Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

You again Scoonie. What is it?

MMI have released their quarterly. The highlights are below + my conference call notes:

• Metro Q2 net FOB prices up 13% on Q4 2023 as market continues to strengthen

• Record Q2 shipments of 1.42 M WMT – up 12% YOY

• Final components of the 7 M WMT pa expansion successfully commissioned with OFT Ikamba and new screening circuit ramping up

• Successful $40M Placement and $5M Share Purchase Plan completed, allowing early repayment of $17M in junior secured debt with a further $22M to be paid in Q3

• 2024 shipment guidance revised to 6.0 to 6.4 M WMT reflecting delays in Q2

• In recent weeks, all assets have demonstrated 7.5 Mt pa rates with integrated system rates at 6.5 Mt pa and trending higher

MMI Conference Call notes:

“The ramp up is there as planned however 1 month late due to wet weather + a minor breakdown in the barge loader and getting all plant commissioned.”

“Continuing strength through the next quarter in bauxite prices”

“With the capital raise in May MMI will pay down $39m in junior debt and will pay this off in the coming month”

“Capital budget of $36m and works 100% complete and 90% of the capital spent. On budget”

Further 7% volume growth China expected this year in traded bauxite. Growth from less locally produced Chinese bauxite and more imports.

“Australian traded (RIO) bauxite prices up 48% in the last 2 years. MMI prices will follow. MMI expects a 8% price rise in the current quarter”

Would describe the mood of CEO Simon Wensley on the Conference call as somber. Simon talked of ‘bumps in the road”, “a frustrating time” and “unpredictable things”.

Firstly, how is MMI’s debt tracking?

With the cap raise in May 24 and the operation now up and running again MMI is unlikely to go broke. That is a positive.

At the end of this quarter they will have paid down some of the high interest short term debt and should have manageable net debt of around $60m.

Well, just how much money did MMI make?

We know from the June quarter cash flow statement they were operationally cash flow positive in an amount of $1.2m.

What NPAT will MMI make once operations are running at optimal levels?

From the information MMI has provided this is not a straightforward question to answer. MMI talks of a “site margin” of $15/WMT however it is not entirely clear just what is in and out of this figure. (Clarification requested of management and pending. Don't hold your breath)

We also know they received in the latest quarter FOB revenue of $43.40 WMT.

Their production chain is: dig up bauxite/truck/screen/load barges/tow to offshore ships/load ships. This maxes out at 7.5MWT/pa. MMI have advised they have on an individual process component basis hit this target in July, and in time seek to get the production chain in its entirety to this figure.

Assuming no price changes in the sale price of the bauxite, this results in an annualised revenue of $325m.

Lets say it takes a further 6 months for the above production to be reached.

A production rate of 7.5 WMT/yr on currently company guided figures, results in a “site EBITA” of around $112m.

Using the 2023 accounts as a guide: call depreciation around $20m and interest charges of around $5m and Admin expenses $10m.

This leaves a PBT of around $77m and a net profit after tax of around $54m.

There are currently 5.9 billion shares on issue (+716m performance rights) @ 4.7 cents share price so results in a m/cap of around $275m.

So MMI at 4.7 cents a share is selling on a forward PE of about 5.

Well that's pretty pathetic. Really for a small miner, why would you pay any more?

Agreed, as a yardstick BHP and RIO currently sell on a consensus forward PE of around 10 -11. So a forward PE of 5 is probably about right, but there is further potential upside.

The CEO on the conference call indicated that one off site costs represented about $3-$4/t of production costs.

The CEO also indicated that bauxite prices were rising and hinted at positive re-pricing of 8% in the near term. Lets call that a price rise 5% or FOB price of $45.57 WMT.

This results in site margin of around $20.00/WMT .

Site EBITA becomes $151m at max pdtn rates. Resulting in a NPBT of around $116m and NPAT of $81m.

On these figures, then potentially MMI is selling on a forward PE (say 12 - 18 months out) of around 3.4.

So if the above scenario took place it is not inconceivable for MMI to re-rate to a PE of around 5. Would mean a share price of around 7 cents. An appreciation of around 40%.

Mate, you haven't convinced me.

Not trying to. All speculative, being based on target, yet to be fully achieved production numbers, controlled production costs, and bauxite pricing all heading the right direction. In their favour MMI do have a very motivated and competent CEO in Simon Wensly and the bauxite pricing winds are moving in MMI's favour.

