Pinned straw:

Clarity how it’s share price compares?

The best crafted model in the world is just that, a model. I find valuing biotech stocks particularly difficult and there is added complexity on the ASX. As one Straw-person put it recently (I will paraphrase), a biotech’s share price is directly proportional to the number of old boys in agreement at your long boozy Friday lunch. Cynical, yes but honestly there are pre-clinical biotech’s that are valued purely on TAM and hope while other revenue generating companies that are making millions and growing at greater than 25% YOY are hammered for missing guidance by a whisker.

I noticed a lot of talk about Clarity on my Strawman feed. I was curious to look at this biotech a little closer. I am absolutely no expert and I have merely taken a cursory glance, so please correct me if I am wrong and critique away.

My first impression is that it seems to be valued very highly for a pre-clinical stage company. While it seems like great tech – potential revenue seems to be years away. It also plays in the difficult space of cancer. I tend to avoid this space as I find that this is well outside my comfort zone.

I am all for investing in early stage biotech companies, if I understand the science and if there is a bargain to be had. The key to success is getting in early before it is priced for success and perfection.

In this straw I have pitted Clarity Pharmaceuticals head to head against 3 other ASX bio-techs that I am more comfortable and familiar with (and invested in). This is a quick and dirty check to see if I am interested in digging further into Clarity.

Clarity’s technology basically injects special molecules (copper based) into patients to bind to specific targets on cancer cells. PET scans then pick up this energy from injected molecules to help locate and target cancer treatment more effectively. Theoretically there is a more targeted treatment and less damage to non-cancerous cells.

So Clarity has 3 platforms currently in various trial stages but mostly in the safety trial phases, 1 and 2. These platforms are largely targeting prostate, breast cancer and neuroblastoma. Certainly big areas of need and potential revenue if successful. The other companies in the head to head comparison, unlike Clarity, have FDA approved products or drugs which are already revenue generating. 1).Neuren is collecting royalties and milestone payments from Acadia for its lead FDA approved drug Daybue TM 2). Polynovo is currently selling Novasorb TM world-wide and collecting revenue from BARDA trials and 3). Botanix is collecting very small but growing royalties from its Japanese counterpart for sales in Ecclock TM . Botanix is also about to start selling its first and only FDA approved drug Sofdra TM into the market Q3 this year.

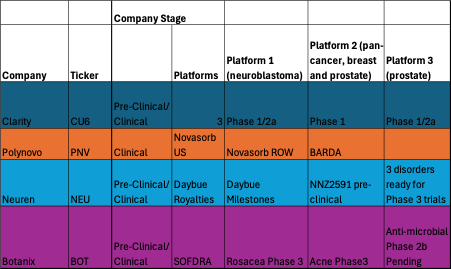

Table 1: Clarity is Pre-Clinical unlike Neuren, Polynovo and Botanix. Neuren has already had 3 successful phase II trials and waiting for Phase III trials. Botanix also is waiting for Phase III trials for Rosacea and Acne and 2b for anti-microbial.

Clarity Pharmaceuticals: A market cap comparison

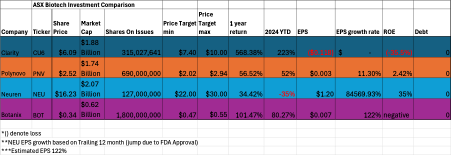

A quick review of Clarity shows a market cap (at time of writing) of about AU$1.88billion. Remembering this is a pre-clinical company with only products in phase 1 and 2 so far. It is not generating any revenue yet has a similar market cap to Polynovo AU$1.74 billion and Neuren AU$2.07billion.

Table 2. Comparison of Market Cap

Clarity has negative Earnings per Share (EPS) and Return on Equity (ROE). While its compatriots Polynovo and Neuren are selling products/drugs into the market and have positive and growing EPS. While Neuren’s ROE has sky rocketed this FY due to approval of Daybue TM by the FDA. This astronomical rise will not continue but should level out over the next few years and have reasonable increasing % royalty returns.

EPS growth is also estimated to increase for Botanix according to Bell Porter’s latest analyst report. Although this is merely speculation and educated guessing as Sofdra TM is a brand new drug for the US market. However there is a precedent with its lead drug currently being sold in Japan and growing strongly YOY. Hence the 122% EPS growth prediction isn’t outlandish.

