Sometimes we need to zoom out to get perspective.

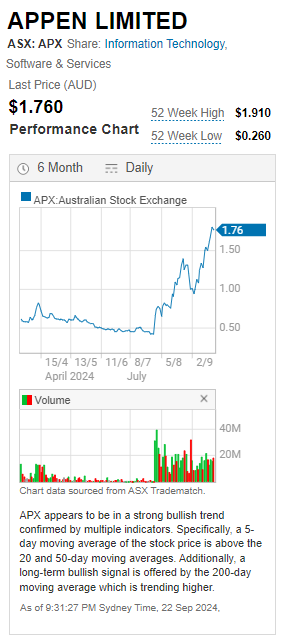

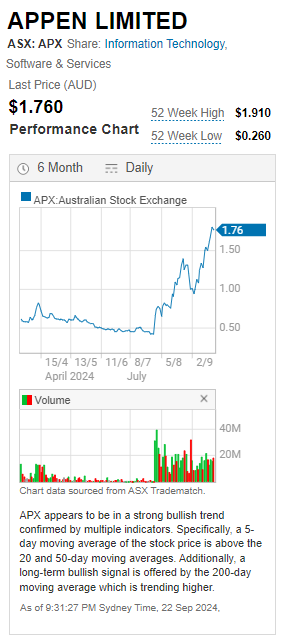

22-Sep-2024: Appen (APX) share price = $1.76.

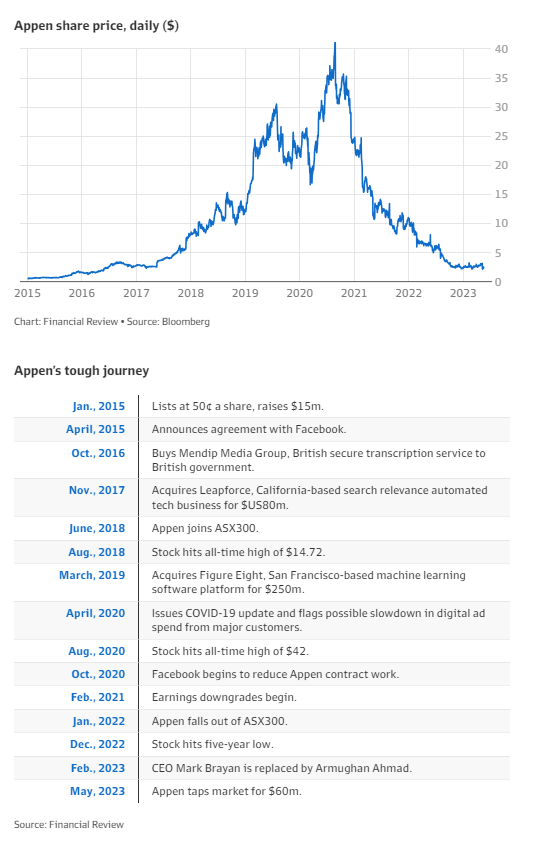

What a ride!

Strong bullish trend, confirmed by multiple indicators. Wow, why aren't I on this one?!

