As the $NEU SP enjoys another SP pop on the back of no new information at a conference this morning, I thought I'd air something that has been bothering me since I analysed the results of DAYBUE in detail over the weekend.

HEALTH WARNING: the charts I have posted below are the just the results of modelling. Even historical data are not disclosed results and there are discrepancies with disclosed facts. So the analysis should not be understood to be my forecast.

With the disclaimer out of the way, I realised I cou;=ldn't fully reconcile the DAYBUE Q1 sales results with some of the statements made on previous calls. Understandably, with the product in the market for only one year, $ACAD are being careful.

Top Level Question: Can DAYBUE sale reach 2024 Guidance (The market seems to think it can with only modest downgrades to TP's for $ACAD and $NEU)

Facts: What do we know?

Sales Revenue ($US m):

Q223 $23.2

Q323 $66.9

Q423 $87,1

Q124 $75.9

Patients Taking the Drug

Q223: not disclosed; 400 prescribers had written scripts, with 7/10 so far converted to paid prescriptions

Q323: about 800 patients taking the drug

Q423: almost 900 patient taking the drug (ok, I assume 890)

End-Feb: 860 patients taking the drug

End-Mar: 862 taking the drug of 1300 who have initiated.

Other Key Facts

Over the winter holidays there were payer delays with getting refills.

January: significantly reduced Rett Clinic days in over 50% of COEs

January-February: discontinuations peaked (due to massive uptake in Q4) exceeding new starters, hence net patient declines.

For the 6 weeks up to 3-May, net patient adds positive again for each week (which means net declines continued to late March!)

