Since Feb 2023 when Connexion Mobility announced its agreement with General Motors (GM) in the US and following Aaryn Nania appearance on Strawman in the same month i have been impressed with how two key areas of CXZ have evolved :

- Culture of the organisation and

- Capital allocation at CXZ.

I will step through why such a view has been formed.

Firstly having held Connexion Mobility from mid 2021 and having monitored the progress via (Quarterly 4C release as well as half yearly and annual results) the risk reward to the upside is more evident today than ever.

Recognising that Connexion Mobility revenue is heavily dependant on GM and due to confidentiality any investment MUST factor this into the risk.

Much of the 7,000 GM dealerships are independent and thus even though GM has an agreement with CXZ it is the dealership discretion to determine the best software. No dealership is obligated to shift to CXZ platform and can make their own decisions on which platform is most suitable in seeking to effectively manage loan car as well test drive systems.

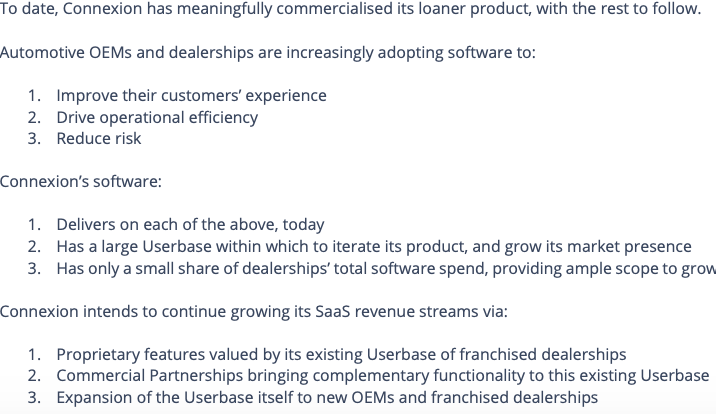

As an investor what is appealing about this model is the incentive for CXZ to develop and show the merits of their system is their for them to show. Failure to do this well will not only led to poor uptake but ultimately loss of contract longer term.

CXZ led by Aaryn recognise this and have not only invested into product development and resources but taking a considered approach to ensure the product is meeting the needs and is of great value.