So for every dollar I invest I have can choose to buy a company that is generating positive returns or is about to or I can invest in Clarity which is loss making and will be several years away from generating any earnings, if ever.

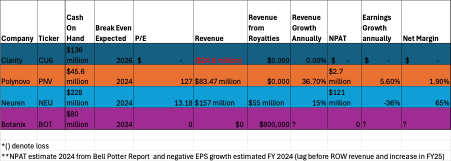

Table 3. Comparison of Cash on Hand, P/E and Revenue

Clarity Pharmaceuticals: A sales comparison

Comparatively CU6 does have significant cash on hand following $120 million dollar raise in the first half of 2024. However bio-techs are notoriously cash burning with most examples of drugs and products costing between $50-$300 million to bring to market. It is pretty clear with $136 million cash left on hand that Clarity will have to raise again in upcoming years. Raises in bio-techs usually cause significant dilution for long-term holders.

Polynovo with a similar market cap has enough cash on hand to fund revenue growth of near 36% annually. This is now self-funded and the company had its first net profit after tax in the 1H of FY 24. Further dilution and raises are very unlikely unless there is an upcoming acquisition that makes financial sense to bolt on to Polynovo’s portfolio of products.

Neuren has seen large annual growth this FY and royalties and milestones as well as cash on hand of $228 million will be sufficient to self-fund two phase three trials. Whether Neuren does this on their own or is acquired is anyone’s guess but Jon Pilcher has confirmed that the upcoming trials are likely to cost between AU$50 million and $100million and take approximately 3 years to get its second drug NNZ2591 to market. If this occurs Neuren and trials are successful it will keep 100% revenue generated.

Botanix is funded $80 million to take its lead drug Sofdra to market launch. Whether this company becomes self-funded or will need to raise again remains to be seen. Q3 this year will give us insight into the future trajectory of this company. Being on the eve of becoming revenue generating and better yet Botanix will keep approximately 95% of all revenue with only a small royalty going to Bodor the original creater of Sofdra.

So I can invest in Neu and PNV with similar market caps to Clarity and get access to self-funded revenue generating companies that have positive NPATS. Or I can invest in Botanix which has a much lower market cap, admittedly untested and higher risk but also soon to be revenue generating. Whereas Clarity is not revenue generating and yet has a higher market cap than Botanix and is years from making profit.

P/E comparisons

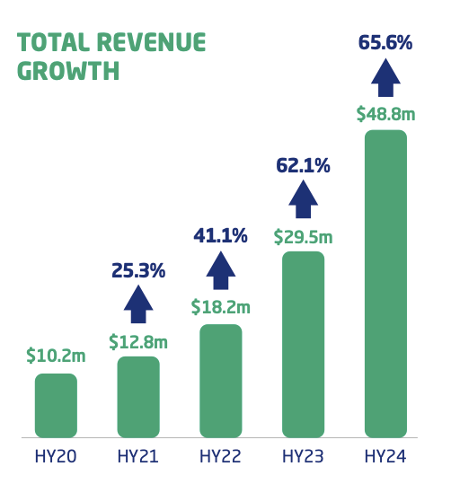

Clarity has no P/E ratio as it has no earnings (except R and D tax rebates). Polynovo has a high P/E 127. However paying $2.52 a share allows access to a company growing revenue at 54.9% STLY. Including BARDA this revenue increases to 65.6% growth on STLY. By comparison Polynovo has a very high P/E and shares seem to be fully valued whereas Neuren has a low P/E for a biotech of 13.18.

Polynovo seems reasonably valued compared to other successful pharmaceutical company's such as Pro Medicus, whos P/E sits at 191 with much lower growth rates of 23.8%. This makes sense given Polynovo is such an early stage company and Pro Medicus is much more mature.

While Neuren seems grossly undervalued with such a low P/E to get access to a growing royalty and milestone revenue stream with an impending priority review voucher thrown in. There is also a second future drug potential on the horizon that doesn’t seem to be contributing to valuation currently.