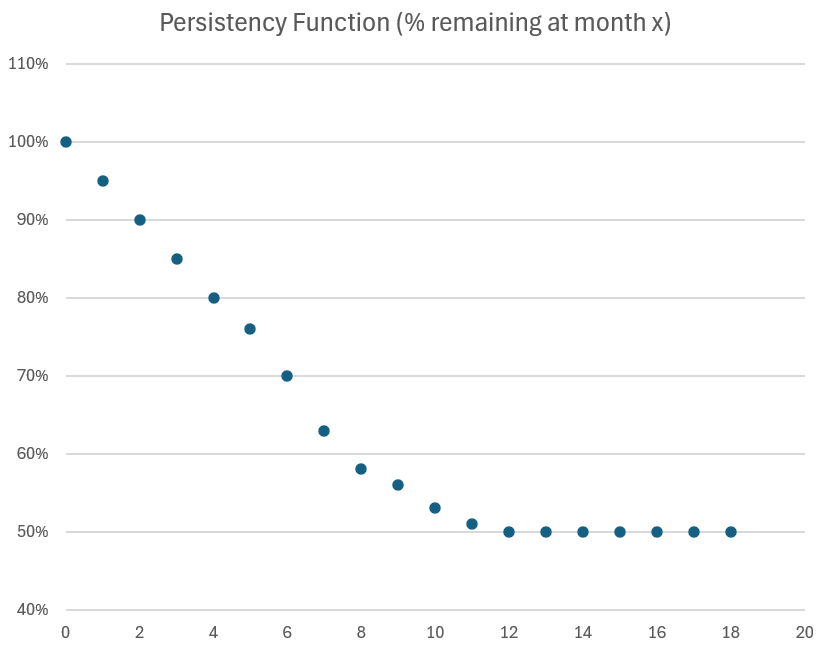

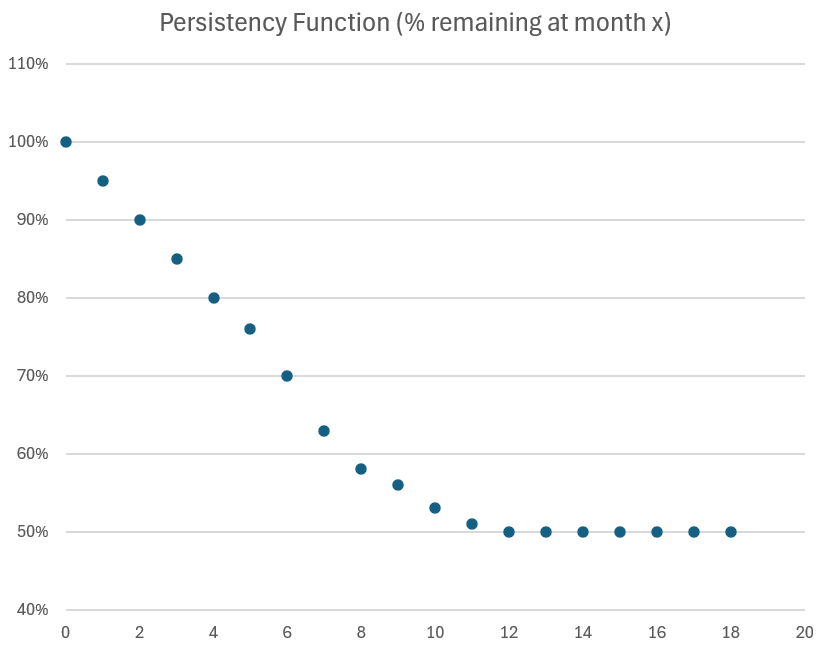

We know the Persistency of the drug over time. Below is my modelled curve which interpolates gaps in published data.For the purposes of this analysis we can treat this as a fact (even though there is long term uncertainty).

Modelling Method

With all the above information, I have built a simple model as follows.

Patients (month m) = Patient (month m-1) x Persistency Function + New patients (m)

Guess and iterate patients in months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11 to fit reported numbers

Ramp down new patients in month Dec, Jan, Feb and March to hit reported numbers

Ramp back new patients from May 24 and hold new adds constant to match company statement that we are entering a more linear phase (this was the report at Q4 results and essentially repeated most recently).

So what will the rate of new patient adds be? That's the billion dollar question.

