AVA

AVA

Q3 2024 Update

Pinned straw:

fcmaster26

3 months ago

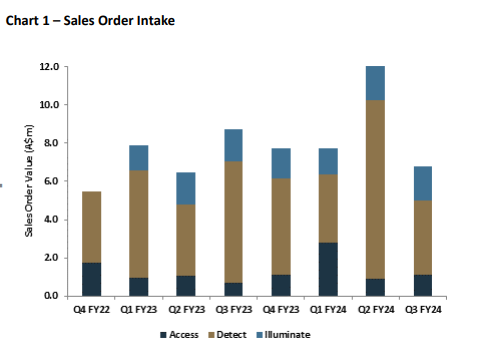

A weak Q3 order intake is an indicator of a weak H1FY25, if we all agree that the stronger H2FY24 is a direct result of record high Q2 order intake. If the company still wants to hit the $37M revenue safely, the Q4 order intake has to be extraordinarily large, even larger than Q2FY24 since this Q3 is below average.

I'll call bullshit and maybe start selling for the first time in many years if the Q4 result is below $8M.

19