Pinned straw:

Monday 25-March-2024: The Money of Mine lads discussed the positives and negatives from the GMD Five-Year Strategic Plan - and possibly why the GMD SP dropped by -6.25% (-12 cents from $1.92 to 1.80) on Friday - when Genesis released that 5 year plan - and their SP didn't move today (closed flat), in their podcast today:

https://www.youtube.com/watch?v=_pVf3Dk2lgc&t=402s [that link will skip the intro and the PLS discussion, and will start at the GMD discussion]

From: Pilbara Minerals Picks a Partner (youtube.com) [25-March-2024, MoM podcast video]

"Pilbara Minerals (PLS) kick starts the show by finally sharing more on its downstream plans while Genesis (GMD) vied for our attention with the big 5-year strategy."

"Brightstar (BTR) is tying the knot with unlisted Linden whilst raising capital and the Battle for Sierra Rutile (SRX) has taken some fascinating twists over recent days, as well as Leo Lithium (LLL) giving long suffering shareholders an update & the OreCorp (ORR) board recommends Perseus’s (PRU) bid."

CHAPTERS

0:00:00 Introduction

0:00:51 Pilbara picks Ganfeng

0:06:42 GMD's long awaited 5-year strategy

0:17:08 Brightstar & Lindin tie the knot

0:27:14 The Battle for Sierra Rutile!

0:45:16 Leo Lithium updates long suffering holders

0:47:22 OreCorp recommends Perseus's bid

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

-------------------------------

Further Reading:

Genesis unveils five-year growth strategy - Australian Mining [22-March-2024]

Genesis Minerals' five-year plan - ShareCafe [25-March-2024]

Genesis Minerals' five-year plan - SMS Finance [22-March-2024]

Gold price: Bill Beament’s Develop Global, Raleigh Finlayson’s Genesis Minerals prepare for take off (afr.com) [by Peter Ker, Resources reporter, AFR, Mar 24, 2024 – 4.15pm]

Mining rock stars Beament and Finlayson face their reinvention tests

The divergent paths taken by Bill Beament and Raleigh Finlayson over the past two years sum up Australian mining’s green transition. Who’s on the right track?

Mining industry legend Bill Beament got a surprise on Thursday when Raleigh Finlayson’s gold play, Genesis Minerals, revealed its five-year strategic plan across 438 pages of market filings.

“I thought he was going to put his out Monday which is why I got mine out this [Friday] morning, but then they dropped out the same day,” says Beament, after his company, Develop Global, published its own 47 pages for the market to digest on Friday.

Former gold miner Bill Beament: Gold is “not green” he declared to a shocked Diggers & Dealers. [Image credit: Stefan Gosatti]

Like former members of a boy band whose solo careers are perennially compared, Beament and Finlayson’s shared history through the creation of gold giant Northern Star means their new corporate ventures will inevitably be regarded as stablemates, even though they are on different paths.

Finlayson will present Genesis investors with the company’s first major strategy update on Monday, while Beament is expected to give Develop investors a similar mission statement in the weeks ahead.

These presentations make it an opportune moment to study the reinvention of two brilliant and intertwined mining careers.

For those new to the Bill and Raleigh show, they got their big breaks leading gold juniors at the start of last decade.

By late 2020 they soared to the top of the charts when they forged the $16 billion merger of Northern Star out of the companies they had respectively built from scratch.

Beament was the industry rock star, who rode electric skateboards, landed big acquisitions and commanded the spotlight. He created extraordinary wealth for shareholders along the way.

Most in the mining industry would probably agree that Finlayson cuts a slightly more homespun, quietly spoken figure than Beament.

When the Northern Star merger came together in late 2020, a gold mining dream team was formed; Beament was supposed to remain as executive chairman, while Finlayson would be managing director.

But realistically, no encore was ever going to match the creation of Northern Star. Beament exited three weeks after the merger was legally finalised and Finlayson was gone six months later.

Beament was first to launch a solo career. In February 2021, he took charge of – and significant ownership in – a little-known exploration company called Venturex.

