Sharing some thoughts on a company called Little Green Pharma (LGP) that I have been following for a few years and have recently started buying IRL and here on Strawman.

In a nutshell this is a deep value play.

LGP is a medicinal cannabis business. There was furious excitement for medicinal cannabis companies in 2021 when share prices peaked. Since then market sentiment has fallen and the share price for these companies is in the dog house. Most of these companies are loss making. We are now in a period of consolidation for this sector. When market sentiment is poor like it is in the cannabis sector the baby can get thrown out with the bathwater.

The industry is a strange mix of “health and wellness” companies, biotech’s rolling the dice on specific applications for humans and in some cases animals, the cannabidiol (CBD) sleep bros and traditional dry flower growers/producers for medicinal purposes. Majority are private companies in Australia.

According to data from Australia’s Therapeutic Goods Administration (TGA) medical cannabis approvals for new patients through an Authorized Prescriber have continued to grow in 2023. From January to June 2023, the aggregate of all new patients reported was 307,846 compared to 137,111 new patients from January to June 2022 and 30,662 from the same period in 2021.

The Australian Government Office of Drug Control lists 44 entities who are approved manufacturers and suppliers of medicinal cannabis products. Most of these are private companies. Of the handful of public companies I can't find any that are profitable. LGP have said they are cash flow positive in March excluding their R&D rebate. I think their business is at an inflection point and no one is looking.

In my opinion medicinal cannabis flower sales are growing because there is a transition from illicit sales to prescription sales. This is a reflection of the softening regulation occurring in all markets which makes the logistics of transport, storage, accounting and access of cannabis easier. As the public perception of cannabis becomes less negative it use is moving into new areas such as elderly people with terminal cancer.

LGP was the first company in Australia to grow medicinal cannabis for domestic use. Their main facility is in WA. In 2021 LGP acquired one of Europe’s largest medicinal cannabis cultivation and manufacturing facilities in Denmark for $21m from Canopy Growth. This was at a significant discount to the asset value.

