Fair points @Strawman - and you could well be right, but it would probably be a good idea to have an exit strategy in place, in terms of: What would make me sell? And/Or: What is the minimum that this company needs to achieve, and over what timeframe, for my investment thesis to stay intact in my view?

I have found that writing down answers to such questions and then holding myself accountable to that does prevent a fair amount of additional losses with companies that do NOT recover. We don't need to make these answers public - so they don't need to be recorded here on SM for everyone to read, but we should have a good idea of the answers to these questions for the companies we hold.

If we always re-evaluate only based on company announcements, reports, and external reporting on the company or the sector, then we'll probably find that we are unwittingly engaging in some thesis-creep. What I mean is that if we don't have targets in mind, such as timeframes for certain events (such as cashflow positive, bottom line profitability, minimum growth rates, etc.) and we only look at each new piece of data on its own merits without any investing framework (such as a written investment thesis for that particular company) to compare it to, then we are repositioning the goalposts again and again in relation to the new data.

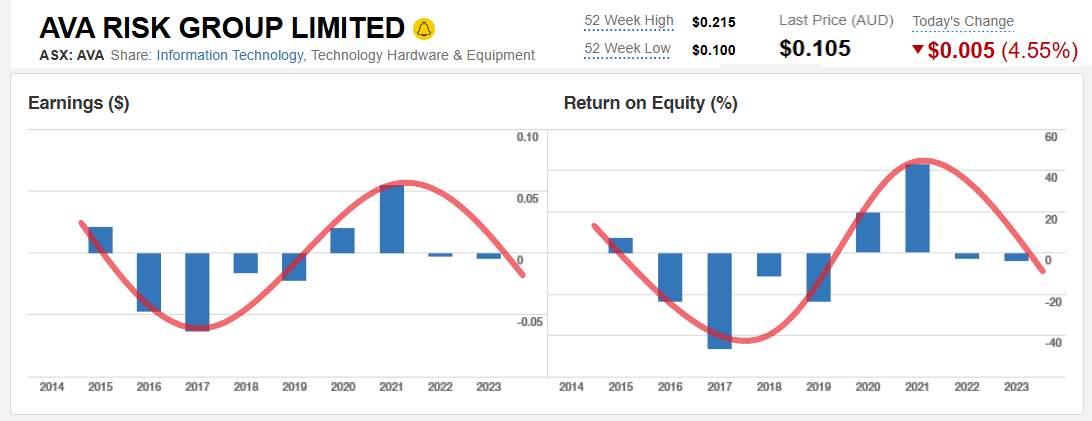

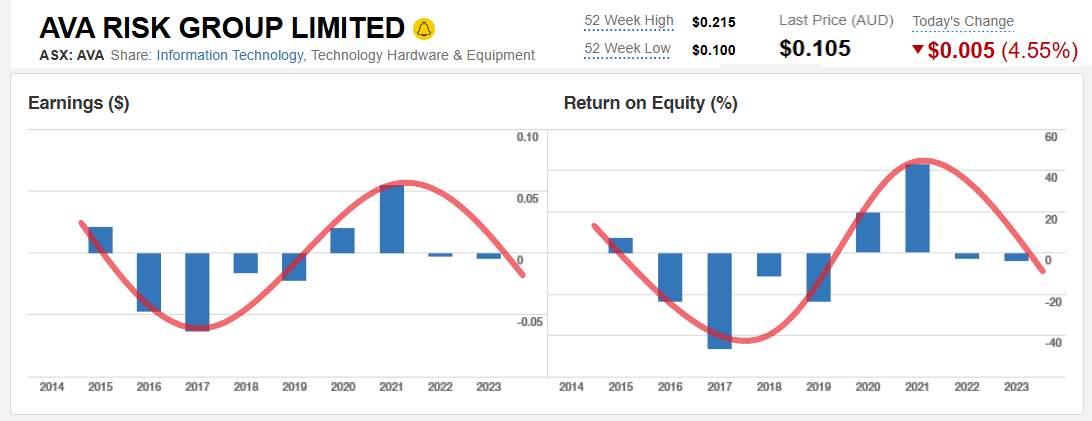

I know it ain't easy with these microcap and nanocap companies, because they can bounce around along the bottom for ages and then come good real quick and take off, however beware the ones that turn around and start heading south again in terms of important business metrics, which is what has happened with AVA since they sold their Services Division in 2021 - see here: AVA-sells-Services-Division-August 2021.pdf

