Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Covertrue investment - I'm not overly excited about this overall. Seems like CEO using their previous fund manager experience. Is Connexion focused on core business or will other investments like this be made? Notes in quarterly that Connexion is actively interested in M&A so this type of buying may continue.

- Priced on an EV/P of less that 4 so continues to be very cheap and buy back shares at that price.

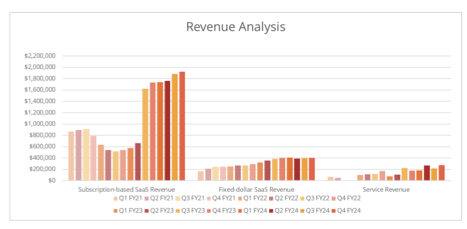

- Not much else to note besides revenue and subscriptions continuing to grow QoQ:

Will continue to hold. Covertrue is a relatively small investment. Connexion is a small holding as well. Still a value play given the very low EV/P ratio.

Connexion Mobility announced after COB Tuesday a 2.94m stake in Covertrue a private business who's primary business is Liberty Signs based in Australia with revenue of approximately 6million pa.

Liberty signs have over 150 outlets Australia wide servicing the corporates predominantly in car wrapping / logo / advertising. Half of the revenue comes through dealerships when the fleet is turned over with manufacturers making up most of the other demand. Although no specific synergies the line of business is familiar and will look into the opportunity it presents Connexion in Australia going forward.

Sector is growing at high single digits with Liberty leading the charge.

As expected with Aaryn (CEO) or CXZ disciplined investment manner commented that Covertrue was attractive as it met its hurdle rate with it being EPS positive immediately and a move to get the cash working at a greater rate of 7% which is what has been achieved through investments . The investment is also a move to grow revenue base and diversify revenue away from just GM in the USA.

Overall positive and will explore further on the long term implications of the investment.

Disc Held IR and SM

Connexion Mobility released full year results today and its hard not to be impressed with the results and continued discipline manner Aaryn Nania and the management team.

Before getting into the results its important to note that the biggest risk remains the concentration of revenue to General Motors (GM) which constitutes 99% of the groups revenue and is due for renewal over the next 12months . CXZ work for many years with GM has led to deep and meaningful relationships and seen the expansion of dealers on its platform which is fundamental to its business . CXZ has been able to capture 22% of the General motors franchise light vehicle dealership in the USA (as all dealership are not obligated to switch to CXZ) , so the contract remains important in terms of current revenue and future revenue.

One could say that the share price reflects such risks and if this is successfully negotiated and the concentration is reduced significant upside may lie ahead.

It is also important acknowledge that both Aaryn CEO and Ben CFO have customer diversification as the highest weighting in their incentive structure (see below) reflecting the importance this plays for the business long term.

OK on with the business results in which since Aaryn took the helm in 2021 we have seen

Revenue has risen by 253% , NPAT increased by 486% and EPS rise 500%.

Net profit margin have risen from 11.53% in 2021 t0 22.16 in 2025.

The share price however has risen 66% and thus valuing the business at 21m.

In Australian dollars CXZ is valued at just over 1x revenue, 5.46 NPAT and PE looking back of 9.

The low valuation has seen CXZ actively buy back its shares with a 104,714,395 share reduction in FY 25 or 10.84% of total shares (see below)

For the FY 2025 results were hard to fault.

The fall in Gross profit of 1% caused higher expenses in cost of sales in supporting " the higher engineering and product resources being deployed to support customer delivery and implementation activities". This investment secures future cashflows and has been a hallmark on how CXZ treat such costs.

In summary revenue rose 13.66% , NPAT rose 31.73% and EPS rose 50%.

I posted my thoughts on valuation for CXZ of 6.12c today.

Would appreciate thoughts from broader team on CXZ

Disc Held in RL and SM

Remain Bullish on the future of Connexion Mobility.

Underpinning the business is quality leadership led by Aaryn Nania and the businesses capital allocation skills.