Botanix will be interesting to watch but the wait is not far away and the company is ridiculously cheap with impending US revenue due shortly.

Investing in Polynovo gives you access to this:

Investing in Neuren Pharmaceuticals gives you access to this:

In the last 12 months Neu has grown its EPS from AU$0.0015 to AU$1.23. This was a EPS 12 month trailing growth of 84569.93% due to the FDA catalyst approval of Daybue. The EPS of course will not continue at this rate.

PE ratio for NEU is 13.18% to buy into this growth. The ROE has been 35% in this time. A good company is considered to have an ROE of 15-20%.

Investing in Botanix gives you access to:

Royalties of AU$800 K annually growing at an estimate of 122% according to Bell Porter. Possible projected revenues of US$ 20-$90 million (200,000 units x $490) in FY2025

Management Comparisons

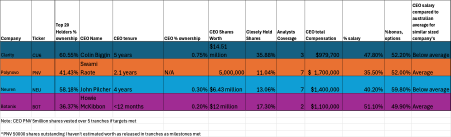

Table 3. CEO compensation and % of tightly held shares

Clarity is certainly a tightly held shares 35.88% being owned by management and the CEO owning 0.75% of the company. Collin Biggin also seems to take a reasonable salary for his position.

There is a lot of speculation about a Neuren buyout. However there is also some protection from hostile takeovers with 13.06% of the company being held by company management. Jon Pilcher takes a very reasonable salary and a majority of his compensation is performance based (59.8%). He also has a 0.3% ownership stake in the company.

Swaomi Raote for all his years of experience is also only drawing an average salary with a 52% performance based compensation. While his % proportion of company ownership is not disclosed when I looked at Simply Wall St.

Howie McKibbon draws an average salary and has the shortest CEO tenure of any of the company's. He was however appointed by Vince Ippolito Executive Director and the two had worked together for many years across different dermatology company's. His compensation is also very heavily performance based. A good sign for shareholders.

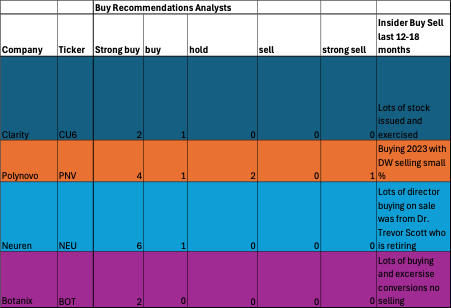

Analyst Insights: A comparison

Analysts are in agreement that clarity is a buy and a strong buy according to the 3 analysts covering this stock. Polynovo and Neuren and Botanix are largely also touted as strong buys.

Management teams are largely in agreement with analysts and having been buying stock through 2023. However, Clarity has had lots of stock issued and exercised. PNV has seen Chairman fork out large amounts of his dollars to buy stock in 2023. He did have one sale during this period. Neuren’s former director Dr. Trevor Scott also sold some Neuren shares at retirement. However there has also been plenty of management purchases.

There have been no sales of stock by Botanix management that I am aware of.

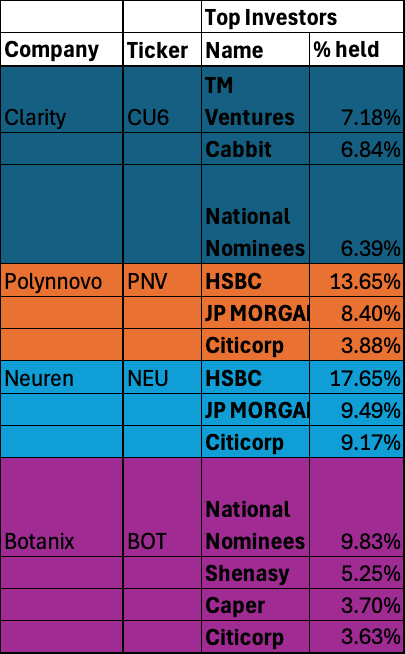

Who owns these shares: a comparison

Clarity has yet to have the big end of town hold large % of its shares. One can speculate and argue this is why the price has shot up but I wouldn’t be that cynical. Polynovo and Neuren have a common top 3 investors. We all saw what happened with PNV share price and Neuren’s SP is not fairing so well currently. It will be interesting to keep a watch of substantial holder notices for both company's in the future.

