Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

LGP released their 4C today and their share price rose 30% on the news!

Highlights

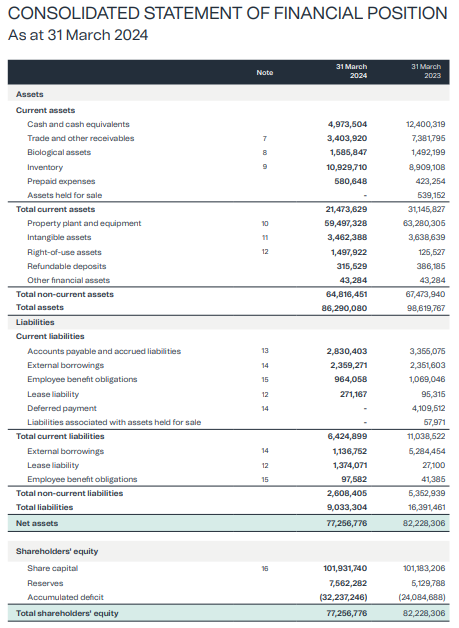

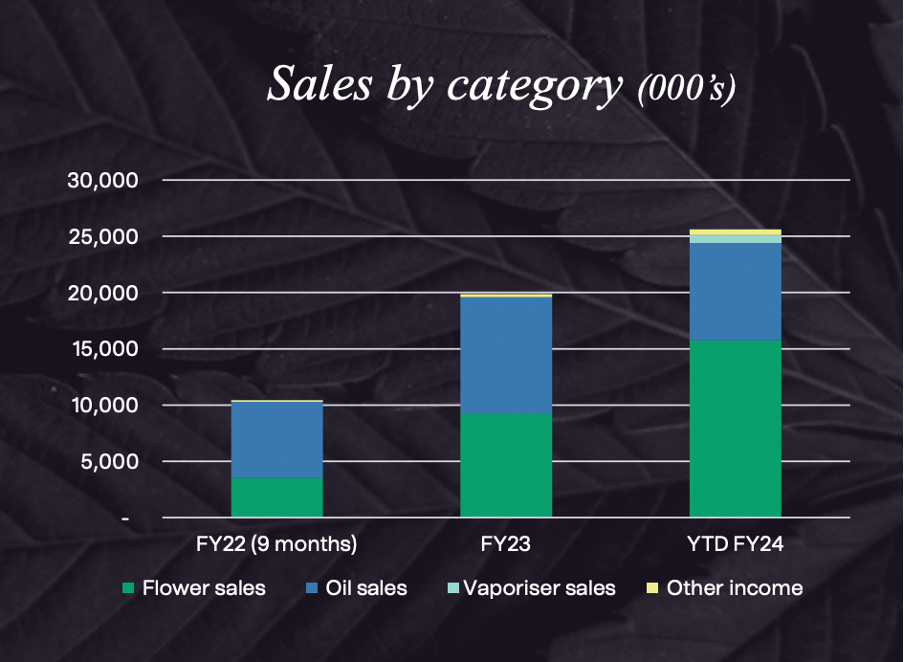

- Revenue of $10.2 million up 40% on prior quarter

- cashflow positive quarter of $0.6 million

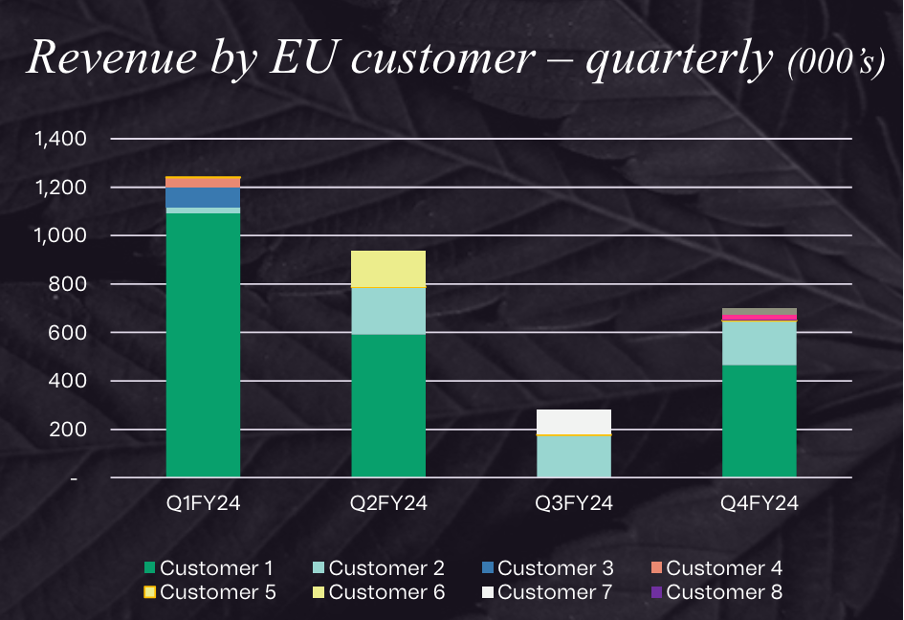

- They are getting some traction in the European market with 60% increase in flower sales into Europe with over 110% increase in French oil sales

- Scale emerging with 30% increase in cash receipts but <15% increase in operating cash costs

- Cash in bank of $4.8 million, up from $4.3 million

- Seven of original 20 cannabis peers from 2022 currently delisted or suspended from ASX: LGP one of only two companies with positive operating cashflow, and of these the only one with growth

This is the best quarter in the companies history and they appear to be in a strong position to emerge from the rubble of cannabis companies in Australia. LGP have strong branding and this is helping sales.

I sold out of this stock (just a couple of weeks before this pop!) for two reasons:

- This is a commoditised product (despite the strong branding) and Canadian producers have been dumping onto the Australian market. LGP does not have a durable business advantage.

- There is increasing pushback from Australian college of general practitioners and psychiatrists and government regulation is becoming more likely in this area. See here.

For me this is an example of making the right decision for the right reason but getting the wrong outcome.

LGP were close to break even with a negative cash flow of $397,000 last quarter.

Overall this was a sideways moving quarter for LGP with some positives and some negatives:

Positives

Receipts from customers was $8.2 million, up 19% on prior corresponding period. May a record revenue month of over $3.0 million. This is annualised to about $29 million (FY24 $25 million).

CherryCo sales up 19% on record prior quarter despite sales-driven stock outages in April.

LGP are investing into their new Smalls product range with outflows comprised of about $0.5 million in additional thirdparty inventory and SKU-related costs for the launch of new brands.

Capex expenditure down significantly to $20,000.

Staff costs were down $750,000 on prior quarter

Negatives

Receipts from customers was flat compared with the prior quarter.

