Pinned straw:

Being a shareholder of EZZ I am going to list a few things I don't like about the company and results

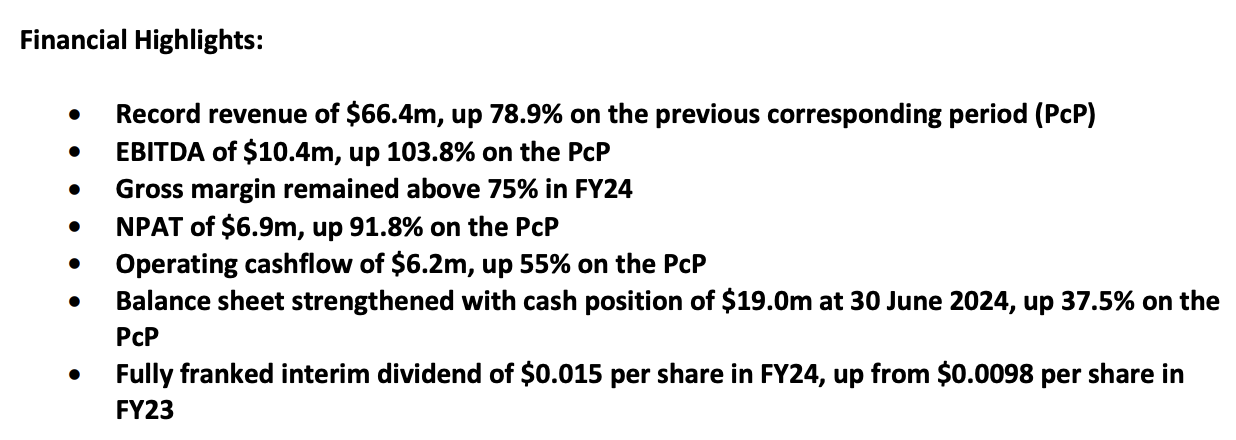

"Gross margin remained above 75% in FY24" - I hate vague statements like this, particularly when they were less vague on all the other information (see financial highlights below. Gross margins might have dropped from 98% to 75.1%. That would be signifcant. On first galnce, seemed to me they are trying to hide something.

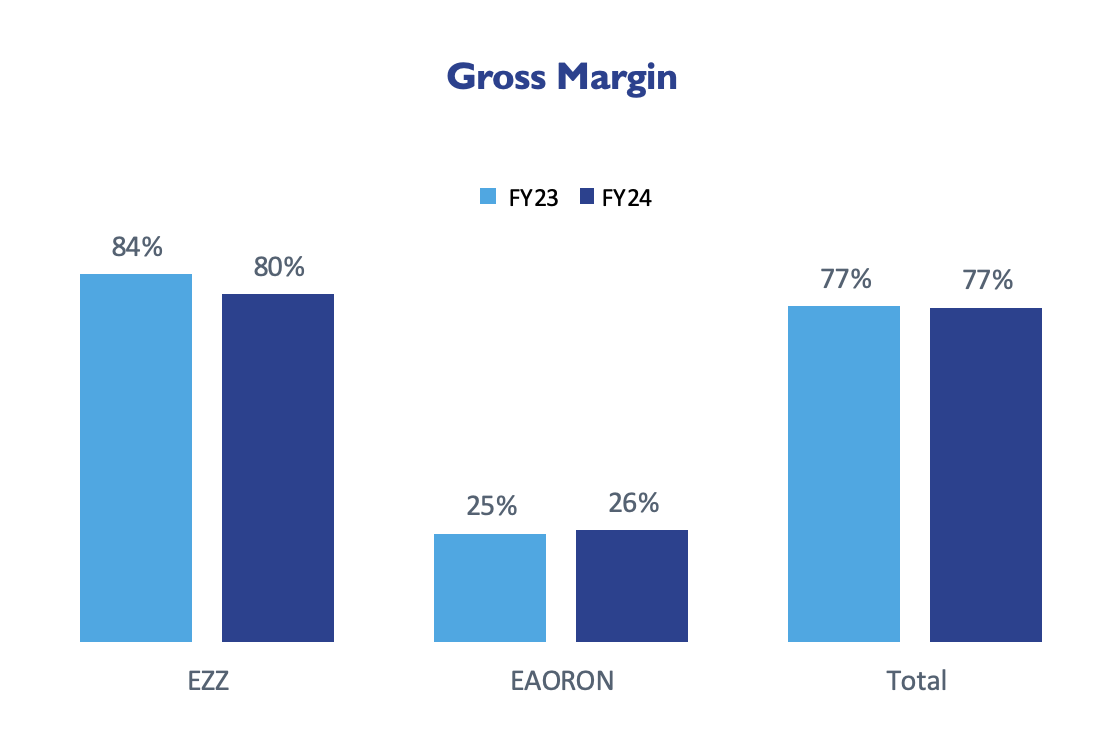

Speaking of gross margins. This is a high gross margin company. Is it sustainable? I doubt it. Falling gross margins dropping is one red flag to focus on. Though overall gross margins remained flat for the year, gross margins for the EZZ side of the business dropped from 84% to 80%. Is this a sign? Not necessarily so just yet ...

