Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

$CU6 burned $25m in the last Q, up from $23m in prior Q. With $226m left, that's about two years runway - plenty of time for multiple significant developments currently in the pipeline.

Last year's $203m placement agilely timed at $4.20 shows the benefit of having a former investment banker as an Exec Chair of this kind of business.

Disc: Held (RL 2.75%)

Radiopharma company $CU6 have this morning announced the latest clinical trial progresss of 64Cu‑SAR‑bisPSMA .

The Investigator-Initiatied Co‑PSMA Phase II trial provides statistically significant superiority of 64Cu‑SAR‑bisPSMA over the current Standard of Care, 68Ga‑PSMA‑11 in lesion detection at low PSA levels. This confirms the biological rationale and reinforces earlier data (PROPELLER, COBRA). While the result materially improves confidence in efficacy and diagnostic differentiation, it remains a supportive, not pivotal, dataset.

My Assessment

The NDA path still depends on Phase III outcomes (CLARIFY, AMPLIFY) and CMC readiness. These are in progress and don't report until 2026.

Overall, my "gusesstimate" of NDA probability‑of‑approval is around 66% prior to today's supportive news. While the news slightly de-risks the broader trials, it is not material enough for me to add to my position (2.7% RL). This is mainly due to the incomplete readout of this IIT. For example, it is not clear from the release what accuracy verification / reader-blind data protocols were in place - these details will be important when the FDA consider this additional information. It will be interesting to read the full account of the study when this is available.

So, good news, I expect the market will react positively, however, I'll not be taking any action today as a result.

Disc: Held in RL and SM

Earlier in the year when CU6 shares were around $2, Phil King at Regal was shorting it. See minute 7 of Alan Taylor interview with Michael Frazis.

Clarity Pharmaceuticals, with chairman Dr Alan Taylor

CU6 is now selling for $5.60 and today Regal revealed they are now substantial.

In a matter of months Regal went from believing CU6 was an overpriced heap of shit and shorting it, to jamming around $70m into it. No wonder the CU6 share price is bouncing around.

It is turning out to be quite the day for my biotechs, with another "non-price sensitive" announcement, this time from radiopharma aspirant $CU6.

Even though this is a VERY EARLY PRE-CLINICAL preliminary result, I'm going to go into this one in some detail, because it is an example of why I hold a small $CU6 position. Basically, IF $CU6 can get approval for one or more of their imaging agents currently in Phase 3, and get a first product commercialised, THEN the operating cash flow will drive a material expansion and acceleration of their pipeline to more fully exploit their unique science platform.

It is a big if, and yes entirely speculative at this stage, but in the success case, I believe the payoff might be huge.

OK, So that's the connection to the thesis. Let's now look at the specifics.

What's Today's Announcement About?

$CU6 announced that new preclinical data on its pan-cancer theranostic candidate 64/67Cu-SAR-bisFAP will be presented at the World Molecular Imaging Conference 2025. The compound targets fibroblast activation protein (FAP), highly expressed on cancer-associated fibroblasts (CAFs) in the tumour microenvironment across a wide range of cancers (e.g. breast, colorectal, pancreatic, lung, brain, ovarian), but minimal in normal tissue — making it an attractive target for imaging and therapy

Clarity compared a monomeric product (SAR-FAP) with a dual-targeting version (SAR-bisFAP) and found the latter achieved superior tumour uptake and retention in FAP-positive glioblastoma mouse models. Therapeutically, 67Cu-SAR-bisFAP doubled median survival (28.5 days) compared to 67Cu-SAR-FAP (14.5 days) and exceeded the performance of an industry benchmark, 177Lu-FAP-2286 (11.5 days).

The company plans to commence a Phase I trial of 64Cu-SAR-bisFAP in 2026, initially focused on diagnostic applications, followed by therapeutic trials with 67Cu-SAR-bisFAP targeting cancers with unmet medical needs. It highlighted the improved retention and efficacy of the bis-structure and the advantages of copper-64/67 pairing with Clarity’s proprietary SAR chelator.

OK - So Why Is This Potentially Significant?

1. Strategic Implications – A Shift Toward Tumour Microenvironment Targeting

This announcement underscores Clarity’s strategic positioning in the emerging FAP-targeted theranostics space, which represents a complementary approach to tumour-cell-directed therapies. Targeting CAFs and the tumour stroma could enable treatments to overcome resistance mechanisms and broaden applicability across tumour types. If translatable to humans, this pan-cancer approach significantly expands the addressable market beyond single-indication radiopharmaceuticals.

2. Preclinical Data – Strong but Preliminary

The doubling of survival compared to both the monomer and a benchmark product is highly encouraging and suggests meaningful biological efficacy. Moreover, the superior tumour retention observed preclinically indicates potential for improved dosing efficiency and therapeutic index. However, these results are based on murine xenograft models, and translation to human efficacy and safety remains uncertain. The leap from preclinical to clinical success in FAP-targeted therapies has historically been challenging. (So this is a major caveat!)

3. Competitive Positioning – Benchmark Outperformance

Beating 177Lu-FAP-2286, a leading FAP-targeted radioligand from Novartis/ITM, is notable. If replicated clinically, Clarity could differentiate itself in a crowded field with a dual-targeting construct and leverage the logistical and dosimetric advantages of the copper-64/67 theranostic pair over lutetium-based agents.

4. Timeline and Development Path – Key Risks Ahead:

A planned Phase I diagnostic trial in 2026 suggests Clarity remains 12–24 months from initial human proof-of-concept, and therapeutic validation will come later still. Regulatory, manufacturing, and clinical-trial execution risks remain substantial. Demonstrating safety, tumour targeting, and dosimetry advantages in humans will be critical inflection points for value creation.

My Overall Assessment

At the time of writing, the SP has ticked up arouind 13% on this announcement. On the basis of this news as a standalone potential future product, that reaction is way, way overdone. But such is the world of speccy biotechs.

However, what I have tried to spell out here is why this is an important confirmation of the thesis. $CU6 has a science platform with the potential to spawn many products.

As we know from the recent Strawman interview with Alan Taylor, $CU6 is being laser focused on getting its first prostate cancer screen diagnostic over the critical Phase 3 hurdle. But that product is just the point edge of a potentially vast portfolio of other products, and today's announcement is providing a glimpse of that potential.

I'll be honest and say that earlier in the year I was a lot more bullish about the likes of $TLX and $CU6 to at least get a high proportion of the diagnotic imaging agents approved. However, the $TLX experience in quick succession with both Zircaix and Pixclara have provided sobering reminders (if we really needed any) that Phase 3 is a real hurdle, and that products do fail to clear it.

And that's why I have a very small $CU6 position. 2.0% in RL. There is no need to put a lot of capital at risk on this one, because in the success case, the payoff could be very substantial indeed. And yes, of course, it could all go to zero!

Disc: Held in RL and SM

The interview with Dr Taylor is now up, and the transcript is here CU6 Transcript 2025.pdf

Clearly the products in development, SAR-bisPSMA in particular, have a huge potential market, and (taking Alan at face value) minimal competition, with medium term commercial opportunity (~2 years or so). He was very keen to stress the big picture stuff, but I didnt do a great job at pinning him down on more specific stuff.

It's great that have some clear air in terms of their immediate funding, and the enthusiasm is clear, but from the outside I have a lot of trouble assessing the odds, magnitude and timing of success -- let alone whether the $1.2b market valuation is fair or not.

Other than to guess that *if* their tech is as good as is pitched, and they dont experience any major executional blunders, then yeah, it's probably worth a lot more than it is today. But even then it'll be a couple of years before much of that is clear, and no doubt one or two more raising along the way.

Anyway I think it represents exciting potential, but for now it'll sit in my "too hard basket".

Here's the AI summary:

Company Overview

- Clarity is an Australian biotech focused on next-generation cancer diagnostics and therapies using copper isotopes.

