Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

@Hackofalltrades recent post has prompted me to post a straw for Playside considering the same question, is it time to buy or are there larger issues at play. Before I look at a valuation, below is a look at some headwinds.

I came across this slide pack a while back which I think helps inform from an industry level some of the issues that Playside will be facing for both WFH and OIP revenue growth.

State of Video Gaming - 2025

A pdf version of the presentation can be found here. PowerPoint Presentation.

Matthew Ball has a massive 230 page summary of the gaming industry leading into 2025 and ahead. In summary, what has been a fast growing industry is now facing some serious headwinds.

There are a few key takeaways that can be used when assessing Playside’s recent downgrades and changes to forescasts.

- Spending across the industry is flat over the last 3 years, which is short of analysts forecasts. Other media industries have continued to grow, but the numbers of gamers declining has been since Covid.

- The Industry is reacting with game cancellations, studio closures and record rates of layoffs. These types of responses from large studios are going to have a direct impact on the amount of WFH work that is out there for Playside to compete for.

- Mobile gaming time is decreasing as other media such as social video continues to grow. Global mobile penetration has also reached saturation and now grows in line with population growth.

- AR/VR growth forecasts are consistently being revised down as sales continue to miss expectations. This medium has not taken off yet. Playside has kept at the forefront here as can be witnessed by the reception of Shattered, however total sales still seem to be quite low. Their involvement in Civ VII VR also highlights their strength in this area.

- Unlike other media industries, prices for games have not grown significantly over time which has resulted in large sale price declines in real terms. Yet development costs have continued to grow as the expected production value continues to increase for AAA titles. As Playside tries to push into this area with titles like GoT they will experience more of this. (They market themselves as a AAA developer but I given their PC / Console releases to date I would still group them in the indie category)

- Although the cost of development is up comparatively, the number of games released per month on steam is also up significantly, which don’t just compete against each other, but all games previously released. Playside may need to reconsider their historical sales forecast indicators

The challenges were summarised in the following slide:

There are many many more slides in the presentation and its a highly recommended read for anyone looking at Playside or other gaming stocks.

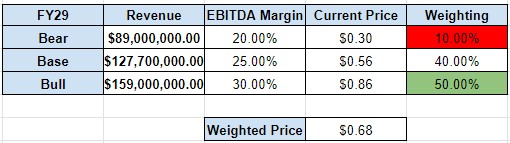

After listening to @Strawman talk about Playside on the Motley Fool pod machine, I thought I’d check back in on progress.

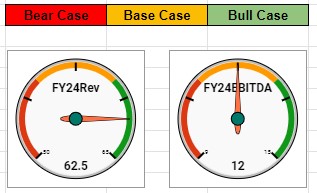

At the AGM management indicated that FY25 will be a year of consolidation and building for the next wave of bigger and better future titles. A revenue guidance of $62m to $68m (in-line with FY24) was given for FY25. So how do they get there?

In June, the forward 12 month WFH book was at $28.8m.

With no new contracts or extensions announced to date, it has to be assumed that this remains at the same value. At the AGM, there was the indication of active leads after a quiet period in the industry, but this is yet to play out.

This leaves $33.2m from Original IP that are being released this year and mobile.

Current titles expected to be live in FY25:

Kill Knight - PC, Xbox, PS, Switch

Released 2nd October - RRP$20.00 - Developed and published by Playside

Receiving positive reviews, but in a niche genre overall sales volumes wouldn’t be expected to be massive. As indicated in the AGM, this title was more of an exercise in releasing a title across multiple platforms simultaneously.

https://www.metacritic.com/game/kill-knight/

KILL KNIGHT Review | Bytesized

Current PC download estimates from SteamDB.

Dumb Ways to Die - Free For All - Meta Quest - Developed by Playside - Revenue Share (& licence fees?)

Released - 6th November - RRP $29.99

The Dumb Ways To Die franchise expands across to the Meta Quest platform with a VR party game. So far it seems well received but downloads and users are quite low at this point. A new DLC with additional mini games has recently come out which may help increase awareness of the game.

Meta Store Reviews:

Trying NOT To Die In DUMB WAYS In VR! - Dumb Ways Free For All - YouTube

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02690123-3A622133

Shattered - Meta Quest - Developed by Playside - Revenue Share

Released - 4th December - RRP $29.99

Shattered is a Mixed Reality puzzle thriller that was released without much fanfare. It is getting a solid reception for pushing mixed reality forward which is a positive for future titles and work with Meta.

Meta Store Reviews:

https://www.youtube.com/watch?v=15ueyuO_XYg

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02601238-3A607700

Shattered [Meta Quest 3] | REVIEW - Use a Potion!

Age of Darkness: Final Stand - PC - Developed by Playside

Full Release - 15th January 2025 - RRP $40.00

Age of Darkness will get its full release in early 2025 since coming out in early access in October 2021. Multiplayer should help give the game a bit of a bump in overall downloads as that was a major complaint about the game in early access.

Previously it was announced as published by Team 17 but now shows up on the Steam Store profile as published by Playside, which means there will be a higher revenue share from sales, however there would have been some cost in parting ways with Team 17.

Steam DB stats. - Compare after release to get an indication number of new downloads

Thrive: Heavy Lies the Crown - PC - Published by Playside

Full Release Q2 2025 - RRP $40.00

The city builder currently in Early Access since 7th of November will be Playside Publishings first full release once it comes out in Q2. So far reviews have been mixed, but trending toward more positive as the developers respond to the feedback they are getting.

Review summary from Steam Store

Dynasty of the Sands - PC - Published by Playside

Early Access - Early 2025 - RRP - TBC

Beanland - PC - Let's not talk about that.

Mobile

Playsides latest mobile titles seem to be performing ok, but still have a long way to go before they reach the status of Animal Warfare. Currently with less impact for mobile revenue from the Dumb Ways titles (Dumb Ways to Survive - Netflix - Licence fees? Announcement) I expect mobile to be less of a contributor to the Original IP revenue for FY25.

Summary from Sensor Tower.

Overall, Playside is maintaining a high level of quality for the games they are developing and publishing and generally are well received. The next 6 months will be telling on how they market the existing titles and the upcoming titles for FY26. (Mouse and GoT). Original IP revenue was $17.66m at H1FY24 and dropped off to $12.6m for H2FY24. As half the titles are only expected to be released in the second half, revenue for H1FY25 will likely sit somewhere in the middle of these two numbers.

Coming up to the release of Playsides full year results I thought it would be worth starting to track the titles in production again. As Playside moves into larger titles with larger production budgets, managing the production timeline will be an important factor on the cost side.

H1 Review (Trying to get this out before the Q3 update)

The Good

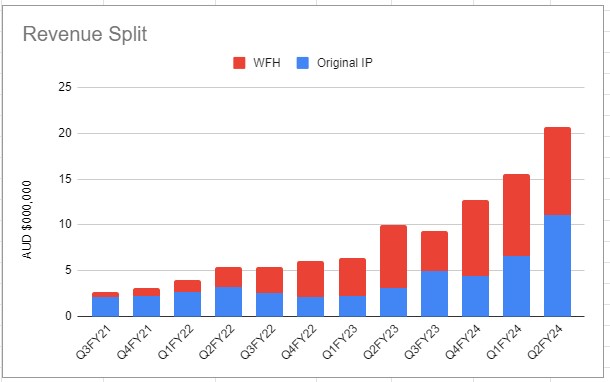

- QoQ revenue growth of 34% to $20.7m and $36.2m for the half. Annualised out to $72.4m which is above the increased guidance range of $60m-65m. Original IP increased 68% QoQ to 11.1m. This is likely going to be lower in future quarters based on the FY24 guidance.

- Quarterly EBITDA of $8.0m which is ~39% of revenue. Guidance for FY24 is $11-$13m on $60m which works out at ~ 20% of revenue.

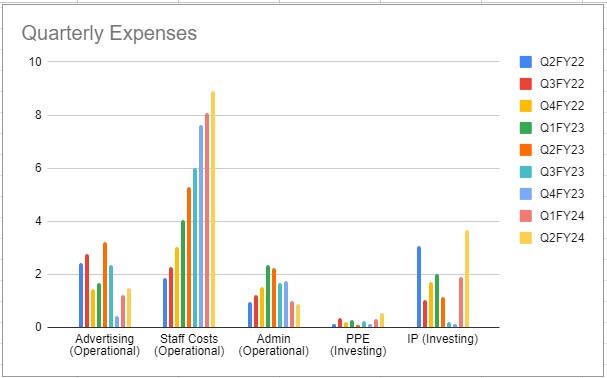

- Even though staff expenses have increased, overall they have decreased as an % of overall revenue.

- Increase in cash position to$38.3m which is allowing playside to take on larger projects like the WB IP deal.

- Playside Publishing now has three titles in the works with the first scheduled for release this FY

The Not So Good

- Both Age of Darkness and Beanland appear to be on limited resources to reach a final release, with no target dates for either in the recent updates. This has been discussed in other straws, but so far, Playside has not had a commercially successful PC release and has relied heavily on DWTD franchise.

