Lovisa shared their Macquarie Conference Presentation back on the 5 March 2022. This has been the most recent ASX news out of Lovisa…albeit old news now. What else has been going on?

Friday’s episode of ‘the Call’ with Luke Winchester (@Wini) and Claude Walker prompted me to review my IRL holding in Lovisa, which is currently sitting at about 2.5% of my portfolio.

I first became interested in Lovisa in July 2019 after hearing Owen Rask talking to Angie Ellis from ‘8020 Invest’ about Lovisa in this podcast. Lovisa sounded like a very promising high performance business, so I put it on my watch list.

In July 2019 Lovisa was trading around $11 per share. Then in Feb 2020 comes the onset of COVID19 and the Lovisa share price plunged as low as $2.45 before beginning it’s recovery to an all time high of $22.82 in November last year.

I started buying Lovisa in March 2020 (too early as usual) at an average cost of about $7 per share. Nervous about the market and economy I lightened off half of my holdings between March and November last year. I still hold 2.5% of my portfolio in Lovisa now. What should I do…Buy, Hold or Sell?

On the Call, Luke said if you look at Lovisa’s economics, it has the perfect recipe for a retailer:

- Very high gross margins

- Very high inventory turnover, and

- Very low store footprint

Luke said the growth was all in the US and if over the next 5 years Lovisa could grow US stores from 100 to 1000 or 1500, the shares sound cheap. But when Nadeem Blayne pressured Luke for a call, Luke went weak at the knees and said it was a ‘Genuine Hold’ (…not even a nibble)! :D

Claude had a different view saying Lovisa would be a company you would buy for the yield and that there is a real threat of competition.Claude said What is to stop ‘Lovisa 2’ coming along and reducing those nice margins? Claude thought Lovisa was closer to a Sell than a Buy!

Nadeem even threw in her thoughts saying that even though Lovisa has competition now, she has taken both her children to Lovisa to have their ears pierced…not really knowing why!

My view

Lovisa has been in the ‘too hard basket’ for me lately, so I’ve just Held. There is so much going on in Lovisa’s geographical footprint that it is hard to get a clear picture of what might happen to the businesses going forward. There’s also the relentless down selling of retailers lately (could be a good reason to buy??).