- Originated from University of Melbourne research, now in late-stage clinical trials.

- Core programs target prostate, breast, and neuroendocrine cancers.

Flagship Program: Prostate Cancer (SAR-bis PSMA)

- Built a bispecific molecule (SAR-bis PSMA) that outperforms first-generation PSMA agents.

- Advantages:

- Greater sensitivity (detects smaller lesions earlier).

- Longer half-life isotope (Copper-64, 12.7 hours vs 1–2 hours for current agents).

- Enables central manufacturing, broad distribution, and flexible imaging windows.

- Market Opportunity:

- Current PSMA diagnostic market ≈ US$2B.

- Clarity estimates potential > US$5B.

- Large unmet need: ~600,000 US patients with recurrent prostate cancer cannot be imaged using current standards.

Clinical & Regulatory Progress

- Running two Phase 3 diagnostic trials (Clarify and Amplify).

- Received three FDA fast-track designations (two diagnostic, one therapeutic).

- Conducting head-to-head clinical trials vs current standard (Gallium PSMA) – early results show 2–5x stronger tumour-to-background ratios.

- Therapy side: Copper-67 isotope for targeted radiotherapy.

Funding & Financial Position

- Recently raised ~$200M at a premium, adding to ~$280M cash reserves.

- Prior raises (IPO $92M, 2023 $121M).

- Current market cap ≈ $1.2B.

- Funds to complete Phase 3 trials and prepare for commercialization.

- Quarterly R&D spend ≈ $16M, mostly on clinical trials (not manufacturing).

Commercialisation Strategy

- 2-year horizon to potential market entry, pending trial success and FDA approval.

- Partnering with established manufacturers (e.g., Spectrum) – Clarity will not produce isotopes itself.

- High-margin product: pricing guidance around US$5,000 per dose.

- Focused first on prostate cancer, while maintaining pipeline in breast cancer and neuroendocrine tumours.

Market & Competition

- Current competitors (e.g., Lantheus, Telix) rely on short half-life isotopes with poor sensitivity.

- Clarity believes its product is differentiated and defensible (patent life 13–14 years).

- Acknowledges risk of new entrants but sees little direct competition near-term.

Capital Markets & Strategy

- Dr Taylor emphasised adaptability and resilience, not reacting to short-term share price moves.

- Notes biotech volatility: external market events and index movements can drive share price swings unrelated to fundamentals.

- Strategy is to stay focused on core programs, push through clinical milestones, and prepare for revenue generation.

Key Takeaways

- Clarity is transitioning from R&D to commercialisation, with strong confidence in its lead prostate program.

- The company has a large cash buffer, global partnerships, and regulatory support.

- If successful, SAR-bis PSMA could redefine prostate cancer imaging and therapy, addressing a multi-billion-dollar market with significant unmet need.

Has imaged the first patient in its registrational Phase III 64Cu-SAR-bisPSMA diagnostic trial in participants with biochemical recurrence (BCR) of prostate cancer, AMPLIFY (NCT06970847) 1, at XCancer in Omaha, Nebraska (NE).

Just the CU6 cash position,

- Quarterly Activities/Appendix 4C Cash Flow Report:

https://hotcopper.com.au/threads/ann-quarterly-activities-appendix-4c-cash-flow-report.8561064/

Clarity's cash balance at 31 March 2025 was $95.1 million

Last

$2.16

Change

0.010(0.47%)

Mkt cap !

$694.1M

Interesting interview with CU6 CEO, Alan Taylor by Michael Frazis. The interview undertaken towards the end of March. As everyone knowns in the last few months it has suddenly got very hard for biotechs, particularly for non-revenue companies like CU6. Stock price wise, TLX and NEU have fared better, having products in the market and both being cash flow positive.

Clarity Pharmaceuticals, with chairman Dr Alan Taylor

Some points from the interview:

- AT outlines the science case for CU6 including:

i) Currently they have 3 FDA fast track approvals.

ii) comment on sensitivity of 2 competitors with products in the market (Telix and Lantheus), stating their prostrate diagnostic sensitivity is a poor 30 – 40%. CU6 claims their Cu64 product gets contrast (sensitivity) up to 15 times better than the competition with equal specificity.

- FDA employs 18,000 people it turns out that only 1,000 have been terminated and according to Alan many of them being asked to return. (The recent NEU Phase 3 FDA meeting was not postponed and presumably speaks to a functioning FDA).

- Its obvious CU6 is financially in a bind, needing soon to raise capital. Whilst they have $100m as at the end of March, this will only get them to around halfway into next year. They are, assuming continued scientific success, 2 – 3 years away from commercialisation and revenue.

- AT made the point that CU6 is around 60% is owned by the top 20 shareholders with mainly institutions represented. The inference by AT, is they are likely to be a more amendable to a capital raise than a predominantly retail shareholder base. (State Street became substantial yesterday).

- AT said of CEO of Telix Chris Berenbrauch Telix: “He reached out to me to partner with him”. (Cannot imagine AT and CB ever happily power sharing)

- Clarity is currently 6% shorted. AT says Phil King (Regal) of Opthea-step-in-dog-shit fame, is one of the CU6 shorters. (The games people play)

Of course the success of CU6 all hinges on their continuing to deliver on their clinical trials. And the market’s continued confidence in them. Who really knows.

Interesting watching the chatter vaporise around Clarity.

The speccy biotech's share price has plummeted from almost $9 to $2.13 in months as the hype has settled.

Shouldn't the high conviction types be going in hard ?

Where's all the love gone ?

"It's a deal! It's a steal, It's the sale of the century! It's chicken soup!" (quote from Lock, Stock, &..)

Anyways, I'm genuinely sorry fo the peeps that succumbed to the bbq/lunch hype and bought at the peak.

A few years ago that was me, and it was one of the best investing lessons I've ever had.

I'm extemely grateful it happened at the beginning of my investing journey and not now.

Obviously it's a long road, and the company may still commercialise and start selling its miracle cure.

I hope so, but until it de-risks and starts selling the stuff, it's still on the watch list for me.

Alternatively, we could see cap raises and this drawn out likely over years.

Would have made more of a return probably just buying a broad based etf at the beginning of the story.

An interesting article from Endpoints, a biopharma newsletter out of the US:

#ASCOGU: Pfizer’s prostate cancer data leak shows promising results in early-stage study

It describes a potential new treatment for prostate cancer that Pfizer is taking to Phase 3. Not good news for ASX listed CU6 or TLX, should Pfizer be successful. Particularly since the drug is a non-radiopharmaceutical, and the urologist keeps the patient rather than pass on to a nuclear medicine doctor. So if this potential new oral drug if ever commercialised would make it very hard for TLX and CU6. Though the diagnostic part of the CU6 and TLX businesses you would think would survive.

No doubt this is just one of many new drug ideas nipping at the heals not just CU6 and TLX, but any drug incumbent. Add into the equation the opaqueness drug development in China that the West knows little about and you have a dangerous investment landscape.

Of course this is not just confined to drug development. As an example, the previously unassailable Google is now looking very wobbly with the AI challenge and may end up like a Yahoo or like a stone-dead Netscape is not out of the question.

No wonder investors will pay 32 times forward earnings for Wesfarmers to get hold of Bunnings and all things that feed the Australian residential real estate obsession. Though some cluey bastard right now is probably working on how to get a drone with an attached bag of nails from a shipping container at Moorebank to your backyard.

Any investing is dangerous. And all the time you have management are blowing in your ear with cutesy stories about how great everything is going to be. And all this other stuff is going on around you that you know nothing about and is just going to kill your retirement plans. A dangerous world all right. But no reason to give up!

