No worries @jcmleng I reckon a lot of people don't realise that with industry funds like AustralianSuper and CBUS, HostPlus, and a lot of others, you can direct the fund to invest in various different companies for you, but the shares remain in their name, not in yours. And that's one of the reasons why we don't get to participate in SPPs through those funds. We only get to participate in rights issues when the rights are listed and tradeable, otherwise no dice. I don't mind because (a) these funds have no debt and they're not going broke, and (b) the fees are very low so it's a cost-effective way of running my SMSF. One of the reasons the fees are low is that these industry funds do not have shareholders, just members, so once overheads are paid for, the remainder (the vast bulk) of trading profits, dividends and other profits are all credited to members' accounts. That's a big reason why most of these industry funds outperform most of the retail super funds run by companies like AMP who DO have shareholders, albeit not very happy ones most of the time.

Have a read of this @jcmleng - Inside AustralianSuper's active ownership strategy - Investment Magazine [by Glenda Korporaal, October 18, 2023]

Top 20 ASX Equity Holdings A/S Ownership – Value (%)

1. BHP GROUP LTD 3.44%

2. COMMONWEALTH BANK OF AUSTRALIA 3.49%

3. CSL LTD 3.58%

4. NATIONAL AUSTRALIA BANK LTD 3.94%

5. WOODSIDE ENERGY GROUP LTD 4.34%

6. WOOLWORTHS GROUP LTD 5.62%

7. MACQUARIE GROUP LTD 3.64%

8. WESFARMERS LTD 3.89%

9. WESTPAC BANKING CORPORATION CORP 2.75%

10. TRANSURBAN GROUP 4.75%

11. QBE INSURANCE GROUP LTD 8.56%

12. ORIGIN ENERGY LTD 12.69%

13. ARISTOCRAT LEISURE LTD 6.65%

14. COMPUTERSHARE 10.76%

15. ANZ GROUP HOLDINGS LTD 2.11%

16. THE LOTTERY CORPORATION LTD 10.73%

17. JAMES HARDIE INDUSTRIES PLC 6.67%

18. ENDEAVOUR GROUP LTD 8.37%

19. ORICA LTD 14.20%

20. AMPOL LIMITED 12.61%

Sources: PERPETUAL, ORIGIN ENERGY, AUSTRALIANSUPER, ERARING, BROOKFIELD, ENDEAVOUR GROUP, MARK DELANEY, ACCC, as per article (link above).

