Pinned straw:

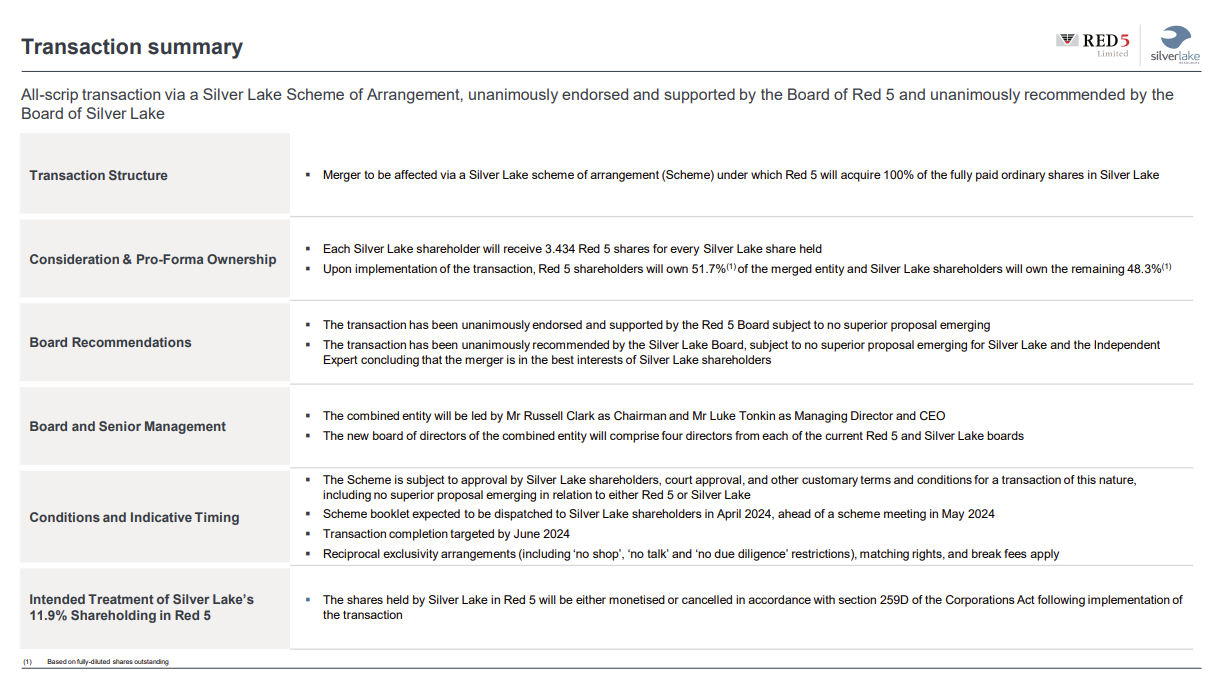

31-May-2024: The scheme meeting went ahead today and the scheme was voted up by the requisite majority of SLR shareholders: SLR-Silver-Lake-Shareholders-Approve-Scheme.PDF

- 96.84% For

- 3.16% Against

- Motion Carried.

Here's the indicative timetable from now:

As I mentioned when they first proposed this idea of a merger between SLR and RED, it was interesting for a few reasons:

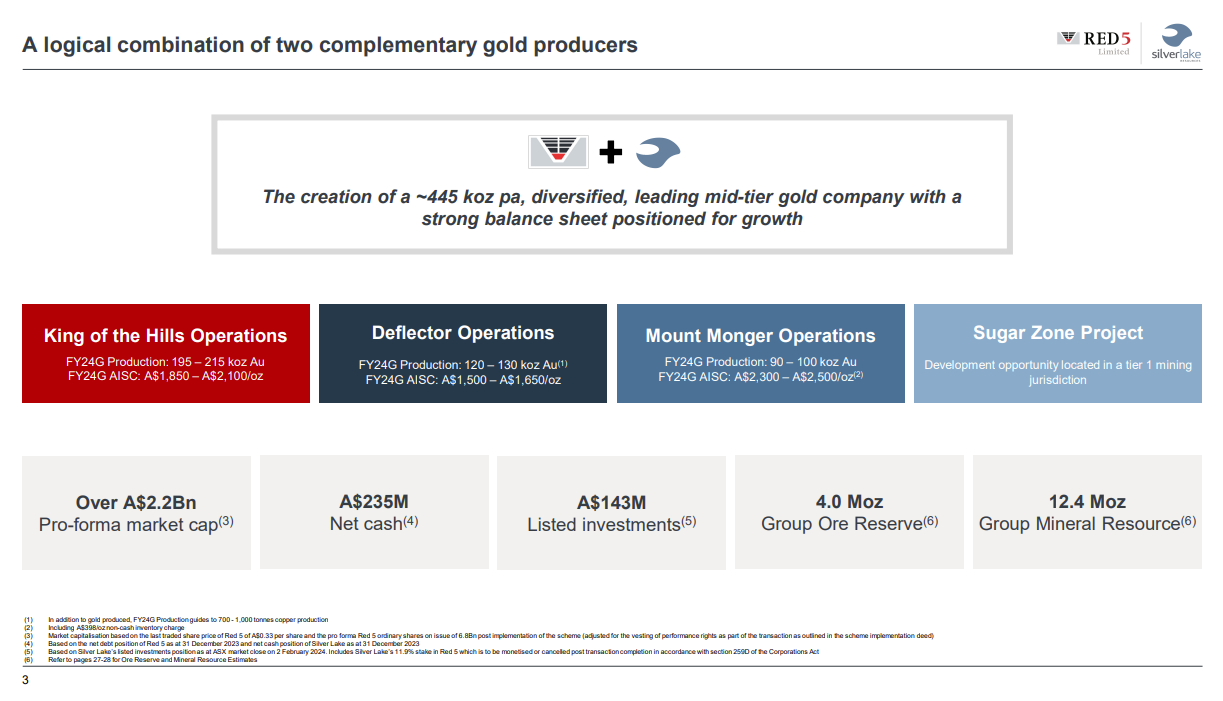

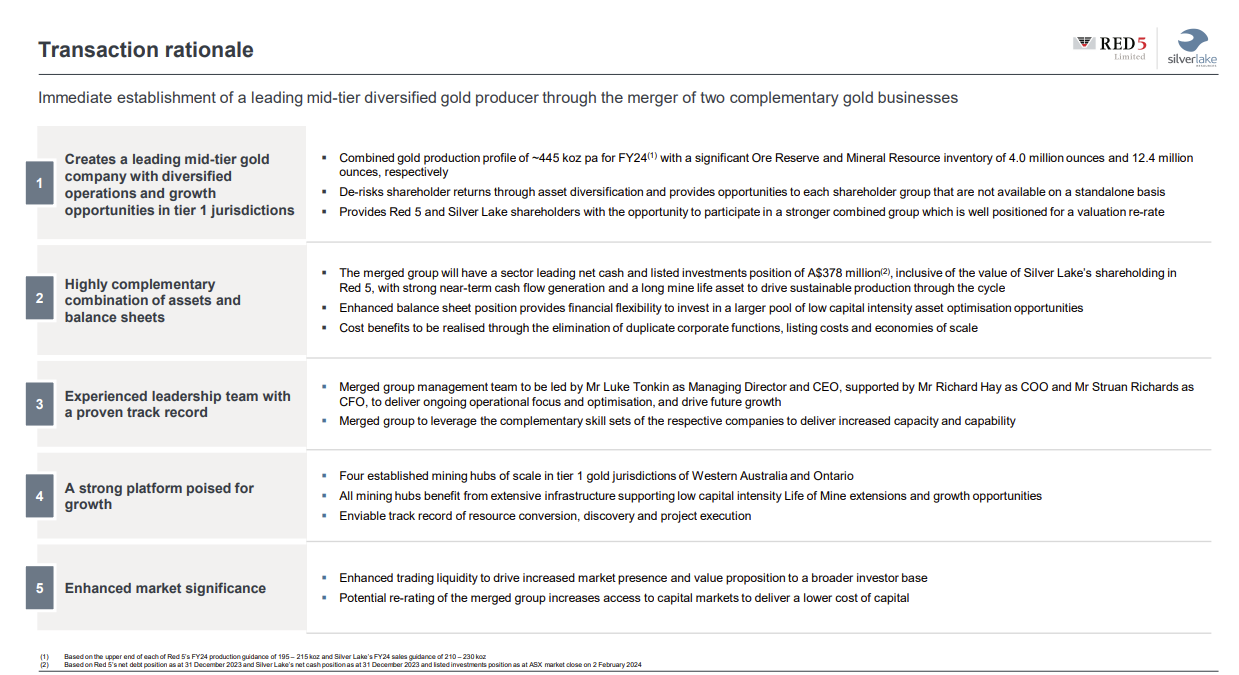

- While RED and SLR were similar sized companies at the time of the announcement (back in early Feb - see here: Red-5-and-Silver-Lake-Resources-to-Merge.PDF), the deal was structured in a way that SLR was being acquired by RED, even though RED's MD and CFO would both lose their jobs and SLR's MD (Luke Tonkin) and CFO (Struan Richards) would both keep their jobs despite their company being the target rather than the acquirer. However Richard Hay, the COO (chief operating officer) at RED would be the COO of the merged company (to still be named "Red 5" with the "RED" ticker code). And the Chairman of RED, Russell Clark would keep his job also, with the new board being split 4/4 between RED and SLR appointees; and

- The structure meant that the only way that Genesis Minerals' Raleigh Finlayson could block it would be to either lodge a takeover for RED himself (the agreement between SLR and RED allowed for superior offers to be considered by both the target and the acquiring company, a clause that RED apparently fought hard to have included) or to buy a substantial enough stake in SLR to use that to vote against the scheme at the scheme meeting (that was held today). Buying RED shares wouldn't have done Raleigh or his company GMD any good as RED was the acquirer not the target this time; and

- Everybody knew that Raleigh would have liked his Genesis Minerals (GMD) to own RED's KOTH (King Of The Hills) gold mill and gold mine because of it's proximity to his Leonora base of operations, and that he wasn't even vaguely interested in owning any SLR or dealing with Luke Tonkin who had tried multiple times to slow down and/or block GMD's acquisition of SBM's Leonora assets in the first half of calendar 2023 (Raleigh's former company Saracen Minerals used to own KOTH by the way); and