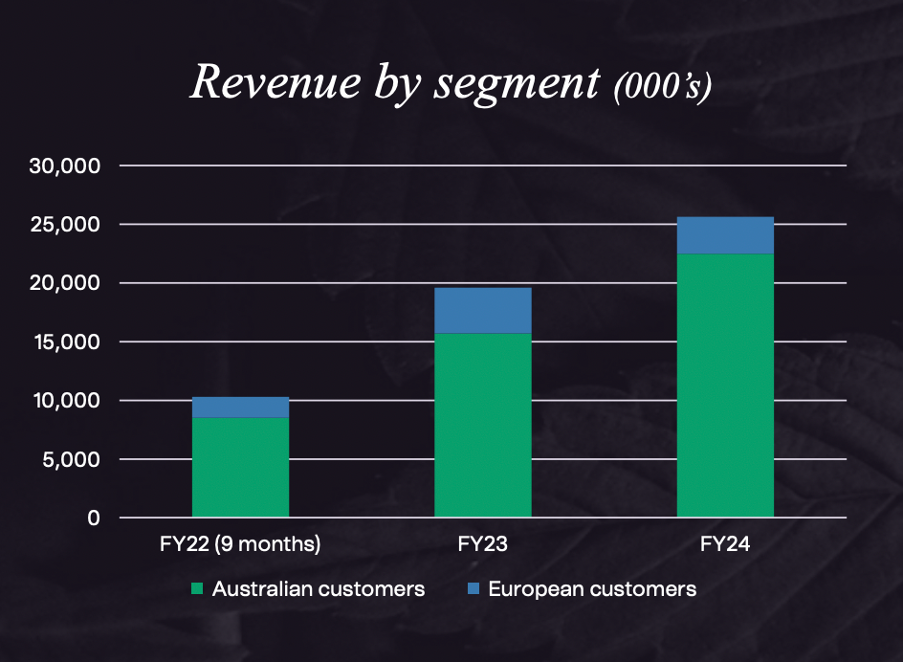

Overall flower sales were down 8% on record prior quarter (This was offset by oil and vaporiser sales which were up 17% and 23% respectively). However management did not indicate why there was a fall in flower sales. I would speculate and say it could be competition, especially cheap imports effecting both price and volume of sales. Another possibility is they were supply limited as has been the case with their new popular CherryCo brand. It is also possible that overall flower sales declined in Australia last quarter. If their flower sales in Australia are being competed away then LGP have very little control over their market share and this business would be uninvestable.

This is a deep value play in a discarded sector in the early stages of consolidation.

Specific thesis:

LGP’s will demonstrate cash flow positivity in their next 4C without the use of an R & D government grant.

Failure to do this will be break the thesis and I will exit the position.

Excellent interview again Andrew and just wanted to add some thoughts in addition to his after rewatching it.

Brand is important

The Australian medicinal cannabis market is becoming brand sensitive. This has been important in competing with imported products. LGP have seen this as an opportunity and can see the market moving toward a "FMCG" - Fast Moving Consumer Goods style market. One that is creative and innovative.

Their "cherrico" brand is the first in this style of product and Paul said that they are completely selling out of this product as they bring it to market. This has encouraged LGP to pursue other FMCG style branding which will include a premium brand and one aimed at females.

Their understanding of the acquisition costs for a patient and how long they stay on a product is driving the move to a FMCG style product.

Complete legalisation of cannabis, which Paul said is inevitable and would be welcome, would significantly open up the market. LGP's FMCG branding would be well positioned in this market eg quick over the counter sale from a convenience store.

There is a craft style product demand in the market also ("like buying a $100 bottle of wine on a special occasion rather than the $15 bottle for Monday") will be met with a future partnership with a Canadian producer which will be a new brand.

Cashflow positivity

Paul said, "we were cashflow positive with R&D in our last financial year AND in our last quarter"

To understand this statement it is important to know that LGP's financial year ends the month of March. LGP have previously told us that they were cash flow positive in the last quarter of their financial year (which is the first quarter of this calendar year) including the R&D rebate. They are no longer getting this rebate because they have passed the $20m turnover threshold. So when Paul says "and in our last quarter" he means the quarter just gone. In my opinion this is an important piece of information as it suggests LGP were cash flow positive in the quarter just gone without an R&D rebate. If true this is a significant inflection point for the company.

France is a big opportunity

LGP were one of two companies who supplied cannabis to a big national French trial. Because of this they will have a 1-2 year first mover advantage when France likely move to a similar model to Australia's prescription style cannabis market. Paul said France has a 15% illicit cannabis penetration compared with Australia who were 10% illicit penetrated prior to the change to prescription medicinal cannabis where there has now been 3-4% conversion.

If France were to have a similar conversion rate to Australia then they would reach about a 5% conversion of the population to prescription cannabis. The population of France is about $68 million so this would be about 3.4 million people using prescription cannabis. This is about 6 times the current size of the Australian market.