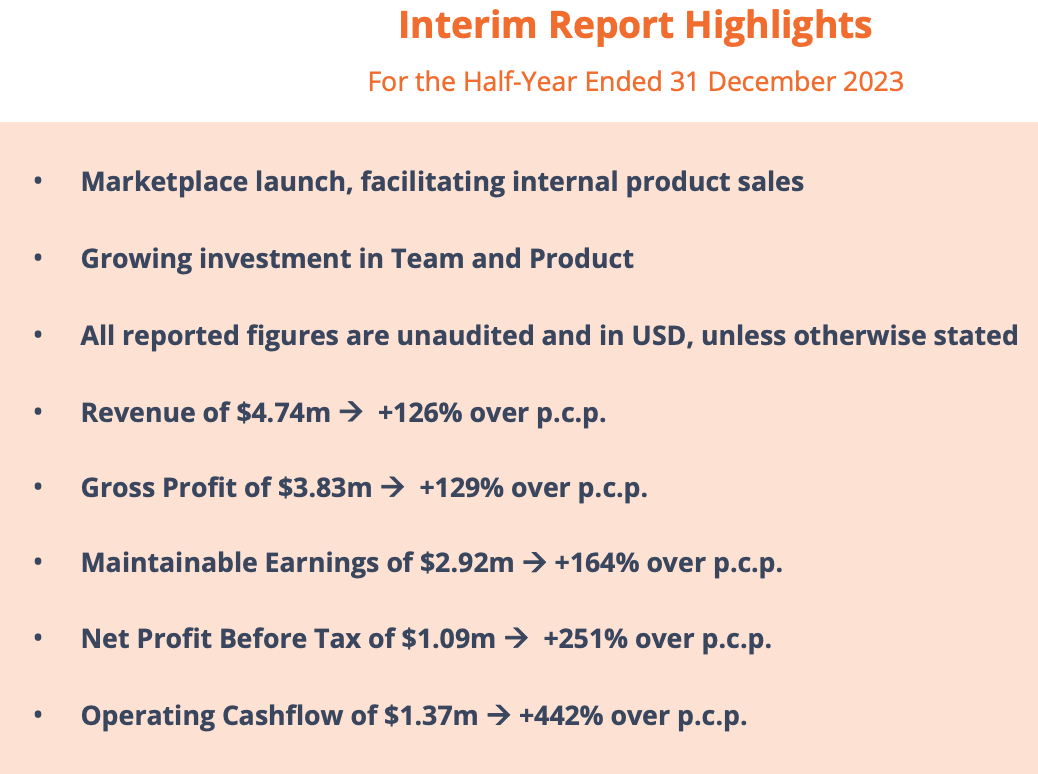

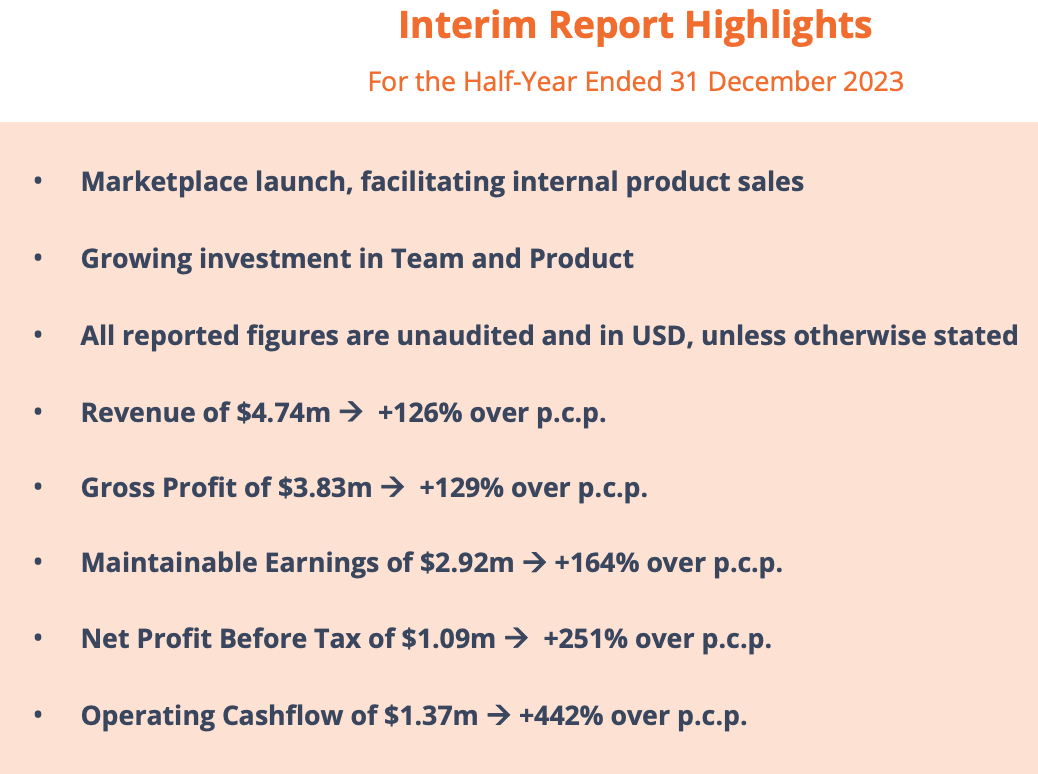

Results over the past year 2023 and expectations for 2024 and beyond

Hard to fault with positive CF , earnings and NPAT and in doing this reinvestment back into the business to drive improved sales and margins.

Back to my two original points re the Culture and Capital allocation in which CXZ have done very well.

Culture of Organisation

Over the past year CXZ have recruited in a manner which is prudent and in line with revenues rising which has ensured financially profitability is still in check but at the same time place the appropriate resources on the sales and product focus to grow the number of GM dealers whom seek to convert to the platform. This is unfolding and expect this investment to deliver meaningful lift to revenue and profitability going forward.