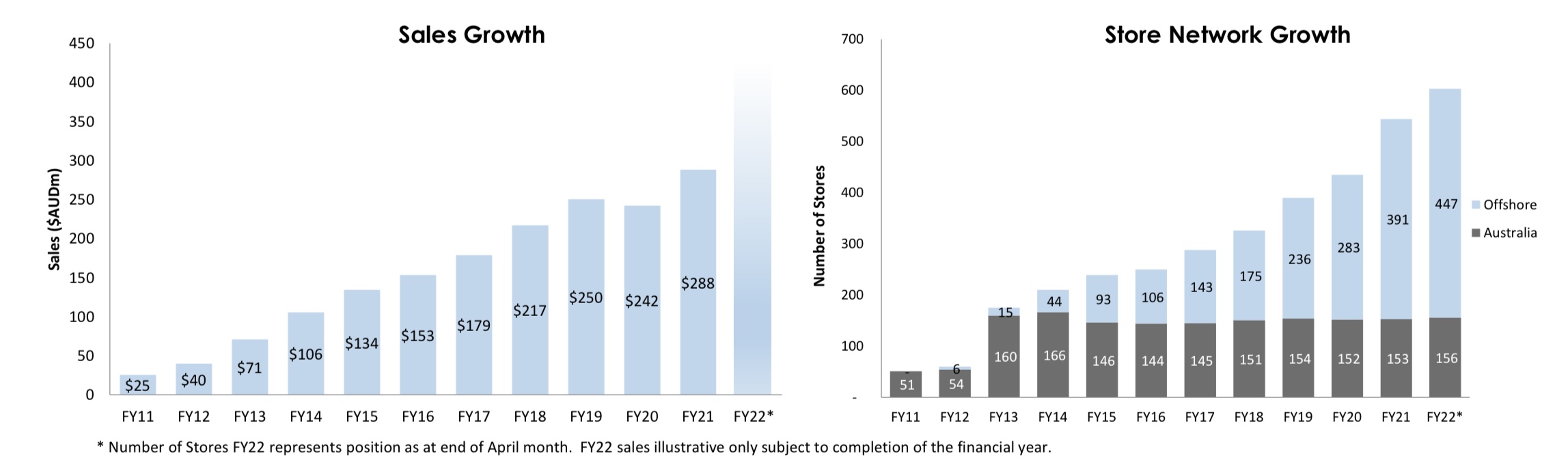

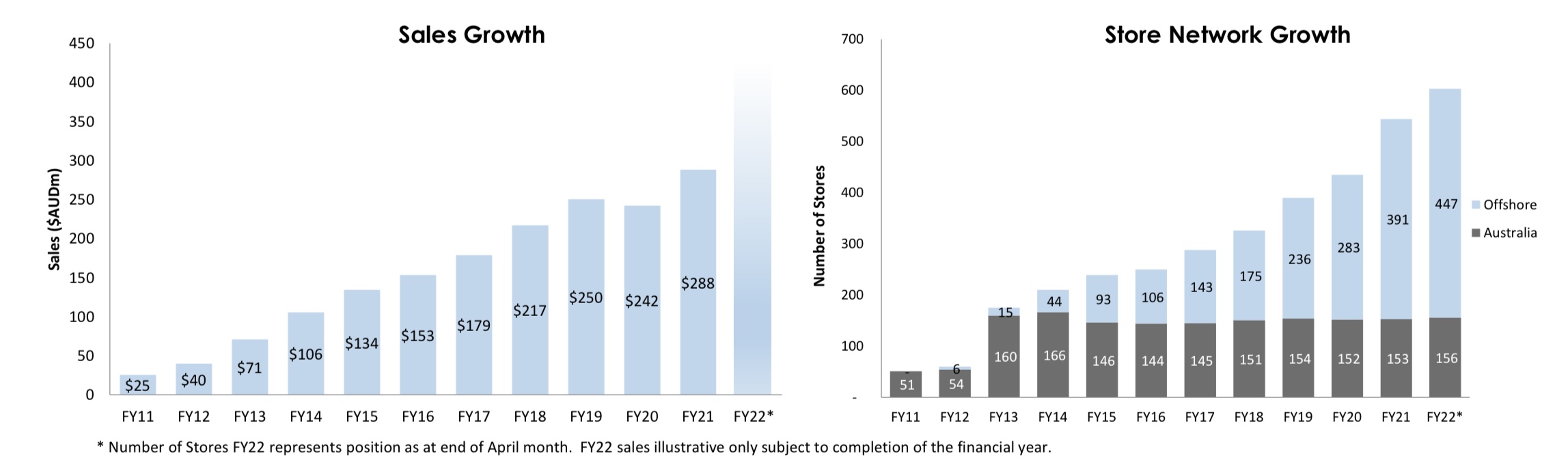

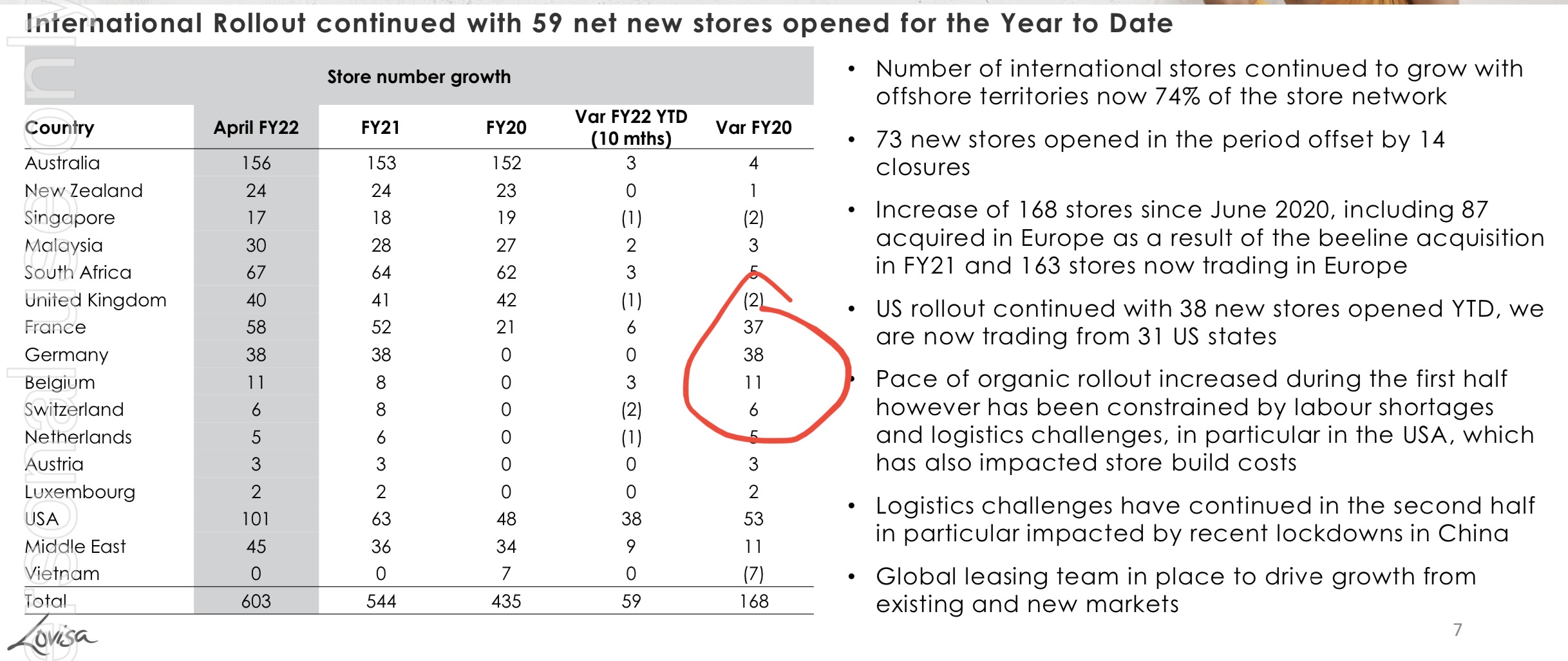

Luke talked about the growth in the US. However, there is also huge potential for growth in Europe.