As Andrew has already pointed out that their nearby Danish facility is currently only producing 4 tons of a 30 ton capacity and Paul mentioned twice that they have a relatively "fixed cost base" and could scale their Danish facility with minimal additional staff and by "turning on the lights".

Risk

Not much was mentioned which is not a surprise! Paul did say that Africa and South America are the cheapest producers.

Final thoughts

I suspect that as cannabis becomes further deregulated it will become a differentiated product with many quality tiers perhaps not that different to drinking wine. Companies with a strong brand and high quality product will be well placed in this style of market.

The first thing that LGP need to do is demonstrate that they can travel forward as a company under their own steam financially. The CEO suggested in this interview that LGP were cash flow positive in the quarter just gone. They will report to the market on 29 August and we will see if this is an inflection point for the company.

Disc Held

A pot stock that continues to remain unprofitable, and whose share price has dropped ~90% from its peak?

Not something that would capture your attention, but I thought Paul made some interesting points in today's interview:

- A lot of 'hot money' flowed into the sector during the easy money days circa 2020. This led to over-investment, over-supply and irrational competitor behaviour. But this is slowly being washed out, and Paul hinted that there would likely be some consolidation in the space

- Indeed, they picked up a ~$100m facility for $20m, and are currently using only <15% of capacity

- The regulatory lead time to get proper approvals is a period of years -- which gives them a bit of a head start to any would-be new entrants

- Adoption rates have grown significantly in Australia -- from 1% of adult population to 4% in a few years.

- Australia represents 90% of their business, but over the next ~5 years or so, he thinks 90% will come from Europe.

- Costs have been held steady for a couple years and the business is very close to cash flow positive. They will lose their R&D rebate soon (as they are now too big to be eligible) but as volumes grow they expect to scale into profitability

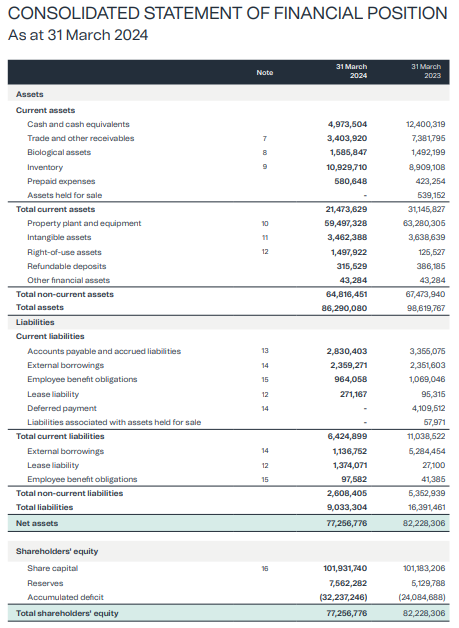

- The company's market cap is presently $30m and the enterprise value slightly less at ~$28.6m -- but the net asset position is $77m:

- Even if you write off ALL the inventory, forget about any accounts receivable and intangible assets, and even if you halve the value of land & buildings, you still have a NTA per share of ~10c per share (ie the current share price)

- Of course, they are losing ~$7m per year on a statutory basis, so at a 50% margin they'll need to see a sales increase of at least 60% to be in the black (all else being equal)

- This wasn't discussed during the call, but last year they spent $6.3m on R&D, which seems like a lot (especially on top of almost $8m in G&A and Sales costs). I get that they argue product consistency and quality are paramount, but still.. On the plus side, it feels like a lot of money could be saved on that front (potentially) if they needed to.

- I think there's genuine and growing legitimacy to the sector, and we will likely see a maturation of the industry in the years ahead. LGP do seem well placed to capitalize on this trend, but shares really seemed priced for disaster -- perhaps a hangover form the previous irrational exuberance in the sector? And, as Paul mentioned, expectations for another raise.

- There's a deep value case to be made here so long as you think they can sustain reasonable sales growth while keeping costs contained.