- Luke Tonkin's SLR had bugger-all assets in the Leonora area and there were no obvious synergies to be had by merging SLR and RED because each owned mines in different areas of WA - although SLR had a nice cash war-chest and RED did not, so there's that, which might add some value to RED through the possibility of further gold to be discovered through exploration - which would cost money that RED didn't have; and

- Luke Tonkin had a history of doing things to upset Raleigh Finlayson and Genesis Minerals and this seemed to be another one of those things, after SLR bought 11% of RED last year; and

- I was seriously hoping that Raleigh would NOT take the bait, and would step aside and let this one through because (a) RED had become way too expensive for what it was, and (b) Raleigh had accumulated enough assets and gold mills (i.e. annual gold ore milling capacity) to no longer need the KOTH mill, so he just did not need RED now; and

- No, that's about it.

Anyway, good job Raleigh. You did exactly what I wanted you do in relation to this deal, i.e. nothing at all, and now Luke Tonkin gets what he wants, whether he really wants it or not...

Disclosure: I hold GMD shares. I do not hold SLR or RED shares. I also hold NST and BGL shares.

Today's share price movements:

- SLR, +$0.085 (+5.86%) to close at $1.535.

- RED, +$0.015 (+3.45%) to close at $0.45.

- GMD, +$0.075 (+4.17%) to close at $1.875.

- NST, +$0.390 (+2.79%) to close at $14.35.

- BGL, +$0.115 (+6.23%) to close at $1.96.

There were 11 Aussie gold sector companies that closed more than +5% up today (DEG, PDI, SLR, RMS, BGL, TTM, WAF, YRL, RND, TGM & MDX, with those last three being up by +8.48%, +15.39% and +29.27% respectively).

It was a good day to be in Aussie Gold companies.