- Kill Knight release trailer meant to be released in Feb. Still no updates.

Watch Status:

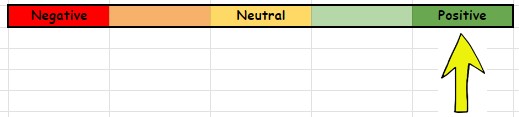

Valuation Status:

Increase to bull case. Valuation upgrade.

What To Watch

- New mobile title coming out currently in early release - Wedding Planner - Match 3 Title (Target 4-6 Titles per year)

- Warner Bros IP to be announced in Q4

- Thrive - HLTC - Release target Q4 (Publishing)

- Dynasty of the Sands - Release target H1FY25 (Publishing)

- Project Phoenix announced as Kill Knight - Release targeted for H1FY25

- DWTD Netflix Title - Dumb Ways To Survive

https://www.youtube.com/watch?v=E4cT_PRRDRo

- DWTD PC / Console title - CY25

- Mouse - CY25 (Publishing)

- Updates on Beanland and Age of Darkness

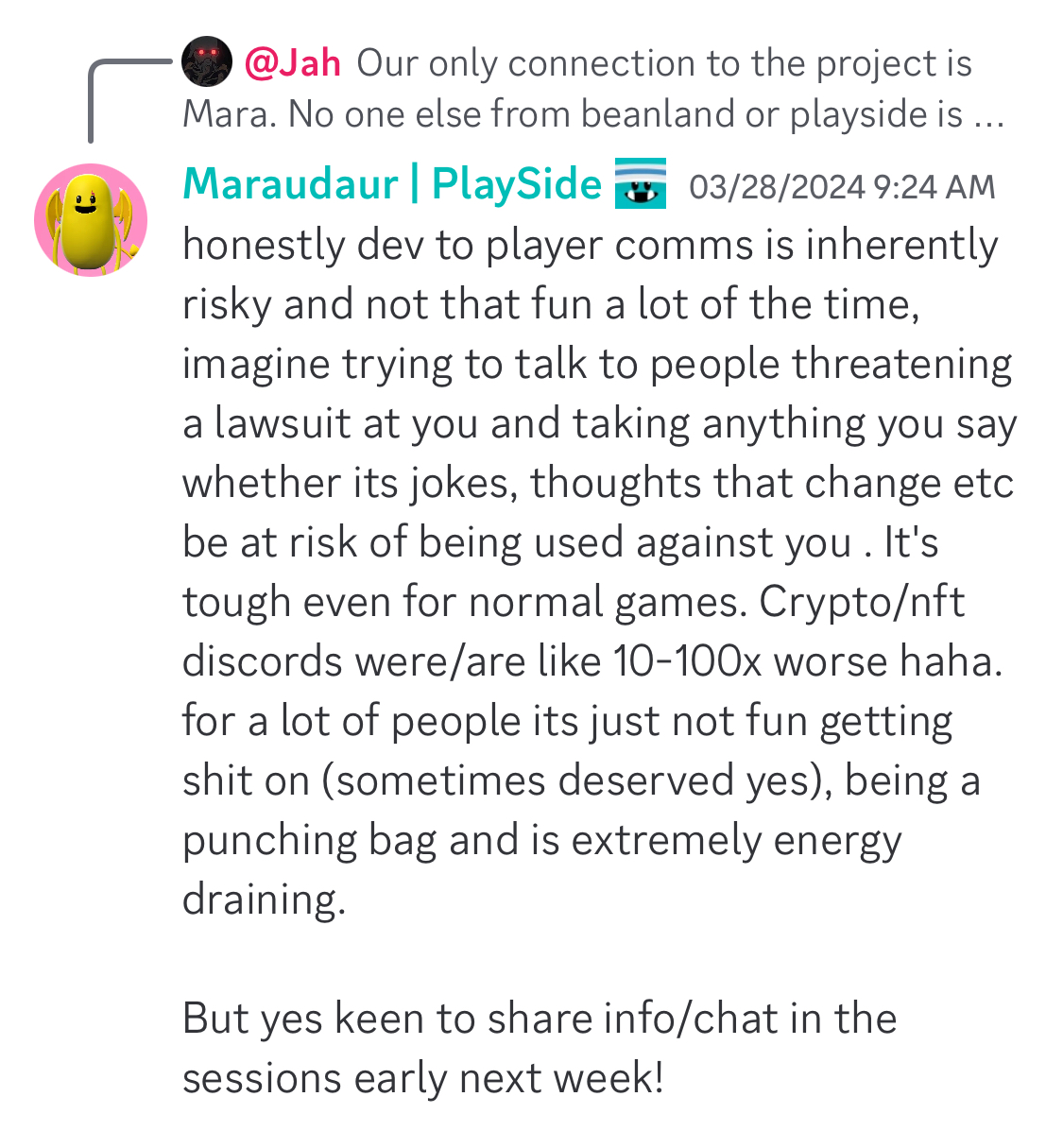

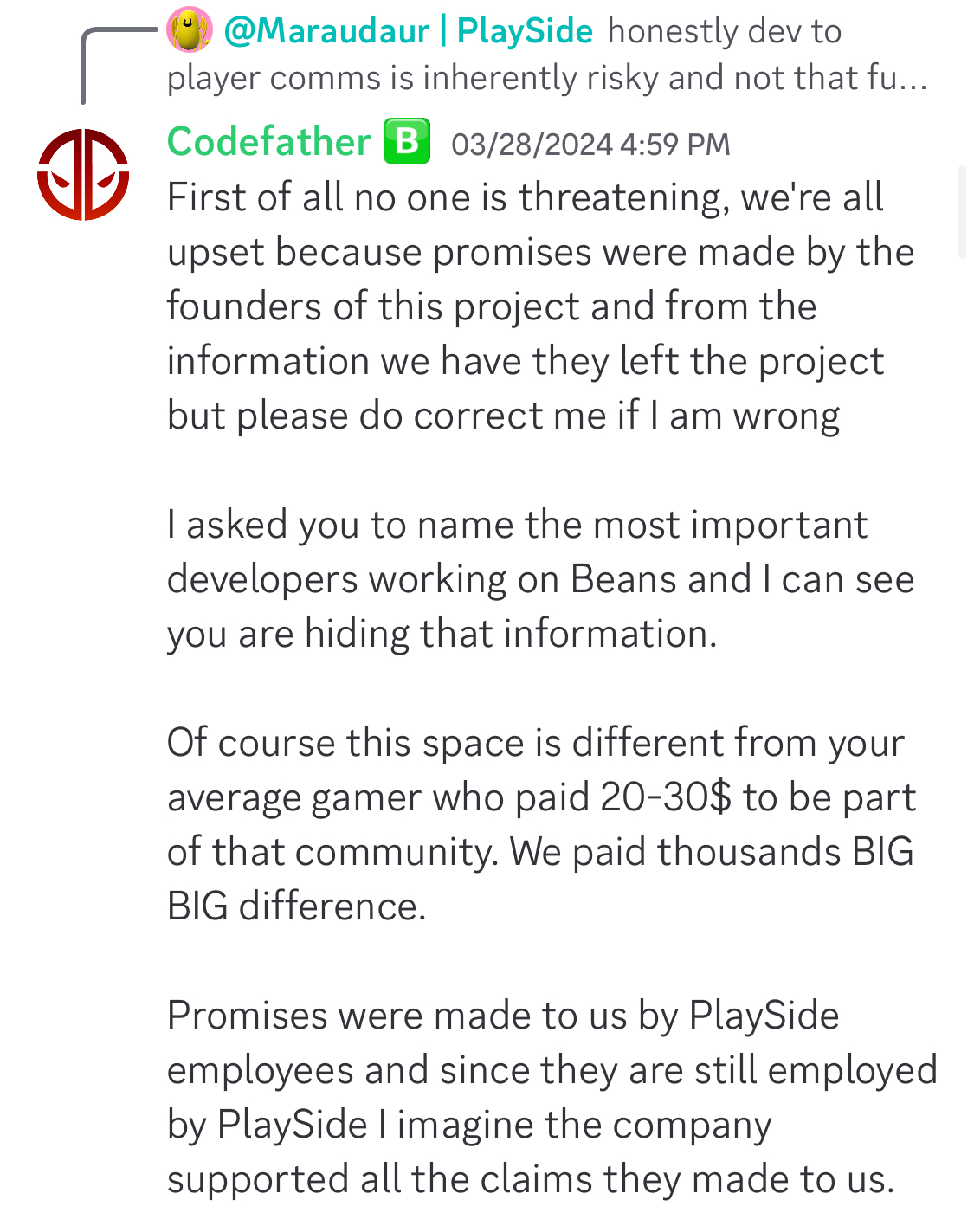

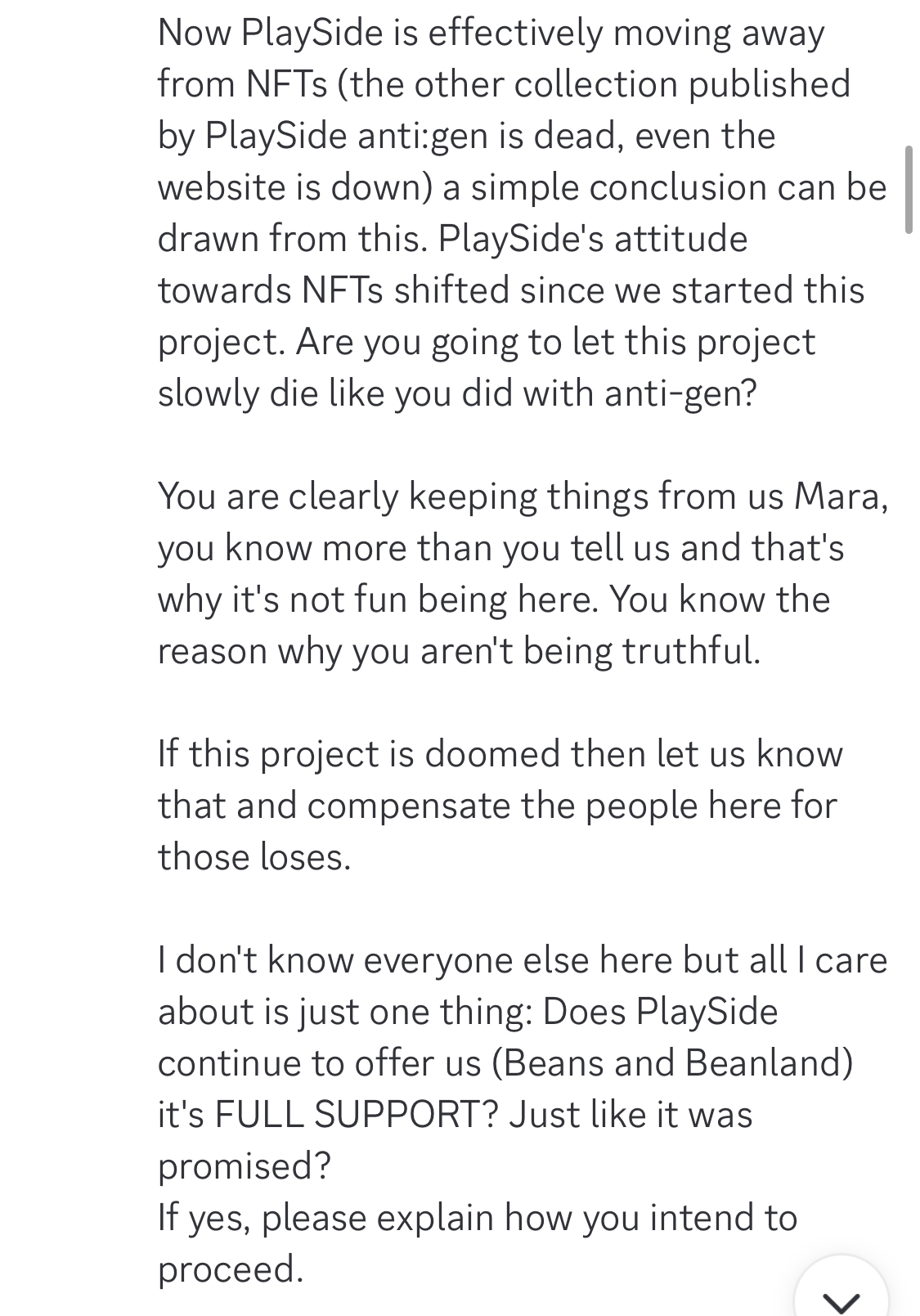

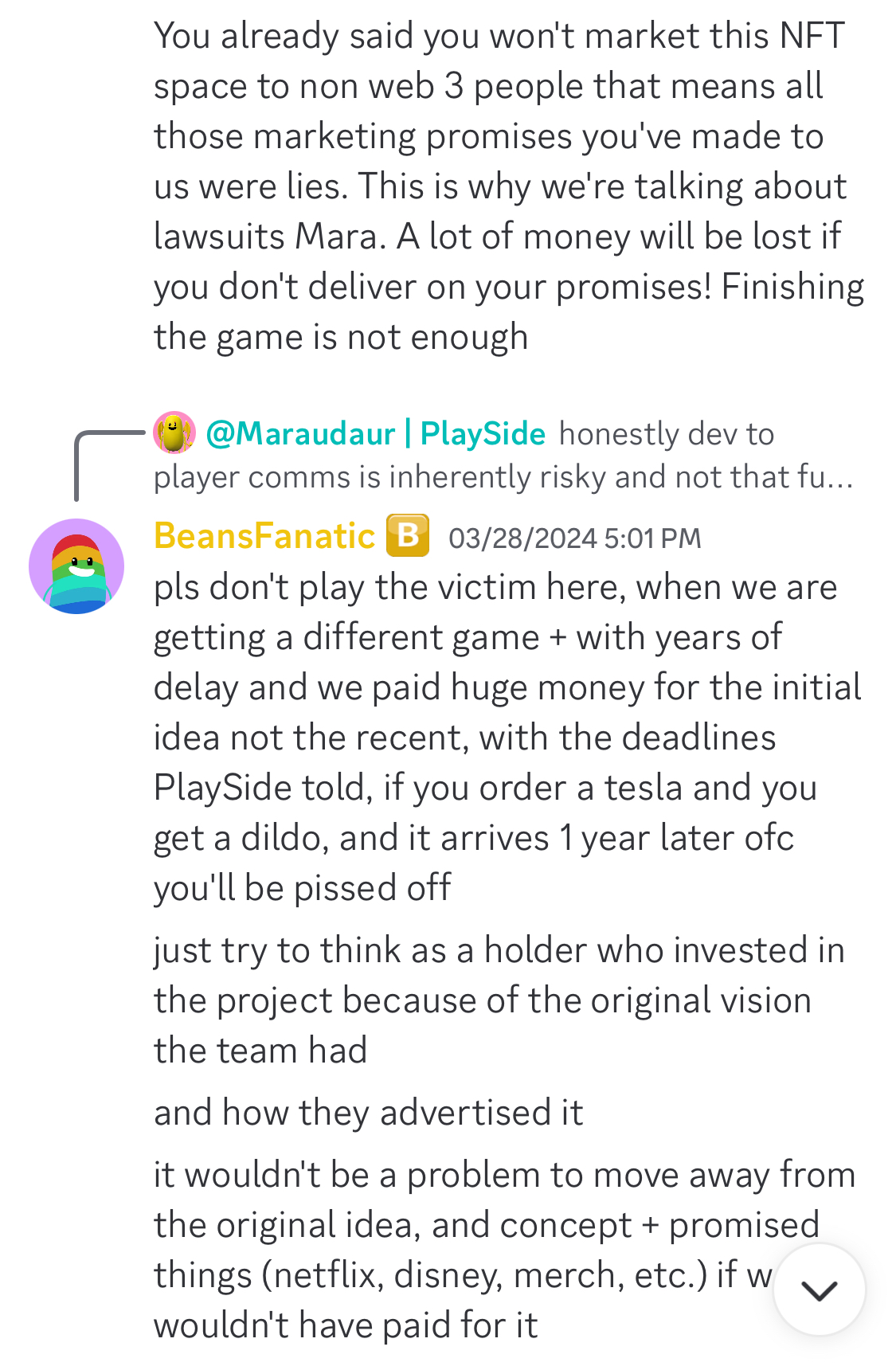

There’s been quite a bit of negative sentiment on the Beanland discord channel recently and rightly so after the long delays and constant changes to the development road map.

Whilst it is unlikely to have any major impact to the company overall, it isn’t a great look for a listed company to make a cash grab and then effectively deliver nothing to those that backed the project as they weren’t small amounts of money for the bean NFTs.