Aaryn has been at the helm since Feb 2021 and throughout that period we have seen:

Revenue grow from $4.42m USD to $11.18M USD, 253% increase

NPAT grow from $510k USD to $2.479m USD, 486% increase

EPS grow from 0.06c USD to 0.3c USD , 500% increase

Net Profit Margin rose from 11.53% in 2021 to 22.16%

Biggest RISK for CXZ remains that 99% of CXZ revenue is derived via General Motors, with contract expiration in 12months . Expect to have this negotiated by 1st quarter 2026 with no current concerns.

This concentration is a KPI for CEO and CFO and plans are in play in seeking to obtain more diversification via, other car makers and market place platform.

Assumptions underpinning the valuation are:

Customer concentration to be reduced from 99% revenue in 2025 to 50% by 2029

FX @ 65c with USD

Revenue to rise 12% pa to 17.6m USD in 2029

NPAT margins to grow to 25% through to 2029 = 4.4m

SOI to be reduced by 10% or 86,126,598n to 775,139,389 to 2029.

This is conservative considering in 2025 the shares on issue were reduced by 104,714,395 or 10.84% .

Highlights the strong capital controls and discipline Aaryn and Senior leadership team adhere to as stated in the 4E report released 15th Aug 2025.

EPS to grow to 0.56c

Applying a multiple of 15 EPS leads to share price of 8.4c

Discounted back by 10% per year = 6.12c

What to like ?

- Disciplined growing business with 90% recurring revenue

- Business method is centred around deepening relationship to continue growing revenue ie land and expand.

- New and emerging divisions such as market place on demand, UVeye/Privacy4cars and tollaid set to grow revenue outside General Motors (GM)

- Conscious and actionable strategy to diversify revenue base away from GM .

- Capital allocation skills a real strength. Disciplined and alignment clear to ensure costs are aligned with growth and where divisions such as Quickride are not performing reviewing their viability.

- No Debt and shareholder focused

What to watch?

- Continued concentration of revenue and potential loss of GM as a customer

- Low of no growth in subscriptions and thus revenue

- Churn of existing subscriptions

- Change in leadership

July 2025

Based on EV/NPAT = 8X. Valuation = $2.1m X 8 (EV/NPAT) + $9.0m (cash) = $25.8m MC or 3.2c per share.

Dec 2024

Based on an approximate average of probability of outcomes in thesis post and a EV/NPAT valuation of 8x LTM NPAT.

Overview Comment:

Thesis playing out as expected. Connexion Mobility is gradually increasing revenue and profitability each quarter. Back stopped by a large cash pile and buying back shares. Will remain a small position, however, will increase in size.

General notes:

- Revenue growth 3% QoQ.

- Repurchased 18.7m shares during quarter at an average price of 2.5c.

- Main metrics continue to slowly trend upwards:

Positives:

- Diluted EPS for FY = 0.263 US cents = 0.40 AUD cents.

- Cash/investments = $5.9m US = $9.0m AUD.

- Subscriptions continuing to grow every quarter:

Negatives:

- No indication of success with other OEMs.

Has the thesis been broken?

- No, as expected. Still very cheap and keeping as a small position for risk management due to the knockout factors of the investment.

- Meeting all key investment KPIs of increasing revenue, continued buy backs and improving profitability. Will add to position.

Valuation:

Based on EV/NPAT = 8X. Valuation = $2.1m X 8 (EV/NPAT) + $9.0m (cash) = $25.8m MC or 3.2c per share.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Continuing to grow revenue and EPS.

- Continued buy backs.

I have increased my valuation from $0.023 up to $0.027

CXN: Net Profit Margin V Good for a market cap of $21.7Mill.

EPS Growth: has slowed.. Needs new contracts.

below: For the Quarter Ended 31 March 2025

............ .................... .....................

at 10 July 2024 Return 1yr: -10.00% 3yr: 34.89% pa 5yr: 8.45% pa

Valuation: (Try the Strawman - Google idea)

Todays Share Price is $0.027

Say Best Case $0.03078 = $0.027 x 1.14% growth per annum

Valuation: at June 2023 $0.023

Pricing - Connected Car Software Development - Leaders in Smart Car Technologies (connexionltd.com)

Debt / equity ok.

