by Sarah Jones and Joanne Tran, AFR, Dec 21, 2023 [so forecasts for calendar 2024]

Excerpt:

Chris Prunty, QVG Capital

“We like insurance builder and disaster recovery company Johns Lyng Group (JLG). The stock is down 5 per cent this year despite our earnings expectations moving up over the past 12 months. We think next year’s earnings expectations are modest, and the valuation is compelling for a company with such a strong track record of earnings growth.”

Others:

David Allingham, Eley Griffiths

“A key pick for us is SiteMinder, which is hitting a free cash flow inflection point in 2024 and is in the early stages of accelerating monetisation of its existing global customer base.”

Simon Brown, Tribeca

Qualitas IPO’d in December 2021. It’s an alternative credit fund manager that raises funds from investors to be deployed into real estate lending. The alternative lending sector has been growing rapidly for the past five to 10 years as major banks have been retreating from lending to the sector, leaving opportunities for smaller players.

“Since listing, Qualitas has grown its assets under management by 90 per cent to $8 billion, and management forecast this growth to continue, with a recently provided FY28 AUM target of $18 billion.”

Alex Shevelev, Forager

“RPMGlobal is the largest investment in the fund. The company provides software to miners and mining services businesses. Many of the products are industry standard and key to the operations of a mine site, so very few clients stop using the products. The business is run by an aligned management team, has net cash on the balance sheet, and has been continuously buying back shares.

“Last year, revenue grew by 18 per cent, while profits more than tripled as the business showed excellent cost control. So far this year, RPM has upgraded earnings expectations twice and is on track to deliver another year of strong operating leverage.”

Damon Callaghan, ECP Asset Management

“A notable company to watch is Hub24, a leading wealth platform used by Australian financial advisers, which has plans to reduce inefficiencies in typical financial adviser workflows. Advisers, burdened with extensive administrative tasks, have less time for their core functions, like meeting new and existing clients. So, Hub24 employs its proprietary machine learning tools to organise data and develop automation solutions. Such innovations could prove transformative for clients.”

James Sioud, Regal Funds Management

“We are bullish on Domain, with the stock likely to benefit from falling interest rates – as a long duration growth stock – but also as a beneficiary of increased turnover in the housing market.

“Since 2022 Domain has fallen 40 per cent whilst REA Group has risen 5 per cent, a stark contrast to the very strong correlation between the two stocks over prior years, and illustrative of this market’s preference for large caps. We think this historic performance gap is poised to close.”

Phillip Hudak, Maple-Brown Abbott

”GQG Partners is leveraged to more favourable markets and a recovery in global fund management flows. It offers earnings momentum as evidenced by consistent positive net inflows, stable fee margins, disciplined expense growth, strong distribution franchise and a robust balance sheet. The company trades at a material discount to both domestic and international fund management peers with an attractive dividend yield on offer.”

Martin Hickson, 1851 Capital

“Our largest position is Light & Wonder. They are one of the top three developers of content and hardware for the gaming industry and are competitive to Aristocrat. Around three years ago, Aristocrat’s ex-CEO and ex-CFO joined the company and brought around 80 of the team with them.

“Market share in Australia has gone from around 8 per cent two years ago to around 30 per cent today. That’s partly been driven by one of these new games, Dragon Train, currently ranked [a top] poker machine game in NSW and Queensland. It’s got the potential to enter the ASX 100, and trades on attractive multiples.”

[Martin Hickson is ex-WAM Funds, and his new gig at 1851 Capital is run by another ex-WAM Funds man, Chris Stott.]

---

That was published in December. Who got it right? Yeah I know the year's not over yet, but it is September next week, so...

Here's the article's preamble (just to go from back to front):

Small-cap fund managers are starting to get excited.

After two years of trailing their large-cap peers, there are signs of life in the less liquid part of the market as investors have piled into the space in the last two months, sending the ASX Small Ordinaries Index up 13 per cent.

In the US, the gains are even more pronounced over the same period, with the Russell 2000 Index soaring more than 20 per cent.

David Allingham of Eley Griffiths says the prospects for small caps are good. Brook Mitchell

The US Federal Reserve’s unexpected pivot on monetary policy this month has helped, turbocharging a broad rally that sent the major bourses at or near record highs as chairman Jerome Powell revealed that rate increases were “not the base case any more”.

War-weary fund managers say 2024 could be the making of small caps after a rough two years battered by the fastest global monetary tightening in a generation and fears of a recession that, as yet, has failed to materialise.

“I’m optimistic on small caps going into 2024,” Chris Prunty, founder of QVG Capital, tells AFR Weekend. “Then again, I was optimistic going into 2022 and 2023, and look how that turned out.

“[But] there are signs of life in small caps. For the year to October, the small-cap benchmark was down 6 per cent, but since then, the market has improved.”

Best conditions since GFC

The Small Ordinaries Index looks set to finish the year up at least 4 per cent versus an 8 per cent gain for the S&P/ASX 200. It’s a marked improvement on 2022, when a brutal equities rout sent the gauge tumbling 21 per cent, versus a 5.5 per cent retreat for larger stocks.

In an environment of rising interest rates, small-cap stocks typically don’t fare well as investors seek the safety of large liquid companies such as banks and miners. But that appears to be changing as traders price in about six rate reductions in the US and at least two in Australia in 2024.