Botanix has largely flown under the radar of these giants and it is a very tightly held company with 17.3% ownership by management. Remembering Botanix and Clarity have both essentially been pre-revenue company's until now so they will not have the same investment appeal for large funds.

SUMMARY

My overall take-away is Clarity is certainly one to watch. I certainly would not have faith investing in the company in the short to medium term. Others clearly disagree and with a price target of $10.00 a share. If you invested 12 months ago you would have achieved a 568% return on your money. So excellent if you were lucky enough to ride this wave. Will it last? Time will tell.

I will watch with interest. I will stick with my measly yearly returns of 34-101% in by current biotechs which are revenue generating and growing at good cadence for now.

So whether there were some long lunches and nods and winks who can say. This is all my opinion, DYOR but a $1.88 billion market cap is certainly interesting. Hopefully the tech eventually helps to improve lives and I would consider buying if the technology passes phase III and if it ever hits a reasonable price.

OliverC00

@edgescape @mikebrisy You may have aleady heard this interview with the chairman of CU6, Dr Alan Taylor. He talks a big game and is pretty scathing of the competition.

https://fraziscapitalpartners.com/podcast/70-clarity-pharmaceuticals-with-chairman-dr-alan-taylor/

mikebrisy

@OliverC00 I hadn’t heard it, so thanks for sharing. I’m not really across $CU6.

I thought it was a great podcast, and a “must listen” for anyone investing in the radiopharma space. Alan has a great gift of communicating the science and making it accessible.

Having listened, I am starting to understand the basis of the valuation. $CU6 has deep science and IP around a platform technology in one of the hottest areas in oncology. So, even if they don’t get taken out, there will be a lot of deals done and capital to be raised over the years, as it sounds like there are a lot of potential applications and so their development portfolio is probably constrained by the size of their team.

Given the attention this space is getting from Big Pharma, the prospect of M&A should be expected to hold up their SP for as long as their platform has promise. The early clinical results sound very encouraging, so it will be interesting to watch the news flow on that front.

You might reasonably bet that, should their lead product firm up in Phase 3, the platform potential makes them very attractive to big pharma. And the price tag could easily make $2bn appear cheap! There are ample examples of pre-revenue biotechs going for a lot more.

He backed up his knocking of competitors. IMO executives don’t spend enough time talking about the competitive landscape, so it was refreshing to hear him going into so much detail about it. Obviously, it’s from his perspective. But that provides a lot of leads to follow up on.

A key takeaway for me is the multiple competitive advantages of the longer half-life products versus $TLX. Very good to know!

He did make a few extreme remarks to be taken with a grain of salt, e.g., in stating why it doesn’t make sense to invest in commercial biotech. (Try explaining that to anyone who invested in $CSL anytime in the last 10-15 years.)

I love science and it was uplifting to describe the patient benefits of these technologies. Just his vision that radiopharma offers the prospect that in future cancer could become more like HIV is today!

I can’t even begin to put a value on this business, But I can understand the potential and why it carries the price tag it has. Equally, should there be some discouraging data (e.g. a read out from some trial patients who don’t do well for whatever reason), there is a long way to fall. Equally, with further good news, the sky is the limit.

One to watch. But it’s not for me at this stage. As a speculation on an M&A takeout, I can see why many are willing to take the bet.

mikebrisy

Great comparison @Nnyck777 - you've summed up precisely why I've also chosen $BOT, $NEU, and $PNV - revenue-generating, cashed-up, with huge runways ahead and clear competitive advantages/market gaps to fill. And, in the case of $PNV and $NEU, compelling, proven economics. ($BOT passes my risk-threshold because of ECCLOCK in Japan - which is kinda unique.)

$CU6 is a fundamentally different proposition. In many respects, its an earlier stage $TLX (which I wrote about yesterday), developing both diagnostic and therapeutic radiopharmaceuticals.

One issue is that over 50% of its development portfolio is targeted at prostate cancer, for which there are several dignostic products in the market already. They have one diagnostic product at Phase 3, and two therapeutics also in phase 3 - forthese latter two, the bar to approval is much higher.

