10-July-2022: Johns Lyng Group (JLG) were one of the 10 stocks covered on Ausbiz's "The Call" last Monday (4th July) with Mathan and Gaurav - Here's the link to that episode: the call: Monday 4 July on ausbiz

Plain text link: https://www.ausbiz.com.au/media/the-call-monday-4-july?videoId=22509

The JLG coverage starts at the 35 minute mark. Mathan seemed to like JLG, saying it is a quality company with quality management and that it is on his shopping list, but more of a Hold than a Buy at current levels. His main initial concern (last Monday) was rising input costs, such as the tradies charging more for their services and building materials becoming more expensive.

Gaurav thinks JLG is a sell because they are expensive (60 times earnings by his calculations) and every fund manager and his dog are already in it so the boys suggested that there might not be (m)any fundies left to drive up the price from here unless the ones who are already there decide to up their own stake further. More on that in a minute (they're wrong about that).

Gaurav also mentioned that JLG's margins are around 4%, so he rates them as a good business, but not a great business. However, they both rate JLG's management highly and think they've done an excellent job to date. However neither rate the company as a "buy" here and I get the feeling it's just not the type of company that interests Gaurav, so he would be unlikely to consider them a buy at any time - regardless of the prevailing share price (IMO).

I prepared my first investment thesis (or IT) for JLG back in late December 2017 when they hadn't quite been listed for 2 months, and decided not to buy them based on the risks being too high and there being too many unknowns with such a young company (in terms of being publicly listed). Geoff Wilson's WAM Microcap fund (WMI) already held 5.06% at that very early point (they got an allocation in the IPO and then added to it on-market) and WMI itself was only 6 months old (from their own IPO in June 2017) and their (WMI's) share price during that initial period was all bottom left to top right, so I was interested in anything they took a substantial holding in; Interested enough to prepare an IT, but not always interested enough to buy shares. It depended on how compelling the IT was, and I didn't think that JLG (based on the IT that I had prepared back then) was one of my best investment ideas at that time. I did hold WMI shares during that period, having participated in the WMI IPO due to already holding shares in WAM and WAX and liking the whole WAM Funds LIC set-up quite a bit.