“We believe we are seeing one of the most favourable environments for the Australian small-caps market to outperform into 2024 since the global financial crisis,” says Maple-Brown Abbott’s Phillip Hudak.

“A lot of the negative outlook is already priced in for Australian small companies. In addition, there are signs that financial conditions are easing, with inflation moderating and interest rates have peaked.”

Managers from Maple-Brown Abbott to Regal Funds Management and Eley Griffiths also say the balance sheets of many smaller companies are in good shape, with many debt-free and boasting “remarkably resilient” earnings.

“[Small caps] continue to confound fears of far more negative revisions in the face of higher interest rates, weaker demand, and cost inflation,” Mr Hudak says. “Many of these headwinds are expected to ease into the new year.”

And he’s not alone. Bank of America’s long-running global survey of fund managers shows a net 5 per cent of the 254 respondents who oversee $904 billion in assets expect large-cap stocks to outperform small caps, the lowest reading since June 2021.

Eley Griffiths’ David Allingham says a peak in bond yields and a marked easing in liquidity this month supports the case that, “at the very least, small-cap underperformance has finished”.

“This is positive as there is a significant mean reversion opportunity for small caps to play catch-up relative to large caps ... the question is, how long investors have to wait for this to eventuate?

“The prospects are good for small caps to outperform, but most importantly for investors looking at the space, it is highly unlikely that small caps will underperform.”

--- end of excerpt ---

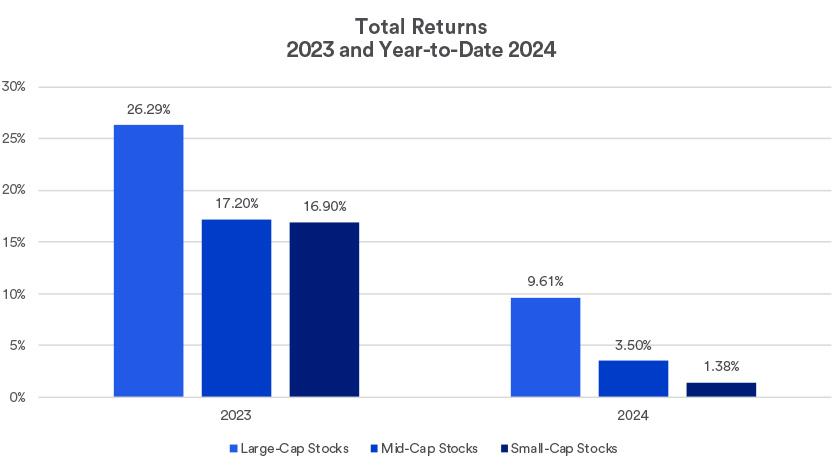

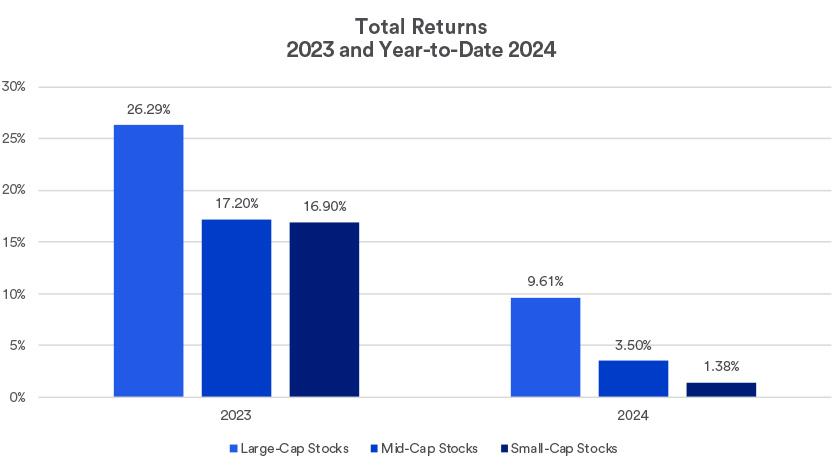

yeah, depends which ones you're looking at - but I'm pretty sure the Small Ords has underperformed the All Ords and the ASX200, and the smaller the companies are the worse they've performed in the USA so far this year:

Source: S&P Dow Jones Indices, LLC. And FTSE Russell. *Year-to-date through August 5, 2024.

Source: https://www.usbank.com/investing/financial-perspectives/market-news/is-a-market-correction-coming.html [08-Aug-2024]

Not sure how well the ASX correlates to that however I do get the sense that we're still waiting for that long-overdue rebound in small caps and microcaps here.

JLG however has a market cap of over $1.5 Billion, so not so small now. It was +37% higher yesterday (due to the -27% drop today). Studies have shown that often when a company disappoints the market that much when they report, they will keep falling or trade sideways for at least 3 months, in the absence of a circuit breaker like a particularly positive announcement... but there are exceptions to that rule obviously - like Lycopodium (LYL) which fell -12% (-$1.68 to close at $12.34) last Wednesday (21-Aug) when they reported, and they rose +44 cents (+3.6%) today on a day when the market finished lower, but then again, LYL can lack liquidity, so maybe there just weren't that many sellers, and they're all out already.

(Disc: I hold LYL, not JLG)