Even if 64Cu-SAR-bisPSMA is approved for diagnostics, $TLX's ILLUCIX is into its third year of sales and appears to be rapidly gaining share in this growing market for diagnostic radiopharmaceuticals, and advanced prostate cancer diagonstics more generally. Importantly, they have built their supply chain and sales and marketing footprint (partially), and (I think this is correct), they even control the supply chain for some of the inputs to $CU6. They will have 5-years+ headstart on $CU6. For $CU6 to succeed, it will need to demonstrate significant advantages, as a "me-too" performance would be unlikely to dislodge an incumbent.

Of course, a late-to-market product strategy can also be successful, particularly if companies like $TLX and others have changed the clinical standard to use of radiopharamceuticals. Once clinician behaviour has evolved, a differentiated product can gain even more rapid market traction. Of course $CU6's products would be even more of a competitive threat if in the hands of one of the industry giants, like Novartis or AZ, because of the weight of their sales field force.

So, I am certainly going to track $CU6's progress very closely and with interest, and it will be a key point of focus to study the results of the phase-3 trial in detail. Importantly, cancers are complex and multi-faceted diseases, with many different forms in each headline condition. Once more "devil is in the detail" (my catchphrase of the week!)

Depending on how $CU6 allocates money to their development program (see below), there is a chance the current cash might get them to a 2026 launch of 64Cu-SAR-bisPSMA, if everything goes well. But as the chart below shows, they are pushing on multiple fronts, so you may be right in that further raisings and dilutions lie ahead. Indeed, given that timeframes have a clear bias to slip to the right (think FDA "do-loops") an investor would be wise to assume further raisings in 2026. (2024 and 2025 look safe enough ... maybe another passing of the hat in late 2025?)

On your question of valuation, as we've exchanged before on NNZ-2591 for $NEU, I find it hard to evaluate products in clinical development. For $CU6, it is clear that they justified the valuation for the capital raising on three recent deals in radiopharmaceuticals. In fact, the capital raising valuation slide prominently displayed the quote:

"The willingness of large pharma companies to pay high premiums for radiopharmaceutical companies further demonstrates the burgeoning interest in the field” - Nature, March 2024

So, I end up on a slight note of disageement. I don't buy the nudge-and-a-wink-over-lunch narrative. Biotech valuations can be readily benchmarked by comparable deal multiples and product market TAMs. I haven't done the work to assess whether the deals cited by $CU6 are valid comparables. But closing on an agreement, it is advisable for any investor to get proper advice in this space, and preferrably to really get into the details and understand what they are investing in. And, in any event, to buckle in for a wild ride!

Disc: Not Held

Source: $CU6 Investor Presentation, 26 March 2024

Nnyck777

Yes a bit tongue and cheek @mikebrisy. I find it fascinating how companies at a glance like CU6 get oodles of funding pointing to previous sales examples and yet companies like Neu have a drug that is further along and can point to sales such as Reata and get valued at bubkiss by the same market. Interesting no?

topowl

Another great reason for going nowhere near speccy biotechs.

It's speculating, not investing.

edgescape

@Nnyck777 @mikebrisy Thanks for offering a very factual yet different perspective.

There are probably some funds frontrunning the index inclusion. After that I think price will likely fall.

Other than that I'm not offering any comment on the product in case I shoot myself in the foot!

It would also be good to get a list of stocks where Bell Potter, CG and Euroz has had no involvement in any capital raise as well.

Nnyck777

Well EH certainly was involved in capital raises for BOT. The SP languished for 5 or so years. And went from 20c to 2 c at one stage. As a long suffering share holder I still see EH involvement dread. This was multi factorial a complex acne result, COVID but I still cautious when I see there involvement as a share holder that there will likely be a long wait.

Nnyck777

Hi @topowl I agree and also disagree if you understand the science, have a good management team and understand the competitive landscape it can be very lucrative. I absolutely agree it’s a niche space and not for everyone or for the impatient. I would feel the same way about mining stocks as I have a very poor understanding of this space. Early stage biotechs can be incredibly challenging. I have strict rules and this mostly works so far. But it is never quick. I don’t agree that it is speculating. I know how many hours of research it takes before I invest. It is more aligned with educated guessing. Ultimately isn’t that what investing is?