And compare that to this:

Remember this:

"The consideration received will be approximately US$46.4 million payable in cash on completion of the Transaction. Of that amount, approximately US$31.1 million will be retained by Ava Risk Group, and US$15.3 million will be paid to certain Ava Global employees pursuant to accrued entitlements (both FY2021 incentive bonus and exit value calculation) under Ava Global's existing performance incentive plan previously disclosed to the market. "

Board and Management got to keep US$15.3m of the total consideration of US$46.4m (i.e. around one third of the total received), and then AVA paid a generous special dividend out to shareholders - see here: https://www.theavagroup.com/ava-risk-group-announces-fy22-results/

Highlights for FY22 include: "Cash distribution of $38.8m to shareholders during the year, via a capital return and special dividend."

Coincidentally their current market capitalisation is now less than what they paid out to their shareholders in FY22 - AVA is currently valued at $31.84m according to the ASX website today.

That huge capital return resulted in a massive share price decline - as capital returns of that magnitude tend to do - and the company also stopped making money because they'd sold off their most profitable division and none of the proceeds from the sale of that Services Division were reinvested back into the Business. They couldn't have been. Not with US$15.3m of the US$46.4m being retained by their Board and Management as bonuses and a further A$38.8m being paid out during the following 12 months to their shareholders - which of course included that same Board and Management.

Sure - Mal Maginnis wasn't there for that, but the other 3 AVA Directors (of their current 4-member Board) WERE there for that - they've been there since 2018 (Dave Cronin and Mick McGeever) and 2015 (Mark Stevens). So while it's fair to say that Mal has inherited a difficult situation - as in a poorly funded company that should really have had a lot more money at their disposal to fund their own growth - it also pays to remember that Mal is the only Board change since those decisions were made (Mal in, Rob Broomfield out), so they're still running with 75% of the same Board who oversaw those decisions in 2021 and 2022 that left the management with millions but the company seriously underfunded.

And then they paid out another small dividend late last year and that understandably copped a fair bit of critisism, and I actually tried to defend that dividend at the time, mainly because it was so small and rather immaterial and I didn't really think it would have a significant impact on the company, but I was wrong to defend it, as they should NOT have been handing out money to shareholders in the position they were in. Looking back now, I see that AVA director Dave Cronin owns 12.71% of AVA through his company Pandon Holdings (32,463,070 AVA shares) and is the company's largest shareholder. Mick McGeever holds 6 million AVA shares. Mark Stevens owns 1.7m AVA shares.

There's arguably an element of looking after themselves here rather than making decision that are in the best interests of ordinary retail shareholders. Just saying - it's worthy of consideration. Capital management is very important with small companies, and AVA's track record of capital management is pretty poor.

And I believe the share price is reflecting that:

So I haven't looked at their current management incentives in any great detail, but do note that they do use a lot of performance rights as part of their KMP remuneration - and some of those have been lapsing (hurdles not met) and some have been vesting (hurdles must have been ones you could step over easily) - see here: Change-of-Director's-Interest-Notice---Maginnis(05Feb2024).PDF - page 2: Vesting of 333,333 Performance Rights to Ordinary Shares plus Lapsing of 500,000 Performance Rights (Mal M). However it is clear that they were very incentivised to sell that Services division back in 2019 to 2020 and the Board allowed the date by which the Services division had to be sold by for management to secure those bonus payments (incentives) to be extended - TWICE! So they were very keen to get that money. And they did get that money, albeit it took them to 2021 and two time extensions on the bonus scheme to achieve it.

So incentives are important. How are the current management incentivised? And Capital Management. Again, it's really hard to say with hand on heart that AVA have been good capital allocators, unless you're talking about allocating capital to themselves as individuals - because they have certainly mastered that. But that is NOT good for ordinary retail shareholders when management are NOT being given bonuses for anything that in any way benefits ordinary retail shareholders, but instead are rewarded for selling off their most profitable division and NOT reinvesting the proceeds of that sale.

Has this leopard really changed its spots now, just by bringing in a new CEO/MD (Mal) with some new ideas but no cash to invest?