@GazD When you know someone that has gone through radiotherapy definitely you will learn lots in this space that the ordinary person or investor doesn't know.

Regarding the market cap. if you compare the recent acquisitions for RayzeBio, Point and Fusion that were bought out then Clarity is still cheap. However Clarity is still in Phase IIa which is not a full Phase II while the others I believe had completed Phase II or higher.

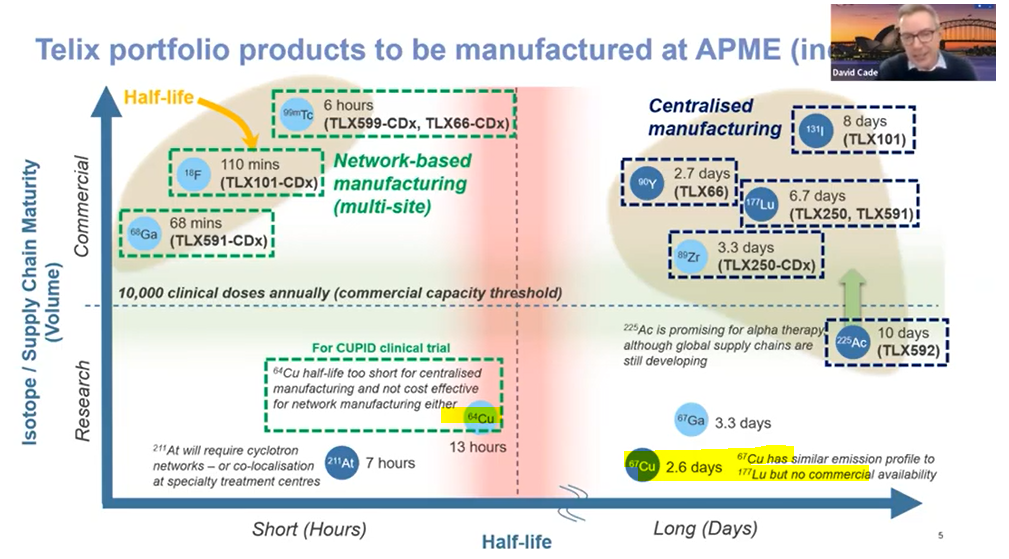

And when you are betting on CU6 you are also betting against the larger brother Telix (which I no longer hold). They took a veiled swipe at Clarity a few years back:

