In this straw, I summarise the market response, analyst response, and my own valuation update, following the surprisingly good result/outlook yesterday for $WTC.

Suffice to say, its a pattern we've seen before.

Market Reponse

The market opened positively, yesterday up 20% with the day's volumes of 1.8m about 4x daily norms. Today has added another 9%+ (at time of writing) on another 1.7m shares, taking the cumulative uplift to around 29%. Just to be clear, that's about $9bn market cap added.

Analysts

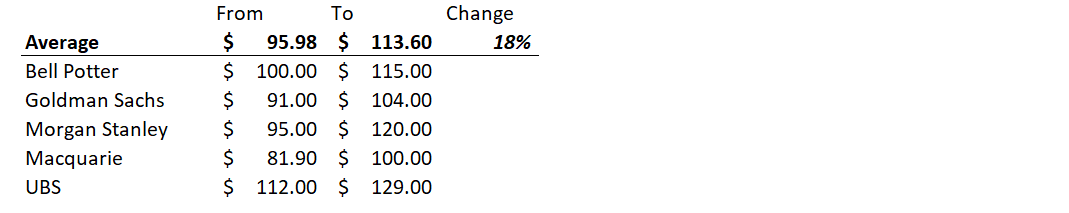

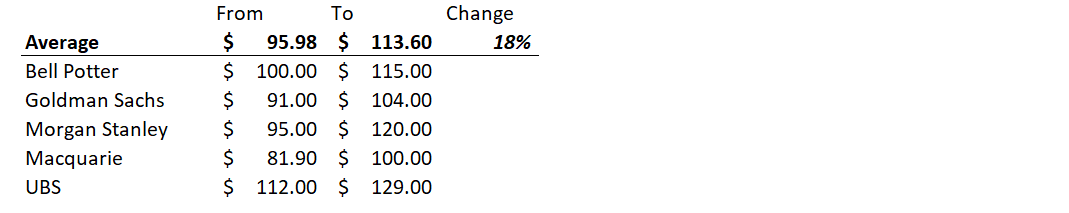

Overnight, several analysts updated their valuations and TPs. (Remember there TP's are 12m targets)

Here's a snapshot of the individuals I've been able to track:

The more complete set on marketscreener.com has moved as follows:

Prior to result: Average $92.82 ($55-$115; n= 18)

Post result: Average $107.32 ($55-$129; n=18)

An average change of +16%, albeit not all have updated.

My Valuation

I have previously reported the details of my detailed, long-run DCF model, built a couple of years ago.

Today was the first day I updated it following the Blume and Envase acquisitions early last year, which always muddy the waters, and I find that I need a clear 12 months for things to stablise, which they appear to.

Based on my range of scenarios for revenue and margin evolution, I get the following:

P(exp.) = $103; Range ($92 - $123)

My Divestment Decision

Earlier this year I sold my full $WTC holding at c.$96, because at that time the SP had flown up towards the top of my valuation range. On 5th August, I bought the position back at a cost base of $87.37, ... courtesy I think of the unwinding of the Japanese carry trade.

Although $WTC is a quality business, its share price is fairly volatile, partly because the market continually misjudges the temporary impact of %GM compression following acquisitions (which are about acquiring capability and market footprint, to then fold into Cargowise). This time a further misreading was due to $WTC taking time to develop the next set of product enhancements, resulting in high R&D and capex, with organic revenue slower to respond.

But whenever the market gets behind the eight-ball on what's really going on, and the result surprises, there is an over-reaction. This most recent "over-reaction" has even caught me by surprise. Having realised a gain of almost 40% in less than three weeks, I have today sold down 50% of my RL position.

I know it can be dumb to sell your winners. Real dumb. But over the last 8 years I have consistently sold down $WTC when it hits the top of my valuation range and bought back when the SP moves to the low end of the band.

One measure I track is the EV/EBITDA(forward) mulitple. Historically, this moves around quite a bit within the band of 38 to 52. Today at my exit price, it hit around 58. I'm confident history will prove that's not sustainable.

Whether its P/E or EV/EBITDA or any other valuation multiple, $WTC moves around quite a lot. So even though it is probably my favourite stock, and the business on the ASX I understand well (second only to $PNV), I do tend to move in and out of it every 1 to 2 years.

I didn't sell my entire position because sometimes the market gets completely irrational about $WTC, and it is not uncommon for it to go even higher over the coming weeks. Worst case, scenario, I'll hold what is still a 5% position in my portfolio for the long term.

Happy Days.

Disc: Held in RL (5%)