It also leads into another risk I see with Playside leading into their big IP console titles, which is their ability to close out projects in announced timeframes. This is likely due to their WFH contracts taking precedence over their own titles at this stage of the company growth, but Age of Darkness has been having similar issues in reaching final release.

Small exchange from discord below:

The Good

- QoQ revenue growth of 22% to $15.5m. Annualised this is above the $50-$55m revenue guidance provided at the end of FY23. Revenue growth was strongest in the original IP division, with a new record quarter of $6.6m. This was just shy of my last quarters estimate.

- Original IP revenue increase is likely driven by the milestone payments for the DWTD Netflix and Meta titles as following the mobile downloads there hasn’t been any significant changes across the catalogue.

- Staff costs look to be levelling out from the recent growth phase. If playside can continue to generate growing IP revenues, this is where operating leverage will come into play, otherwise further staff growth may be required to continue to grow the WFH revenue streams.

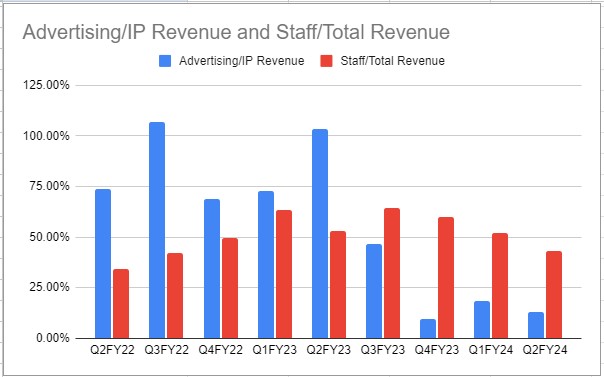

- Only slight increases in advertising expenses and still significantly down as a proportion of IP revenues.

