Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Lovisa shares are up 6% today, possibly as a result of an upgrade by Morgan Stanley. I found this on The Motley Fool:

Analysts at Morgan Stanley have upgraded this fashion jewellery retailer's shares to an overweight rating with a $38.00 price target. According to the note, Morgan Stanley believes that recent volatility in Lovisa's growth is transitory rather than structural. The broker sees earnings per share rising 83% by FY 2028. This is expected to be supported by its agility on product range and best-in-class supply chain execution. In light of this, Morgan Stanley views the recent de-rating of its shares as an opportunity for investors to build a position in a competitively advantaged Australian retailer.

Held IRL

Lovisa

- Type: Fast-fashion jewellery retailer.

- Founded: 2010 in Sydney, Australia.

- Products: Affordable, trend-driven jewellery and accessories (earrings, necklaces, rings, hair accessories).

- Style: Inspired by runway and street fashion; focuses on frequent style updates.

- Price Range: Low to mid-range (typically $10–$50).

- Target Audience: Fashion-forward shoppers looking for affordable accessories.

- Global Presence: Over 1,000 stores in 50+ countries.

- Brand Positioning: “Brilliantly affordable, on-trend jewellery”.

Jewells (new brand)

- Type: Premium fine jewellery brand launched by Lovisa in 2025.

- Founded: 2025 in the UK by Brett Blundy (Lovisa founder).

- Products: High-end jewellery including 14-karat gold, lab-grown diamonds, gold vermeil, birthstone pieces, and collectible charms.

- Style: Elegant, elevated, and contemporary; positioned as a luxury evolution of Lovisa.

- Price Range: £30 to £3,000 (approx. $60–$6,000).

- Target Audience: Style-conscious customers seeking premium jewellery and experiential retail.

- Store Experience: Offers luxury piercings, fine-line tattoos, personal styling, and interactive “Make Your Own Memory” stack bars.

- Current Footprint: 7 flagship stores in major UK shopping centres (Westfield London, Bluewater, Lakeside, etc.), with plans for global expansion to 1,000+ locations in 5 years

Why is it an attractive business?

Software like gross margin at 80% and relatively high asset turnover.

Small format stores, lower wage staff, same format/layout in every country.

All results in high ROE.

100 new designs each week and quick to store via air freight - low inventory obsolescence risk.

Low ESG risk as quick fashion but low landfill with textiles.

Risks

Competition. Harli+ Harpa start up in Auss/NZ by ex CEO. Slightly higher price point and does mens as well. Similar to Jewels concept trialed in UK.

Online retailing. Less profitable for Lovisa due to high cost of postage on low value items. Most prefer to touch so think less of a risk.

Tariffs. None issue really as high gross margin pass on cost. US only too.

Class Action seems manageable as per below - Probably looking at $150M max?

Macro risk with decline in consumer spend? low price point and lipstick effect?

Class action

· The class action alleges systematic underpayment and workplace breaches by Lovisa Pty Ltd between January 2019 and January 2025, including:

· Failure to pay overtime and other entitlements under the Lovisa Enterprise Agreements (2014 & 2022) and the Fair Work Act 2009 (Cth).

· Directing staff to skip meal and toilet breaks during extended shifts.

· Requiring unpaid pre-shift and post-shift work (e.g., arriving early or staying late to clean and balance tills).

· Mandating extra hours during peak periods (e.g., Christmas) via “Individual Flexibility Agreements” without proper overtime pay.

· Unpaid training and requiring staff to purchase and wear Lovisa products.

· Alleged breaches span over a decade, impacting an estimated 1,000 current and formr employees.

Scale of the Case

· Registered Group Members: Over 500 confirmed, with estimates exceeding 300–1,000 affected staff.

· Claims seek underpayments, interest, and penalties.

Key Factors Driving Exposure

- Class Size: Estimated 300–1,000 employees affected. [aderolaw.com.au]

- Period: Six years (2019–2025).

- Claims: Unpaid overtime, missed breaks, unpaid training, forced product purchases, and penalties under the Fair Work Act. [aderolaw.com.au], [ragtrader.com.au]

- Comparable Cases:

- Woolworths underpayment case: $571 million for ~250,000 staff in 2021. [flux.finance]

- Retail wage class actions often settle at $5,000–$15,000 per claimant, plus penalties and legal fees.

Valuation

PE high for a retailer so likely compression as growth slows.

Consensus EPS of $1.86 by FY30. Reasonable? ~1000 stores currently. Looks like could double that globally. Morningstar thinks they top out at 1700 globally but seems low (Claire's alone was 2000). Some like for like store sales growth. Claires bankruptcy in US so could get some prime stores. So possible target but perhaps as stretch.

From $31 current market price

Scenario 1 to FY30:

· 37.5% decline from PE moving from 32x to 20x.

· 142% increase from EPS growing from $0.77 to $1.86

· $37.20 PT in FY30 (20% capital return)

· 20.2% from dividends.

· ~7.3% pa

Scenario 2 to FY30

· PE decline from 32 to 25x

· 142% increase from EPS growing from $0.77 to $1.86

· $46.50 PT in FY30 (50% capital return)

· 20.2% from dividends

· ~11.46% CAGR

Reasonable return but would prefer a bit lower price to be confident. Seems 10%pa returns around current price.

It looks like the first 20 weeks of FY26 have been a cracker for Lovisa! Total sales are up over 26% on FY25 driven by 44 net new stores and a 3.5% lift in comparable store sales. Analysts are forecasting c.19% revenue growth for FY26. At this stage it looks like the year is well on track to meet market expectations. Did I just hear Brett Blundy pop the cork on another expensive bottle of Champaign at his new Monaco residence?

Held IRL

LOVISA HOLDINGS LIMITED (LOV) ANNUAL GENERAL MEETING TRADING UPDATE

In advance of our Annual General Meeting today, we would like to provide an update on the status of the company’s store network and current trading conditions.

We continue to maintain our focus on expanding our global store footprint across all markets in which we operate, with 44 net new stores opened for the financial year to date, including 62 new stores opened and 18 closures (including 6 relocations). This has taken the store network to 1,075 stores across more than 50 markets, and we are currently trading from 148 more stores than this time last year.

Global total sales for the first 20 weeks of FY26 were up 26.2% on FY25, benefiting from the continued growth in the store network over the past year, with global comparable store sales up 3.5% on FY25 for this period.

A few thoughts after reviewing the Lovisa results and investor call

New Management:

I was looking for continuation of a product-focused management team. While commenting on the Jewells rollout, they referenced the Jewells product line and data. Paraphrasing their comment, it was something like: "We are collecting data on customer preferences, such as earring drop and necklace length, to work out optimal ranging." This shows a level of detail and product knowledge not always seen at management levels and is exactly what I was looking for, albeit just one comment in a call.

If there was ever a change of management to bean counters it would be a thesis breaker for me- this seems unlikely while Blundy is involved.

Jewells Assessment

In typical Lovisa style, management were tight-lipped about the Jewells rollout, apart from the repeated message that it's a test/pilot.

For what it's worth, I have a few observations:

A 6-part YouTube documentary was produced on the setup of Jewells. The stated aim in the clips was 15 stores in 6 months - big ask. 7 stores were opened, mainly due to lack of suitable locations. Stores opened one week late.

Initially, I wondered whether this was just about ego—“look what we can do!”—the clips were shot in a reality TV style and I watched them at double speed. However, I’ve since concluded it was an attempt to engage customers ahead of the store openings. The limited YouTube views suggest this approach wasn’t very successful. That said, the buzz around the store launches and how they boosted the brand is evident in other formats, mainly TikTok and Instagram—opening with queues with a new brand is no small feat. The question now is: will the hype continue?

What Product is New at Jewells?

- Tattoos: Offering fine-line tattoos, micro to large (£75-£155), in permanent ink and made-to-fade lasting 3 years. This seems like a winner idea to me - get the look without committing for life! I found the fade tattoo info on social media but no detail on the website, which only shows permanent tattoos. Only one store is currently offering tattoo services Friday-Sunday, with lots of appointment availability.

- Welding: Pick your charms and attach them to your chain permanently. Likewise online booking had lots of availability across all stores. I also like this idea, they are encouraging people to “play” and create their own look, and you probably add more charms/$

- Piercing: Obviously included.

- Lab grown diamonds: everyone offers this option now.

All appointments can be booked for 1-2 people - take your friend, I wonder if 2 people increases the basket size?

