therapies have proven to be life changing and it is one of the world's most respected providers of burn treatment solutions," said Peter M. Carslon, Chief Executive Officer of Spectral AI. "Understanding when it is appropriate to apply these therapies is paramount to realizing improved patient outcomes. We believe that the Day One wound healing assessment provided by the DeepView(TM) System empowers clinicians with the knowledge to make an informed and rapid diagnosis when time is of the essence. We are honored to work with an established market leader as we take these initial steps to familiarize clinicians in Australia with Spectral AI's technology, support their life-saving work, and help to elevate the level of patient care."

About Spectral AI

Spectral AI, Inc. is a Dallas-based predictive AI company focused on medical diagnostics for faster and more accurate treatment decisions in wound care, with initial applications involving patients with burns and diabetic foot ulcers. The Company is working to revolutionize the management of wound care by "Seeing the Unknown(R) " with its DeepView System. The DeepView System is a predictive device that offers clinicians an objective and immediate assessment of a wound's healing potential prior to treatment or other medical intervention. With algorithm-driven results and a goal to change the current standard of care, the DeepView System is expected to provide faster and more accurate treatment insight towards value care by improving patient outcomes and reducing healthcare costs. For more information about the DeepView System, visit www.spectral-ai.com.

Forward Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements regarding the Company's strategy, plans, objectives, initiatives and financial outlook. When used in this press release, the words "estimates, " "projected," "expects," "anticipates," "forecasts," "plans," "intends, " "believes," "seeks," "may," "will," "should," "future," "propose" and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. As such, readers are cautioned not to place undue reliance on any forward-looking statements.

Investors should carefully consider the foregoing factors and the other risks and uncertainties described in the "Risk Factors" sections of the Company's filings with the SEC, including the Registration Statement and the other documents filed by the Company. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Investors:

The Equity Group

Devin Sullivan

Managing Director

Conor Rodriguez

Analyst

Their Product:

Novosorb - a biocompatible synthetic polymer used to create a dermal matrix, effectively scaffolding, to assist in the healing of the deeper layers of the skin (dermis). Used for burns and other wounds to fill and secure the wound as it heals, biocompatibility means the polymer is safely absorbed into the body as it heals.

2 versions of the matrix exist:

- BTM - consisting of Novosorb with a laminated outer layer to strengthen the foam and to seal the wound from external contaminants. The laminate has to be eventually removed as it does not biodegrade within the body.

- MTX - Novosorb without the laminate, can be implanted within the body and will be entirely degraded

Being synthetic Novosorb is a more consistent product (from batch to batch) in comparison to biologic equivalents resulting is less post-operative complications.

Their Customers:

In simple terms, based on who they receive money from, their customers are the medical institutions (public and private) that purchase Novosorb.

However, I think their actual customers are doctors and surgeons primarily in burns and trauma centers, but also other types of hospitals, medical centers and medical research institutes.

You could also say the patient that receives Novosorb as treatment is the end customer/consumer though.

To stich these all together:

Polynovos customers are medical institutions whose practitioners use Novosorb to treat patients. Practitioners will prefer Novosorb if:

- It is easier to use than other products

- Can be used in wider array of procedures

- Provides better outcomes for the patient

The crux of this is while the Institutions buy the product, it's the doctors they sell it to.

Moat:

Sources of a moat for Polynovo include:

- Regulatory approval - Polynovo have approval for Novosorb in North America, India, UK and Europe, Australia and parts of S.E Asia. This is a significant hurdle for new competitors to get over

- Hospital approvals - individual hospitals will assess and approve new products. Polynovo has a good history of expanding the number of hospitals is sells into.

- Becoming the standard of care. Once you become the go-to product it makes it harder for new players to compete. They will have to work hard and spend a lot of money on sales people to convince doctors to switch to their products. The more indications the product is useful for the greater the entrenchment.

- Lower cost - while I have not seen the pricing exactly myself, my understanding is the synthetic product is cheaper to produce than the equivalent biological product

The first 3 are kinda a tiered network-effect moat - First you need Country/Regional approval, then the hospitals themselves, then finally the doctors. In the end it becomes a network effect as you become the standard.

2 and 3 are still expanding for Polynovo with Novosorb as it adds more hospitals and doctors as its customers

Their Competitors

There are a lot of companies in the space, however not all of them are direct competitors.

Some examples are:

Integra Life Sciences

Integra produces a range of biologic dermal products used for wound reconstruction - some of these compete directly with Novosorb. Based on the last few earnings calls it seems revenues for these products are declining. With their guidance anticipating flat growth for these products for 2024.

