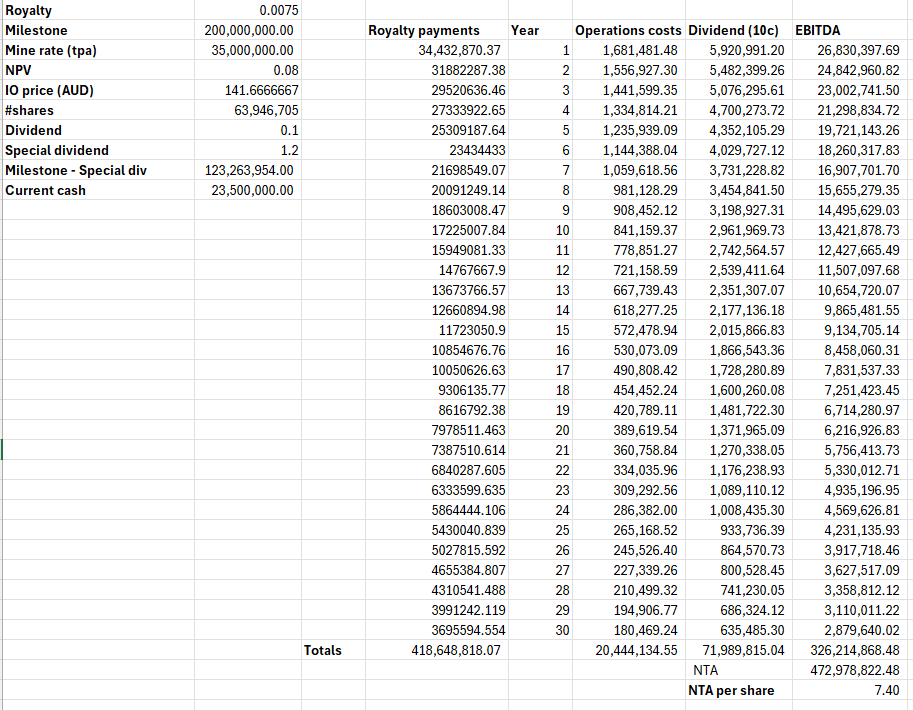

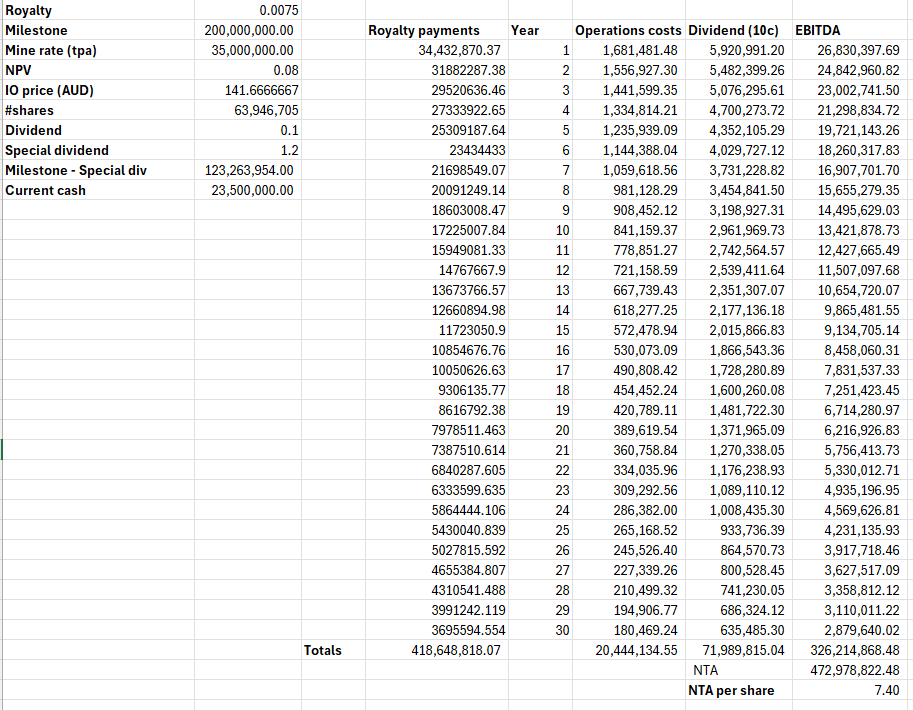

Revised valuation taking into account operational costs and dividends so this is a more complete picture of RHI.

Looking at past quarterlies, the operation cash outflow is around 450K which equates to 1.8m per annum although last quarter they got a tax refund of 1.2m. I'm going to exclude that one off and just say they spend 1.8m per year running the show.

Also converted long term IO price of $85 to AUD.

Share price has to be around $7-7.40 (before special dividend of $1.20). Once special dividend is paid I predict the share price will stay around 5.80. So that will be our 12 month price target I think although the current price has probably factored this in.

With royalty the main income, the sums are quite easy to calculate so I have probably missed something here just a caveat.

I could even include fluctuations in commodity prices to make it more realistic but no time for that right now. Point is RHI is fully valued no matter which way you look at it unless MinRes announces another upgrade.

[held]