Asset remediation and maintenance specialist $DUR announced their FY24 results.

ASX Announcement

Their Headlines

- Record Revenue of $555.8m (up 13%)

- EBITDA of $47.6m (up 22.6%)

- NPAT of $21.4m

- Gross profit 17.3%, up from 16.7% in FY23

- Strong cash on hand of $65.2m, with a cash conversion of 84% in FY24

- Annuity style contracts of $145.8m, making up ~26% of revenue

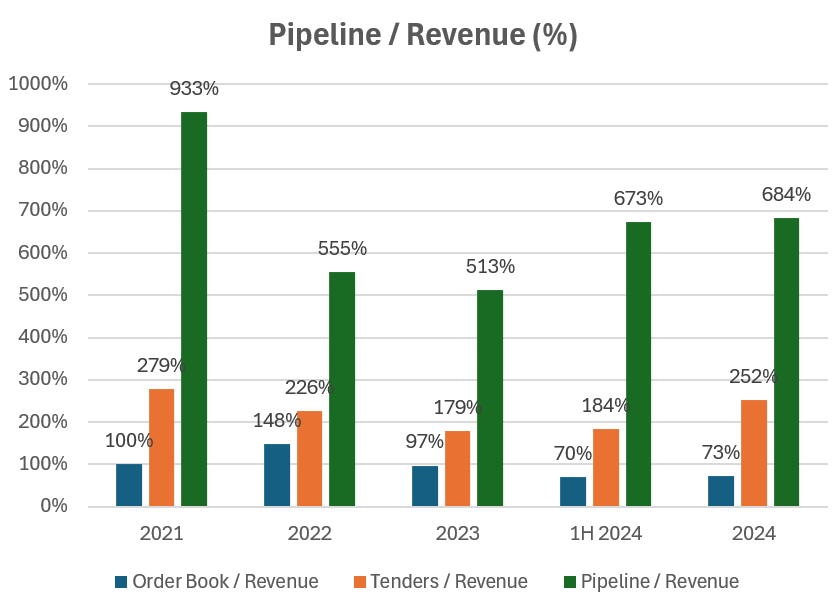

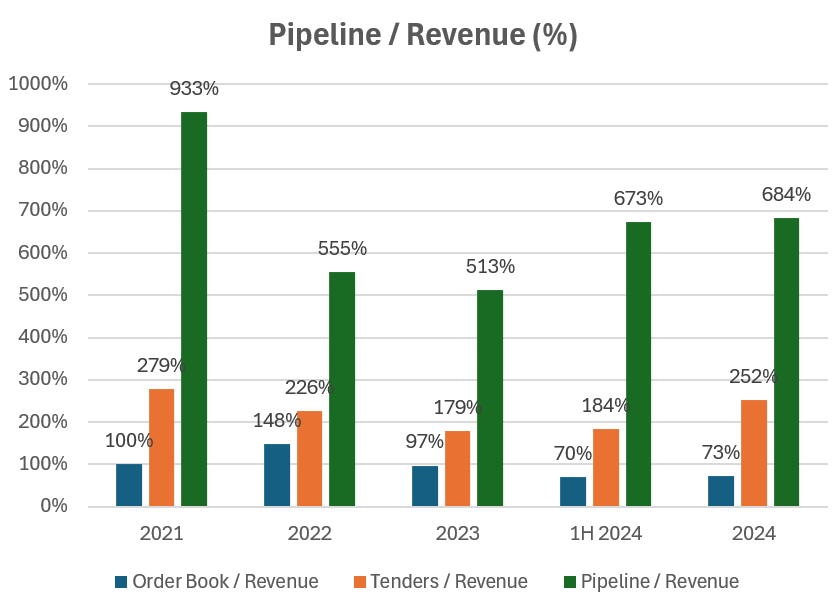

- Improved order book with quality tender opportunities continuing to grow

- Early Contractor Involvement (ECI) presenting significant opportunities across the business

My Analysis

The result was well-guided to at the end of May.

NPAT growth of 11.6% is well below what we've seen in recent years/underwhelming, but meeting expectation. Note: the analyst TP is about +21% ahead of the market, so room for SP to continue to advance (if you believe that means anything!)

Net Margin % of 3.9% the same as FY23 - so managing costs and commercial exposures well. (And better than FY21 3.0% and FY22 2.5%)

I include the updated picture on pipeline - slight increase in order book. The continuing build in Tenders bodes well for the year ahead. "Pipeline" is more a "whatever you want number" - but being high means they have line of sight to lots of work, and therefore can be selective in bidding for jobs that play to their strengths.

Joining the call at 11am.

Overall looks good.

Disc: Held in RL and SM