Results Investor presentation and a CR announced. Good news is the increase in Sentia sales and the reduction in expenses and therefore losses. Not so good news is a 40% dilution, $12.5M Cap raise at a historically cheap price of 15c when they have $10M in the bank. Suggests that they are not expecting a profit in the next 18+ months? Viburnum possibly increases its 26% stake by underwriting the raise and receives a 5% fee in options or 6% in cash.

Language has changed for Xprecia Prime FDA "Current US FDA 510k submission under review with feedback expected Q1 2024." in the annual report "assuming there are no further queries, an FDA decision is expected during Q1 2024;" are they being conservative is a further delay expected? One of the uses for CR is stated as "Ongoing costs associated with the approval of Xprecia Prime in the USA" positive that "Large European and USA deals in negotiation." Xprecia Prime still has to be the biggest potential for increasing revenue significantly in the short term but dependent on FDA approval.

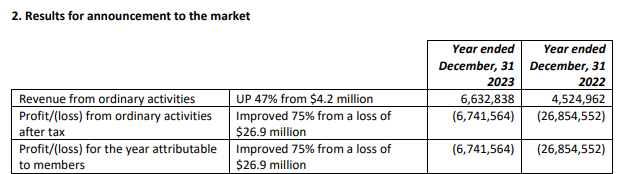

Highlights Year-on-year (2023 v 2022)

Key developments during 2023 include:

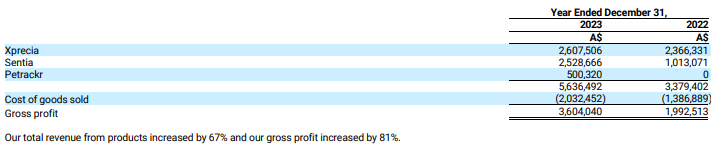

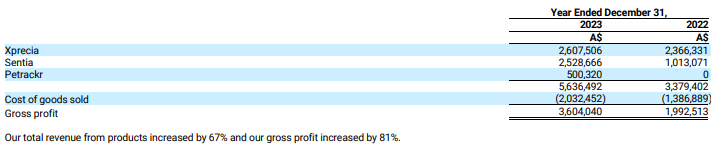

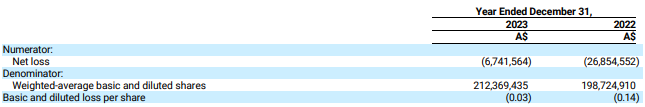

Revenue from the sale of products increased 67% to $5.64m

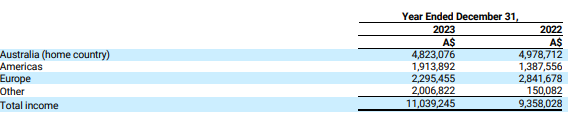

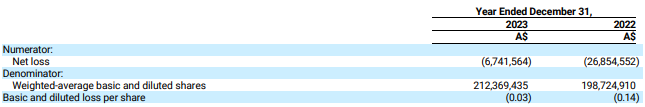

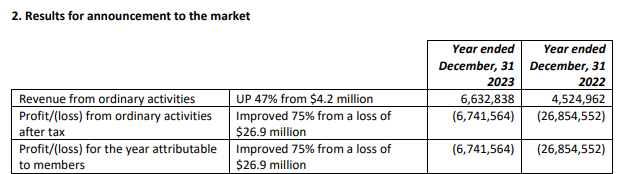

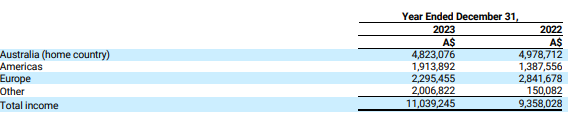

Total revenue increased 47% to A$6.63 million

Gross profit increased 100% to A$4.28 million

Operating costs decreased as follows:

R&D expenses declined by 60% to A$4.97 million

Total operating expenses declined by 43% to A$20.97 million

Net loss after tax and impairment of intangible assets improved by A$20.11 million

Revenue from coagulation testing products grew 10% but was negatively impacted by the “aggressive selling of stock” by Siemens as a result of its rights to sell Xprecia products ending formally on March 31, 2023.

