Clarity how it’s share price compares?

The best crafted model in the world is just that, a model. I find valuing biotech stocks particularly difficult and there is added complexity on the ASX. As one Straw-person put it recently (I will paraphrase), a biotech’s share price is directly proportional to the number of old boys in agreement at your long boozy Friday lunch. Cynical, yes but honestly there are pre-clinical biotech’s that are valued purely on TAM and hope while other revenue generating companies that are making millions and growing at greater than 25% YOY are hammered for missing guidance by a whisker.

I noticed a lot of talk about Clarity on my Strawman feed. I was curious to look at this biotech a little closer. I am absolutely no expert and I have merely taken a cursory glance, so please correct me if I am wrong and critique away.

My first impression is that it seems to be valued very highly for a pre-clinical stage company. While it seems like great tech – potential revenue seems to be years away. It also plays in the difficult space of cancer. I tend to avoid this space as I find that this is well outside my comfort zone.

I am all for investing in early stage biotech companies, if I understand the science and if there is a bargain to be had. The key to success is getting in early before it is priced for success and perfection.

In this straw I have pitted Clarity Pharmaceuticals head to head against 3 other ASX bio-techs that I am more comfortable and familiar with (and invested in). This is a quick and dirty check to see if I am interested in digging further into Clarity.

Clarity’s technology basically injects special molecules (copper based) into patients to bind to specific targets on cancer cells. PET scans then pick up this energy from injected molecules to help locate and target cancer treatment more effectively. Theoretically there is a more targeted treatment and less damage to non-cancerous cells.

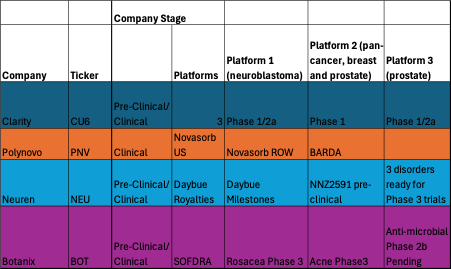

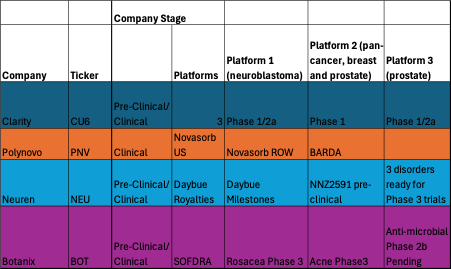

So Clarity has 3 platforms currently in various trial stages but mostly in the safety trial phases, 1 and 2. These platforms are largely targeting prostate, breast cancer and neuroblastoma. Certainly big areas of need and potential revenue if successful. The other companies in the head to head comparison, unlike Clarity, have FDA approved products or drugs which are already revenue generating. 1).Neuren is collecting royalties and milestone payments from Acadia for its lead FDA approved drug Daybue TM 2). Polynovo is currently selling Novasorb TM world-wide and collecting revenue from BARDA trials and 3). Botanix is collecting very small but growing royalties from its Japanese counterpart for sales in Ecclock TM . Botanix is also about to start selling its first and only FDA approved drug Sofdra TM into the market Q3 this year.

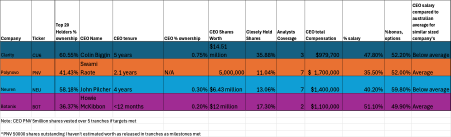

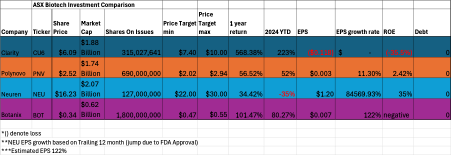

Table 1: Clarity is Pre-Clinical unlike Neuren, Polynovo and Botanix. Neuren has already had 3 successful phase II trials and waiting for Phase III trials. Botanix also is waiting for Phase III trials for Rosacea and Acne and 2b for anti-microbial.

Clarity Pharmaceuticals: A market cap comparison

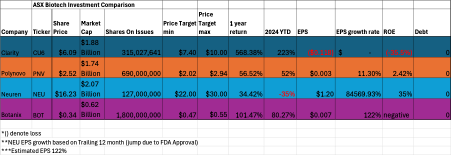

A quick review of Clarity shows a market cap (at time of writing) of about AU$1.88billion. Remembering this is a pre-clinical company with only products in phase 1 and 2 so far. It is not generating any revenue yet has a similar market cap to Polynovo AU$1.74 billion and Neuren AU$2.07billion.

