Two points in this post:

1) Persistency

2) $ACAD SP response

1) Persistency

@Slideup while I agree it would be nice for them to report that, there's no chance they will IMO, given what I can only describe as willful lack of clarity in some of their disclosures to date.

However, it is quite easy to model the information from the sparse datapoints on number of patients to date who have tried DAYBUE and the number on it at any time. The complication is that they report approximate numbers in some cases, so there is some modelling error.

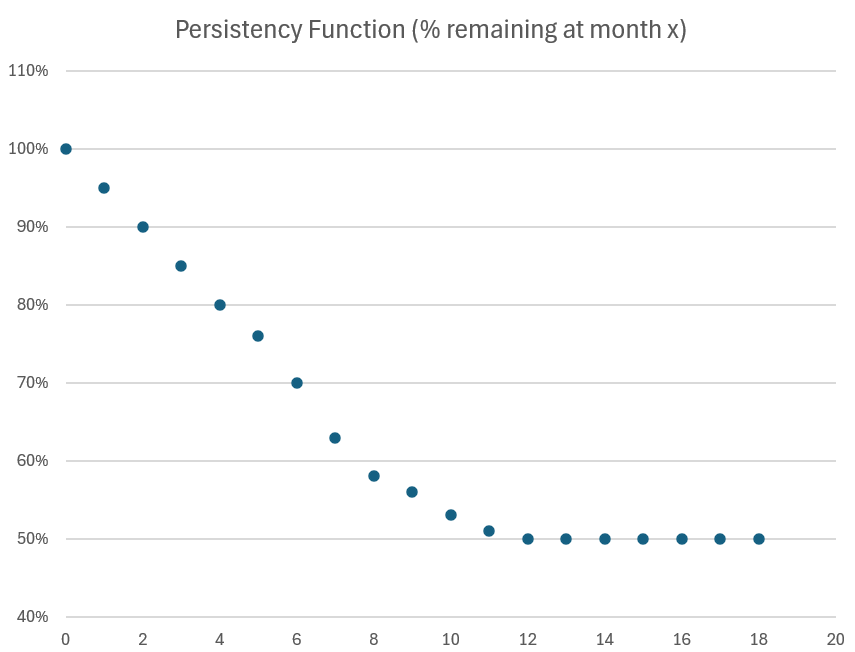

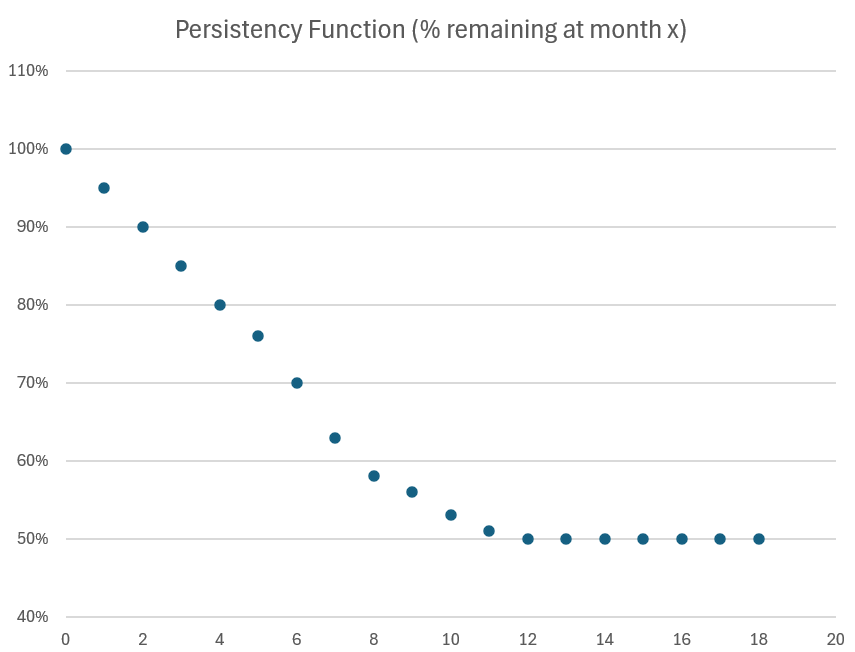

From the clinical data, I have developed (and extrapolated) the persistency function below.

At month 9, my model predicts 56% persistency, whereas the latest data reported by $ACAD gives 58%.

In truth, we don't know the real world persistency beyond month 9. This is important because the RW result is quite different from the clinical result.

From clinical studies, long term persistency appears to be about 40%, However, the clinical results don't allow for; a) GI management plans b) patient pauses (whether for temporary illness, to take a break from the medication for any reason before resume, or a delay beyond 60-days in getting a refill), and c) returning patients, who first stop taking the drug, but then return based on better education.