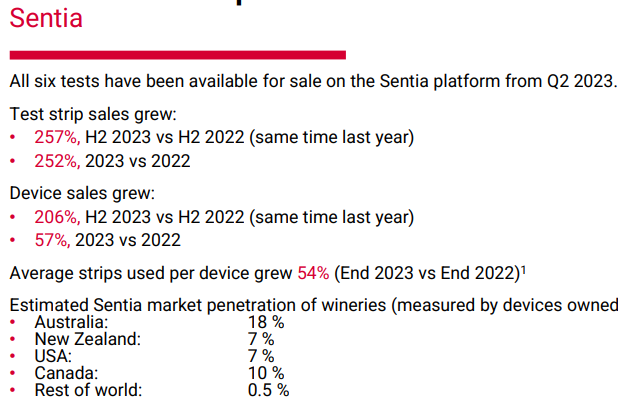

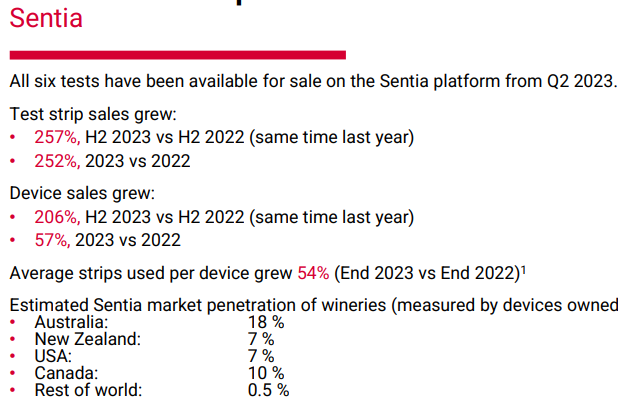

Revenue from wine testing products increased by 150%. During 2022, our revenues from wine testing products were primarily from the sale of Sentia analyzers, Free SO2 and Malic Acid test strips. During 2023, we began generating revenues from the sale of the following additional test products – Fructose, Glucose, Acetic Acid and Titratable Acidity.

Petrackr, launched in May 2023, generated revenue of A$500,320.

Universal Biosensors, Inc (ASX: UBI) ("UBI") advises that it intends to raise approximately $12.5m of capital.

The capital will be used to support UBI’s: • working capital requirement (to support the expected inventory build and growth in sales); • ongoing product development; • operating losses in the shorter term; and • Ongoing costs associated with the approval of Xprecia Prime in the USA

An underwritten pro rata non-renounceable entitlement offer of new CHESS Depository Interests over fully paid shares of common stock of UBI to raise approximately A$10 million at a proposed ratio of 1 New CDI for every 2.55 existing CDIs held and a non-underwritten placement of New CDIs to institutional and sophisticated investors to raise up to A$2.5 million

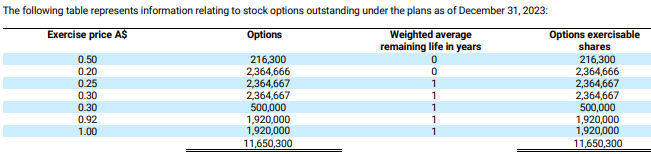

New CDIs will be issued at a price of A$0.15 per New CDI participants in the Placement and Entitlement Offer shall receive one attaching Option for every New CDI issued, at an exercise price of A$0.20. The Options will vest upon issue, expire 3 years from the date of issue, be exercisable in multiple tranches and each entitle the option holder to 1 CDI upon exercise

UBI has received a binding commitment from existing shareholder Viburnum Funds (Viburnum Funds holds a beneficial interest and voting power over approximately 26% of our shares.)to fully underwrite the Entitlement Offer. Viburnum is an associate of Mr. Craig Coleman (the Non-Executive Director of UBI who is also the Executive Chairman of Viburnum and a substantial shareholder in Viburnum). Viburnum shall have the right to require the Entitlement Offer to be repriced in the event that the trading price of UBI CDI's falls below A$0.10 per existing CDI for any three consecutive days prior to the securityholder meeting (see below). In the event the parties are unable to agree the repriced amount, Viburnum shall be entitled to terminate the underwriting agreement. Viburnum will receive 13,849,567 options, as its underwriting fee , equal in value to 5.0% of the underwritten amount of A$10 million. The Underwriter Options will be issued on the same terms as the Options issued to investors under the Entitlement Offer. If the Underwriter Options are not issued, including where securityholder approval is not obtained for the issue of Underwriter Options, UBI shall pay Viburnum an underwriting fee equal to 6% of the underwritten amount in cash, at the time of issue of CDIs under the Entitlement Offer.

Technology update

Lead & Heavy Metals detection UBI’s has identified a significant market opportunity in detecting heavy metals and other impurities in water. The opportunity uses UBI’s existing infrastructure and technology and is low cost. UBI is completing proof of concept for Lead and Copper sensors