Pinned straw:

Yeah i think we went through this one post the interim, its my biggest position due to SP, i let some go, i don't like to sell out of these stories completely, and sometimes it can be hard to buy back in. having said that any pullback i will replace the sold shares circa $24. i think your conclusion was it could be a volatile but rewarding ride. to each his own

Well articulated case, and yes, it is hard to see much upside from here, though high quality companies can surprise positively.

"Good things tend to happen to great companies..."

@ballermania I've been thinking along the same lines as your straw.

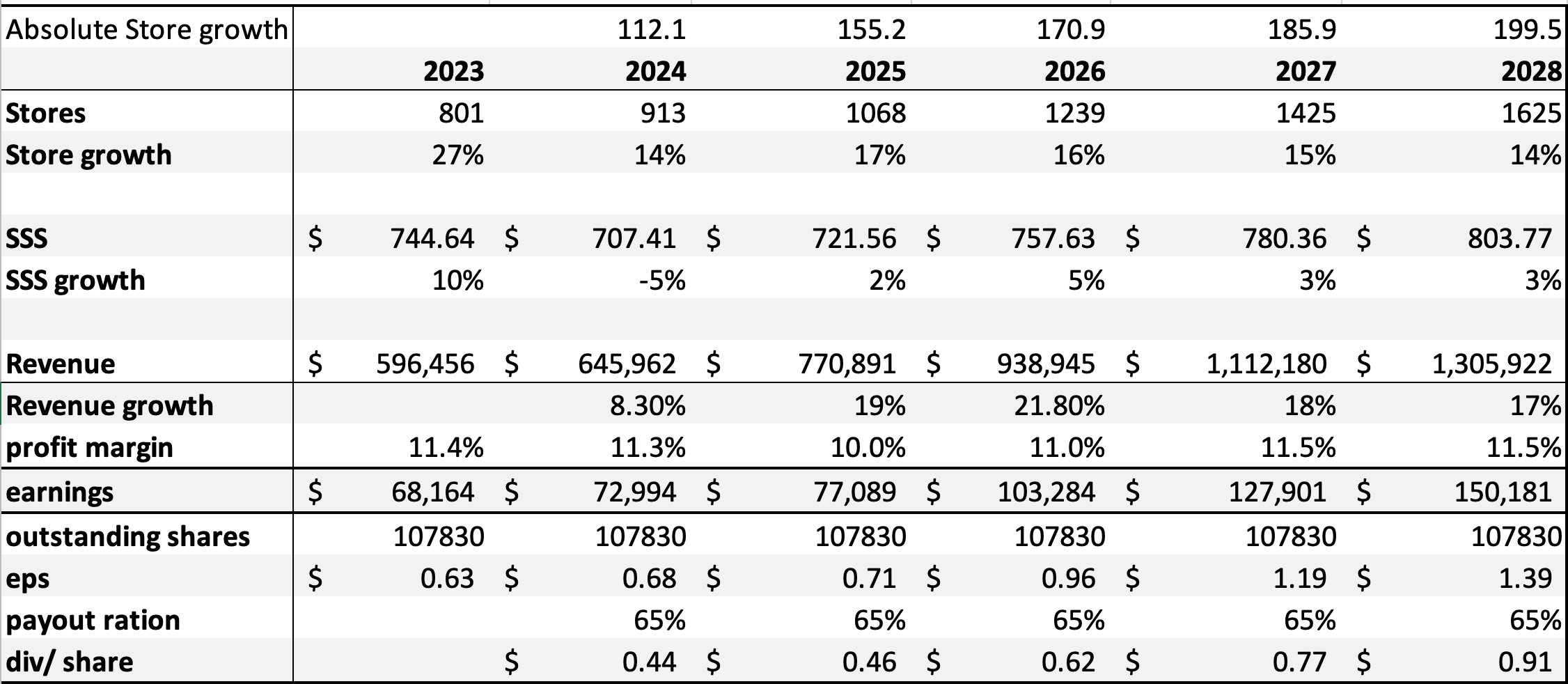

On my valuation of $LOV, I can get to $37 with renewed vigour in the store rollout and a bit of debt. But its looking very stretchy and I have to remind myself its just numbers on a spreadsheet!

At the current capital structure, I get around $25 as my expected value, and $30 with some more debt.

As you say, its a fantastic company and one of the ASX's few - if not only - truly global retailers (Ok, Ok, there's also $DMP, but they are multi-regional and not fully global)

Standing here today with the SP getting close to $34, the risk-reward is looking very different from when I acquired back at $20 (RL average buying price through Jun-Aug 2023)

Add to that, while there are some signs of recovery in the global economy, things aren't exactly roaring back ... and Australia looks to be some way from coming back.

Furthermore, I don't know if the pace of global rollout has ticked up again. I haven't heard if they've started rolling out in China yet, for example. Retail is still quite weak there, and youth unemployment is still an issue - which hits their target market.

Also, at the moment, its a fundies' and retailers' favourite again. And valuations can get stretched when that happens (witness what happened to $DMP!) .... until they're not.

I'm going to have a look at some of the overseas discretionary retail LFL comps from the most recent reporting seasons, and also see if I can get some intelligence on new store openings.

Then there is the question of portfolio allocation - focusing on retail: how do I view the upside compared with $SUL, $AX1 and $NCK. I've previously held $SUL, and that one is looking attractive again and might be a better home for the capital. As for the SM portfolio, I need to free up some $ for more $AD8, but now waiting for it to bottom out. Started trimming $LOV to fund my recent buys.

Mulling this one over.