Competition Analysis

Jewells: My quick look suggests that at this more premium level of jewellery there is more established competition than Lovisa's demographic. I also think the fast rollout with multiple stores was deliberate to grab market share quickly. Anything slower and the competition has time to adapt. Stores such as Gorjana and Kendra Scott in the US and Pandora seem like direct competition. I'll do a deeper dive into this when I have some time. For now I have to trust that the Jewells team have identified a niche in the current market.

Overall I think Lovisa's market positioning and demographic seems to have less competition. Yes, anyone can copy and produce jewellery at the lower end, but packaging that up with the store experience and adding the touchy-feely value is much harder. I think Claire's experienced this when they opened Icing, which was direct competition to Lovisa.

Claire's Liquidation

Is there an opportunity here? It received attention from analysts on the call. If Lovisa could buy Claire's at an opportune price they would, but I don't think they'd do it at any cost, their ROI bar is high. I think the real opportunity is the potential store locations it may open up in the States. And you never know there might be the opportunity to cherry-pick part of the business, ie the 120 Icing stores.

Product on Sale on UK Websites

Given Lovisa has always been aggressive in managing stock turn and selling out slow lines quickly, it's no surprise both Lovisa and Jewells have items on sale up to 70% off currently for the end of season sale. At a glance, Lovisa hovers around 50% off, while Jewells discounts seem more aggressive across the board up to 70%.

- Jewells has 282 items on sale

- Lovisa has 162 items on sale,

Jewells operate at completely different price points to Lovisa, so I'm wondering if this takes away the impulse buy factor. When it's only £5-10 that's one thing. At £35, it's a different story, and that’s on sale.

Top-Up Considerations

My plan was to top up after seeing the results, but the price has gotten away from me. At $43 it's probably around fair value if you extrapolate out the 8-week trading update, which was surprisingly good, but to me it is at the optimistic end.

Buy Opportunities Ahead

I think patience is required now, but Lovisa has periodically given great opportunities to top up I'm looking to add around $35.

I'm waiting for:

- Market correction: Any bad news could see Lovisa drop 20%+ at its current high PE. Opportunities could include poor consumer data, Cost of Liv, inflation, tariffs, anything really.

- Store count milestones: If in 3-4 months the pace of store rollouts is hitting/exceeding my expectations, I would top up.

- Jewells performance: Either strong traction (upside catalyst) or failure leading to scrapping the trial (potentially a buy opportunity on a pullback). Very hard to judge from so far away, so I’m not factoring this in for now.

Overall: I am happy to hold and add opportunistically. I feel this report has cleared up some issues on management, store growth, and revenue, and I can see a growth path forward for the next 5 years.

Held IRL

Nice performance by Lovisa Today after a bit of a flat period

Lovisa Store Openings (June)

Just sharing an update with the latest Lovisa store openings as per the website as of June. The numbers aren’t guaranteed to be 100% perfect, but they’re usually close.

I count 138 store openings, which I think sets them up ok for the EOY results. (Note: I haven’t consolidated the store numbers for the Middle East, Africa, and South America as per Lovisa’s reporting.)

Overall openings seem to line up with what management’s been saying.

- US: Slow?, as highlighted previously

- Canada: Store count has doubled, but not a high store count overall, so expansion could continue here

- China: stagnant

- EU: Expansion continues, with Ireland called out as a recent success in the last commentary. Given the store counts in major EU countries, France, Germany, UK etc there is potentially further store growth opportunities here.

- Eastern Europe: Management flagged this as a good opportunity, but I’m not seeing that reflected in the latest store numbers.

Overall, I’m happy to keep holding into results.

Greeting,

I note Lovisa is popping on this signalled announcement, but John Cheston's last two companies there have been controversial departures ( "allegedly"), so a little surprised at the positive market reaction.

Note: Hold Lovisa in Strawman and IRL

Does anyone have an idea for the sell off today? Retail sales figures aren't out yet?

Harli and Harpa (H&H) Competition

The H&H website is now live, presenting a clean and polished look. (FYI, it wasn't up when the first stores opened) It’s hard to find on Google due to name spelling variations, this should resolve as brand recognition grows. Their Instagram following is currently (2.3k), Lovisa's (461k), a metric worth tracking to gauge customer interest.

Product Range

The product range looks good, and I've changed my mind about the target age bracket (re my comments post LOV agm). After reviewing the website, I feel the product is more suited for an older customer base, 20-25+ and easily caters for a much older market too. To me, the product range appears more "mature" than Lovisa's offerings at this point.

Price points & SKUs

H&H's price points cover a broader range than Lovisa's, with products priced up to $200. Could this wide range potentially confuse customers about the store's target market positioning or is it a product fit test to see what works? Monitoring these price brackets going forward will help define where their market sits. For reference, Lovisa's highest price point is $75, with a total of 40 SKUs between $50-75 out of 6.4k+, so the bulk is well under $50. (ref: aust site)

Here's a breakdown of H&H's wristwear category, as per website 4/12/24

I've attached a comparison of a $200 bangle next to a $30 one, this is how it came up on the website. This price disparity might be confusing for customers, though the quality difference may be more apparent in-store. TBC

Product items by Major Categories as per websites, 4/12/24, (Note: This total doesn't capture all SKUs, especially for Lovisa, which has many subcategories.)

Bridal Category

The bridal category comparison was particularly interesting. H&H features it as a main menu item, with appealing product styling. Lovisa's bridal section, is hidden under "occasions," appears less attractive and to me looks "cheap" in comparison: no one wants to feel cheap when buying wedding jewellery. I think this could be a lucrative sub-category within the business.

Photography

A side-by-side product search for silver hoops revealed significant differences in image quality between Lovisa and H&H websites. Lovisa's product shots are arguably unacceptable for an online store. I suspect the images are being provided by manufacturers to accommodate their fast product turnover. While photographing small, reflective items on a tight budget is challenging (good jewellery photography is difficult and expensive), there's room for improvement in Lovisa's imagery. Enhancing photo quality could potentially boost online sales, maybe? This raises the question: what are the implications of trying to develop an online presence in China with subpar images? The flip side is it's perhaps this comment on product photos is misplaced, given that in-store sales remain the main driver of Lovisa's business. A focus on the important part of the business?

Store count

H&H currently has 11 stores open across VIC, NSW, and QLD.

Conclusion

My current thoughts, which are subject to change are that the H&H product is targeting an older customer than the Lovisa store. Side by side, the H&H website feels more luxurious and is easier to navigate and find items, although this is probably a reflection of the smaller number of SKUs available. Has Lovisa's ranging become too broad and less specific/targeted?

In contrast, Lovisa's site feels cheaper, this is partly due to the current Cyber Monday marketing, which is loud and in your face. At different times, the presentation has been "classier" so take this comment with a grain of salt.

Obviously, we need a lot more time to really see how H&H and LOV compete head-to-head, or if they are they actually targeting slightly different markets, with clear overlap in some areas but perhaps not all?

I'll revisit this after I have a chance to visit a store, (no idea when I’m next in Melb) and see if the online experience matches the in-store experience. I'm also v interested in accessing the quality of the product.

Store-Product Feedback

It would be great to get wider feedback on customer insights on Lovisa and H&H stores & product. So if you, your wives, daughters, or other family members have shopped there, I'd love to hear their thoughts on:

- Product, store layout & atmosphere

- Customer service

- Anything really, all feedback is valuable, esp from real consumers

Thanks

held

This summary is based on my notes from the meeting. Direct quotes appear in italics, and unless otherwise noted, all responses are from Brett Blundy. My personal observations appear in [square brackets]. Questions have been reordered by topic for clarity.

Trading update and store openings as per ASX announcement.

Brett Blundy (BB) announced that three new stores were just approved in the US, expecting to reach 1000 stores "before we know it". The company's focus going forward is on:

1. Succession planning: Bringing team members through the system into management and country management roles.

2. Systems to support growth: Improving logistics, computer systems, and inventory control.

Official business:

Received a second strike on the remuneration, but avoided a spill with a huge margin

Q&A Session

Hybrid Meeting System

Q: Why is there no hybrid meeting system, and can one happen in the future?

A: The company prefers a single, straightforward meeting format and will continue this way. Shareholders interested in the company can attend in person. [me: This response seemed dismissive and offhand; a virtual meeting seems unlikely at this point.]

CEO Succession & Leadership

Q: Provide an update on Victor's step down and the plan for the incoming CEO.

A: There's no change. It's still business as usual, focusing on continued growth.

Risks

Q: What are the top risks for the company?