- Cash position remains strong at $31.7m

The Not So Good

- Age of Darkness release date still TBC. It looks like this is waiting for multiplayer to be locked down, however updates from the Playside team in the Discord channel indicate that this has been a challenge. The longer this is in pre-release, the more development costs need to be recouped.

What Status:

What To Watch

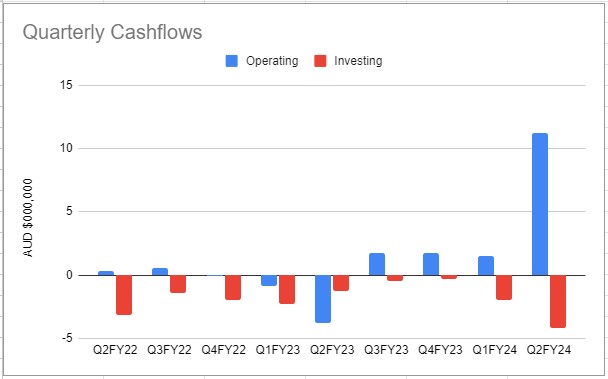

- Expect Q2 to be cash flow and EBITDA positive. Track EBITDA margin for future valuation estimates.

- New deal announcements from recent games conferences. As @Rocket6 has stated, this may lead into the AAA title announcement and start to show up as increased investing cashflows.

- Original IP revenue lumpiness. Given the milestone payments for the DTWD title development, these have the potential to create lumpy IP revenues throughout FY24 until the titles are released.

- Pipeline Targets

- Next release - Beanland (Q2FY24). I don’t expect any significant revenue contributions from beanland given it will be free-to-play. There is a very small chance that it could spark some interest in the Beans NFTs again. I don't really attribute any value to the Web 3.0 segment of the business.

NFT Sales since launch (Volume & Price)

- Project Phoenix title announcement.

- Potential increase in capitalised development costs

- Third publishing title announcement

- New mobile title

The Good

- Record quarterly revenue of $12.7m, demonstrating ongoing growth especially in the WFH business. Original IP revenues continue to remain strong, likely driven by the DWTD IP.

- Another cash flow positive quarter, again driven by low advertising revenue. I thought that this would have increased this quarter, however it has moved in the other direction. I still don’t think this level of expenditure can be maintained, however it is a positive indication that Playside isn’t having to resort to buying revenue.

- Dumb Ways To Die IP continues to drive business for Playside with a title for the Meta Quest in development. This title includes development fees and ongoing net revenue share. Both the Netflix and Meta deals include licensing fees to be paid out during development. Mobile downloads have also remained high from the peak.

- $50m to $55m revenue guidance provided for FY24 which is at least a 30% increase on the $38.4m for FY23. This shows confidence from management

- Strong cash position of $32.2m. With the company moving into consistent positive cashflow territory this leaves a very strong capital position for future business development and larger title development budgets.

The Not So Good

- Staff costs continue to rise. This is to be expected to be able to service the increased WFH contracts as long as staff to revenue ratio doesn’t increase beyond historical levels

- World Boss' full release at the end of June didn’t do anything to boost the player numbers. At this point in time it would be reasonable to assume that so far World Boss has been commercially unsuccessful.

- Mobile titles (ex DWTD) downloads on the decline

What Status: Positive

What To Watch

- How the gaming tax offset is reported. I’m not sure how the rebate is handled by the ATO but potentially a substantial payment in Q1FY24? Are WFH expenses counted within the rebate?

- Based on the guidance numbers provided from the vantage point conference slides can expect Q1 WFH revenue to stay within the $7m to $8m range

- AoD release date and ongoing downloads

- Dynasty of the Sands updates and progress

- News on new PC / Console title - Project Phoenix

- New mobile titles planned in FY24. The first of these to come out is Dumb Ways To Climb. Currently ranked number 64 in Action on the app store. Once again this is a re-skin of other similar games on the market, but its probably a good time to be cashing in on the DWTD IP

Article from ABC News today talking about the games industry in Australia and the rebates available from governments to promote the industry and new impact of the new Digital Games Tax Offset that was effective from 1 July 2022.

Source: ABC news

So far this year, Playside have spent $16.4m on staff, and will likely land somewhere in the $22m to $23m range for the full year

Based on the legislation expenditure up to $67m is claimable, so Playside still has quite a large window of growth to be eligible for these rebates.

Source: ATO

What I did find valuable is this comment here about exchange rate risks for the WFH business, which although fairly obvious, I hadn't considered before. Although Playside isn't owned by a US company, the cost effectiveness of outsourcing is still impacted.

Playside have added a new mobile title to their catalogue this month. Find It: Scavenger Hunt which is free to play so will rely on the normal model of advertising and in game purchases. The game itself is pretty polished in the artwork and seems like a relaxing time filler.

But wait, what's that, this game is basically identical to many others in the store already all using some combination of Find and Scavenger in the title or description.

This is one of the main areas I'm not sure what to think of Playside's business model. I know Gerry has talked in the past of using data better than competitors to optimise their traffic and conversions, but without knowing the development and ongoing support costs of a title like this, its hard to see where the value is in competing is a crowded space like this. For me it also detracts from the image of Playside as a studio.

I will add this to my download tracking with the others in the catalogue, to try get an indication of how this performs in comparison to their other titles

World Boss full release date has been announced:

As World Boss is a free title, revenue boosts for Q1FY24 will need to come from in game purchases. There will be a new battle pass and I imagine some new content packs at release, but they will only matter if people are playing the game and currently regular numbers are very low. There will be a new map and sounds like new game modes, so that may be more enticing to new players on release.

Based on World Boss being release just in time for Q1 I think we will see Age of Darkness getting its full release around Q2FY24

The Good

- Record Original IP (OIP) revenue of $5m, which exceeded my forecasts for the quarter. This was largely driven by the DWTD games, which management said provided an extra $1.9m for the quarter. The increased revenue shows the power of viral marketing across social media networks and Playside did well to try to maximise engagement across these channels. The DWTD IP continues to bear fruit for Playside, having acquired the IP for $2.25m.

- Cash flow positive quarter. This was largely driven by the increased original IP revenue, which was recorded off a lower advertising requirement. How much Playside can maintain this in the future is uncertain, but I expect higher advertising cost ratios going forward.

- 30 Month WFH hire contract signed with Skydance. Whilst the value of this contract hasn’t been announced, it shows that Playside is continuing to keep a solid stream of contracts in the pipeline. Given WFH still makes up a significant portion of revenue, to maintain positive cash flow, the WFH deal pipeline needs to continue as staff costs continue to rise to meet the resourcing requirements.

- Further indications that the company is progressing through the transition to larger titles with a new indie game to be announced in coming quarters.

The Not So Good

- Total revenue slightly down on the previous quarter at $9.3m vs $10m. This was largely driven by a decrease in work for hire revenue, but management have highlighted that these contracts are based on milestones so some lumpiness is to be expected going forward.

What To Watch

- Based on the guidance numbers can expect Q4 revenues at a similar level ($9 - $10m) with OIP ~ $3.5m -$4m & WFH $5.5m to $6m.

- DWTD 4 coming out in May. This release may just miss the TikTok spike, but if the game is good and engaging, it will start from a strong position.

- No updates on AoD & World Boss, these are looking likely for full releases in FY24 which will help contribute to future revenue growth. Other contributors to monitor:

- Meta Mixed Reality - Revenue Share

- Beanland Alpha/Beta release & impact on NFTs

- Publishing division first game

- Based on the success of the DWTD IP the company may be on the lookout for other similar opportunities where they can own IP rights rather than licence. This wasn’t flagged but I can imagine that management have considered it given the success. This could be a risky use of capital.

Games Update

Download stats are out for March and it looks like there has been a general decline in most titles except for the DWTD TikTok boost. Based on these numbers and the forecast of additional revenue from DWTD I expect the original IP numbers to be marginally better than Q2, which may bump up to an new all time high for original IP (Current is $3.28m in Q2FY22)

Looking forward into Q4 there is an opportunity for the revenue increase to continue with a few key events:

- Legally Blonde and Godfather have recently both just had significant updates, which means they may start to get another marketing push. This will be seen in a change in download trends

- DWTD4 is scheduled for global release on May 2nd which may catch the end of interest TikTok trend

- Beanland is scheduled for alpha release in May progressing for to open beta in July

- The beans NFT are starting to get more attention as the beanland release approaches

- Age of Darkness full release is getting close. As a full price game, the initial release sales should also provide a nice bump to original IP revenue.

- Worldboss reviews continue to improve as further updates are released. No indication yet for date of the full release.