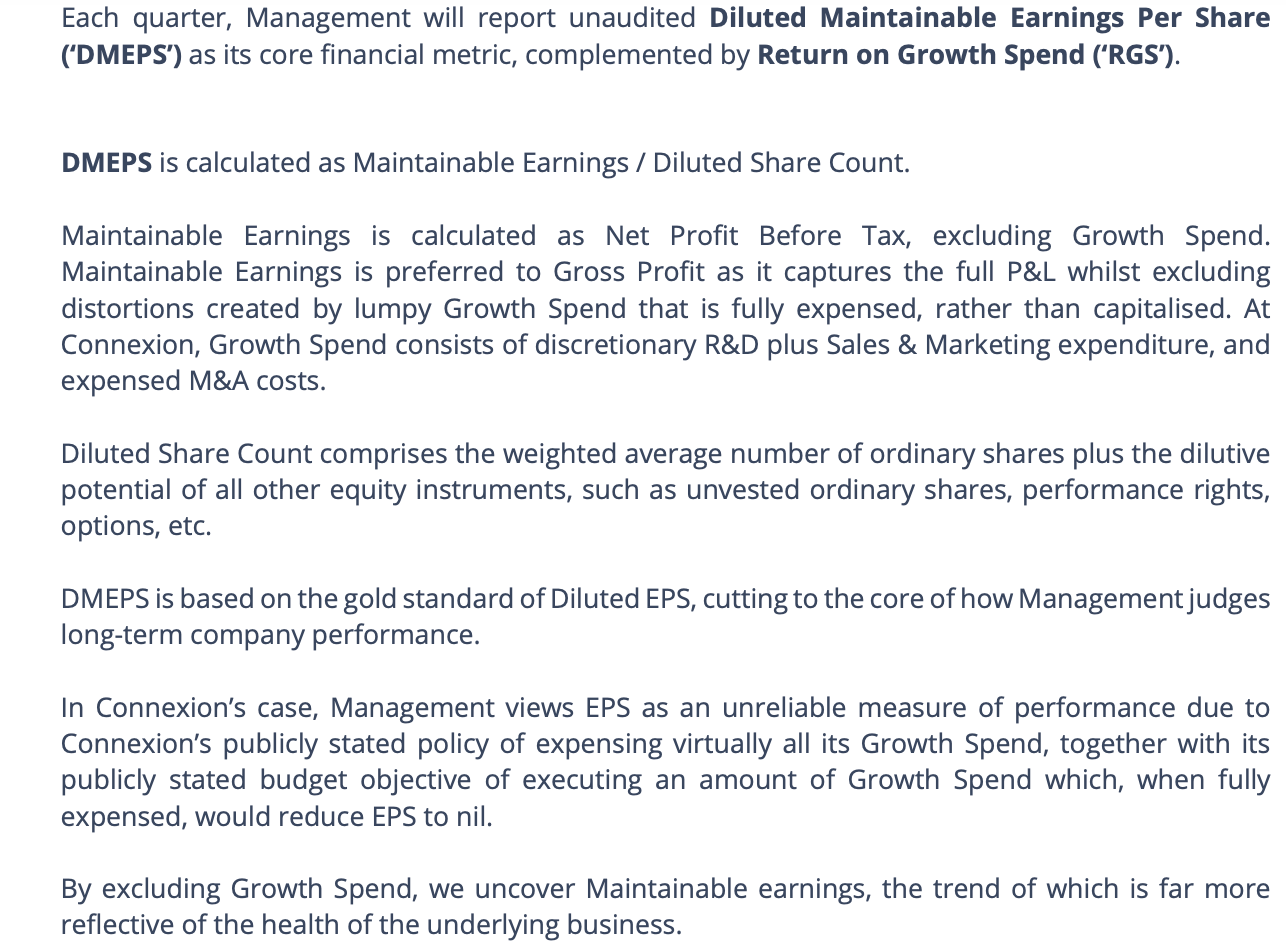

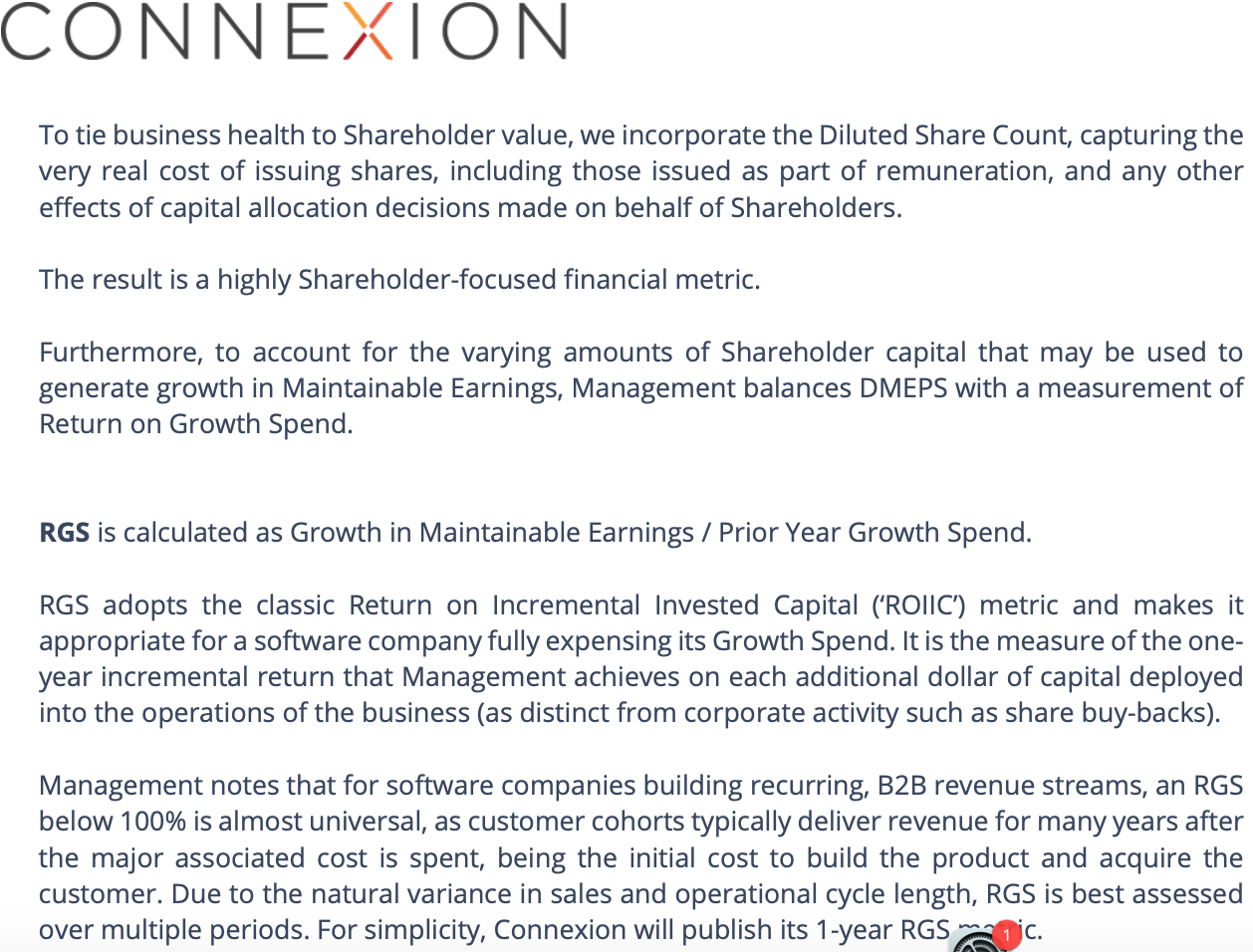

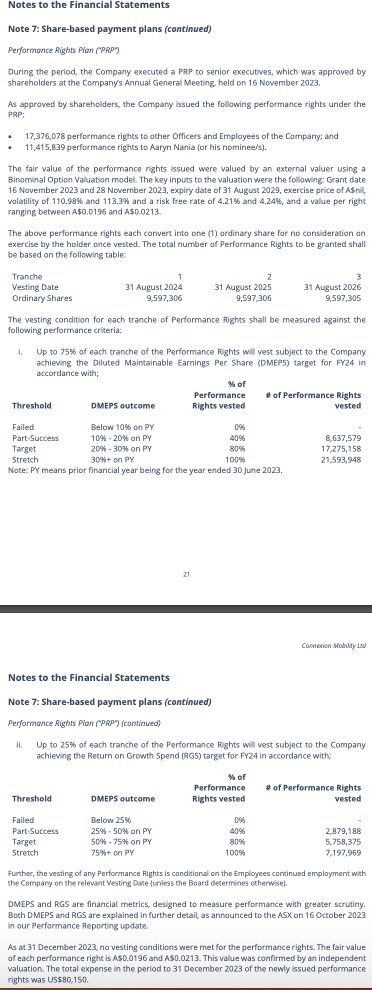

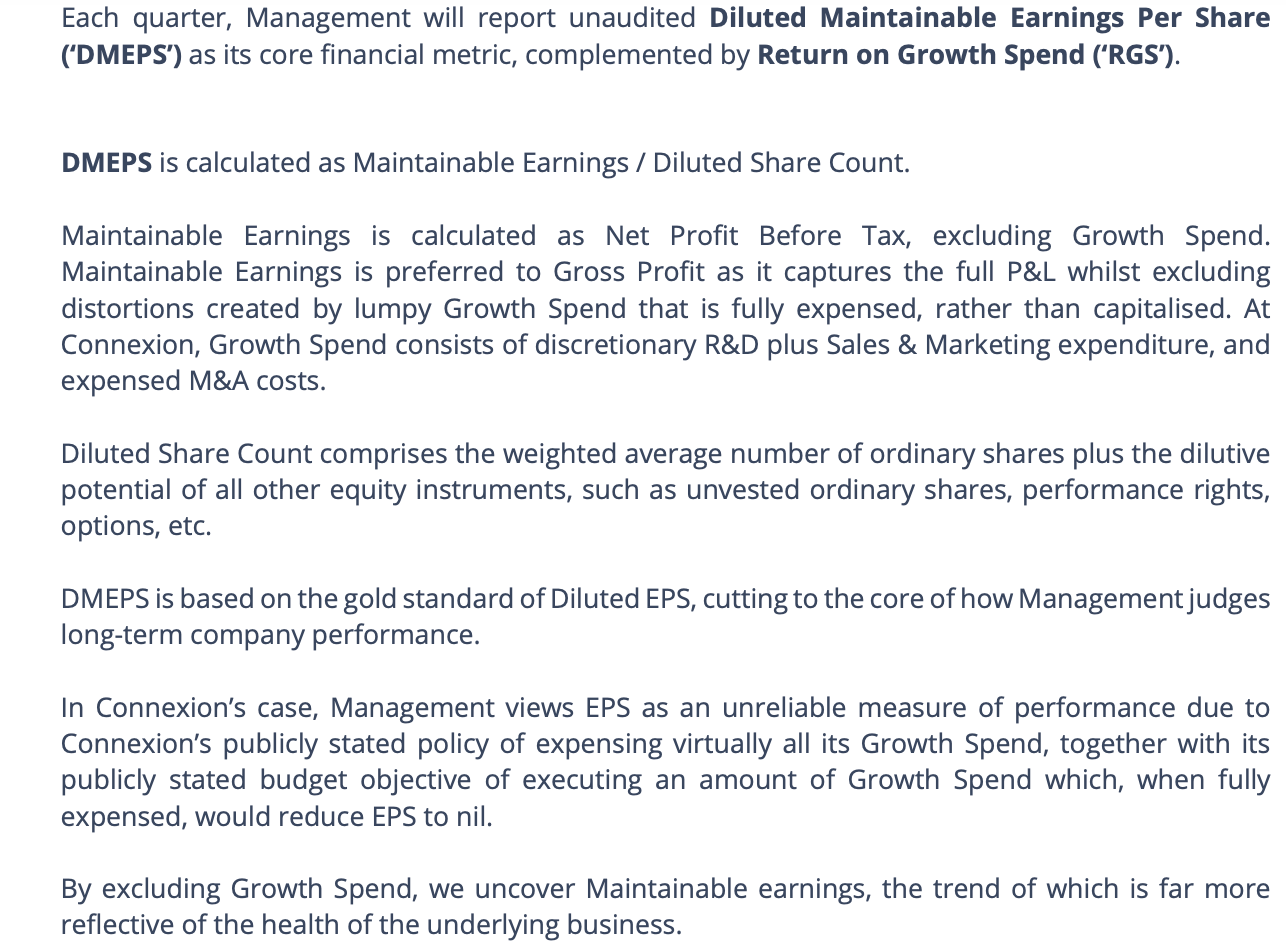

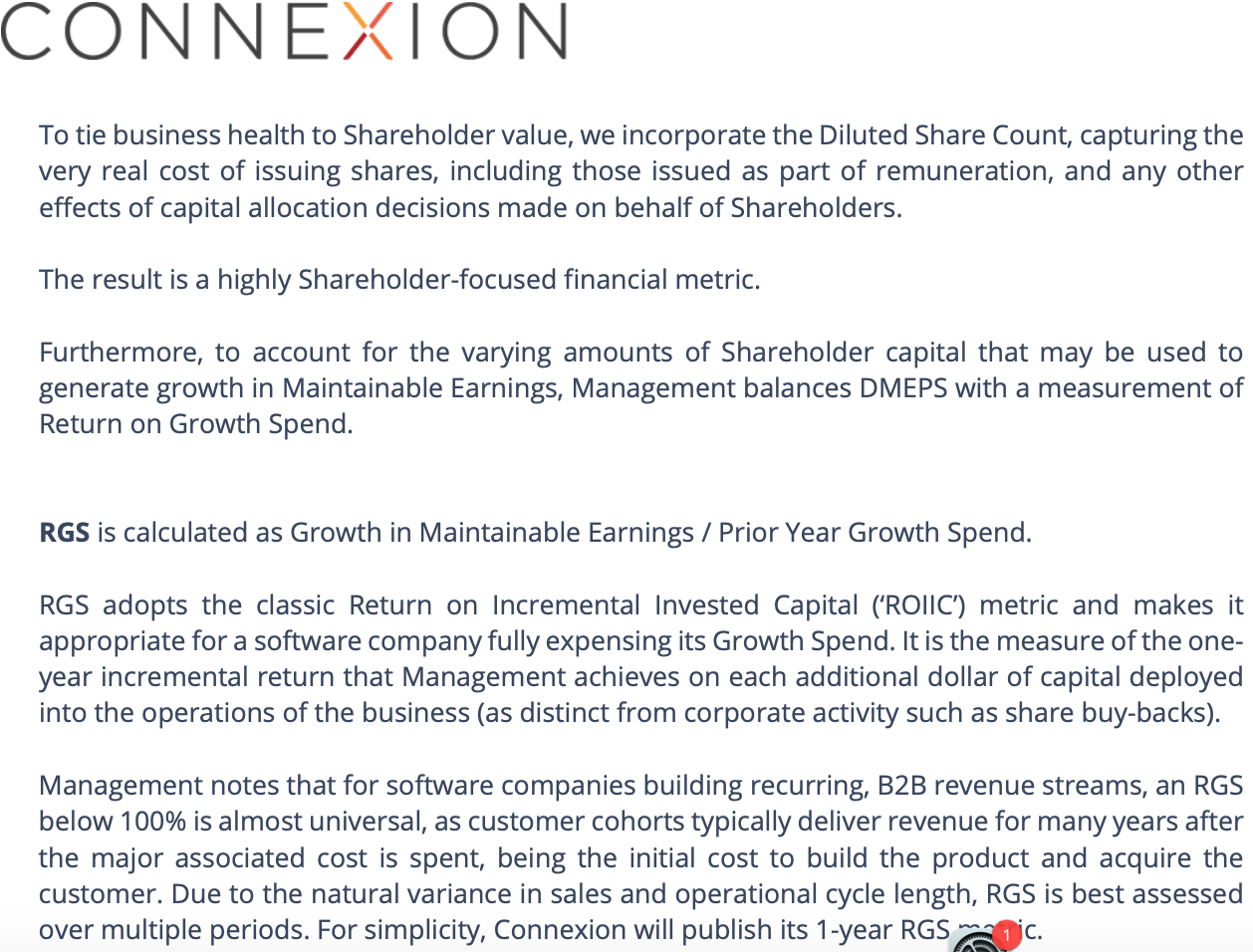

Second Half 2023 Management brought in metrics to align and improve the accountability of the team. The two metrics which are key to future are,

- Diluted Maintainable Earnings Per Share or (DMEPS)

- Return on Growth Spend (RGS)

If the previous guidance by Aaryn and the leadership team on focus on gross profit is anything to go by whereby in Q23 2022 GP was 605k and by Q2 2024 this increased to $3.83m the evolution of these two metrics provide optimism on the customer penetration that may be achieved and thus improved financial results that will flow.

Below is a extract from October 16th 2023 press release re both definitions and the link to management LTIP.

In respect to Capital Allocation i am very positive of the actions taken by Aaryn. His finance background as Co - Founder and Chief Investment officer at Lucerne Investment Partners is no doubt proving to be a real strength for the organisation. Below data speaks for itself.

- Share Count Reduction in 2023 of 45,233,733 ordinary shares or 4.7% of total share count which brings the share count down to under 900m.

- Investment into new product has been done without the need to raise monies or dilute shareholders.

- Cash on Hand of $4.3 mil

- No debt on balance sheet

From a valuation standpoint i will complete an update but support the 3.2c listed last year.

Disc : Held on SM and RL

CXZ H1 2024 Interim-Report-Highlights.pdf

CXZ Feb 9th 24 -Half-Yearly-Report-and-Accounts.pdf

CXZ GM Agreement 2023 Market-Update.pdf