To date Real World data has been running at approximately +10% persistency compared with clinical studies. So 50% long term persistency seems a reasonable estimate.

On yesterday's call, $ACAD outlined a number of HCP and patient "support" initiatives, which they hope will reduce abandonment and encourage lapsed patients to return.

So hopefully, over time, long run persistency will nudge up and be better than 50%.

2) ACAD SP Response

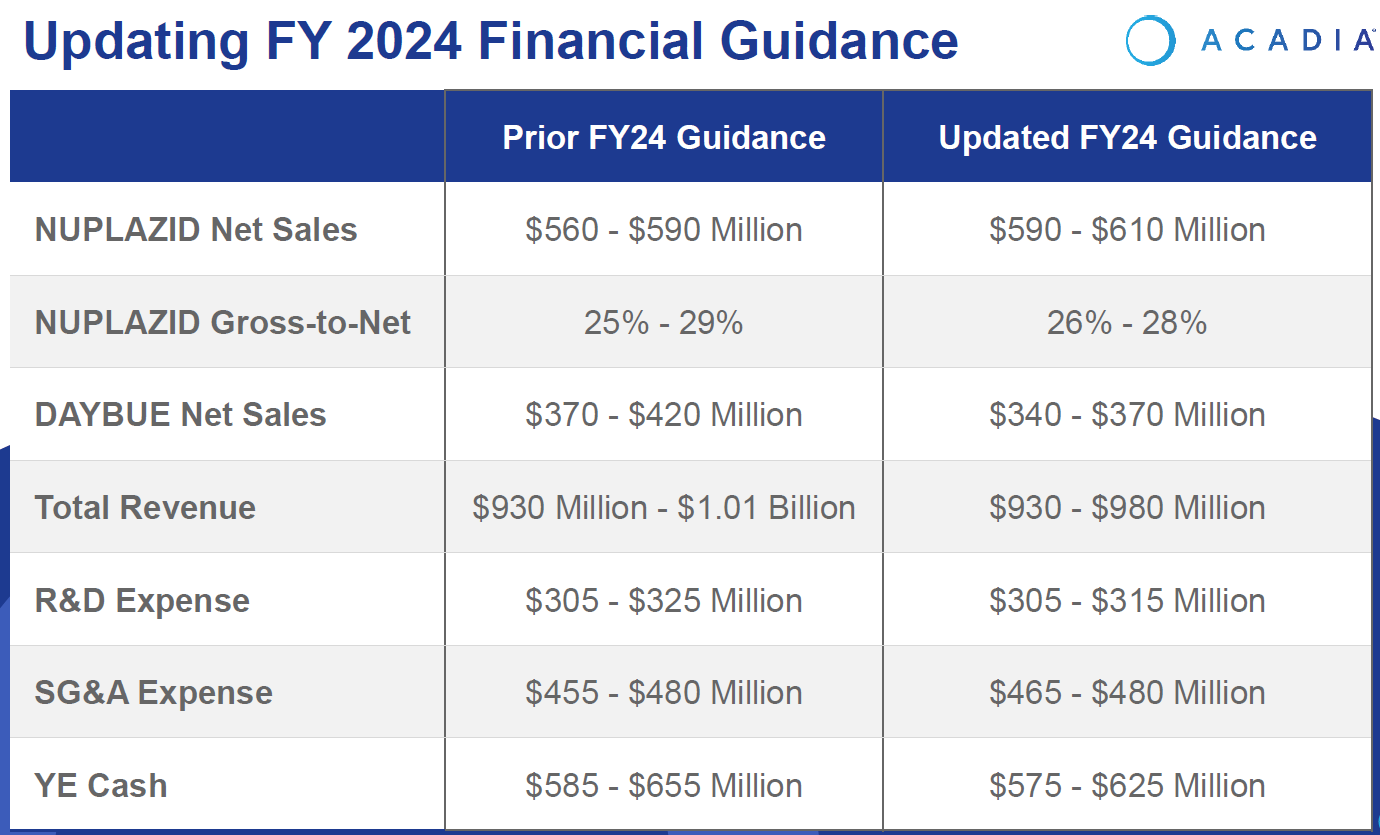

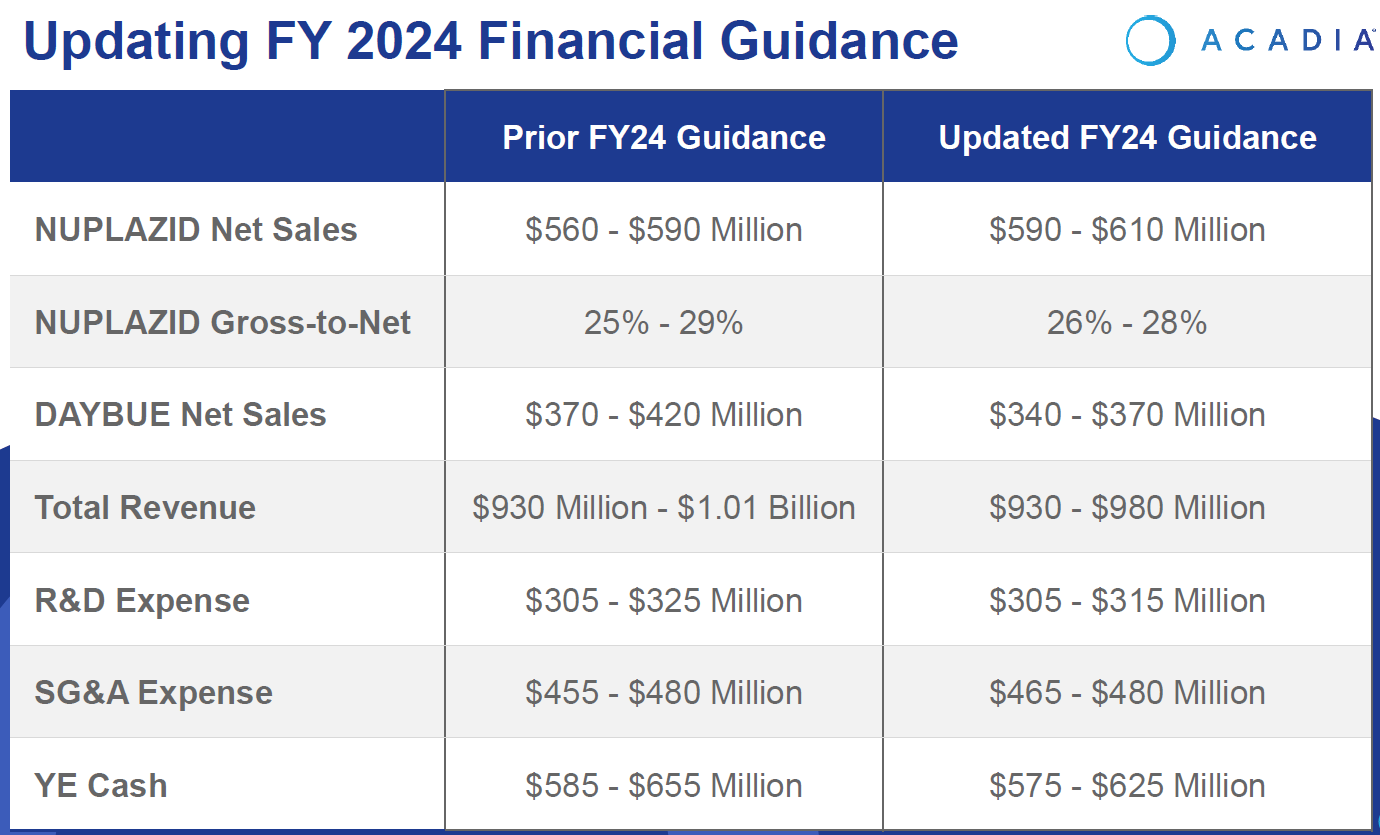

The 20% drop in SP for $ACAD was savage. On the face of it, it was an over-reaction, given the overall changes to guidance. (See below)

Revenue forecast narrowed within original guidance, albeit towards the lower end.

The main driver is the reduced expected revenue from DAYBUE, which more than offsets the improved forecast for NUPLAZID.

I expected the NUPLAZID improvement to mute the SP impact of the DAYBUE disappointment, but of course $ACAD will still have to pay the full $50 million milestone payment to $NEU. On that basis, you might think that the hit to the $NEU SP will be muted, but of course, $NEU only has the one revenue stream.

However, as @Slideup proposes, there is something else going on here.

I haven't seen the transcript some through yet, so this morning I am going back over the call (which I recorded) as I think there were some other embedded disclosures in the narrative around the presentation and in the Q&A. But I want to get my facts straight before reporting here.