@RobW has already touched on this one, but I am also reassured that the team at Playside are making the right calls with business strategy. For me, although the bottom line numbers for the half weren’t great and the outlook for weaker original IP revenue for the remainder of FY23 is still in place, this half was about the longer term direction that the company wants to head in.

Mobile titles still remain a focus for Playside and revenue from the catalogue of titles is becoming more diversified which is a positive. What I didn’t expect to see was that Legally Blonde was the best selling mobile title, which aligns with the sensor tower revenue data. (This may be based on in-game purchases and other games generated more, but through advertising?)

Although there has been some success with the new mobile titles, Gerry did confirm my thoughts that they are looking toward larger titles in the future.

In terms of the titles that were written down, it looks to be the Anti Gen NFT project, Pillage Party and DWTD titles. Gerry’s reasoning for this direction was sound.

The Work For Hire business looks to remain at consistent levels for some time and the deal structures are improving in both size and revenue share arrangements. The fact that Playside can pitch ideas, get paid for developing and also get to share in revenue demonstrates the relationships they are forming.

For the publishing division, looking to sign something this calendar year, and starting off small and low risk in terms of resource requirements.

Side Notes:

Sounds like World Boss might be taken out the back of the shed if the full release isn’t substantially better than the soft release (in a few months). Referred to as a brand building exercise. Without substantial resources I don’t see the game improving.

I may have been a bit harsh on the Legally Blonde and Godfather downloads. It sounds like the marketing on these titles has been scaled back while they improve features (They still have to essentially buy downloads though)

@Rocket6 posted about DWTD going viral. The original IP revenue will get a nice boost this quarter with a conservative forecast of $800k coming from DWTD alone.

Well thanks for the shout-out @Wini, too bad I took more of a wait and see approach. So what did waiting get me…

The Good

- Total quarterly revenue up to $10m up 56% on the prior quarter. WFH up 68% to a record $6.9m & IP up 35% to $3.1m which is just short of all time high $3.3m. The $3.3m result was also distorted by the development revenue payment from Team 17. Annualised this result puts Playside on track for a record year ($36.5m), however management did indicate that IP revenue is expected to drop again in Q3.

The Not So Good

- Still fairly high cash burn. This was driven by increases in costs for both staff and advertising.

- Looking at a comparison to these for revenues advertising spend vs IP revenue has trended higher again, which indicates that a much higher advertising spend was required to increase the IP revenue to the $3.1m for the quarter. What is a positive, is that staff spend vs total revenue has come down against the previous quarter.

- Cancellation of several work in progress games, without listing the titles or providing further detail. This led into the revised revenue guidance indicating that Playside no longer expects that the original IP will exceed the Work For Hire revenue for FY23. My takeaway from this:

- Significant revenue growth and improved terms for WFH have increased the outlook for this revenue stream.

- Delays to the full release of Age of Darkness will impact time in the market for sales to contribute to the IP revenue.

- There may be a change in strategy from the churning out of the same mobile games with different paint jobs, that then require ongoing maintenance and support. I won't be disappointed as this was a bit of a negative indicator for me.

- The shift to relying on WFH revenue will likely mean that operational margins will be lower over the medium term.

- Overall there were some decent updates to the numbers in the quarterly, but it was overshadowed significantly by the stripped back update that focussed on the cancellation of titles and change in guidance. Potentially this could be an indicator on management’s sentiment going forward.

What To Watch

- The list of titles that got pulled will provide key direction on the company's longer term strategy. There may be some more coverage on this in the Half Year report.

- Age of Darkness is still progressing through Early Access updates, potential for Q3 full release but more likely Q4 given the expected decrease in revenue. I expect that AoD will perform reasonably well given the positive ratings and how Playside has been responding to feedback from players.

- The full release of World Boss is also on the horizon, but this is unlikely until FY24 given the lacklustre reception of the early access release. The team will want to attempt to work out the kinks and improve the player experience prior to announcing a full release. Reviews have been improving with the ongoing updates.

As Playside’s last several quarters of Original IP revenue have been relatively flat, ($2.6m, $2.1m & 2.3m) I have been tracking monthly downloads on SensorTower to use as a proxy for revenue to try get an indication if there is looking to be any change to this trend. This is only one set of data that I haven't verified the accuracy of, so should be treated as such.

There are several high level takeaways which can be inferred from the trends over the last 5 months.

- Animal Warfare continues to remain the most popular mobile title and is maintaining consistent monthly downloads.

- Older titles such as Battle Simulator and Garbage Truck 3D are showing an ongoing downtrend in downloads.

- The titles released over the last 6 months (Highlighted Yellow) are not yet showing ongoing growth in downloads to replace the outgoing titles. (Fantasy Warfare is still in soft release)

Based on the above and given that AoD and World Boss are still early access, I don’t expect that the original IP revenues are going to have any uplift in Q2.

Notes:

SensorTower also offers revenue estimates, however as revenue is also generated from advertising in free games, I am using the downloads data.

DWTD Titles have not been included but will be added going forward.

My list only includes titles that have received updates within the last 12 months. Based on this the following titles will be removed going forward:

- Monkey Ropes

- Idle Area 51

The Good

- Highest quarterly revenue to date (excluding Beans NFTs) with a total of $6.5m, this annualises out at $26m which is getting close to FY22 revenue ($29.2m including Beans sale).$4m of this was Work For Hire which I had previously estimated and as @RobW stated they had the $15m backlog of WFH revenue which should now be around $11m and have resigned the Meta deal with an expanded scope, so this should continue around this level, so long as further deals are signed.

- Presentation of the new investor materials looks good, however more on that soon.

- Expenses maintained with growth in staff and admin expected due to the additional office, still have a high level of cash with a balance of $34.7m

The Not So Good

- Original IP Revenue of $2.3m which is a slight improvement over last quarter but still down on previous highs. Given the release schedule, a slower Q1 was to be expected, but this should start improving from Q2 onwards as more titles in the pipeline are released. In the annual results management were forecasting that original IP revenue would exceed WFH revenue, however given the lacklustre reviews of World Boss so far, I'm a little less bullish than RobW and I think this forecast may not be met. Q2 will be key in determining how FY23 plays out.

- Much of the detail from previous quarterly announcements has been removed with the announcement being much more of a summary. Target release dates have been removed, likely given the frequency at which these dates were being pushed. ( I would rather them delay a title than release it early . World Boss is a key example of the impact that this can have on a game)

- Operational cash burn for the quarter was down to $800k, however this doesn’t account for the capitalisation of game development expenses which were $2m for the quarter. (Notes from FY22 report)

What To Watch

- No details on how the publishing division is tracking. (A quick search of the steam store doesn’t bring up any titles, which would be expected given the timelines of game production. I estimate first deals announced in H2FY23 with revenues in FY24)

- Advertising / Revenue. If this metric can start decreasing it will indicate that the titles are generating more revenue organically and are more successful. Currently this is around the 70% mark.

- No update on the Anti:Gen NFT and not a lot to be found on the website, however it has been included in the development schedule so it can be assumed that a game will be associated with the NFTs.

- Any new titles added to the release schedule

- Ongoing extensions to the WFH agreements will be required to sustain the new expanded work force.

World Boss has now been released on steam for Early Access and so far the reaction from players hasn’t been great with negative reviews far outweighing the positive.

The biggest detractors so far are the performance issues and the lobby issues on launch day which the team were quick to address but it definitely hurt first impressions.

This game was meant to be one of Playsides marquee titles so I will definitely be watching reviews and so far the poor market reception is a strong signal to review my thesis and holding

World Boss now has an official Early Access date, which has been confirmed as 20th of October.

It was announced in conjunction with a demo at PAX Australia with Lazarbeam & Fresh. There was also the release of a launch trailer on youtube.

https://www.youtube.com/watch?v=zlqiq8zoaNo

Hopefully there will be some details on the monetisation strategy for the game in the upcoming quarterly update.

Following on from @RobW and @Rocket6 posts I was going to wait until the end of the quarter to put this together but wanted to add my thoughts to their posts. Below is a table showing the status of the targeted release schedule from previous company announcements. Green is full release, blue is a soft release.

First up the Mobile Titles

Legally Blonde

The Legally Blonde game was released across 100 countries at the start of the quarter. Tick. The game itself is a pretty basic colour match puzzle game with a legally blonde “story” overlay. Progress through the game is incentivised by requiring levels to be completed to progress through the story and earn rewards to customise your character. Customisation and level power ups can be purchased to fast track progress.

In August the game started to get a bit of traction with an estimated 160k downloads and $100k in revenue for the month.

Mobile game download and revenue statistics from Sensor Tower https://app.sensortower.com/

Godfather

Next up is the Godfather game which is still in early release and currently only available in Australia, Great Britain, Canada and the Philippines. The game is an “idle” style which involves upgrading items to generate more money, wait a while then upgrade them further once you have accumulated the required amount, the game in general nudges the user to speed up the upgrade cycle with purchases. There is some Godfather flavour to the game but it really is superficial with some basic dialogue and quests. The level layouts and artwork is generally well done, but that's as far as the game goes. Reviews on the game have been mixed so far, mostly down to bugs that are still being worked out, but to me there isn’t a lot of “game” there and I feel like it is a missed opportunity with some good IP.