Mate, can't you spend your time more productively looking at better opportunities than this sh#t?

Noted.

Metro Mining that’s a queer name. So what do they do Scoonie, mine stuff in the city or something?

Its just a name. They are an ASX listed company with a m/cap around $220m that mines bauxite 100km north of Weipa in North Queensland. Last year they shipped about 4.6wmt to China and this year with improved logistics they hope to ship around 6.5wmt.

So what. Why are you telling me about this?

Because there is opportunity. They are a company that has been beaten up and nearly went broke with COVID and a cyclone. With their backs to the wall were forced to raise money on very unfavourable terms. However they are pulling out of this trouble with an increasing share price and a $44m cap raise last week. The cap raise will be used to pay down junior debt of around $21m and the remainder to broadly de-risk the whole operation. Post the raise MMI will have net debt of $60m and cash of $22m. I think wisely management have, with the cap raise traded reduced risk for more a diluted future share holder return.

How much money will they make?

You can look at the MMI website and do the maths yourself, but all going well this season (due to the northern wet they only work about 9 months of the year), they could be selling on a PE of around 3.5. Lot of factors and assumptions go into this of course but this is obviously cheap. It gets better, they can earn more in the following year with modest spend to further improved logistics. It is of course all about squeezing more volume out of what you have.

Bauxite in North Queensland. Sounds like a shit load of trouble to me.

You are correct, there are all sorts of risks. Some are listed below:

i) MMI is highly dependent on the bauxite price. The bauxite from this region has a higher silicone content than most other producers particularly the world’s major producer, Guinea and receives a lower price. Also MMI don’t further beneficiate on site so it sells at a discount to what otherwise would be the same material mined by neighbour RIO at Weipa. Bauxite prices have recently been in an uptrend with prices up around 40% since January 2022. Who knows what will happen in the future.

ii) The operation appears to be highly dependent on two or three Chinese buyers. Bauxite like all bulk mineral commodities has specific specifications that help determine price and can act to make the product very refiner specific. A long way away from gold that can be sold at your local shopping centre. CEO Simon Wensley contends the need for the Chinese to diversify their resource base (mainly Australian versus Guinea), works in MMI’s favour.

iii) The whole operation is highly weather dependent. Since there is no natural deep water port, the bauxite has to be barged out and loaded onto ships out at sea. It is not just the rainy season that is the problem, it would seem you get a swell more than about 2.5m they you cannot safely load from the barges to the larger ships. Rain can be make handling material troublesome.

iv) Foreign exchange position. (Last year they lost $6.4m).

v) Freight costs are huge. Out of last years cost of sales of $222m, $51m of this was freight costs. This is a big figure and how this might play out in the medium term who knows. During COVID increasing freight costs were a major problem for MMI.

What else?

i) A way to think about is it is roughly analogous to iron ore in the Pilbara. RIO and BHP got there first and pegged all the best ground. The likes of FMG, MIN and others have been able to make good money with the second rate country the majors left behind. Similar with MMI. RIO grabbed all the best located bauxite around Weipa back in 1961. And over the years they have put in hundreds of millions worth of infrastructure. So have a much better operation. MMI are just babies (malnourished) living off the scraps. They are a low cost producer, but their high silica content means they can only attract a low price for their product.

ii) The current reserves have a life of mine of around 10-12 years. The CEO indicated they are currently working on converting resources. (An obvious course of action and potential a weak part of any buy thesis unless they can this figure get up)

iii) Weipa is a tough place to operate with a lot of regulation and even though it is remote there remains a great deal of scrutiny, especially around environmental legislation and indigenous matters.

iv) Labour is a problem, with turnover running at about 25% in 2023.

v) The new management have been there about 2.5 years. Chair Doug Ritchie has 4.4m shares, earnt $148k in 2023 along with 11.5m performance rights. CEO Simon Wensley earnt $610k base salary in 2023 with further share based payments of around $440k.

vi) MMI has accumulated tax losses that should see them not paying tax for the next two years. These don’t appear on the balance sheet for accounting reasons however the CFO is adamant they are available for MMI to use.

vii) Underneath the bauxite there is serval metres of Kaolin. This has been mined in the past and is being investigated however is not a priority. Too much to be done getting the bauxite business working properly, and may be just pie in the sky.

What are the blokes running it like?

Well some unkind people have called them a bunch of deadbeats on the basis they have been there over 2.5 years they have not delivered on what they said they would. I think this is very unfair. They have achieved a lot of very difficult milestones and have had more than their share of bad luck.