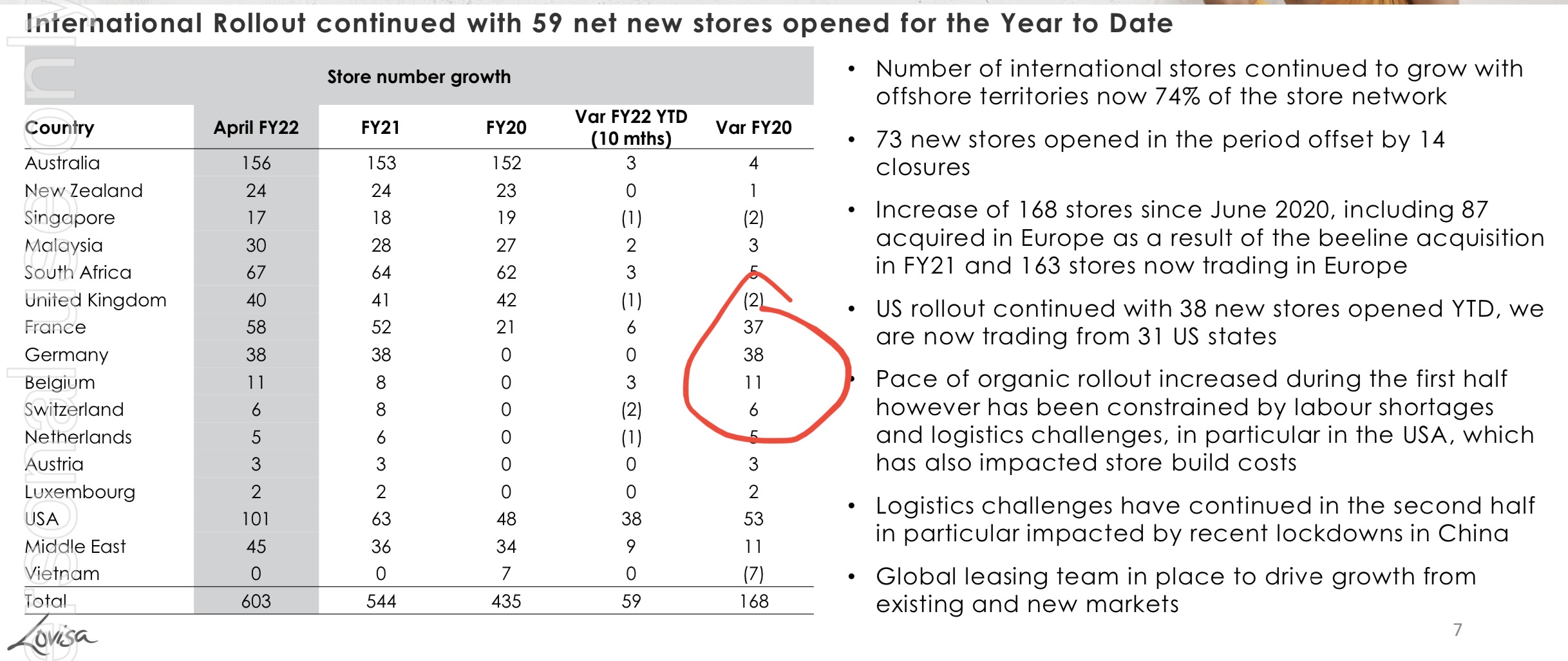

I think Europe could be a wild card. Lovisa has added 168 stores since June 2020, 87 we’re acquired in Europe as a result of the beeline acquisition in FY21 and 163 stores now trading in Europe. This compares to 53 new stores in US.

What I like about the European Beeline acquisition is the price Lovisa paid for it, a total of 60 Euros from memory. Lovisa almost stole the distressed business when European retail businesses were being hit the hardest.

Headwinds

There are some real headwinds to consider, and the impact could last for a while:

- labour shortages and logistics challenges, in particular in the USA, which has also impacted store build costs

- Logistics challenges have continued in the second half in particular impacted by recent lockdowns in China

- The impact of a recession (if we have one) on discretionary consumer products.

- continuing COVID lockdowns?

Lovisa seems to be impacted more by COVID than many other retailers. Easy to understand when you think about it, people are staying at home so there’s no need for jewellery. Who wants to get up close and personal and have their ears pierced when COVID is spreading? Who wants to jam up in a tiny Lovisa store and try on jewellery others might have also tried on?

How well can this business perform if the headwinds disappear?

We only need to go back prior to COVID to see how well this business can perform in the absence of headwinds.

