H1 Review (Trying to get this out before the Q3 update)

The Good

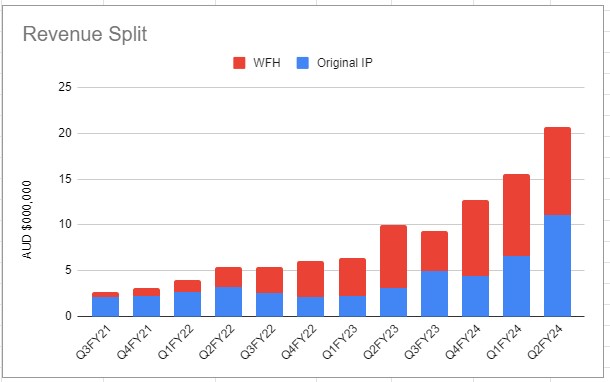

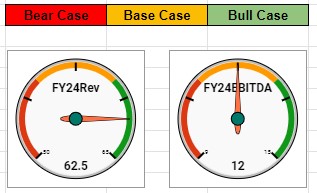

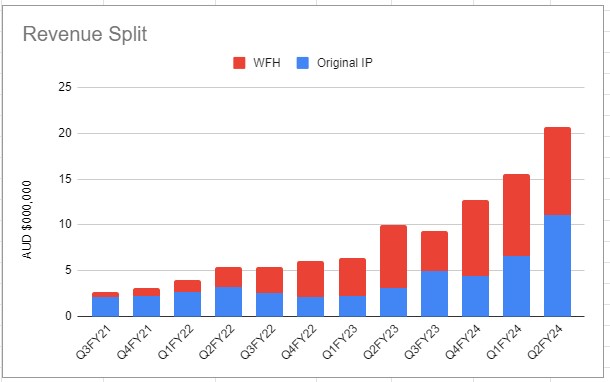

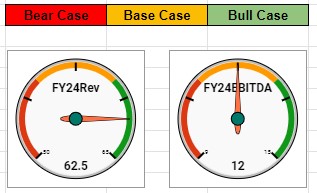

- QoQ revenue growth of 34% to $20.7m and $36.2m for the half. Annualised out to $72.4m which is above the increased guidance range of $60m-65m. Original IP increased 68% QoQ to 11.1m. This is likely going to be lower in future quarters based on the FY24 guidance.

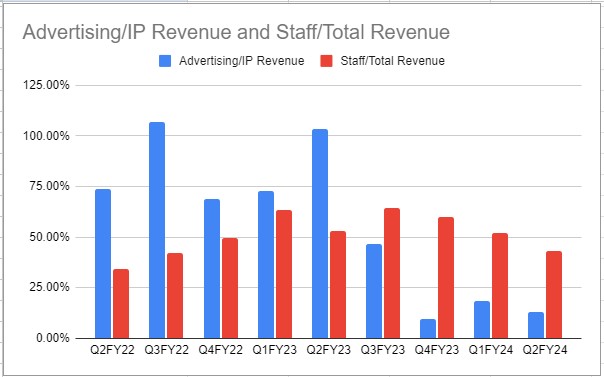

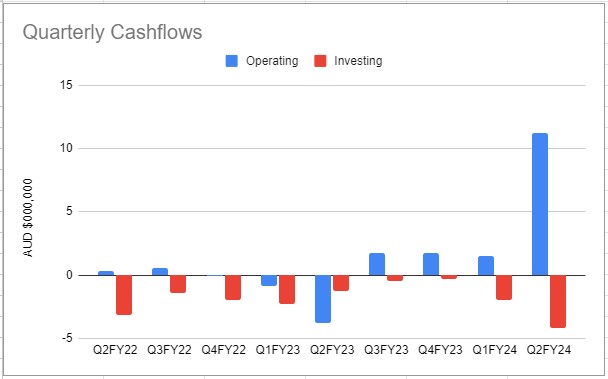

- Quarterly EBITDA of $8.0m which is ~39% of revenue. Guidance for FY24 is $11-$13m on $60m which works out at ~ 20% of revenue.