Return (inc div) 1yr: 109.09% 3yr: -5.20% pa 5yr: 35.69% pa

Dealerships:

The Connexion platform for locations focused on cost recovery & essential management of courtesy vehicle fleets$150 /month

Groups & OEMs:

The fully connected solution for Dealer Groups & OEMs looking to deliver consistent & efficient fleet programs across a network of dealership locations.

A profitable 26m small cap. Today’s 10% jump might suggest investors are starting to notice?

Overview of Thesis:

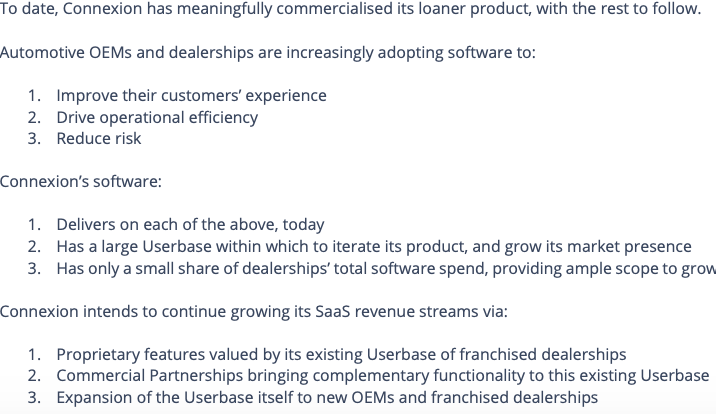

Connexion is a small software company providing software to manage courtesy transportation for car dealerships. Currently GM is their main/only customer and is a significant risk to the business, however, this has always been in a way a partnership.

The purchase of Connexion is based on a value play with potential upside for any additional growth. At an EV/NPAT of approximately 5x, Connexion is providing a 20% owners earnings yield. The investment comes with significant risks, therefore, only plan on taking a 20% of full position to begin with and then slowly add over time as conviction is built. A rug pull by GM would end the business, however, given the time and effort already put into the relationship I put this at a very low probability.

Connexion has an active capital management strategy to buy back shares. Without this prudent capital management, I probably wouldn't be buying.

Customer Value Creation:

End customers the dealerships are provided with a courtesy transportation software tool while the OEMs are able to have oversight of aspects of courtesy transportation.

Positives:

- Cheap valuation

- Core customer

- Book value makes up a significant portion of share price providing a floor to potential losses.

- CEO appears very competent and focused on return on capital for any investment. IE not going to throw money at growing the business for the sake of growing.

- SaaS business model.

General negatives/Risks:

- Concentration risk - GM could not renew or only renew on their terms. Connexion is basically wholly reliant on the revenues from GM.

- Management risk - CEO Aaryn Nania seems like a very genuine character that understands the business and capital allocation. Him leaving would be a big red flag.

- Inability over time to sign on other OEMs. The company is current fragile with the GM contract concentration risk so over time needs to reduce this risk.

- The potential reduction over time of car dealerships.

- Unable to execute on growth. Company still appears to be in the discovery phase of what the right product is especially in terms of "extras" they can monitise. If they can't find extra ways to grow revenue and expand from GM then they are very venerable.

- CEO Aaryn presented very well on Strawman. Therefore, generally have a favorable opinion which may be incorrect.

Probabilities of outcomes:

Valuation based on probability of outcomes = 3.85c:

- 10% - GM cancels contract. Connexion stops business, cash returned to shareholders. 0.5c shares.

- 20% - Lower profitability with 5x mutliple maintained. 1.5c shares.

- 60% - Profitability remains the same and GM contract renewed. 3.5c shares.

- 20% - Significant growth in revenue and/or new OEM signed up. 7c shares.

Investment KPIs:

- Incrementally increase revenues

- Continue to buy back shares at cheap valuation

- Improved profitability over time.

- Increase number of products and revenue opportunities.

How I expect this will play out:

- Relatively flat share price or gains due to buy backs.

- GM to extend contract when

When to get out:

- CEO leaves. Seems to have owner attitude.

- GM contract is not renewed.

- Revenue moves backwards.

- Clear that they will not be able to increase number of OEMs and GM has reached it's limit in case of sales.

- Unable to execute on growth avenues.

Connexion announced today that they are doing an on-market buy back kicking off on the 25/10. This was approved by shareholders a few days ago at their AGM. Which should add a floor to the current SP at around 0.027.