He brought two other big names with him: former Detour Gold chief Mick McMullen and Mineral Resources founder Chris Ellison. Shares in the pre-revenue explorer tripled in a day on the back of the Beament brand and rose more than eight-fold over the next three months.

Scene stealer at Diggers

At Kalgoorlie’s Diggers & Dealers conference that year Beament stole the show with a presentation that some attendees likened to a U2 concert.

Venturex was rebranded as Develop and Beament unveiled a new business model that would blend his expertise in underground mining services with mine ownership in the same way billionaire Ellison had done at Mineral Resources.

Most notably, Beament told the conference that his prime focus would be “clean metals” such as copper, zinc or lithium rather than the gold mines that had rocketed him to stardom.

He doubled down on the pivot, declaring that gold was “not green” in the way copper or lithium were. Gold was unfashionable at the time, but the comment was still tantamount to blasphemy in Kalgoorlie.

Seven weeks later, Finlayson launched his solo career in a way that was eerily similar.

Genesis Minerals boss Raleigh Finlayson, right, in Kalgoorlie last year next to sister Marnie Finlayson. [Photo credit: Chuck Thomas]

Finlayson was announced as the new managing director and investor in a little-known ASX exploration stock called Genesis Minerals. Genesis shares doubled on the day Finlayson and former Fortescue boss Nev Power were announced as the new backers of the company. Kerry Stokes and AustralianSuper would soon follow.

While Beament was determined to experiment with new metals, Finlayson kept to the same formula that had delivered him big hits over the previous decade. Genesis would mine gold and even use the same font and colour scheme in its presentations as Raleigh’s first company, Saracen, had done.

‘New fancy metals’

“It would have been the easy and obvious option to flip out of gold and into the new fancy metals,” Finlayson told The Australian Financial Review in April 2022.

“When sentiment is low that is when you have got to have the courage of your convictions to swim the other way, so that is the primary reason why I am in this gold vehicle Genesis Minerals.”

The fact that Finlayson pursued his new gold play on land around his childhood home only stoked a perception of loyalty to the cause.

From that moment on, Beament and Finlayson’s entwined careers became a metaphor for the generational transition the Australian mining industry was grappling with.

Should a successful heritage in commodities such as gold and coal make way for a future in “green metals” such as lithium, copper and rare earths? Gold rushes in Ballarat, Bendigo, Bathurst and Kalgoorlie were nation-building events which paid for the high Victorian architecture along Melbourne’s Collins Street.

But for all the effort and carbon emitted to produce gold, the metal is used for little more than sitting in vaults and storing theoretical value; an outcome that is harder to justify in the age of decarbonisation and utilitarianism.

Putting the lithium in electric vehicle batteries is an easier mission to eulogise.

Common ground

Fast-forward to this month and the divergent paths taken by Beament and Finlayson have brought them to a relatively similar junction. Both were busy last week, publishing dozens of pages of information and updates to the market.

Develop is now worth $580 million, up from less than $50 million before Beament’s arrival in February 2021. Genesis is worth just over $2 billion, up from about $150 million in August 2021.

Finlayson and Beament’s personal brands, and the strength of their backers, is responsible for most of that value creation. Both Develop and Genesis are pregnant with potential.

In the fickle world of commodity prices, the simple assessment at a time of record high Australian-denominated gold prices – $3327 per ounce – and low lithium prices would be that Finlayson chose the right path by sticking with gold.

