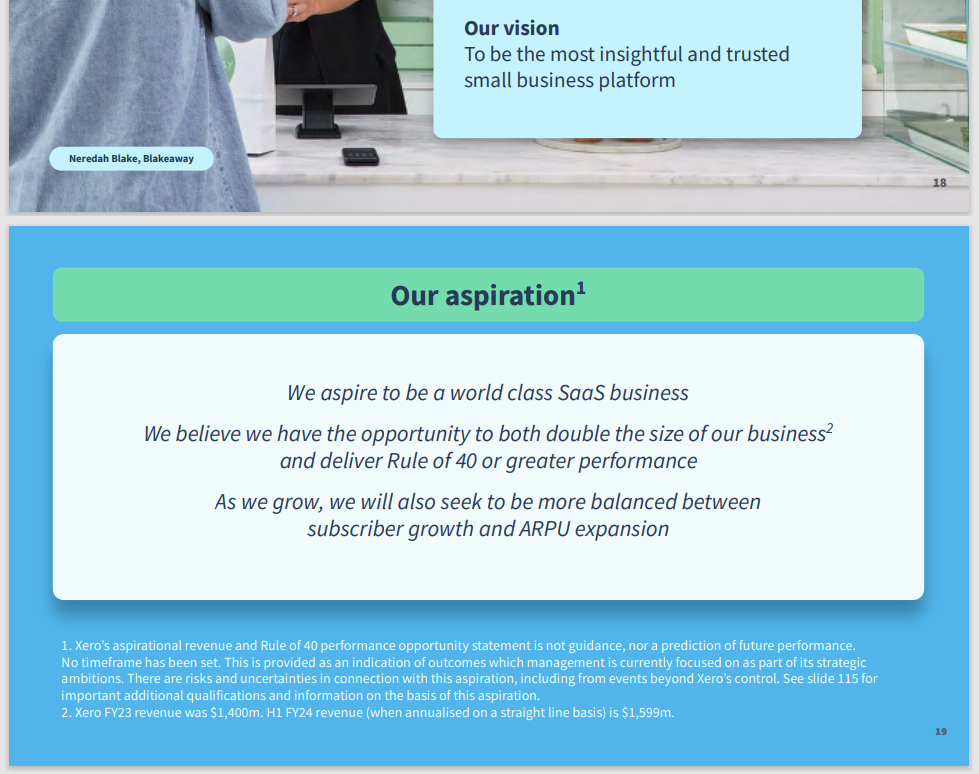

05-March-2024: Interesting that Xero's new CEO, Ms Sukhinder Singh Cassidy, has signalled a reduction in spending at Xero and a focus on the "Rule of 40", as shown on slide 19 of their recent Investor Day Presentation last week (29th Feb):

The Rule of 40 is a principle that states a software company's combined revenue growth rate and profit margin should equal or exceed 40%. SaaS companies above 40% are generating profit at a rate that's sustainable, whereas companies below 40% may face cash flow or liquidity issues. (Source: https://www.cloudzero.com/blog/rule-of-40/)

Ben and Jeremy from TMS Capital reckon that's a different approach for Xero and it could be an inflection point for them in terms of sustainable growth and profitability. See here: TMS Insights February Reporting 2024 - YouTube [29-Feb-2024]

In that video and in their previous "Insights" video (TMS Insights January 2024 (youtube.com)), the boys also discuss the recent spate of takeovers in the building products space, including CSR (https://www.afr.com/companies/manufacturing/saint-gobain-buys-into-csr-s-dark-past-along-with-its-bright-future-20240227-p5f887), Adbri (ABC, formerly known as Adelaide Brighton Cement) (https://www.afr.com/companies/manufacturing/irish-giant-crh-and-barro-family-in-2-1b-bid-for-adbri-20231218-p5es4e) and Kerry Stokes' Seven Group's bid for Boral (BLD) (https://www.afr.com/companies/infrastructure/kerry-stokes-seven-group-bids-to-take-full-control-of-boral-20240219-p5f5xo)

Further Reading: https://www.afr.com/chanticleer/why-bids-are-flying-for-australia-s-overlooked-building-materials-groups-20240222-p5f6wo

It's interesting that Ben & Jez reckon that Brickworks (BKW) is the one they like most in the sector and one that could see some fund inflows in terms of Instos reinvesting money from BLD, ABC & CSR, because all three are all-cash bids and Insto's often look to redeploy funds into the same sector in these cases.

In the same vein, Insto money from the Altium takeover might be looking to redeploy into the Aussie tech sector - which brings us back to Xero (XRO) and Wisetech (WTC), being the premier remaining ASX-listed tech exposures.

I had previously held Xero shares but sold out a couple of years ago because they looked like pushing out that "profitable and growing those profits" stage indefinitely, partly due to overpaying for acquisitions with questionable strategies behind those acquisitions (booking write-downs/impairments in subsequent years, suggesting they overpaid and that the synergies just were not there). New management at Xero seem to have a clearer focus on sustainable profitability, as demonstrated by this reference to trying to adhere to that "Rule of 40".

Positive!