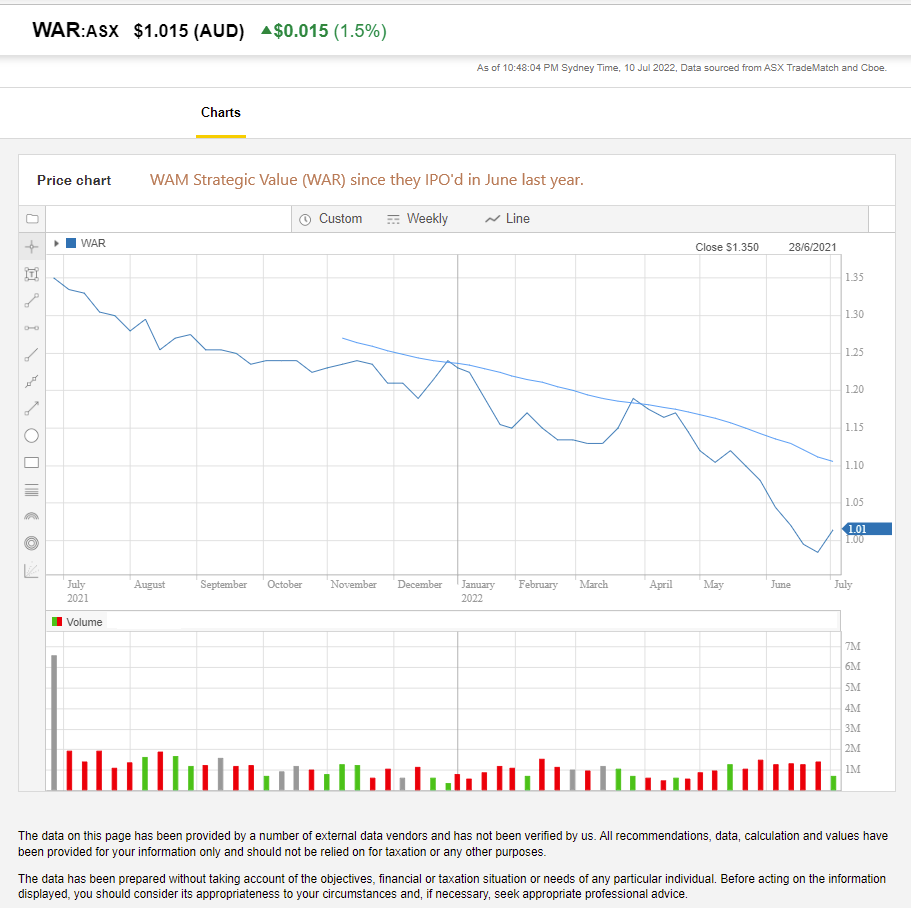

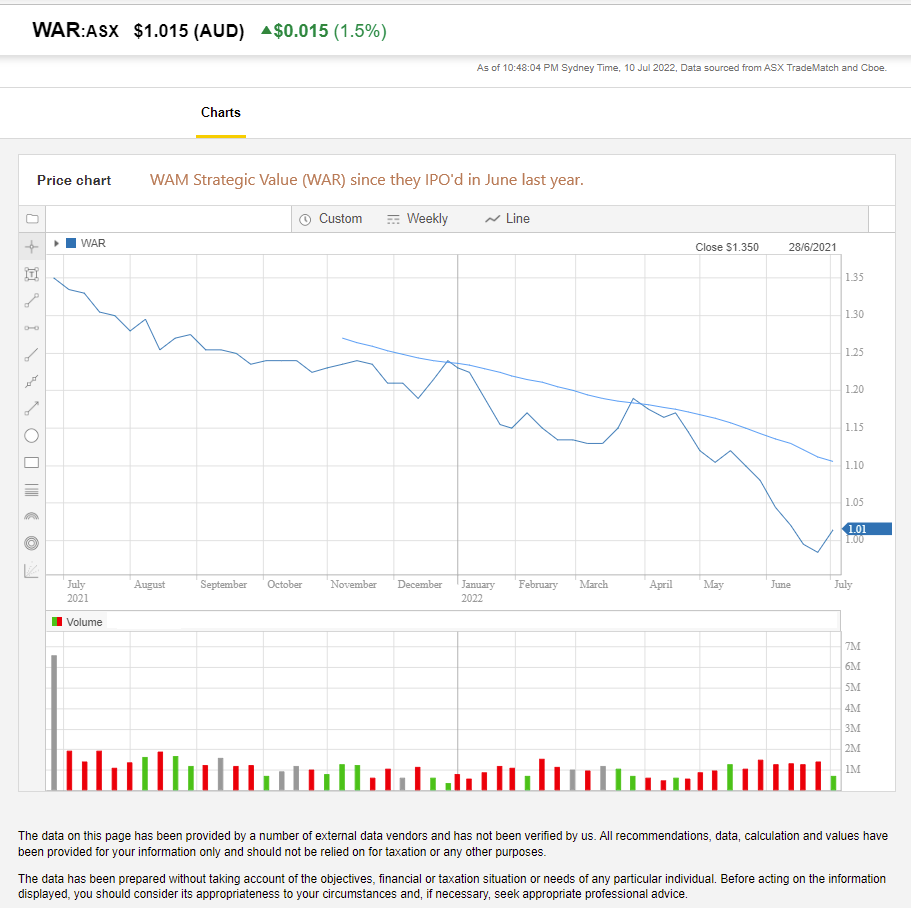

I don't hold any WAM Funds managed LICs right now, but I've held 7 of their current 8 at various times and mostly done quite well out of them. The only LIC of theirs I have never owned is their most recent one, WAR (WAM Strategic Value) which has been all top left to bottom right, the exact opposite of what you want to see on a share price graph of a company that you hold, so I'm glad to not be holding it. WAM Funds as a funds management company have now gotten to the stage where they are simply trying to milk too much money out of their once-very-loyal shareholder base, and managing 8 LICs is probably about 3 or 4 too many. Plenty of fees being generated for the management company (WAM Funds), but the consistent outperformance their individual funds (all structured as LICs - Listed Investment Companies) enjoyed in their earlier years is often lacking now.