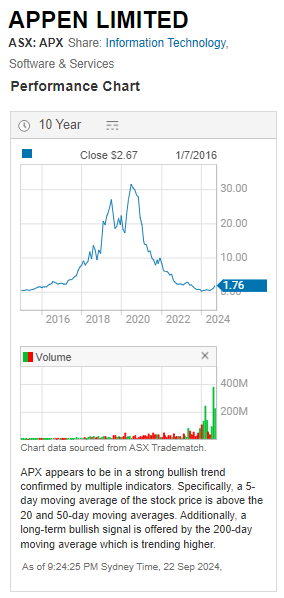

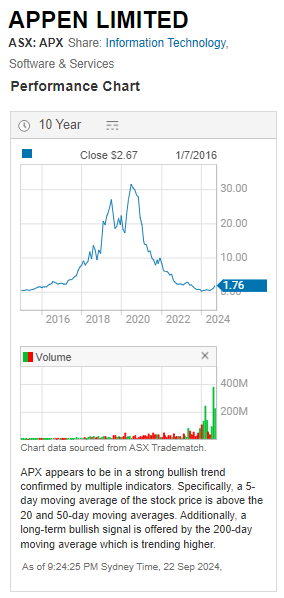

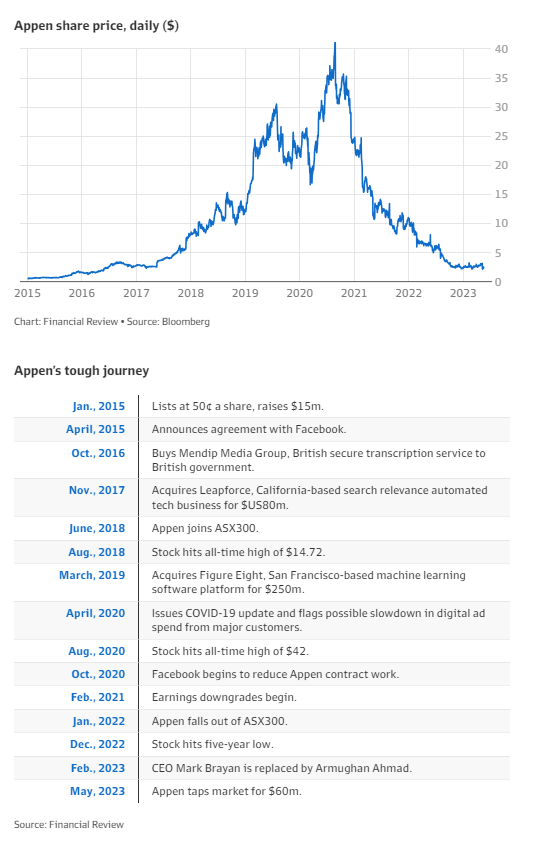

Because they're still losing money themselves, and they've lost a HEAP of money for their shareholders. That chart above, is a dead-cat bounce when you zoom out a little:

Sure there's a curl up on the right edge of that graph, which is the recent SP rise shown on the six month share price graph above it, but they've done that before, and then resumed falling again afterwards.

[Additional: That graph above only has monthly data points; APX actually made an all-time high of around $42 in 2020, as shown in the AFR graph below.]

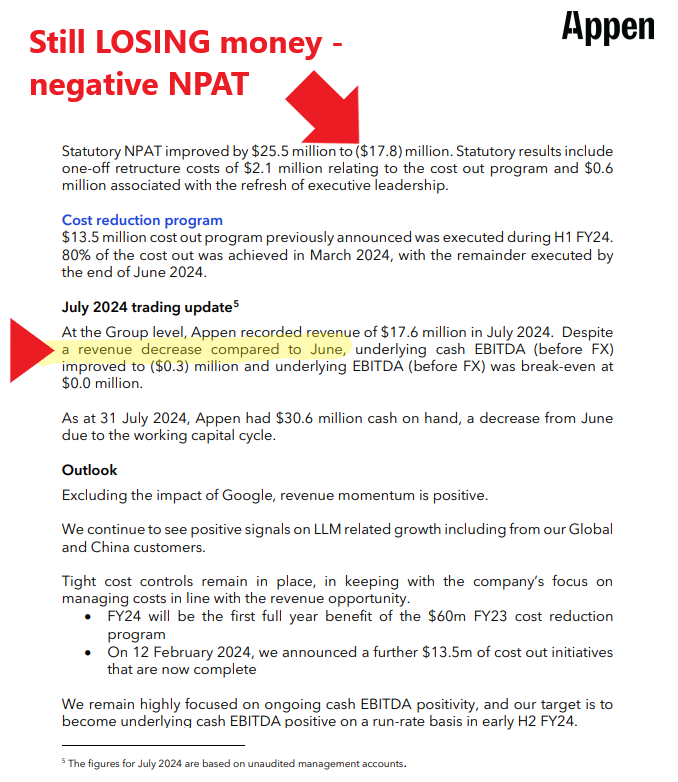

Where are they at? Have they turned a corner? They're always turning a corner. No end in sight. Must be a roundabout and they don't know how to exit.

