https://www.afr.com/companies/mining/china-warns-winter-is-coming-for-iron-ore-miners-20240814-p5k2fv [Aug 14, 2024, 7:25pm, Peter Ker, AFR]

Chinese steelmaker Baowu has warned of a “long and harsh winter” ahead for the steel industry putting Australian iron ore miners on notice and sending the price of Australia’s No.1 export tumbling for the sixth time in seven days.

BHP and Fortescue shares fell to the lowest level since November 2022 while shares in Mineral Resources slumped to a 25-month low. The oversupply of Chinese steel has prompted Indian steelmakers to accuse China of exporting at “predatory prices”.

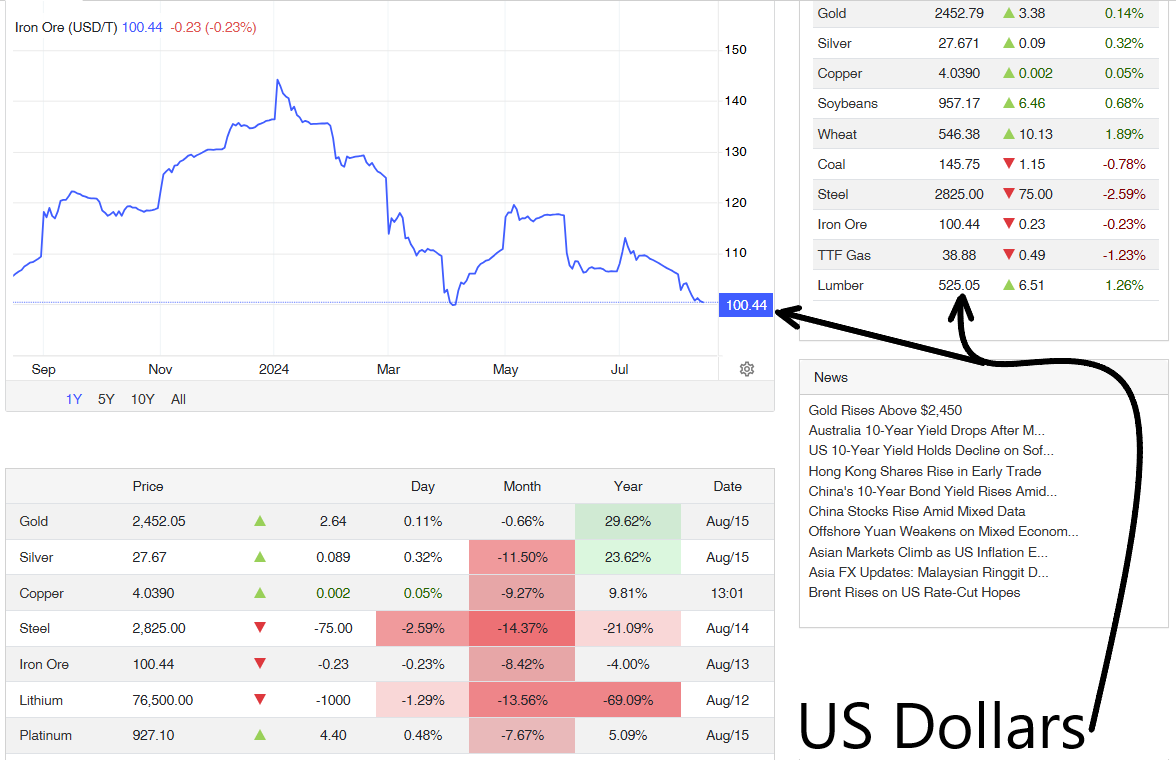

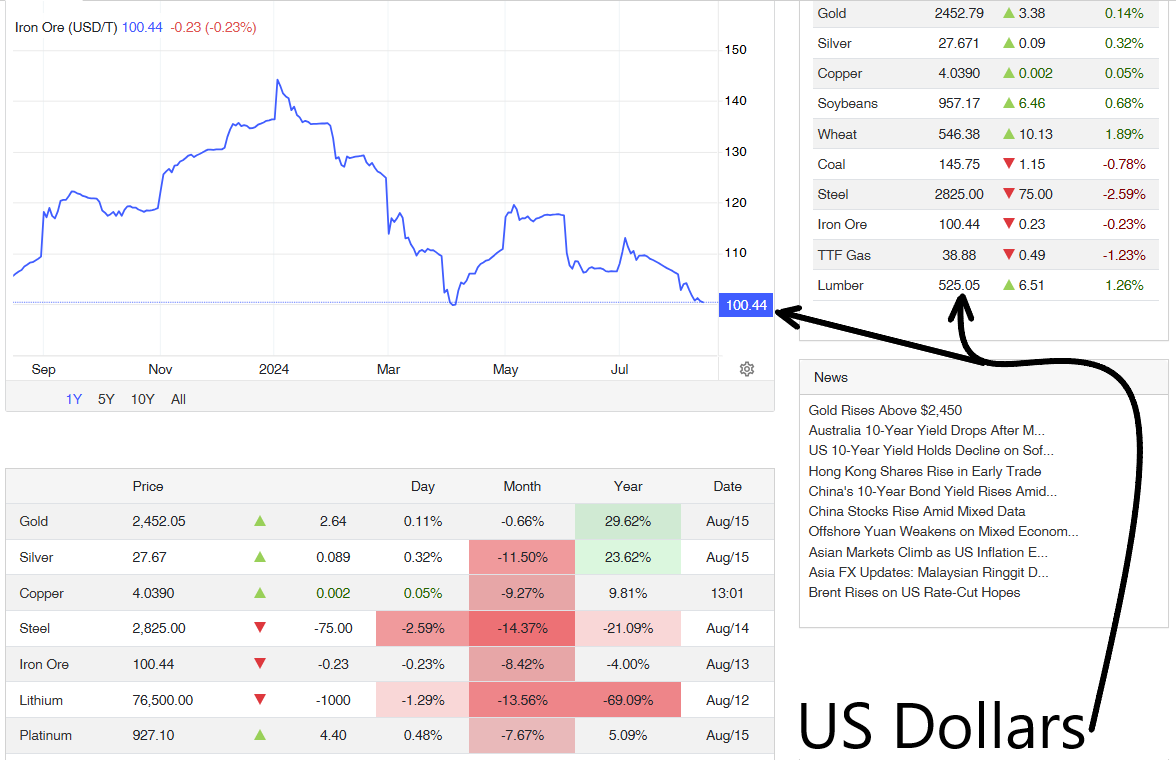

Benchmark iron ore prices have slumped 30 per cent this year to $US98.25 a tonne on August 13, according to S&P Global’s Platts, meaning the price is nearing the $US80 a tonne support level where BHP believes a large chunk of seaborne supply would be unviable.

Bundles of steel tubes at a metal stock yard in Shanghai. Bloomberg

Weak demand from the Chinese property sector and robust supply has forced steel prices down to almost $US500 a tonne, and prompted Chinese mills to ramp-up steel exports to an annualised rate of about 100 million tonnes a year.

Chinese government-owned Baowu is the world’s biggest steelmaker. Baowu chairman Hu Wangming issued a statement on Wednesday urging his staff to focus on cash preservation because the industry downturn was likely to last longer than expected.

“In the process of crossing the long and harsh winter, cash is more important than profit,” he said, according to Bloomberg. “Financial departments at all levels should pay more attention to the security of the company’s funding.”

Baowu is partnering with Rio Tinto on construction of a new Australian iron ore mine at Western Ridge and is also a shareholder in Mineral Resources’ new iron ore mining and export hub in the West Pilbara.