Anyway, I digress. Back to JLG. There were other fundies also talking up JLG right at the start (just after they IPO'd/floated on the ASX) - like Perpetual - see here: https://www.livewiremarkets.com/wires/a-small-company-with-a-wide-moat

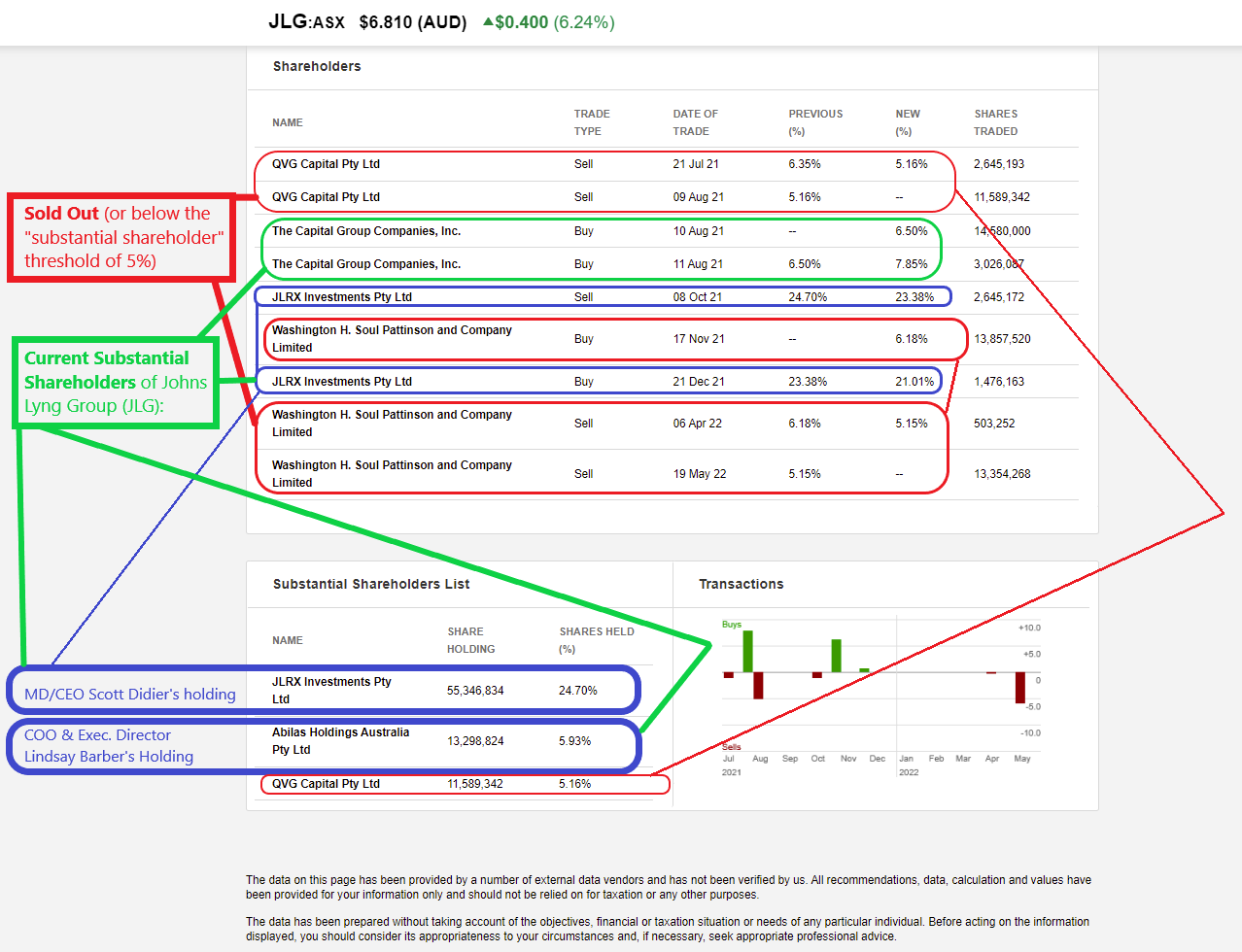

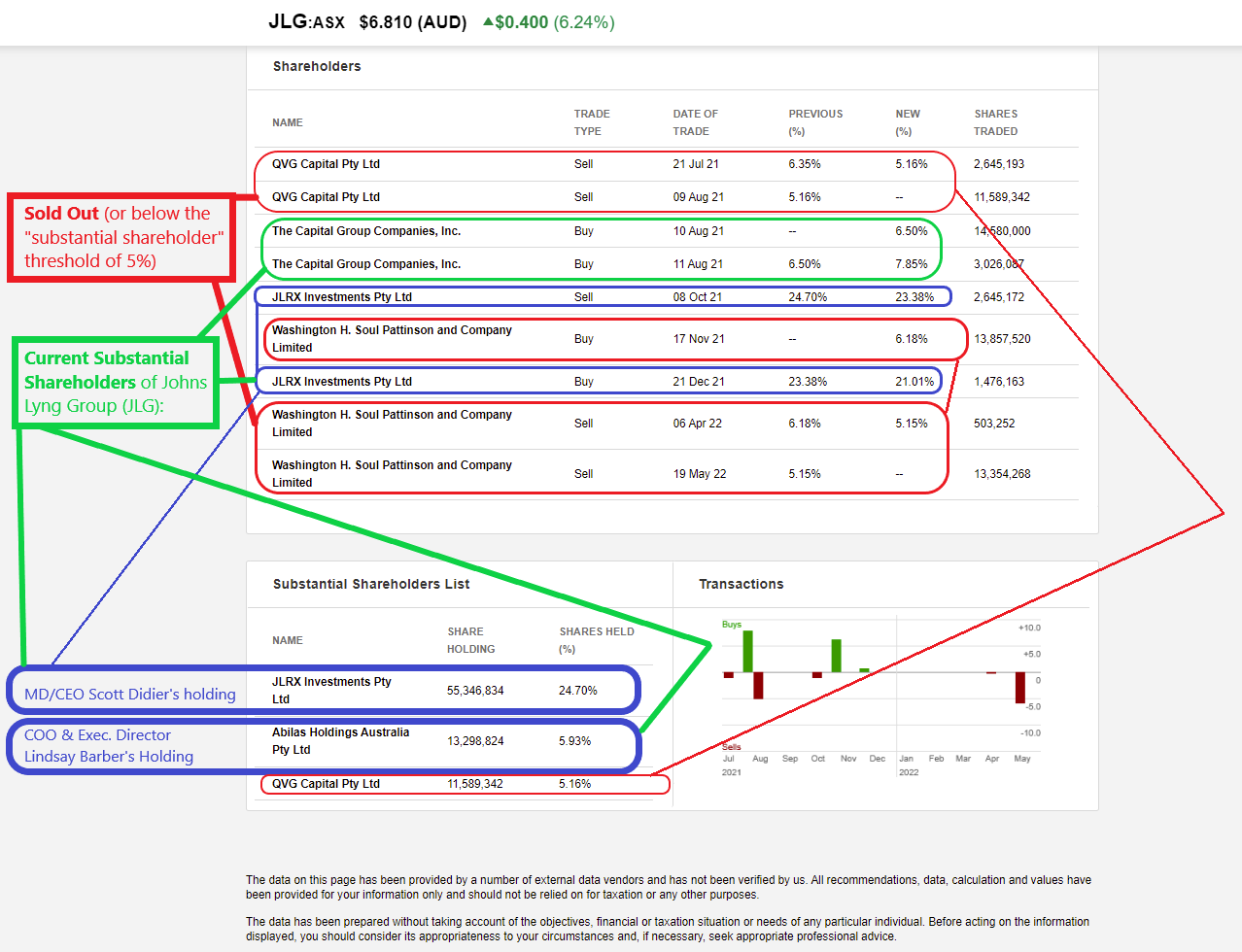

Here is how the substantial shareholder list for JLG looks now:

Source: Commsec, edited by me.