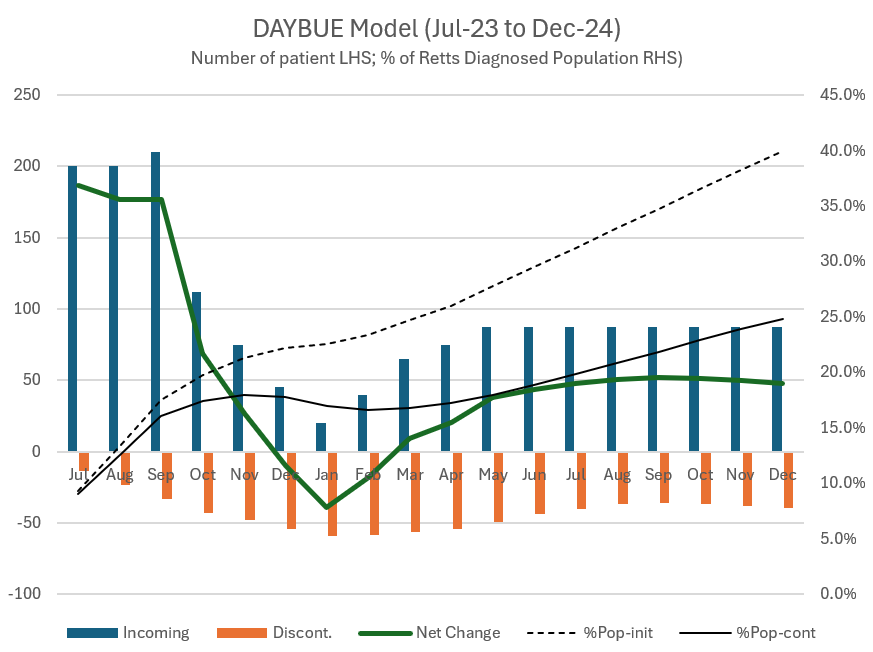

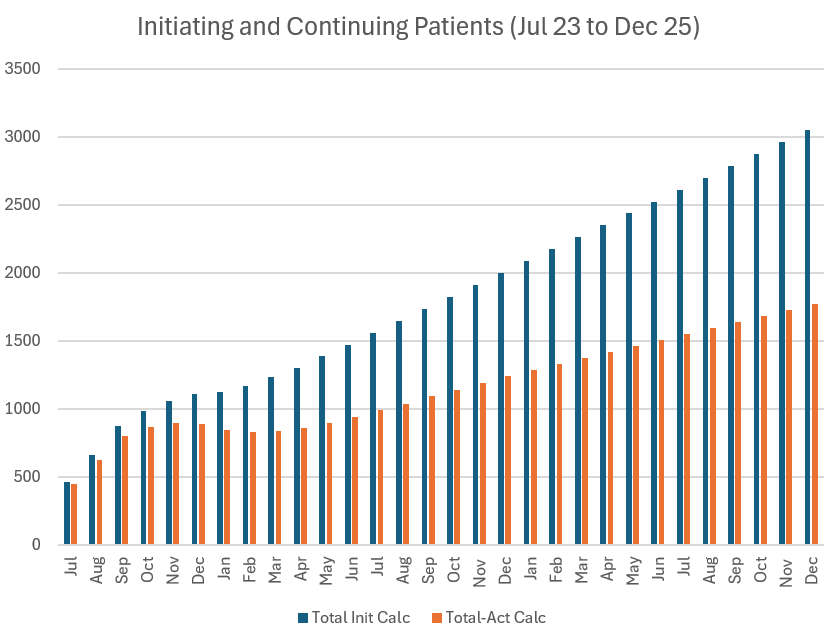

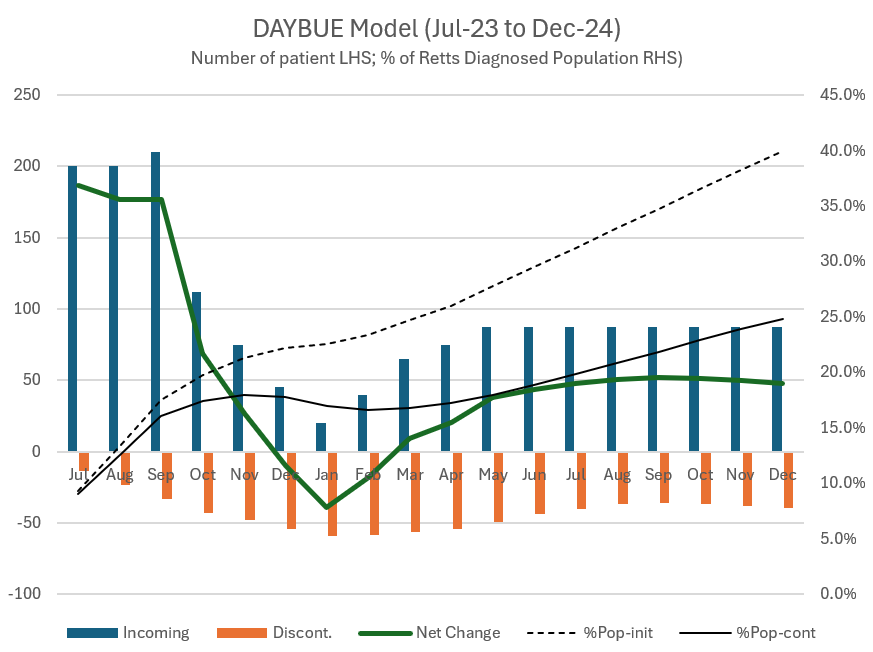

In the scenario below, I've modelled 88 per month. That would take them from 1300 patients having started the drug by end April 2024 (26% of the US diagnosed population) to 2000 (or 40%) by end 2024.

Note: you can't do the maths without the model because you need to apply the perisistency function to each cohort.

Here's what it looks like.

Revenue Calculation

This is the hairy bit. I do a prop rata calculation on the quarterly revenue based on the average modelled number of patients taking the drug in the quarter and BINGO. (I could have been more sophisticared and taken the unit price x n x 75-80% average rate, but I am nore sure that this leads to a better answer. Add to the "to do list".)

For the scenario shown above, my modelled 2024 DAYBUE revenue is: $US346m (versus guidance of $370m to $420m)

So, if I believe the model, the question is what level of monthly new patient adds do I need to hit the bottom of guidance.