Looks like they are intending to buy-back circa 170,628,991 shares (approx. $4.6 million a current prices). Shares on issue are 849,891,492. So this equates to about a ~20% buy-back of current shares! That's a decent purchase.

According to their most recent Quarterly, they also purchased 33.7m worth of shares between Jul - Sep 2024. Appears they have approximately $5.1m cash on hand at the end of the quarter.

I haven't viewed the meeting with them from last month, but I have been meaning to take a look, today's announcement pushes that up my priority list.

Another frank and detailed meeting with the CEO, Aaryn.

Seems calm, methodical, across the details, competent, adaptable. Investment background.

What he thinks you should understand

- how customer-concentrated they are with the Courtesy management system contract for GM dealerships and

- what they are doing to branch out -- Aaryn intends to lay out more detail at the AGM

Good background on the company. They stumbled into this and ran with it.

What are they doing to diversify customers

While keeping their eye on the ball with GM's retail incentive team, the small unit who are their current primary contacts:

1. Find other decision makers outside of that team in related areas of GM. For example employee vehicle programs. Some success.

2. Other OEM dealership networks. Not yet. This takes time, there are competitor SaaS providers and the OEMs don't all procure in the same way. Some already contract exclusively with the main competitor, some have approved supplier lists that you need to get on. Have got on lists but then figuring out the decision makers takes time.

3. Sell complimentary software direct to existing dealer base. In this way move from being a one OEM company to a 4000 dealer company.

a. The lowest hanging fruit and what we have most clarity on

b. We need to work on integrating with various DMS - dealer management software.

c. Services related to courtesy car, since that's what we're known for (Courtesy shuttle, ride hail, tollway management.)

d. Launched a marketplace in Jan. Steadily increasing sales but not a material income yet.

We're no where near getting into the DMS space but we're playing at the edges.

Competitors

- TSD Web - the incumbent, 16,000 dealerships. They have all the exclusives except GM. Can't worry about them yet.

- Dealerware - the up-and-comer. Need to stay ahead of them.

Sales force

3 US based sales, plus mgmt make regular sales trips for insight and feedback because it's not easy to keep dealers attention in their busy retail environment. Learning the reality of different dealerships across US, figuring out how to engage, in person or within the software. Data analytics. Locate the bottlenecks.

Board members

one Detroit based founder of Onstar (the GM emergency assist service), one runs a VC fund, knows startups (sounding board)

Capital allocation decisions

First: Organic growth. No dividends for a while (no tax credits due to history), buybacks as long as suitable. Conservative investment of cash to stay ahead of inflation. M&A considered, 2 investigated but ultimately passed on. Hard to find suitably sized profitable target.

Shareholder base

Previously shit, now good. (my words not his)

The potential for a bigger business is there but it would take time. The current business generates cash. They will not fluff the share price, only update when something happens.

The courtesy ride hail project

Previously announced agreement with undisclosed ride hail partner. Taking longer than they wanted. Details to iron out eg tax.

Share float: 934 million

CXZ brought back 29 million on September 3. 3% of float in one day.

DISC - HELD

Just tweaking the valuation - Assuming EPS of 0.33 cents per share (current quarterly profit run rate, and a PER of just 10, I come up with a valuation of 3.3 cents...

Firstly, the negatives:

1) One major customer, General Motors Courtesy Transport Program. All the eggs are in one basket here.

2) Average investor relations communication.

Positives:

1) CXZ has been profitable for many years now, and will report about $3.7 M AUD PBT for 2024 (CXZ has a market cap. of $25M!) .

2) CXZ has been growing revenue over the last 3 quarters at a rate of 15% pa.

3) CXZ share count has been fairly stable. Share count inflation of 3% since 2021.

4) +90% of revenue is subscription based. The GM network is 22% of all US franchised LV dealerships in the US.

5) There is no optionality or growth priced in. So, CXZ drive to expand offerings of it's Connexion platform, and its direct to dealer strategy.

5) Capital management. Management is has implemented strict capital allocation policies as per 2023 AGM presentation, which has allowed them to remain profitable for many years.

