My thoughts on C79's Appendix 4C and the Friday SM Meeting:

SM MEETING SUMMARY

- Reinforced thinking that long-term opportunity ahead and strong moat for C79 ahead is very much intact - disruptive technology that is defining the new sampling process standard, free run due to no competition, long TAM ahead, clear evidence of increasing adoption

- But the reality is that this journey to market and industry domination is not going to go in a linear straight line - time and effort is needed to keep pushing the technology forward, to overcome the deployment challenges etc - walk away with the sense that C79 management is acutely aware of, and is under no illusion of the effort and focus required - have to readjust expectations of this operational reality

- Need to reduce expectations of the share price and be more patient as the market also adjusts to this reality and C79 works through the operational realities - my expectation was that the deployments will march forward in a straight line which is clearly not realistic

APPENDIX 4C

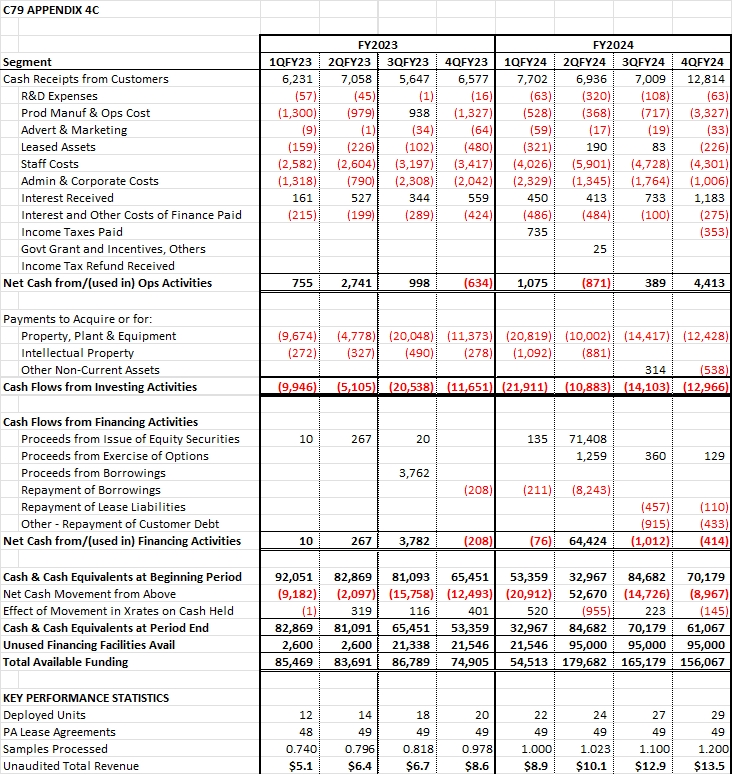

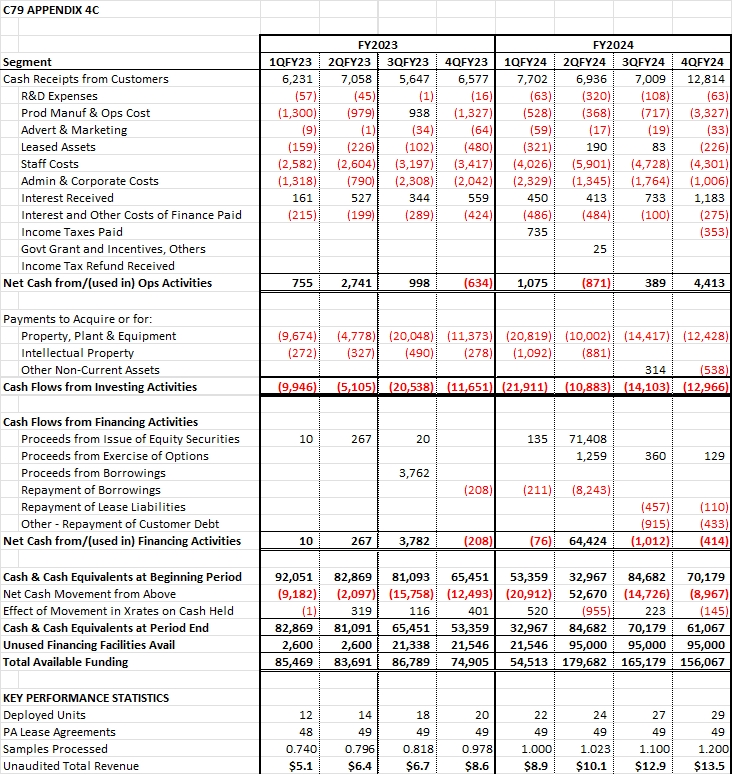

Positives

- 2 new units deployed

- 2 new contracts signed - the first additions since 1QFY23 - big thesis tick!

