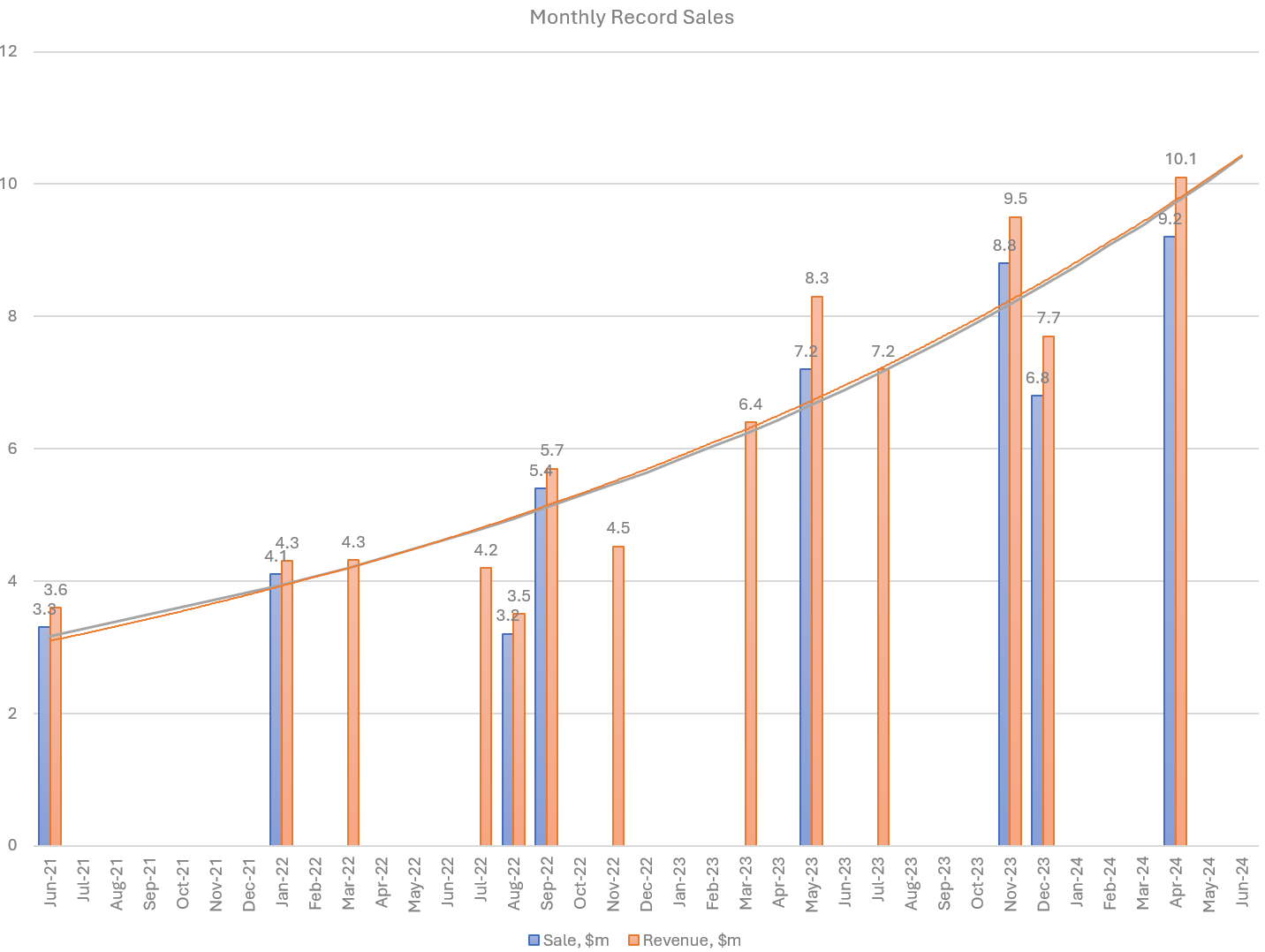

The frequency of these "record" months is gradually increasing, as you'd expect: 8-9-8-6-5 (time in months befween recent records).

Just to help understand the lumpiness, I've plotted all recent reported and inferred monthly sales and revenue numbers, and fitted the revenues with a best fit curve (a couple of different exponential growth models, actually). Its a reasonable fit to the data, and the difference between the curve and the orange bars gives a PARTIAL indication of the lumpiness (partial because the dataset is incomplete, and the data is biased towards high revenue months). The actual sales performance will be even more lumpy!

Note the curve is not a curve of revenue, but a curve biased by the reporting of Record Revenues (those reported numbers, plus values I have been able to backout from other results when they have disclosed 6m-ly, quarterly, or YTD values). To estimate the revenue curve you'd have to subtract an offset so that the area under the curve gives the reported annual or 6-monthly revenue .... which I haven't done.

You can get a sense of the lumpiness by looking at how far the Aug-22 bar and May-23 bars are from the curve: about +/- $1.5 million, so the range between a good month followed by a poor month appears to be around $3m!

Another point of value in the curve, is that it causes you NOT to look at the May-23, Nov-23, Apr-24 results and conclude there is a trend that growth it slowing. The individual monthly numbers are too lumpy for that to be a valid conclusion with any reasonable confidence.

Despite the limitation, the picture helps visualise the level of lumpiness against an underlying strong growth trend.

WARNING: don't even think about extrapolating the curve!

Of course, all this analysis is unnecessary, and I just wish they'd report quarterly numbers for revenue, rather than these sales records, which are hard to gain meaningful insight from, as I've tried to explain.

At this stage, however, $PNV appears to be sustaining a rate of revenue growth well in advance of the consensus forecasts for the next year or two. I estimate we are likely to come in just over FY24 consensus of $102.7m (but who can possibly tell given there's at least $3-6m of uncertainty remaining due to lumpiness.

Importantly, FY25 revenue growth "consensus" of +30% looks undemanding, given the current trajectory.

Disc: Held in RL and SM