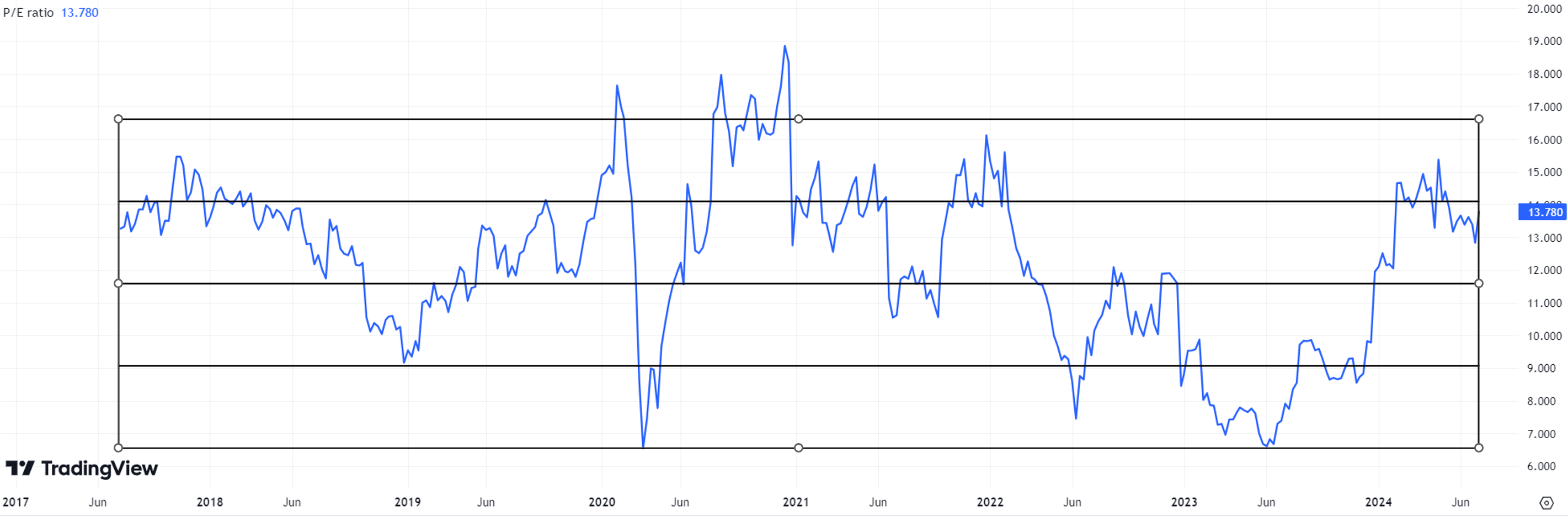

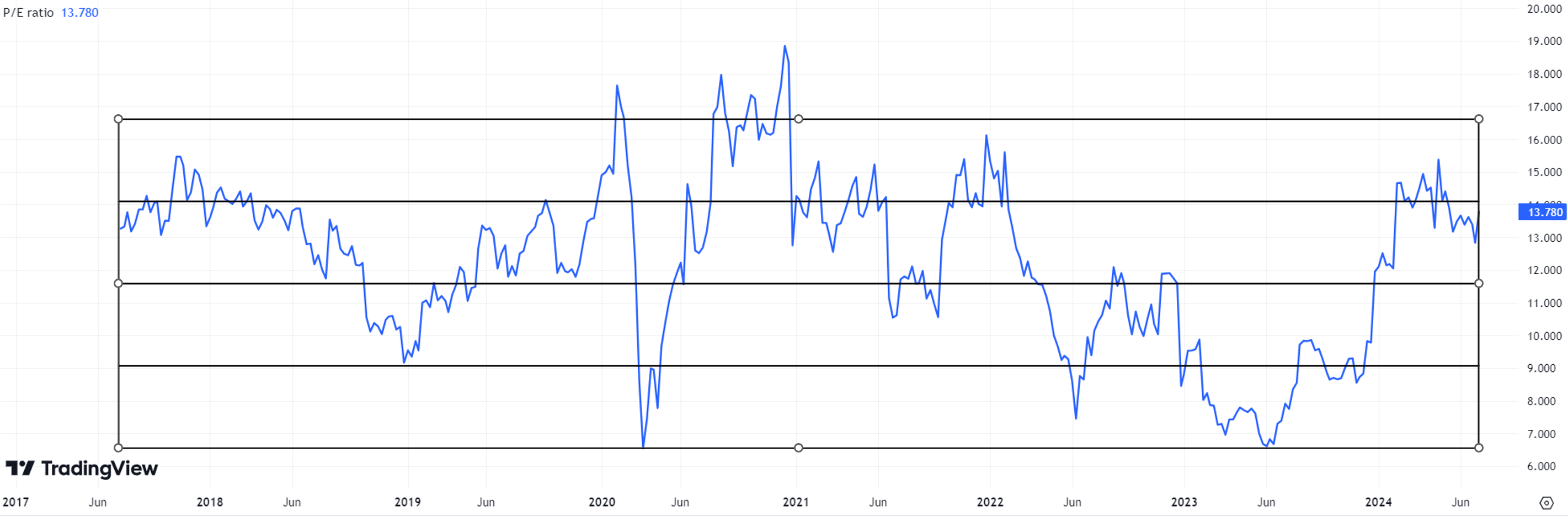

@Karmast - your point makes perfect sense to me (see below graph).

I did consider the P/E ranges, but when the price dipped recently taking the P/E down to below 13, I felt it wasn't too far north of the mid-cycle average. (My overlay grid is done by eye-ball only - I ignore the very high PE peaks during the COVID-bounce, as an aberration.)

I know some investors will only buy when a stock is in the bottom quartile - and this makes sense I guess if you are talking about a pure cyclical. However, I see $NCK as a cyclical-growth play, and so I am more than happy to add when it is in the vicinity of mid-cycle. I use the P/E only as one consideration and not a hard filter.

I would like to hold a bigger position in $NCK, but am keeping powder dry for the situations you've described. I am a relative newcomer to the stock, having initiated my RL position only in Feb-2023. At 3.6% of my RL-ASX portfolio, I'd happily add another 50% over time, and I agree that 1) retail macro and 2) getting going in the UK may well lead to some "opportunities for disappointment", hence buying opportunities, over the next 6-12 months.

However, from a valuation perspective and long-term view, I was happy to add some.

I also liked @UlladullaDave's post on the retail cycle and mean reversion etc.

Where I differ from you, is that I'd need to see $NCK's P/E fly up quite a bit more before I'd consider trading it. (My default preference is just to hold for a long time, unless the stock gets beyond my valuation high case.) Still, that's what makes a market. One investor's sell is another's buy. (Thanks for selling me your shares!:-) )