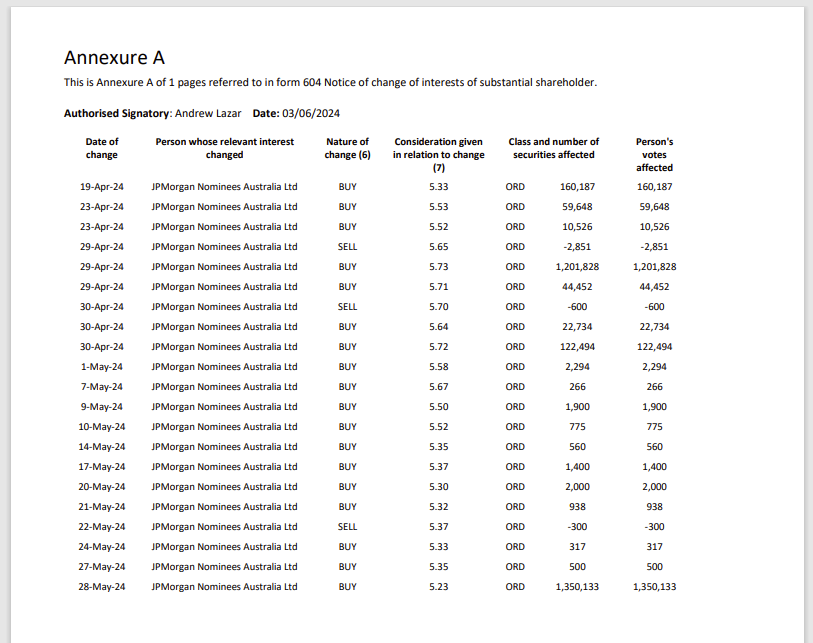

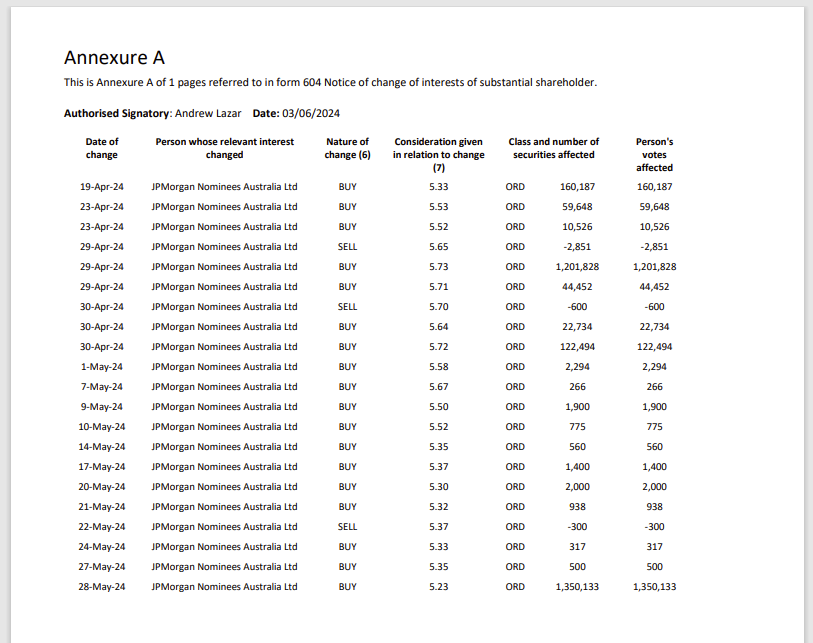

That article discusses some of the direct deals and holdings that AS has, however whether or not the position changes in notices for ASX300 companies are mostly caused by underlying AS member buying/selling through their member direct service can often be determined (or at least hints can be found) by examining the Annexue A in the notices and looking at who holds the shares for AS (the prime broker used) and how often the shares were bought and sold and in what quantities (per day). I have reproduced the Annexure A from that Change-in-substantial-holding-for-SiteMinder.PDF from today (below):

In AS' case they always use JP Morgan (JPM), so that part won't tell you anything in AS's case. However, in terms of quantity and regularity of trading, you can see that apart from the 29th April when almost $7 million worth of SDR shares were bought by JPM for AS (that 1,201,828 share buy) and another $7m were purchased on the 28th May (the last line in the list above), the trades have been relatively small, and quite frequent, so I would imagine there is a bit of both here but that most of the trades are likely down to individual members - with perhaps those two larger ones being as a result of buy orders from fund managers either within AS or working for AS.

If you look at the Change-in-substantial-holding-for-Origin-Energy.PDF lodged back in November, you'll see that JPM were the prime brokers once again for all trades but the quantities were generally a LOT bigger, so most of the buy transactions were multi-million-dollar transactions. The smallest buy was for $11.7m and the largest buy was for $89.5m, and that list just covered a move from 15.03% to 16.50%, so an increase of just under 1.5% of ORG's SOI (shares on issue). That wasn't down to individual members - that was one of the moves that AS were making that was described in that article (link at the top).

Further Reading: AussieSuper weighs bringing more ops in-house - Investment Magazine [by Sarah Jones, February 14, 2020, so more than 4 years old this time, but it gives you some insight into when they started bringing a lot of the analysis and decision making in-house rather than leaving it to their Custodians, JP Morgan (JPM).]

OK, one last example - here's a recent update from AS about their position in ComputerShare (CPU) - Change-in-substantial-holding-for-CPU.PDF

You'll find there are around 10 pages to their list of trades in Annexure A - and the majority of those trades were for relatively small amounts, but they occurred on almost every trading day during the period covered - or on the majority of trading days during the period - which was from 17-June-2022 through to 12-April-2024, so 22 months (one year and ten months). There were some decent volumes traded in some months, like Nov/Dec '22, Feb '23, June '23 and especially in April '24, but it was fairly quiet in volume terms through most of the other months with the occasional decent size trade thrown in. If it was all insto buying it wouldn't have taken 22 months to move +1.03% on a stock as liquid as CPU - which is a $15 to $16 Billion company that trades over 1m shares/day on most days, so over $25m worth of CPU is traded almost every day (and on some days a LOT more than that) - so that suggests to me that while AS had indeed chosen to take a long position in CPU, there were also a fair few of their members trading CPU shares as well, which did add to those trades.

But the short answer is we can't know for sure - we can just look at the clues and make assumptions based on likely probabilities. All I'm saying is there is often more to these notices than you might assume at first glance.

One more thing to muddy the waters a bit more - beware notices by global managers of ETFs because the global ETF market is MASSIVE and they manage trillions of dollars of investors money and ETFs are open-ended funds, so as demand for each passive (index-hugging or otherwise non-discretionary) ETF increases, the manager of that ETF is buying shares in all of the companies that are held in the ETF to keep it all in balance, and on the flip-side, when there are more people exiting the ETF than entering it, the manager of the ETF is selling shares on-market in all of those names that are held by that ETF.