Valuation. For the valuation, I am discounting future cashflows by 20% to take account of key customer risk. I am assuming marginal success in expanding its customer base, and product offering to existing customers.

Assuming CXZ achieves $26 M AUD revenue in 2029, and $4.4 M AUD profit, at a PER of 17, I come up with a valuation of 0.031....

DISC - HELD

Connexion reported FY results and pleasing overall.

ALL the reported numbers are in USD.

I have pasted the key elements of the report below but in summary

- Strategy outlined by Arryn found interesting, "come for the tool, stay for the network". As has been consistent Connexion are playing the long game growing and enhancing dealership usage and product offerings. This creates stickiness / high retention.

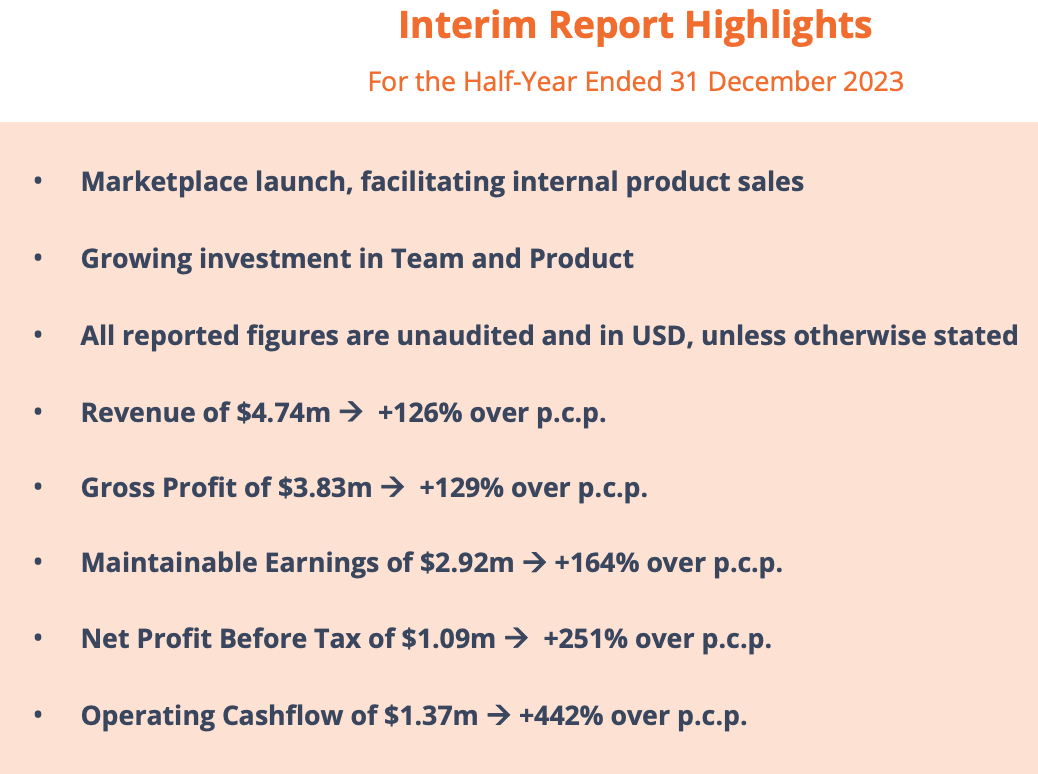

- Top line growth strong with revenue growing at 47% to $9,841,340 USD and Gross profit 78% to $7,680,585USD. It was a 200 basis point decline from 2023 but considering Connexion expense the R&D this is a plus.

- NPAT rose 7% to $1,882,127

- From a Capital allocation perspective just under 7% of shares were repurchased at a favourable purchase price.

- Balance is solid with NO debt and total current assets growing by 29.97% to $7,9120,38. Total equity also grew by 19.3% to $6,280,349.

- Long term alignment across the organisation via LTIP is a feature and is intended to assist with retention which s crucial in capturing new dealerships long term.

- Guidance was non existent for 2025 but this reflects the nature of the Connexion business which has 99% of revenue coming from General Motors dealership in the USA. The ability for Connexion to shift out of this single customer focus will be the challenge over the next 2-3 years. It also reflects the conservative style of Aaryn.