A: 1. Competition: Staying ahead of both store and online competitors.

2. Succession planning: Helping people improve and move up within the company.

Debt

Q: Can you talk about the company's debt levels?

A: The goal is to not exceed one times EBIT, note, the company has never come close to that. BB commented that they don't like debt but will use it if needed.

Store Growth and Strategy:

Q: Why does the store rollout rate seem to be slowing?

A: The company is strategic about store openings, always testing markets before expanding even though it looks like we go in fast. BB described themselves as "growth junkies" and said that's not going to change.

Comment: Ireland has performed exceptionally well, beyond expectations. They now have six stores, with an additional store opening yesterday and more planned.

Q: Where are the greatest opportunities for expansion?

A: Eastern Europe is seen as a huge opportunity. There's also potential for expanding the store base in the EU and various Asian markets. BB mentioned visiting Germany recently, where the EU country manager was pushing for additional store openings. BB emphasized there is still significant runway in many markets.

Q: What's the status of store expansion in China?

A: There was a slight admission that the market has been tougher than expected. They are currently seeking 3-4 store locations to run as a test scenario before further expansion and then "putting the foot down" as per BB.

Q: How are negotiations with US landlords progressing?

[Me: There appeared to be some challenges in securing favourable lease agreements in the US.]

A: BB stated:

- "We do all right," but "the landlord always wins" [cheap laugh]

- Brand recognition is now creating some tailwinds in landlord negotiations

- We are now finding it easy to engage with landlords just not easy to close

- Some US stores closed due to unreasonable rent increases

- Planning approximately 150 store openings in next 12 months (unclear if US-specific or global)

Q: Why has the ideal store size increased to 60-70 square meters?

A: The slight increase accommodates piercing services and expanded product ranges. Most stores will remain 50-60 square meters, with new locations being slightly larger. The new Series5 store layouts reflect evolution in product and customer needs. The cost increase in rent is negligible.

Q: Why has franchising been chosen in some African countries, and what are the economics?

A: Franchising is used where joint ownership is required to operate. While Lovisa prefers company-owned stores, the franchise model maintains similar profit profiles as Lovisa controls pricing, product, and advertising. Agreements vary by country, with franchisees primarily managing store operations and inventory ownership. The Ivory Coast operation was noted for its outstanding performance.

Competition & Market Position:

Q: Can you comment on Harper and Harli?

A: The company faces competitors worldwide and emphasizes the need to view Lovisa as a global company, not Aust-centric. Aust’s revenue as a % of the company’s sales has greatly reduced over time. But we don't take our advantages for granted and we must stay in front through evolution of stores, product, systems, & people.

Q: What is the impact of online platforms such as Shein and Temu?

A: We need to remain relevant and monitor all competition.

Systems & Operations:

Q: Can you expand on the focus on systems?

A: The number one priority is RFID system. It is hugely important, but we're currently going through cost versus benefit analysis as the investment to update to it is significant. But when we get this, it will be a “game changer” BB

The company is also revaluating various other logistics system, merchandise management was mentioned, several systems were said to need updating

Target Market

Q: Has the target market for Lovisa changed? - this was an observation from a shareholder who felt that the ranging was now targeting younger clientele

A: It was reiterated that the core market remains 25-35 years old and expressed some surprise that the shareholder felt this. It was noted that they do have ranges within the store targeting younger age groups. At this point Victor weighed in and said the trends in in fashion at the moment are looking at more premium type product rather than fashion product. He commented that the fashion style product is actually a bit off trend but will return. [Me: interesting comment]

[Me: I went to the store after the meeting, and this really did stand out. There was product targeting the younger age brackets. I'm not sure I agree with the comment that there were limited items for an older customer. In my opinion, there were options I could see my sisters and friends wearing, and I am in the older customer category, note: this is purely an opinion]

The shareholder also commented that they'd spent time at Harper and Harli at Doncaster doing some scuttlebutting. They felt that the quality was not up to the same standard as Lovisa, but the ranging was more suitable for an older customer.

Supply Chain:

Q: How will potential US tariffs affect the business?

A: Multiple manufacturing options and simple product construction provide flexibility and reduce vulnerability to tariff issues compared to US business heavily reliant on China manf.

Summary:

The Lovisa AGM had a relaxed yet confident atmosphere, Brett Blundy is an engaging speaker. Shareholders seemed supportive, despite a remuneration strike (though those responsible seemed absent).

But yeah, take my personal observations with a grain of salt, we can all get sucked into a story and I have no previous AGM exposure to benchmark this against.

Discl: I won't be making any changes to my position at this stage.

Store opening: Harli + Harpa

Woah, I totally missed this! I've been away a lot in the last couple of months, but I just found out about this via the Intelligent Investor weekly report. (It was a 1-liner in the II report to explain the recent SP drop)

Thought I'd share it in case others missed it too.

Lovisa's ex-CEO Shane Fallscheer has opened a new jewellery store called Harli + Harpa. They launched their first store on the Sunshine Plaza last week, with a second one in Westfield, Doncaster.

Interestingly, I couldn't find a website for them, and their Instagram only has six images so far. Looks like a soft opening.

Their message: Harli + Harpa is positioning itself as ‘Your walk-in jewellery box’, focusing on fashion-forward, long-lasting pieces for every occasion, good tagline.

Fallscheer at the helm is a huge advantage for this new chain. With his Lovisa background, he knows the prime locations with the biggest ROI and will target those first. I reckon they could easily ramp up to 20+ stores quickly - he's probably got the funds to make it happen.

Excerpts from AFR, link below

"Mr Fallscheer has deep retail connections after working with billionaire Mr Blundy for three decades, and is aiming to shake up a sector that Lovisa has dominated with its affordable earrings and friendship bracelets."

"The retail executive surprised the market in October 2021 when he flagged his departure from Lovisa after 12 years leading the fashion jewellery company, which at the time of his exit spanned more than 550 stores in 20 countries."

"Mr Blundy, who is the chairman of Lovisa, said at the time that Mr Fallscheer was the driving force behind its creation."

A major threat is the potential migration of key Lovisa staff, which may have already happened. SF has working relationships with important players at Lovisa, making poaching or offering new opportunities very tempting. My thought has always been: if you wanted to compete with Lovisa, poach their product development staff first, followed by other key operational positions. So, this could be exactly what's happened here.

Another reason for Herrero’s departure?

Store layout looks familiar

Same goes for the Insta styling

It's worth noting that Claire's in the US recognized the threat of Lovisa and established a new chain called Icing to go head-to-head with them. However, in my opinion, they aren't in the same league as Lovisa, so I never really considered this a real threat. On the other hand, Harli + Harpa, with Fallscheer at the helm, is potentially a long-term real threat to Lovisa's business.

Where to from here:

I'll be tuning into the AGM on Friday, keeping a close eye on developments, and reassessing my options. It’s probably time to reduce my position size, which is quite large IRL due to cap growth. While the long-term impact on Lovisa will take time to materialize, there could be a quick hit to individual Aussie store profitability if they are head to head in a shopping centre.

For example, if jewellery spend in a shopping centre gets split between two stores, it immediately impacts Lovisa's profitability at a store level and, by extension, their bottom line.

held

Following the ASX announcement this morning of the CEO departure I'm reluctantly selling.

This was one I was looking forward to holding for years to come. The timing of the announcement worries me, and I've been burnt before by unexpected CEO departures.

It's possible this is positive news, and a change was needed.

If the new CEO is able to deliver more store growth (particularly waiting to see what happens with China) I'll look for the right price to buy back in.

This morning $LOV announced their CEO succession. I didn’t see that one coming.

Rock Star Victor Herrero is staying on for another year until 31st May 2025, and will be replaced by John Cheston, who I understand is currently the MD of Smiggle, in the $PMV stable.

Given that Victor only joined in late 2021, this wasn't a long tenure.

This morning I sold my entire holding at the open, for three reasons.

- Part of my thesis was that Victor's experience in leading Zara's Asia-Pacific expansion would be key to the group success in China

- Following last week's exchanges on here, I did a deep dive over the weekend into new store openings. Not that great, (See below)

- Shares are currently priced for perfection, and require flawless execution to sustain their premium.

Store Count

Assuming their global website is up-to-date AND that all franchises lists their store on it, I gleaned the following insights from some weekend data analysis.