Clarity released an announcement to the market on Friday indicating they had received FDA fast track designation for Cu64 SAR-bisPSMA in biochemical recurrence of prostrate cancer imaging:

The announcement says in part:

“The market for first-generation diagnostic PSMA PET today is approximately US$2 billion (AU$3.2 billion) in the U.S. alone, with little differentiation between products. It is expected to further grow to US$3 billion (AU$4.75 billion) by 2029. The development pipeline of new products coming to market, outside of 64Cu-SAR-bisPSMA, also offers no differentiation from the existing offering, with some new entrants commercialising the unpatented 68Ga-PSMA-11 agent, which has been capitalised on by three separate groups already.

A couple of points:

- CU6 is saying to their knowledge there is no credible challenger on the horizon

- One of those “three separate groups” is the ASX listed Telix and their molecule for the imaging of metastatic castrate resistant prostate cancer using a Gallium isotope called Illucix. Telix are ahead of CU6, and are commercialised with in Q4 2024 Illuccix sales of $218 million. This is Telix’s lead product. Telix have a lot going on, and even if they do in time lose some/all of this market to a superior product it will be no means the end of Telix.

- The imaging market is a fraction of the therapeutic market.

CU6 had $123m in the bank as at 30/9/24 and is spending around $12m/qtr and it is at least 2 years off any revenues. So the risks are financial as well as developmental.

We don’t know if there is some lab in Beijing or elsewhere which has worked out a better molecule of if there is going to be some cancer cure-all drug that will arrive and blockbust everything from some other angle. Like GLP1 drugs with weight loss. Nothing is risk free. However it is encouraging to see an ASX listed company which has measurable technical advantages over its competitors which in time should see it become a market leader. These companies are rare.

When you look at CU6's imaging and therapeutic molecules for prostrate cancer, and its potential to make a meaningful difference in a very large number of people's lives it puts another ASX biotech success story, NEU in the shade.

Not to be too critical of NEU, however NEU's drug Daybue may eventually reach around 8,000 Rhett's suffers in the US and NNZ2591, assuming it is approved may reach around 25,000 US PMS sufferers. And the efficacy of these drugs is very subjective.

Each year around 230,000 men are diagnosed with prostrate cancer in the US. And if you are unlucky enough to have life threatening prostrate cancer, believe me you want the very best treatment available.

CU6 has a market cap of $1.4b and NEU $1.8b

And CU6 can be bought at half the price of when the market was going bananas over it back in September.

Clarity Pharmaceuticals has piqued my interest lately. Recently I was diagnosed with prostate cancer and I am a potential beneficiary of this new technology, if the trials are successful and the imaging is approved.

PSMA PET/CT is currently the most accurate imaging test for detecting prostate cancer in men. It has been a game changer as it can detect very small prostate antigen specific cancers that may be missed by other scans and it can more accurately stage cancers.

Clarity Pharmaceutical’s 64Cu SAR-bisPSMA promises another level up in accuracy. In my case the cancer is confined to the prostate… for now! This new technology has the potential to pick up metastatic spread of prostate cancer more accurately and before it becomes a problem.

According to a note shared by James Mickleboro from The Motley Fool, Bell Potter is bullish on the prospects for Clarity in 2025, particularly given the impending release of the final data from the SECuRE trial.

“SECuRE is a Phase I/IIa theranostic trial for identification and treatment of participants with prostate-specific membrane antigen (PSMA)-expressing metastatic castrate-resistant prostate cancer.

Commenting on the company, the broker said:

Clarity Pharmaceuticals has continued to produce high quality interim data readouts from its numerous clinical trials during 2024. In 2025 we anticipate a flood of new data led by headline readouts from the pivotal study in prostate cancer imaging (CLARIFY) and perhaps more importantly, final data from SECuRE being the therapy trial also in prostate cancer.

Earlier data from imaging studies indicates 64Cu SAR-bisPSMA is able to detect cancerous lesions in lymph nodes at a far earlier stage than the standard of care. Similarly, PSA50 data from the SECuRE trial is highly anticipated and is expected to be highly supportive of further development of this drug candidate.

Bell Potter currently has a speculative buy rating and $10.00 price target on its shares.”

Don’t be complacent!

I’d like to take this opportunity to remind all my Strawman mates out there who are over the age of 50 to make sure you have a PSA blood test every year. If you are over 50 and haven’t been tested yet, don’t delay! Make an appointment with your GP today, get a blood test, then rinse and repeat annually. It’s important to establish a trend in PSA results.

I’ve had yearly PSA blood tests for over a decade now. I had no symptoms of prostrate cancer and the rising PSA levels were the only alert I had. This led to follow up testing. An annual PSA blood test can save your life. Don’t be complacent. See the stats below.

I’ve got plenty of mates out there to share my issues with…more than I realised! If you’re one of us and you are struggling to deal with it, or just want to chat about it, feel free to DM me. There is lots of great support out there!

Worldwide, prostate cancer is the second most commonly diagnosed cancer and the fifth leading cause of cancer death among men, with an estimated 1,414,000 new cancer cases and 375,304 deaths in 2020. https://www.prostate.org.au/risk-and-symptoms/facts-figures/#:~:text=Prostate%20cancer%20is%20the%20most,of%20all%20newly%20diagnosed%20cancers.

“Nearly 72 Australian men are diagnosed every day, with 1 in 5 at risk of being diagnosed in their lifetime, according to the estimates. This is because your risk of prostate cancer increases as you get older.

Of the Australian men predicted to be diagnosed with prostate cancer in 2024:

- 416 (1.8%) will be under 49

- 3,233 (12.3%) will be 50–59

- 9,559 (36.3%) will be 60–69

- 9,584 (36.3%) will be 70–79

- 3,572 (13.6%) will be over 80

Disc: Not held, but on my watch list

Listening to the Alan Taylor interview and Strawman comments got me thinking more about risk.

As an individual Alan Taylor is pretty impressive. Coming from a modest background where his Maltese parents busted themselves to send him to Waverly College, he went on to win the university medal at SU in applied science, completed a science Phd and spent 15 years in investment banking. As a young man he reached reserve grade NRL with Eastern Suburbs. I am sure he has plenty of faults, however this guy is clearly not just another blabber-mouth CEO phony.

Many investors take the line Biotechs are too risky, and this is true. However if you think about Alan Taylor at CU6, John Pilcher at NEU, Matt Callaghan and Howie McKibbon at BOT - all have clearly articulated the business hurdles, how they intent to overcome them and what the prize at the other end looks like. And they have not come across, nor can I find evidence they are spivs. Promoters yes -and they have to be.

Contrast this with so many previously called by some as “safe” industrial stocks, a few of which have recently crashed. The Star Entertainment Group (SGR) with gross breaches of the regulatory framework including money laundering. Lifestyle Communities (LIC), in many ways can be argued is a species of Ponzi scheme. Its business model being based on increasing asset revaluations, taking on debt and duping gullible retirees into fee traps. Johns Lyng Group (JLG) for whom a large part of their business is built around a nefarious link between owing strata management companies that get JLG to quote overpriced building maintenance works, and then gull sleepy strata committee members to accept the rip-off quotes.

Essentially these business models have been built, in part on a lie. Lies management spent considerable time and effort concealing from investors.

CU6 may or may not live up to expectations. Maybe the above thinking about CU6 is both too simple and wrong. However, as an investor if you have the time at least you can get some understanding of the Science Risk and can take some comfort the Spiv Risk is likely fairly low.

Wow. What an unusual and fascinating interview. Just to be clear @Strawman I am great fan of CU6 and Alan Taylor but did not suggest the meeting. My thanks to ever did! I agree with your comments mikebrisy it pays to be both skeptical and cautious however I don't think the CU6 story is over yet by a long way.

See my meeting notes below:

Alan Taylor (AT) took it upon himself to talk more broadly about his career and investment journey and towards the end spoke more specifically about CU6.