DWTD

DWTD: Dumb Choices is out as a very early release and so far early reviews have not been kind. Currently it’s not available in the appstore to try out. Screenshot is from Playside promotional material

The other DWTD title is a sleep assistance / meditation app for kids. Dumb Ways to Sleep. I gave this one a download and listened to a few of the tracks. It looks like the team has gone to some effort to create some decent content here and the app itself is pretty polished in regards to the UI and artwork. Playside have partnered with Peaceful Kids, a mindfulness and positive psychology program when developing the app. The problem I see is the price point. $15 /month in a very crowded market place.

Idle Recycle

Idle recycle is another idle game. This time about recycling! Collect cash, upgrade your facility, repeat. If this game looks familiar, it’s because it is identical to the previous game Idle Area 51. In previous updates Playside said they had developed a toolkit which allowed for the fast development of new titles. It appears that the toolkit is just changing the skin of the game and changing a few lines of text. Other than that, some of the initial reviews look to be positive.

Dino Warfare

On toolkits, the other toolkit Playside have developed is WARKit which looks to also be getting a few reskins. Dinosaurs this quarter, fantasy beasts in Q2. Once again there aren’t any new developments in this iteration of the Warfare series. There are dinosaurs though.

For those who are unfamiliar with the warfare titles, you start with a single unit and earn coins after each successful battle. Those coins are then used to run a lucky dip on a new unit, which you can then merge to upgrade, rinse and repeat against progressively larger and harder armies. Both armies are controlled by AI so there isn’t any skill involved in the game. I was going to say that the difficulty level doesn’t even force you to watch ads to progress, but I did hit a wall at Mega Iguanodon below.

The previous warfare titles have been successful and I can’t see why this one will be any different as I can see the dinosaur theme being attractive to players. So far there isn’t much data to be able to determine how this title is heading, however there should be some better metrics available after the month’s end. (For this title and the other recent releases). These will be worth tracking month to month.

On pricing of the mobile titles in game content in general, the price of items in the store are downright crazy. $100+ for some gems (insert other object) to get some more items / speed up the game?! This was always one area where I was hesitant in investing in Playside due to the predatory nature of the in game currencies in mobile gaming. I will definitely be reviewing my holding in the company after seeing the cost of items in Playsides stores.

PC Titles

Age of Darkness

Age of Darkness is now coming up close to a year in Early Access. In the Annual Results summary it was advised that the release will be pushed into H2FY23 to continue to develop the campaign and multiplayer modes. This is the release I am most interested in as it is the first of the real games that Playside have in the development pipeline. AoD continues to get downloads on the steam store, however any meaningful revenue won’t be generated from the game until it is a full working title. I’m still yet to play AoD as I was hoping to wait for the full title, but might have to give the early access a spin. Reviews on steam continue to indicate good things with 82.98% positive out of 4474 reviews.

Some recent gameplay footage below.

https://www.youtube.com/watch?v=7AjrLVBpWfM

World Boss

World Boss was the next PC game that was scheduled for an early access release this quarter. It looks like it may miss the window, with SteamDB recently showing that it could be up for a 20 October 22 release. Currently it is in closed Beta testing, with some streamers releasing gameplay footage. It's hard to get a read on how the game is received in the discord channel as there is so much other general chat room noise.

https://www.youtube.com/watch?v=zQFYwAehVYo

Game website:

The game looks like it could be a fun straight forward FPS. Do I think it has what it takes to get a cult following? Not at this point, but as @Rocket6said promotion is where the streamer partners will get to earn their keep

.

.

@Hands s posted in a straw a year ago that at the time based on the game catalogue, Playside did not have a future, currently I think the truth of that statement is very dependent on the success of these bigger PC titles. Mighty Kingdom is cautionary tale of what happens when IP fails to hit the mark. Particularly with the time and resources required.

The next several months are going to be telling for Playside, whether they can continue their growth as a studio in its own right or end up functioning as a labour hire for the big studios that reskins some mobile games every few months.

A good episode of Invest Like the Best podcast featuring Mitch Lasky a long term investor in the game industry.

https://www.joincolossus.com/episodes/99764091/lasky-the-business-of-gaming?tab=shownotes

Covers topics that are very relevant to Playside and the market segments they working in:

- Mobile

- Augmented Reality

- Web 3.0 & NFTs

I will see if I can get the time to make some notes comparing and contrasting Playside with each of the topics.

See @shivraks post for announcement summary

The Good

- Several titles ready for global release in Q1 and multiple other titles coming up for soft launch. If the titles are successful it will help offset the decreasing revenue share from the existing Original IP which are ageing out. Management has forecast that Original IP will be the biggest contributor to revenue in FY23. There has been an additional Warfare title added to the release schedule. These have been by far the most popular mobile titles so this should be a good addition to the catalogue as long as they give them enough space between releases.

- Legally Blonde will be the first new mobile title this quarter. So far the July release in the US seems to be positive after some middling reviews in other countries earlier in the soft release. Increasing toward the top 100 Free Puzzle games in the Apple & Android Stores

Source: SensorTower

- Continuing Work For Hire growth ~40% QoQ Growth to $3.97m. This is forming a solid base that is close to covering operational costs during quieter periods of games sales. With the forward contracted work, likely expect a similar level over the next 2 quarters.

- Outside of the growth in staff costs due to expanding into the Gold Coast HQ, there was a marginal difference in admin costs and a reduction in advertising spend which resulted in operational break even.

- Maintaining a high level of cash @ $39.7m in cash.

The Not So Good

- Ongoing reduction in Original IP revenue split back on par with Q3FY21. Although Playside markets themselves as a AAA studio, they still don’t have any major PC/Console titles to generate long durations of revenue. Some of the more recent mobile titles have been popular, however attention spans are much shorter in that area.

What To Watch

- Second NFT collection to be released. Beans was released with the intent for MMO application. It will be interesting to see how Playside intends to provide a use case for the next foray into the NFT space.

- Ongoing monitoring of performance of the soft release titles. Significant level of negative reviews could be an indicator of ongoing reduction in Original IP revenue. In particular is the next PC title World Boss which has been created in collaboration with the gaming influencers. This will be a big indicator on how successful the influencer marketing / development strategy is. (World of Pets seemed like it was a miss)

- Time taken for the new publishing division to start landing some wins and how revenue contribution is reported.

- For operating expenses given the releases coming out this quarter I would expect an increase in advertising spend again and some minor increases in staff costs for the publishing division.

@thamno has covered the announcement already so I will only add a few thoughts.

My initial impression of this update is that it is a positive for the company on several fronts. The first is that the addition of the publishing division will provide opportunities for additional revenue streams outside of the existing Work For Hire and Original IP. There is a large market for indie games of which some can be hits (An example being Untitled Goose Game out of Melbourne which has sold over a million copies and won multiple awards). Having this division will also give Playside exposure to emerging talent within the industry for ongoing collaboration or future additions to the team.

Also if the publishing division is successful it will allow the company to self publish its own in-house titles providing a greater share of revenue for the company. There is the risk that if Playside publish their own titles they may miss out on the exposure that a more established publisher could provide however with the appointment of the management team with experience in major games companies, Playside is hitting the ground running, so it will be good to see the first titles that come out.

I do expect that the new division will be a drag on operational cashflow for the several quarters at least. While the company has a decent amount of capital available ($40m cash) the upside potential is there.

The Good

- No further delays to near term release dates. Require the additional revenue streams to offset the expansion of offices and staff. Games being launched in each of the next several quarters.

- 33% Increase in WFH revenue from $2.08m to $2.78m.

- $40m in cash. Well capitalised for upcoming growth phase.

The Not So Good

- Record revenue for the quarter $13.76m, which is a great result, however is distorted by the one off NTF Beans sales of $8.4m. Adjusting for this overall revenue was similar to Q2 at around $5.36m. Using the reported IP revenue figure of $10.98m and removing beans, original IP was down from $3.28m in Q2 to $2.58m in Q3. I was expecting a drop, however further drops from this level will be a red flag on sustainability of revenue from releases and need further investigation.

- No updates on continuation of Facebook / Meta contract.

What To Watch

- New studio on the Gold Coast is opening in May and the headcount increased from 92 to 152 in Q3. Expect an increase in operating expenses in Q4 to follow from this. Expenses have been steadily increasing with growth hovering near cash flow breakeven. (Q3 follows this trend if the adjusting for the $8.4 one off).

- Legally Blonde launch in Q4 and Godfather soft launch. Monitor reviews and app stores data.

- 3D NFT Wallet platform to be released in Q4. The NFT space is getting punished at the moment and Playside have been working hard to keep their community engaged and interested on social media platforms. Sales on Opensea have flat lined and minimal revenue being generated on sales.

- Further licensing deal announcements

A bit late to this one...

The Good

Increase in both WFH (57% QoQ) and Original IP (21% QoQ) revenue in Q2FY22. There has been growth in both company sectors for several quarters now which demonstrates the company is executing on its strategy. At current price levels a high level of growth is priced in so this needs to continue to meet the current market sentiment.

