Yep, I agree too. And in relation to your other post @mushroompanda this is where I am most confused - more than a 50% reduction in revenue is obviously significant - basically the European segment at a standstill for three months. This leaves me with two main questions.

1) were they aware of this, and if so, why didn't they report it earlier?

2) were they blindsided?

Either way, its bad -- they either haven't met their disclosure requirements or they are incompetent and didn't realise a key business segment had some serious issues. Option 2 in particular suggests they don't have their ears to the ground. Perhaps supportive of this option, like @Slomo alludes to, is recent director buying (including the founder, Hales) in Feb. If you see an issue coming like this, you would be nuts to buy shares on market with this on the horizon. This suggests to me in Feb they knew likely knew bugger all about the glaring issues in front of them. That in itself is mind-boggling for me.

@Slomo like you, I spoke positively about Camplify in the last fortnight. Two kisses of death are worse than one! Whatever the outcome, firstly, it is clear the update was a poor one. It lacks transparency and frankly I have more questions than answers as a result. Consequently we have likely seen the share price take a bigger whack than it otherwise would have if they were just up front about their issues and own their error.

Does a one-off hit to revenue -- the result of an integration delay -- warrant a company being worth 25% less? Absolutely not. But I dont blame holders for running for the hills with such uncertainty in the update.

If we see another revenue grab in the short to medium term, particularly with shares where they are, I would suggest this is a serious red flag (another one) and one that is not worth hanging around for. The tent hire business was already an orange one and quite frankly lacks focus when the business is in such a change period.

I still think the outlook is favourable for Camplify, and the glass half full in me wants to believe this is a one-off cost due to unforeseen issues or a screw up. Learn from them and get back in the ring. But I would be lying if I suggested doubt hasn't started to creep in after this release. This is also the first real cross mark against management's name. I don't expect them to get everything right along the way but when they do screw up, I expect that they will address and own it -- don't drop a half-arse update that leaves us wondering.

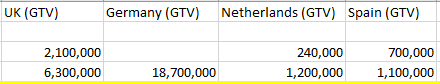

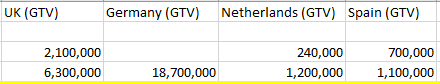

In terms of the growth runway, my gut tells me there is plenty more left to come. The idea of using vans as accommodation is still quite new, and is undeniably more common among those under 35 -- the same group who also happens to travel the most. Additionally, when you compare the Gross Transaction Value (GTV) for key PaulCamper markets in H1 FY23 and 24, there are clear increases in the UK, Dutch and Spanish market (as below - top line is H1 FY23 and bottom line is H1 FY24). We aren't given German data, so can't make an assessment there, but the increases alone in the other markets suggest PaulCamper is at least recording increases in transaction volumes (well, was).

In short, I have no idea what has caused revenues to fall off a cliff during the integration and that has left me wondering. I also don't like how management have dealt with it. @Slomo I think you are spot on -- if its a one-off issue, shares are cheap, with a current market cap under 80m and 2x trailing revenue. The other option has increased in likelihood following this update: we see more downgrades, management are out of their depth and they search for growth and destroy shareholder capital/wealth.

Disc - I made a small purchase on Strawman last week but haven't yet in RL. For what its worth, I will be waiting for the dust to settle a little before doing any further - i want more info.