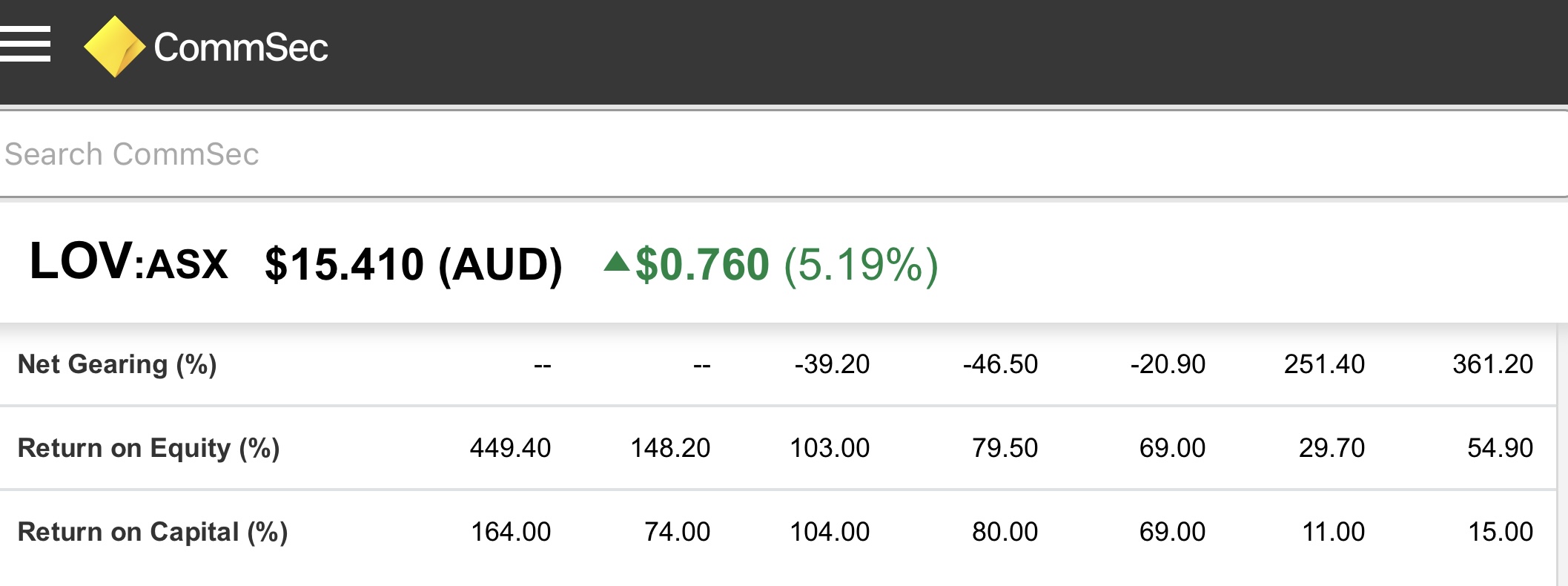

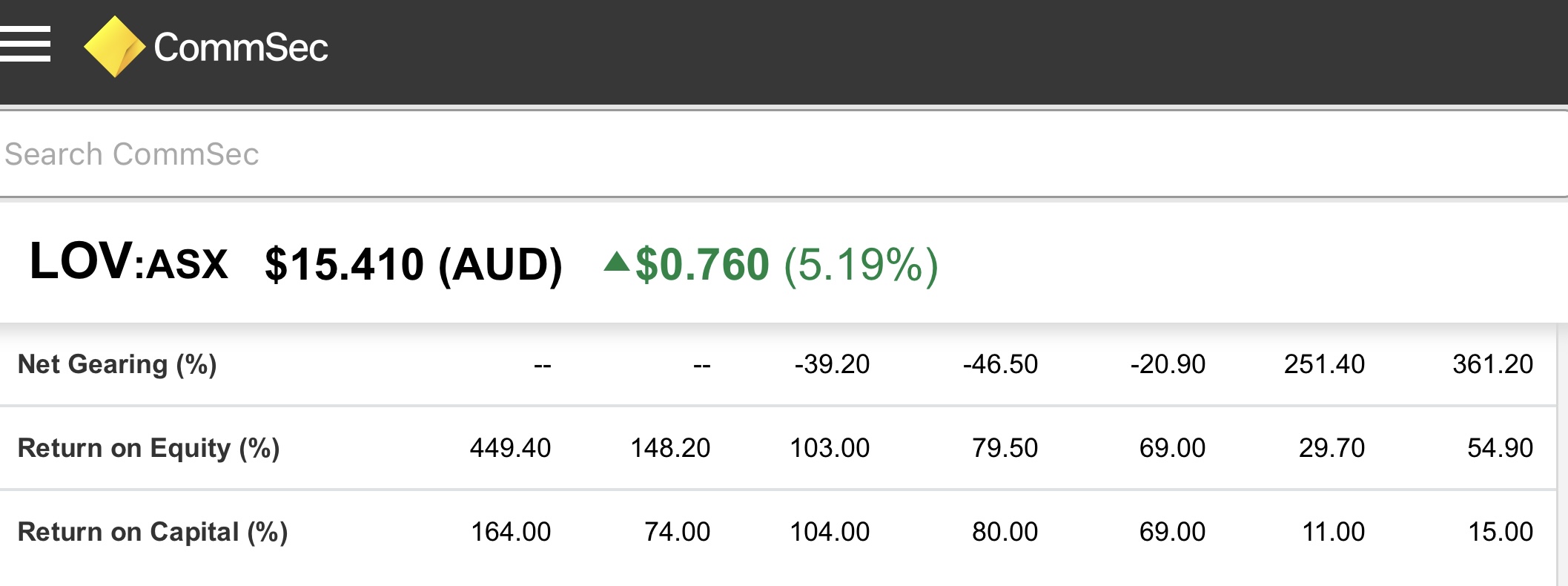

ROE has been gradually declining over several years from over 100% in 2016 to 29% in 2020. Declining ROE is something I really don’t like to see in a business and is usually a signal for me to get out, but hey…when you start out with ROE of over 400% (2015), something has to give!

in 2021 the ROE lifted back up to a respectable 55% and according to 10 analysts from S&P Global (Simply Wall Street data) Lovisa could return to ROE upwards of 90% and earnings growth of 18% over the next 3 years.

If we use McNiven’s StockVal formula and apply a 90% ROE as the APC, 28% reinvested earnings (RI), and shareholder equity of 58 cents (E), the valuation for a 10% required return is $17.20. That makes Lovisa good value if you want to take the risk!

A lot is hinging on a quick turn around over the next 12 months. It’s still a bit of a gamble for me, so I’m going with Wini on this one…it’s a ‘Genuine Hold’!

Disc: Held IRL