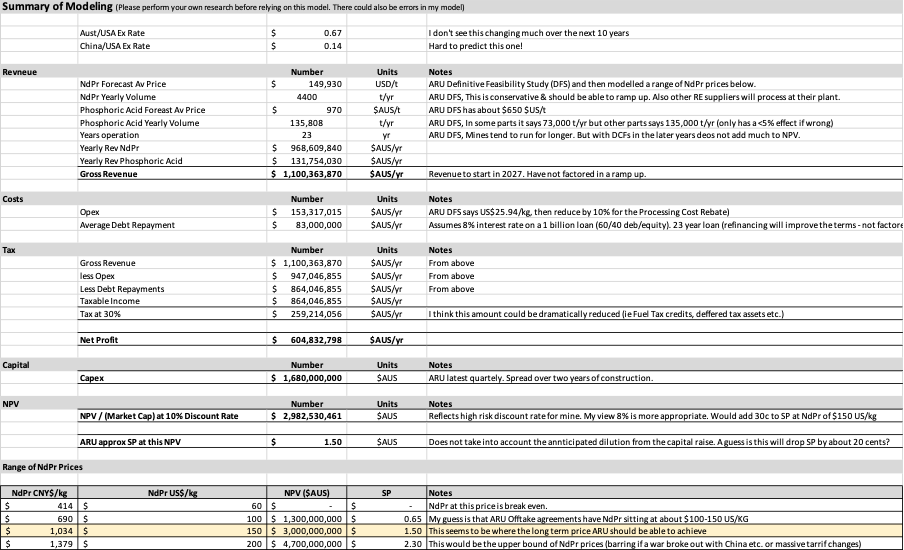

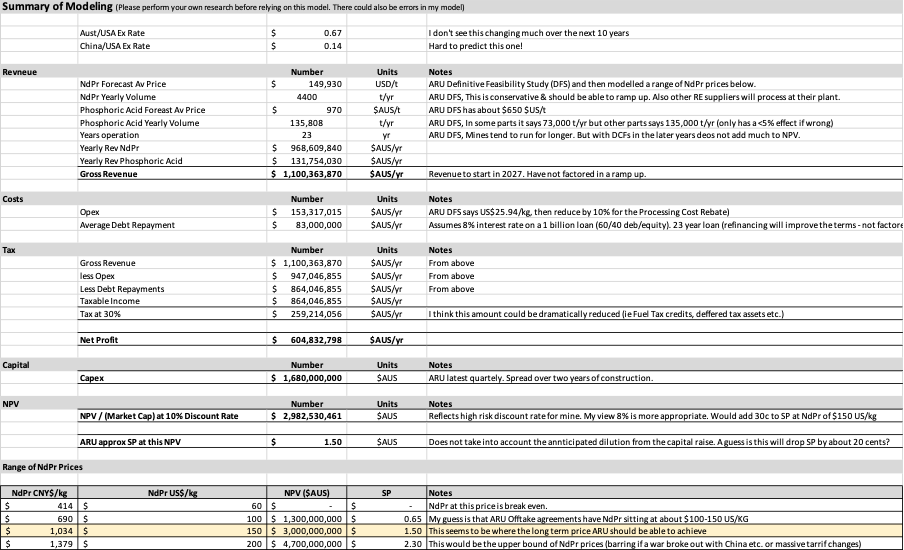

It has been a while since I have tried to value ARU. I have rebuilt my NPV model for ARU given the new information to date.

Notes on my model:

- I have used information from the Definitive Feasibility Study (DFS) (7 February 2019) and updated for recent events.

- My model tries to broadly look at the cash flows for 23 years (mine life). It is quite a ‘coarse’ approach but the results are broadly in line with the results of the DFS which would have generated its results from a much more detailed model.

- I’m not a tax specialist, so I have tried to be conservative with the tax assumptions.

- I’m unsure how much Phosphoric Acid is to be sold (ie revenue) and how much is retained to offset the opex costs. This is not clear in the DFS. But even if I am wrong, it is only a small amount in the total revenue <5%.

- I have used a discount rate of 10%. I think this is quite conservative (especially given the Govt backing). But I have kept it at 10% which was also used in the DFS.

- For those of you running your own model, be very careful with currencies and units. Lots of data is provided in Chinese, USA and Aust. And different units like Kg, Tonnes etc.

- It does not factor in the dilution that will happen in the final equity raise.

Key points to note:

⁃ NdPr Pricing - The NdPr price obviously is key to the profitability of ARU and its corresponding Share Price. So to invest in ARU you need to take a view of the future of NdPr pricing. So I note the following on NdPr pricing:

o ARU will have lowest opex cost to produce NdPr. So it will have higher margins but also importantly, if the China tensions disappear (unlikely) it can ride out the troughs of NdPr pricing. Also, there is only so long China can sell NdPr at a loss. Or if they do, it will make western countries nervous. They are backing themselves into a corner with this price suppression strategy.

o ARU has locked in NdPr Pricing in its offtake agreements that are well above current spot market pricing. This means ARU will be profitable in the short term.

o NdPr demand is growing (even with the recent media saying it is not). And there are just no other NdPr projects coming online soon at scale. This will give monopoly type pricing power for ARU for its remaining 15% of supply. And if we can ramp up production, just adds to the profitability.

o The USA (and soon Euro) China tariffs will create large demand. These tariffs could be increased if Trump wins. This is a massive tailwind for NdPr pricing. I’m yet to estimate the impact of these policies. But I would expect it to be quite large. Again….this is NOT factored into my model’s assumptions.

⁃ Additional Revenue - ARU should be able to process other companies’ deposits (Minhub?). This is another revenue stream not factored into the model. We have asked ARU to clarify what it can do in this respect. Also, ARU have stated they will seek approval for Phase 2 for Nolans with much more NdPr below 200m. Either of these events will warrant a rerate of the SP.

⁃ Cost Overrun Risk - Much of the risk for a rare earth project is getting the processing plant working as designed. Lynas had massive issues in the early days. ARU has been on a 20-year journey. So there has been a lot of work done in this space. And the Cost Overrun Facilities provide a good-sized buffer should things not be quite right. So I think this risk has been managed quite well. But something to keep an eye on towards the end of construction and into the ramp up phase.

⁃ Processing Cost Rebate - The 10% government Processing Cost Rebate is great. But if it is removed by the Liberal Party, it will not have a massive impact on ARU.

The ARU Model:

Here is a screen shot of the inputs/outputs from my ARU model:

Conclusions:

- The modelled cashflows show a SP around $1.00-1.50 is realistic.

- NdPr pricing is likely to be strong given the current and prospective geopolitics and commitment of Governments to the energy transition.

- ARU has great potential for additional revenues (more NdPr onsite, additional processing of others, acquisitions).

- Senior management’s incentives aligned with shareholders.

- Strong environmental credentials.

Note - I will also post on Hotcopper.