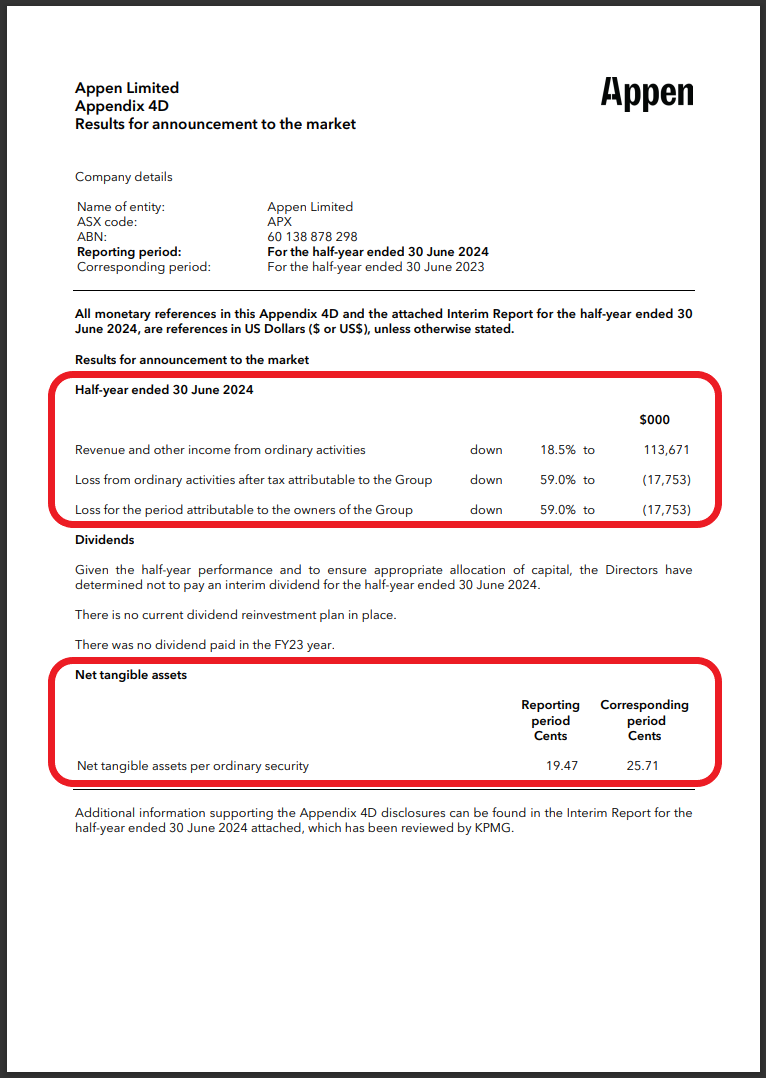

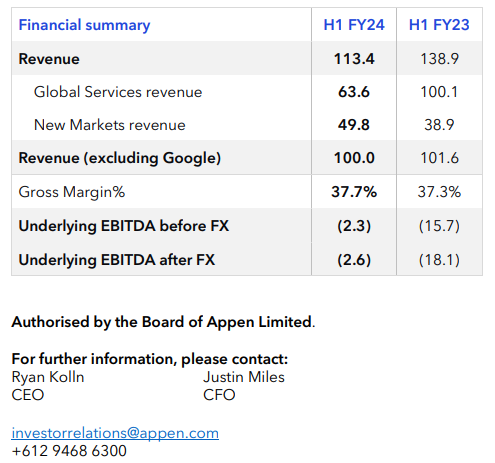

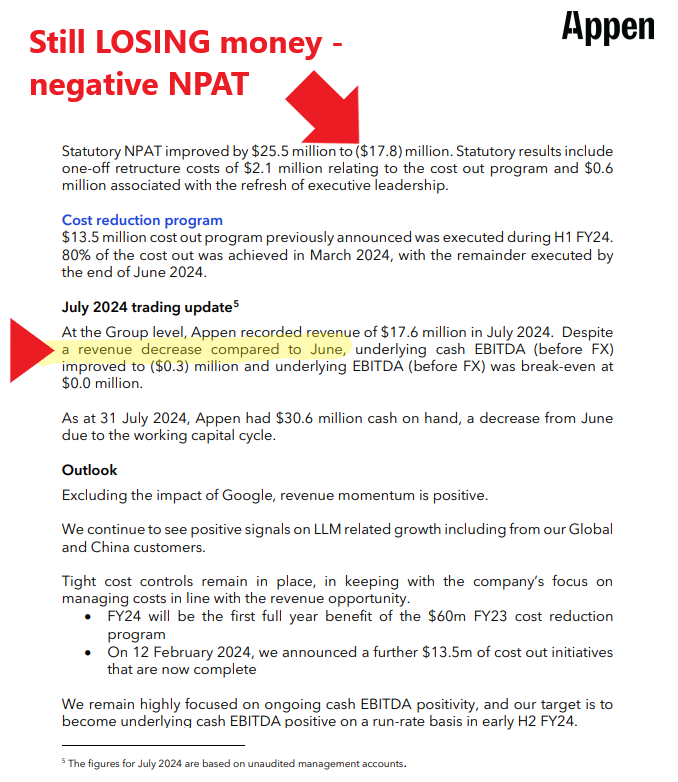

From their latest results:

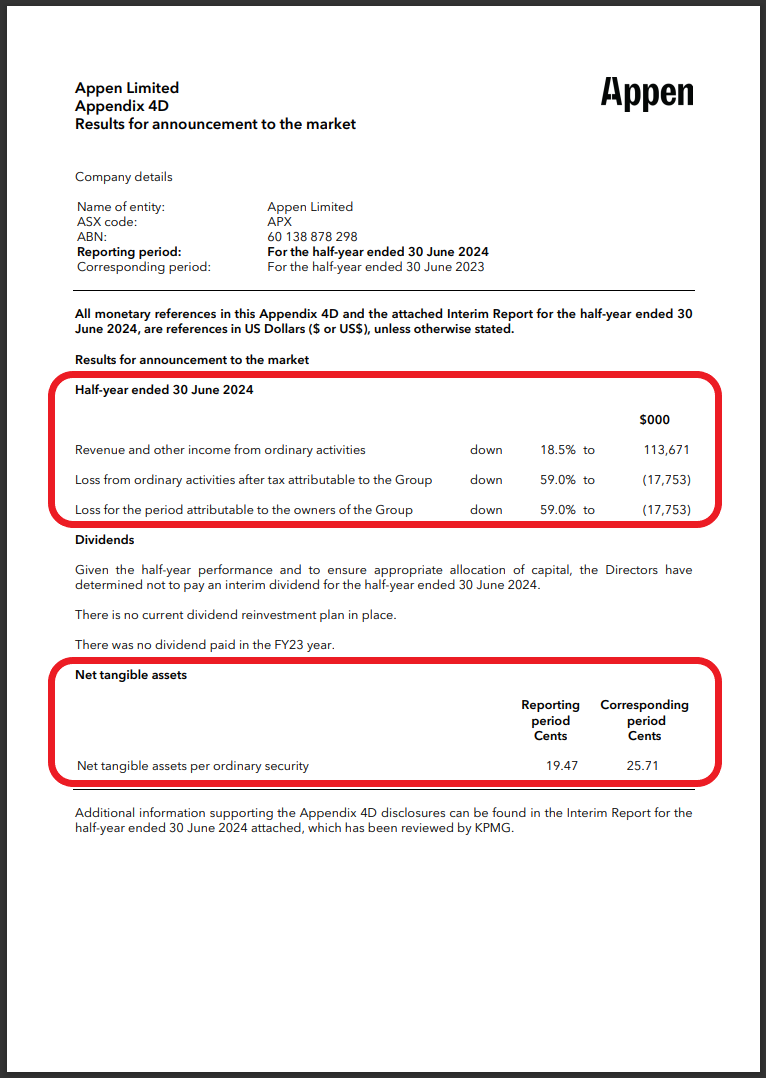

Revenue down -18.5%, loss down -59% to a $17.753 million loss, NTA down -24% to 19.47 cents per share.

Yet the share price has risen +274.47% from 47c at 30-June-2024 to $1.76 on Friday (20-Sep-2024).

Mind you, again, some context:

- $4.96 closing share price on 30/6/2022

- $2.17 closing share price on 30/6/2023

- $0.47 closing share price on 30/6/2024

So despite a +274.47% rise from 47 cps to $1.76, they're still below their 30-June-2023 SP of $2.17, and they're still -64.5% below their 30-June-2022 SP (of $4.96), and the further back you go, the worse it is, back to mid-2020 when they peaked at $42/share because everyone thought they were a tech stock, well, almost everyone, not Claude Walker and a few other savvy investors who were warning that Appen was a glorified labour hire company whose business was fast being made redundant by machine learning that would make Appen's labour intensive offerings pointless and no longer in demand. And that's exactly what happened of course.

So when Appen were trading at $42/share back in 2020, their market capitalisation was $5 Billion with 138 million shares on issue. Today it is $400 million. Less than half a billion, with 223 million shares on issue. So massive dilution from capital raises and issuing more shares, while the share price has been dropping like a stone up until a couple of months ago.

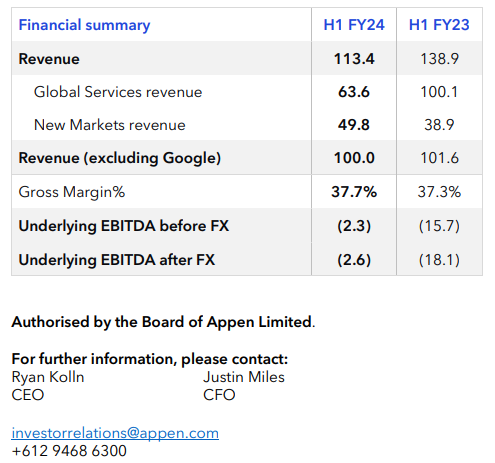

Their latest client lost is Google (Alphabet) - and Appen are already quoting revenue EXCLUDING Google, as in taking Google out of the previous half as well for a comparison.