Answer: 116

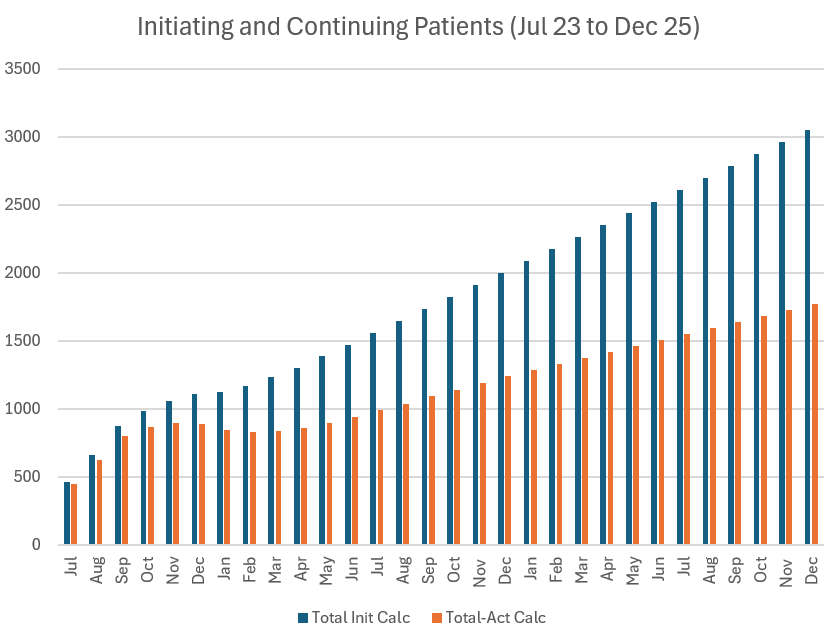

This gives end 2024 patients of 1428 with 2225 having initiated, which is 44.5% of the diagnosed population.

If they can sustain that rate of patient adds, they'll get to 2313 patients by end 2025, with 3613 patients having initiated or 72.3% of the diagnosed population.

I won't model higher rates because I don't think its credible. Here's why. Reaching the entire population will be a challenge. My scenario above assumes linear growth is sustained, which is very unlikely into 2025 as you start to penetrate the second half of the population. (New adds will follow some kind of exponential decay function).

One reason uptake will fall off, is that a significant proportion of the population will likley elect not to try the drug. Side effects and limited efficacy will put some off. Furthermore, there will be accessibility issues.

Implications

First, maybe my modelling is wrong. But do far I haven't found the bug.

Second, maybe my revenue calculation introduces signfiicant error. After all, the model predicts that Q124 revenue should have been $88m, whereas is was $76m, but maybe they really got hit bad by reimbursement delays over the winder holidays?

But if the model is right, why didn't $ACAD update guidance? Who knows. Maybe they want a clear quarter, so they can update when they report in August. But by then if my model is right it will be very, very clear. So continuous disclosure obligations would push them to announce an earlier update.

$ACAD have better data than me, and would be able to build a much better model. (Mine only took an hour's work!)

The Bear Thesis

DAYBUE sales were blamed on seasonal effects impacting: 1) reimbursement and 2) new patient adds.

The model, which is pinned to reported data, help visualise how significant this must have been. It is interesting to re-read the transcripts with this picture in mind.

$ACAD might just hit bottom end of guidance. Too early to tell. But likely guidance will be revised downwards, once they have a better handle on monthly new patient adds. They only have 6 weeks of stabilisation at the last call, so maybe fair enought.

Implications for $NUE

2024 - the US$50m milestone is safe, so that's great news.

2025 - the next US$50m milestone will just be hit in 2025, if $ACAD hit 88 new patient adds per month and sustain this into 2025. If new patient adds fall in 2025, then it will miss.

Canada will help royalties for 2025.

My rough forecasts for $NEU as follows (consensus in brackets):

88 monthly patient add:

2024 $130m ($152m); 2025 $163m ($172m)

116 monthly patient adds (to be clear, I consider this scenario unlikely, based on the modelling)

2024 - $134m and 2025 - $185m

Implications for the Investment Thesis

The modelling confirms my hunch that the $ACAD results point to more than a seasonal blip.

That said, with Canada, Japan and EU in the pipeline, DAYBUE could still become a $bn+ drug by 2027 / 2028.

However, the weight of my thesis has shifted squarely over to NNZ-2591.

The result on the Phase 2 trials due in Q2 and Q3 this year will guide my portfolio weighting.

In the interim, I am bracing myself for an $ACAD downgrade - which would knock the SP.

On balance, my sense of risk-reward has shifted, and I have taken the opportunity today to trim my position size by one-third.

Investment Strategy

I now have a model to which I can history match the Q2 result. This will add a lot to my insights and projections.

If NNZ-2591 continues positive results in future indications - will add back to my full position as SP allows.

Likely catalyst to add back will be the $ACAD guidance downgrade, which I am pretty confident is only a matter of time. Based on commentary so far, the downgrade will be a surprise and so $NEU will take a hit.

If NNZ-2591 results are not positive AND DAYBUE disappoints, I'd potentially exit quite quickly.

Looking to $NEU Strawman Bulls to challenge this ... after all its a strawman!

Disc: Held in RL and SM