Table 2. Comparison of Market Cap

Clarity has negative Earnings per Share (EPS) and Return on Equity (ROE). While its compatriots Polynovo and Neuren are selling products/drugs into the market and have positive and growing EPS. While Neuren’s ROE has sky rocketed this FY due to approval of Daybue TM by the FDA. This astronomical rise will not continue but should level out over the next few years and have reasonable increasing % royalty returns.

EPS growth is also estimated to increase for Botanix according to Bell Porter’s latest analyst report. Although this is merely speculation and educated guessing as Sofdra TM is a brand new drug for the US market. However there is a precedent with its lead drug currently being sold in Japan and growing strongly YOY. Hence the 122% EPS growth prediction isn’t outlandish.

So for every dollar I invest I have can choose to buy a company that is generating positive returns or is about to or I can invest in Clarity which is loss making and will be several years away from generating any earnings, if ever.

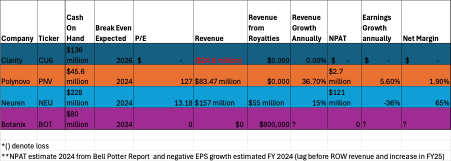

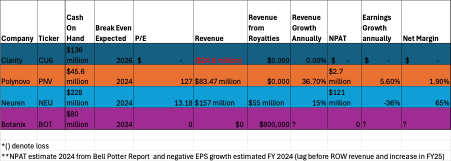

Table 3. Comparison of Cash on Hand, P/E and Revenue

Clarity Pharmaceuticals: A sales comparison

Comparatively CU6 does have significant cash on hand following $120 million dollar raise in the first half of 2024. However bio-techs are notoriously cash burning with most examples of drugs and products costing between $50-$300 million to bring to market. It is pretty clear with $136 million cash left on hand that Clarity will have to raise again in upcoming years. Raises in bio-techs usually cause significant dilution for long-term holders.

Polynovo with a similar market cap has enough cash on hand to fund revenue growth of near 36% annually. This is now self-funded and the company had its first net profit after tax in the 1H of FY 24. Further dilution and raises are very unlikely unless there is an upcoming acquisition that makes financial sense to bolt on to Polynovo’s portfolio of products.

Neuren has seen large annual growth this FY and royalties and milestones as well as cash on hand of $228 million will be sufficient to self-fund two phase three trials. Whether Neuren does this on their own or is acquired is anyone’s guess but Jon Pilcher has confirmed that the upcoming trials are likely to cost between AU$50 million and $100million and take approximately 3 years to get its second drug NNZ2591 to market. If this occurs Neuren and trials are successful it will keep 100% revenue generated.

Botanix is funded $80 million to take its lead drug Sofdra to market launch. Whether this company becomes self-funded or will need to raise again remains to be seen. Q3 this year will give us insight into the future trajectory of this company. Being on the eve of becoming revenue generating and better yet Botanix will keep approximately 95% of all revenue with only a small royalty going to Bodor the original creater of Sofdra.

So I can invest in Neu and PNV with similar market caps to Clarity and get access to self-funded revenue generating companies that have positive NPATS. Or I can invest in Botanix which has a much lower market cap, admittedly untested and higher risk but also soon to be revenue generating. Whereas Clarity is not revenue generating and yet has a higher market cap than Botanix and is years from making profit.