Cannabis clinics are driving the increase in cannabis flower sales in Australia.

The model is clinic like Alternaleaf provide a telehealth consultation for $59 no referal needed.

Access is very easy if you have one of these conditions:

Leafio is their distributor which has a number of suppliers one of which is Little Green Pharma. LGP run about 1/4 of their sales through these clinics who take a 30%+ commission.

Alternaleaf recently had the Therapeutic Goods Administration (TGA) launch court proceedings against the sponsor’s parent company for breaching the Therapeutic Goods Act for advertising on The Dolphins jersey who were forced to tape then remove the logo.

Alternaleaf is owned by Montu which is a private company. Corporate records show Montu earned $96 million in revenue in Australia last financial year – an annual increase of 471 per cent.

The TGA, "Alleged that Montu and Alternaleaf unlawfully advertised medicinal cannabis using terms including ‘medical cannabis’ and ‘plant medicine’ to promote the Alternaleaf online clinic, which enabled patients to purchase prescription-only medicines after completing an online consultation process."

Some of these cannabis clinics have been set up to purely capitalise on on the boom in regulated cannabis flower sales and don't have an interest in genuinely promoting the medicinal benefits. There is some unconventional promotion by these companies which is drawing the ire of the TGA. PlantMed have sponsered an event called Buds & Bowls a Brisbane event that included DJ sets, lawn bowls and a tent in which patients could vaporise their medicines.

Aggressive advertising tactics employed by parts of the industry have also attracted scrutiny from psychiatrists, who are concerned that products containing THC are being inappropriately prescribed to young patients at risk of psychosis. There is a risk that these clinics, which are on the boundary of illegality, will be shut down/regulated. This would affect some sales for Little Green Pharma and more importantly have a broad negative impact on the industry.

Sharing some thoughts on a company called Little Green Pharma (LGP) that I have been following for a few years and have recently started buying IRL and here on Strawman.

In a nutshell this is a deep value play.

LGP is a medicinal cannabis business. There was furious excitement for medicinal cannabis companies in 2021 when share prices peaked. Since then market sentiment has fallen and the share price for these companies is in the dog house. Most of these companies are loss making. We are now in a period of consolidation for this sector. When market sentiment is poor like it is in the cannabis sector the baby can get thrown out with the bathwater.

The industry is a strange mix of “health and wellness” companies, biotech’s rolling the dice on specific applications for humans and in some cases animals, the cannabidiol (CBD) sleep bros and traditional dry flower growers/producers for medicinal purposes. Majority are private companies in Australia.

According to data from Australia’s Therapeutic Goods Administration (TGA) medical cannabis approvals for new patients through an Authorized Prescriber have continued to grow in 2023. From January to June 2023, the aggregate of all new patients reported was 307,846 compared to 137,111 new patients from January to June 2022 and 30,662 from the same period in 2021.

The Australian Government Office of Drug Control lists 44 entities who are approved manufacturers and suppliers of medicinal cannabis products. Most of these are private companies. Of the handful of public companies I can't find any that are profitable. LGP have said they are cash flow positive in March excluding their R&D rebate. I think their business is at an inflection point and no one is looking.

In my opinion medicinal cannabis flower sales are growing because there is a transition from illicit sales to prescription sales. This is a reflection of the softening regulation occurring in all markets which makes the logistics of transport, storage, accounting and access of cannabis easier. As the public perception of cannabis becomes less negative it use is moving into new areas such as elderly people with terminal cancer.

LGP was the first company in Australia to grow medicinal cannabis for domestic use. Their main facility is in WA. In 2021 LGP acquired one of Europe’s largest medicinal cannabis cultivation and manufacturing facilities in Denmark for $21m from Canopy Growth. This was at a significant discount to the asset value.

Majority of sales are in Australia. LGP had record quarterly revenue of $7.3 million, up 34% on previous quarter.