- Connexion is clearly growing well and doing so profitably.

FY 2025 Projections (my projections)

- Revenue grow - 15% plus

- EPS and NPAT - grow faster than revenue

- Share repurchase to continue as opportunity presents itself.

Disc: Held on SM and RL

Connexion Mobility released Q4 results Friday 19th July.

Solid quarter to finish the year with no change to the thesis in terms of Connexion mobility being a long term buy and hold.

Difficulty in assessing CXZ is the lack of client transparency to understand the traction they are getting with dealerships or OEM but the revenue does provide a solid guide as the direction.

It is important to point out that this lack of transparency means understanding the customer concentration is not clear but something Aaryn (CEO) is seeking to reduce and something as shareholders we must keep at the back of our mind as a risk.

CXZ have and are placing a high priority when working with dealers and OEM's to build a solution that solves their problem in managing their fleet of cars and associated issues. Ultimately the uptake will be seen in revenue.

High level Results were as follows:

- 2024 FY Rev 9.8m USD v 2023 6.6m USD . 32% Higher YOY.

- Subscription revenue in Q4 was a significant driver of this growth hitting a all time high to 1.92m of. Total Q4 revenue of 2.6million.

- Currently there are 46 partners as subscribers with a trial underway to have many more join the network.

- To ensure this occurs and is supported the additional 3.5 FTE during the quarter reflects the priority to develop deep relationships with dealers and OEM's.

- This is also being supported by 5% plus increase in the past quarter in costs in the areas of Sales and Marketing and Research and Development.

- With these additional costs profitability for the year remained flat to 2.63m implying a 26.8% net profit margin. Very healthy and positive.

Capital Management strength continues to shine through.

Net cash under Aaryn's leadership has grown from 2.8m in Q4 2022 to 5m in Q4 2024.

Share Buybacks similarly have been used very well to be value for shareholders.

The buyback and retiring of 153million shares since 2022 at a price range of 1c-2.74 (all below current share price of 2.8c) is solid and not something common on the ASX, especially in small cap land (see below)

Looking to the future the best results for Connexion is ahead of them.

It is pleasing to see a CEO take a long term view to build what is necessary to deliver products which are sticky and when scaled will see net profit grow to be 30% plus. How wide can this software be applied time will tell ?

Mission and Vision is clear as noted below :

Finally from a valuation standpoint CXZ @2.8c has MC of 24m AUD.

Converting the key metrics from USD to AUD @ 1.5x

Rev AUD 14.7m

Cash AUD 7.5m

Net Profit 3.9m

Disc Held RL and on SM

Connexion is an interesting little business and one that I probably would never have either, come across or looked twice at if it wasn't for this platform. @TEPCapital (not sure if he is still around) did some really good work on this a year or two ago and then we had a CEO interview last year which was informative. @wtsimis did a good summary of the recent half year results, which have continued into the recent quarterly. The stability of the earnings in this business really are impressive.

The big risk is customer concentration as they are almost entirely dependent on General Motors, and initially this was enough for me to stay clear, but having watched how this dynamic works I am less concerned about this risk, although if anything changes at GM then this would seriously impact CXZ. The GM contract will be up for renewal again next year but this is now a long standing relationship and this will be the 3rd renewal, and I think this is more of a partnership than a dependency type setup. The other reason I have less concern about this risk was the announcement in Jan 23, about how GM would now pay to have the CXZ software rolled out to all of its dealerships where as previously it was the preferred supplier this boosted ARR by US$3m. There is good detail on all this in the straws but I can't see why they would terminate the partnership if they see value in what CXZ is providing which they clearly do. A negative is that they have struggled to penetrate the non-GM dealers.

What I have been impressed with is the management team, they have very clearly articulated hoe they see the priorities of the business and how they are tracking their progress against these. Its worth checking out the quarterlies on how they are measuring return on growth spend and maintainable earnings. It is refreshing to have a CEO that spells out their metrics and holds themselves accountable to these measures. These guys aren't going to burn cash on unproductive ventures or dilute the share base. Management competency and trustworthiness gets a big tick here for me.