- In the last few months, it appears few if any net new stores have opened in the US

- In ANZ it looks like they have opened only 3 net new stores since end 2023

- They still have only one store in Mainland China

- The main countries growing are Canada, Ireland, Germany, Belgium - 26 of the new stores by my count

- By my analysis stores have increased from 854 to just over 900 since Dec-23. About +50

Now my analysis might be wrong, because I had some data integrity issues with my web-scraping and data analytics, but I did do some manual checking, and I think it is directionally correct.

What is interesting, is that the counting confirmed my hypothesis about China. Despite having been open there for one year, they either haven't cracked the formula to rollout and/or the market conditions are not favourable.

I am working on other things today, but combined with the ongoing global consumer weakness, my hypothesis is that $LOV will be tracking along the lower bound of my valuation, indicating that it is significantly OVER-VALUED.

Hence I exited immediately this morning on the news about Victor. (This is one big tax bill I didn't want!)

Victor was on an extremely lucrative package. But hitting all his incentives required a continued strong global rollout. Maybe he knows something. Speculation, but can't help it.

Disc: Not held in RL, still held in SM

Gaurav Sodhi has been a long term Bull on Lovisa and here are his latest thoughts post reporting season.

Gaurav is still very positive about Lovisa's future. He said he hopes to be still holding it in 5 or even 10 years time as they roll out around the world into a Global Brand.

https://ausbiz.com.au/media/lovisas-30-on-the-way-to-50-or-60?videoId=34817

This straw examines the performance of $LOV over recent years and considers how the business might evolve over the next decade, to form a basis for my valuation.

I’ve not been very reader-focused in writing it up, as it is more a download of the thought process I went through. So for those for whom life is too short, I’ll summarise the key messages below, and then for those who have developed their own valuations of $LOV and want to get into the details, I’ll leave it to you to wade through my brain dump (good luck!).

Key Messages

- $LOV along with most of the retail sector has rallied strongly over the last 6-months

- This has been driven by excessive market pessimism combined with operational outperformance by many, including $LOV

- $LOV is still early in its global rollout, having established clear and compelling unit economics

- The rate of the future rollout is a key unknown which drives uncertainty in the valuation

- $LOV has significant optionality in capital management including i) new store openings, ii) dividend policy and iii) capital structure.

Valuation

- $24.80 ($19.50 - $30.50) – at constant FY23 LT Debt of $65m

- $30 ($23 - $37) – capital structure with LT Debt of 0.5x EBITDA (“Levered Case”)

- To achieve a 10% Return in the Levered Case requires a SP of $18.50 ($14 - $23)

Conclusions:

- At the current SP of $31.65, I’m a HOLD on $LOV. While at the top end of the valuation range with the current capital structure, it represents reasonably fair value considering the balance sheet and growth optionality.

- I'm a Buy around $19 and a Sell above $36.

DETAILED NOTES and ANALYSIS

1. Retail Context

$LOV broadly reflects what has happened to the retail sector over the last 12 months. We saw a low point in market expectations around 6 months ago – when many were predicting a 2024 recession in US, EU and Australia, which would necessarily result in serious belt-tightening in discretionary categories.

While the results have indeed shown some slowdown, like-for-like (LFL) comparisons between the last quarter of calendar 2023 and trading updates in January and February have indicated the resilience of the consumer. With interest rate cuts anticipated in CY24, and job markets generally strong (albeit weakening), consumer confidence in US and Australia has picked up more recently. The EU area and UK – both in recession – remain in the doldrums. While global economies are not yet out of the woods, it appears increasingly likely that many areas will avoid recession and recessions, where they occur, will likely be shallow and short-lived.

So, with this macro backdrop, retailers headed through 2023 preparing for the worst. Many managed inventories tightly, continued to benefit from normalised supply chains, and managed costs of doing business as well as they could in an effort to minimise the negative operating leverage of their high fixed cost bases. Certainly, there were significant profit falls, but generally retailers performed better than expected. SP's have rebounded accordingly.

$LOV reflects this broad trend. Compared with FY23, when the P/E was 30.5x, after 1H, the forecast P/E for the FY24 has rocketed back up to 41 – near its highs in the last 24 months.

So, I am keen to understand what a reasonable range of valuations is for $LOV, at this point.

Lovisa is still at the early stages of a global roll-out. It now has a significant presence in ANZ, US and the EU/UK, but is in fact now present and growing on every continent and it in 40 countries.

It has proven compelling economics at the store level, and with strong free cash generation, a key question is at what rate will it continue to roll out new stores. This is clearly a perpetual question on the analysts’ minds – rightly so – and one which CEO Victor Herrero steadfastly refuses to give guidance on, sticking to the key message that they will open stores when they get good deals. Personally, I like this approach, as it has capital discipline written all over it. However, as my analysis shows, the uncertainty creates a wide range of potential outcomes for valuations.

2. The$LOV Global Rollout Under Way

I like to invest in companies that are building leadership in global markets (think $ALU(sniff), $RMD, $WTC, $PNV,…and yes $AD8 and $PME). So, part of my thesis is that $LOV is building a global brand and footprint in fashion jewellery and, provided it continues to execute, it has a very long runway ahead, even if the business is now relatively mature in ANZ. (Even my small home town in NZ with a population of <100,000 has a $LOV store!)

Table 1 below shows the evolution of the store footprint. The bottom row of the table shows the net annual change in stores. What this table doesn’t show is how actively the network is managed. Underperforming stores or even entire franchise agreements will be exited where necessary.

Considering the ANZ store footprint as indicative of a relatively mature market gives an indication of the potential ahead. For example, with 207 stores in the US today, the potential here could be 1500-2000 stores, double the size of all $LOV today. The same is true for the EU/UK region.

Table 1: Store Footprint

3. Revenue Growth Tells the Story of the Recent Retail Cycle

Next, I want to understand the historical story of revenue growth.

Figure 1 (below) shows annual sales growth by half-year increment, on both a like-for-like (LFL or comparable stores) basis and total revenue growth. The latter benefits from the significant new store opening programme of the company's global roll-out.

Figure 1: $LOV Annual Revenue Growth (%, Total and LFL)

Source: Annual Reports

Consider first the LFL sales growth. Pre-pandemic, $LOV experienced a slowdown from 2017 into 2019. At that time, $LOV was dominated by ANZ, and I can’t see anything in the macro for clothing and accessories retail segment to support the companies claim at the time that macro factors could justify their claims of “cycling strong prior periods” and “tougher trading conditions”. In any event, strong new store grow meant that overall revenue growth was strong.

The pandemic dip in 2020 and sharp rebound in 2021 requires no explanation.

And the graph clearly shows the retail cyclical slowdown from 2023 into 2024, with modest single digit LFL growth falling into negative territory. On a volume basis, given inflation and pricing icnreases, the down turn is probably deeper. 2023 was probably flat, and 1H FY24 was probably closer to a LFL contraction of 6-8%.

So, in terms of future, long term modelling, I will consider LFL sales growth scenarios (in nominal $) of 2%, 3% and 4%.

At the low end (assuming long run inflation of 2.5%), this actually represents a scenario where same store sales decline in real terms, with the 3% representing broadly flat, real sales, and 4% a modest increase. Given the competition that will exist in this segment, I don’t consider it reasonable to consider higher growth scenarios, even though these have been achieved in the past, as I don’t see a case where strong brand value creates pricing power in this market. (I’m not a branding expert,… so I’d rather be conservative).

Now turning to total revenue growth, the difference between the orange bars and the blue line in Figure 1 is the global rollout of new stores.

4. Global Store Rollout

Key to understanding the value of $LOV is knowing the future pace and economics of the store rollout program. On the last two investor calls Victor Herrero was clear that the rollout trajectory is “not linear”, that they open stores when they can get a deal that works, and that each time they open a new market, a new set of “blue sky” awaits them.

So, what does history look like? Consider Figure 2, below.

Figure 2: $LOV Store Roll-Out (Annual Net Change in # Stores; and % Change from PCP)

Source: Annual Reports

$LOV appears to not be driven by a pre-determined target of number of new store openings.

The drop in 2020 is easily understood due to the pandemic restrictions impacting 2020. In fact, the net store increase masks a larger number of closures, no doubt due to the pandemic.

2021 can be explained by the pent-up demand following re-opening, as well as (potentially) a brief window when good deals could be struck with shopping mall owners seeking to repair their balance sheets and attract quality tennants.

So, with the backlog of 2021 out of the way, 2022 probably reflects a return to something like BAU, which then makes 2023 a surprise with a massive step up in new stores, which drove revenue and SP.

So, what of 2024?

