Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

August 2025

Updating NPAT expectation for FY26 to $20.5 (10% increase) and moving to an EV/NPAT ratio due to high cash.

- NPAT = $20.5

- Target PE = 18

- Cash = $34.9m

- Target MC = $404m

- Target price = $12.80

August 2024

Updating for NPAT expectation of $17m for FY25.

- NPAT = $17m

- Target PE = 18

- Target MC = $306m

- Target price = $9.72

April 2024

Started a deep dive on Fiducian Group but valuation is now getting close enough to where I think is on the higher end of fair value so will put Fiducian on the watchlist. Overall, looks like a well run financial services business, returns from funds management over the longer term are very good (relatively). Business has grown revenues and profits steadily over time.

Valuation:

Target PE = 18

NPAT estimate = $15mil

Target MC = $270mil

Valuation = $8.58 per share

Overview Comment:

Company executing as expected. Outlook looks good based on July results.

General notes:

- Funds under management, advice and administration up 10% to $14.84b.

- Net revenue up 13% to $68.2m

- Total dividend for FY 46.6c fully franked. Yield of around 3.8%.

- My "FCF" number of $20.5m.

Positives:

- NPAT up 23% to $18.6m and "Underlying NPAT" (nil amortisation) up 19% to $21.0m. Operating leverage at work.

- FUM for core platform already up 10% over FY25 average at end of July. Indicating extra revenue of $1.6m and $800k-1m in PBT based on margins.

- FUM for Funds Management up 12% at end FY. July 2025 number already 7% higher than FY2025 average.

- Market liked results/outlook up about 12% on results day.

- Strong balance sheet with net cash = $34.9m

- Last year through to 10-year return numbers have Fiducian above median manager rank in almost all funds and years. Continues to be above average manager.

Negatives:

- Nothing obvious.

Has the thesis been broken?

- No, company is executing better than expected. However, like at half year results I think valuation is fair. Will continue to slowly add to position as I think there is potential for a better result than $20.5m NPAT for FY26.

Valuation:

Updating NPAT expectation for FY26 to $20.5 (10% increase) and moving to an EV/NPAT ratio due to high cash.

- NPAT = $20.5

- Target PE = 18

- Cash = $34.9m

- Target MC = $404m

- Target price = $12.80

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Continue to be an above average manager. This is a core competitive advantage over other managers and making the practice of using their own funds much more defensible.

- Again like 1H results, move during trading day was significant. Up around 10% from open to close. Need to have some rough numbers ready to pull the trigger for a buy on results day if you want to take advantage of this.

Indy with a rare media spot on Ausbiz -

https://ausbiz.com.au/media/we-can-disrupt-the-disruptors?videoId=43599

Overview Comment:

Good result overall, most segments and KPIs all moving in the right direction. There continues to be operating leverage in the business. However, valuation is now fair in my view but not overvalued to the point where I won't be adding.

Market liked the result up just under 10% after results. However, opened only up slightly then throughout the day moved up to 10% gain. Note for next time to be ready to make a quick call, this happened last results as well. Did see the results in the morning and thought overall they were good so could have pulled the trigger then. Will give it a week or two before buying again, see what happens after the rush to buy after results ends. Last time this resulted in about a 10% drop in price after this rush. Given the fair valuation not in any great rush to jump in.

General notes:

- Staff numbers only grew slightly. Wage increases have been offset by efficiency gains.

Positives:

- PCP financial figures good:

- Net revenue up 15%

- Underlying NPAT (NPATA basically) up 20%

- NPAT Up 26% to $8.6m

- EPS = 27.4c

- Figures above show Fiducian continues to have operating leverage.

- Dividend of 21.9c fully franked.

- Funds under administration up 14% YoY and FUM up 15% YOY.

- All segments growth in revenue and PBT look good:

Negatives:

- Going to stop cycling the excellent previous longer-term results over the next few years as the poor 3-year return moves further into the past. Funds could be less of a selling point as a result. At least 1-year results appear to have done ok overall.

Has the thesis been broken?

- No, company is doing well at or above my expectations. However, is at a full valuation. Will add as per buying plan.

Valuation:

Updating for NPAT expectation of $17.5m for FY25.

- NPAT = $17.5m

- Target PE = 18

- Target MC = $315m

- Target price = $10.01

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- NPAT growth of 15% minimum given 26% gain in 1H.

- Monitor risk in the case of a market downturn.

- Be ready to go for a buy if results look good on release, these results and the previous had a big move from open to close. There was a chance to get in early that day if I was ready.