The interesting news recently was the launch of a new product. Given that CXZ is generally pretty conservative in the way they release things I thought this announcement was interesting. Basically they have partnered with a Global ride-share company to provide a dealer shuttle service called Connexion OnDemand. Its a pretty clever initiative to remove a cost and hassle from the dealer side and outsource the shuttle service to a third party. The details were light as it will launch next quarter, but the gist I got from listening into the quarterly call was that they are pretty excited about the potential of it.

At the current 2.9c mark I think it is valued at the status quo with minimal growth expectations. This isn't going to spit off free cash for a while as most of the earnings are being put back into the business and product development, which I think is the right decision, if you want a dividend buy a bank. The important thing for me though is that this product investment is coming from cashflow. This is a $3-3.5m NPAT business with a market cap of $26m. The secret sauce here is the competent management.

@Strawman it would be good to get Aaroyn back on for an update later this year.

Since Feb 2023 when Connexion Mobility announced its agreement with General Motors (GM) in the US and following Aaryn Nania appearance on Strawman in the same month i have been impressed with how two key areas of CXZ have evolved :

- Culture of the organisation and

- Capital allocation at CXZ.

I will step through why such a view has been formed.

Firstly having held Connexion Mobility from mid 2021 and having monitored the progress via (Quarterly 4C release as well as half yearly and annual results) the risk reward to the upside is more evident today than ever.

Recognising that Connexion Mobility revenue is heavily dependant on GM and due to confidentiality any investment MUST factor this into the risk.

Much of the 7,000 GM dealerships are independent and thus even though GM has an agreement with CXZ it is the dealership discretion to determine the best software. No dealership is obligated to shift to CXZ platform and can make their own decisions on which platform is most suitable in seeking to effectively manage loan car as well test drive systems.

As an investor what is appealing about this model is the incentive for CXZ to develop and show the merits of their system is their for them to show. Failure to do this well will not only led to poor uptake but ultimately loss of contract longer term.

CXZ led by Aaryn recognise this and have not only invested into product development and resources but taking a considered approach to ensure the product is meeting the needs and is of great value.

Results over the past year 2023 and expectations for 2024 and beyond

Hard to fault with positive CF , earnings and NPAT and in doing this reinvestment back into the business to drive improved sales and margins.

Back to my two original points re the Culture and Capital allocation in which CXZ have done very well.

Culture of Organisation

Over the past year CXZ have recruited in a manner which is prudent and in line with revenues rising which has ensured financially profitability is still in check but at the same time place the appropriate resources on the sales and product focus to grow the number of GM dealers whom seek to convert to the platform. This is unfolding and expect this investment to deliver meaningful lift to revenue and profitability going forward.

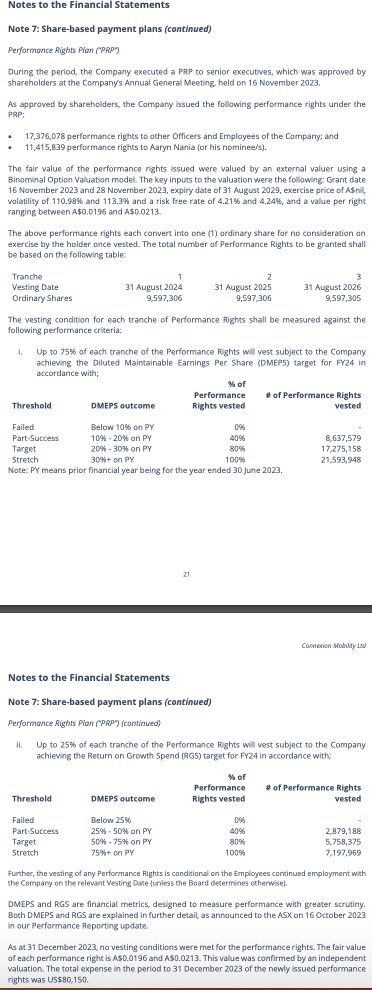

Second Half 2023 Management brought in metrics to align and improve the accountability of the team. The two metrics which are key to future are,

- Diluted Maintainable Earnings Per Share or (DMEPS)

- Return on Growth Spend (RGS)

If the previous guidance by Aaryn and the leadership team on focus on gross profit is anything to go by whereby in Q23 2022 GP was 605k and by Q2 2024 this increased to $3.83m the evolution of these two metrics provide optimism on the customer penetration that may be achieved and thus improved financial results that will flow.