Well, 1H has seen only 54 net store openings, with an even slower start to 2H. It seems likely that FY24 will end up with somewhere between 80 and 100 new stores – back around 2022 levels. There were no capital constraints to store opening in 1H FY24, because $LOV paid down $22m of its $65m long term debt, finishing the year with $58m cash, up from $50m 6 months earlier.

Perhaps the conservative approach is prudent given high interest rates and continuing marco-uncertainty, with the EU and other markets in now squarely in recession, Australia in a per capita recession, and the US being somewhat the exception in the OECD group.

Based on the current operating economics, $LOV has the capacity to take on more debt, increase the rate of store buildout AND modestly increase the dividend. So, Victor has a lot of levers at his disposal. (The fact that Victor won’t provide forward indications as to the rate of store openings is clearly driving some of the analysts nuts.)

Next, we have to understand store level economics.

On the recent 1H call, Victor said in Q&A that the best way to figure out the cost of opening a store is to get it from the capex and number of stores, recognising the following:

· Australia or South Africa about $0.15m per store

· US “about double that”, so $0.30m

· Cheaper markets “a bit less”, so assume $0.1m per store

Having looked at the accounts for 2022 and 2023, I get higher numbers of around $0.4m per store. So, what is driving the difference? In calculating a Net Change in Stores, I am blending several factors which all impact the investing cashflow (capex) line:

· New store openings;

· Store closures (there were 31 in FY23 and 19 in FY22);

· Acquired stores; and

· A reduction to capex from contributions from Owners to fitouts. When Lovisa takes on a lease and fits out a shop, some of the investment improves the store beyond the life of the lease, so the landlord makes a contribution to the fitout.

So, this explains why a simplified Capex per net new store results in a higher figure than those indicated by management, and it allows me to keep the model simple.

Because the market potential is large, and we cannot know the rollout rate, I’ll run three scenarios:

· Low Case: 100 net new store per year

· Mid Case: 135 net new stores per year

· High Case: 165 net new stores per year

I’ve chosen a fixed number per year rather than a % number to reflect that as the rollout continues, while the company will have progressively higher financial capacity to open more stores, countering this it will become progressively harder to find good deals in each market (law of diminishing returns).

The analysis is conservative because, in the high case, we are simply repeating a level of store openings already experienced in 2023. Total stores across the three scenarios considered are shown in Figure 3.

Figure 3: Number of Stores – 3 modelling Scenarios

In the scenarios contemplated, the 2033 store counts are 1804, 2108, and 2412, given a 1H FY24 count of 854, so a two to three-fold increase.

This is in the context of a global roll-out already underway where the US at 207 stores is arguably 10%-20% penetrated, and the EU/UK at 249 is at a similar level. Based on these scenarios, there will plenty of growth potential beyond 2033 (if the brand remains relevant and if the competitive landscape allows!)

These projections Also seem reasonable for global retail brands. Retailer H&M grew its global physical store network from 550 in 1998 to a peak of 4,500 in 2019. If anything, subject to financial capacity constraints, my Scenario 3 could be considered modest, because opening what is a relatively small Lovisa boutique is arguably a less ambitious undertaking than an entire H&M store.

4. Margin Evolution

Gross Margin

Pre-COVID, $LOV achieved gross margins of 80%. (That’s pretty impressive, when compared with $SUL at 47% and $NCK at 63%.) While gross margins dipped through COVID, they have most recently been restored to 79.9% at FY23, and even 80.7% in FY24. To keep things simple, I assume %GM is maintained at 80% in all scenarios.

I’ve done this partly because I don’t understand the potential impact of i) increasing scale, driving future economics of scale in manufacturing, offset by ii) a potential increasing proportion of stores in locations where prices may be lower (e.g., middle income countries). Having said that, my modest store growth scenarios could be achieved in the high value markets of the US and EU/UK alone, however, it is clear that $LOV are truly going global!

Cost of Doing Business

While the store level expenses are directly scalable, as the network of stores scales in any country or region, there will be efficiencies in a) distribution, b) regional overheads and c) e-commerce.

On e-ecommerce, I have not modelled this separately. $LOV has an online offering in each of it’s markets, however, it has not been particularly transparent in breaking out the key value drivers. This is a limitation in the model. If $LOV achieves increased brand recognition and ability to move loyal customers online, this will result in the lower cost of doing business and increased margin potential.

Figure 4 shows the Cost of Doing Business, which I have calculated as:

= Salaries and employee benefits expense + Property Expense + Distribution Costs + Other Expenses.

Figure 4: Cost of Doing Business

CODB as a % of revenue increased significantly during 2022 and 2023. However, judging by the comparison of 1H FY24 to 1H FY23, the result for FY24 appears to be stabilising.

What can explain this trend? There are three factors:

- First, we should ignore the results for FY20 and FY21, as these will have been impacted by various closures, restrictions, and subsidies during the pandemic.

- FY23 also saw a record number of new store openings. So, this is likely to result in a period where stores incur their full operating cost during a period when store sales are ramping up. As the network scales, this effect will become proportionately less important over time.

- FY22 saw higher distribution costs and FY23 was a period of peak inflation.

For future periods, I therefore assume that CODB/Revenue is maintained at FY22 levels. The modelling assumption is described fully in the next section on Operating Margins.

Operating Margins (OM)

%OM was 18.0% in FY22 and 17.7% in FY23. Margins appear to have stabilised in FY24, with 1H FY24 at 21.9% compared with 1H FY23 at 22.2%. (Note: 1H %OM is significantly higher than 2H due to the stronger 1H revenues)

Over time, as the store network continues to expand there should be economies of scale in the distribution network. For example, the distribution infrastructure for US, EU/UK and ANZ is now largely in place. Further buildout of the stores within these regions should enjoy lower incremental distribution costs.

What is less clear is how the CODB and margins scales as the mix of stores across regions evolves. For now, it is assumed that US, EU/UK and ANZ will continue to contribute the large majority of stores. This assumption could be changes in future, for example, if there was a major build-out of the network in China. However, this seems unlikely to change the overall assumption given the prior progress of Western retailers in China, who generally have not built out networks beyond about 200 stores (e.g. Carrefour).

Model Scenarios - Operating Margins

Going forward, my model assumes FY24 %OM will be 17.5%, with scenarios as follows:

- Flat %OM = 17.5% from 2024-2033;

- 0.1% p.a. margin improvement reaching 18.4% in 2033;

- 0.2% and 0.25% p.a. margin improvement in the high-store buildout scenarios, reaching a %OM of 19.8% in 2033, in the highest case.

5. Capital Structure

In running the valuations, I have run all 9 scenarios across three cases:

- WACC = 7.9% with constant LT debt at $65 million (calculated off the current balance sheet with cost of equity of 9.5% and cost of debt of 6.0% - applied to both debt and leases)

- Increase LT debt to maintain a constant leverage of 0.5 x EBITDA (this drives significant FCF generation while still maintaining a conservative balance sheet. For example, this is approximately the level of debt at $JBH)

- I’ve also modelled a 10% discount rate, to show the SP required to deliver that investment return.

6. Continuing Value

Across the scenarios modelled, by 2033 $LOV will have established a global network of between 1804 and 2412 stores, compared with the 854 at the end of 1H FY24.

2033 need by no means represent “Peak Lovisa”. For example, Zara reportedly has around 3,000 stores worldwide, and H&M has between 4000 and 5000.

Therefore, assuming annual market growth of 2.5%, I assume ongoing growth in Free Cash Flow in the continuing value period of 4.0% p.a. achieved through any combination of i) network growth, ii) brand value improvement, iii) operating efficiencies, and iv) increasing contribution over time from stores in middle income countries.

7. Key Risks

Some key risks are not considered in my valuation model:

- “Peak Lovisa” is reached beore 2033 or shortly thereafter, due to a global shift away from fast-fashion, costume jewellery.

- Growing competition – others seek to replicate Lovisa’s model. (We have seen this before in fashion as Zara’s disruptive business model was replicated over time.)

Either risk materialising would see a slowing of network expansion, followed by pressure on margins, over time. Emergence of these risk would likely see a rapid contraction in the earnings multiple, back into the pack of retail more generally. (P/E of 12%-15%).

Note that in the current model, the implied P/E at 2033 ranges from 17.6x to 19.3x – so my valuation assumes that $LOV retains its growth premium over the retail sector for the next decade.

8. Valuation

Figure 5 shows the NPAT over the 10-year period across the 9 scenarios. The scenarios spanned the ranges of the parameters shown in the blue box.