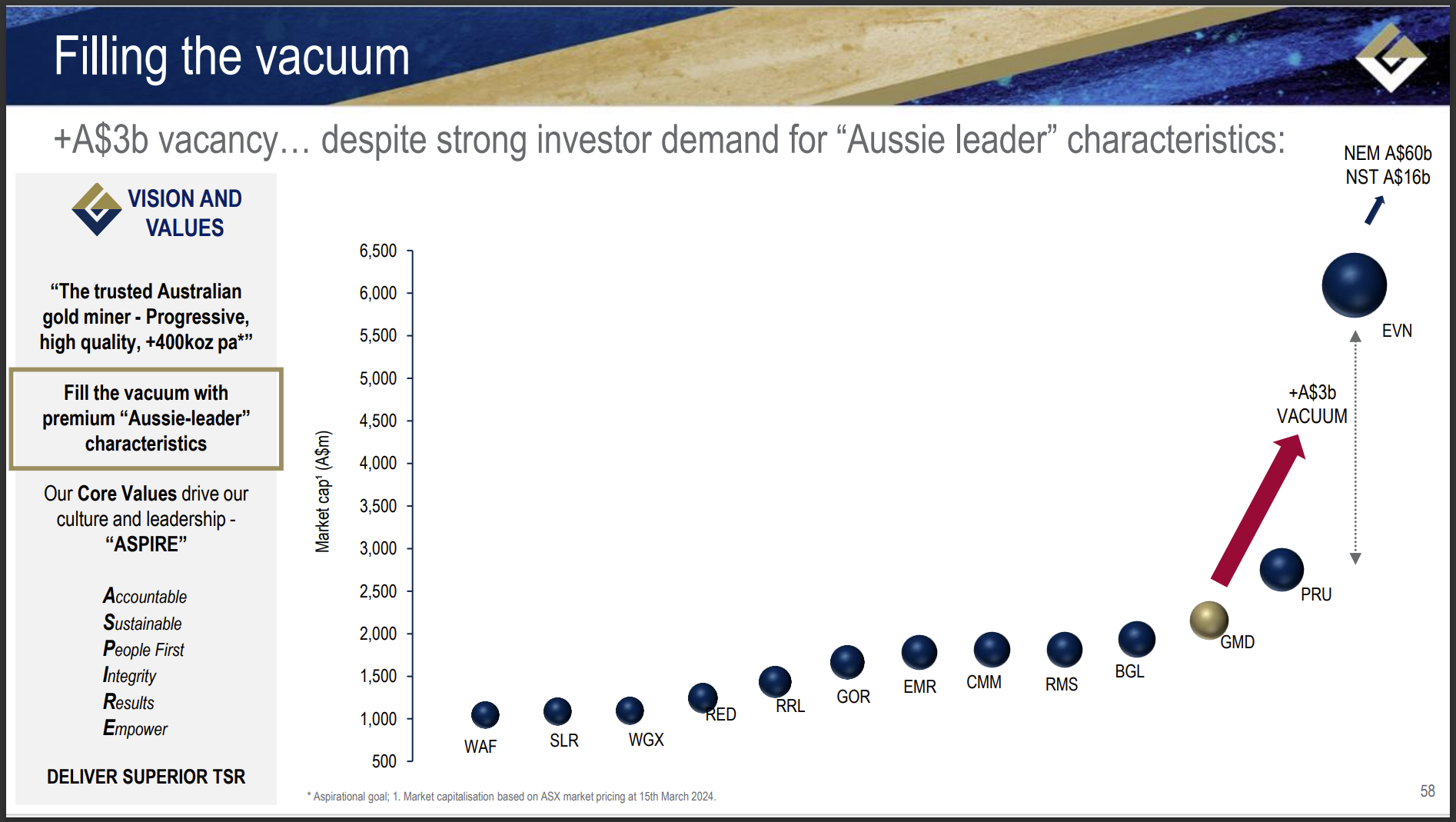

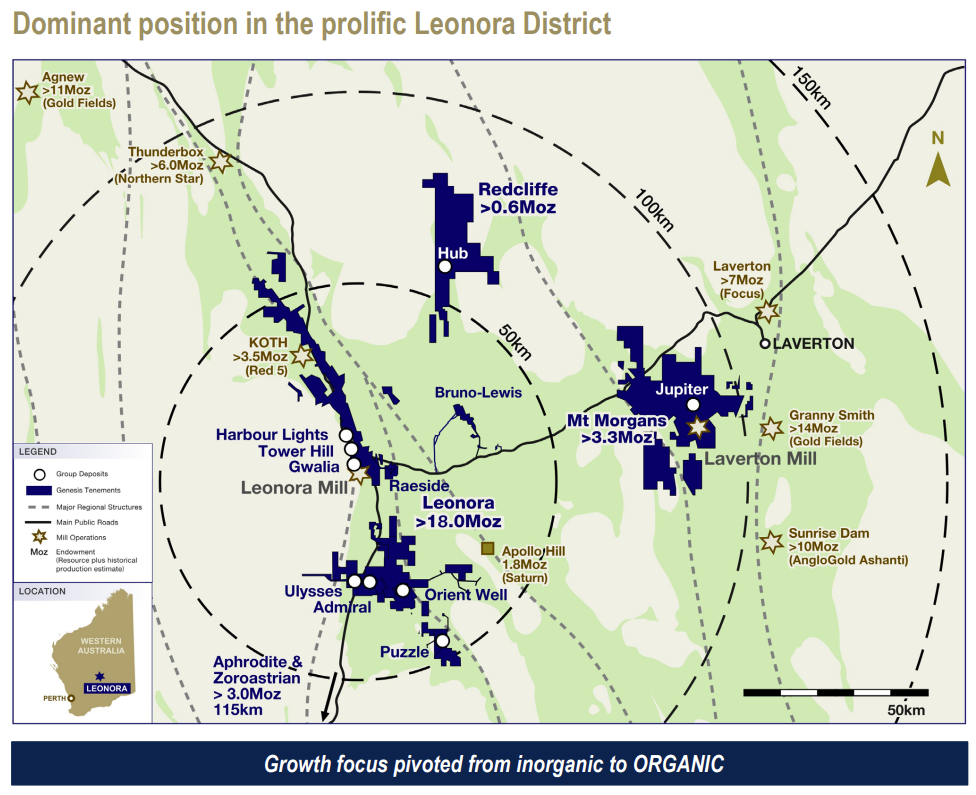

Genesis also seems to have the smoother path to delivering on its potential after two years of hard slog consolidating a gold province around the south-eastern side of Leonora.

Assets that were previously held across Dacian Gold, St Barbara, Kin Mining and Genesis can now be blended with a fluency that belies the roadblocks and ambushes put up last year by the likes of Delphi Group and Silver Lake, both of whom forced Finlayson to pay more to consolidate the region.

Finlayson’s bigger outlay on consolidation is being offset by the fact Australian dollar-denominated gold prices are higher than they were at the time his deals were struck.

The Leonora district won’t be fully consolidated so long as Red5 continues to own the King of the Hills mine. But Finlayson’s message this week is that he has consolidated enough, and investors should not expect further mergers and acquisitions any time soon.