I was thinking about CSL recently I invested 8 or so years ago like cochlear and did well. I got divorced and rebought CSL on my own and gave COH a miss fearing Chinese competition. Observing the last 6 years of trading has been interesting. I certainly would have made a better choice 6 years ago investing again in COH. It has risen steadily.

Instead I invested in CSL and it has fluctuated significantly and essentially gone nowhere ultimately:

CSL and COH are considered bonafide investment strategies by fund managers and biotech experts. They pay dividends, which still didn’t make CSL a good choice over this period.

My educated researched guesses however have certainly ended up being much better decisions. PNV and BOT which I discovered years ago trawling the asx and NEU which I researched voraciously thanks to a discussion over a few beers with a very clever Strawman member @CanadianAussie have ended up with better outcomes.

I absolutely agree throwing money into companies that FOMO, have nothing but potential and the promise of cancer cures however is incredibly high risk.

However biotech investing even early stage if approached with caution, skepticism and due diligence, with respect, isn’t just “speculating.”

Nnyck777

More to the point some that I researched extensively and avoided:

Opthea:

and Eye:

It’s not just the good decisions it’s the bad decisions we avoided which takes so much time to wade through. I would be very interested to hear about other peoples near misses:)

mikebrisy

@Nnyck777 re: $NEU I believe it might also have something to do with 1) ASX-listing, 2) rare disease therapies and 3) limited research coverage.

Also Reata had a porfolio of molecules, with one of the lead ones having multiple potential signficant indications,as you are no doubt aware. A bit like NNZ-2591 in that respect. Perhaps patience at $NEU will be rewarded? (That is part of my thesis.)

Given that $TLX (market cap $6bn = 7.5 x 2024 revenue - a reasonably undemanding M&A multiple given the pipeline) is c.5 years ahead of $CU6, then a $2bn market cap for the latter is not crazy, but there is a LOT of potential downside if there's any bad news, so I wouldn't touch it with a barge pole!

Regarding the ASX bit, many of the very good biotech investment analysts are in California and NY/NJ. Although some cover $ACAD, I don't think many have followed the trail of breadcrumbs yet to $NEU. Or at least those that have, might be acting for clients with an interest not to publish research.

I was also joking about "conversations over lunches" too. However, one of my closest US friends was for many years a biotech analyst in California in the 1990s/early-2000s for a major US investment bank. He was very good at his job and made his fortune by his mid-30s. He spent a lot of time flying around the US visiting the labs and the management teams. Lunches and dinners were an important part of getting his head around the science and the valuations, even before papers were published or trial results released. Of course, he had to deal with CEOs and major shareholders (pre-IPO) pitching their businesses for a knock-out offer, but more gets disclosed in those conversations than makes it onto a slide deck, if I believe what I was told. Or - more importantly - the disclosures in conversation happen before the slide decks are printed. He was deeply into the science and had an MD(Harvard)/PhD(MIT) double degree.

That's another reason why I don't invest in the pre-commercial phase companies, because I believe from my own observation over many years that there are significant informational advantages for those with the finger on the pulse that enables them to make better assessments of risk. I can't compete with that, even if I wanted to - I'd always be on the dumb side of the deal. Circle of competence!

Nnyck777

You make a good point about TLX comparison @mikebrisy. A very interesting perspective regarding your friend’s investment experience. So often in life the deck is stacked and it really does come down to who you know and what rooms you are in re investing. We aren’t all privy to the same info which makes it really hard. Having direct access to CEOs on Strawman and an ability to have our questions answered is better than no access at all :)

CanadianAussie

Thanks for the shoutout Annyck and glad to see NEU is doing well for you. Maybe next time I'll take my own recommendation!

Nnyck777

Hi @OliverC00 i looked at this company several years ago. I work in this industry. I certainly have been meaning to take another look at it. It did have some promising trials coming shortly. Anything to prolong retinal injections would be amazing. Happy to poke around again in the next week or two and share some ideas.

OliverC00

@Nnyck777 That would be great if you can. I have been following your back and forward with @mikebrisy on NEU and BOT. The information gleaned has been worth the Strawman subscription 10x over.