Figure 5: NPAT Evolution Across Scenarios

Figure 6 shows the resulting valuations, with the red lines reading off the mean, p10%, and p90% valuations for the valuations run at constant LT debt ($65m) and WACC of 7.9%.

The light grey line shows the valuations run with LT debt increased each year to a level of 0.5 x EBITDA.

The orange dotted line shows the SP required to achieve a Rate of Return of 10% in the Levered case.

Figure 6: Valuation Results

Table 2 below provides some more of the modelling puts, including earning growth rate, margins and implied P/Es over time.

Disclaimer: The analysis has been performed for my personal use and should not be used as the basis for investment decisions. Model calculations and outputs are not validated to be free from error.

Disc, Held in RL and SM

See valuation straw for justification.

LOV valuation of $ 27 based on their 1H FY24 results, and Investor presentation released on 22/02/204.

Positives

Revenue up 18.2% to $373m with improving trend through Q2

Gross Margin 80.7%, up 40bps

74 new stores opened during the period, 854 at period end

China and Vietnam markets opened during the half year

EBIT $81.6m up 16.3%

Net Profit After Tax up 12.0% to $53.5m

Operating cash flow of $150m up 29.1% on prior period

Net Cash of $15.5m at period end, with $120m of available cash facilities in place

Reduction in CEO Long-Term Incentive expense from $15m in the prior half year to $6m in the current period.

Interim Dividend of 50.0 cents per share, 30% franked

Negatives / What to Watch

Comparable store sales down 4.4% on HY23

Inflationary pressures in most areas of the business, particularly on wages resulted in higher cost of doing business.

Interest expense increasing due to the associated increase in lease liabilities combined with a higher interest rate environment and higher debt levels.

Company's Future Focus

Lovisa will continue to focus on expanding both their physical and digital store network in existing and new markets.

Key takeaways & important update:

- revenue up 18% ( $373 M)

- Profit up: 11.7% ($72.7 M)

- Store roll out: network now at 860 stores, with 9 new stores opened in 2024.

- LFL sales in 2024 up 0.3%

- Overall sales up $19.6 on PCP for January 2024.

Summary new store sales growth more than offsetting LFL store sales growth. 3 new markets - China, Vietnam, and Ireland opened in 2024.

Looks like a long runway of growth form US, Europe, and China........

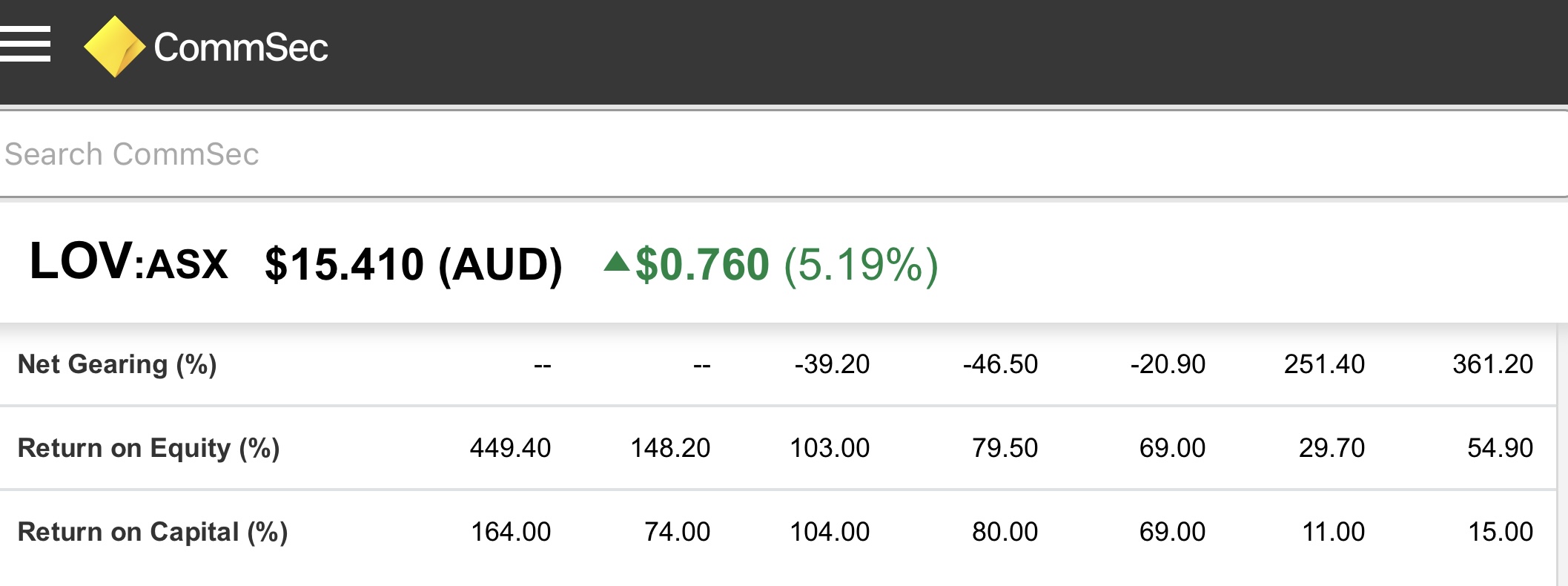

I have a few companies reporting today. At a quick glance the Lovisa results look good, and ahead of FY24 analyst consensus. ROE, based on doubling 1H24 NPAT (ie. $107 million) and 1H24 equity reported ($104 million) is approx 100%. This assumes next half will be as good as 1H24. Does this look right Strawpeople?

I’ve been working on ROE of 90% for my valuation. I think the market will like it. I hope I haven’t made any huge errors here. I’ll have a more accurate look later.

Summary:

• Revenue up 18.2% to $373m with improving trend through Q2

• Comparable store sales down 4.4% on HY23

• Gross Margin 80.7%, up 40bps

• 74 new stores opened during the period, 854 at period end

• China and Vietnam markets opened during the half year

• EBIT $81.6m up 16.3%

• Net Profit After Tax up 12.0% to $53.5m

• Operating cash flow of $150m up 29.1% on prior period

• Net Cash of $15.5m at period end, with $120m of available cash facilities in place

• Interim Dividend of 50.0 cents per share, 30% franked

LOV ASX: Lovisa shorts hit $100m ahead of results (afr.com)

Short sellers are piling into Lovisa Holdings at the highest level in almost four years before what could prove a pivotal market update on the health of the discount jewellery retailer on Thursday.

Hedge funds betting against the stock now make up about 4 per cent of the share float, the most since 2020, when short positions topped 7 per cent amid sweeping pandemic-induced store closures and a global retail slump.

About $100 million is betting against Lovisa’s share price before its half-year result on Thursday.

Shorts against Lovisa started to rise around November when the retailer reported a 6.2 per cent drop in same-store sales during its expansion effort in the US and China. That missed market expectations, fuelling shareholder concerns about chief executive Victor Herrero’s $30 million salary.

Short positions have accelerated in the lead-up to the retailer’s half-year report on Thursday and now amount to about $100 million – the highest level in dollar terms since the stock listed almost a decade ago.

“Expectations are very high coming into this result,” a local long-short fund manager, who is betting against the stock and was not authorised to speak publicly about the trade, told The Australian Financial Review.

“It’s been priced for perfection,” the fund manager, citing the stock’s historically high share price, mounting global headwinds for retailers and declining same-store sales as the reasons behind the fund’s short bet.

“Some of the new stores may not be achieving the level of economics that the market analysts have been expecting.”

Analysts had become increasingly divided on the Lovisa stock as the half-year report approached. UBS downgraded Lovisa to neutral last month, noting that the shares had rallied substantially (up 48 per cent) since November and pointing to growing signs that the store rollout was losing steam.

Jarden, which upgraded the stock to a buy in November, has held firm on its valuation, even as its analyst Ed Woodgate cautioned that investors should be “buying for the long term” as there “may be surprises before then”.

“Like every other retailer, Lovisa is facing a tough consumer environment,” he said in a note this month.

“While the trading update may be weak as Lovisa has to cycle one more period of strength and the net store rollout may disappoint, we expect investors will start to look long term once the worst of the bad news is in the rearview.”

Funds also appear similarly divided on the stock. Hyperion, ECP Asset Management and Fidelity are among those holdings large long positions, based on recent filings.

QVG’s Chris Prunty, who counts the stock among the largest holdings in the firm’s long-short fund, is bullish on the outlook.

“We like Lovisa because the return on capital on new stores is very high, and they have a long runway to open stores in existing markets like the US and new ones like China,” he said.