AT indicated he had not grown up in a business or commercial environment but had to learn investing himself from a zero position. AT expressed common understanding with Strawman, its philosophy and its investing ambitions.

AT on the history of CU6: Science is about observing and measuring to understand within a range of probabilities a particular outcome. Two things exist: A scientific method and a body of knowledge.

AP as a young scientist at Garvin Institute observed the importance of discovery and the need to translate into commercialisation.

AT started concurrently with his science PHd in learning about investing, because he knew little about and saw it as very important and was not valued enough by the traditional science community.

Important to understand outcomes and probability. AT read Ben Graham - wanted to understand companies and value investing.

AP identified a key issue was the lack of information flow to shareholders. At CU6 communication is very important – a high value is placed on transparency. “Shareholders not the enemy but are your family” “The Chair has a fiduciary duty to shareholders.”

AP left science after PHd and shifted to investment banking. Wanted to put deals together.

AT started thinking about domain expertise. Goal was to “better understand the game” – value deriving from IP, barriers to entry + building data (pre-clinical and clinical). Spent 10 years in Investment banking – initially in Resources.

Sees life sciences as similar to resources model – but has own nuances. However concept the same: – low probability, high risk, low value and then build out to a higher probability and more value.

Investing from a distance when information was not there was very difficult. Saw as important companies told their stories correctly. Spoke of: “My community – shareholders and the CU6 Team”. "Relationships are most important.”

April 2013 – started at CU6. Strategies: – wanted more time with kids and to focus on translation of Australian science to the world. In Aust we do not always do this well. Cochlear and Resmed were 30 years ago and only have one CSL.

In 2013 the precursor to CU6 was TM Ventures - had provisional patents with a chelating copper technology. No employees and no cash.

Keytruded – uses the immune system to kill cancer. AT liked the idea of imaging then treating with therapy using the same molecules. Generates information as soon as you put into patient. Early information flow – get important data - critical. With CU6 from the start made sure information is transparent.

By way of CU6 explanation he said: "Radio pharma is a niche area. It is isotopes attached to biologics that hit the cancer."

Leader in radio pharma for therapy is Novartis with Pluvicto in the US - a blockbuster drug.

Other companies grabbed products that were available and commercialised. CU6 built from the ground up a prostate cancer product – developed a product the same as the competition except not Gallium or Lutetium based. Used Cu isotopes.

AT commented that 5 years ago their Cu based product was equally as bad as Novartis. However Novartis has been successful since it is better than previous technologies

With the Uni of Melbourne CU6 went to build 64Cu-SAR bisPSMA molecule for prostrate cancer treeatment.

Did with the knowledge of the inferior products the competitors had. With 64Cu-SAR bisPSMA at least twice as much finds its way into the cancer lesions. the molecule has found lesions that the competition could not find.

Cu64 has a 12 hour half life versus Gallium which has a 1 hour half life. Can image the next day. (Scoonie: have been on conference calls where this is seen by some analysts as a negative because the patient has to come back the following day for the imaging. AT as you would expect pitches this as a positive)

AT talked of 5 x greater binding to the cancer tumour than the competition: Pluvicto has high specificity but low sensitivity (about 40%) – ie mises lesions. AT rates as "terrible" but since better than nothing Pluvicto sales took off.

Clear visibility of what competitors are doing since CU6 runs its trials in parallel with competitor products.

Important question for surgeons pre prostatectomy – has the lesion escaped from the prostate or not? Ph 3 clinical trial now running to see if can better detect cancers outside the prostrate.

Other part is biotechnical recurrence – ie 1 in 2 currently treated with available therapies continue to get cancer. If can pick up the smaller lesions then better outcomes - current treatments cannot detect lesions less than about 5mm. CU6 can pick up the less than 2mm lesions

Pluvicto – monomer they did not dose optimize. Uses 7.5 GBq used of Lutecium.

Dose escalation trials were undertaken – because CU6 did want to dose high early. They got 2 – 3 time of product into the lesion – CU6 now aiming for 12 GBq dosages (up from 8).

CU6 64Cu-SAR bisPSMA results: 8 Gb all patients had psa 50% drops – a remarkable result. Got one complete response on the second dose. This patients had failed 5 – 7 lines of therapy - now patient still lives without cancer. Safety profile has been exceptional.

Now working with 12 GBq in the sickest patients – great results from a single dose. Clinicians want to provide an extra two doses – Safety Review Committee wanted this - very unusual and are now doing.

Found to be highly efficacious safe in late-stage patients because it is only the hopeless cancer cases they have been allowed to treat. AT asks: what about early stage patients?

CU6 has a radioactive platform. Currently in Ph 3 for diagnostics and Ph 2 in therapy.

Focus on one asset. CU6 have a further 10 opportunities in preclinical.

Same product for imaging and therapy. Key if the ‘cage” - has potentially very broad application.

"Investing at asset level – that is what CU6 is doing and will continue to do."

"Safety and efficacy – that is what CU6 has. Can transform this market but not limited to current prostate cancers."

“Bayesian view – prove out something gather information probability of success changed over time by doing great science.”

Competitors – big pharma and there have been many recent transactions - $4b Actinium and is a generic

Point Biopharma was bought by Liley – AT told them it will fail as was inferior product and it failed

“Cu6 - Isotopes easier to make – today ASX announcement about US supplier shores this up.”

“CU6 is investing more money in their platform since it is blockbuster - even for the diagnostic let alone the therapy.”

On the time frame for when commercialise and will be revenue generating? AT would not be drawn.

“Have been on every side of the table – about being empathetic, podcasts, announcements but do not have a focus on retail. Important to have sophisticated investment institutions on register."

"Focus: so many opportunities, CU6 is hedging bets. Focus to drive results. 64Cu-SAR bisPSMA in Ph 3 and Bombesin is a fast follower."

Radion pharma is hot sector and CU6 “is the only one left”. $130m in the bank $2.5B m/cap So can bring to clinical development. “R&D tax halves the price of doing the work when done in Australia."

"Is a no brainer– payoff is in billions. Can do very cheaply. Great model. Smartest people in the world have in the organisation.”

Who fell by the wayside in the radio pharma race? Big transactions taken place over the last year – they have been driven by strategy. Point Biopharma purchase was a strategy to compete with Pluvicto. They rushed into the development paying $1.4b and it did not work! Data just released and it is inferior to Pluvicto. AT gave further examples.

Question about foray into alpha particles: AT indicated that CU6 wanted to do things better. There is a lot of excitement around Alphas – they are higher energy. A lot of Alpha marketing going on – however AT is a little skeptical. CU6 thinking is they have the cage molecule so why not make an alpha product. Thomas Rumdalh on the Board had alpha expertise. Used to treat old men with late stage disease. Thought if market want alphas then CU6 can produce a superior one. AT stressed this is part of pre-clinical program and does not take away from Cu67. Alphas might give opportunity for late stage patients. Actinium is hard to get however. Safety is also a concern. Novatis does not have an alpha strategy. JJ used actinium and had to stop as was killing patients.

Upcoming new in next 6 months? Secure – taking the world by storm. Wants the next 3 patients dosed quickly. There is call from Clinicians for more product – AT would love to see more earlier stage patients getting drug. Diagnostics – would like to see Phase 3 clinical trial detecting lesions much earlier. Curative outcomes in really stage diseases wanted.

Question around patent protection: Can use the urea targeting Telix and Novartis products as they are generic. Outside of the urea targeting part the rest is all CU6 IP. So the product is considered new and has a further 15 years of patent to run. CU6 patent attorney is Davies Collison Cave and an operative from them works a one day per week at CU6.

Question. With only 64 staff can CU6 carry through on their workload by themselves? AT indicated there was only him there at the start. CU6 has done it all from a chelator – which is all their own proprietary position. Is a hot market with many players and CU6 want to be in this radio pharma space. New area and niche and CU6 will continue to build out. CU6 owns everything. Partnering – never done before – have to be careful don’t get IP leakage. Never say never – will see If a deal came along that can’t say no to then would do. At this point don’t want to shift value out of the business.