Q2 was operationally cash flow positive, which is a solid position to be in with the number of titles ready for hard launch at the tail end of this year. Staff levels are increasing and the new office , so costs

Additional Work For Hire deals with major gaming labels. Management reiterated the fact that along with the economic benefits of these deals, they are also strategic as it allows them and their staff to collaborate and learn from major studios. This can only help refine future titles that Playside are working on.

The Bad

The OTK Partnership announced in December was terminated by the quarterly announcement in January. This is fairly soon after the announcement so likely some DD issues or creative differences? It’s not the best look and hopefully there isn’t much more to this one, but something to note and better that any potential issues are identified and dealt with early.

What to Watch / Targets:

Original IP is the key operating area where Playside needs to kick goals as this is where the upside in revenue and margins lie. So this means a solid forward schedule of games that are meeting release dates. Between the quarterly update and half year update the Age of Darkness date changed from Q1FY23 to Q2FY23. Until the full game we have likely seen most of the early revenue from this title unless another update / marketing push is carried out. As a guide there has only been ~3,000 new followers on steam this quarter.

In the mobile titles The Godfather game also shifted from Q4FY22 to Q1FY23 between the January and February reports.

Two new mobile titles based on the existing Idle & Warfare infrastructure are also scheduled for FY23. Given the current release schedule I would expect that original IP will be down in H2FY22 (excluding Beans NFTs - This may be captured in a separate Web 3.0 operating sector?) with a move back higher in H1FY23.

Current Facebook WFH agreement ending this quarter. A portion of the WFH deal terms have been for less than 12 months. (Blizzard & Shiba both end this year) As PLY are expanding to another studio on the Gold Coast and expanding staff count, will need to continue to expand on WFH deals or sign with new companies if they are maintaining a dedicated staff of developers for this division.

Foray into the Web 3.0 world has had its ups ($8m in revenue in one month but this has now settled down to roughly an annualised rate of $500k / year in royalties from secondary sales) and downs (Several security breaches), so this will be an area to watch on how they keep their user base engaged until the linked beans MMO comes out at the end of the year. Following the discord channel for this, NFT investors have investment horizons and attention spans that are measured in days.

After the initial success they have hinted at further Web 3.0 projects. As mentioned in other straws from my point of view, Playside needs to ensure these projects have some application other than a quick NFT dump and cash grab or it tarnishes the integrity of the company.

It looks like Playside are learning the hard way that life in the current Web 3.0 is still very much the Wild West after having their discord channel hacked and potential comprise of holders wallets.

This will be interesting to see how they navigate through this and how it impacts the current Beans NFT project

I know @shivrak will have some input on this but thought I would get in early.

It looks like there has been a bit of funny business going on with the Beans NFTs. Recently on the discord channel the team has announced that the NFTs that were to be burned have now been minted and released to the market impacting the value of the secondary NFT market.

https://opensea.io/collection/beans-dumb-ways-to-die

So now the company has taken the initiative to keep community sentiment in the project by buying back NFTs to raise the price.

This could be a costly exercise which will impact the total proceeds from the project announced today, given they are going to be buying back at a premium to the minting price. Currently there are 396 listed NFTs below 0.6 ETH. There will likely be an on market announcement tomorrow to follow on from this. Interesting times.

Building on the Dumb Ways To Die Beans story, PlaySide have now announced the direction they will be heading in with the Dumb Ways To Die franchise with a post on Medium which from my limited experience with the website is a bit of a crypt/NFT project pumping ground.

https://medium.com/@beannfts/weve-bean-thinking-about-the-future-178008658cbd

TODAY WE ARE ANNOUNCING

- The Beans MMO / Metaverse

- 3D NFT avatars

- “Bean Pet” NFTs

- Dumb Ways to Die 4 & More!

- Metaverse, TV & Franchise Extensions.

So my initial takeaways:

- PC Launch late 2022, Mobile 2023 so will potentially contribute to revenue in FY23

- DWTD MMO? Interesting, but will need to see more on how this develops. Potentially a platform for twitch streamers to stream new creative ways to die? I know I seen enough random gaming streams in my Facebook feed that there must be an audience out there for it. From my scratching at the surface of gaming NFTs it seems that typical gamers aren't really interested in the crossover between the two. The 3D Avatars will at least provide some use case for the NFT release and potentially drive further interest in the game.

- The Bean Pets sound like fluff to drive a secondary market where Playside will potentially continue to generate revenue through royalties. To get a free pet "drop" you will need to own 2 Beans and there will be few people who manage to get 2 in the initial drop. This will be something to keep an eye on as on Opensea royalties can be set up to 10% of every future transaction and could provide further boosts to revenue. (Or overall assets as @shivrak pointed out). I could be wrong on how this process works and happy to be told so. (The only NFT I have ever owned was a brief experience with a digital race horse on ZedRun)

- 3 more DWTD mobile games to be released. No dates mentioned.

- The final point sounds like continued expansion of the brand, but a potential TV Series is probably the biggest iron in the fire there.

The DWTD team have been really pushing the socials marketing on this one, and pushing the AAA background of PlaySides involvement so hopefully the deliver the goods.

Disclosure: HODLer

Playside are jumping into the NFT space under the Dumb Ways To Die franchise with the announcement of Beans NFTs under the Playside and DWTD twitter accounts. I really hope that Playside incorporates some utility into the NFT, as it seems that every man and his dog are creating a NFT for something these days. Based on the roadmap on the project website, it looks like there will be an upcoming AR Title that provides utility for your “Bean” within the game.

Project website www.beansnfts.io

Currently scheduled for minting in February 2022, this is likely to contribute to Q3 revenues, however there are no details as yet on qty or minting costs.

The DWTD franchise lends itself well to the current NFT mania with its bright colourful characters that also carry with them a sense of nostalgia. If the discord channel is an indication then this project will likely be a success as it has over 17,400 members since creation on January 6, although for myself as a holder of Playside, I really hope this is more than just a cash grab.

In the FY22 Roadmap released in the Q4FY21 update, Playside had indicated that a multiplayer update would be released in Q2FY22 for Animal Warfare which has been their most successful mobile title to date.

Multiplayer was added in Version 2.9 in December 2021.Multiplayer adds a more challenging element to the game as it is fairly easy and repetitive in solo mode. This update should add some extra longevity for players and continue to generate revenue from the title for the rest of FY22.

The update itself isn’t major, however is a positive as an indicator of Playside hitting release targets. If the PVP is successful, it could also be incorporated into the other warfare titles.

Having a bit of a scan around the internet to see what has driven the bump in Playside's share price at the end of last year and it looks like their upcoming first person shooter developed with LazarBeam and Fresh has made its way onto Steam. Link Here

Very little details available so far and from the screen shots it looks like it is going to be a similar style to Fortnite and Team Fortress 2, which was to be expected given the influencers backgrounds in Fortnite. It is also listed as free to play.

Another interesting detail I am came across was that the release date was originally posted as April 2022, which was then later changed to 2022. This may mean that the team are currently working through a few more bugs than expected but hopefully we should be looking at a FY22Q4 early access release. Source

What will set it apart in the tightly contested genre is unknown, but there will may be more information in the upcoming quarterly update as Playside typically provide decent updates across the projects they are working on.

Disc: Held

The share placement details for the Playside capital raise came out yesterday and going through a quick review before potentially jumping in this round at the $0.75 price.

@Shivrak covered this in an earlier straw and I got to a similar revenue forecast by breaking down estimates of each of the revenue streams.

Using $21 million for FY22, this puts the placement at a Price/ Sales of ~14.5, which isn't massively high, however the company would need to continue its current growth rate to justify such a multiple.

My previous valuation for Playside prior to first quarter results had a FY22 price target of $0.42 on a P/S multiple of 10, so this is at a premium to that estimate, however I was previously forecasting revenue around $15.7m.

Currently the share price is trading at a premium to the placement price, however it is now falling likely to continue to fall within a pretty close band of the $0.75 cent range as the SPP are issued tomorrow.

Playside has so far demonstrated an aggressive growth strategy with a management team who appear to be focussed on executing and in my eyes the raise is a positive for the company.

Playside released their Q1 update today, and the market has lapped it up, driving up the share price by 20% to new all-time highs. So, what has got everyone so excited?

Key numbers are Total Revenue of $4m which consists of $2.7 million for Original IP and $1.34m for Work for Hire. These numbers are in-line with meeting my previous FY22 price forecast estimates, and show a nice increase however aren’t mind blowing.

Not trying to take away from the result as it demonstrates the company is delivering on its growth plans since listing, however trying to remain aware of results in the context of company valuation.

If annual rev to end of Q1 is estimated ~13m then at the current market cap of $256m at close today gives a P/S of 19.7x which is starting to head to the expensive side of things.

Other Items of Note:

Assuming the Team17 deal contributed 270k based on one monthly payment being made in September, it shows that revenue from other IP outside of AoD is continuing to grow (~9% on prior quarter)

Going forward the Work for Hire revenue may be lumpy given that the extended Facebook contract may end in March. Given the increase in value, this contract is likely a key contributor to the uplift over previous periods.

