As @Nnyck777 has highlighted, $ACAD announced their Q1 results including sales for DAYBUE.

I attended the call early this morning, and wanted to drill into the results in a little more detail. (all numbers USD)

While sales of $75.9m represented a decline of 13% over Q4, this had been signalled at the FY23 results presentation in February.

$ACAD has retained 2024 Guidance of $370-420m.

Decline, what are you talking about?

So, why the decline, if such strong growth is expected for the FY? Three reasons have been cited:

- Many patients who started in Q3 and Q4 faced admin delays with payers over the holiday season

- The initial surge of new patients in Q4 also saw a high level of discontinuation, as not everyone can tolerate the drug well vs. the benefits they see

- Severe weather during the East Coast winter saw access to prescribing physicans, especially, the important Centres of Excellence fall, due to a reduced number of "Rett Clinic Days"

$ACAD reported that prescribing has now picked back up, with the last 6 weeks showing postive net patient additions. Because of this they are holding to their guidance for the full year. The high level of discontinuations in the early part of the year as a result of the surge in prescriptions in Q4 has now levelled off.

My Revenue Analysis

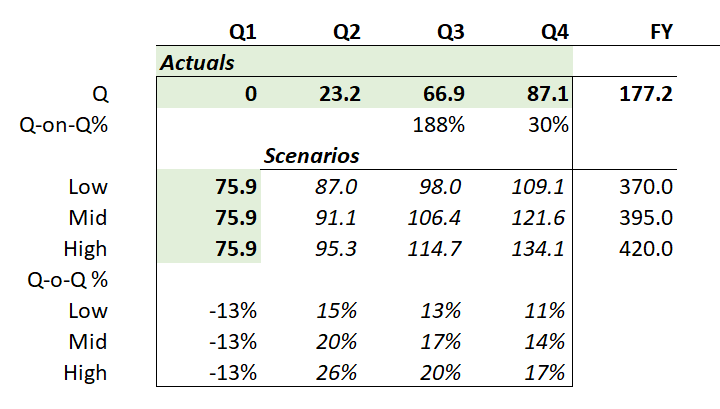

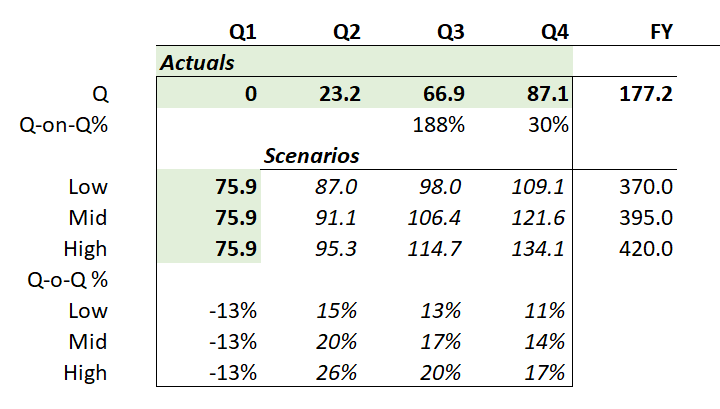

The table below indicates the kind of quarterly revenues that will be required to hit the revenue guidance range of $370-$420 (midpoint $395)

Table 1: Daybue Sales Scenarios Required to Hit 2024 Guidance

So how reasonable is this?

Well, at the FY call, $ACAD disclosed the following information, in terms of number of patients taking the drug:

- End Q3: about 800

- End Q4 about 900

- 27th Feb: 860

- 8th May; [862]

Today, I think I heard them say there are 862 patients on the drug (I'll have to check the transcript when it comes out as I am not sure I heard this correctly).

If that's true, and if 862 represents 6 weeks of net additions, then its likley that Q2 Revenue could reasonably get back to the low point or the mid-point of guidance. What we don't know if what the trough was and what the rate of recovery has been.

If they could get back to 900 patients by end of Q2, that would require net weekly addition of 5-6 patients. At that level, average patients for the Q would be about 870-880, compared with c. 850 in Q4. So, in broad terms, you'd expect Q2 revenue to be north of $87.

Importantly, with all this information and the "noise" of Jan and Feb out of the way, the Q2 result is going to be a key predictor of longer term growth. This is for three reasons: 1) the intial surge of highly motivated patients has passed, 2) we will be clear of the seasonal noise and 3) the product is now moving into a more steady state / linear growth phase.

Other Key Insights

To date, 1300 of a prescribed population of 5000 have started taking the drug.

Although it is believed that 6000-9000 people have the condition in the US, and it is expected that there will be increased diagnoses, we haven't heard any evidence of that, as yet.

9-month persistency is 58% (versus 47% on the Lavender trial), so the real world setting outperformance on persistency above the clinical trial appears to be holding up.

Importantly, $ACAD have reported that of the patients who took the drug during the Phase 3 trial, more than 50% are continuing to take the drug after 2 years. They further said that discontinuations are at a maximum over the first two refills, and decline significantly after refills 4 and 5.

On discontinuations, they have observed the following:

- Some patient discontinue before they have titrated to the effective dose and therefore may not be seeing the benefits

- Some patients prescribed outside of COEs, may be starting on the label dose, and then discontinuing due to GI side effects

- They are having success with GI management plans

Overall, as experience with the drug grows, they believe there is an improvement opportunity to help physicans and patients 1) have realistic expections 2) be patient to wait for benefits to show through and 3) improvement management of side effects.

International Timeline

We got some more specific details on the timeline:

- In Europe, they have engaged with the EMA, who has agreed the Pediatric Investigation Plan (PIP). They expect to file the NDA in Q125. (I think this indicates that a decision in 2025 is possible, depending on the priority given by the EMA)

- In Japan, they have scheduled a formal meeting with the PDMA to "discuss clinical plan"

- NDS (New Drug Submission) has been accepted for filing in Canada, and priority review granted. Decision is expected around end of 2024

My Conclusions

These are OK results and $ACAD appear to be managing the challenges that come from patient experience with the drug.

It is important to be realistic. Rett's is a very challenging condition for sufferers and their families. The drug does deliver some benefits, but not to everyone. And treatment brings unpleasant side effects to many. Depending on the individual patient experience of benefit versus discomfort, a significant proportion of patients abandon treatment.

It is encouraging that Canada have granted priority review. The decision in Canada later this year will be a key marker as to how a regulator assesses the drug with a longer body of clinical trial and real world experience to consider. The Canadian decision will be a key leading indicator for the EU and Japan.

From my reading of the report, the low to mid range of guidance remains on track. The upper end looks challenging and potentially out of reach. Where we end up will depend as much on how successful $ACAD are in their sales and marketing execution, particularly as they move beyond the COE's into the large institutions and small clinical practices.

I am less bullish about DAYBUE that I was at the end of last year. Today's result was less definitive than I had hoped, as it is not clear what the current trajectory is.

I am not sure how on top of the $ACAD details the Australian investment community will be, and it will also be interesting to hear how $NEU portrays the results.

In any event, much of my investment thesis rests on NNZ-2591, so I remain a HOLD. Today's result indicates that sales of DAYBUE are recovering from the early bumps in the road. But Q2 will be an important confirmation.

(Will post a brief update when I can access the presentation transcript)