Pinned straw:

20-May-2024: Duratec - REVISED-GUIDANCE-FOR-FY24-AND-BUSINESS-UPDATE.PDF

One negative - Revenue guidance has been reduced to a range of $550 - $565m from $570 - $610m as a result of delays in expected project awards.

That's revenue. What's more important is earnings - and their earnings guidance has been narrowed but is still within previous guidance: EBITDA guidance has been tightened to a range of $46 - $48m from $45 - $52m previously. Tightened towards the lower end, but still within guidance.

Positives:

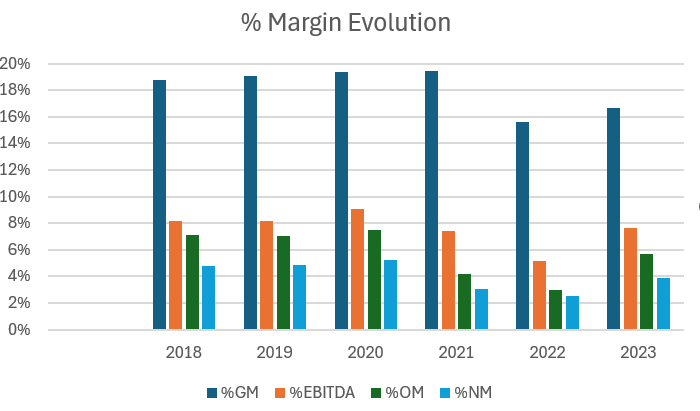

- The Company’s 2H FY24 performance has been solid to date with EBITDA margins increasing due to strong project performance across all sectors.

- Early Contractor Involvement (ECI) projects continue to contribute to Duratec delivering stronger project results.

- The reduction in revenue guidance reflects the delay in expected project awards across the Defence, Mining and Energy segments. These tendered opportunities remain in the Company’s tender section, with the award of these tenders now expected to occur in the first half of FY25.

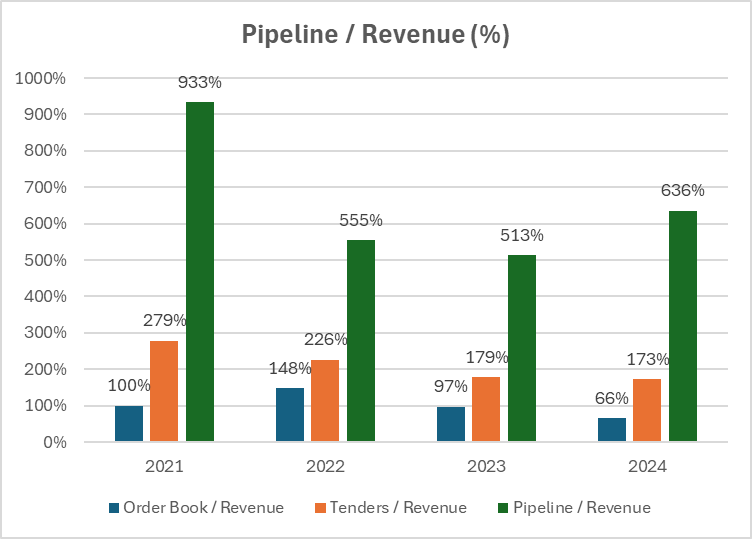

- Duratec maintains a healthy orderbook of $377m with the Company continuing to secure small to medium contracts as well as annuity style projects in line with historical win rates.

- The Pre-Contracts team continue to strengthen Duratec’s pipeline of work and these efforts have contributed to a 40% increase in tendered work to $1.47b and a $200m increase in the pipeline to $3.95b.

- Along with strong project performance, improved margins and increased tenders and pipeline, the Company’s cash generation continues to improve due to the receipt of a number of contract milestone payments and bonding facilities have increased in line with award expectations to ensure further headroom.

So, quite a few positives - and if they aren't telling porkies, then the revenue has just been pushed back into H1 of FY25 - so not terrible.

Holding. Not adding. Not selling. No change to investment thesis.