Question around radioactive supply: Cu 64 can be easily made. Potentially 4 suppliers in Aust alone. 2 dedicated cyclotrons that supply to CU6 now. Novartis product lutecium – comes from Nuclear reactors – so can never own supply chain. Low millions cost for a cyclotron. Cu64 can make at the one facility and will be doing this with Northstar later this year. In 5 – 10 years time as a stand alone radio pharma company them CU6 might have a small number of cyclotrons in the US supply product from single site and distribute to US and Europe and then Asia. Sole focus now in US and Australia. Focus on clinical development but later on supply of radioactive materials

One take home investors seem not to understand? Is all about strategies – have adopted what Strawamn does with investing - understand the business – know the market. Be very commercially focused. Many said "impossible". Work around the clock. Have an area of expertise and stick to it. Have bright people, smartest in the world. Stick to knitting. Have not acquired companies. Love the science. Making sure we are number 1.

In summary there is a lot to like about the company and its driving force Alan Taylor. Not hard to see why CU6 has a market cap of around $2.5b. Huge potential. If there would not be selling just yet.

@Strawman - a great meeting with Alan.

He's not the first to draw the analogy between pharma and resources. In fact, some of the world largest resource and pharma companies have studied each others' R&D / Exploration and Development processes to gain learning into better capital allocation and decision processes. (As an aside, I find it interesting that 75% of my career has been in either resources or pharma. The reason I prefer healthcare to invest in, is that the IP protection means that prices aren't commoditised when it counts - i.e., the early revenue years!)

In previous straws and posts, I've said I wasn't considering investing in $CU6. However, as a result of my early position in $TLX, I have been doing a lot of research into radiopharma in oncology. Much of what Alan said in the meeting confirmed and added to my understanding. I am now shifting in my thinking.

In the event that CLARIFY and even more importantly SECURE continue their early initial promise, and should NDAs be granted in due course, the pre-existing products in the market are doing the hard work of building the market of clinicians using these products to diagnose and treat. Should clearly superior products become available, then of course switching products in an existing market and associated workflows, is an easier thing. Because of this, should $CU6 get both the Cu64 and Cu67 products approved for prostate, we'd be look as a very different valuation from today, with the potential for very rapid adoption - particularly if there are positive stats in differentials in patient outcomes.

It was interesting to hear about the clinician demand to get more patients on Cu67, and the relative benefits of the longer half-life both in the imaging and therapy modes (Alan's mentioned this before on investor calls and other podcasts). $TLX have tried to spin their very short half-life issue as a benefit around speed of treatment. They have knocked the idea that a patient might be imaged a day after dosing for better S/N due to the inconvenience of have to be in the process for longer. But given what these patients are dealing with in terms of important life decisions, and potentially earlier failed lines of treatment, I'm not so convinced.

$CU6 is still not aligned with my usual risk appetite. After all, an adverse reaction or series of less promising results, could dampen the outlook quite quickly. However, as Alan says, it is all about understanding the probabilities. I'm not far off from concluding that a small speculative investment might be justified for me.

I'm glad we have some companies like these on the ASX to consider. More work to do! But a great meeting.

The meeting with Clarity was originally scheduled for tomorrow morning -- before I realised it was a long weekend!

I've pushed it back to Tuesday morning at 11am AEDT (all details on the meetings page, and we'll send an email reminder tomorrow night).

Hope everyone is having a nice weekend.

Clarity how it’s share price compares?

The best crafted model in the world is just that, a model. I find valuing biotech stocks particularly difficult and there is added complexity on the ASX. As one Straw-person put it recently (I will paraphrase), a biotech’s share price is directly proportional to the number of old boys in agreement at your long boozy Friday lunch. Cynical, yes but honestly there are pre-clinical biotech’s that are valued purely on TAM and hope while other revenue generating companies that are making millions and growing at greater than 25% YOY are hammered for missing guidance by a whisker.

I noticed a lot of talk about Clarity on my Strawman feed. I was curious to look at this biotech a little closer. I am absolutely no expert and I have merely taken a cursory glance, so please correct me if I am wrong and critique away.

My first impression is that it seems to be valued very highly for a pre-clinical stage company. While it seems like great tech – potential revenue seems to be years away. It also plays in the difficult space of cancer. I tend to avoid this space as I find that this is well outside my comfort zone.

I am all for investing in early stage biotech companies, if I understand the science and if there is a bargain to be had. The key to success is getting in early before it is priced for success and perfection.

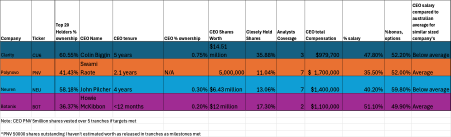

In this straw I have pitted Clarity Pharmaceuticals head to head against 3 other ASX bio-techs that I am more comfortable and familiar with (and invested in). This is a quick and dirty check to see if I am interested in digging further into Clarity.

Clarity’s technology basically injects special molecules (copper based) into patients to bind to specific targets on cancer cells. PET scans then pick up this energy from injected molecules to help locate and target cancer treatment more effectively. Theoretically there is a more targeted treatment and less damage to non-cancerous cells.

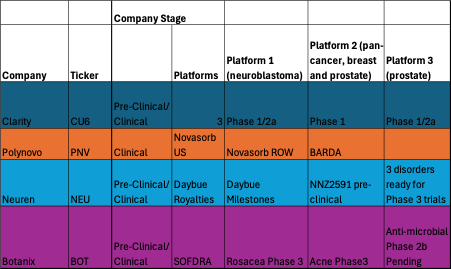

So Clarity has 3 platforms currently in various trial stages but mostly in the safety trial phases, 1 and 2. These platforms are largely targeting prostate, breast cancer and neuroblastoma. Certainly big areas of need and potential revenue if successful. The other companies in the head to head comparison, unlike Clarity, have FDA approved products or drugs which are already revenue generating. 1).Neuren is collecting royalties and milestone payments from Acadia for its lead FDA approved drug Daybue TM 2). Polynovo is currently selling Novasorb TM world-wide and collecting revenue from BARDA trials and 3). Botanix is collecting very small but growing royalties from its Japanese counterpart for sales in Ecclock TM . Botanix is also about to start selling its first and only FDA approved drug Sofdra TM into the market Q3 this year.

Table 1: Clarity is Pre-Clinical unlike Neuren, Polynovo and Botanix. Neuren has already had 3 successful phase II trials and waiting for Phase III trials. Botanix also is waiting for Phase III trials for Rosacea and Acne and 2b for anti-microbial.

Clarity Pharmaceuticals: A market cap comparison

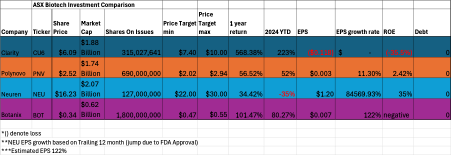

A quick review of Clarity shows a market cap (at time of writing) of about AU$1.88billion. Remembering this is a pre-clinical company with only products in phase 1 and 2 so far. It is not generating any revenue yet has a similar market cap to Polynovo AU$1.74 billion and Neuren AU$2.07billion.

Table 2. Comparison of Market Cap

Clarity has negative Earnings per Share (EPS) and Return on Equity (ROE). While its compatriots Polynovo and Neuren are selling products/drugs into the market and have positive and growing EPS. While Neuren’s ROE has sky rocketed this FY due to approval of Daybue TM by the FDA. This astronomical rise will not continue but should level out over the next few years and have reasonable increasing % royalty returns.