General notes:

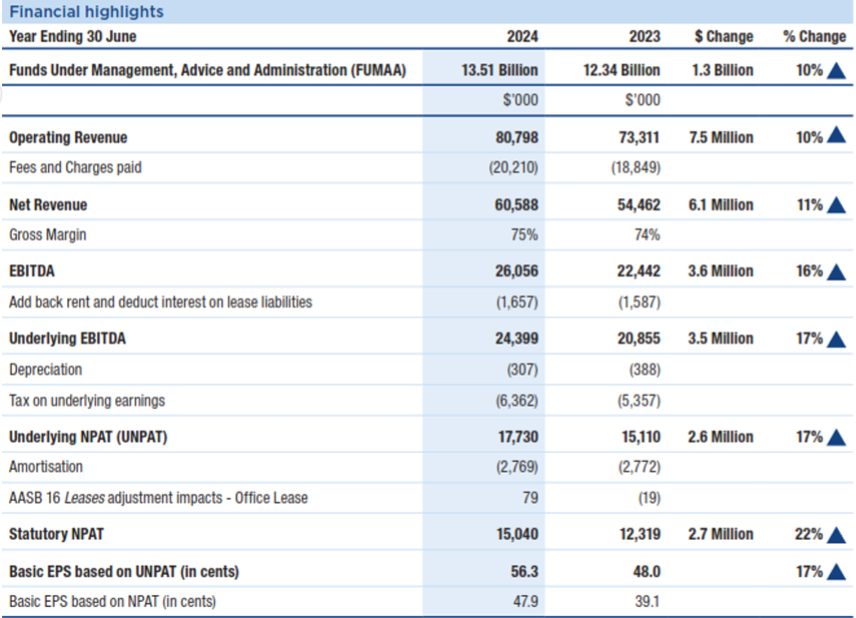

- Financial figures:

Positives:

- Operating leverage of the business showing. Revenue up 10% with NPAT up 22% (17% underlying).

- Final dividend of 21.1c fully franked. 39.3c fully franked dividend for the FY. At a closing price of $8.37 this represents a 4.7% yield.

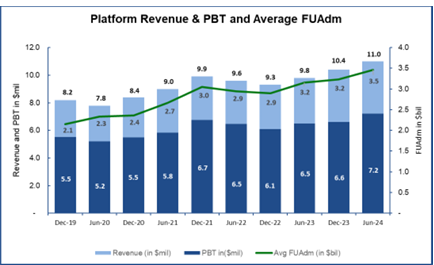

- Platform Administration business continues to grow steadily:

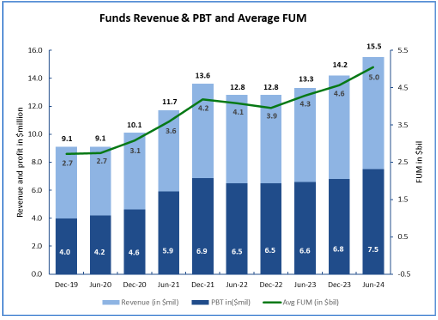

- Funds management business:

- FUM up around 15% with an additional increase of 11% in July 2024. This could contribution approximately $2.4m of revenue over the next year.

- Continues to rank very highly compared to other fund managers returns.

- ROE remains high at approximately 28%.

- Market liked the results, up 13.88% at close to $8.37.

Negatives:

- Funds under advice only up 4%.

- Longer term need to think of the impact of the focus on clients using Fiducian products. This will probably pass the test while they outperform compared to other managers but can expect more scrutiny if this isn't the case.

Has the thesis been broken?

- No, company performing as expected. Will be increasing my position as per my buying plan.

Valuation:

Updating for NPAT expectation of $17m for FY25.

- NPAT = $17m

- Target PE = 18

- Target MC = $306m

- Target price = $9.72

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- NPAT growth of 10-15% over the next year.

The market is liking the results out this morning

https://investorpa.com/announcement-pdf/20240815/23945.pdf

APRA imposes licence conditions on Fiducian over data accuracy issues - InvestorDaily

APRA imposes licence conditions on Fiducian over data accuracy issues

15 July 2024

APRA has imposed additional licence conditions on Fiducian to address data accuracy concerns ahead of the annual superannuation performance test.

In a statement on Monday, the prudential regulator said it has imposed additional licence conditions on Fiducian Portfolio Services Limited to address data accuracy and completeness concerns ahead of the annual superannuation performance test, affecting its management of Fiducian Superannuation Service with 8,770 members and $2.57 billion in assets.

The regulator explained that the action comes after issues were identified with the accuracy and completeness of data submitted previously, which, it said, raised concerns about FPSL’s ability to identify, assess, monitor, and submit accurate data.

Under the terms of the new licence conditions, which came into force from 15 July 2024, FPSL must:

- take reasonable steps to ensure that an expert completes a review of the accuracy and completeness of data submitted ahead of the 2024 performance test;

- develop and implement a remediation plan, to be approved by APRA, to address any recommendations or areas of concern identified by the expert; and

- provide APRA with an attestation regarding the accuracy of data and governance processes for data submissions.