So WAM Funds (WMI) and Perpetual are out, QVG and SOL (Washington H Soul Pattinson and Company Ltd) have sold down or out, but we have "The Capital Group Companies, Inc." with 6.5%, plus JLG's MD & CEO, Scott Didier (JLRX Investments) with 21.01% of the company and JLG's Chief Operating Officer (COO) and executive director, Lindsay Barber (Abilas Holdings) with 5.93%.

So Gaurav and Mathan were somewhat concerned that there were "too many" fundies in JLG but it actually looks like there is now just one - US-based "The Capital Group" whose registered address is in Los Angeles, California. When they lodged their Becoming-a-substantial-holder.PDF notice in August 2021, they said:

The Capital Group Companies, Inc. (“CGC”) is the parent company of Capital Research and Management Company (“CRMC”) and Capital Bank & Trust Company (“CB&T”). CRMC is a U.S.-based investment management company that serves as investment manager to the American Funds family of mutual funds, other pooled investment vehicles, as well as individual and institutional clients. CRMC and its investment manager affiliates manage equity assets for various investment companies through three divisions, Capital Research Global Investors, Capital International Investors and Capital World Investors. CRMC is the parent company of Capital Group International, Inc. (“CGII”), which in turn is the parent company of five investment management companies (“CGII management companies”): Capital International, Inc., Capital International Limited, Capital International Sàrl, Capital International K.K, and Capital Group Private Client Services, Inc. CGII management companies and CB&T primarily serve as investment managers to institutional and high net worth clients. CB&T is a U.S.-based investment management company that is a registered investment adviser and an affiliated federally chartered bank.

Neither CGC nor any of its affiliates own shares of your company for its own account. Rather, the shares reported on this Notification are owned by accounts under the discretionary investment management of one or more of the investment management companies described above.

--- end of excerpt ---

I guess I should quickly point out what JLG do., for those who don't know. Their main revenue is earned from providing repairs to properties for insurance companies here in Australia, as explained on their home page of their website: Johns Lyng Group - Johns Lyng Group - Building Australia - Plain Text: https://www.johnslyng.com.au/

Also - see here: https://www.johnslyng.com.au/history.html

They have been very successful here in Australia and have very good relationships with a number of insurers, however they are now looking to take that success and try to replicate it in the USA, something that might be a bit trickier to achieve in Gaurav's opinion.

Back in 2017, JLG's client list included:

AAMI. AIG. Allianz. ANSVAR. APIA. AustBrokers. Aveo. BJS Insurance Brokers. Cerno. CGU. Chubb. CommInsure. Crawford and Company. Cunningham Lindsey. Dan Murphys. Department of Education. DTZ. Fitness First. IAG. Innovation Group. Insurance Adviser Net. Kathmandu. Kmart. LMI Group. Macedon Ranges Shire Council. Nike. Peter Stevens Motorcycles. PSC Insurance Brokers. QBE. RACV. RACQ. Spotlight. Steadfast. St Ives Retirement. Stockland. Suncorp. Vero. Victoria Police. Woolworths. Zurich.

They have obviously added more clients since then (they'd only been listed a couple of months then). Remember however that JLG WERE operating as a private company before they listed, so they had built up that client list over a number of years.

JLG do remediation and repair work for all types of damage, from a burst water pipe in a bathroom or in the wall cavity of a house, to flood damage of the sort we have been getting in Queensland and NSW recently. Obviously they are very busy at the moment, so that's a tailwind, but the shortage of tradepeople and rapidly rising costs in the building industry are probably headwinds.