Senior managers are ex-RIO. They have clearly been in and around the bulks business for a while and clearly saw the opportunity to have a go themselves. The CEO Simon Wensley seems to be operationally right into the weeds and does not come across as a quitter.

Eh, anything else?

I spent some time talking with Simon earlier today at the RIU Resources conference in Sydney and went through what I saw as the risks that were worrying me. Short term, there are two key determinants of whether they will make money. (i) Logistics - digging it up and getting it onto the ship and (ii) Selling the stuff - price they can get from the Chinese refiners.

A key logistics risk is the Ikamba, the transhipper. It is onsite now and this month working. Trucks, loaders, screens, barges and to some extent tugs are all pretty commonplace and with enough cash can be bought. However getting good operators is always an issue for the land based equipment. Interestingly, the international crew on the trans-shipper are so grateful to be on Australian wages and conditions they function as highly motivated and stable team members. Was satisfied with the answers provided around the Ikamba in relation to breakdowns, spares and maintenance. Nothing is certain though.

On the relationship with the customers, two major Chinese refiners underpin sales to 2026. There is incentive for existing customers to continue to use an existing supplier in their refineries. A sudden change to feedstock can cause problems. Security of supply and having a diversity of suppliers is also very important to them. MMI talk more on this in their cap raise material. More generally on trade with China whether you be a bauxite exporter, wine maker or lobster fisherman, there will always be that thought in the back of your mind that things can go bad very quickly.

So what is it worth?

Well, it’s hard to say, it is trading at around 0.04 cents and last year they lost money. They do want to start rewarding shareholders with a dividend in the next two years, once they have further reduced debt and got the whole thing running smoothly.

Most the majors BHP,RIO and FMG sell on a forward consensus PE of around 10 to 12. It has had a bit of a run in the last few months. However it would not be unreasonable to see it trading on a PE of around 5 - if management can prove themselves to the market. So in time, say around 12 or 18 months it is very possible the stock could double.

Oh, right. You, think it could double. And you want me to put my money in a pissant dirt digger located in some swamp in North Queensland! Listen Scoonie, you need your arse kicking to a point and kicking off mate!

Well maybe. But I’m not asking you to do anything. It’s your money, do what you like.

MMI completes their capital raise. Extra 900+m odd shares at 4.1c.

$40m will be used to pay down debt and increase working capital which was already low from the last quarterly. Might be due to timing issues with cashflow from customers

I guess a good time given the share price rally.

$4m SPP for retail holders.

Not sure about this Kaolin route though. Hope they don't turn into another HPA company

I don't have a big holding here. The SRL is much bigger than the personal one.

Seems like a good move in transferring value from the debtholders to the equityholders - but at the expense of more upside

[held]

Throwing the Saltwater Croc into the mix

Loading triples to up to 3000 wmt/h. Average rate of 2000 wmt/h so at least a doubling from the current rate of 1000 wmt/h. Plus better resilience to bad weather. Target of 7m WMT becoming likely.

[held]

All I'm going to say is that there is something not quite right here

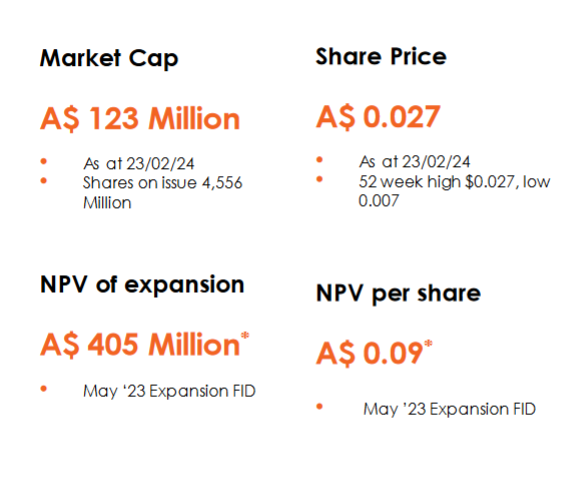

Now trading at market cap of 200m but still below the NPV.

Sometimes you can't use NPV or NTA as a guide for future returns - especially when it is a mining company that always seem to trade at deep discounts and are always price-takers.

Especially when it is an out of favour metal such as bauxite

But I do remember doing something like this before with Red5 and totally missed an opportunity.

An opportunity sitting in plain sight, or one to avoid?