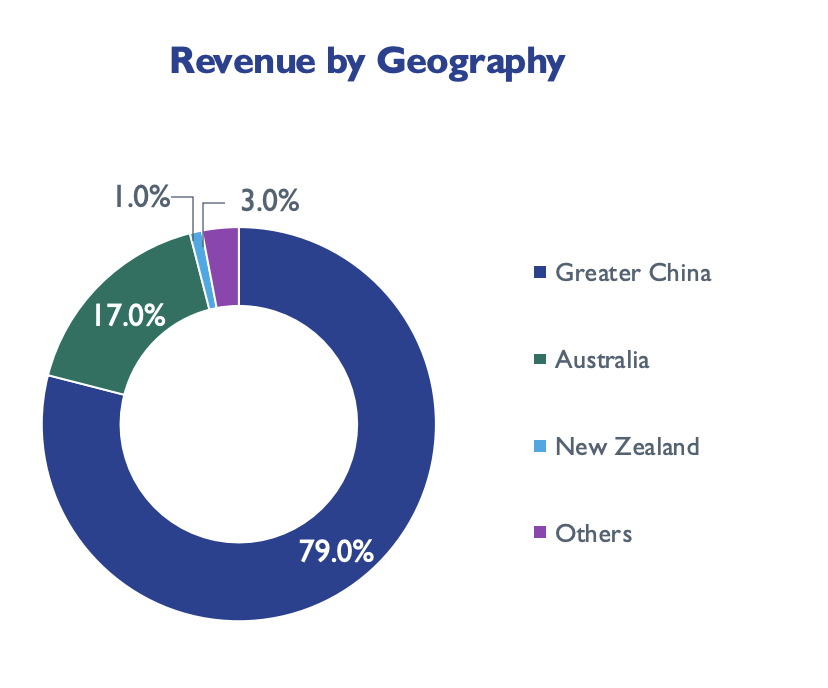

I am not a fan of highly concentrated geographic businesses, particularly when that concentration is in China. They are trying to address this by expanding into USA

I am NOT a fan of their products. This a personal bias/issue against supplements. Not an issue with EZZ's products as per se

In saying all that, share price is 20% so I am maybe a bit too nit-picky

edgescape

How many tried to ride the China/Southe East Asia wave and failed though?

One word that springs to my mind is RLF. They have given up on China and concentrating locally now.

Another one is that water company (can't remember the name).

But I see Waterco and Vital Life Sciences has done well.

That's what happens when you get too skeptical. Sometimes better to ride the momentum

Bear77

I reckon the company you were thinking of is Phoslock Environmental Technologies @edgescape

https://www.fool.com.au/2021/11/29/whatever-happened-to-phoslock-asxpet-shares/

https://www.afr.com/rear-window/phoslock-fraud-worth-an-australia-day-honour-20210406-p57gy1

Bear77

22/09/2024: This post contains commentary on Phoslock Environmental Technologies (PET) (SP: 2.5 cps and suspended from trading - likely will never trade again on the ASX) and Clinuvel Pharmaceuticals (CUV) which is still trading and closed at $14.39 on Friday (-2.77% on the day):

Yes, China is certainly an "interesting" place to do business for Australian companies and individuals @edgescape . The "old" way to do business in some countries was often to just pay the right people and/or get some local in-country shareholders to do some public relations work for you - which of course meant allowing others to hold (i.e. own) a decent chunk of your company's shares, something that is now standard practise in many countries for mining companies - i.e. to be granted mining permits a company has to have a certain percentage of the company owned by locals - or the country's government (shares the government don't pay for; because it's the price you pay - or one of them - for access to the land and a licence to operate in the country) - but it shouldn't have been the case for a company trying to clean up polluted lakes and rivers in China - but there you go - give a local plenty of money and the freedom to do whatever he thinks he needs to do, and he'll do it. And look after himself in the process. In Phoslock's case anyway.