“We understand the market has some concerns around the generosity of the CEO’s remuneration package, but we believe that if he can replicate half the success he had as Zara’s head of APAC, then he will have been underpaid,” he said.

One Lovisa short-seller says the stock could slip as much as 30 per cent – should the fund’s thesis behind the short play out.

“What we’ve seen with companies on high multiples in the past is that when you start to see cracks in the business, the market tends to be a bit more forgiving, until the cracks become the crevices,” the short-seller said, citing Domino’s Pizza and Pro Medicus as two stocks to have suffered this fate in recent weeks.

That said, funds that have been holding Lovisa for some time might not blink at the near-term dip short-sellers are betting on. The shares are up more than 1000 per cent since it listed in 2014 and more than 150 per cent in the past five years.

I know this observation has been made before but sometimes seeing is believing…

took the kids to the Myer Christmas window in Melbourne last night (china town dinner beforehand). Was great combo for anyone other young fans in Melbourne.

Anyway being a 40something bloke lovisa is not exactly my thing but: walked past the Bourke st one.

Could not believe how small the footprint was!!! but how stocked the place was with merchandise. And they had customers in there!

I can see how the combination of small footprint, small staff numbers and high turnover leads to such high net margins.

if this can be reproduced in the American market (which I understand is already well underway) there are some real natural advantages in their model which could see them grow massively IMO…

Assumption ~15% Revenue Growth next 5 years, Net Margin 15%, PE25 Discounted back giving 24.72. I used what I think are conservative numbers.

Lovisa Acquisition History

· December 2020 beeline execution of a put option agreement in relation to the acquisition of the beeline France sotre network of 30 stores. Lovisa will acquire beeline France for a purchase price of €10 (ten Euros) https://announcements.asx.com.au/asxpdf/20201201/pdf/44qh128v116s7z.pdf

· November 2020 beeline purchase for €60 as part of the transaction, upon completion, of the take over approximately €3 million of bank guarantees associated with the leases of the acquired beeline entities, as well as provide a further €3 million bank guarantee to the vendor to support our obligations under the share purchase Agreement, expiring on 31 March 2022. beeline store network consists of 114 stores, including 30 stores in France subject to the Put Option discussed above. https://announcements.asx.com.au/asxpdf/20201113/pdf/44ptns0td4ydfy.pdf

· May 2017 Acquisition of 17 fashion accessory stores from Klines South Africa the majority of which will be rebranded as Lovisa’s stores following the handover. The acquisition includes the sotre locations (lease assignments) and fixtures and fittings at a total cost of A$800K https://announcements.asx.com.au/asxpdf/20170501/pdf/43hxkw534sfcr8.pdf

· March 2015 LOV acquires 21 Retail Stores in South Africa, the majority of which will be re-branded immediately following handover. Purchase price of A$2.0m with a further deferred payment of A4250K payable 12 months post transaction. https://announcements.asx.com.au/asxpdf/20150326/pdf/42xj6xwvl113r1.pdf

No Capital Raises since IPO!!!

In the the AFR this morning. Citi has cut its price target for Lovisa by 38 per cent to $16.

Citi says sell Lovisa

Tom Richardson ( AFR, 15/06/23)

Broker Citi has taken a second look at the valuation of jewellery retailer Lovisa and weak consumer confidence to downgrade its rating on the stock from neutral to sell.

It also warned of headwinds from minimum wage rises to slash its price target by 38 per cent to $16.

Lovisa shares have plunged 27 per cent over just the last month and last closed at $18.81.

Disc: No longer held.

Lovisa shared their Macquarie Conference Presentation back on the 5 March 2022. This has been the most recent ASX news out of Lovisa…albeit old news now. What else has been going on?

Friday’s episode of ‘the Call’ with Luke Winchester (@Wini) and Claude Walker prompted me to review my IRL holding in Lovisa, which is currently sitting at about 2.5% of my portfolio.

I first became interested in Lovisa in July 2019 after hearing Owen Rask talking to Angie Ellis from ‘8020 Invest’ about Lovisa in this podcast. Lovisa sounded like a very promising high performance business, so I put it on my watch list.

In July 2019 Lovisa was trading around $11 per share. Then in Feb 2020 comes the onset of COVID19 and the Lovisa share price plunged as low as $2.45 before beginning it’s recovery to an all time high of $22.82 in November last year.

I started buying Lovisa in March 2020 (too early as usual) at an average cost of about $7 per share. Nervous about the market and economy I lightened off half of my holdings between March and November last year. I still hold 2.5% of my portfolio in Lovisa now. What should I do…Buy, Hold or Sell?

On the Call, Luke said if you look at Lovisa’s economics, it has the perfect recipe for a retailer:

- Very high gross margins

- Very high inventory turnover, and

- Very low store footprint

Luke said the growth was all in the US and if over the next 5 years Lovisa could grow US stores from 100 to 1000 or 1500, the shares sound cheap. But when Nadeem Blayne pressured Luke for a call, Luke went weak at the knees and said it was a ‘Genuine Hold’ (…not even a nibble)! :D

Claude had a different view saying Lovisa would be a company you would buy for the yield and that there is a real threat of competition.Claude said What is to stop ‘Lovisa 2’ coming along and reducing those nice margins? Claude thought Lovisa was closer to a Sell than a Buy!

Nadeem even threw in her thoughts saying that even though Lovisa has competition now, she has taken both her children to Lovisa to have their ears pierced…not really knowing why!

My view

Lovisa has been in the ‘too hard basket’ for me lately, so I’ve just Held. There is so much going on in Lovisa’s geographical footprint that it is hard to get a clear picture of what might happen to the businesses going forward. There’s also the relentless down selling of retailers lately (could be a good reason to buy??).

Luke talked about the growth in the US. However, there is also huge potential for growth in Europe.