Note Integra make the bulk of their revenue from products unrelated to Polynovo (e.g. Neurosurgery products and instruments)

Mallinckrodt Pharmaceuticals

Mallinckrodt acquired the company developing StrataGraft, a direct competitor to Novosorb, however according to their website the product is still in clinical trials.

Their Scalability

While Novosorb is a manufactured product, according to David Williams the facilities are not that capitally intensive. (It is a to-do to assess the capital cost of their factories). Worth noting they do have software like gross margins (~80%).

Existing manufacturing + the new facility (due to come online in 2025) should provide the capacity to deliver ~18x the devices manufactured in FY23.

Creating extra manufacturing, if required, should not be an issue and will be possible from the amount of cash they currently have + future cashflow.

The TAM is large, but hard for me to quantify in $.

As a guide, currently there are 145,000+ burns and soft tissues wounds in the US each year. I think an increase in sales of 2 orders of magnitude would not be unreasonable.

Management

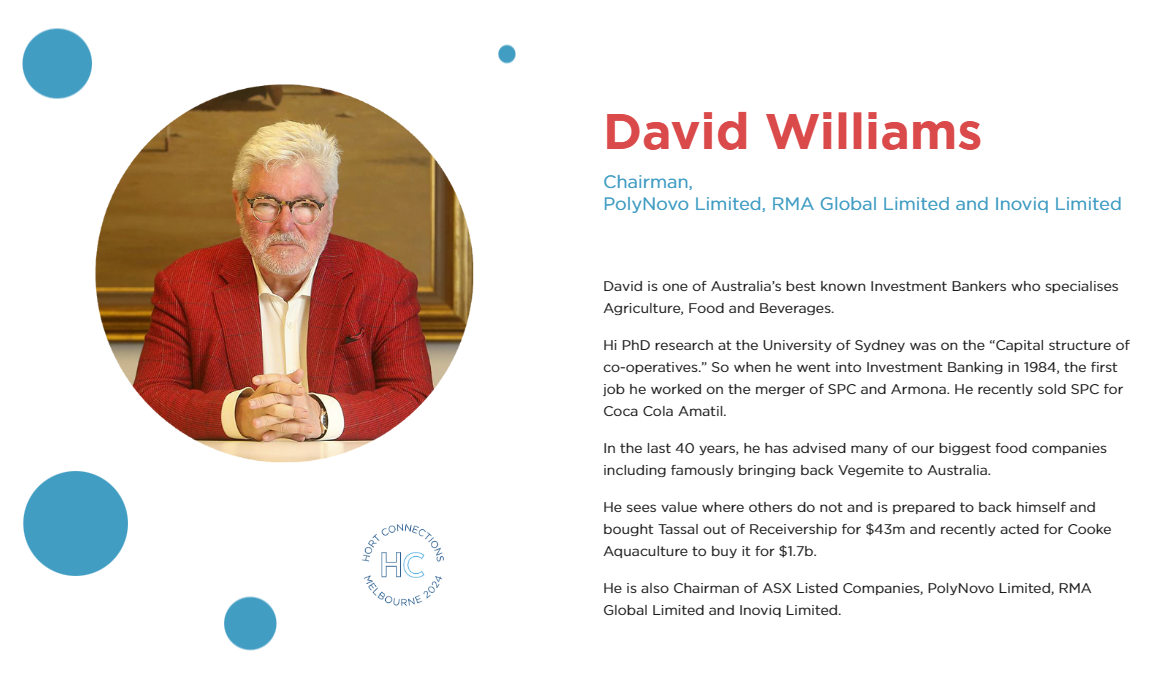

Mr David Williams - Chairman

Experienced director and investment banker. Has special interest in the medical and pharma industry. Most importantly, used his own money to buy shares in Polynovo.

Stake: 21m shares (3.1% of PNV)

Mr Swami Raote

Was previously divisional head at Johnson & Johnson. Has no stake in the company as far as I can tell

A number of their senior leadership and board have stakes in Polynovo - while not large percentage-wise these do amount to reasonable amount in dollar terms.

Jan Gielen - CFO: 930k (0.14%)

David McQuillan - CTO: 670k (0.1%)

Leon Hoare - Director: 1.2m (0.18%)

Bruce Rathie - Director: 3.2m (0.47%)

Risks

They have a product which is (or at least seems) significantly better than the status quo and is being increasingly adopted, both in terms of their target market but also new markets (use cases). They have reached cashflow breakeven, have ~$40m in cash and basically no debt. From here I think there are 2 main risks: