Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Completed A$6.6M Placement at $0.20 per share

Directors have committed to participate for up to $130K subject to shareholder approval.

Share Purchase Plan (SPP) on same terms to offer to retail shareholders to raise further $3.0m

Announcement Below

https://announcements.asx.com.au/asxpdf/20250728/pdf/06m6fn7byr8k8g.pdf

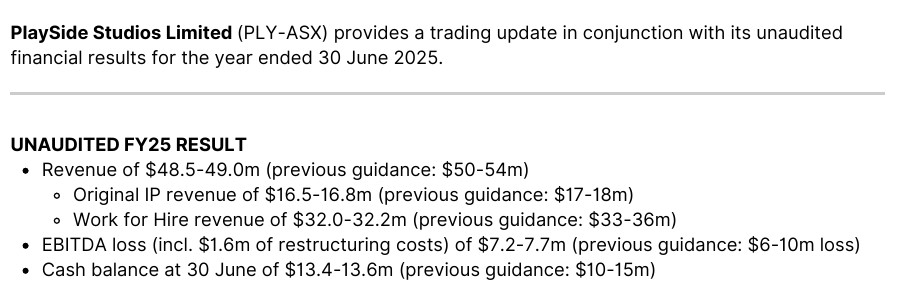

Not fabulous results, just not as bad as feared.

Still some cash on hand, a little more than forecast.

RESULT COMMENTARY The Company’s revenue was slightly lower than the guidance range provided during the second half. Original IP revenues on individual titles were in line with projections, however subsequent to the Company’s restructure in April several smaller titles were cancelled that were either in soft launch or late-stage development which explains the variance relative to guidance. PlaySide won some small extensions to Work for Hire contracts with existing clients but experienced delays in sales cycles for new opportunities. The Company continues to progress discussions on several large contracts and has also secured two smaller opportunities with new clients in the last four weeks. While not individually material enough to announce, current industry dynamics have meant that many clients are seeking prototyping and/or technical demo work prior to committing funds for large projects. Management considers this dynamic to be reflective of a turning point in the industry after more than two years of layoffs and underinvestment in content. PlaySide has been active in procuring these types of deals and using this opportunity to expand the breadth of its Work for Hire client base, and is confident it remains well-placed to convert some of these into longer term contracts. Importantly, cash levels remained within the guidance range despite $1.6m in restructuring costs incurred during the period, and a substantial commitment to support successful marketing campaigns for Game of Thrones: War for Westeros and MOUSE: P.I. For Hire. Management has been effective in significantly reducing the Company’s overheads and considers that this leaves PlaySide well-placed to convert successful game launches into sustainable growth in revenue and cash flow. While management will not be in a position to provide explicit FY26 guidance until closer to the launch of MOUSE: P.I. For Hire, it is confident of delivering revenue growth and operating cost savings relative to FY25. PlaySide expects to release its FY25 result on Wednesday 27 August and will host an Investor Webinar on the day

For those that missed it, Playside's CEO (Benn Skender) released a letter to shareholders today. Copied below for awareness. What do I think? I have no idea, to be frank! Too many unknowns for my liking with Gerry no longer at the helm (who was a big part of my investment decision in the first place), so I have cut my losses. But I wish those that hang around all the best. They will remain on my watchlist going forward and I will be keeping an eye on their IP and publishing ventures.

________________________________

Fellow shareholders

It has been a busy and eventful first few weeks of my tenure as CEO of PlaySide Studios, and I wanted to update you on how the business is going.

Our Company restructure

The announcement of the restructure in April 2025 was painful, but a necessity. As Work for Hire projects rolled off from October last year and were not replaced by anticipated new work, latent staff were put onto existing projects as we elected to absorb the costs of keeping extra personnel in the business for as long as we could. This acknowledged that: i) our people are our most valuable asset and holding onto staff we didn’t technically need for a time is a demonstration of commitment to our people and our culture, and ii) we have a long history of consistently winning regular contract work, and some patience was considered sensible albeit that would risk impacting our financial guidance for the year.

The restructuring process is now complete, and has resulted in a reduction in headcount at PlaySide from 334 on the day we announced the restructure, to 265 at the time of writing. Resourcing on all of our smaller Original IP projects was reduced and clear gates (criteria for ongoing investment) were placed on projects that we have no contractual obligations to continue so that we can internally resource new contract work opportunities where possible or move staff onto our most promising projects.

That said, all new Original IP projects burn cash during their development phase. We have committed to substantial investments in the Game of Thrones RTS (Real Time Strategy game) and MOUSE in particular, and these are the best opportunities we’ve ever had as a studio. Despite this, we were continuing work on many other projects when we only needed to execute well on these two major titles to deliver growth in revenue and earnings for shareholders. Unfortunately even a moderately soft patch in Work for Hire demand quickly highlighted the risk of investing in too many things at once with limited flexibility in our cost base, and returning to a more focused approach has been costly in the short-term.

The day after our restructure was initiated I conducted a Town Hall with remaining employees to give them a forum to address the many questions they had as to the circumstances that had given rise to this situation, and what we would do to provide more stability in the business going forward. It is motivating to receive feedback that many staff appreciated this transparency and openness albeit at a difficult time, and I think it’s important that I continue to operate that way with the support of other leaders in the Company.

Our leadership team held a three-day workshop away from the studio, and we focused on the critical elements that would help us get better at the process of making good games, winning new contract work, and improving studio culture. As a group we have shared the news of several changes (processes, team structures, Company values) with staff at a number of follow-up meetings. I am confident that our staff acknowledge these changes are positive, and am cautiously optimistic that each change will contribute to a meaningful improvement in morale and performance.

Resignation of co-founder

The decision of co-founder Gerry Sakkas to resign from PlaySide was unexpected, but ultimately one we can confidently absorb as a studio. Gerry spent many years at PlaySide helping to build the business and, although his absence will be felt, he has personally reiterated his belief in me to lead the Company going forward and continues to be a supportive major shareholder.

As someone who has played video games all their life but is not a game developer by trade, I believe part of my job as CEO is to shine a light on the tremendous amount of talent we have at PlaySide and empower them to fully realise their potential. Our Vice President (VP), General Manager (GM) and Director layers are a mix of industry veterans who came to PlaySide with an understanding of the value of the processes and knowledge it takes to deliver premium titles, and “OGs” - PlaySide veterans who shine at switching priorities quickly and selflessly trading their resources with each other when the business needs it. These are not discrete camps at PlaySide; on average these leaders have spent 6 years here, all are experts in their respective fields, and have absorbed and grown from the variety of skills displayed by others in the team. They work well with and respect each other, and are ultimately the right people to deliver on the opportunities we have in front of us. I’m excited to work with them.

What to expect as a PlaySide shareholder going forward

As a Company we have taken feedback from frustrated shareholders in the last few weeks. While institutional shareholders are often afforded several opportunities to meet with us at various forums through the year, I acknowledge that we have several thousand retail shareholders on our register and typically their main opportunity to engage with us is at the Annual General Meeting and the handful of Investor Webinars we conduct every year. If you are a retail shareholder, we will make sure that we engage with you more meaningfully at these times, particularly in respect of providing more detail during Q&A. You are also encouraged to come up and say hi to me and our staff when we present at industry events like Melbourne International Games Week and PAX Aus (which, if you’re a shareholder or interested in our sector, you should absolutely attend this year).

Transparency in investor communications is always a tricky thing to balance for a business like ours. We have tight Non Disclosure Agreements (NDAs) regarding the nature of the work we do with several of our counterparties, we try to avoid leaks of our Original IP projects to maximise the effectiveness of our marketing campaigns, and given our games compete with a variety of other entertainment products, there is often merit in having flexibility around launch windows which makes it hard for us to guarantee exactly when a game will be released.

That said, we will provide clearer updates on what we are making and why. We can better acknowledge when things don’t go well and what we have learnt from these. We can help you better understand how our industry works, noting that there aren’t many publicly listed comparables in Australia. And we can do better with our balance sheet so that, even though our business can be hit-driven in any given year, we can set the Company up for sustainable growth in revenue and earnings.

Final comments

Our near-term challenges remain, but we are working hard to address them. We have won some small expansions of work from existing Work for Hire clients; nothing individually material enough to announce, but continuing to help us meet our objectives. We have resourced these internally to maximise the profit we can generate off our post-restructure cost base. We have also set the business up to achieve some solid cost savings in FY26, and that should ensure that the successful execution of our game launches will result in a much stronger balance sheet to work with.

The near-term opportunity remains the successful delivery of MOUSE. We have three main criteria to ensure that game is as successful as possible - wishlisting well in excess of 1M prior to launch (we are just shy of 900k at the moment), a strong velocity of wishlist growth in the weeks immediately before launch (driven by greater investment in marketing campaigns), and delivering on a great experience for gamers. We continue to target a launch in the December half of 2025, and the recent delay by Rockstar Games of Grand Theft Auto VI from calendar 2025 to May 2026 provides us with a bit more flexibility to find the right time within that window to launch.

Very shortly, we will commence our marketing campaign for the Game of Thrones RTS as well as further initiatives for MOUSE, and as we strive to maximise our opportunities in Original IP, Publishing and Work for Hire going forward, there is an acknowledgement that we will also need to invest more in our brand and public-facing efforts as a studio. The recent appointment of Guy Costantini to the Board has been tremendously instructive in this respect, and indeed all of the board members have uniquely contributed to support me in what I hope I look back on as the most challenging month of my time here at PlaySide ahead of a sustained improvement in our business.

Benn Skender

CEO, PlaySide Studios

Monday 5th May 2025: Resignation-of-Co-Founder.PDF

RESIGNATION OF CO-FOUNDER

PlaySide Studios Limited (ASX: PLY) today announced the resignation of Co-Founder Gerry Sakkas as Creative Director. Mr Sakkas has also resigned from the PlaySide Board.

Given the work completed in advance of his decision to step down as CEO in March 2025 and the successful completion of the Company’s restructure, the Company will not seek a replacement for his role.

Mr Sakkas remains a committed shareholder of PlaySide, and has offered to escrow approximately 90% of his existing shareholding in the Company for a period of twelve months. He is permitted to sell up to six million PLY shares prior to this time.

The Board wishes to thank Gerry for his contribution to establishing PlaySide as a leading Australian video game developer and publisher.

Source: Resignation-of-Co-Founder.PDF [8:27am]

Also: Final-Director's-Interest-Notice.PDF [9:49am]

And: Notice-of-Initial-Substantial-Holder.PDF [3:43pm; Restrictions on the disposal of shares under the voluntary escrow arrangements that were entered into with Gerry Sakkas].

New all-time low of 10.5 cps hit during the day before PLY closed at a new all-time low closing share price of 13.5 cps.

Was once a darling here, like EVS, LBL, 8CO, AVA, ALC, 3DP... All have terrible 5 year charts.

Don't believe the hype, especially when it's coming from the company's own management; instead examine their track record of capital allocation decisions and whether or not they have delivered on what they said they would do and achieve. And don't keep giving them more time. When a thesis is busted, it's busted.

Disc: Not held.

@Hackofalltrades recent post has prompted me to post a straw for Playside considering the same question, is it time to buy or are there larger issues at play. Before I look at a valuation, below is a look at some headwinds.

I came across this slide pack a while back which I think helps inform from an industry level some of the issues that Playside will be facing for both WFH and OIP revenue growth.

State of Video Gaming - 2025

A pdf version of the presentation can be found here. PowerPoint Presentation.

Matthew Ball has a massive 230 page summary of the gaming industry leading into 2025 and ahead. In summary, what has been a fast growing industry is now facing some serious headwinds.

There are a few key takeaways that can be used when assessing Playside’s recent downgrades and changes to forescasts.

- Spending across the industry is flat over the last 3 years, which is short of analysts forecasts. Other media industries have continued to grow, but the numbers of gamers declining has been since Covid.

- The Industry is reacting with game cancellations, studio closures and record rates of layoffs. These types of responses from large studios are going to have a direct impact on the amount of WFH work that is out there for Playside to compete for.

- Mobile gaming time is decreasing as other media such as social video continues to grow. Global mobile penetration has also reached saturation and now grows in line with population growth.

- AR/VR growth forecasts are consistently being revised down as sales continue to miss expectations. This medium has not taken off yet. Playside has kept at the forefront here as can be witnessed by the reception of Shattered, however total sales still seem to be quite low. Their involvement in Civ VII VR also highlights their strength in this area.

- Unlike other media industries, prices for games have not grown significantly over time which has resulted in large sale price declines in real terms. Yet development costs have continued to grow as the expected production value continues to increase for AAA titles. As Playside tries to push into this area with titles like GoT they will experience more of this. (They market themselves as a AAA developer but I given their PC / Console releases to date I would still group them in the indie category)

- Although the cost of development is up comparatively, the number of games released per month on steam is also up significantly, which don’t just compete against each other, but all games previously released. Playside may need to reconsider their historical sales forecast indicators

The challenges were summarised in the following slide:

There are many many more slides in the presentation and its a highly recommended read for anyone looking at Playside or other gaming stocks.

When you see the words ‘restructure’ it gives you pause for thought, but when you consider what has been announced here, the decision making appears sound.

Bottom line, Playside are making some staff redundant as a result of delays in the WFH space. I would much rather this proactivity vs say an Alcidion, who diluted their shareholder base significantly while waiting on work to arrive with a hefty staff and admin bill.

The announcement stresses this does NOT affect staff working on the upcoming Mouse and GoT titles, which would have been a deal breaker for me.

They have reconfirmed guidance – revenue of 50-54m, EBITDA loss of 6-10m and closing cash balance of 10-15m. This will reflect a heavy year of investment in their current titles in development and will see total cash outflow of around 20-30m, a scary proposition that will no doubt scare off a lot of potential investors.

Gerry recently announced a transition away from the CEO role into the newly created role of Creative Director but will remain as Executive Director. This is sensible – at least from the outside – and will enable Gerry to focus on his strength (and what he is passionate in doing).

With a current market cap of 65m, they are trading just over 1x revenue. I think more than ever this investment is a bet on the success of their two titles in development: MOUSE: P.I. For Hire and the GoT, in addition to the ongoing success of their DWTD franchise a bonus. WFH has enabled them to establish connections and a footprint in the industry, but isn’t enough to sustain them being worthy of this current valuation.

MOUSE in particular has made quite a splash in the gaming community, garnering a lot of interest in the upcoming release. It has a current Steam wishlist of approx. 45k (top 25 of world games wishlisted), and several YouTube videos highlighting gameplay which have amassed 1m+ views, having been shared from various big gaming channels. The official MOUSE social media presence is respectable too, with 46k followers on Twitter, 59k followers on TikTok, 38k followers on Instagram and 1.6k followers on Facebook. In general, there is a lot of excitement for the upcoming release with niche graphics/animation that isn’t regularly explored in contemporary gaming (old school gamers will remember the hit ‘cuphead’, which had a similar vibe to what MOUSE is going for – at least in my view).

Hard to add any value re: the GoT IP in the works, but partnering with Warner will no doubt help them advertise what is hopefully a really polished game by release. I will say this IP has been slightly watered down (for the lack of a better term?) by the recent release of Game of Thrones: Kingsroad (PC and mobile) which was released last week by Netmarble (in early access) to mixed reviews, set during S4.

Kill Knight, released late last year, reviewed really strongly across console and PC but didn’t make a big enough impact in terms of sales. Further validation that Playside can produce high-quality content, but likely a loss for Playside cash flow wise – part and parcel of being a developer/publisher and evidence of how tricky this industry can be.

I think the risk/reward is pretty interesting at these levels.

Updates for additionally purchase from Mark on 7 Feb 2025

After yesterday implosion, the director have pick up a few shares on-market, adamant very small holding. Summary below

Aaron Pasias

· 30 January 2025

Buying 100,000 Ordinary Shares at average price $0.2011 ($20,110 incl Brokerage)

· 3 February 2025

Buying 150,000 Ordinary Shares at average price of $0.22 ($33,181.50 incl Brokerage)

Mark Goulopoulos

· 30 January 2025

Buying 150,000 Ordinary Shares at average price $0.2004 ($30,066 incl Brokerage)

· 7 February 2025

Buying 150,000 Ordinary Shares at average price $0.2005 ($30,817.65 incl Brokerage)

Gerry Sakkas

· 30 January 2025

Buying 100,000 Ordinary Shares at average price $0.20 ($20,165 incl Brokerage)

Has trended down since the 20th on higher volumes…coincidence? I doubt it!

Further down grades - eek!

note: own shares

Would highly recommend reading this - PRESENTATION: The State of Video Gaming in 2025 — MatthewBall.co - may explain performance.

After listening to @Strawman talk about Playside on the Motley Fool pod machine, I thought I’d check back in on progress.

At the AGM management indicated that FY25 will be a year of consolidation and building for the next wave of bigger and better future titles. A revenue guidance of $62m to $68m (in-line with FY24) was given for FY25. So how do they get there?

In June, the forward 12 month WFH book was at $28.8m.

With no new contracts or extensions announced to date, it has to be assumed that this remains at the same value. At the AGM, there was the indication of active leads after a quiet period in the industry, but this is yet to play out.

This leaves $33.2m from Original IP that are being released this year and mobile.

Current titles expected to be live in FY25:

Kill Knight - PC, Xbox, PS, Switch

Released 2nd October - RRP$20.00 - Developed and published by Playside

Receiving positive reviews, but in a niche genre overall sales volumes wouldn’t be expected to be massive. As indicated in the AGM, this title was more of an exercise in releasing a title across multiple platforms simultaneously.

https://www.metacritic.com/game/kill-knight/

KILL KNIGHT Review | Bytesized

Current PC download estimates from SteamDB.

Dumb Ways to Die - Free For All - Meta Quest - Developed by Playside - Revenue Share (& licence fees?)

Released - 6th November - RRP $29.99

The Dumb Ways To Die franchise expands across to the Meta Quest platform with a VR party game. So far it seems well received but downloads and users are quite low at this point. A new DLC with additional mini games has recently come out which may help increase awareness of the game.

Meta Store Reviews:

Trying NOT To Die In DUMB WAYS In VR! - Dumb Ways Free For All - YouTube

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02690123-3A622133

Shattered - Meta Quest - Developed by Playside - Revenue Share

Released - 4th December - RRP $29.99

Shattered is a Mixed Reality puzzle thriller that was released without much fanfare. It is getting a solid reception for pushing mixed reality forward which is a positive for future titles and work with Meta.

Meta Store Reviews:

https://www.youtube.com/watch?v=15ueyuO_XYg

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02601238-3A607700

Shattered [Meta Quest 3] | REVIEW - Use a Potion!

Age of Darkness: Final Stand - PC - Developed by Playside

Full Release - 15th January 2025 - RRP $40.00

Age of Darkness will get its full release in early 2025 since coming out in early access in October 2021. Multiplayer should help give the game a bit of a bump in overall downloads as that was a major complaint about the game in early access.

Previously it was announced as published by Team 17 but now shows up on the Steam Store profile as published by Playside, which means there will be a higher revenue share from sales, however there would have been some cost in parting ways with Team 17.

Steam DB stats. - Compare after release to get an indication number of new downloads

Thrive: Heavy Lies the Crown - PC - Published by Playside

Full Release Q2 2025 - RRP $40.00

The city builder currently in Early Access since 7th of November will be Playside Publishings first full release once it comes out in Q2. So far reviews have been mixed, but trending toward more positive as the developers respond to the feedback they are getting.

Review summary from Steam Store

Dynasty of the Sands - PC - Published by Playside

Early Access - Early 2025 - RRP - TBC

Beanland - PC - Let's not talk about that.

Mobile

Playsides latest mobile titles seem to be performing ok, but still have a long way to go before they reach the status of Animal Warfare. Currently with less impact for mobile revenue from the Dumb Ways titles (Dumb Ways to Survive - Netflix - Licence fees? Announcement) I expect mobile to be less of a contributor to the Original IP revenue for FY25.

Summary from Sensor Tower.

Overall, Playside is maintaining a high level of quality for the games they are developing and publishing and generally are well received. The next 6 months will be telling on how they market the existing titles and the upcoming titles for FY26. (Mouse and GoT). Original IP revenue was $17.66m at H1FY24 and dropped off to $12.6m for H2FY24. As half the titles are only expected to be released in the second half, revenue for H1FY25 will likely sit somewhere in the middle of these two numbers.

#Operating Update & FY25 Guidance

The early success of Kill Knight is positive.

But the lowered EBITDA guidance and significant cash burn expected in FY25 indicate that the company is entering a pretty crucial time.

If major titles perform well, PlaySide is positioned for strong growth.

Looks like they're betting heavily on the success of its upcoming games which we'll have to keep a close eye on, particularly Game of Thrones.....

Sep 24

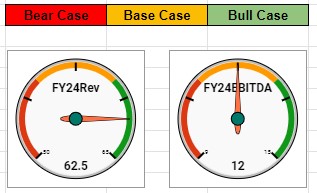

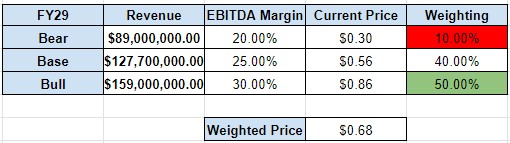

Bear - Growth 10% slowing to 5% - EBITDA Margin of 20%

Base - Growth 20% slowing to 10% - EBITDA Margin of 27% (Match FY24)

Bull - Growth 25% slowing to 10% - EBITDA Margin of 30%

Discount Rate - 15%

As Playside grows it will become harder for them to maintain a constant growth. Most growth in these scenarios comes from growing Publishing division. A hit title could significantly change these outlooks.

Jan 24

Playside released their financials this morning. Some impressive numbers showing the growing opportunity. How did the market respond? Dropped down to 55-55.5c in the first 30min before rebounding.

Update – 12/07/2024

With H2 reporting not far away, it is as good as time as any to update my valuation. Taking into account recent guidance upgrades, I am forecasting the lower end of revenue guidance at 63m for FY24. With capex costs of around 2.5m, and cash flow from operating activities at a forecasted 21m for the year, this gives me a free cash flow of over 18m. Having made almost 9m NPAT in H1, I think 14m NPAT is a reasonable estimate (noting I expect them to hit the upper end of EBITDA guidance).

For the coming years, I am estimating free cash flow of 25m in FY25, increasing in 5m yearly increments until 2028. This suggests modest growth, something I think they will achieve as they mature, but a big 'hit' game could blow this forecast out of the water. That said, should growth stunt for whatever reason (not out of the question in an ever-changing gaming market), the existing market of over 300m will appear exxy.

With a discount rate of 10%, I reach a company valuation of 503m. Divide this by shares outstanding and I reach a share price of $1.20.

Update - 03/02/2024

As discussed by @Strawman and @RobW already, the recent quarterly result was an absolute cracker. The thesis is coming along really nicely here -- WFH continues to provide the business with a stable revenue base in addition to a marketing tool, while we are starting to see IP dividends from a seriously good investment in DWTD. I maintain my view that this could well be a billion dollar + business in the future.

My previous valuation now looks conservative. I certainly don't want to extrapolate them spitting out 11m in cash flow for the next few quarters, but my 1m FCF estimation for this year is likely to be surpassed. I think 8m for the year is reasonable. In FY25, 26 and 27, I am increasing my FCF forecasts to 15m, 20m and 25m respectively. Perhaps this might be a little bullish, but I am comfortable with those assumptions. There is also the question mark around them working on a major title (the title of which is soon-to-be-announced) and the impact this will have on the bottom line.

With a 10% discount rate and the above assumptions, I reach a company value of 300m. Divide this by shares outstanding (408m) and I reach a valuation of 0.75c.

Update - 04/06/2023

I have flipped my DCF from revenue focused (don't we all miss those times?) to free cash flow. In hindsight, my initial valuation was generous and presumed the good times would keep on rollin'. I paid the price.

My revenue projection many months ago (35m for FY23) shouldn't be far away, but I suspect this will be closer to the 32m mark. Where they have really struggled is free cash flow: last year's 6.4m was much more respectable than the -6m they reported at H1. The company was rightly punished. Playside's share price is back at the levels when they first came to my attention. They remain tricky to value -- like lots of the discussion around them in recent weeks, revenue will be lumpy and unpredictable.

Management have subsequently gone back to the drawing board and reprioritised where they think their resources will be best spent. Q3 showed some improvement, primarily due to the success of the DWTD suite of games. I am looking for more of the same in Q4 and moving into FY24.

I remain of the opinion that Playside could be a sleeping giant. They are Australia's largest gaming studio and have moved into publishing which should expand revenue streams with potential for high ROI. Going forward, WFH should provide a stable base of revenue for Playside to pursue their original IP and publishing plans. That said, there are risks here too -- lumpy revenue, increasing competition and management execution to name a few.

I have made the following assumptions for FY23:

Revenue: 32.5m

FCF: -3m

Income: -2m

Going forward, I think they will return to cash flow positive in FY24 (forecasting a conservative 1m) before doubling that to 2m in FY25. A successful hit in this time would almost certainly result in multiple expansion well beyond this valuation -- here is hoping -- but in the meantime I will play it safe.

--------------------------------------------------------------------------

FY21 free cash flow: -4.3m

FY21 revenue: 10.8m

FY22 projected revenue: 20m

FY23 projected revenue: 35m

A possible sleeping giant, PlaySide has grown rapidly in the last 24 months. Based on current business activity – with the company recently signing its largest work-for-hire deal since listing (2K Games, 10m+ deal) – I think the company will continue to impress industry majors, gamers and shareholders long term.

Armed with a whopping 39m in cash, the company will invest in existing IP titles across mobile and PC, pursue additional licence opportunities and further scale the company’s work-for-hire business – with the latter establishing itself as a real golden egg in the last year. The cash will also fund the opening of new studios across Australia, commencing with a new studio on the Gold Coast in Q3 FY22, which will bring with it some handy tax incentives due to Qld’s 15% rebate incentive – in place to attract gaming studios and developers to the state.

The successful release of Age of Darkness (which is currently on sale for those interested) and current work-for-hire agreements with Facebook Technologies and 2K Games, amongst others, provides endorsement of PlaySide’s development capabilities and raises its growing profile in the industry.

PlaySide will also establish a dedicated Metaverse R&D team to pursue opportunities in what is considered a rapidly evolving space. That said, I am mainly interested in watching how PlaySide develop and invest in its own IP titles, while working on AAA games for industry majors. This is where I think it will be the real winner over the next couple of years.

Using a 10% discount rate, which I have increased to account for the 'unknown' elements associated with gaming companies, I reach a company value of 414m. Divide this by shares outstanding and I reach a current valuation of 0.93c.

Disc: Held

Coming up to the release of Playsides full year results I thought it would be worth starting to track the titles in production again. As Playside moves into larger titles with larger production budgets, managing the production timeline will be an important factor on the cost side.

playside and WB have announced that the 2 game contract they signed in december will be based around Game of thrones! Doesnt come much bigger than that. Exciting times ahead. This is a multi year collaboration

Overview • We are the largest games development studio in Australia • 330 staff • ~260 staff working from three offices (two in Melbourne, one on the Gold Coast) • Remaining staff working remotely across Australia, NZ and the UK • 240+ artists, engineers and designers • Single-digit attrition rate • Very small executive/management layer • Almost all of our staff are actively contributing to the development of games • Average management (GM level+) tenure is over six years • A$360m market cap • Majority-owned by three co-founders (49%) and staff (~5

H1 Review (Trying to get this out before the Q3 update)

The Good

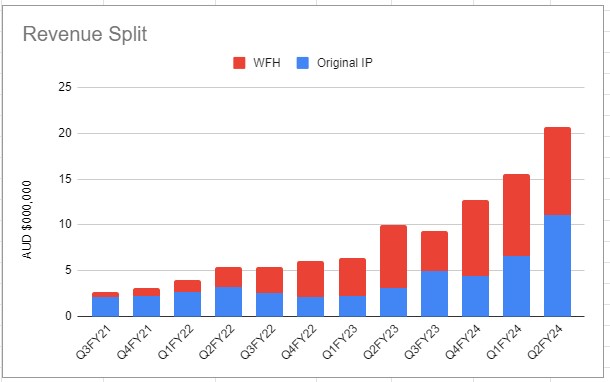

- QoQ revenue growth of 34% to $20.7m and $36.2m for the half. Annualised out to $72.4m which is above the increased guidance range of $60m-65m. Original IP increased 68% QoQ to 11.1m. This is likely going to be lower in future quarters based on the FY24 guidance.

- Quarterly EBITDA of $8.0m which is ~39% of revenue. Guidance for FY24 is $11-$13m on $60m which works out at ~ 20% of revenue.

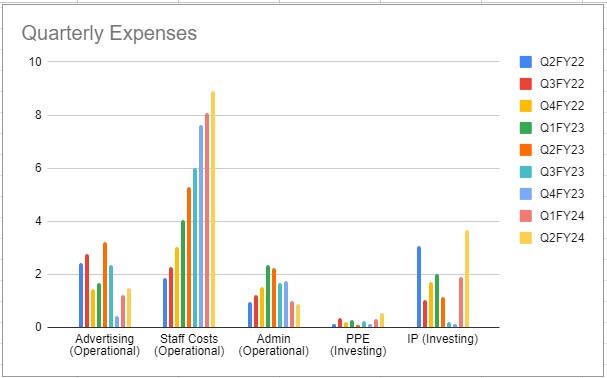

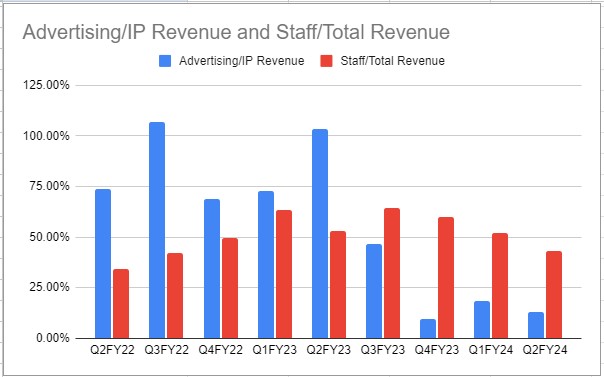

- Even though staff expenses have increased, overall they have decreased as an % of overall revenue.

- Increase in cash position to$38.3m which is allowing playside to take on larger projects like the WB IP deal.

- Playside Publishing now has three titles in the works with the first scheduled for release this FY

The Not So Good

- Both Age of Darkness and Beanland appear to be on limited resources to reach a final release, with no target dates for either in the recent updates. This has been discussed in other straws, but so far, Playside has not had a commercially successful PC release and has relied heavily on DWTD franchise.

- Kill Knight release trailer meant to be released in Feb. Still no updates.

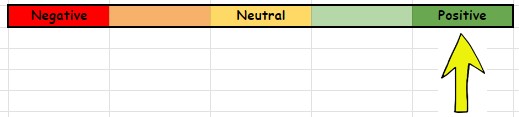

Watch Status:

Valuation Status:

Increase to bull case. Valuation upgrade.

What To Watch

- New mobile title coming out currently in early release - Wedding Planner - Match 3 Title (Target 4-6 Titles per year)

- Warner Bros IP to be announced in Q4

- Thrive - HLTC - Release target Q4 (Publishing)

- Dynasty of the Sands - Release target H1FY25 (Publishing)

- Project Phoenix announced as Kill Knight - Release targeted for H1FY25

- DWTD Netflix Title - Dumb Ways To Survive

https://www.youtube.com/watch?v=E4cT_PRRDRo

- DWTD PC / Console title - CY25

- Mouse - CY25 (Publishing)

- Updates on Beanland and Age of Darkness

My two cents worth.

Playside did not invent NFT's in gaming. They created something which generated AUD 8million of Revenue in a short space of time and good on them for achieving that outcome. It is easy to forget the volatility in Crypto at that time, probably the main reason they have avoided this going forward. Suspect most that parted with money at the time saw it as another way to get involved in Crypto. The idea that the Company should reimburse these people is ludicrous. Got to question why after two years, people now emerge blaming the Company. Current Crypto prices ! Oh, by the way, Beanland is still alive and well.

I only judge the Company on what it has achieved since listing. Stellar performance and investors have shared in the spoils. Already a 2+ bagger in 3 yrs. Sakkas is one smart cookie and their strategy is likely to continue to deliver for us investors going forward.

RobW

There’s been quite a bit of negative sentiment on the Beanland discord channel recently and rightly so after the long delays and constant changes to the development road map.

Whilst it is unlikely to have any major impact to the company overall, it isn’t a great look for a listed company to make a cash grab and then effectively deliver nothing to those that backed the project as they weren’t small amounts of money for the bean NFTs.

It also leads into another risk I see with Playside leading into their big IP console titles, which is their ability to close out projects in announced timeframes. This is likely due to their WFH contracts taking precedence over their own titles at this stage of the company growth, but Age of Darkness has been having similar issues in reaching final release.

Small exchange from discord below:

A rather significant (9.8% of the company to be exact) sell down by the 3 largest shareholders announced this morning. The price was $0.75 so also quite a large drop from their last close of $0.84. It will be interesting how the market reacts to this news. I'll be also interested to see who the new shareholders are too.

@Strawman. Thanks for setting up the meeting with Gerry. The depth of strategic thinking and his willingness to openly share this is quite rare. An increasing number of irons in the fire point to continued momentum going forward.

As I have said previously, he has a 360 degree view of the gaming market, new technologies in Gaming, an intimate knowledge of Playside capability as a business and together with his passion and vision, will most likely navigate a course which proves to be very lucrative for investors. When you talk investing in gaming, RISK is always at the forefront of peoples's minds. Believe we are in very safe hands and being perfectly aligned for current / future opportunity.

For those that missed the meeting, worth a watch IMO.

RobW

Nice to see a 20%-odd jump in the share price today, which takes shares in Playside back to an 18 month high (and double where it was in late Feb last year). Talk about a wild ride.

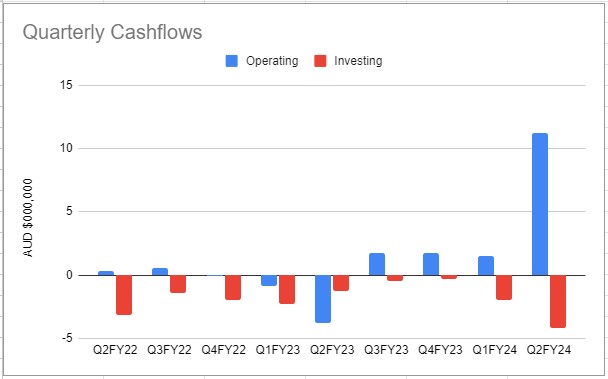

The catalyst of course was the latest Q2 result (see here), which delivered record revenue across all segments -- about double the previous corresponding quarter, and 33% from the preceding quarter.

Also very nice to see positive EBITDA, which came in at double the Sept quarter read, as well as a operating cash inflow of $11.2m which takes the cash balance to just over $38m (about 15% of the current market cap).

Playside even increased FY revenue guidance from $55-60m to $60-65m; about a 9% lift at the midpoints and will be a 63% improvement on the prior year. EBITDA is expected to be flat in the second half due to a first half skew and increased headcount (needed to support future growth) but is expected to be $11-13m for FY24.

Accounting for today's jump, that puts Playside on a forward EV/EBITDA ratio of ~21x. Doesn't seem excessive given the growth and runway, especially as with a healthy balance sheet and free cash flow generation.

Held.

Playside has struck a multi-game license with Warner Brothers. They'll produce two games based on Warner Brothers IP (I believe they own the rights to DC Universe, Harry Potter, Looney Tunes, Game of thrones, among others) -- we'll find out exactly what brands the games will be based on in the next 6 months or so. (I'm personally gunning for a Batman title!)

Playside will pay a license fee and provide Warner Bros with royalty payments based on the revenue they generate from the titles.

No specific financials mentioned, and the games could be a total flop, but it is encouraging that they are striking deals with such big name counterparties.

ASX announcement here

Held.

Some interesting comments at the AGM today (I wasn't there, just reading the ASX release)

The key point being an upgrade to FY24 revenue guidance, which they lifted from $50-55m to $55-60m. At the midpoint, that's a 50% lift on FY23.

The Good

- QoQ revenue growth of 22% to $15.5m. Annualised this is above the $50-$55m revenue guidance provided at the end of FY23. Revenue growth was strongest in the original IP division, with a new record quarter of $6.6m. This was just shy of my last quarters estimate.

- Original IP revenue increase is likely driven by the milestone payments for the DWTD Netflix and Meta titles as following the mobile downloads there hasn’t been any significant changes across the catalogue.

- Staff costs look to be levelling out from the recent growth phase. If playside can continue to generate growing IP revenues, this is where operating leverage will come into play, otherwise further staff growth may be required to continue to grow the WFH revenue streams.

- Only slight increases in advertising expenses and still significantly down as a proportion of IP revenues.

- Cash position remains strong at $31.7m

The Not So Good

- Age of Darkness release date still TBC. It looks like this is waiting for multiplayer to be locked down, however updates from the Playside team in the Discord channel indicate that this has been a challenge. The longer this is in pre-release, the more development costs need to be recouped.

What Status:

What To Watch

- Expect Q2 to be cash flow and EBITDA positive. Track EBITDA margin for future valuation estimates.

- New deal announcements from recent games conferences. As @Rocket6 has stated, this may lead into the AAA title announcement and start to show up as increased investing cashflows.

- Original IP revenue lumpiness. Given the milestone payments for the DTWD title development, these have the potential to create lumpy IP revenues throughout FY24 until the titles are released.

- Pipeline Targets

- Next release - Beanland (Q2FY24). I don’t expect any significant revenue contributions from beanland given it will be free-to-play. There is a very small chance that it could spark some interest in the Beans NFTs again. I don't really attribute any value to the Web 3.0 segment of the business.

NFT Sales since launch (Volume & Price)

- Project Phoenix title announcement.

- Potential increase in capitalised development costs

- Third publishing title announcement

- New mobile title

Very basic calculation

Revenue FY24 between 50-55m (used 52.5)

Assume Share count raises 3%

Revenue per share 12 cents

Revenue multiply of 4

Giving share price of $0.48

Inside Ownership Ordinary Shares % PLY Issued Net Value at $0.38

Cristiano Nicolli 679,019 0.28% $258K

Gerry Sakkas 81,189,142 19.79% $30.8m

Mark Goulopoulos 79,300,000 19.50% $30.1m

Aaron Pasias 79,250,000 19.49% $30.1m

Benn Skender 650,000 ~ $247K

Total 241,068,161 59.17% $91.6m

*Total Market Cap today at $0.36 is $154.8m

Director Buying

Mark Goulopoulos

· 3 March 2023

Indirect 68,333 Shares price $0.30 per share ($20,499.90)

· 1 March 2023

· Indirect 65,000 Shares price $0.3196 per share ($20,775)

Aaron Pasias

· 2 March 2023

Indirect 59,223 Shares price $0.31 per share ($18,359.13)

Market not that impressed with Playside's results. They seem ok to me:

- Revenue up 90% (ex NFT sale)

- EBITDA and Cash flow positive in second half

- Well funded, with $32m in cash

- Guiding for (roughly) 37% growth in revenue for FY24

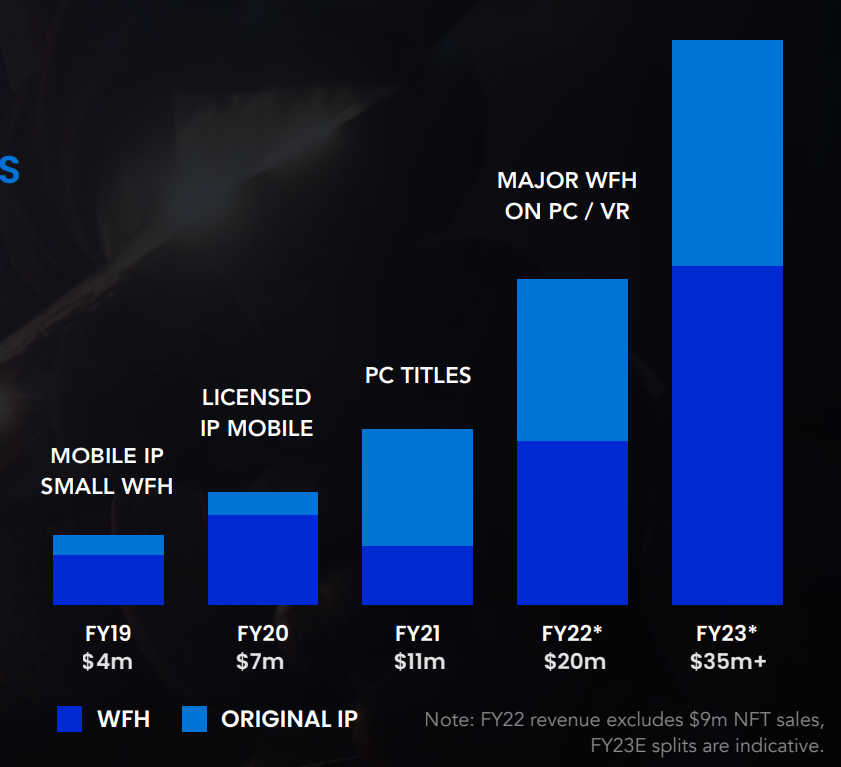

Revenue growth has been pretty strong historically, as they highlight here:

Shares now on a P/S of about 3.5x

Let's see what Gerry says later today when we catch up with him.

The Good

- Record quarterly revenue of $12.7m, demonstrating ongoing growth especially in the WFH business. Original IP revenues continue to remain strong, likely driven by the DWTD IP.

- Another cash flow positive quarter, again driven by low advertising revenue. I thought that this would have increased this quarter, however it has moved in the other direction. I still don’t think this level of expenditure can be maintained, however it is a positive indication that Playside isn’t having to resort to buying revenue.

- Dumb Ways To Die IP continues to drive business for Playside with a title for the Meta Quest in development. This title includes development fees and ongoing net revenue share. Both the Netflix and Meta deals include licensing fees to be paid out during development. Mobile downloads have also remained high from the peak.

- $50m to $55m revenue guidance provided for FY24 which is at least a 30% increase on the $38.4m for FY23. This shows confidence from management

- Strong cash position of $32.2m. With the company moving into consistent positive cashflow territory this leaves a very strong capital position for future business development and larger title development budgets.

The Not So Good

- Staff costs continue to rise. This is to be expected to be able to service the increased WFH contracts as long as staff to revenue ratio doesn’t increase beyond historical levels

- World Boss' full release at the end of June didn’t do anything to boost the player numbers. At this point in time it would be reasonable to assume that so far World Boss has been commercially unsuccessful.

- Mobile titles (ex DWTD) downloads on the decline

What Status: Positive

What To Watch

- How the gaming tax offset is reported. I’m not sure how the rebate is handled by the ATO but potentially a substantial payment in Q1FY24? Are WFH expenses counted within the rebate?

- Based on the guidance numbers provided from the vantage point conference slides can expect Q1 WFH revenue to stay within the $7m to $8m range

- AoD release date and ongoing downloads

- Dynasty of the Sands updates and progress

- News on new PC / Console title - Project Phoenix

- New mobile titles planned in FY24. The first of these to come out is Dumb Ways To Climb. Currently ranked number 64 in Action on the app store. Once again this is a re-skin of other similar games on the market, but its probably a good time to be cashing in on the DWTD IP

This one slipped past me yesterday -- Meta (Facebook parent) has engaged Playside to develop a VR title for its Quest device, based on the Dumb Ways To Die (DWTD) IP.

Playside will get a license fee as well as periodic development payments. They also get a share of net revenues in perpetuity.

They expect launch will take 18 months.

As a reminder, they bought the rights for DWTD for just $2.25m in 2021. They already made $9m just from NFT sales!! (yeah, a terrible "investment" for those that bought them, but it was great for PLY). Anyway, what a great purchase that's turned out to be.

This news has led Playside to guide for FY24 revenue of $50-55m. They recently told investors to expect $35m in revenue for FY23.

The top line growth has really been remarkable:

Also worth noting they have $30m in cash and were cash flow positive in the March quarter.

Yes, shares are on something like 4x sales. But maybe that's not so high given the growth and scalability of the business.

See full announcement here

Playside have added a new mobile title to their catalogue this month. Find It: Scavenger Hunt which is free to play so will rely on the normal model of advertising and in game purchases. The game itself is pretty polished in the artwork and seems like a relaxing time filler.

But wait, what's that, this game is basically identical to many others in the store already all using some combination of Find and Scavenger in the title or description.

This is one of the main areas I'm not sure what to think of Playside's business model. I know Gerry has talked in the past of using data better than competitors to optimise their traffic and conversions, but without knowing the development and ongoing support costs of a title like this, its hard to see where the value is in competing is a crowded space like this. For me it also detracts from the image of Playside as a studio.

I will add this to my download tracking with the others in the catalogue, to try get an indication of how this performs in comparison to their other titles

The presentation today from Playside had a bit of new information. Specifically, the 12 month forward work for hire order book is $28.6m as of today (this compares to $4.3m in WFH revenue in the recent quarter).

They did just over $10m in WFH revenue in FY22, and they expect about $20m in FY23. So great to see some ongoing traction for a segment that generates about half of total revenue.

Also, interesting that they highlight the consolidation of the sector with some of the large deals out there, and strategic stakes in many mid-tier studios. Not sure if that's suggesting they could catch a bid?

World Boss full release date has been announced:

As World Boss is a free title, revenue boosts for Q1FY24 will need to come from in game purchases. There will be a new battle pass and I imagine some new content packs at release, but they will only matter if people are playing the game and currently regular numbers are very low. There will be a new map and sounds like new game modes, so that may be more enticing to new players on release.

Based on World Boss being release just in time for Q1 I think we will see Age of Darkness getting its full release around Q2FY24

Good news this morning: Playside has announced that Rocket Flair Studios’ (RFS) Dynasty of the Sands is the first title to be signed to its publishing division.

The game is an Ancient Egypt-inspired survival city builder, teaser trailer here.

Playside will provide RFS with development advances relevant to agreed milestones, consistent with industry benchmark requirements for bringing the game to launch. Playside will be responsible for publishing and marketing, and will pay RFS a share of net revenue from the sale of the game as part of the agreement.

Playside has indicated it cannot predict likely revenues at this stage. This slide from H1 FY23 provides some clues around potential performance for indie games:

It is difficult to make forecasts at this stage, but it is obviously good news for the division to have signed its first deal. Should Playside gain traction with its publishing division, there is real potential of this one day being the largest revenue contributor for the company.

The Good

- Record Original IP (OIP) revenue of $5m, which exceeded my forecasts for the quarter. This was largely driven by the DWTD games, which management said provided an extra $1.9m for the quarter. The increased revenue shows the power of viral marketing across social media networks and Playside did well to try to maximise engagement across these channels. The DWTD IP continues to bear fruit for Playside, having acquired the IP for $2.25m.

- Cash flow positive quarter. This was largely driven by the increased original IP revenue, which was recorded off a lower advertising requirement. How much Playside can maintain this in the future is uncertain, but I expect higher advertising cost ratios going forward.

- 30 Month WFH hire contract signed with Skydance. Whilst the value of this contract hasn’t been announced, it shows that Playside is continuing to keep a solid stream of contracts in the pipeline. Given WFH still makes up a significant portion of revenue, to maintain positive cash flow, the WFH deal pipeline needs to continue as staff costs continue to rise to meet the resourcing requirements.

- Further indications that the company is progressing through the transition to larger titles with a new indie game to be announced in coming quarters.

The Not So Good

- Total revenue slightly down on the previous quarter at $9.3m vs $10m. This was largely driven by a decrease in work for hire revenue, but management have highlighted that these contracts are based on milestones so some lumpiness is to be expected going forward.

What To Watch

- Based on the guidance numbers can expect Q4 revenues at a similar level ($9 - $10m) with OIP ~ $3.5m -$4m & WFH $5.5m to $6m.

- DWTD 4 coming out in May. This release may just miss the TikTok spike, but if the game is good and engaging, it will start from a strong position.

- No updates on AoD & World Boss, these are looking likely for full releases in FY24 which will help contribute to future revenue growth. Other contributors to monitor:

- Meta Mixed Reality - Revenue Share

- Beanland Alpha/Beta release & impact on NFTs

- Publishing division first game

- Based on the success of the DWTD IP the company may be on the lookout for other similar opportunities where they can own IP rights rather than licence. This wasn’t flagged but I can imagine that management have considered it given the success. This could be a risky use of capital.

Non-executive directors Mark Goulopoulos and Aaron Pasias both recently purchased shares on market -- spending 40k and 20k respectively.

Mark and Aaron are two of the three largest existing shareholders, each owning around 20% of the business. I am comforted that they also see value in the current price, noting the share price has taken a battering recently.

Clearly the market was spooked by the PIVOT announced via the 4C.

Here's my take...

Analysts measure and monitor a Company's track record on the ROI following Capital Allocation, normally associated with acquisitions. The PIVOT as announced on Tuesday is nothing more than a strategic decision in support of an improved ROI on the allocation of Human Capital. This call is clearly not motivated by any economic stress nor any particularly failure. The Company is living through their own experiences as well as through their partner experiences, with a leaning to the future in gaming. Gerry Sakkas is not only a 'switched-on' individual, but enjoys a 360 degree view of the business and it's prospects. So, in my opinion. he is simply capitalising on the areas of greatest opportunity. Likely to see much more of this going forward.

As far as the 4c is concerned, I was expecting receipts to come in at AUD 7.5m - AUD 8 m range. So 10- 15% light. The declaration of the 'underlying' Revenue of AUD 10m provides a more than healthy offset. Accustomed to the common term 'underlying EBITDA' where once off or irregular inputs are removed. Intrigued with what is implied with 'underlying Revenue'. Something to do with write offs ? Dont think so. Anyhow, all shall be revealed inside of 4 weeks (H1 Financials).

And finally, they have signalled pulling the plug on mainly titles in pre-production (Original IP). This implies it is most likely to come from the following list : Dumb ways to Die 4, Dumb ways to Die Dumb Choices, An 'untitled' Dumb ways to Die and then Pillage Party and Anti Gen. Be interested to see what happens with the newly announced Dumb ways to Survive for Netflix. Was this the 'untitled' game from the above ?

In closing worth remembering that they do enjoy Revenue sharing on many of the Work for Hire programs. Elevates them to the Big Stage and by all accounts, their partners like the quality of their work. Remains a strong hold for me to be confirmed when we get to see the H1 Financials.

RobW

The Digital Games Tax Offset (DGTO), which will provide a 30% tax rebate for game development projects that reach an expenditure threshold of AUD $500,000, has been introduced into Parliament to be implemented imminently. More here.

The Interactive Games and Entertainment Association thinks the DGTO is "one of the best game development incentives anywhere in the world", and when combined with Screen Australia's "Games: Expansion Pack" funding initiative and various state-based incentives, Australia will be "among the best places in the world to make video games".

With Playside being one of the biggest developers in Australia, this offset represents a significant tailwind for the company.

Trading halt until Wednesday - Interesting...

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02600656-3A607594?access_token=83ff96335c2d45a094df02a206a39ff4

World Boss has now been released on steam for Early Access and so far the reaction from players hasn’t been great with negative reviews far outweighing the positive.

The biggest detractors so far are the performance issues and the lobby issues on launch day which the team were quick to address but it definitely hurt first impressions.

This game was meant to be one of Playsides marquee titles so I will definitely be watching reviews and so far the poor market reception is a strong signal to review my thesis and holding

World Boss now has an official Early Access date, which has been confirmed as 20th of October.

It was announced in conjunction with a demo at PAX Australia with Lazarbeam & Fresh. There was also the release of a launch trailer on youtube.

https://www.youtube.com/watch?v=zlqiq8zoaNo

Hopefully there will be some details on the monetisation strategy for the game in the upcoming quarterly update.

Thanks @RobW. This was the reminder I needed to do some DD on World Boss. With early access expected to occur in Q2 FY23, it is probably a good time to open up some dialogue on Strawman.

First things first, World Boss is a collaboration with influencers LazarBeam and Fresh. Who are they?

LazarBeam

Lannan “LazarBeam” Eacott is an Australian YouTuber, who rose to fame at the height of Fortnite’s popularity boom in 2018. By 2019, Lazar had hit 10m subscribers and was the third-most-subscribed Fortnite content creator on YouTube.

He still streamed Fortnite separately on Twitch until Jan 2020, when he signed an exclusivity deal with YouTube. He currently has over 20m subscribers on this platform, with a few million on Twitter.

Fresh

Harley ‘Fresh’ is an Australian Twitch streamer and YouTube celebrity – and like Lazar, he is known for his Fortnite content. Fresh currently brings around 18 million followers and subscribers across his socials and his YouTube channels and has accumulated over 2.5 billion lifetime views throughout this career.

I mentioned this a few months ago – getting influencers on board can have a significant impact on the reach and subsequent revenues associated with a game. Playside has done one better here: they have collaborated with two significant gaming influencers that have millions of subscribers between them and an ability to reach gaming markets across the world, with minimal (paid) advertising required.

The game

World Boss is a first-person shooter with a roguelike progression system, where players will take on 15 other players in fast-paced arena combat. The game itself looks pretty appealing, with clear similarities to Fortnite and Apex Legends, although slightly more ‘Arcadey’ based on the snippets I have seen. Like these games, World Boss looks like it has the ingredients to be addictive.

Playside is the developer and publisher (unlike AOD, which Playside developed in conjunction with Team17).

The game will be free to play, with in-app purchases offered to allow for earning rewards and unlocking cosmetic options (again, similar to Fortnite). This makes forecasting the success of the game incredibly difficult, even when we are able to provide estimates around player numbers. Essentially, successful free to play models require an ability to reach people globally, so the collaboration with two prominent YouTube personalities is really important. Finding the balance is also really important -- on one hand you want as many people playing the game as possible, and this is easier when it is free to play; but on the other hand, there is a requirement to make money and keep the lights on. Fortnite nailed this, and many games are starting to shift towards this model (eg Counter Strike, Apex Legends), so it isn't exactly new. But this also results in World Boss relying heavily on in-game purchases to pay for servers and recoup game costs -- and then split any profits between the collaboration team and Playside. But announcements already suggest the game will feature a comprehensive progressive system, with unlockable perks and weapons, customisable builds and playstyles, and a rankings leaderboard. If they are able to foster a competitive landscape where players are actively involved in trying to 'progress', often helped by in-game purchases, a free to play model could work really well.

Both Lazar and Fresh have started to market the game, requesting that followers ‘Wishlist’ the game on Steam and join the new Discord group.

For example, Fresh released a video in Jan 2022 discussing the game. It has received more than 1.3m views to date – link here. As we get closer to release, you can bet that both Lazar and Fresh will start to hammer their socials promoting the game. Additionally, post-release, Lazar (and probably Fresh) will start to stream the game. When you consider the audiences that will see what they are playing, it will peak curiosity and naturally start to draw people to the game. If it starts to gain popularity, it will attract other prominent streamers, and this is where the snowball effect can start to happen. As mentioned above, it looks like World Boss has lots of similarities with Fortnite. This is obviously the game where both Lazar and Fresh made a name for themselves. As you would expect, a good majority of their subs would be Fortnite fans and interested in watching/playing similar arena-based games like World Boss. This bodes well for the game's release.

Herewith an extract from an investor news letter which will add to future Revenue.

Worth remembering that Playside have indicated a carry on Work-for-Hire into FY2023 of more than AUD 15 m. They are also on record that they expect Original IP Revenue to exceed WFH Revenue in FY2023. Worth a read ....

I am pleased to share two very exciting pieces of news that have recently occurred at PlaySide. The first is that we successfully launched our mobile game Legally Blonde: The Game on iOS and Android mobile devices globally a few weeks ago. The second is that we recently made a new key hire in our Chief Strategy Officer Benn Skender.

You may recall that back in March 2021, PlaySide signed a license agreement with Metro-Goldwyn-Mayer (MGM) to develop and publish a mobile free-to-play game based on its feature films Legally Blonde and Legally Blonde 2: Red, White & Blonde. Under the multi-year agreement, PlaySide was provided with a license to incorporate the movie themes and branding from the iconic films into a mobile title.

Legally Blonde: The Game is a combination of captivating legal narrative and Match 3 puzzles, including extensive character customisation options, casting, and empowering freedom of expression and speech through narrative choices. Players earn stars to continue the storyline, unlock sleek fashion designs, earn exclusive boosters and more across 500+ levels of themed board layouts.

Now that the title has launched globally, we will focus on our marketing plan including influencer promotion, global PR and press and social media coverage. We also have a real focus on continuing to improve the title by regularly adding new features and content updates to further enhance the users’ experience. If you haven’t already, check it out!

Early key metrics and reviews during the soft launch phase have been very positive and demonstrate that our vision for the game is resonating with the audience. This is a key milestone for PlaySide as it is the first of many planned launches for FY23 as we execute on our strong pipeline of Original IP titles.

****

Love the bit I have highlighted in Bold. The Godfather to follow and then the big one ' Age of Darkness'. Another year of 'stellar growth' on the cards.

RobW

@thamno has covered the announcement already so I will only add a few thoughts.

My initial impression of this update is that it is a positive for the company on several fronts. The first is that the addition of the publishing division will provide opportunities for additional revenue streams outside of the existing Work For Hire and Original IP. There is a large market for indie games of which some can be hits (An example being Untitled Goose Game out of Melbourne which has sold over a million copies and won multiple awards). Having this division will also give Playside exposure to emerging talent within the industry for ongoing collaboration or future additions to the team.

Also if the publishing division is successful it will allow the company to self publish its own in-house titles providing a greater share of revenue for the company. There is the risk that if Playside publish their own titles they may miss out on the exposure that a more established publisher could provide however with the appointment of the management team with experience in major games companies, Playside is hitting the ground running, so it will be good to see the first titles that come out.

I do expect that the new division will be a drag on operational cashflow for the several quarters at least. While the company has a decent amount of capital available ($40m cash) the upside potential is there.

Playside and Meta Extend & Expand Work-for-Hire Agreement

In addition to @Learner’s comments, I think the key words in the announcement are ‘significantly expand’. The extension is one thing, but Meta doubling down and expanding what Playside were already offering is impressive. This provides further validation into their offering and some insight into what is increasingly becoming their competitive advantage – their brand. If Playside continue to set realistic goals – that are attractive to AAA counterparts – and meet their deadlines, their competitive advantage will only continue to grow. The gaming industry is full of ‘maybes’ and delays; Playside appear to be bucking this trend.

The company signing a separate six-month contract to provide VR services is further evidence of this. If they do traditional WFH so well, why not give them a crack at the VR side of things too? Playside are investing lots of time and money into this capability – so its good they are attracting interest here – and there could be lots of blue sky ahead if they can capture even a fraction of that future market.

Lastly, while there is no reference to revenue in the announcement, my expectation is the expansion in services will have a material impact on FY23 receipts.

Disc: held

Highlights

- Cash flow positive, with 8.5m inflows and PLY’s second quarter of cash flow positive results.

- Record quarterly revenue of 14m – up 403% on pcp and 157% on QoQ. That sort of growth requires no commentary…. bloody impressive. BEANS generated 8.4m alone – exclude this and PLY have experienced revenue growth of approximately 5.4m (vs 5.3m in Q2).

- This takes revenue to 23m for the FY thus far. This blows my initial 2022 revenue projection out of the water (20m).

- Generated a record 14.77m cash receipts from customers during the quarter, an increase of 642% pcp and 167% QoQ.

- Over 40m in cash holdings, a stronger position than when they entered the quarter – plenty to fuel future growth without having to tap shareholders on the shoulder.

- WFH agreement with Activision Blizzard, which similarly needs no introduction or commentary.

- Signed the lease for a new studio on the Gold Coast, with a planned opening of early May.

- PLY increased its workforce to 152, with a whopping 60 staff added during Q3. This includes producers, programmers, artists etc etc.

This was a cracking result, largely fuelled by PLY dipping their toes in the murky NFT waters. The business will launch additional products within the BEANS universe over the next 48 months, so that is something to keep an eye on – particularly due to this being key for PLY’s Metaverse and Web 3.0 strategy.

Original IP was again impressive, with 11m in revenue (including 8.4m from BEANS). This figure also includes Age of Darkness development revenue in addition to revenue from its mobile games’ portfolio, but they don’t reveal how much. Of note, the Age of Darkness release is planned for global launch in Q2 FY23.

Work for hire revenue from the quarter came in at 2.78m. Nothing phenomenal, but the ongoing validation here – in addition to steady revenue inflows – provide PLY with brand benefits and cash to keep the lights on while they pursue original IP opportunities.

The business provided updates for their original IP titles in development. I won’t repeat them here, but there are 7 titles (not including Age of Darkness which I discuss above). The majority are planned for launch in early FY23.

The business will split original IP into three divisions – mobile, PC/console and Metaverse/Web 3.0 – with GMs appointed to each. This sounds pragmatic and will help the business align staff with relevant skills to the right division. The business has also hired a GM for WFH – lets hope this individual knows how to talk the talk because you would think the role is primarily outwards facing -- dealing with AAA developers/publishers.

Last thing from me – this quarter's cash flow statement reflects how efficiently gaming companies can generate cash when original IP titles start to gain success:

When you compare this with PLY’s Q2 results, you will see that there is almost no difference to the business’ marketing, staff and corporate costs – so revenue earned will shift straight to PLY’s bottom line – an excellent example of operating leverage.

Disc: held

A bit late to this one...

The Good

Increase in both WFH (57% QoQ) and Original IP (21% QoQ) revenue in Q2FY22. There has been growth in both company sectors for several quarters now which demonstrates the company is executing on its strategy. At current price levels a high level of growth is priced in so this needs to continue to meet the current market sentiment.

Q2 was operationally cash flow positive, which is a solid position to be in with the number of titles ready for hard launch at the tail end of this year. Staff levels are increasing and the new office , so costs

Additional Work For Hire deals with major gaming labels. Management reiterated the fact that along with the economic benefits of these deals, they are also strategic as it allows them and their staff to collaborate and learn from major studios. This can only help refine future titles that Playside are working on.

The Bad

The OTK Partnership announced in December was terminated by the quarterly announcement in January. This is fairly soon after the announcement so likely some DD issues or creative differences? It’s not the best look and hopefully there isn’t much more to this one, but something to note and better that any potential issues are identified and dealt with early.

What to Watch / Targets:

Original IP is the key operating area where Playside needs to kick goals as this is where the upside in revenue and margins lie. So this means a solid forward schedule of games that are meeting release dates. Between the quarterly update and half year update the Age of Darkness date changed from Q1FY23 to Q2FY23. Until the full game we have likely seen most of the early revenue from this title unless another update / marketing push is carried out. As a guide there has only been ~3,000 new followers on steam this quarter.

In the mobile titles The Godfather game also shifted from Q4FY22 to Q1FY23 between the January and February reports.

Two new mobile titles based on the existing Idle & Warfare infrastructure are also scheduled for FY23. Given the current release schedule I would expect that original IP will be down in H2FY22 (excluding Beans NFTs - This may be captured in a separate Web 3.0 operating sector?) with a move back higher in H1FY23.

Current Facebook WFH agreement ending this quarter. A portion of the WFH deal terms have been for less than 12 months. (Blizzard & Shiba both end this year) As PLY are expanding to another studio on the Gold Coast and expanding staff count, will need to continue to expand on WFH deals or sign with new companies if they are maintaining a dedicated staff of developers for this division.

Foray into the Web 3.0 world has had its ups ($8m in revenue in one month but this has now settled down to roughly an annualised rate of $500k / year in royalties from secondary sales) and downs (Several security breaches), so this will be an area to watch on how they keep their user base engaged until the linked beans MMO comes out at the end of the year. Following the discord channel for this, NFT investors have investment horizons and attention spans that are measured in days.

After the initial success they have hinted at further Web 3.0 projects. As mentioned in other straws from my point of view, Playside needs to ensure these projects have some application other than a quick NFT dump and cash grab or it tarnishes the integrity of the company.

It looks like Playside are learning the hard way that life in the current Web 3.0 is still very much the Wild West after having their discord channel hacked and potential comprise of holders wallets.

This will be interesting to see how they navigate through this and how it impacts the current Beans NFT project

PLY has an agreement with Activision announcement in the last 7days..

I have noted this update on W.Buffetts holdings..

Q4, the Berkshire chief picked up nearly 15 million shares of Activision Blizzard worth nearly $1 billion, according to a 13F filing tracked by whalewisdom.com. ATVI stock plunged in November amid an earnings miss. But shares surged in January after Microsoft (MSFT) agreed to buy the troubled video game company in a blockbuster $68.7 billion deal.

The conglomerate also bought 107 million shares of Nu, a Brazil-based digital bank holding company, worth more than $1 billion. Nu Holdings isn't Buffett's first bet on Brazilian financial tech companies — he bought....ECT............

* Also I have noted the craze via NFT you purchase Ethereum get a wallet and buy monkey faces.. If you have monkey face on say Twitter you are considered trendy and worth following..

So welcome to web 3.0 of Meta , NFTs..

Wow. Some week it has been for PLY.

The minting exercise was akin to a circus, but the company responded in a way which was commendable. First and foremost, PLY should put revenue opportunities to the side, because reputation and brand are and will always be the most important thing in the gaming industry. The next 6-12 months are irrelevant in the scheme of things – PLY need to position themselves in a way that will act as a springboard for 5-10 years’ time. Companies NEED to know PLY are reliable, but more importantly legitimate - particularly with some of the fluff/risk associated with the NFT, Metaverse and crypto space. So, while the technical issue that occurred was disappointing – and marks for me the first significant error PLY has made in a very strong 12-month period – their reaction was transparent, honest and conceded that what occurred wasn’t good enough. To that extent I give them a ‘OK, fair enough, get back to what you guys do well’. The reaction from the community suggests much of the same (which was initially my biggest concern).

And on to this announcement. PLY has signed a material fixed price WFH co-development agreement with Activision – who need no introduction. This will involve PLY providing fixed-price co-development services for Activision for a 10-month period. Looking a little under the hood – it will involve PLY providing production, engineering and user interface services to Activision. In a nutshell, this is where PLY is really starting to develop subject-matter expertise. There is no mention of price, only that it is material and doesn’t involve revenue share.

That said, I honestly couldn’t care any less about the revenue. PLY should be focused on ensuring they continue to impress and align with the goals of these AAA partners, and provide a service that sets them apart from others. The gaming industry is an enormous but at the same time very small place – impress the leaders with your offering and they will keep coming back.

The agreement with Facebook, and their subsequent renewal, suggests PLY are currently doing this well. In addition, the agreement with Activision suggests they are turning the heads and attracting the attention of the world’s most significant gaming companies. This to me suggests they are doing something right.

Disc: held

I know @shivrak will have some input on this but thought I would get in early.

It looks like there has been a bit of funny business going on with the Beans NFTs. Recently on the discord channel the team has announced that the NFTs that were to be burned have now been minted and released to the market impacting the value of the secondary NFT market.

https://opensea.io/collection/beans-dumb-ways-to-die

So now the company has taken the initiative to keep community sentiment in the project by buying back NFTs to raise the price.

This could be a costly exercise which will impact the total proceeds from the project announced today, given they are going to be buying back at a premium to the minting price. Currently there are 396 listed NFTs below 0.6 ETH. There will likely be an on market announcement tomorrow to follow on from this. Interesting times.

Building on the Dumb Ways To Die Beans story, PlaySide have now announced the direction they will be heading in with the Dumb Ways To Die franchise with a post on Medium which from my limited experience with the website is a bit of a crypt/NFT project pumping ground.

https://medium.com/@beannfts/weve-bean-thinking-about-the-future-178008658cbd

TODAY WE ARE ANNOUNCING

- The Beans MMO / Metaverse

- 3D NFT avatars

- “Bean Pet” NFTs

- Dumb Ways to Die 4 & More!

- Metaverse, TV & Franchise Extensions.

So my initial takeaways:

- PC Launch late 2022, Mobile 2023 so will potentially contribute to revenue in FY23