Below is a extract from October 16th 2023 press release re both definitions and the link to management LTIP.

In respect to Capital Allocation i am very positive of the actions taken by Aaryn. His finance background as Co - Founder and Chief Investment officer at Lucerne Investment Partners is no doubt proving to be a real strength for the organisation. Below data speaks for itself.

- Share Count Reduction in 2023 of 45,233,733 ordinary shares or 4.7% of total share count which brings the share count down to under 900m.

- Investment into new product has been done without the need to raise monies or dilute shareholders.

- Cash on Hand of $4.3 mil

- No debt on balance sheet

From a valuation standpoint i will complete an update but support the 3.2c listed last year.

Disc : Held on SM and RL

CXZ H1 2024 Interim-Report-Highlights.pdf

CXZ Feb 9th 24 -Half-Yearly-Report-and-Accounts.pdf

CXZ GM Agreement 2023 Market-Update.pdf

As @TEPCapital outlined another solid quarter for connexion.

Alot to like in terms of business performance and execution.

Reading into the results its fair to say Connexxion Telematics led by Aaryn Nania are conservative in terms of guidance and outlook.

This should not be mistaken however on the direction the business is heading and disciplined approach in execution.

CXZ focus on Gross profit as outlined at AGM is occurring with gross profit growing form 500k in Q2 2021 to 891k in last quarter.

This focus on gross profit is all about the long game in terms of growing the 'priority on deepening and expanding the current customer relationships'.

The customer focus and investment is best seen in the recruitment of customer success managers across the US in the past several weeks . This has enhanced customer engagement with dealerships and will yield results over from 2024 and beyond.

Tollaid which is a CXZ toll management solution allows dealerships to improve operational efficiency, cost recovery, and customer experience has signed various dealerships in the free trial stage with the expectation of conversion to a paid service to come through in 2023.

Capital Management

- Connnexion Telematics have 881million shares on issue and 37million or 4.2% of shares were repurchased in the past quarter at 1c (Dec 2022)

- Share allocation to the leadership team are linked long term success and retention with specific hurdles.

- In the passed 12 months CEO and management have made share purchases and insider ownership is at 27%

From a valuation standpoint with revenue at 4.5m- 5.5mil in 2023 and net profit before tax of approx 400-600k in 2023 CXZ is trading at 10x net profit before tax and 2x sales.

With clear leadership alignment and a disciplined approach to operations and good capital management connexion telematics presents as good value for the patient long term investor

Thanks TEP and great summary in analysing such a small company and if the challenges with chips are subsiding goes well for the next 1-3yrs .

Connexion is now a play which providing much upside and limited down along the lines of SGI . Why?

Team have developed many ways to win (see below)

- High gross margins (75%+ in Q4) and focus to hold or grow this level

- Ford & Lincoln approval provides upside to grow the business and add value . This will be product led and CXZ sit at a very competitive end of the spectrum

- Strategic alliance with Infomedia in the US . Opportunity to accelerate this in light of the Ford and Lincoln approved vendor .

- Toll aid roll out assisting dealerships to improve operational efficiencies , cost recovery and customer experience

- Marketplace development enabling CXZ to attract and retain participants to the CXZ software ecosystem.

This positive aspect to these elements is that CXZ don't need to win on all fronts to drive great results but if they are able to improve over time across one or more at the gross margins of 75% this will transpire to healthy returns.

The reference and focus on the long game ie building out / deepening relationships with customers to meet their needs and adding products over time presents real appeal and will show up over time.

Management also aren't selling the TAM and aggressively selling the opportunities that lie ahead.

Finally the capital management and employee retention strategy is worth a mention

From a capital perspective currently working through a 20% on market share repurchase . Small holding under $500 are being repurchased . SP have fallen to 1c from under 2c over the past year so a good long term use of capital.

Secondly in terms of the building a retention strategy as the business looks to build teams, awarding shares which vest essentially 6yrs after commencement with the assumption that the share price is higher than it is at the time the team start is also good alignment with shareholders.

Stock to watch that's for sure

Holder in RL