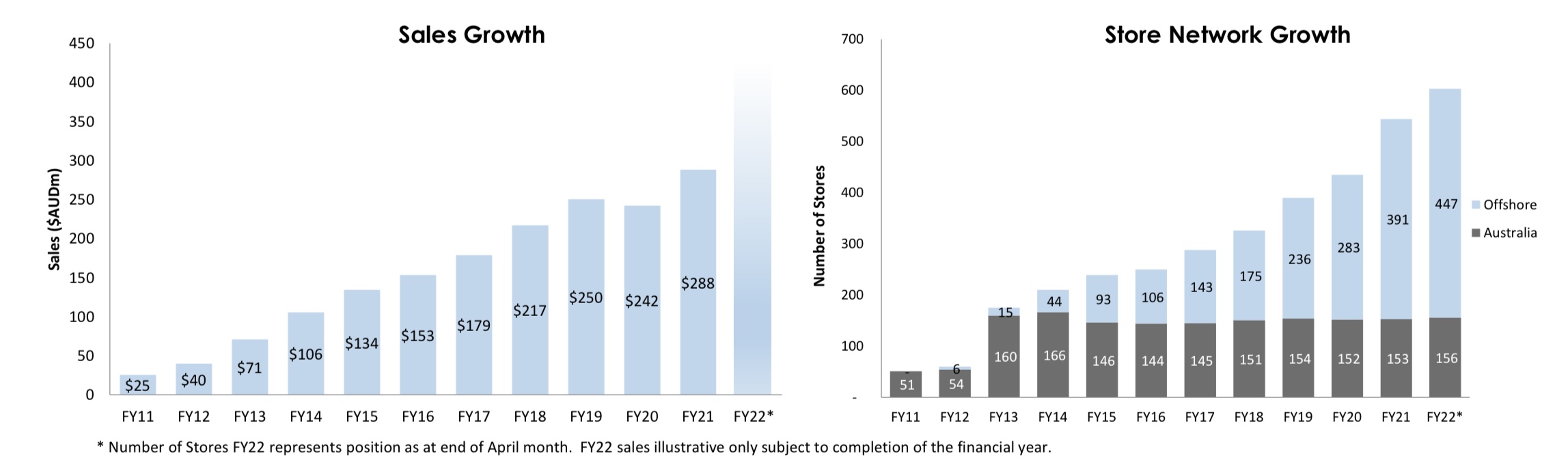

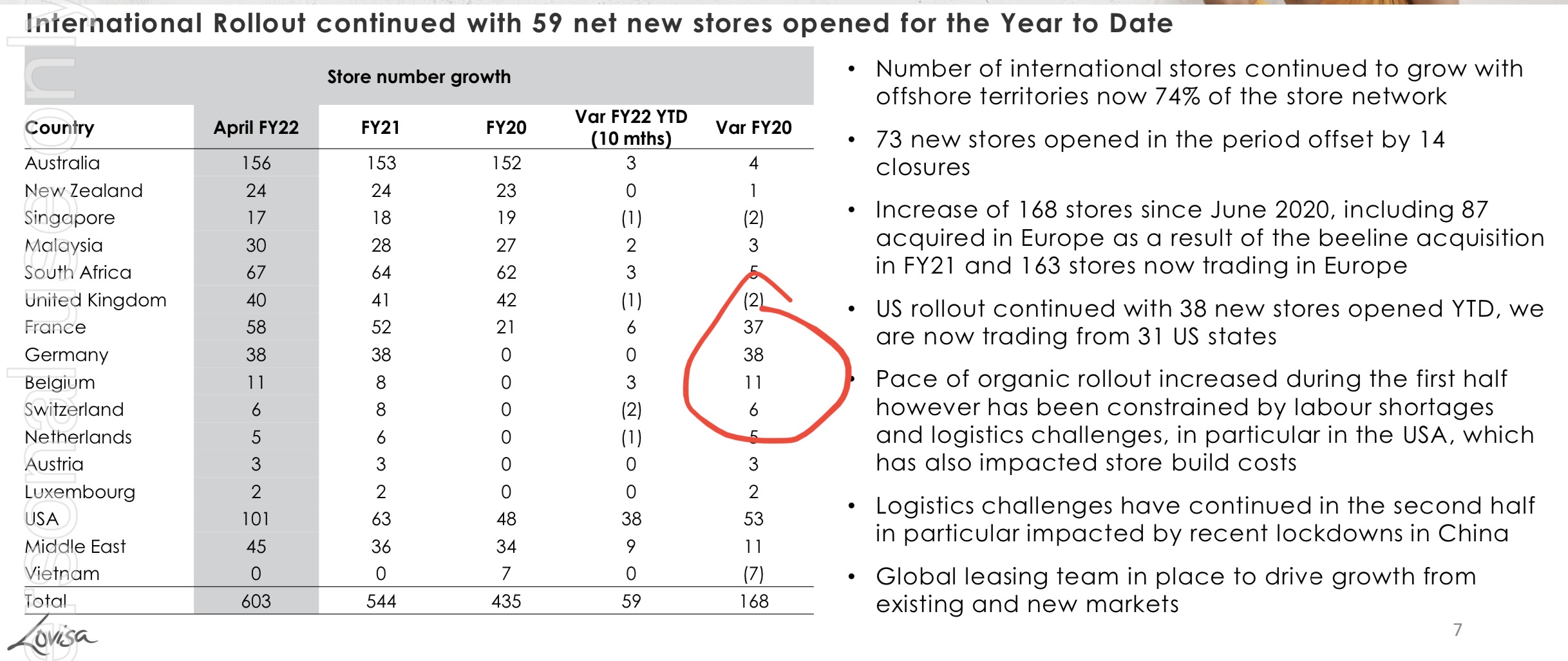

I think Europe could be a wild card. Lovisa has added 168 stores since June 2020, 87 we’re acquired in Europe as a result of the beeline acquisition in FY21 and 163 stores now trading in Europe. This compares to 53 new stores in US.

What I like about the European Beeline acquisition is the price Lovisa paid for it, a total of 60 Euros from memory. Lovisa almost stole the distressed business when European retail businesses were being hit the hardest.

Headwinds

There are some real headwinds to consider, and the impact could last for a while:

- labour shortages and logistics challenges, in particular in the USA, which has also impacted store build costs

- Logistics challenges have continued in the second half in particular impacted by recent lockdowns in China

- The impact of a recession (if we have one) on discretionary consumer products.

- continuing COVID lockdowns?

Lovisa seems to be impacted more by COVID than many other retailers. Easy to understand when you think about it, people are staying at home so there’s no need for jewellery. Who wants to get up close and personal and have their ears pierced when COVID is spreading? Who wants to jam up in a tiny Lovisa store and try on jewellery others might have also tried on?

How well can this business perform if the headwinds disappear?

We only need to go back prior to COVID to see how well this business can perform in the absence of headwinds.

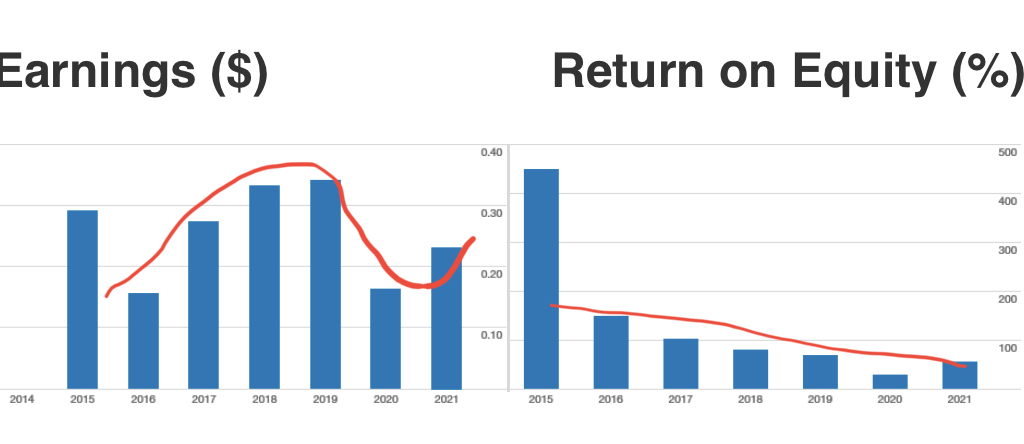

ROE has been gradually declining over several years from over 100% in 2016 to 29% in 2020. Declining ROE is something I really don’t like to see in a business and is usually a signal for me to get out, but hey…when you start out with ROE of over 400% (2015), something has to give!

in 2021 the ROE lifted back up to a respectable 55% and according to 10 analysts from S&P Global (Simply Wall Street data) Lovisa could return to ROE upwards of 90% and earnings growth of 18% over the next 3 years.

If we use McNiven’s StockVal formula and apply a 90% ROE as the APC, 28% reinvested earnings (RI), and shareholder equity of 58 cents (E), the valuation for a 10% required return is $17.20. That makes Lovisa good value if you want to take the risk!

A lot is hinging on a quick turn around over the next 12 months. It’s still a bit of a gamble for me, so I’m going with Wini on this one…it’s a ‘Genuine Hold’!

Disc: Held IRL

Ive looked at Lovisa a number of times over the last year and as others have pointed out its ROE and margins are fantastic.

It reminds me of Michael Hill or H. Samuel (in the UK).Both have done very well over a time period of several years, but extend the SP graph back further and it tells a very different story: a steady decline for 5 years, before the reason uptick.

Both were market darlings and expanded rapidly within their own countries and oversees (MH). Both over-extended and were highly vulnerable to tightening credit to the less affluent members of society. They had to close stores rapidly and exit from new geographies. I am sure there are significant differences in terms of debt load, strategy etc. but discretionary retail is not a space I personally feel comfortable investing in. (Although tempted by Dusk and Adairs on their great valuations)

And they sell crap.

Ratners, another UK jewellery chain imploded fantastically after the founder and majority owner, admitted as much, a decade ago with hilarious consequences

Lovisa shares reached an all time high of $23.07 this morning. According to James Mickleboro from The Motley Fool:

’Investors have been bidding the Lovisa share price higher today after it was the subject of a bullish broker note out of Macquarie Group Ltd (ASX: MQG) this morning.

According to the note, the broker has upgraded the company’s shares to an outperform rating and lifted the price target on them by an enormous 47% to $25.00’.

Disc: Share held IRL

Half Year 2021 Results Announcement Strong Balance Sheet, improving sales trajectory

- Net Cash of $42.5m with $50m of debt facilities in place

- Revenue down 9.8% to $146.9m due to continuing global COVID-19 trading disruption

- Comparable store sales positive in Q2, down 4.5% for the half year

- 25 net new stores opened during the half year, 460 at half year end

- Gross Margin 77.8% on constant currency basis with Gross Profit down 11.7% to $113.4m

- EBIT1 decreased by 23.6% to $30.9m

- Cash conversion of 131% with operating cash flow1 of $52m

- Interim Dividend of 20.0 cents per share, 50% franked

Presentation:-

https://www.asx.com.au/asxpdf/20210219/pdf/44stnmd8tj8djp.pdf