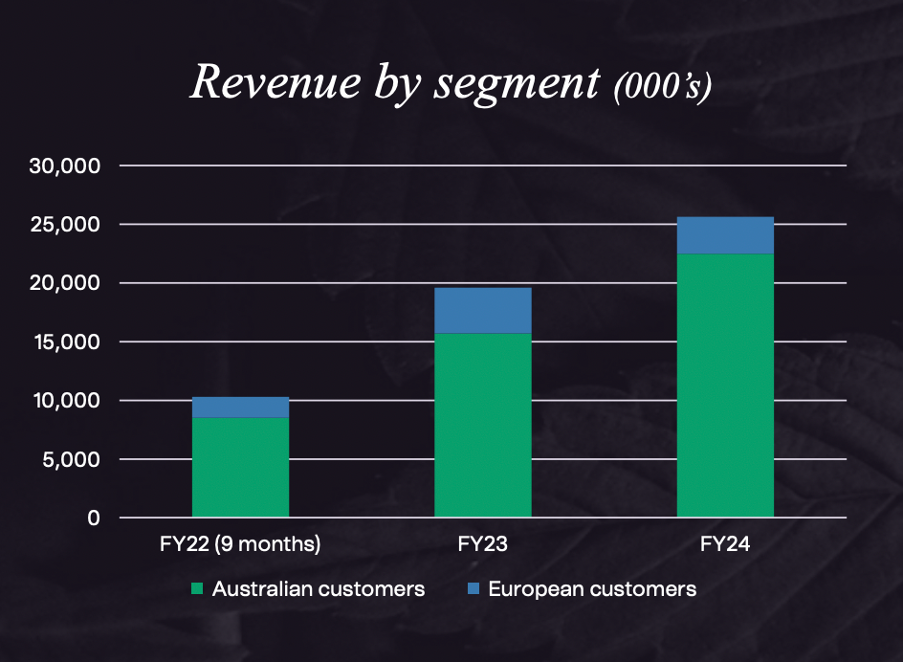

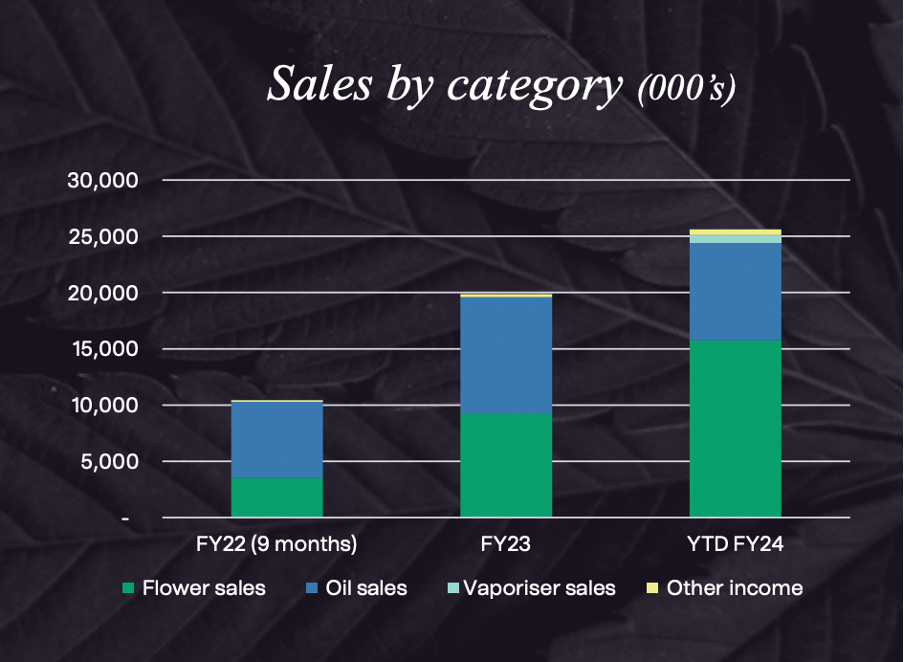

Majority of sales are in Australia. LGP had record quarterly revenue of $7.3 million, up 34% on previous quarter.

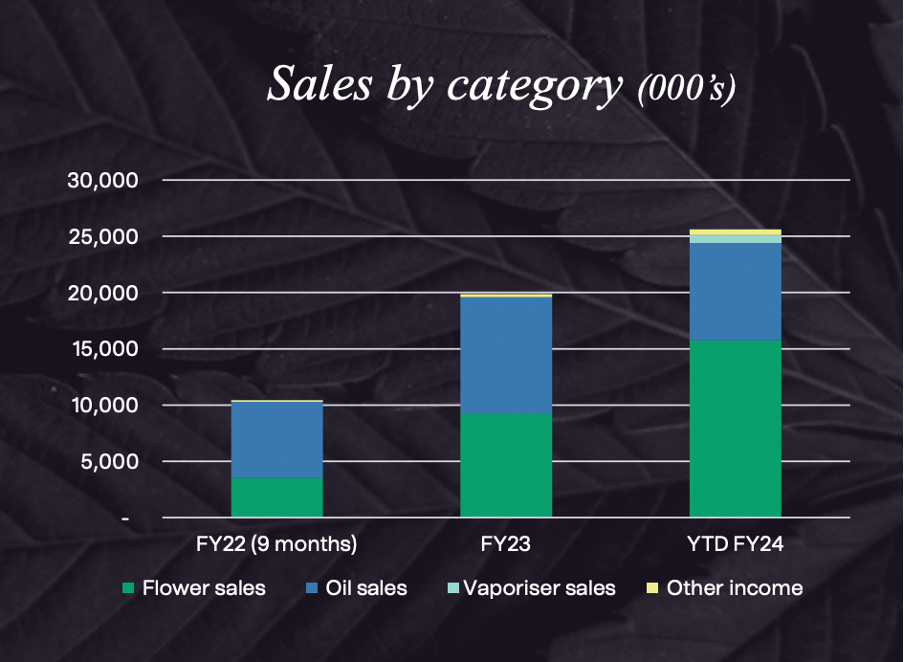

Flower sales were up 57% on the previous quarter and are growing strongly. LGP has strong branding and a good product. Australian sales were up 27% from the prior quarter predominately due to the introduction of CherryCo flower. See this review (https://www.youtube.com/watch?v=ZrtqEhzbIR4)