P/E comparisons

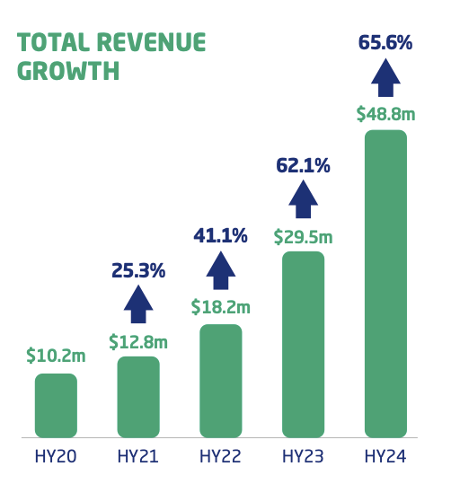

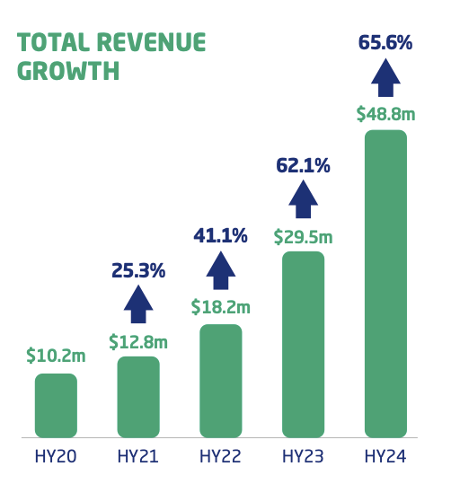

Clarity has no P/E ratio as it has no earnings (except R and D tax rebates). Polynovo has a high P/E 127. However paying $2.52 a share allows access to a company growing revenue at 54.9% STLY. Including BARDA this revenue increases to 65.6% growth on STLY. By comparison Polynovo has a very high P/E and shares seem to be fully valued whereas Neuren has a low P/E for a biotech of 13.18.

Polynovo seems reasonably valued compared to other successful pharmaceutical company's such as Pro Medicus, whos P/E sits at 191 with much lower growth rates of 23.8%. This makes sense given Polynovo is such an early stage company and Pro Medicus is much more mature.

While Neuren seems grossly undervalued with such a low P/E to get access to a growing royalty and milestone revenue stream with an impending priority review voucher thrown in. There is also a second future drug potential on the horizon that doesn’t seem to be contributing to valuation currently.

Botanix will be interesting to watch but the wait is not far away and the company is ridiculously cheap with impending US revenue due shortly.

Investing in Polynovo gives you access to this:

Investing in Neuren Pharmaceuticals gives you access to this:

In the last 12 months Neu has grown its EPS from AU$0.0015 to AU$1.23. This was a EPS 12 month trailing growth of 84569.93% due to the FDA catalyst approval of Daybue. The EPS of course will not continue at this rate.

PE ratio for NEU is 13.18% to buy into this growth. The ROE has been 35% in this time. A good company is considered to have an ROE of 15-20%.

Investing in Botanix gives you access to:

Royalties of AU$800 K annually growing at an estimate of 122% according to Bell Porter. Possible projected revenues of US$ 20-$90 million (200,000 units x $490) in FY2025

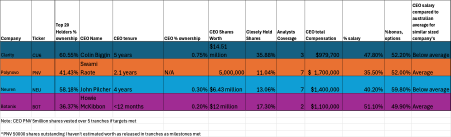

Management Comparisons

Table 3. CEO compensation and % of tightly held shares

Clarity is certainly a tightly held shares 35.88% being owned by management and the CEO owning 0.75% of the company. Collin Biggin also seems to take a reasonable salary for his position.

There is a lot of speculation about a Neuren buyout. However there is also some protection from hostile takeovers with 13.06% of the company being held by company management. Jon Pilcher takes a very reasonable salary and a majority of his compensation is performance based (59.8%). He also has a 0.3% ownership stake in the company.

Swaomi Raote for all his years of experience is also only drawing an average salary with a 52% performance based compensation. While his % proportion of company ownership is not disclosed when I looked at Simply Wall St.

Howie McKibbon draws an average salary and has the shortest CEO tenure of any of the company's. He was however appointed by Vince Ippolito Executive Director and the two had worked together for many years across different dermatology company's. His compensation is also very heavily performance based. A good sign for shareholders.