In terms of the spectacular failure of corporate governance at Phoslock - that AFR article I linked to is worth a read - it made me chuckle:

The one after it (2nd AFR article below) made me chuckle more:

Rear Window (AFR, 06-April-2021)

Phoslock fraud worth an Australia Day honour

by Joe Aston, Columnist, AFR

Back in February, Phoslock Environmental Technologies announced it needed additional time to lodge its audited 2020 financial report, invoking “reporting relief” provided by ASIC and promising to release the full-year accounts “on or before March 31”.

None of this was surprising, given the water treatment company’s admission in October of “accounting irregularities” in its China division. You might recall that KPMG’s forensic accounting team was brought in to review the falsified accounts signed off by house auditor … KPMG!

As promised, Phoslock dropped its annual report on Wednesday last week (March 31) and yep: the extent of the company’s fraud is truly spectacular. KPMG confirmed the suspected “falsification of invoices”, “improper tax reporting”, “potential misappropriation of funds including improper payment of bonuses”, “payments to third parties where the ultimate beneficiary was unclear … or otherwise suspect”, “undisclosed related-party transactions”, and the rest!

KPMG was unable to offer an audit opinion – not even a qualified one – that Phoslock’s 2020 accounts are true or fair. Which is, um, the whole point of an external audit.

This here really feels like the appropriate moment for a shout out to the “outgoing chair” of the Phoslock board’s audit committee, Brenda Shanahan. As dumb luck would have it, she was made an Officer of the Order of Australia on Australia Day for her “distinguished service to … the business and finance sectors”, and to “corporate governance”. Bravo. That really takes some doing.

We’re certainly not suggesting Shanahan had any knowledge of the massive fraud perpetrated on shareholders by Phoslock executives. But she had chaired the audit committee since 2018, accounting irregularities were admitted by the company in October 2020, with the particular fraud allegations being made at the same time, and yet in January 2021, the Order of Australia bestowed on her the second-highest gong for (among other things) corporate governance.

Shanahan is just the latest Australia Day (or Queen’s Birthday) honours recipient whose citation demonstrates the sheer ludicrousness of the system.

One of those “other things” is “medical health research”. She is a former chairman and director of, and a notable donor to, St Vincent’s Institute of Medical Research in Melbourne. Major not-for-profits are superb at luring captains of industry into major bequests and board service, and then actively shepherding their nominations through the honours process. The latter is used as an inducement to the former. And “service to business” is included on such nominations almost as an afterthought.

But what due diligence does the Order then conduct on the corporate side of these nominees’ resumes? None whatsoever, it would seem. This is a peer referral system entirely free of the burden of external verification!

We should add, incidentally, that “service to the business and finance sectors” is no service at all. It’s a job, actually, and invariably a very highly paid one. Yet merely for doing it (sometimes with a little side hustle of philanthropy – but not always), businesspeople receive national decoration you wouldn’t get for fostering 80 children. What a crock.

While Shanahan is being replaced as audit committee chair, she will remain on the board “providing important continuity”. Isn’t that a relief?

--- end of excerpt ---

Source: https://www.afr.com/rear-window/phoslock-fraud-worth-an-australia-day-honour-20210406-p57gy1

Brenda Shanahan, current Non-Executive Director, Clinuvel (CUV.asx): "Mrs Shanahan is a pioneer in the Australian finance community. The first female stockbroker, Mrs Shanahan has also spent more than two decades working and investing in medical R&D and commercialisation. She is currently a non-executive director of Phoslock Water Solutions Ltd. Mrs Shanahan is also a non-executive director of DMP Asset Management Ltd and SG Hiscock Ltd, a director of the Kimberly Foundation of Australia Ltd, and Chair of the Aikenhead Centre for Medical Discovery in Melbourne. In 2021, Mrs Shanahan was recognised as an Officer in the General Division of the Order of Australia.

Previously Mrs Shanahan was a member of the Australian Stock Exchange and an executive director of a stockbroking firm, a fund management company and an actuarial company. Until 2017, she was Chair of St Vincent’s Medical Research Institute. Mrs Shanahan was formerly Chair of Challenger Listed Investments Ltd, the reporting entity for four ASX listed firms and formerly a non-executive director of Bell Financial Group (ASX: BFG) and Challenger Limited (ASX: CGF).

Mrs Shanahan has also served and Chaired various Audit and Risk Committees throughout her career, including Challenger Financial Services Group Ltd, Bell Financial Group, Victoria University, JM Financial Group Ltd, SA Water, AWB International Ltd, BT Financial Group and V/Line Passenger.

Mrs Shanahan joined CLINUVEL in 2007 and was Non-Executive Chair of the Board from late 2007 until July 2010. Her depth of experience across global markets and medical research provides significant value to the current Board and Group."