Mineral Resources believes the new West Pilbara province will be viable so long as iron ore prices are above $45 a tonne. But the downturn is still inconvenient for the company as it sells assets to service its $4.4 billion debt load at a time of weak prices for its other product, lithium.

“We have a strong relationship with our partner Baowu, who have expressed their commitment to unlocking the project’s full potential,” said Mineral Resources managing director Chris Ellison on Wednesday.

Iron ore is Australia’s most lucrative export and the Department of Industry expects miners like Rio Tinto, BHP and Fortescue will collectively ship $114 billion of the material in the year to June 2025.

While those three big miners can put ore on a ship for less than $US30 a tonne, higher cost Australian miners like Cufe Limited spend closer to $US84 producing each tonne, and Mineral Resources has already mothballed its Yilgarn iron ore mines at the expense of 1000 jobs.

Unit costs at Fenix Resources’ iron ore mines in WA are closer to $US53 a tonne and executive chairman John Welborn said Baowu was trying to “jawbone” the iron ore price lower as Chinese mills had often done.

“It sounds like Groundhog Day,” he said, with a nod to the 1993 film of the same name. “If it’s going to be hard for Baowu, then he is recognising there is some resilience in the [iron ore] price.”

The flood of cheap Chinese steel exports is raising tensions in India, where steelmakers like Tata have urged the Indian government to tackle the issue with Beijing.

“China exporting 100 million tonnes [per year of steel] is not something the world can live with,” said Tata chief TV Narendran on August 1. “It is predatory pricing which is again detrimental to the future of this industry in India.”

The other Australian commodity consumed by Asian steel mills – hard coking coal from Queensland – was fetching $US206 a tonne on August 13 according to Platts.

--- ends ---

https://www.focus-economics.com/commodities/energy/coking-coal/

https://tradingeconomics.com/commodity/iron-ore