EPS growth is also estimated to increase for Botanix according to Bell Porter’s latest analyst report. Although this is merely speculation and educated guessing as Sofdra TM is a brand new drug for the US market. However there is a precedent with its lead drug currently being sold in Japan and growing strongly YOY. Hence the 122% EPS growth prediction isn’t outlandish.

So for every dollar I invest I have can choose to buy a company that is generating positive returns or is about to or I can invest in Clarity which is loss making and will be several years away from generating any earnings, if ever.

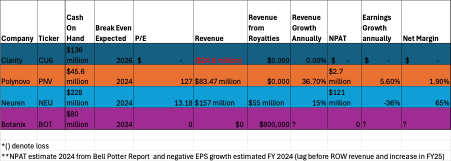

Table 3. Comparison of Cash on Hand, P/E and Revenue

Clarity Pharmaceuticals: A sales comparison

Comparatively CU6 does have significant cash on hand following $120 million dollar raise in the first half of 2024. However bio-techs are notoriously cash burning with most examples of drugs and products costing between $50-$300 million to bring to market. It is pretty clear with $136 million cash left on hand that Clarity will have to raise again in upcoming years. Raises in bio-techs usually cause significant dilution for long-term holders.

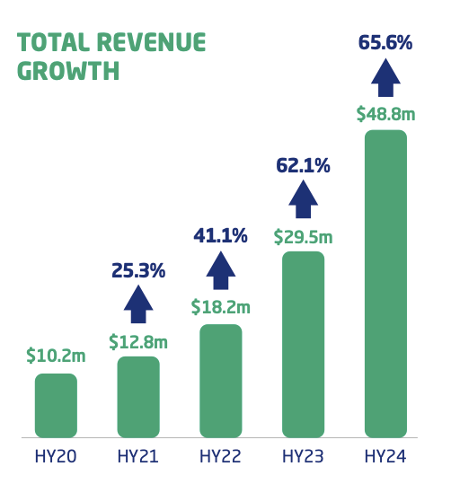

Polynovo with a similar market cap has enough cash on hand to fund revenue growth of near 36% annually. This is now self-funded and the company had its first net profit after tax in the 1H of FY 24. Further dilution and raises are very unlikely unless there is an upcoming acquisition that makes financial sense to bolt on to Polynovo’s portfolio of products.

Neuren has seen large annual growth this FY and royalties and milestones as well as cash on hand of $228 million will be sufficient to self-fund two phase three trials. Whether Neuren does this on their own or is acquired is anyone’s guess but Jon Pilcher has confirmed that the upcoming trials are likely to cost between AU$50 million and $100million and take approximately 3 years to get its second drug NNZ2591 to market. If this occurs Neuren and trials are successful it will keep 100% revenue generated.

Botanix is funded $80 million to take its lead drug Sofdra to market launch. Whether this company becomes self-funded or will need to raise again remains to be seen. Q3 this year will give us insight into the future trajectory of this company. Being on the eve of becoming revenue generating and better yet Botanix will keep approximately 95% of all revenue with only a small royalty going to Bodor the original creater of Sofdra.

So I can invest in Neu and PNV with similar market caps to Clarity and get access to self-funded revenue generating companies that have positive NPATS. Or I can invest in Botanix which has a much lower market cap, admittedly untested and higher risk but also soon to be revenue generating. Whereas Clarity is not revenue generating and yet has a higher market cap than Botanix and is years from making profit.

P/E comparisons

Clarity has no P/E ratio as it has no earnings (except R and D tax rebates). Polynovo has a high P/E 127. However paying $2.52 a share allows access to a company growing revenue at 54.9% STLY. Including BARDA this revenue increases to 65.6% growth on STLY. By comparison Polynovo has a very high P/E and shares seem to be fully valued whereas Neuren has a low P/E for a biotech of 13.18.

Polynovo seems reasonably valued compared to other successful pharmaceutical company's such as Pro Medicus, whos P/E sits at 191 with much lower growth rates of 23.8%. This makes sense given Polynovo is such an early stage company and Pro Medicus is much more mature.

While Neuren seems grossly undervalued with such a low P/E to get access to a growing royalty and milestone revenue stream with an impending priority review voucher thrown in. There is also a second future drug potential on the horizon that doesn’t seem to be contributing to valuation currently.

Botanix will be interesting to watch but the wait is not far away and the company is ridiculously cheap with impending US revenue due shortly.

Investing in Polynovo gives you access to this:

Investing in Neuren Pharmaceuticals gives you access to this:

In the last 12 months Neu has grown its EPS from AU$0.0015 to AU$1.23. This was a EPS 12 month trailing growth of 84569.93% due to the FDA catalyst approval of Daybue. The EPS of course will not continue at this rate.

PE ratio for NEU is 13.18% to buy into this growth. The ROE has been 35% in this time. A good company is considered to have an ROE of 15-20%.

Investing in Botanix gives you access to:

Royalties of AU$800 K annually growing at an estimate of 122% according to Bell Porter. Possible projected revenues of US$ 20-$90 million (200,000 units x $490) in FY2025

Management Comparisons

Table 3. CEO compensation and % of tightly held shares

Clarity is certainly a tightly held shares 35.88% being owned by management and the CEO owning 0.75% of the company. Collin Biggin also seems to take a reasonable salary for his position.

There is a lot of speculation about a Neuren buyout. However there is also some protection from hostile takeovers with 13.06% of the company being held by company management. Jon Pilcher takes a very reasonable salary and a majority of his compensation is performance based (59.8%). He also has a 0.3% ownership stake in the company.

Swaomi Raote for all his years of experience is also only drawing an average salary with a 52% performance based compensation. While his % proportion of company ownership is not disclosed when I looked at Simply Wall St.

Howie McKibbon draws an average salary and has the shortest CEO tenure of any of the company's. He was however appointed by Vince Ippolito Executive Director and the two had worked together for many years across different dermatology company's. His compensation is also very heavily performance based. A good sign for shareholders.

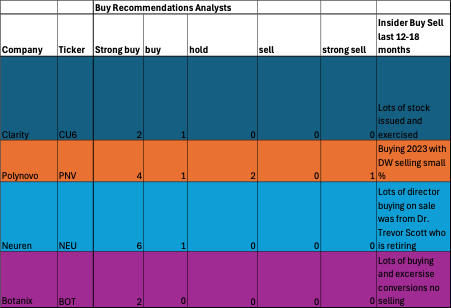

Analyst Insights: A comparison

Analysts are in agreement that clarity is a buy and a strong buy according to the 3 analysts covering this stock. Polynovo and Neuren and Botanix are largely also touted as strong buys.

Management teams are largely in agreement with analysts and having been buying stock through 2023. However, Clarity has had lots of stock issued and exercised. PNV has seen Chairman fork out large amounts of his dollars to buy stock in 2023. He did have one sale during this period. Neuren’s former director Dr. Trevor Scott also sold some Neuren shares at retirement. However there has also been plenty of management purchases.

There have been no sales of stock by Botanix management that I am aware of.

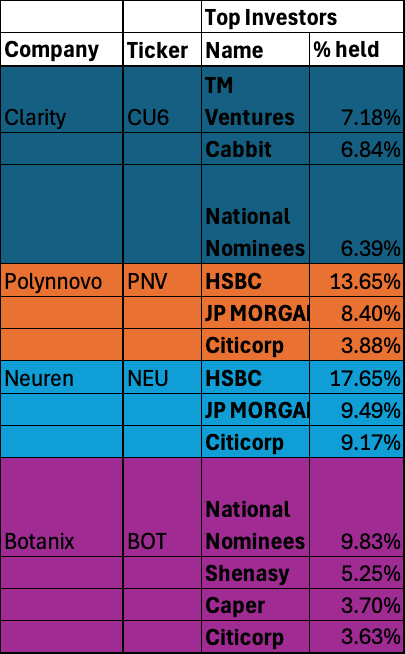

Who owns these shares: a comparison

Clarity has yet to have the big end of town hold large % of its shares. One can speculate and argue this is why the price has shot up but I wouldn’t be that cynical. Polynovo and Neuren have a common top 3 investors. We all saw what happened with PNV share price and Neuren’s SP is not fairing so well currently. It will be interesting to keep a watch of substantial holder notices for both company's in the future.