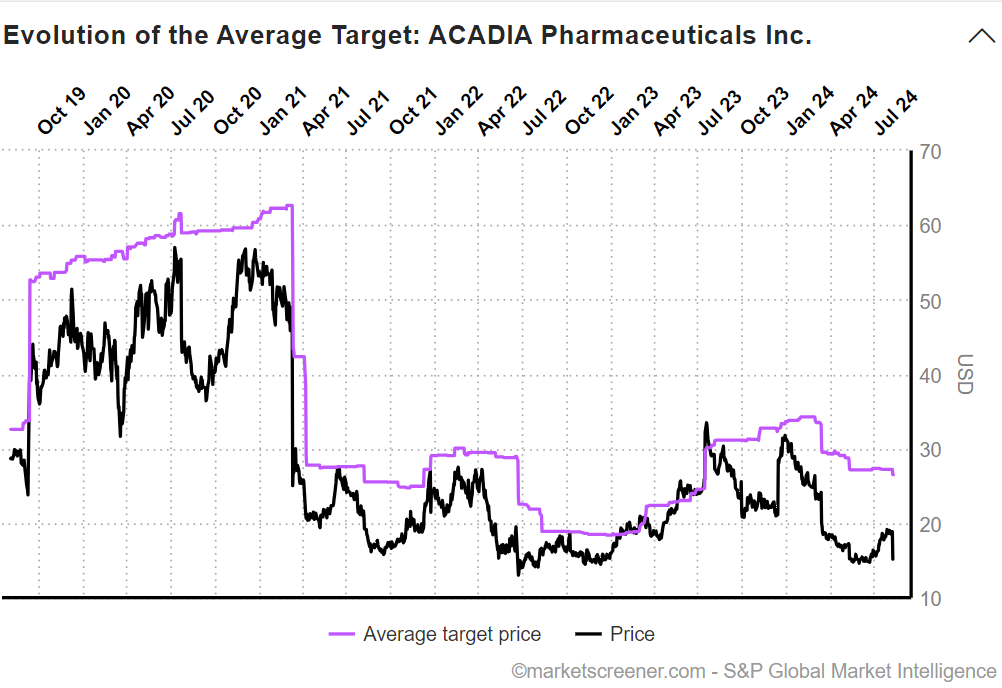

FWIW, here are some of the Broker Reactions overnight:

- RBC from $29 to $26; retains OUTPERFORM

- Morgan Stanley from $28 to $20; from OVERWEIGHT to EQUALWEIGHT

- Needham from $30 to $28; retains BUY

- Cantor Fitzgerald from $37 to $28; retains OVERWEIGHT

Across the group the average PT has moved from $31 to $25.50, while the closing SP was down 20% to $15.17.

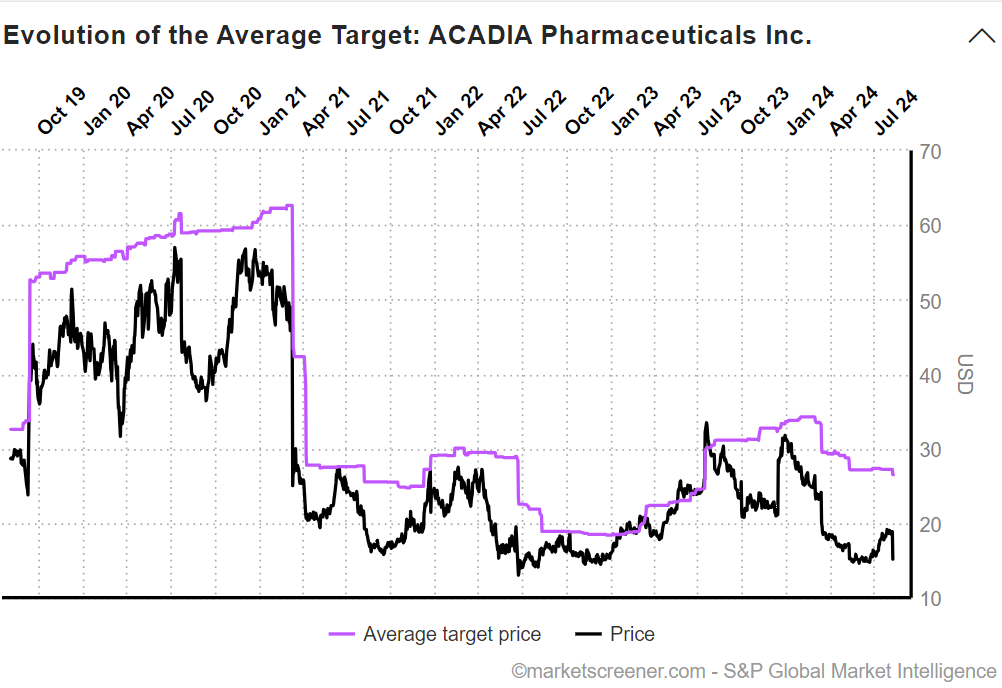

The market has clearly taken a more pessimistic view than the analysts. However, the historical picture shows that the $ACAD is often at a significant discount to the consensus view.