They provide services across residential and business premises. Basically anything that can be insured in terms of structures where an insurance claim for damage can be lodged and repairs need to be made. JLG do emergency repairs as well as full remediation. They have their own team of assessors which are used by some of their clients. Other clients like to use their own assessors to inspect and report on damage and likely causes, but then will get JLG to do the repairs.

My concerns back in late 2017 was more around lack of history (as a listed company with the reporting/data that is available with listed companies) and that over half of their shares on issue (54%) were subject to escrow with the majority of those coming out of escrow in either August/September 2018 or August/September 2019. My thoughts were to wait and see how much selling pressure there was from those shareholders once they were able to sell those shares.

I revisited my IT (investment thesis) in September 2018 and updated it, and then did the same in April 2020.

My concerns had shifted by then. They'd handled the escrowed shares thing quite well. One of my new concerns was that JLG's CEO and MD, Scott Didier, appeared to me to be a bit of an "empire builder" in terms of creating and nurturing a number of companies for his children to run. I did note that at that point this side focus did not appear to have hampered the growth of JLG or the TSRs [total shareholder returns] for their shareholders, but that it was still worth keeping in mind and it made me question whether Mr. Didier was truly aligned with ordinary retail shareholders (he was the company's largest shareholder, owning over 20% of the company) or more interested in looking after his own family and their futures. I just wasn't sure where the majority of Scott's focus was at the time.

I also noted that he was often photographed with high profile sports stars and seemed to enjoy that association, but that he certainly wasn't Robinson Crusoe there; Many successful businesspeople also take active roles in sport, either as fans, financial supporters (sponsors) or in an administrative role, such as becoming the President or Chairman of a football club or the owner of a soccer club (for example).

So what mostly held me back was some minor questions over management focus and the share price being too high for the upside potential (IMO). Poor risk/reward trade-off, IMO, at the time. It's interesting that Gaurav and Mathan said last Monday that their high quality management is probably one of the JLG's best asset. However they still feel the price is too high, particularly Gaurav, who thinks they look VERY expensive for what they are.

Gaurav also raised an interesting point about positive relationships with insurers and a track record of competent repairs done on time and on budget being things that make it harder for would-be-competitors and gives JLG a competitive advantage, however those are the very things that JLG are up against with their plans to break into the US market. The incumbents over there already have those established relationships and track records and that will likely make it hard for JLG to break into that market in a meaningful way. Gaurav further suggested that IF JLG were able to overcome those obstacles and break into the US market and be successful there, building significant market share within a reasonable timeframe (profitably), then he would be worried about their Australian business in that what is there to stop another company doing to JLG here what JLG would have done to the incumbents in the US?

So it's a double edged sword in a way. Either it's a hard market to break into in a meaningful way, which protects them here but should make their US expansion plans problematic, or it's NOT such a hard market to break into which would mean their "moat" here is (or competitive advantages are) probably NOT as compelling and effective as we have previously assumed. One or the other.

There was one aspect where Mathan seemed to be contradicted by Gaurav and it seems Gaurav is right, and that's on M&A. Mathan (near the start of the discussion) was suggesting that JLG management were loathe to buy growth via acquisitions and preferred slower organic growth, with that being a positive thing, however Gaurav said that a lot of their growth HAD been due to acquisitions, and a quick look back through JLG's announcements backs Gaurav up, with a number of acquisitions being made by JLG across their short listed history, from when they were listed in 2017. There's been organic growth as well, but also growth via acquisition. I don't think it's a problem as long as they remain debt free and continue to grow their EPS, which is what they've been doing.

So - Pros and Cons:

Source: Commsec (all graphs in this straw were sourced from Commsec tonight and edited by me)

Pros - Tailwinds:

- The company is very busy doing repairs for insurance companies, asset owners and asset managers; Natural disasters such as floods and other severe weather events are tailwinds for them because they provide JLG with more work.

- After declining from $9 to $5 in about 6 weeks during May and June, the JLG share price is now back in a strong uptrend once again by the looks of it (see graph above), yet is still well below their December to April highs.

