MMI

MMI

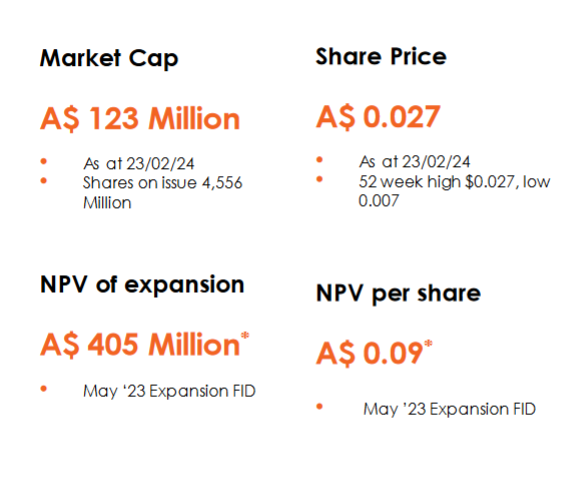

Bear Case

Pinned straw:

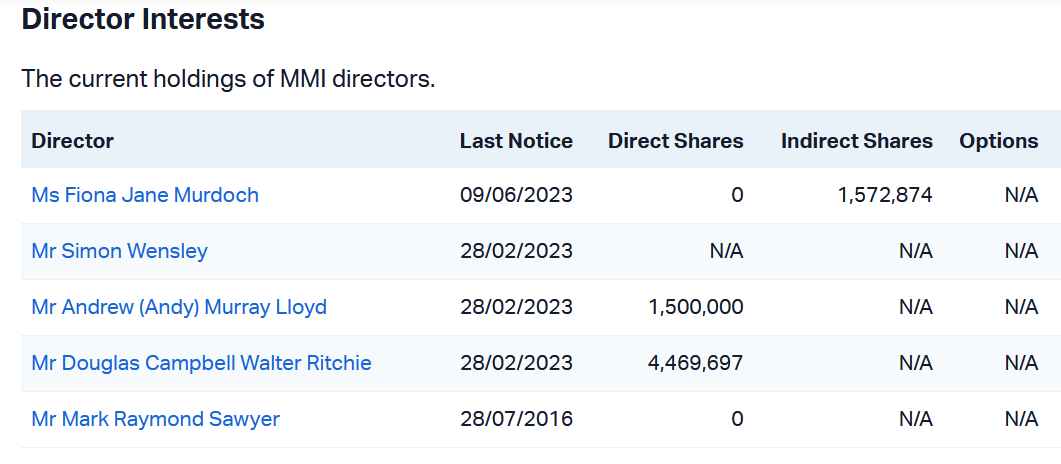

I know nothing of the company as your post is the first I am knowing of their existence so can't comment on much but it did pique my interest as to the directors and if they have been active in accumulating shares. If there was to be a major disconnect between the price and value you would think they would be quite aggressive buyers as they are the ones in the know but there has been for the most part nothing going on years now outside of remuneration in their package being directors. In fact I'd suggest the directors have very little skin in the game for the most part

3