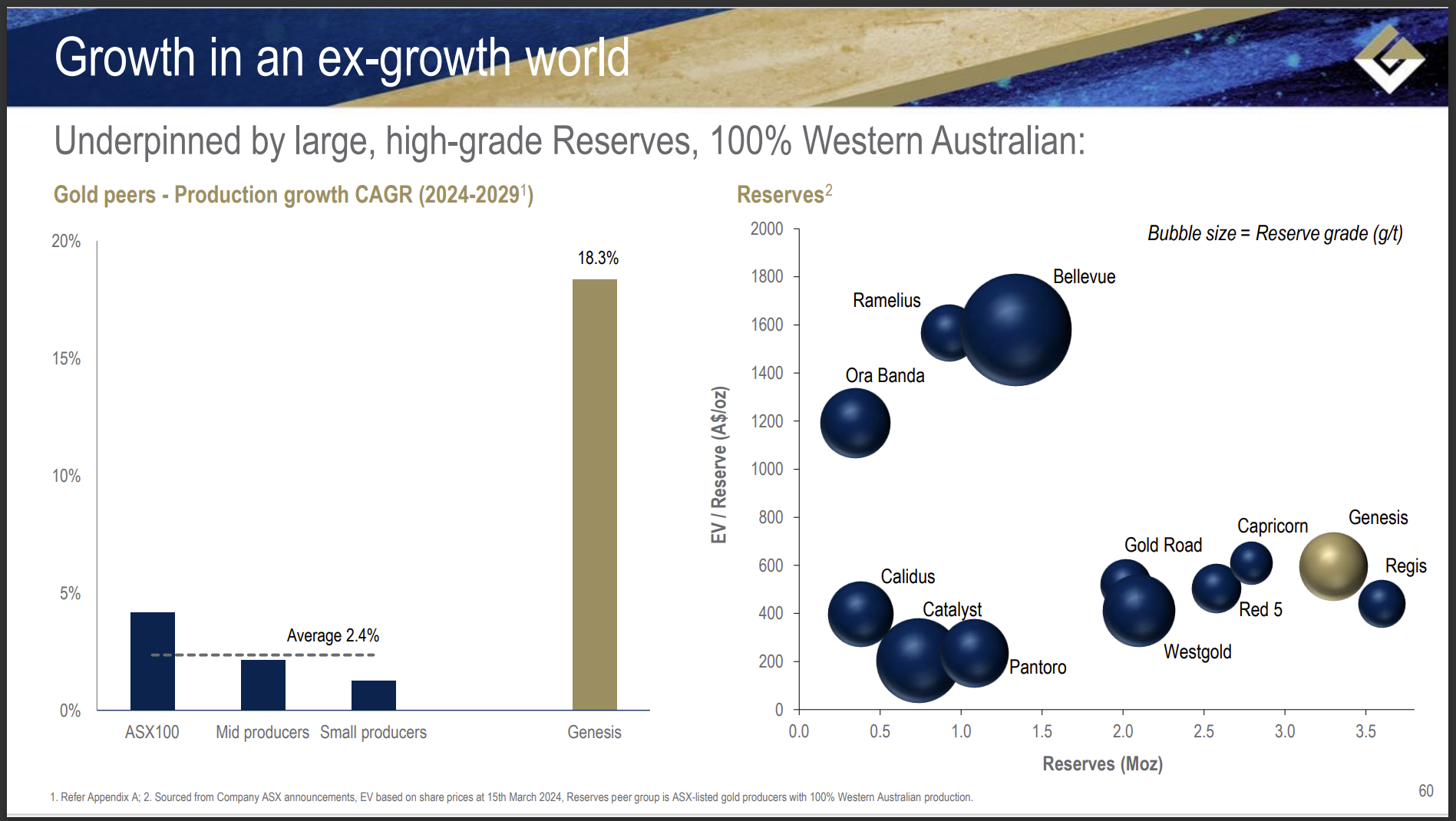

His plan to double gold production over the next five years is based on resources already under control, and a 10-year plan for further growth also excludes some of the resources on Genesis’ books.

“There is no point us chasing other ounces that don’t come forward into the production profile, we have already got so much of that in our portfolio,” Finlayson told the Financial Review last week.

The growth should be affordable out of existing cash reserves and the cash that will be generated by the mines. “I take my hat off to what he [Raleigh] is doing, he is doing a really good job,” Beament said on Friday.

Last year was a bit of a slog for Develop too.

The company’s cash balance declined by 43 per cent in the three months to December as it completed the acquisition of lithium explorer Essential Metals, continued preparing the Woodlawn copper project near Canberra for an investment decision and equipped itself to perform mining services contracts.

Lithium hangover

Weak lithium prices aren’t flattering Develop’s purchase of Essential Metals.

Beament says demand for lithium from the customers he visited in North Asia recently remained strong and Finlayson was also charitable about lithium’s future.

“These things go in cycles. I wouldn’t be surprised if you find lithium back up again in the not-too-distant future,” said Finlayson.

Copper prices are helping Beament; the red metal has rallied by 13 per cent since October.

A final investment decision on the Woodlawn copper and zinc project could come within weeks and Beament was adamant he would not fund development via a dilutive equity raising. He is confident lenders will be keen to participate, as will the “strategic” commodity traders in North Asia.

Finlayson might have got in first with Genesis’ five-year plan, but Beament says Develop’s version won’t be far away.

“Ral has gone this pathway to 300,000 ounces which is fine, but what I will do in May is I will say ‘this is our pathway to significant free cash flow and these are the numbers and this is the assumptions, this is the projects, this is the metal, this is the cost base, this is the capital’,” he said.

“People will start getting a see through about why I am just head down, bum up.”

--- ends ---

Disclosure: I hold GMD and DVP shares both here and in real money portfolios.