Overview Comment:

Good result overall, most segments and KPIs all moving in the right direction. There continues to be operating leverage in the business. However, valuation is now fair in my view but not overvalued to the point where I won't be adding.

Market liked the result up just under 10% after results. However, opened only up slightly then throughout the day moved up to 10% gain. Note for next time to be ready to make a quick call, this happened last results as well. Did see the results in the morning and thought overall they were good so could have pulled the trigger then. Will give it a week or two before buying again, see what happens after the rush to buy after results ends. Last time this resulted in about a 10% drop in price after this rush. Given the fair valuation not in any great rush to jump in.

General notes:

- Staff numbers only grew slightly. Wage increases have been offset by efficiency gains.

Positives:

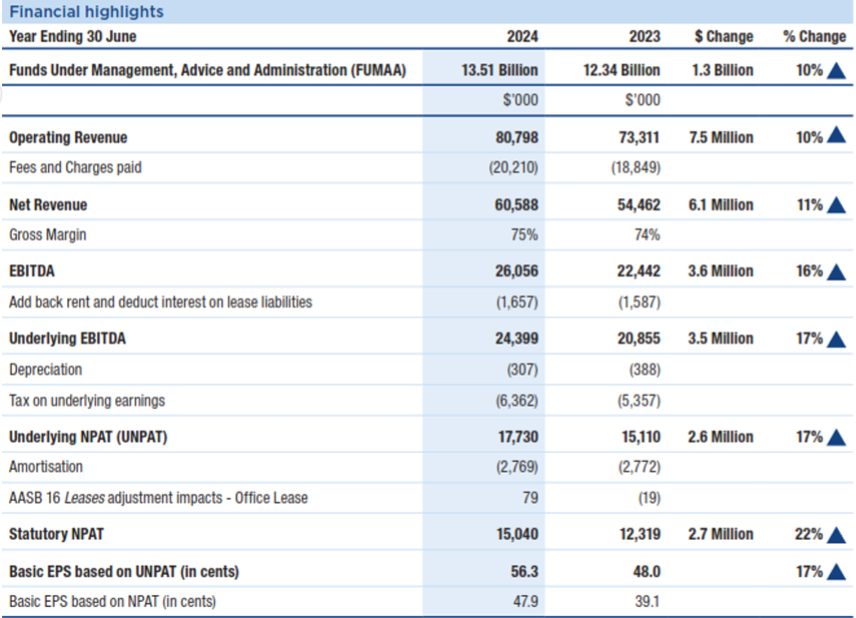

- PCP financial figures good:

- Net revenue up 15%

- Underlying NPAT (NPATA basically) up 20%

- NPAT Up 26% to $8.6m

- EPS = 27.4c

- Figures above show Fiducian continues to have operating leverage.

- Dividend of 21.9c fully franked.

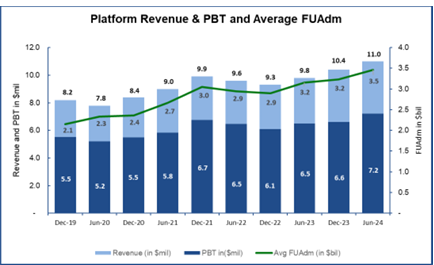

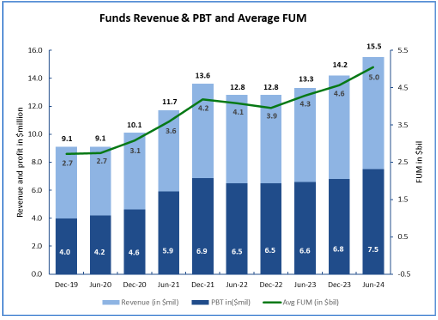

- Funds under administration up 14% YoY and FUM up 15% YOY.

- All segments growth in revenue and PBT look good:

Negatives:

- Going to stop cycling the excellent previous longer-term results over the next few years as the poor 3-year return moves further into the past. Funds could be less of a selling point as a result. At least 1-year results appear to have done ok overall.

Has the thesis been broken?

- No, company is doing well at or above my expectations. However, is at a full valuation. Will add as per buying plan.

Valuation:

Updating for NPAT expectation of $17.5m for FY25.

- NPAT = $17.5m

- Target PE = 18

- Target MC = $315m

- Target price = $10.01

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- NPAT growth of 15% minimum given 26% gain in 1H.

- Monitor risk in the case of a market downturn.

- Be ready to go for a buy if results look good on release, these results and the previous had a big move from open to close. There was a chance to get in early that day if I was ready.