Thing is, even excluding Google, they still had less revenue. They aren't growing. Their revenue is declining. Their only improvements (smaller losses) are coming from spending less money. And yet they are still losing money at the bottom line; their NPAT is still negative.

Their first major key customer loss was Meta, formerly known as Facebook, who started reducing their reliance on Appen in October 2020 and the Appen SP fall was swift and relentless, and lasted for the next three years. Assuming they don't fall further...

Source: https://www.afr.com/technology/inside-appen-s-fell-from-grace-during-an-ai-boom-20230516-p5d8t6

Since then, Microsoft, Nvidia and now Alphabet (who own Google) have all cut ties with Appen - see here: https://www.cnbc.com/2024/05/22/ai-firm-appen-loses-more-executives-months-after-alphabet-cut-ties.html?msockid=09d1fe9b55f7646c1745eb99541d6528 [22-May-2024]

Embattled AI firm Appen loses more executives, months after Alphabet cut ties

Published Wed, May 22 2024 at 7:16 PM EDT

by Hayden Field.

Key Points

- Appen, the Australian AI firm that once helped train AI models for tech behemoths including Microsoft, Nvidia and Google, has lost its chief revenue officer and chief marketing officer.

- The departures took place last week, according to an internal memo viewed by CNBC.

- Alphabet in January said that it would cut all contractual ties with Appen.

---

Appen, the embattled artificial intelligence firm that once helped train AI models for tech giants including Microsoft, Nvidia and Google, has lost its executives in charge of revenue and marketing.

Andrew Ettinger, who was the Australian company’s chief revenue officer, and Alicia Hale, who was marketing chief, stepped down from their roles last week, according to an internal memo viewed by CNBC. Both executives joined the company last year.

“Strengthening our sales and marketing function remains a top priority for the business,” CEO Ryan Kolln wrote in the memo that was shared with CNBC. “There is no change to our strategy to grow revenue from existing and new customers.”

The departures follow Alphabet’s announcement in January that it was cutting all contractual ties with Appen, which once helped train Google’s chatbot and other AI products. Two weeks after that decision, Appen CEO Armughan Ahmad left after just 12 months on the job.

Although generative AI is booming, Appen, once an industry darling, has been losing out on business as tech companies spend billions of dollars training their own large language models (LLMs) or building atop the leading AI platforms. They’re all pursuing a market that’s predicted to top $1 trillion in revenue within a decade.

Despite Appen’s once-enviable client list and its nearly 30-year history, revenue dropped 30% in 2023, after declining 13% a year earlier. The company attributed the decline in part to “challenging external operating and macro conditions.”

Former employees told CNBC last year that the company’s struggle to pivot to generative AI reflected years of weak quality controls and a disjointed organizational structure.

The latest memo also mentioned that the company’s vice president of sales and vice president of global solutions will now report directly to Kolln, who wrote that the company is “targeting customers that are currently spending on data services.”

In the past, five customers — Microsoft, Apple, Meta, Google and Amazon — accounted for 80% of Appen’s revenue, and the company used its platform of about 1 million freelance workers in more than 170 countries to train some of the world’s leading AI systems.

After a “strategic review process,” Alphabet notified Appen in January [2024] of the termination, which went into effect March 19, according to a filing from Appen. The company said at the time it had “no prior knowledge of Google’s decision to terminate the contract.”

In 2023, revenue from work with Alphabet totaled $82.8 million of Appen’s $273 million in sales for the year, according to a January filing.

In August 2020, Appen’s shares peaked at AU$42.44 ($27.08) on the Australian Securities Exchange, sending its market cap to the equivalent of $4.3 billion. The company has since lost 99% of its value.

Appen’s past work for tech companies has been on projects like evaluating the relevance of search results, helping AI assistants understand requests in different accents, categorizing e-commerce images using AI and building out map locations of electric vehicle charging stations, according to public information and interviews conducted by CNBC.

The LLMs of today that are behind OpenAI’s ChatGPT and Google’s Gemini are scouring the digital universe to provide sophisticated answers and advanced images in response to simple text queries. Companies are spending far more on processors from Nvidia and less on external AI training from companies like Appen.

“I’m highly focused on supporting our sales team so they can be as effective as possible,” Kolln wrote in the memo. “To achieve this, we need to equip them with the content and messaging that differentiate Appen vs our competitors.”

Appen didn’t immediately respond to a request for comment.

--- ends ---

As @mikebrisy said here three weeks ago: What's the Investment Thesis now for Appen?

Why are people buying this company now?

What makes people think they are going to become profitable again and then grow strongly from there?

I'd love to know. Won't be buying any myself, ever, but just interested to learn the motivation behind the buying. Because this dog has fleas, worms, and possibly rabies.