“APRA places a high degree of reliance on the quality and accuracy of the data we receive to drive greater transparency of the industry and strengthen the accountability of trustees to act in the best financial interests of their members," said APRA deputy chair Margaret Cole.

"This includes the data submitted for the annual performance test, a powerful tool used by APRA to hold trustees to account for fund performance, fees and costs".

Inside Ownership Ordinary Shares %FID Issued Net Value at $7.75

Inderjit (Indy) Singh 10,949,091 34.78% $84.86m

Frank Khouri 268,323 0.85% $2.08m

Kerry Skellern 8,000 0.03% $62K

Sam Hallab 127,027 0.04% $984.5K

Total 11,352,441 36.07% $87.981m

Management Bio's

Inderjit (Indy) Singh OAM -Executive Chairman

Indy Singh is the Executive Chairman of Fiducian Group and founded the organisation in 1996. Prior to that, he spent over eight years with one of Australia’s largest financial planning and investment management companies, where he played a key role in the development and management of its funds management and research businesses.

Frank Khouri - Non-Executive Director

A CPA accountant for over 30 years, Frank Khouri owns and operates a successful Accounting Practice and Fiducian Financial Services Franchise in Windsor (NSW) where he is an Authorised Representative. A Registered Company Auditor for 24 years, he is also an active member of the Board’s audit committees.

Kerry Skellern OAM -Non-Executive Director

Kerry Skellern was appointed as a director of Fiducian Group Limited on 1 June 2023. Kerry has held non-executive director and chair roles in the building, infrastructure and aged care sectors, with extensive experience in strategic sales, marketing and R&D at senior executive levels.

Sam Hallab - Non-Executive Director

Sam Hallab has over 35 years’ experience in finance and superannuation. Appointed to the Board in 2016 his expertise in accounting and as a registered company auditor is highly regarded. Sam is also a member of Fiducian’s Audit Risk and Compliance Committee and the Remuneration Committee.

Veritas Securities has released a full research report on FID -

Overview:

Fiducian Group is a financial services business that can be split into 3 segments:

- Platform administration - Provides an admin platform and tools for financial planners.

- Funds management - Run a range of funds that have generally done very well. Mostly within the super categories but also have a tech and India funds.

- Financial planning - 80 financial planners in 45 offices.

The company is run by executive chairman Indy Sigh who holds around 1/3 of the company and is the founder. Performance mirrors that of what you would expect of an insider running the business. The company has been a consistent compounder over the last 10 years growing revenues and EPS. The company has a high ROE mainly thanks to a high payout ratio of dividends from earnings and increasing EPS.

Main Thesis:

Thesis can be summarised by the following points:

- Consistently and stable compounder in terms of EPS and revenue growth.

- High ROE business and has been able to consistently maintain this.

- Decent dividend yield at around 4.8% (fully franked).

- Founder with significant skin in the game running the business.

- Australian financial services industry has the constant tailwind of superannuation money for sustained inflows no matter the environment.

- The funds management business is high performing compared to its peers.

- Growth appears to have been steady and share price generally mirrors this. Overall a stable company with stable share price.

- I couldn't find any evidence of direct findings against Fiducian as a result of the Royal Commision into financial services even though they do have vertical integration.

- Seems to have decent transparency for example releasing 4C's quarterly to update investors even when they are not required.

- Buying at a reasonable valuation of around 18x PE. Not cheap but not expensive. Will look to

- Directors have been consistently buying shares on-market. Not huge amounts but the consistency of buying without selling is interesting. See image below (thanks to Market Index for information).

- Share price chart is bottom left to top right moving without significant volatility most of the time.

Risks:

- Thesis is strongly based on company continuing to be able to execute has they have before and that this growth will continue.

- Founder moves on/retires.

- Platform competing against other big players.

- ROE falls way. Would show capital allocation deterioration or EPS growth slowing.

- Returns of managed funds start to underperform.

- Illiquid, small trades can be the cause of noticeable price changes.

- In-housing of investment management by super funds driving down overall fees available for others in the industry.

- Increasing popularity of ETFs.

- Regulatory pressure or regulation. Removal of ability to vertically integrate.

- "Roboadvisors" start to become more attractive and effective than traditional funds management businesses.

Investment KPIs:

- Maintain a high ROE.

- Stable growth in dividend.

- EPS growth of 12%+ over time.

- FUM continue to grow = continued revenue growth at around 10% or greater (depending on market conditions).

When to get out:

- Profit downgrades/EPS doesn't continue to grow.

- FUM doesn't grow.

- Founder leaving without a long transition planned.

- Funds performance especially conservative to growth don't continue to outperform compared to other managers.

- Founder starts to sell significant portions of shares.

- Price below soft stop loss point (ie negative momentum).

Bought on Strawman and IRL.