- The company has a negative net debt to equity (ND/E) ratio meaning that they are in a net cash position with no net debt.

- The company is well positioned within their sector with an impressive client list and a strong track record. JLG have built strong relationships with their major clients which provides them with a competitive advantage ("moat") which makes it harder for would-be-competitors to establish a significant presence in the industry and effectively compete against JLG.

- JLG appear to have very competent and highly incentivised management who have plenty of skin in the game, especially their COO (who owns 5.93% of the company) and their CEO/MD (who owns 21% of the company).

- JLG have upgraded guidance twice in the past 12 months - see here: Johns-Lyng-Group-Limited-provides-earnings-upgrade-for-FY22.PDF ...so they appear to tick the "underpromise and overdeliver" box.

- Commsec lists JLG's ROE as being over 30% (31.6% in FY21, see graph below) and ROC (Return on Capital) as being 30%, 20%, 21% and 25% in FY18, FY19, FY20 and FY21 respectively. That is VERY respectable if it's correct, even though their profit (earnings) margin on revenue is only 3% to 4% according to those Sales (revenue) and Earnings numbers listed below.

- JLG's earnings per share (EPS) have been growing since 2019, as shown below:

Source: Commsec.

Cons - Headwinds or "reasons to be wary":

- On a PER (share Price to Earnings per share Ratio) basis JLG are expensive, even though the share price is still well below recent highs.

- All of the fund managers who were previously substantial shareholder of JLG - including WAM Funds' WMI (WAM Microcap Fund), Perpetual Investment Management's "Perpetual Pure Microcap Fund", QVG Capital and Washington H. Soul Pattinson and Co. - are now NOT substantial shareholders so have either sold out or sold down to below 5%. The only fund manager on the JLG register now as a "sub" (>5%) is US-based The Capital Group Companies with 6.5%, and those shares are held in discretionary investment management accounts on behalf of (presumably US) insto's and high net worth clients according to them. This suggests that those Australian fund managers no longer see the same upside in JLG that they once did. In the case of WAM Microcap and the Perpetual Pure Microcap Fund it's worth noting that JLG is now a $1.767 billion (market capitalisation) company, so they're not a Microcap anymore by Australian standards, so would no longer be suitable for Microcap funds, however both WAM Funds and Perpetual manage other funds that hold much larger companies, and neither WAM Funds or Perpetual show up as current substantial holders of JLG for ANY of the funds that they manage.

- JLG's profit margins on revenue is low, having been between 3% and 4% for the last couple of years, so any cost blow-outs could mean the differences between making profits and making losses.

- Their input costs have risen rapidly in recent months and will likely rise further due to high demand for tradespeople and building materials. If JLG are able to pass those costs through to their clients that might not be a big problem, but if they have any issues passing those cost increases through, that could be problematic for them considering their low margins.

- Their biggest growth should now come from the US if they are successful there, however they could face obstacles from incumbents there who already have those same competitive advantages in the US that JLG have here - such as strong relationships with insurance companies and other clients plus a solid track record of being reliable and getting work done on time and within budget.

In summary, while I admire the management and what they have achieved to date, and there was certainly money to be made in JLG looking back, I'm going to continue to remain on the sidelines with this one, mostly because they are far from cheap on a PER (P/E Ratio) basis and I believe the upside (pros) don't significantly outweigh the downside risks (the cons), IMO. As Geoff Wilson used to say (according to Matthew Kidman in his book, "Bulls, Bears and a Croupier: The insiders guide to profiting from the Australian stockmarket"), back before it was considered politically incorrect, "You can't kiss all the pretty girls". Claude Walker has a more PC version nowadays: "You can't pat all the fluffy dogs".

27-Aug-2024 - Update: - I did briefly buy JLG after the Murray River flooding and noticing their signage around in SA where they were doing restoration work along the river after the floodwaters subsided, but then sold out soon after to rotate that money into a better idea. I could never get quote comfortable with their management to be honest.