Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

@Bear77 have you ever looked over the fence at RHI? (I say over the fence as I think you own most of the tenements that surround where these guy's operate...lol)

On a more serious note though, I must admit I'm liking their model, locations and balance sheet which is why I opened up a smallish position in RL to keep a closer eye on them.

Sept 2024 - Updating to 4.80 to account for slow ramp up of Onslow and IO price drop to 90 USD (138 AUD)

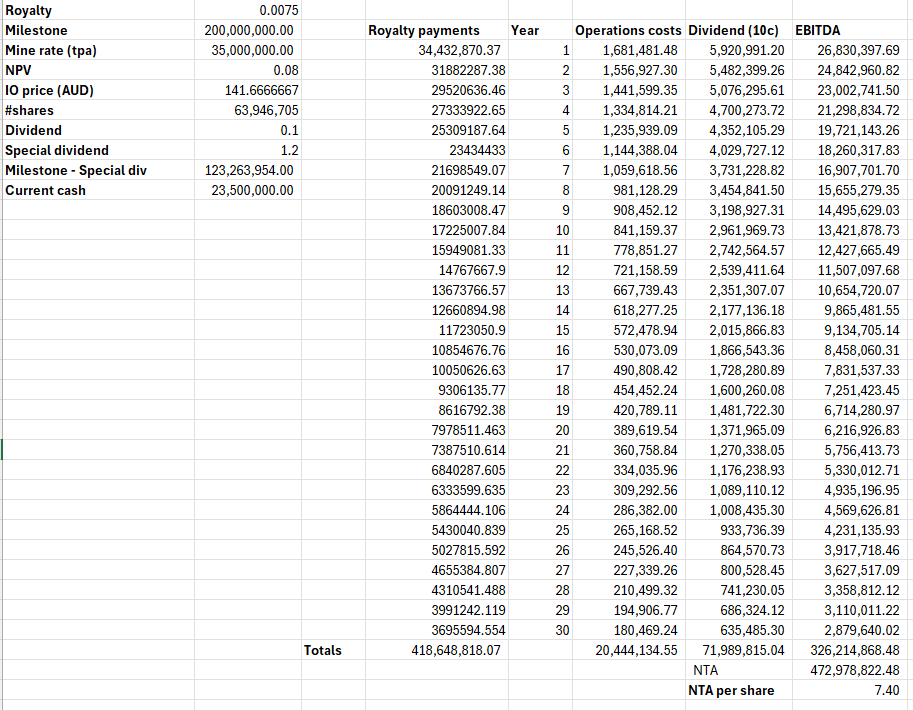

June 2024 - 7.10 See previous straw on financials after 1.50 special dividend was paid. Base case uses IO price of 141 AUD.

Apr 2024 - 7.30. See previous straw on financials. Using 35mtpa. NPV8.

Nov 2023 - 4.95 (nb this is using 16mtpa which is wrong)

See previous straw on financials

NPV11 works out to be 345m for the Minres milestone and royalty payments.

Looks like ramp up has been slow. This will impact the valuation

Bit of a bad call on me. This means the 35 mtpa won't happen next year.

I'll need to include this and come up with a new price. Going to take time.

Explains why the share price has been in freefall. I haven't topped up on this yet.

On top of this, they are doing some earn in agreements with Peel Mining (PEX)

[held]

Updating the valuation after announcement of the $1.50 special dividend.

As an extra, I've done a sensitivity analysis on the NPV discount vs Iron Ore and MTPA processed against NPV discount modelling different price scenarios.

Looks like everyone got a bit excited over the special dividend today. Was expecting no change but it is what it is.

I've used the long term price of Iron Ore of $141 AUD ($85 USD and 0.60AUDtoUSD) which is very conservative. Currently Iron Ore is around $150 AUD.

[held]

Revised valuation taking into account operational costs and dividends so this is a more complete picture of RHI.

Looking at past quarterlies, the operation cash outflow is around 450K which equates to 1.8m per annum although last quarter they got a tax refund of 1.2m. I'm going to exclude that one off and just say they spend 1.8m per year running the show.

Also converted long term IO price of $85 to AUD.

Share price has to be around $7-7.40 (before special dividend of $1.20). Once special dividend is paid I predict the share price will stay around 5.80. So that will be our 12 month price target I think although the current price has probably factored this in.

With royalty the main income, the sums are quite easy to calculate so I have probably missed something here just a caveat.

I could even include fluctuations in commodity prices to make it more realistic but no time for that right now. Point is RHI is fully valued no matter which way you look at it unless MinRes announces another upgrade.

[held]

52 week high at $6.80 today (19 Apr). FOMO has finally arrived

MinRes making Onslow their flagship project with the progress video right at the beginning of the FY24 presentation.

Has been good for Red Hill, not so good for Develop. Unfortunately I hold less RHI than DVP so this has not been a perfect "hedge". Because I think Red Hill is "boring" even though "boring" can sometimes be "good".

And Joshua Pitt track record has been average till now (marketindex). I guess the saying "Every dog will have its day" applies here?

A few bits of info to take away for more valuation into the research as again I think I've undervalued this somewhat (see previous straw on Financials)

Stage 1 is 35 mtpa. How long to wait till Stage 2? How big will be Stage 2? 50mtpa? 75mtpa?

Map of the JV. Have to verify if there is more than just Red Hill in this royalty. Obviously more upside if there is.

[held DVP and RHI]

Giving the Iron ore majors (and the Iron ore price) a run for their money

Popped 10% today from 5.25 to 5.75 possibly on the back of recent updates on the Onslow project from Minires.

Markets obviously factoring high prob of $1.20 dividend (see previous straw).

I also added CZR here since the company is in discussions on joint development of infrastructure for the Pannawonica (RHI) and Robe Mesa Project (CZR) which will obviously benefit both parties.

CZR is top performer so far as they are currently in discussions to sell their interest in Robe Mesa Project for $102 million to Miracle Iron resources (subsidiary of Shenzhen Naao Jiangian Invest Co (SNIC))

Such a development would probably benefit RHI as well if this goes as planned although the market is still divided on the probability of this being successful and hence coming off recent highs

Very illiquid though so buyer beware (and why not added in Strawman as it is too difficult to trade)

[held RHI]

Despite the negative news on iron ore and lack of success on exploration, RHI is still going up. Hit 52 week high

Just checked the queue and nothing on sale

Still doing my sums on those payments but I think some smart guys has already beaten me to it :(

Maybe just pull the trigger and push it to $5?

Edit:Very keen buyers at 5+

Also announced gold drill results.