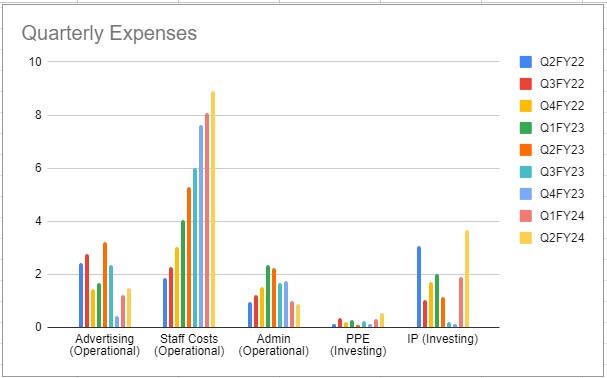

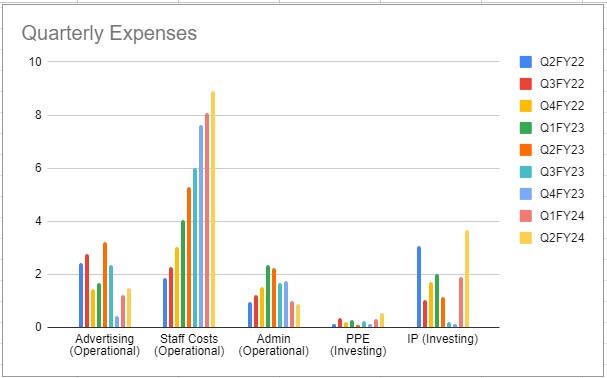

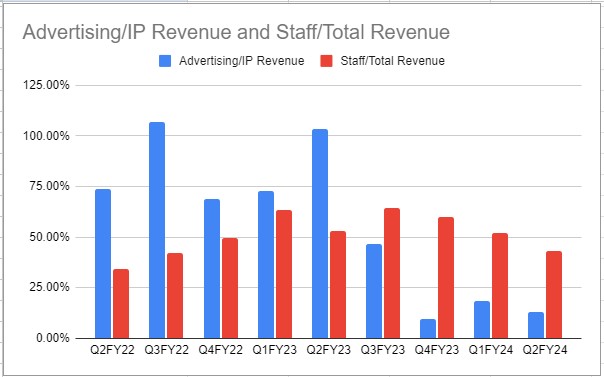

- Even though staff expenses have increased, overall they have decreased as an % of overall revenue.

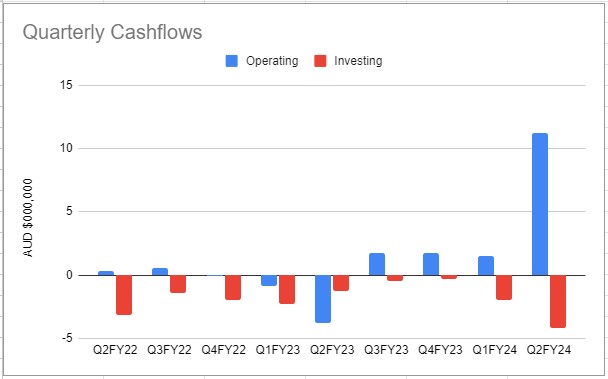

- Increase in cash position to$38.3m which is allowing playside to take on larger projects like the WB IP deal.

- Playside Publishing now has three titles in the works with the first scheduled for release this FY

The Not So Good

- Both Age of Darkness and Beanland appear to be on limited resources to reach a final release, with no target dates for either in the recent updates. This has been discussed in other straws, but so far, Playside has not had a commercially successful PC release and has relied heavily on DWTD franchise.

- Kill Knight release trailer meant to be released in Feb. Still no updates.

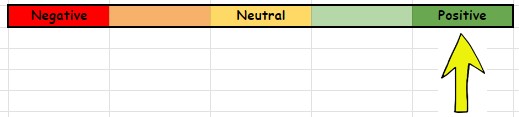

Watch Status:

Valuation Status:

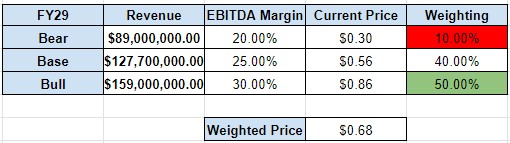

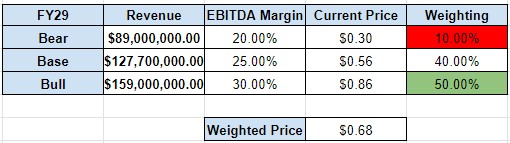

Increase to bull case. Valuation upgrade.

What To Watch

- New mobile title coming out currently in early release - Wedding Planner - Match 3 Title (Target 4-6 Titles per year)

- Warner Bros IP to be announced in Q4

- Thrive - HLTC - Release target Q4 (Publishing)

- Dynasty of the Sands - Release target H1FY25 (Publishing)

- Project Phoenix announced as Kill Knight - Release targeted for H1FY25

- DWTD Netflix Title - Dumb Ways To Survive

https://www.youtube.com/watch?v=E4cT_PRRDRo

- DWTD PC / Console title - CY25

- Mouse - CY25 (Publishing)

- Updates on Beanland and Age of Darkness