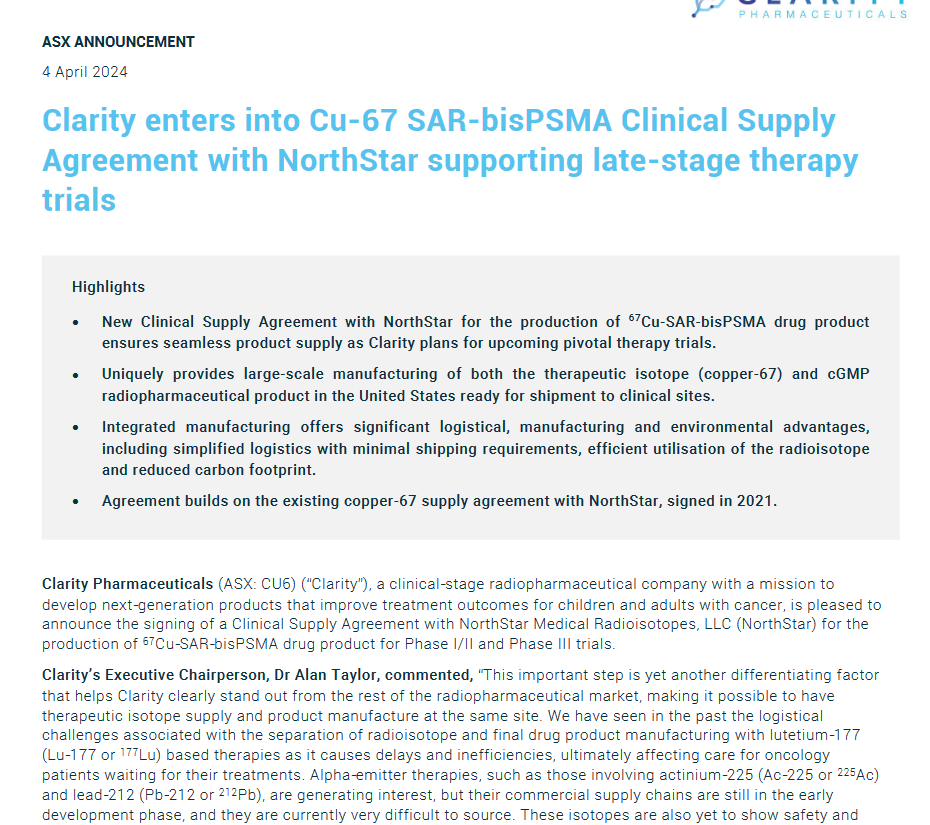

Furthermore, Clarity's move to shore up supply....

We can either think this is pigheaded thinking, or a fairly bold move by Taylor. that they really believe in what they are doing, while clearly showing his talent of Finance at the same time (Taylor has qualifications and experience in Finance as well as University Medal in Applied Science on top of his Doctorate).

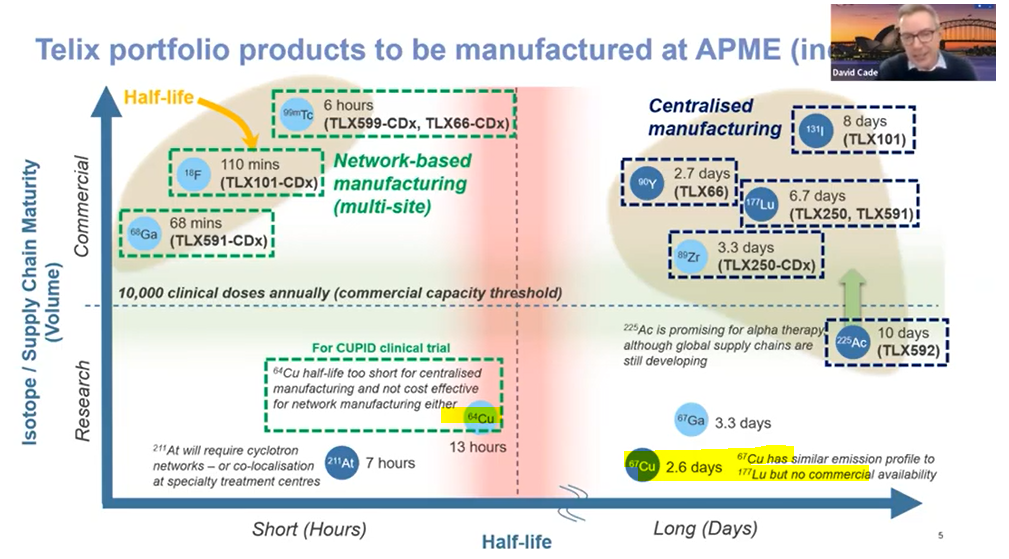

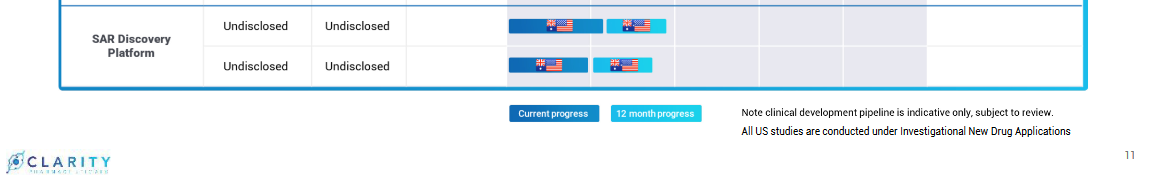

Finally there is this little nugget in the CR presentation The so called "killer slide" that forced my hand and made me tip some money into the placement.

So instead of "multiple shots at goal" that is used by other specs, Clarity is instead focusing on the prize while keeping conservative at the same time and knowing the limits.

Don't know about anyone else but I can't fault management here.