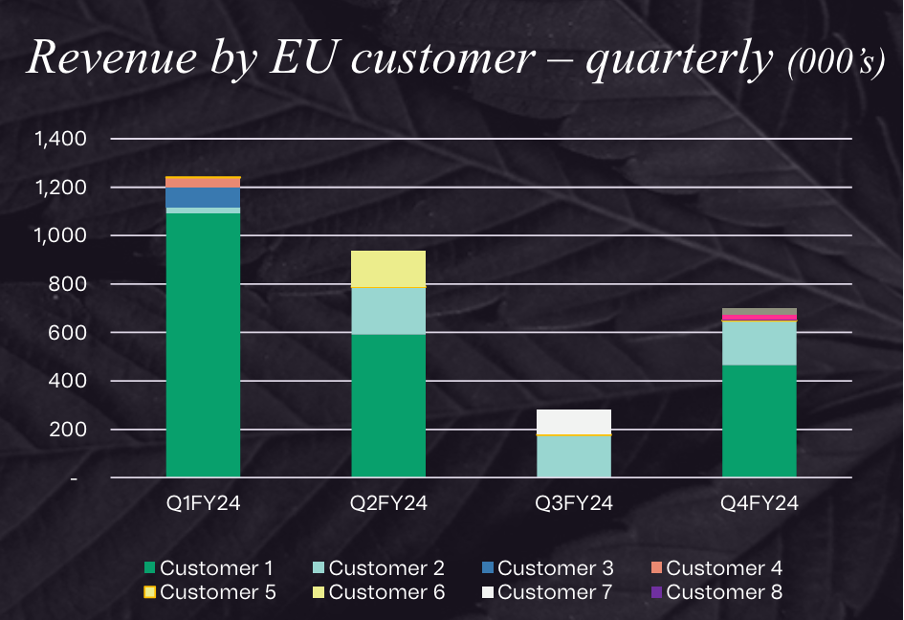

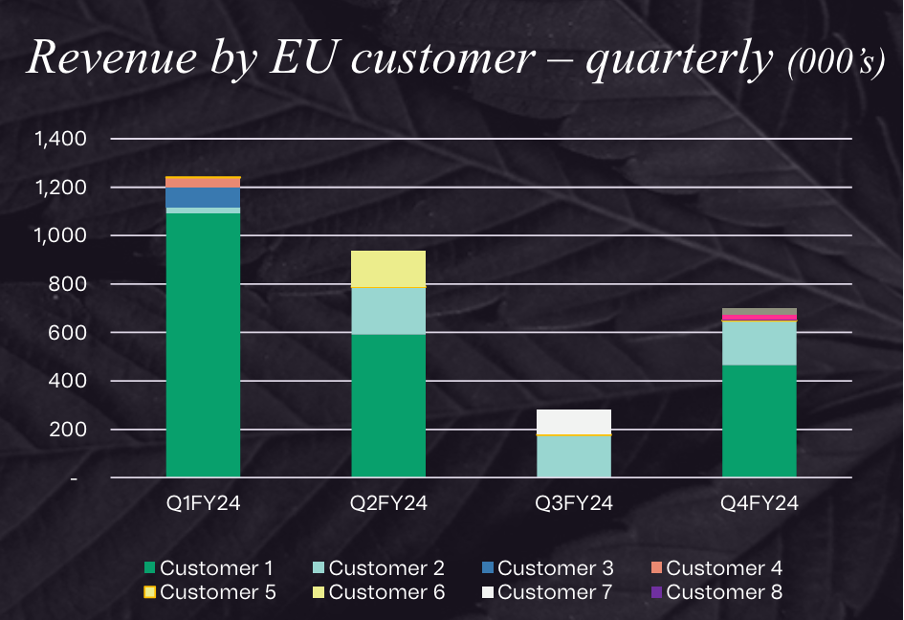

European sales are choppy. On 1 April 2024 cannabis was legalised in Germany with its removal from the Narcotics List and there are early signs of strong patient uptake. LGP’s Danish facility is two hours from the German border and in an excellent position to capitalise on likely improved medicinal cannabis access pathways. LGP was one of two companies supplying a French medicinal cannabis pilot which ended on 27 March 2024. They will have early access to this market. LGP also sell to UK and have just started selling to Poland and Switzerland.

Also the US Drug Enforcement Administration have just confirmed they will recommend reclassifying cannabis from Schedule I to Schedule III. The news has resulted in a re-rating of North American cannabis companies with the MJ ETF and the MSOS ETF both increasing by over 25%. This sector re-rating is expected to flow through to other cannabis companies including LGP given the historical mirroring of the North American markets. The proposed rescheduling would remove s280E taxes which tax cannabis operators at their gross margin level (versus net income) and generate potential momentum for other pro-cannabis legislation at the federal level and increased institutional interest in US cannabis stocks.

The US cannabis companies are the biggest. Most seem to be loss making.

Here is a snap shot of the largest by revenue Curaleaf Holdings (CURL):

Revenue $1.3b

Operating income $43m (noted almost half a billion dollars for Selling and Administration expenses!)

Net income $-280m!! (after tax, impairment of goodwill, interest on debt)

Haemorrhaging cash big time. A lot of consolidation is happening/ gonna happen.

LGP finished FY24 with a positive operating cashflow of $0.5 million. This included a $5m research and development rebate. The month of March being operating cashflow positive in its own right without the R&D rebate.

Management and employees own about 20% of the company so strongly incentivised.

LGP’s net tangible assets are significantly above it’s enterprise value. This means that the value the market has given LGP as a business (about $40m) is less than the value of it’s assets (about $80m)! In other words the share price is deeply discounted. This company has been priced to fail but the market is wrong in my opinion.

Thesis: significantly undervalued company at a profitability inflection point driven by a transition of cannabis flower sales from illicit to prescription

Risks:

The cannabis sector is still bloated and full of loss making companies many of which will fail

This is a commodity business to some degree with a rapidly shifting regulatory framework