Pinned straw:

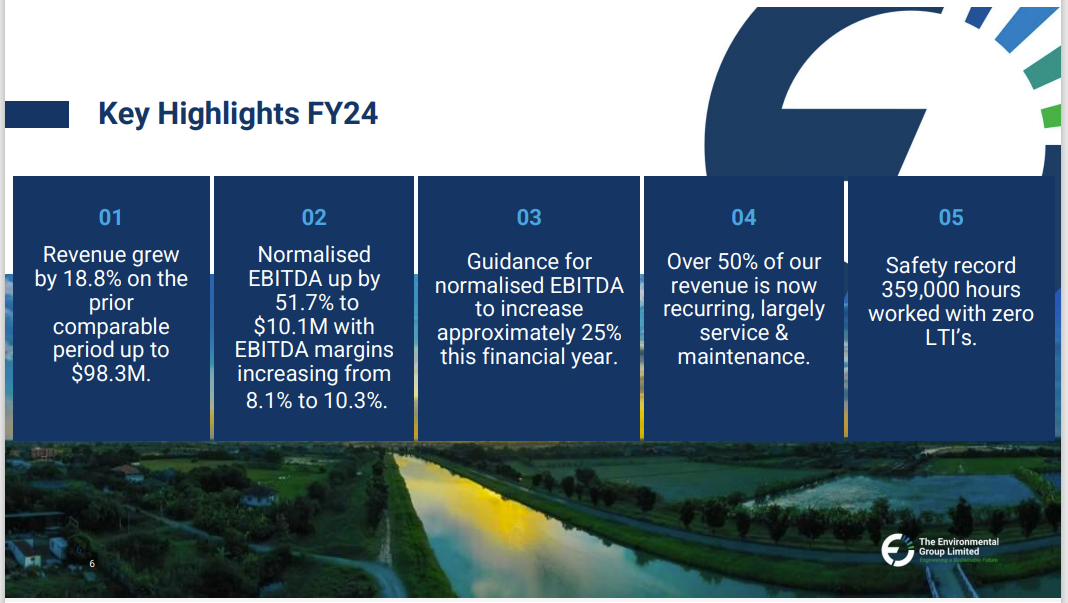

Solid results despite headwinds from TAPC and AT. Baltec the standout, especially in 2H as the higher margin silencer work hit the accounts.

Guiding FY25 to 25%+ EBITDA growth and I think there is upside risk to that over the FY given 63% of its is explained by Baltec run-rate and another 25% by Energy (assuming no change in Clean Air). Getting AT right and hitting 10%+ margin as per the call takes it to overs. Biggest risk here is TAPC taking a serious hit if the remaining pipeline projects get delayed or postponed, in particular ILU’s refinery which will have a business update out later this year as reported in their own results yesterday (ominous?).

Image below is a simple bridge to backsolve what is in guidance.

Based on guidance, EGL’s stat EBITDA for FY25 is $12.6m and with ~$2m in leases, results in $10.6m cash EBITDA which means the stock is currently on a ~11x multiple, which is not demanding if guiding 25%+ growth and upside risk to upgrading, noting EGL has a history of doing this for the last 3yrs already. With more attention from larger small cap funds like Greencape, a multiple of 15x is not an unrealistic potential outcome which would give a val of $0.45/sh.

With upside risk to guidance like a win or two in waste or new distribution agreements like Fulton or Kadant PAAL driving additional organic growth, I think EGL has scope to do $14m+ EBITDA (~$12m+ cash basis) which on a 15x multiple gives a val of $0.51/sh. Maybe a guy can dream and if EGL can upgrade over the year like it has done in the past, maybe a slightly higher multiple could be possible thus extra upsideval could well into the $0.50/sh range.

Fair to say downside from here would largely centre around TAPC performance noting the business is ~3-4x of what it was pre the crit minerals boom and if that biz halved, it could offset a decent proportion of the guided growth with EGL increasingly price for growth and upgrades, likely means downsideval could be around mid to high 20s.

Disclaimer: not in straw book but bigger pos in PA.