General notes:

Positives:

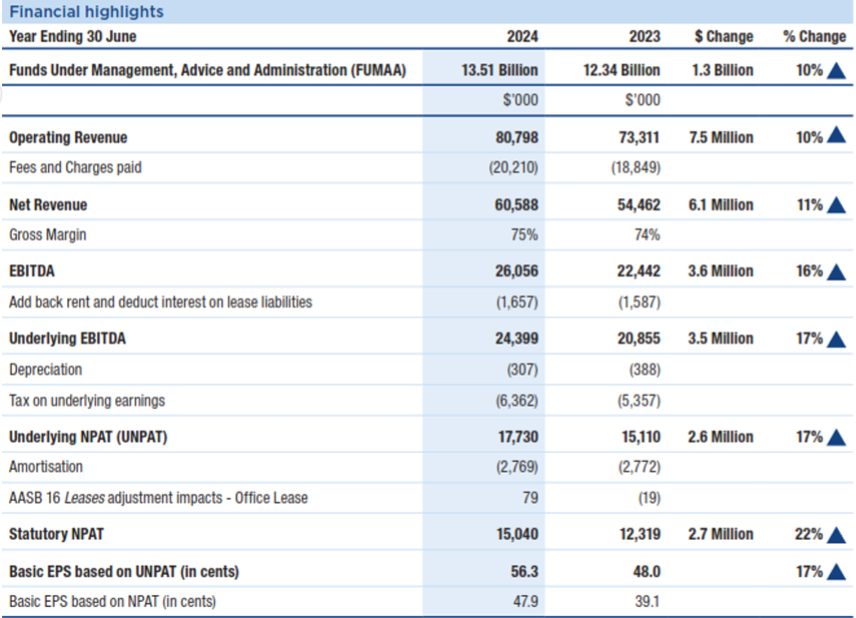

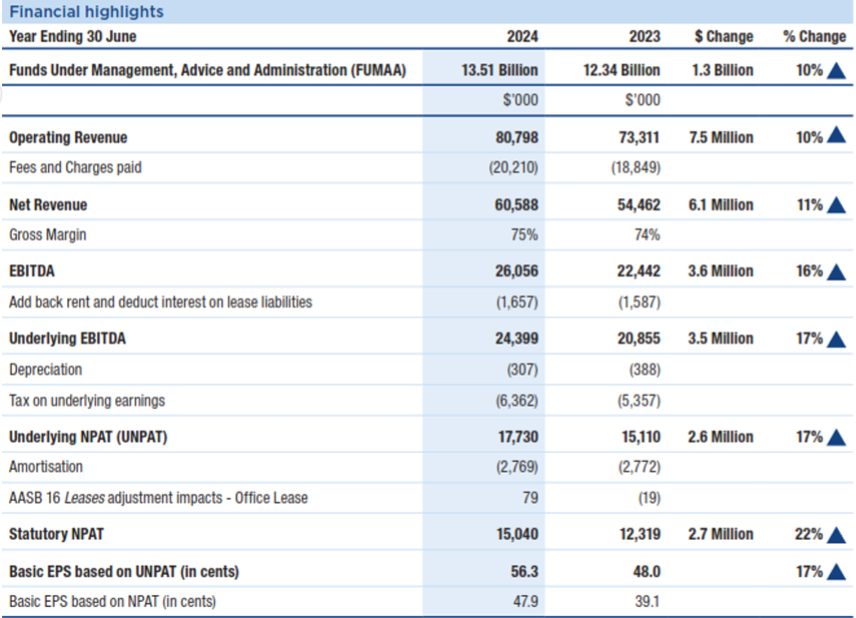

- Operating leverage of the business showing. Revenue up 10% with NPAT up 22% (17% underlying).

- Final dividend of 21.1c fully franked. 39.3c fully franked dividend for the FY. At a closing price of $8.37 this represents a 4.7% yield.

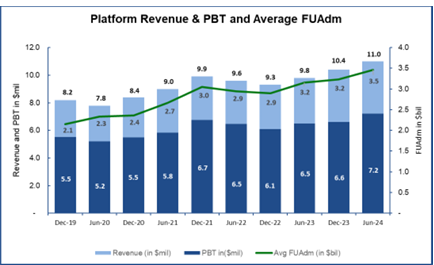

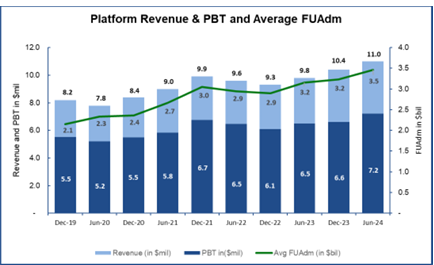

- Platform Administration business continues to grow steadily:

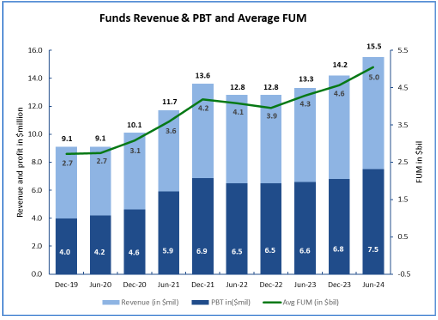

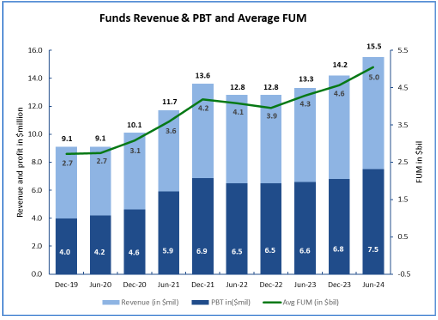

- Funds management business:

- FUM up around 15% with an additional increase of 11% in July 2024. This could contribution approximately $2.4m of revenue over the next year.

- Continues to rank very highly compared to other fund managers returns.

- ROE remains high at approximately 28%.

- Market liked the results, up 13.88% at close to $8.37.

Negatives:

- Funds under advice only up 4%.

- Longer term need to think of the impact of the focus on clients using Fiducian products. This will probably pass the test while they outperform compared to other managers but can expect more scrutiny if this isn't the case.

Has the thesis been broken?

- No, company performing as expected. Will be increasing my position as per my buying plan.

Valuation:

Updating for NPAT expectation of $17m for FY25.

- NPAT = $17m

- Target PE = 18

- Target MC = $306m

- Target price = $9.72

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- NPAT growth of 10-15% over the next year.