Unfortunately for you I will have nothing intellegent to add but Opthea has caught my atention after the recent US$150 mil capital raise, phase 3 enrolment and FDA fast track status. I have all the usual questions:

- First read on the phase 3 looks to be Q2 25 but how long would it be before a definative result?

- How far does the capital raise get them?

- If approved, what would the financial model look like?

- If approved, what are the chances of being bought out and at what price?

edgescape

FWIW we should get CU6 management in for a Strawman meeting and get the questions addressed once and for all.

Reading through this again, while I agree this is overvalued considering they are just about to start Phase II, I have some views which don't appear to tie up with what is stated here.

Or maybe I am a dumb***

mikebrisy

@edgescape I second the request to ask the CEO of $CU6 along to a SM meeting, @Strawman

While I'm not considering investing in them**, I definitely want to understand their products and technology better, because of my growing interest (and initial position) in $TLX.

Valued at 68 x 2026 revenues - the first year that revenues are forecast, and with a very tight dispersion across the three covering analysts ($7.40-$10, vs a SP of $6.03), the only motivation behind my references to them has been to point out that there is a long way to fall, should there be any bad news in the short to medium term.

I don't know ANYTHING about their products or their clinical results to date. I just hope that investors who bought $14m worth of shares on Friday do.

** Disc: Not held. I only invest in biotech and pharma that have achieved the commercialisation milestone. My not holding a stock in clinical development therefore does not reflect a view on its valuation - one way or the other - it's purely a judgement on my competence.

Nnyck777

Sounds like a great idea to hear from the CEO and learn more about where CU6’s value lies.

topowl

Love that bit @mikebrisy ….

“ I only invest in biotech and pharma that have achieved the commercialisation milestone.”

Wise words.

Highly speculative and highly risky to do anything else.

Needs to be said more often.

No matter how much research anyone does, you’re never really going to know.

Strawman

What a great thread. I've emailed Dr Alan Taylor to see if he'd be up for a chat.

topowl

What a business model!

You only have to imply commercialisation dates rather than firmly state them, because of course......it's all up to FDA trials...(yada yada, out of our hands...lol).

But when it comes to capital raising such as in 2024, you get to say in concrete that it will absolutely without a doubt fully fund them until said commercialisation in early 2026.

Where do I get a job with these guys?

I genuinely hope all these guys/companies cure cancer.....you know it's a great intention....but most unfortunately won't.

The brokers, the lunches, the disingeneous bad faith conversations, the marketing, the absolute inability of anyone to be actually inside the "circle of truth" to a high level of probability.....

I mean even the company itself doesn't know what their product will do yet, it's in trials, it's experimental...

imo, purely a speculative play unti fda approvals, commercialisation, and actual sales.

maybe it would be different if you took a venture capital approach and consistently bet on all of these biotech speccys, but just picking one or two out of the bunch, doesn't make sense to me....

good luck to anyone have a go though, I wish you luck.

(lol, that's my strawman argument for the day).

Nnyck777

The interview was interesting. Thanks @OliverC00. I thought the comment was telling for a potential bear case- the funds keep contacting me complaining they are overweight in CU6. That’s an orange flag. I imagine there are fund mandated rules that mean that they will have to sell down a certain % of holdings in the future. This could lead to a share price decline unless other funds are willing to step in and hold their beer. perhaps some funds do see the buy out by big Pharma as a real possibility given the half life of CU64 and CU67. But do funds really hold on buy out speculation? Doesn’t seem to be enough to justify large fund buying for Neuren pharmaceuticals.

edgescape

I'm thinking the same so I free carried early today on the pop instead of acting dumb.

I compare CU6 to Corvus who are actually doing a Phase 3 soon after completing a raising. And Corvus is 290m USD market cap even after the 46% rally.

But I'm not saying you should buy Corvus either. Only making a comparison.

edgescape

Knew I was an idiot doing a free carry.

FDA fast track but lucky for the sellers and nonholders it is only for the diagnostic. If it was the therapeutic then who knows? Perhaps the bear case is still intact?

Sorry for the spam as I know this is a hyperdrive stock!