Examples of these ETF managers are:

- BlackRock - the largest fund manager in the world with around US$10.5 trillion of AUM (assets under management) - see here: Asset Management & Financial Services Australia | BlackRock and here: Low-cost core ETFs | iShares - BlackRock [yep, iShares ETFs are managed by Blackrock too.]

- State Street / State Street Global Advisors - see here: State Street Global Advisors ETF List, Performance & News | etf.com and here: Celebrating 30 years of exchange-traded funds (ETFs) | State Street

- The Vanguard Group, whose founder John ("Jack") Bogle is credited with inventing ETFs, his most famous quote was "Don't look for the needle in the haystack. Just buy the haystack!" - see here: Invest in Vanguard ETFs | Award Winning ETF Provider | Vanguard Australia Personal Investor

There are others, but those are the biggest three - or three of the biggest four (see below), hence they are the only substantial shareholders of Australia's very largest companies, they are all substantial shareholders of Australia's 4 largest listed companies, BHP, CBA, CSL and NAB. There are NO other substantial shareholders for CBA, CSL and NAB, and only one additional substantial shareholder for BHP, with is Citi (or CitiGroup) who are one of America's "Big 4" Banks alongside JPMorgan Chase, Bank of America, and Wells Fargo - I believe Citi are currently the 4th largest bank in America behind those three.

The reason why there are no other "Subs" for these companies is because to be a "Sub", you have to own 5% or more of the company's SOI, and those 4 companies (Australia's largest 4) are currently worth A$226 Billion, $200 Billion, $135 Billion and $105 Billion, so buying 5% of one of them would cost $11.3 Billion, $10 Billion, $6.75 Billion and $5.25 Billion respectively. Vanguard, State Street and BlackRock are three of the four largest ETF providers in the world, so they have that sort of money - or money under management (usually referred to as "funds under management" - or FUM).

Here are the largest ETF providers in the world - so when you see these names (below) crop up as substantial shareholders, you'll know why:

Source: All ETF Issuers (etfdb.com)

Well, sometimes you'll know why - because some of them (like JP Morgan Chase) are also prime brokers and often hold shares on behalf of other entities, such as when they are acting as "Custodians" for entities who are clients.

And that's just the top 25, that website lists 253 ETF providers, although once you get down below the first 145 of them, there are quite a few that only manage one single ETF. The guys up the top however manage hundreds of ETFs - the top 5 providers manage over 1,100 ETFs between them.

A lot of those index-hugging ETFs are often referred to as trackers because essentially that's exactly what they do, they track their index, and the return you get should be the index return less whatever small fees the ETF managers charge, and the best ones charge very low fees because they have so much FUM - and they want to keep it that way - it's all about the volume. That's why well chosen ETFs are usually a decent place to park investable capital while you search for even better places to invest that money. If you can't find anything that is significantly better without additional risk then leaving money in ETFs is NOT a dumb thing to do at all - it's pretty sensible! Remember that the majority of fund managers do NOT beat the index most years (so, on average) - only the really good ones manage to do it consistently. Taking on additional risk for the possibility of better returns is a whole different discussion, which I won't go into here. Let's just say I have no money in ETFs at this point in time but I have used them before and I don't have any problem with using them again - they serve a very useful purpose.

There are all sorts of ETFs of course and some are called "smart ETFs" rather than the original standard "passive ETFs" but the "smart" part really means that there is an element of choice in what the ETF holds, so there is therefore a more hands-on manager making actual decisions about either the investing framework and/or the individual companies they choose to include in the ETF. Those so called "smart" ETFs usually have significantly higher fees, and significantly higher risk too in many cases because they're moving away from the index hugging that ETFs were invented to do, and moving more towards active management, however they will suit some people. Examples are high income (higher dividend paying) ETFs (some pay dividends as frequently as monthly), or ETFs with quality or growth filters that are supposed to NOT hold either low quality or low growth companies. Anyway, I'm getting off track here again...

Point is, just be aware that substantial shareholder notices are simply percentage ownership declarations that the ASX require to be lodged; they don't tell you why the percentage has changed, in terms of why the buying or selling was done, or even for whom it was done, they just tell you that changes have been made. Sometimes that info is useful, but not always.

