In general 8CO has been a dissapointing investment to date. They are running around 12-18 months behind where I thought they would be in terms of the federal government rollout. I still don't have a good reason on why the implementations are so slow, I'm guessing it must be largely on the customer side as otherwise I can't see why they wouldn't be throwing all of their resources (limited as they are now) at accelerating it. Many of these departments only have a few hundred employees so maybe this is part of it.

I was disappointed at the quarterly as I did expect this to be a strong cash build quarter and for them to only generate $1K positive cashflow is underwhelming. This is two quarters in a row now that they have run their balance sheet to an inch of its life. While I don't think this is great, I am taking it as a positive in that they can control spending and manage their own operations within their revenue forecasts. I am still in the camp that doesn't think they will do a cap raise. I think if it was on the cards they would have done it by now.

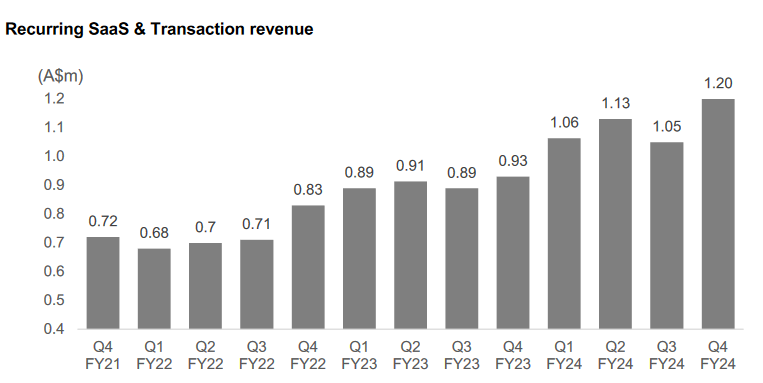

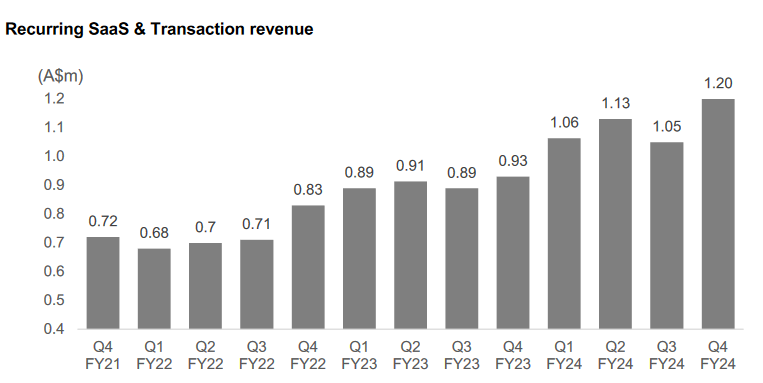

Overall 8CO is moving steadily forward as this chart shows. SaaS revenue is now $5m annualised entering Fy25 (includes the 2k odd users who went live after June 30). There is another $2m min recurring revenue sitting in their committed pipeline, when they actually pull their finger out and get the pipeline moving.

Positives from the quarter - Cardhero is operating at cashflow positive so while it is only $400K annualised, this is no longer a drag on the rest of the business and its rate of change over FY24 is pretty positive going forward. When I originally invested in 8CO I thought Cardhero would have taken off quickly. I was defiantely wrong on that, but better late than never.

Everything else in the quarterly was a bit same same, muddling along.

I have been thinking about 8CO today and about how management have communicated to shareholders and whether i have placed too much trust in them. Have they been deceptive on the growth framing or have I been overly positive in my interpretations of their guidance? I went back and looked at what they said was coming from a year ago when they had what looked like at the time a large break out quarter.

Q4 23 CEO statement and Outlook

FY2023 and in particular the recent quarter has been momentous for 8common as we posted record operating results across the board. More importantly, we recorded positive operating and group net cash-flow as the business works towards profitability. Whilst it remains premature to be able to give forecasts, the $12.4 million in contracts closed during FY23 and robust pipeline places the Company in a very encouraging position.”

The growth of users on our platforms is anticipated to increase our ARPU over FY24 and beyond, delivering material revenue growth for the Company and driving profitability and further positive cash flows for the group.

Q1 and Q2 CEO statement and outlook 24

The Company continues to expand its presence amongst government, not for profit and large enterprises. As more entities progress to the on-boarding phase of Expense8 under the GovERP program, we anticipate user numbers to continue to grow in coming quarters. With a growing proportion of users on our platforms from within Federal government is anticipated to grow our ARPU over FY24 and beyond, delivering material revenue growth for the Company and driving the business towards sustainable positive cashflow.

We are completing 1H FY24 with strong growth and new mandates to sustain momentum in to the second half of FY24. The continued growth in our SaaS & transaction revenue, which is up over 100% over the past 2 years, reflects the growing scale of our business within Federal & State Governments as well as large enterprises. With over $8m in revenue generated in the past four quarters (an increase of 51% on previous 4 quarters) and upwards of 54,000 users currently in Phase 0 or onboarding Expense8 stages we expect the SaaS revenue to continue to grow. Importantly, we returned to positive cashflow during the quarter as we worked on initiatives to reduce the timing mismatch that we had previously flagged between client onboarding expenses and cash receipts.

Q3 24

The Company has clear line of sight towards sustainable positive cashflow and profitability. Active management of infrastructure costs combined with growing SaaS revenue point towards a positive cashflow and profitable Q4 of FY2024 and underpin a momentum into FY2025.

Q4 (current Q) Q outlook

We are pleased with the strong Q4 finish to the year which has set us up nicely for FY25. Our focus on customer success and new implementations drove record SaaS revenue and cash receipts which delivered operational profitability for the quarter. Both expense8 and Cardhero are well positioned for continued growth given the demand for our solutions and our positioning given the blue chip client base. We have begun FY25 on strong footing as SaaS revenue is poised to grow given the recent implementations and strong pipeline of opportunities in the near term. Operational efficiencies and strategic initiatives have also contributed to strengthening our financial performance. We have turned an important corner and look forward to delivering on our goal towards positive cashflow and profitability in FY25.

As i read through these I can't really find anything wrong with what they have said and delivered against, maybe they implied operating cashflow was closer than it was but nothing overly problematic. I look back at my old valuation of 25c and it is clearly wrong, but I can't see how 3.5c is fair value either. The business is steadily moving in the right direction, just slower than I anticipated. I look at this business today and see and $8m market cap that is selling for <1 x revenue or 1.5 x recurring rev, has scant cash in the bank but the security of the director loan that will prevent any forced bankruptcy from lack of cashflow.

I compare this to Change financial (recent Wini writeup), a same same but different fintech business. I was able to listen to the quarterly update today, and it is a good looking business that is growing revenue at 30-40% and should do $14m revenue this year and be EBITDA positive, it is selling for around 4-5 times revenue.

I'm not implying that CCA is overvalued more that 8CO is asymmetrically cheap.