Cash position remains strong at $9.33m and operational cash flow is nearing positive territory, which gives Playside plenty of room for further investment in new titles.

The release also reiterated that the current release schedule is still on track to meet previous commitments:

Q2FY22 – LazarBeam/Fresh Beta, Middleditch Beta

Q3FY22 – The Godfather Mobile Launch, Legally Blonde Mobile Launch

Q4YF22 – Dumb ways to Die Title

My revised forecast for Q2FY22 Rev based on todays update:

IP ~ $3.8m (inc DWTD) WfH ~ $1.35m = Total of $5.15m

Disclosure: Held

So far the intial release of Age of Darkness seems to be solid. Currently showing up on the featured banner and top sellers list on Steam and has ~90% Positive reviews at the time of writing. Playside are also already proactively communicating upcoming updates to the community in the development roadmap which seem to address most of the issues raised in negative reviews. However they haven't provided a timeline around each of the milestones.

For how well the game sells only time will tell, but devs and Team17 seem to be putting it in the hands of streamers with some pretty big followings (eg. SplatterCat - 668k subscribers)

Steamdb which shows download estimates based on the number of reviews and other sources and is currently showing a range of 6k - 18k. I will come back to this site and compare to Q2 quarterly if they release some figures to try gauge the accuracy for estimating revenue from the game.

The other factor for estimating revenue is the split. If they split evenly with Team 17 it would look something like this.

Valve (30%) Team17 (35%?) Playside (35%?)

Which at the current price of $28.75 equates to about $10 to download.

Now I just need to get a better computer so I can actually play the game.

Playside announced that they signed a deal with Team17 as publisher for their first major PC Title Age of Darkness: Final Stand.

Several takeaways from this and things to watch.

First signing a deal with Team17 is a positive indication for PlaySide going forward in how they release and market their games. Team17 isn’t one of the big players like Activision or Ubisoft but they are by no means small, with a market cap of ~ 1Billion GPB (Listed on the London Stock Exchange). This could lead to further partnerships in the future.

The deal is worth $2.44 million in FY22 to fund ongoing development of the title which will help near term cash flow. No details on division of sales revenue and the period over which Team17 will recoup these payments.

It is mentioned that there is the potential to explore release across other platforms. RTS has never been a genre for consoles but worth continuing to watch how this progresses.

The deal did push back the early release on steam from today to 7th of October, however that isn’t a major issue if there can be a bit more marketing prior to release. Also noting that this is just an early release date of the game to iron out bugs and get community feedback to further refine the game.

Having a bit of a hunt through steam for similar titles to get an appetite for the style / genre and closest I found was a self published title They Are Billions which had over 30,000 reviews and a highest concurrent player count of ~22k. (Currently sells for A$42.95) Not fantastic numbers but also hard to determine overall downloads from these figures. It will be worth checking in on reviews and player counts after release.

In a previous straw, Hands observed that PlaySides titles were copies or based off movies and the teens weren’t impressed. Hopefully this title has the goods. We will find out soon.

Disclosure: Held

On the most recent Australian Investors Podcast,Owen interviews Gerry Sakkas the CEO and cofounder of PlaySide Studios.

All items covered generally align with my recent research on the company and how I perceived the business strategy. What I did take from this is that I should be adding management interviews to my research checklist and I think listening to these after forming an opinion on a company will be a useful check to add to my process.

Link to podcast here:

https://www.raskmedia.com.au/2021/08/11/revealed-1-rask-rocket-asx-small-cap/amp/

Disclosure: Held

I came across @Rowey27 straw for PlaySide Studios about a week ago and added this stock to my research list as I thought I owed it my younger self to consider investing in a video game company. Fast forward to Friday where I spontaneously jumped in based off upwards momentum in the share price. I now must go back and carry out some due diligence and try to be impartial during my review.

What does PlaySide do?

PlaySide is an Australian video game developer based in Melbourne. They currently develop games across the Hyper-Casual, Casual and Core gaming categories. Income is generated through several avenues. The first is game development of both original IP & licenced titles with income generated via ad revenue, in app purchases & subscription fees. The second is work for hire development contracts to assist other studios and ongoing technical support and maintenance

Company History / Performance

PlaySide was founded in 2011 with an initial focus on contract work for hire working in conjunction with other studios. In the last few years, the direction shifted towards development for the mobile market which makes up ~ 50% of the overall games market. Since the IPO in December 2020, PlaySide is again looking to shift focus to incorporating larger, core games for both PC and Console into their business strategy.

PLY has structured the business into five core ‘pillars’. The first is the development of original IP games titles which has grown from 20% of revenue to 67% of revenue in the past year.

Recent examples of titles include Battle Simulator: Warfare, which it the third title using the WarKit platform. The first iteration of this title Animal Warfare has reached over 11 million downloads and continues to grow each quarter.

Idle Area 51, which is a top-down management / click style game which has received a rating of 4.8 from 7.1k reviews on the apple Appstore. PlaySide now has the toolkit in place for this style of game which will allow new titles to be rolled out quickly.

I downloaded and tried both titles and they both rely heavily on in game advertising to nudge users to subscribe. Both titles are rather simplistic and have elements of ‘just one more round’ which are traits of the casual game genre. This is where the one-off boost / upgrade payments come in.

A new PC title due to be released in September in the Real Time Strategy genre will be the companies first big step away from the mobile and looking beyond that a next generation console title is scheduled for release in Q3FY22.

The second pillar is developing titles under licencing of third-party IP. Two licence agreements with movies studios were signed at the end of FY21. The firs with MGM to develop legally blonde mobile game and the second with Paramount Pictures to develop a game based on the Godfather franchise. Both these titles are scheduled for release in H2FY22.

The third pillar is the work for hire contract development work, which has provided a steady revenue stream for PlaySide to continue to grow from. Alongside a 6 month contract with Facebook Technologies VR division, management have indicated that they are shortlisted for several material work for hire contracts.

The fourth pillar is industry and influencer partnerships. Youtube and twitch influencers are massive in the industry titles promoted and developed in conjunction come with an inbuilt fan base. An example of this arrangement is the title World of Pets, an MMO released in April 21. This title was created in conjunction with YouTube personalities Norris Nuts and after a successful launch has recently moved under Live Operations contract.

Another title which is being developed under this arrangement is a First Person Shooter (FPS) in conjunction with YouTuber LazarBeam & Twitch streamer Fresh is due for release at the end of 2021. The FPS genre is one of the most popular and lends itself well to potential Esports arrangements. This leads to the last sector of the business which is Esports.

PlaySide have a 27% investment in BIG Esports which is a consultancy aimed at providing business case insights and trends within the growing Esports industry. This stake will unlikely provide any material revenue, however, developing with Esports in mind provides significant upside for any title released that manages to grab the market.

Management

The company has high founder ownership with the three co-founders currently holding just under 65% of shares on issue, however these are locked up via mandatory ASX escrow until December 2022. The board of directors has a range of experience across the video game industry, IT Services industry, and growth of early-stage companies.

Valuation

PLY is currently sitting at a market cap of $142.9 million, which on FY21 revenue of $10.88 million and cash balance of $11.2 million from the recent listing gives an EV/Sales Ratio of ~ 12.1. Given revenue growth of 55% and a shift of revenue streams toward digital sales and advertising, a software multiple is becoming more applicable.

The current development schedule has new several new games being released each quarter, which at the current multiple has a reasonable amount of success for each title priced in. Looking at the valuation purely from a multiple of sales, I wouldn’t say I got in at a bargain price, but it currently doesn’t have some of the astronomical multiples applied elsewhere across the market.

Opportunities / Growth Catalysts

Some other potential opportunities for growth outside of the growing catalogue of games are general tailwinds from the growing industry, the mobile gaming growing at >13% YoY.

Management have indicated they are open to growth opportunities through potential acquisitions within Australia and Asia. The Chinese market has been identified as an opportunity for further growth.

Risks

The video game industry is highly competitive. Particularly in the mobile space where development timeframes are short, and costs are low. It is hard to stand out in such a saturated market. Another issue is trying to monetise games that have been released. With such a wide range of games to choose from and many being offered free, it is hard to derive consistent income from consumers. Reports from PlaySide referenced studies where it was found only 38% of mobile gamers actually pay to play.

There is also transition risk for the company as they move into development of PC & Console games. These titles have much higher development time and capital requirements, and if a title is not well received by the market, that has been significant development time that may have marginal return on capital.

Final Thoughts

After completing my research, I haven’t found my investment to be a terrible one, but it potentially may not be the best allocation of capital I could have found. I do enjoy small caps with a good story, and with a consistent release schedule going forward, there will be plenty of news for me to follow. There is the added benefit of being able to tell my partner that these games I am playing is ‘investment research’.

PlaySide is entering a key phase of the growth of the company and if the launch of some of the upcoming bigger titles is successful, this will reduce some of the execution risk for the company and l will review my position size.

Disclosure: Held

Post a valuation or endorse another member's valuation.