- $13.5m revenue Q4, total revenue FY24 = $45.4m vs $26.8m FY23, 69% FY revenue growth - steady quarterly revenue increase trajectory since FYY23

- Non-APAC revenue > 50%, growing nicely in EMEA and America’s

- Continued growth in samples processed, 27% YoY - 22nd consecutive quarter of PA volumes - continued increasing uptake of the new PA technology

- 14 units ready to be shipped and installed while customer base and site selection has been broadened to overcome site-related deployment obstacles/bottlenecks - underpins FY25 deployment schedule

- $156m of cash and debt available to fund future deployments - at $4m per unit this is funding for ~40 units

- Decisively operational cash flow positive this quarter

Disappointments

- Only 2 new units deployed this quarter - as per revised management guidance, but slower than initial FY24 expectations

Takeaways

In taking a step back and looking at the last 2 FY's, there is:

- A very clear and steady step increase in quarterly revenue

- Continued positive increase in Samples Processed as Photon Assay uptake increases globally

- The number of units deployed per quarter has only been 2-4 per quarter in FY23 which has continued into FY24

- Available Funding has improved via Debt Facilities and the recent Capital Raise

- Cashflow from Operating Activities has also steadily improved

I think the mistake that management made was to set up overly unrealistic expectations of a rapid deployment of units. This may got the market overly-excited as revenue and EBITDA would similarly follow and the market got ahead of itself. Since management tempered expectations earlier this year, the market and share price has similar cooled.

Interestingly also, since 2QFY24, management has no longer provided clear guidance on how many units it intends to deploy in the upcoming quarter and FY and has now switched focus to revenue, EBITDA and industry technology uptake metrics.

But taking this step back and in digesting Dirk's comments in the Friday SM meeting, other than the earlier unrealistic expectations, I remain very comfortable that C79 is actually travelling very nicely and that my thesis is actually very much intact and is currently playing out.

The only change is in my expectations is that the deployment of new units will continue to be a steady 1-unit-at-a-time march, rather than a multi-unit rapid deployment that I thought would be the approach a year or so ago.

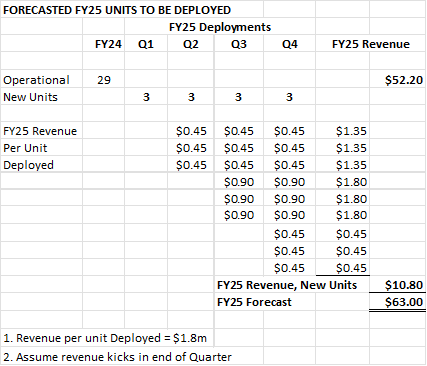

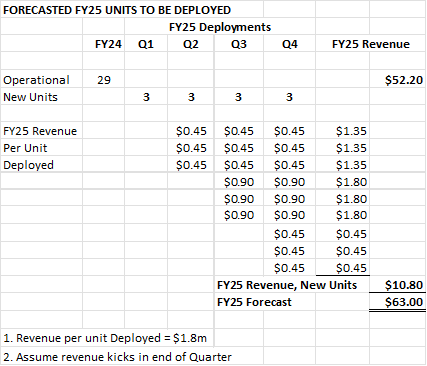

FY25 GUIDANCE

- FY25 revenue guided for $60-70m, between 32%-54% growth YoY

- This back-of-envelope forecast of units that are likely to be deployed in FY25, based on the revenue guidance, suggests that a cadence of 2-3 units per quarter is more realistic.

- This cadence is roughly consistent with the 14 units currently already ready for installation, taking away one big "controllable risk" of missing guidance

- FY25 revenue guidance could thus be conservative as there is upside from (1) additional units deployed (there ARE available units on hand to achieve this) and (2) further sample growth

ACTION

The C79 price is now in the middle of a decent buying zone and will look to be topping up on weakness below $5.00 in the coming weeks. Will keep some powder dry to top up further if the price falls below $4.00, although I can't quite see this happening given that the FY24 results to be released should not provide any surprises following the recent Appendix C.