Also, be aware of mirror notices, which is when 2 entities (companies or persons) lodge similar notices either on the same day or within one trading day of the other, and for identical percentages. These are often just one position, not two, and that is because often one of the entities is the holder of the shares but is considered to be a controlled entity of the other one, so both of them are considered to be in a position to have control of how those shares are voted. The easiest way to check if this is indeed the case is to go through the notices and see if entity A's name turns up in entity B's paperwork as a subsidiary (controlled company or controlled entity) or Company B turns up in Company A's paperwork.

One quick example of this (mirror notices) is SOL and BKW where BKW (Brickworks) is considered to be a controlled entity of SOL (Washington H Soul Pattinson and Company), because SOL owns 43.12% of BKW, and even though BKW also own 26.13% of SOL, BKW is a $4 billion company and SOL is an $11 billion company, so SOL owns BKW way more than BKW owns SOL, so any time BKW lodges a "Subs" notice, SOL lodges one as well, for the same shares. Same holding, not two different holdings, but two companies with the power to control those shares.

The second example is First Sentier Investors, which is a controlled entity of Mitsubishi UFJ Financial Group (MUFG), so on May 17th this year, First Sentier became "Subs" for IEL with 5.79%, and lodged the appropriate "Becoming..." notice on 21-May-2024 after market close (Becoming-a-substantial-holder-from-First-Sentier-Investors.PDF). On the 22-May-2024, also after market close, MUFG also lodged a rather lengthier "Becoming..." notice stating that they had also become substantial holders of IEL with 5.79% but that they had only become aware of that fact on 21-May-2024 (Becoming-a-substantial-holder-from-MUFG.PDF). First Sentier and their subsidiary companies were all listed on pages 7 and 8 of MUFG's notice (in their Annexure A). There are hundreds of these examples, but you get the idea - these are not two different positions; they are one position but two companies are considered to be in control of it, because Company A owns the shares and company B controls company A.

I believe that these "Subs" notices must be lodged "ASAP" but in any case not more than three trading days after the date of the change, although that might be two trading days but three days if you have a good excuse (like MUFG claimed to have had - "We didn't know, your honor! We read about it when you did!"). The ASX usually sends a "Please Explain" letter out if the notices are lodged outside of the allowable window.

This Mirror Notice thing is worth being aware of because if you go off a site like CommSec and their "Shareholders" sub-tab within their "About" tab about any individual company, they will often list either the wrong owners of the shares or they will make it look like two different companies both own different stakes which happen to be the same size when it is really only a single stake, not two. One example of where they got it completely wrong and nobody bothered to fix it for over a year until there was a takeover offer for the company that the Board was recommending to their shareholders, was with Skip's 19.99% of Genex Power (GNX) which Skip acquired in mid-2022, which Commsec showed as having been sold in December 2022 for all of last year and the start of 2024 as well - i.e. Skip Enterprises Pty Ltd (part of Skip Capital) NOT being "Subs" for Genex when they were - because Skip had made an offer back in 2022 for Genex which was rejected, and then they made a higher offer as part of a JV with another group, and that group had to lodge a mirror notice because they had a written agreement to work with Skip to try to acquire Genex so they jointly controlled those shares plus any more that would/may have been acquired by them as part of that takeover attempt. When that deal also fell over (in December 2022), the JV partner exited and lodged a "ceasing..." notice because they no longer had any connection to Skip's 19.99% of GNX. Commsec mistakenly attributed that "ceasing..." notice to Skip as well, and showed on their (Commsec's) site that Skip had ceased to be "Subs" for GNX, so it looked for over one year (to anybody relying on Commsec for their research) that Skip had sold down below 5% or out altogether. I contacted Genex directly last year (as I was also a Genex Power shareholder) and I was assured by Craig Francis, their CFO at that time (and now their CEO) that Skip did indeed still own 19.99% of Genex and had not sold down at all. It wasn't until the second largest shareholder, Japanese renewable energy company J-Power (who owned less than 8% of GNX), made a higher offer earlier this year, and then a higher one again that was finally recommended to shareholders by the Genex Board, that Commsec finally fixed up that error and re-listed Skip Enterprises Pty Ltd as being 19.99% shareholders in Genex - which Skip had been since mid-2022 and still are today - the shareholder vote for the J-Power takeover of GNX is going to be in July and Skip are the only ones who could block it, in which case an on-market offer from J-Power kicks in at 27 cps (half a cent lower than the 27.5 off-market takeover offer that is being voted on in July) so I'm thinking Skip will probably vote "Yes", but you never know with these things.

So sometimes you can't believe everything you read, and other times what you read might not mean exactly what it may appear to mean at first glance.

Clear as mud, right?!?