Botanix has largely flown under the radar of these giants and it is a very tightly held company with 17.3% ownership by management. Remembering Botanix and Clarity have both essentially been pre-revenue company's until now so they will not have the same investment appeal for large funds.

SUMMARY

My overall take-away is Clarity is certainly one to watch. I certainly would not have faith investing in the company in the short to medium term. Others clearly disagree and with a price target of $10.00 a share. If you invested 12 months ago you would have achieved a 568% return on your money. So excellent if you were lucky enough to ride this wave. Will it last? Time will tell.

I will watch with interest. I will stick with my measly yearly returns of 34-101% in by current biotechs which are revenue generating and growing at good cadence for now.

So whether there were some long lunches and nods and winks who can say. This is all my opinion, DYOR but a $1.88 billion market cap is certainly interesting. Hopefully the tech eventually helps to improve lives and I would consider buying if the technology passes phase III and if it ever hits a reasonable price.

Updating an old straw from one year ago. This is to keep track of Rhodotron numbers which is crucial in the production of Cu67 - not that anyone here is keeping track. But it is important visual to see Clarity's target geographies for therapy. Note that Cu67 has a half life of 2.5 days so just maybe Oz may be included???

This is the current number of Rhodotron deployments which hasn't grown in over a year (April 2024). Can't really say for sure if this really is a true picture or IBA has been too lazy to update their website.

Of course Australia is still behind the eight ball behind other developed nations such as Japan, Korea, Phillipines (??) and even China

Original content below for comparison

Clarity Pharmaceuticals Webinar Nov 22

https://www.youtube.com/watch?v=_9G8Gyjx-TI

At the 9 minute mark there is a discussion about using Cyclotrons to produce Cu-64 and Rhodotrons for Cu-67

All in all, not the disaster that Telix and myself made it out to be in the previous straw that copper isotopes are hard to find. And If they were hard to find, then FDA trials would be much harder to proceed.

ANSTO does have a cyclotron and a synchrotron. However, it looks most of the Rhodotrons installed are based outside Australia, the closest being in Singapore/Malaysia. Could see some share price upside if ANSTO decides to purchase a Rhodotron for local use.

Source: IBA industrial

Also have to note the IPO price was $1.40 so in the meantime the price could drag along the current range (0.8-1.00) for longer.

[held]

A result so good it is difficult to believe. Great news for prostrate cancer sufferers and investors.

Doesn't look like Dr Alan Taylor is participating in the latest placement.

And non exec director Dr Christopher Roberts also did not take any recent placement

Also long termer TM ventures not taking any of the insto placement.

Maybe a clue that I should not take the retail placement?

Maybe the bears will be proved right and this is overvalued

[held]

@edgescape , I am not sure if this report helps you decide whether the CR is worth it. Interesting idea of risked vs unrisked valuations. So many things to consider and not in my wheelhouse enough to realistically consider.

Wilson's CU6 update 9 April.pdf

Nessy

David Williams who is chairman of PolyNovo pens a few thoughts on Clarity Pharma

Full version from the AFR behind the paywall:

I'm still considering whether to take the entitlement.

[held]

Why picking ASX biotechs is mostly for the crazy brave

Tom Richardson

3 April 2024

The Australian Financial Review

Sharemarket It's a space with a reputation for rollercoaster returns, but some investors get really lucky, writes Tom Richardson.

The Australian biotechnology sector has produced massive winners such as the $140 billion blood products giant, CSL, but is also notorious for its unnerving volatility and costly clinical trials.

The ASX has 171 companies in the healthcare sub-sector, 85 in the pharmaceuticals sub-sector and 39 in a biotech sub-sector. Aside from gems like CSL, it is a space with a reputation for rollercoaster returns and outlandish claims about "breakthroughs" that never materialise.

Hugh Dive, the chief investment officer at Atlas Funds Management, says picking biotech winners is tricky because each company is underpinned by inherently complex science. "So much rests on understanding the science, so you get a very binary outcome - either it works fabulously, or it goes to zero," he says.

"Unless you have extreme specialisation in an area, it's hard."

Dive points to CSL's recent setback with a drug known as CSL112 to treat heart attacks, as an example of how failure can occur despite positive market expectations and a $1 billion investment by an already wildly successful company.

On the other hand, one of the sector's biggest recent winners is $4.1 billion cancer diagnostic radiotherapy group Telix Pharmaceuticals. The stock is up 1453 per cent over the past five years and has added 1880 per cent since its November 2017 float price of 65¢. It was trading around $12 yesterday.

Biotech investor David Williams, who runs corporate advisory firm Kidder Williams, says Telix's success shows Australia's radio pharmaceuticals sector is "hot as Hades" in producing huge winners like Telix and Sirtex. Sirtex, which is best known for its technology to fight last-stage colorectal liver cancer, soared on the ASX before snaring a $1.9 billion takeover bid in 2018.

"I got China Grande [China Grand Pharmaceutica] to take 8 per cent of Telix about a year-and-a-half ago when it was worth $300 million, and now it's worth more than $3.5 billion," he says.

"Now I'm an investor in [ASX-listed] Clarity Pharma. It has a radiotherapy product for pancreatic and prostate cancer. The testing in humans is unbelievable, so it's gone from almost nothing to $800 million and [I think it] will be $5 billion someday soon."

Since listing on the ASX in August 2021 at $1.40 a share, Clarity's value has climbed 96.4 per cent to $2.75 a share, with backers including Mr Williams, former Cochlear chief executive and Clarity director Chris Roberts, fund manager Firetrail Investments and KKR-backed cancer care provider GenesisCare.

"It may sound funny, but third-party endorsement adds to a biotech's credibility," says Dive. "The presence of large corporates or well-known fund managers on a company's share register is one form of endorsement we look for, especially the multinational fund managers with vast teams of analysts."

Williams says he targets biotechs with a disruptive product that could work as a platform technology across multiple applications. He says burns treatment specialist PolyNovo, a company in which he is both investor and chairman, is an example of a rare platform technology success as the product is now used by surgeons for applications other than treating burns.

"In Australia, there's about 150 pure biotech companies listed, but 95 per cent of them have never done anything, I guess 20 per cent will fail before June," he warns. "Lots have just spent 10 years testing on mice, recycling themselves, and paying themselves.

"So you better make damn sure a company has a viable product, you've also got to raise money, there's plenty about, but you need someone who knows what they're doing, and you need great executives to run it."

He says some biotechs may get lucky if they invent a product that becomes popular for an off-label purpose. "Take botox," he says, "people take that now and go, holy shit, this is great, and Ozempic was supposed to treat diabetes but is taken for weight loss."

The S&P/ASX 200 Health Care Index, which comprises leading medical and biotechnology businesses, has gained 1 per cent over the past 12 months, versus a return of 9.3 per cent for Australia's flagship S&P/ASX 200 Index over the same period.

However, one speculative biotech that has thumped its peers and the broader market is Opthea. The biotech is running two large clinical trials in patients to develop a therapy to treat common eye diseases.

The stock has swung wildly over the past five years, with the company boasting around $150 million cash on hand as at December 31.

Gerard Satur, chief executive of MST Financial, says Opthea is among his top picks for success, alongside neuroscience success story Neuren and neurodegenerative researcher Alterity Therapeutics. "You have to be very selective to invest in biotech stocks on the ASX, there are too many stocks we believe do not offer attractive risk-return as an investment," says Satur.

