Pinned straw:

I listen the entire presentation this morning. Nothing surprising in my opinion. Mal did mention the involvement of Melbourne University in the Telstra deal, which was inline with my previous finding.

Mal gave a great presentation as always. He seemed to be very excited about finishing this transaction year. As a shareholder, it’s a bit annoying to see AVA went from being profitable and debt free to a capital raising, money losing but dividend distributing company.

The part that really pissed me off was Joyce explaining the dividend policy. All he said was the board talked to shareholders and believed the policy was fine. He should at least explain the reasoning behind making this policy, unless there’s none.

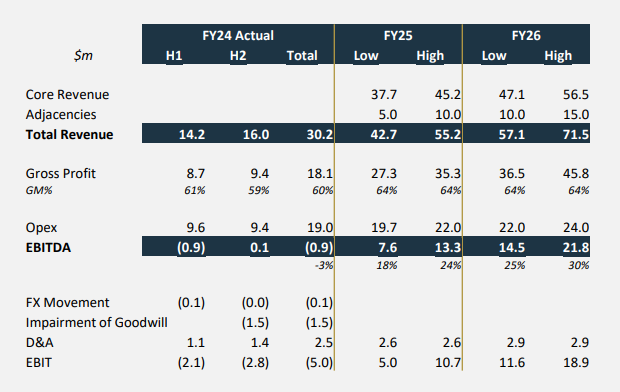

In my opinion this company has officially ran out of excuses. It’s time to deliver. 35M revenue with a solid EBITDA margin around 12% would be a great FY25 for me. I know it’s far below the projection but this is still fast growth.

@Strawman so what do you think you are specifically looking for to indicate the kind of improvement we are hoping for?

Ie., what's a fail mark, what's a pass mark, what's a success mark?

Thanks @Strawman for the call review. Good to see some expected numbers moving forward (I know we have heard this before). I am in the same camp next year, holders need to see some big step forwards. If they can meet those target numbers we may see this revisit the 20s again in 2025.

Hold in RL (down 45%).