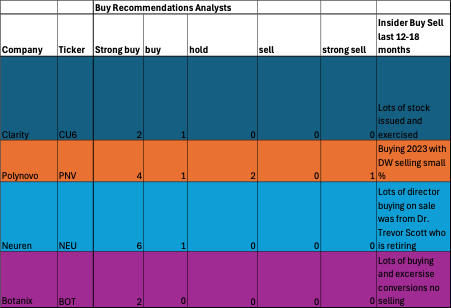

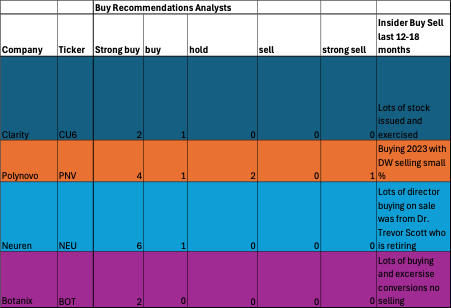

Analyst Insights: A comparison

Analysts are in agreement that clarity is a buy and a strong buy according to the 3 analysts covering this stock. Polynovo and Neuren and Botanix are largely also touted as strong buys.

Management teams are largely in agreement with analysts and having been buying stock through 2023. However, Clarity has had lots of stock issued and exercised. PNV has seen Chairman fork out large amounts of his dollars to buy stock in 2023. He did have one sale during this period. Neuren’s former director Dr. Trevor Scott also sold some Neuren shares at retirement. However there has also been plenty of management purchases.

There have been no sales of stock by Botanix management that I am aware of.

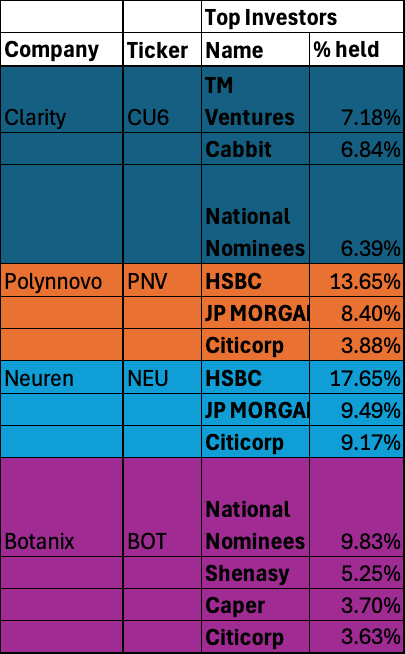

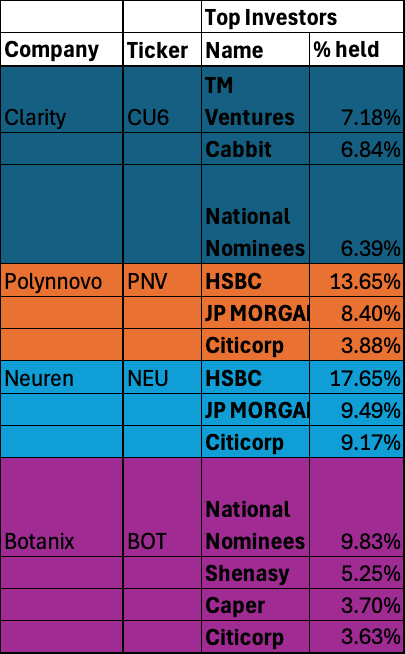

Who owns these shares: a comparison

Clarity has yet to have the big end of town hold large % of its shares. One can speculate and argue this is why the price has shot up but I wouldn’t be that cynical. Polynovo and Neuren have a common top 3 investors. We all saw what happened with PNV share price and Neuren’s SP is not fairing so well currently. It will be interesting to keep a watch of substantial holder notices for both company's in the future.

Botanix has largely flown under the radar of these giants and it is a very tightly held company with 17.3% ownership by management. Remembering Botanix and Clarity have both essentially been pre-revenue company's until now so they will not have the same investment appeal for large funds.

SUMMARY

My overall take-away is Clarity is certainly one to watch. I certainly would not have faith investing in the company in the short to medium term. Others clearly disagree and with a price target of $10.00 a share. If you invested 12 months ago you would have achieved a 568% return on your money. So excellent if you were lucky enough to ride this wave. Will it last? Time will tell.

I will watch with interest. I will stick with my measly yearly returns of 34-101% in by current biotechs which are revenue generating and growing at good cadence for now.

So whether there were some long lunches and nods and winks who can say. This is all my opinion, DYOR but a $1.88 billion market cap is certainly interesting. Hopefully the tech eventually helps to improve lives and I would consider buying if the technology passes phase III and if it ever hits a reasonable price.