"We have the largest healthcare research team in the market, we do thorough due diligence on companies like Opthea, which we like because it has the potential to be the first drug for wet AMD [age-related macular degeneration disease] in more than 15 years.

"The divergence between good and bad is massive in biotech. We turn away a lot more companies than we cover for research as we just don't feel like they should take investors, and we hate it when companies spruik too much."

Satur says the returns are lucrative if an investor manages to unearth a winner and a successful company can raise a lot of capital if necessary in Australia. "Regularly there can be five or 10-baggers," he says. "And there needs to be, as there's risk with biotech." A 10-bagger is an investment that appreciates in value 10 times its initial purchase price.

Ultimately, the speculative nature of the sector means it is an "avoid" for Dive as the risk of permanent capital loss is too great. The stock picker says he prefers to focus on established, profitable players such as CSL or Sonic Healthcare, but that should not preclude others prepared to take more risk.

"Often with small biotechs you hope they get taken out by big pharma companies that write a cheque if the tech is good, so sometimes you get takeovers and the rewards," says Dive.

"But it takes vast amounts of time and money to get a biotech through the hoops. And probably the most crucial thing is how much cash runway a company has, so if it's burning tonnes of cash and doesn't have much in the bank, you're probably facing a highly dilutive capital raising or worse.

"If the capital markets are unfriendly, the company may run out of cash prior to their therapies being approved, or may be unable to fund the next stage in the testing process."

Always get the feeling that retail is last in the queue

Retail gets one share for every 33 held at around $2.50

First it was Dimerix and now Clarity. Wonder if this is always like this in biotech land?

Not known how much the proportion of the 20.6m going to costs of the offer (ie: Bell Potter)

Not known how much the proportion of the 20.6m going to costs of the offer (ie: Bell Potter)

The raise was always going to happen soon, given only 40m left from the last report which is a few quarters of cash.

Given the breakdown above and the lofty market cap compared to the small recruitment target in the SECuRE trial (see my previous straw) will give this a pass for now and see if the shares I don't take up get sold at a lower price.

I also need to spend time going through some of the recent takeovers by Big Pharma but I believe most of those (Fustion, Point, RayzeBio) were more advanced in their trials and thus more attractive acquisition targets.

A takeover could be a long wait for Clarity.

[held]

You heard it first from me 2 weeks ago :)

https://strawman.com/member/forums/topic/8550

https://www.afr.com/street-talk/clarity-pharmaceuticals-preps-110m-raise-wilsons-on-the-tools-20240325-p5fex4

Street talk thinks the raise will be around $2.60 which was around the time those options were excised @ $2.50.

[held]

Table to visualise current progress of the SECuRE PSMA therapy trial

Cohort trial design and dosage below

Alternative table from the Wilsons Broker note

Data from the announcement "Clarity’s theranostic prostate cancer trial advances to multi-dose phase"

Cohort 1 result can be found in "Ann: Theranostic prostate cancer trial advances to cohort 2" 24th May 2023

So in summary 12GBq is most effective.

[held]

8/3/23 - Due to recent perf options excised @2.50.

12/12/23 - Still keeping my valuation that was made beginning of this year (see recent straw). Understand that Wilsons has a price target of $2.30 but also need to remember this IPO was at $1.40 and still need to wait at least 2 years for revenue.

31/1/23 - Price of IPO. Going to assume this is where stale holders will try to exit

Despite the lofty market cap of 700m (and higher than Develop Global and a few others that made it), Clarity is still not in the ASX 300!

I must admit I broke my rule on the valuation and did buy those shares that got excised recently that tanked the share price down to $2.50. Could be a bad omen but hasn't dipped below that level since.

And congratulations to those that bought Clarity at 70c at a time when Genesis was selling. A little bit of research on the forced selling by Genesis goes a long way and I wished I did more digging on it.

But with Frazis currently giving this one some attention, I can understand that Clarity will be at the bottom of the pile in terms of valuation.

[held]

The latest update from Wilsons with the change in pathway to market for those who are interested. Potential for a slow down in the Phase 3 results it seems.

Clarity Pharma Wilsons advisory 15 Feb 2024.pdf

Nessy

not held

Received this note from Frazis Capital Partners for anyone not yet subscribed to his email updates

Clarity Pharmaceuticals

This is the most exciting company I’ve come across in Australia lately. Clarity has been steadily releasing data from patients treated with their copper therapies with late stage prostate cancer.

Clarity has been on a bit of a tear lately. If their data continues to hold, this is still early days, and it remains a fraction of the value of recent acquisitions in the space with early stage data.

I will send out a note on the space shortly.

Current players include Novartis, which entered the space through their US$2 billion acquisition of Endocyte, Lantheus, which offers a radiodiagnostic, and Telix which is rapidly gaining diagnostic share from Lantheus. The whole space itself is growing fast and expanding into new areas.

M&A activity has been intense.

Two days ago Bristol Myers Squibb bought RayzeBio for US$4.1 billion, with early stage data for their alpha-particle emitting Actinium-based radiotherapy targeting gastroenteropancreatic neuroendocrine tumors. The company is enrolling patients in a Phase III trial.

And Novartis paid $2 billion for Endocyte in late 2018 with only Phase II data. This has proved a big winner, with first year revenues for their first product Pluvicto forecast at over US$1 billion.

Point Biopharma, in partnership with Lantheus, was itself bid for by Eli Lilly for US$1.4 billion - again with only Phase II data. Last week Point’s data came in a little soft, leaving open space for new entrants like Clarity.

This is going to be a large market. In prostate cancer, the trend is towards increased monitoring and (where possible) fewer surgeries and hormone therapy, which involves the unwelcome side effects of incontinence, impotence, low testosterone and depression.

These companies are focused on heavily pre-treated patients. But the hope is that these targeted treatments, with their milder side effects, will move further up the treatment timeline, which could double or even triple industry revenues.

This will take time, given the high hurdle for changing standard-of-care, but is looking more likely than ever today.

In the meantime, a steady rise in the incidence of prostate cancer, combined with an increase in monitoring, suggests the market will expand significantly regardless.

In a space where companies with promising data are being acquired for billions of dollars, and Clarity’s early indications look best-in-class, the company’s post-runup US$340 million valuation looks cheap.

And just today (28 Dec 23) the share price reached an all time high of $2 before settling back down to $1.89

I presume the rally was on the back of coverage from this email update.

Michael Frazis of Frazis Capital Partners is known for ignoring financial metrics in favour of more unconventional measures of customer satisfaction, loyalty, addressable markets and ideas that involve cutting edge technology and science. His style is more inline with ARK invests Cathie Wood

For the record, I'm not as enthusiastic as Frazis on the growth of the PSMA market, I think the rise of drugs such as Ozempic could slow the rate of growth in Prostate Cancer and the underperformance from Lantheus and Telix is evidence of this. Frazis could be just a victim of wanting to catch the CU6 uptrend late in the cycle while ignoring his bad call on Paul Hopper's Radiopharm Theranostics.

[held]

CU6 has really been on a tear recently

Apart from the latest report from Wilsons shared by @Bear77, there was also an earlier update on the SeCURE Therapy trial for Cohort 2. Although there were only results from 3 patients, the update on page 1 looked promising but as usual I brushed it off

The more significant part is on page 2 where I have highlighted the update where patients has had radiogland therapy with not much success but has showed progress in the SeCURE trial

While the radiogland therapy is not named, we can probably guess that the one they could be referring to is either Novartis (Pluvicto) or maybe others from Lantheus (can't think of the name) or Telix (TLX591)

In either case, the news seems significant enough to justify the current rise.

However this is still early stage with only 3 patients tested (cohort 2). And still a "science experiment" with no revenue till 2026 and why I've held back on putting any more in CU6. Seems fairly priced now.

[held]

Interesting to see Clarity getting bid today.

There was a Bell Potter conference a few days ago

Milestones to look out for

[held]