Flower sales were up 57% on the previous quarter and are growing strongly. LGP has strong branding and a good product. Australian sales were up 27% from the prior quarter predominately due to the introduction of CherryCo flower. See this review (https://www.youtube.com/watch?v=ZrtqEhzbIR4)

European sales are choppy. On 1 April 2024 cannabis was legalised in Germany with its removal from the Narcotics List and there are early signs of strong patient uptake. LGP’s Danish facility is two hours from the German border and in an excellent position to capitalise on likely improved medicinal cannabis access pathways. LGP was one of two companies supplying a French medicinal cannabis pilot which ended on 27 March 2024. They will have early access to this market. LGP also sell to UK and have just started selling to Poland and Switzerland.

Also the US Drug Enforcement Administration have just confirmed they will recommend reclassifying cannabis from Schedule I to Schedule III. The news has resulted in a re-rating of North American cannabis companies with the MJ ETF and the MSOS ETF both increasing by over 25%. This sector re-rating is expected to flow through to other cannabis companies including LGP given the historical mirroring of the North American markets. The proposed rescheduling would remove s280E taxes which tax cannabis operators at their gross margin level (versus net income) and generate potential momentum for other pro-cannabis legislation at the federal level and increased institutional interest in US cannabis stocks.

The US cannabis companies are the biggest. Most seem to be loss making.

Here is a snap shot of the largest by revenue Curaleaf Holdings (CURL):

Revenue $1.3b

Operating income $43m (noted almost half a billion dollars for Selling and Administration expenses!)

Net income $-280m!! (after tax, impairment of goodwill, interest on debt)

Haemorrhaging cash big time. A lot of consolidation is happening/ gonna happen.

LGP finished FY24 with a positive operating cashflow of $0.5 million. This included a $5m research and development rebate. The month of March being operating cashflow positive in its own right without the R&D rebate.

Management and employees own about 20% of the company so strongly incentivised.

LGP’s net tangible assets are significantly above it’s enterprise value. This means that the value the market has given LGP as a business (about $40m) is less than the value of it’s assets (about $80m)! In other words the share price is deeply discounted. This company has been priced to fail but the market is wrong in my opinion.

Thesis: significantly undervalued company at a profitability inflection point driven by a transition of cannabis flower sales from illicit to prescription

Risks:

The cannabis sector is still bloated and full of loss making companies many of which will fail

This is a commodity business to some degree with a rapidly shifting regulatory framework

Purchase of Denmark cultivation/ production facility

- LGP recently purchased (21/6/21) a Denmark cultivation and production facility for A$21.4m

- This is capable of producing 12 tonnes pa of dried flower

- Its production facility in West Australia is hitting output capacity limits as a result of orders which has an output of 1.5 tonnes pa of dried flower

- This increases output from 1.5 -> 23 tonnes pa

- New facility in EU avoids many EU export/import barriers allowing early mover advantage in EU markets

- Efficiency gains through economies of scale

- Maintains LGP's focus on medicinal cannabis

Headwinds

- The Faculty of Pain Medicine of the Australian and New Zealand College of Anaesthetists (ANZCA) has recomended to its pain specialists and anaesthetists to, "Do not prescribe currently available cannabinoid products to treat chronic non-cancer pain unless part of a registered clinical trial."

- The Dean of the Faculty of Pain Medicine, Associate Professor Mick Vagg, a specialist pain medicine physician, said while managing chronic, non-cancer pain is complex, there has as yet been no evidence from clinical trials to support the use of medicinal cannabis as a treatment.

- A study called the QUEST (Quality of Life Evaluation Study) is being run by Sydney Uni. It has recruited 805 patients and includes Professor Stephan Schug as an advisor who is a recently retired Chair and Director of Anaesthesia and Pain at Royal Hospital.

- I am an anaesthetist. There is currently a very low prescriber rate for cannabis products amoung our profession.

- The outcome of these higher quality studies are important in determining whether these products will be incorporated into the armentarium of doctors