--- end of excerpt ---

Source: https://www.clinuvel.com/about/people/

--- --- ---

Further Reading: https://www.afr.com/rear-window/arnold-bloch-leibler-back-in-proxy-wars-20221012-p5bpbz

Rear Window (AFR, 12-Oct-2022)

Arnold Bloch Leibler back in proxy wars

by Joe Aston, Columnist, AFR

Proxy adviser Ownership Matters has recommended its clients vote against Clinuvel Pharmaceuticals’ remuneration report at the company’s annual meeting on October 26.

Chief executive Philippe Wolgen’s fixed pay in financial 2022 equated to 5.5 per cent of Clinuvel’s revenue and 10.6 per cent of its pre-tax profit. Wolgen’s scandalously outsized rewards – at the 2019 AGM he was awarded $44 million of zero-priced options, the largest ever allocation to an ASX 300 CEO – is a matter of record.

Ownership Matters also recommended shareholders vote against the re-election of Clinuvel non-executive director Brenda Shanahan given her other role as a director of Phoslock Environmental Technologies.

"Fraud occurred on Brenda Shanahan’s watch." (AFR)

From 2018 until last year, she chaired the Phoslock board’s audit committee, during which time a massive accounting fraud was perpetrated upon shareholders by company executives in China.

We’re talking “falsification of invoices”, “undisclosed related-party transactions”, “potential misappropriation of funds, including improper payment of bonuses”, “payments to third parties where the ultimate beneficiary was unclear … or otherwise suspect”, et cetera.

We are not suggesting Shanahan was aware of the fraud, only that it occurred on her watch.

Fake revenue was reported in order to meet the performance hurdles for $20 million of shares issued to two Chinese executives. Phoslock now concedes that the “vesting condition” of those performance shares granted in 2019 were “lacking accounting rigour and any reasonable level of governance”.

Shanahan was also chair of the board’s remuneration committee from 2018 to 2020.

Nevertheless, Clinuvel has taken great exception to Ownership Matters’ recommendation against Shanahan, sending in its (and Phoslock’s) house law firm, Arnold Bloch Leibler.

Who else?! ABL has the market cornered in helicopter parenting for governance deplorables, and its proprietary crusade against proxy advisers hand-delivered Josh Frydenberg the greatest humiliation of his political career (at least until he was thrown out of parliament).

The former ABL solicitor, who left to join Frydenberg’s office and shepherded the proxy package into law, Luke Jedynak, is already back at the firm! To think The Australian issued a correction last year for saying Jedynak was “on secondment”.

Ownership Matters voluntarily sent Clinuvel its voting advice in advance of publication (failure to do so under Frydenberg’s short-lived proxy regulations was cause for an $11 million fine).

In a letter of response, ABL claimed that “Clinuvel’s shareholders are entitled to receive, and would benefit from, information which provides a balanced view of Ms Shanahan’s role at Clinuvel, her expertise and track record spanning four decades in public markets, her service as a director in numerous public companies, government organisations, and private research institutions over time, as well as her role at Phoslock”.

Of course, Clinuvel shareholders are entitled to no such thing. Proxy memoranda are not episodes of This Is Your Life.

As for Shanahan’s four decades in public markets, should every proxy report mention that her stockbroking licence was suspended for nine months in 1987 over her part in the Humes takeover controversy?

Perhaps it could even mention that Shanahan served on the board of Challenger until 2017 with ABL partner, Neon Leon Zwier?

ABL even accused OM [Ownership Matters] of “intentionally omitting a lifetime of achievement in public and private services”, and insisted on an addendum in OM’s report stating that Shanahan is an Officer of the Order of Australia. What corporate untouchable isn’t?

There were no fewer than three Order of Australia dignitaries dozing away on the Star Entertainment board, and how well did that go for them?

OM did us all a service by extracting crucial passages of ABL’s letter in the report it ultimately distributed to clients.

It remains astonishing today that this argumentative nonsense, this undiluted time-wasting, was briefly the core business of a Commonwealth regulatory regime, even if it was revoked by the Senate 72 hours into its effect and left Frydenberg with full-body gravel rash.

Yet ABL is still at it, defending the indefensible. By its reasoning, when could a public company director ever be voted off a board? You chair the audit and remuneration committees through a massive remuneration-driven accounting fraud and the company goes down the toilet, but everyone must remain focused on your lifetime achievement vibe from prior decades? Someone ought to lock up the laughing gas at 333 Collins Street.

ABL’s arguments rise from pathetic to objectionable when you consider that it’s Clinuvel shareholders, not Shanahan, paying for them to be made.

--- ends ---

Source: https://www.afr.com/rear-window/arnold-bloch-leibler-back-in-proxy-wars-20221012-p5bpbz